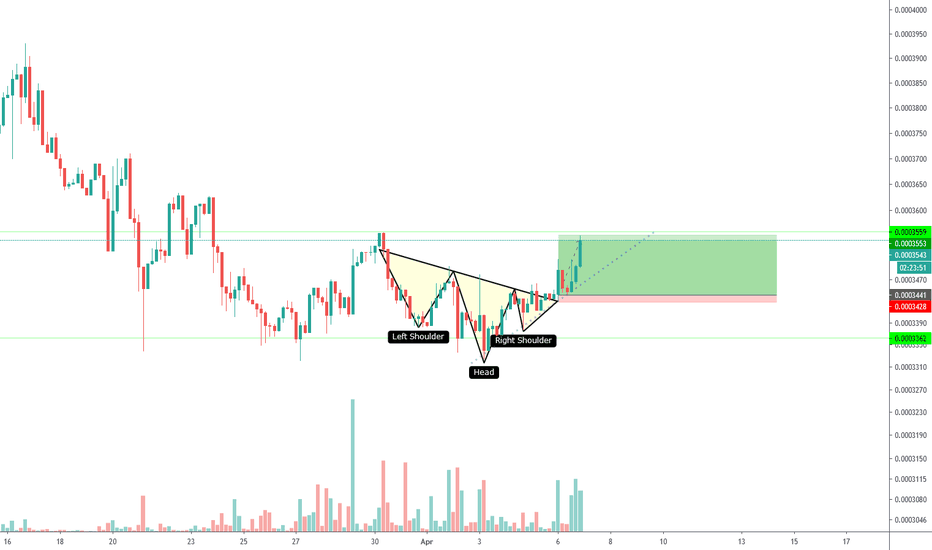

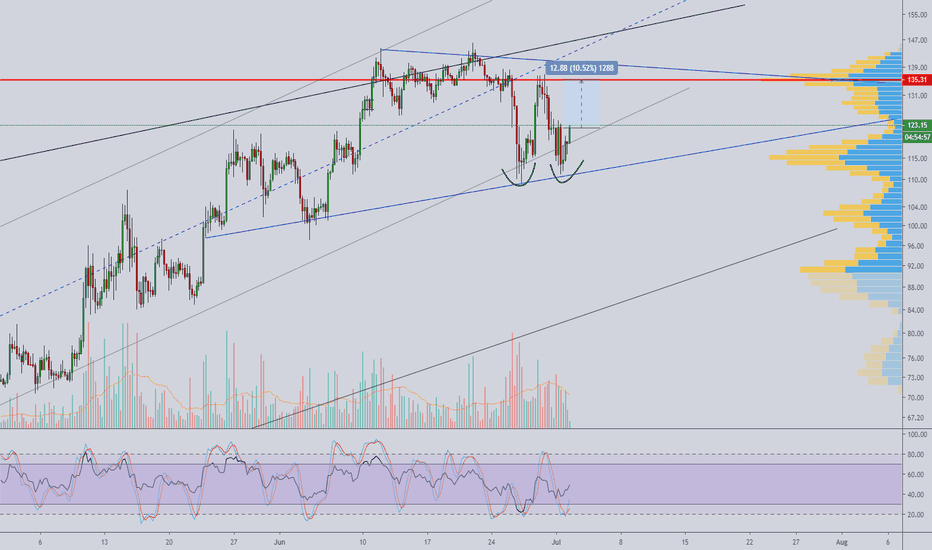

EOS - LONG EARLY APRILHopped onto the charts earlier in the morning. Started out with basic support and resistance zones and noticed an uptrend. While looking at the uptrend i noticed a inverted head and shoulders.

Using that indicator and trading with the trend, I was able to find a nice trade which although it hasn't hit my take profit just yet, it did play out quite quickly.

Cyrpto

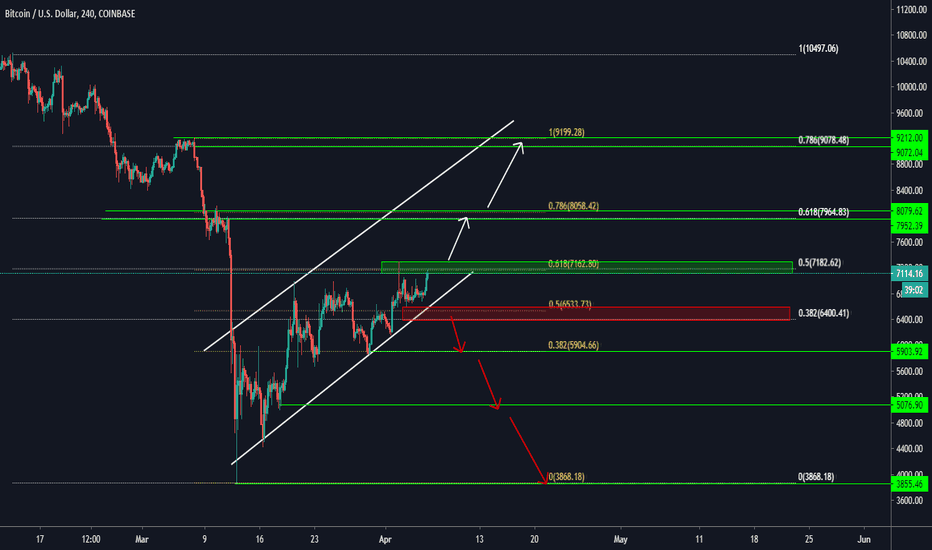

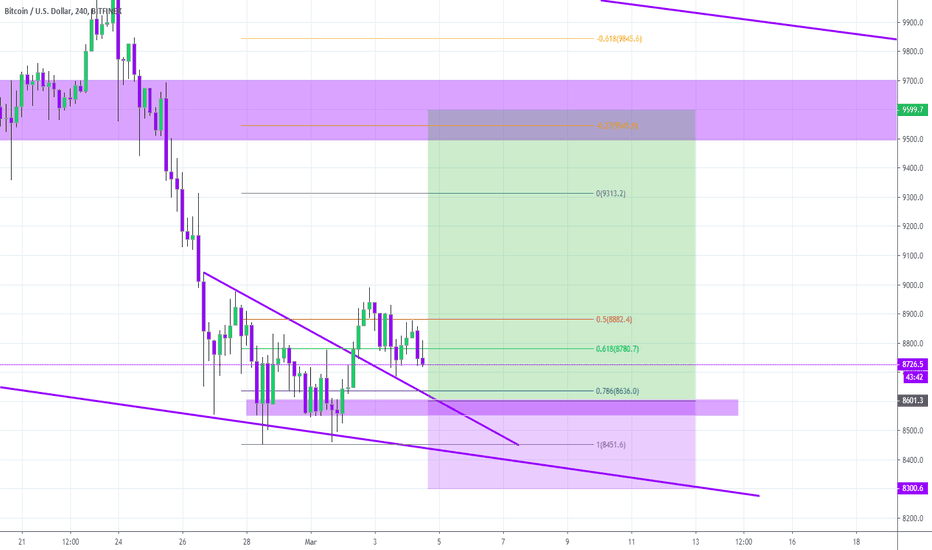

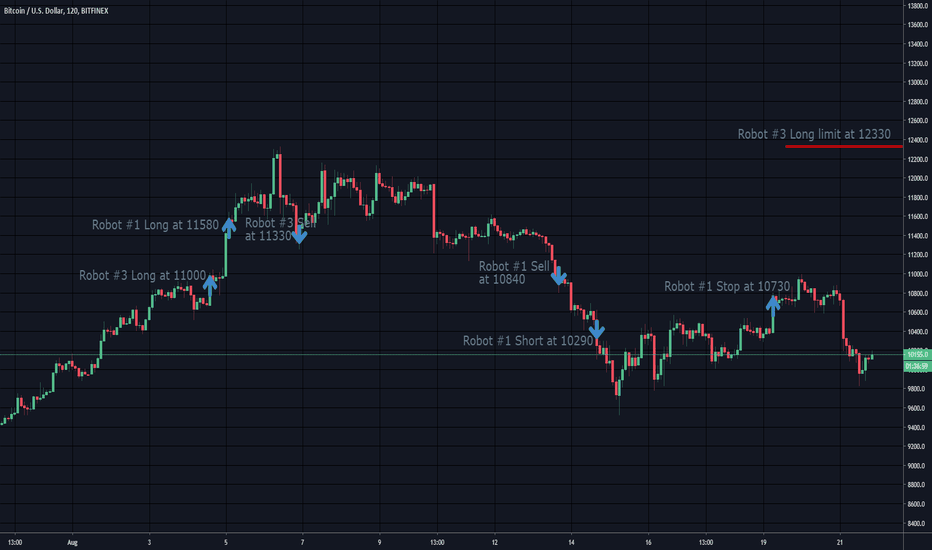

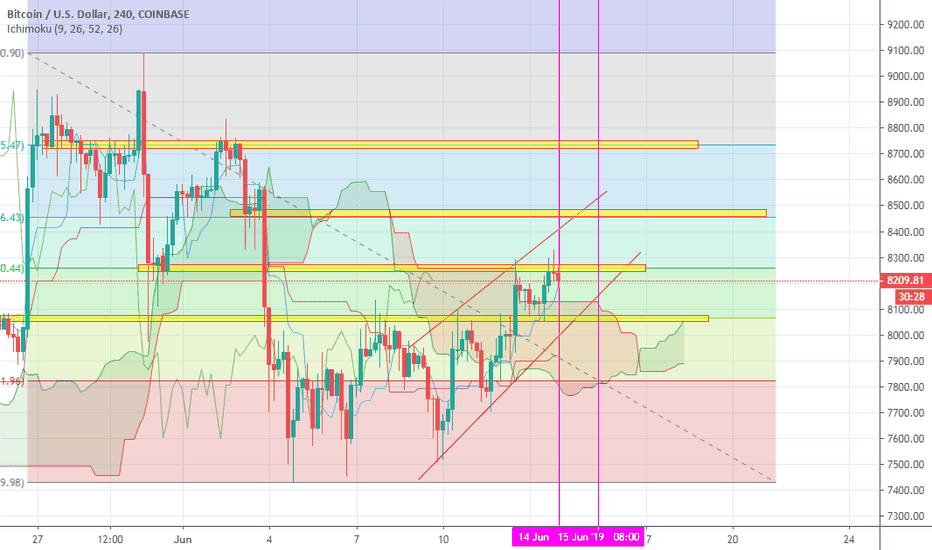

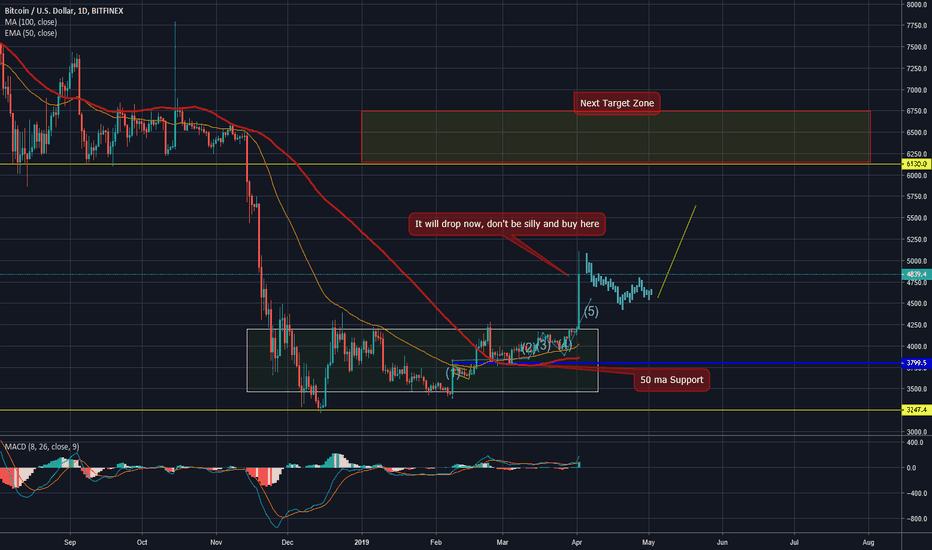

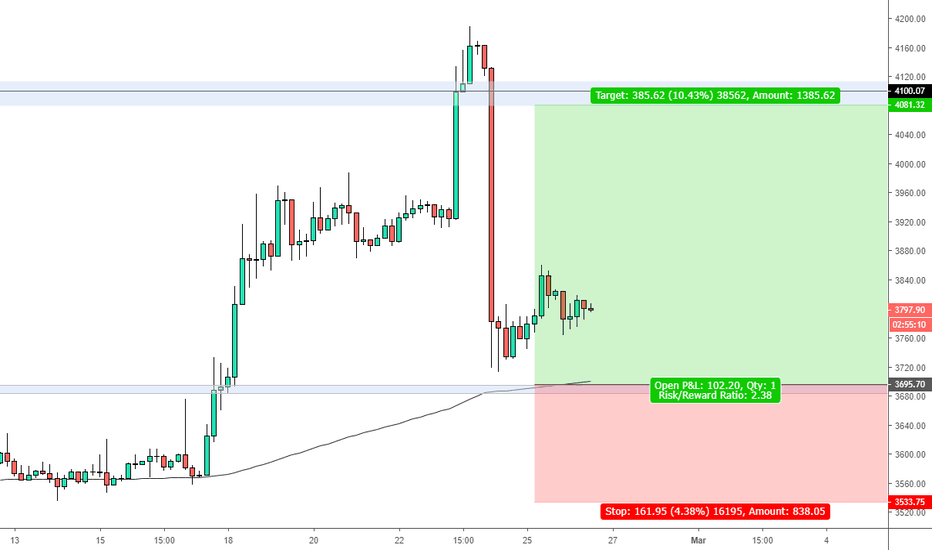

BTC Long- 78.6% Fibonacci, Counter Trendline Retest and SupportAs you can see BTC is getting ever closer to tapping the 78.6% Fibonacci Retracement that perfectly aligns with the Counter Trendline retest too. Further confluences such as the level of 4 hourly Support that is located just beneath our Entry zone also validate this setup.

Can history really repeat itself?

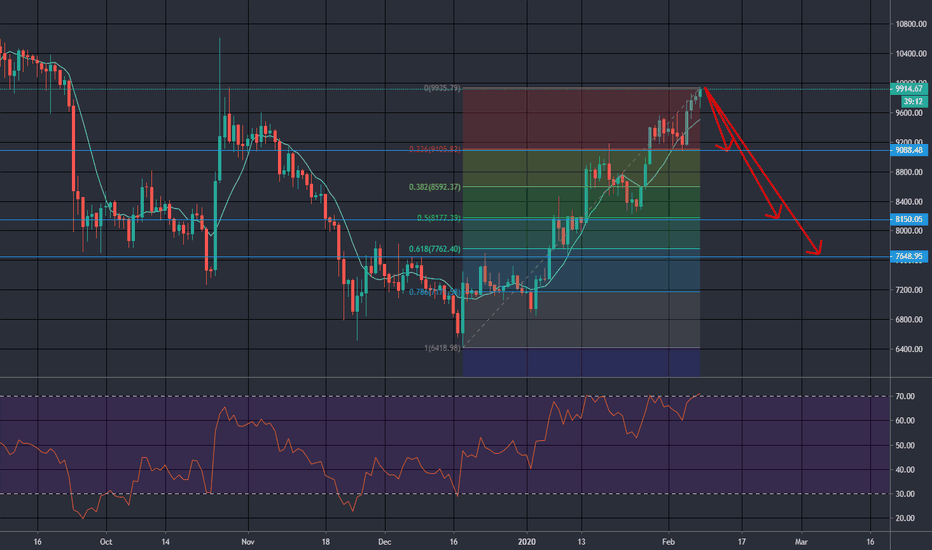

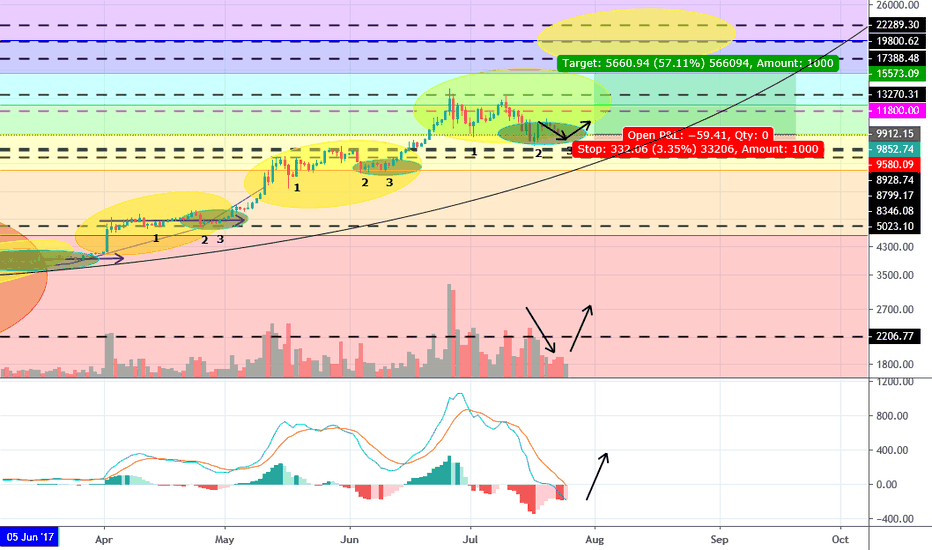

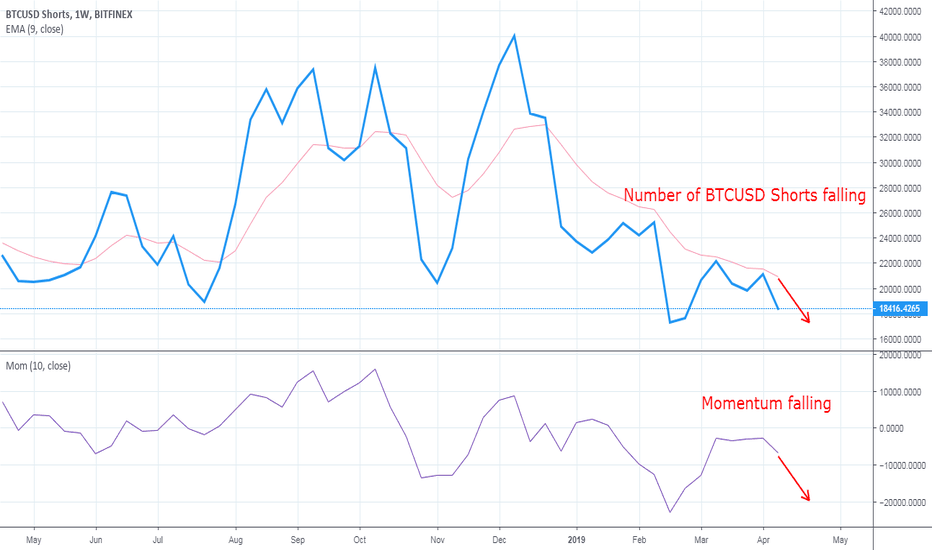

On October 15, 2018, I was having dinner at noon, WeChat from a friend, a tether had an accident, some people in them, like the plague in the news spread quickly on the market, I was the first feeling this should not be a simple message, should be somebody in the release of the news, because two days before just tumbling prices, the market is weakening, creating panic at this time, it must be have a purpose. Then it went viral in various communities, tether was unable to withdraw money, and those who were scared started to sell usdt in large quantities and exchange it for BTC. In a short time, the bitcoin on various exchanges started to soar, rising 20% in just a few hours. But the good times did not last long, and soon there was a sharp decline. Later, it was found that tether was not the legendary bankrupt, and that the main force's successful escape was almost perfect.

And yesterday's big good, will not also become a long victory escape? Let's wait and see!

Strategy: at present, the breakthrough trend channel is still uncertain, if the closing price can not stand above $9250, perhaps this breakthrough is fraudulent line. On the weekly line, macd does not form a bullish trend. From the current indicators, there is no definite point of purchase. So be careful to be bullish here.

Short line does not chase high, this is our standard, if fall, look for the low point to choose admission opportunity, if not, would rather miss, the trend is stable and then enter not late.

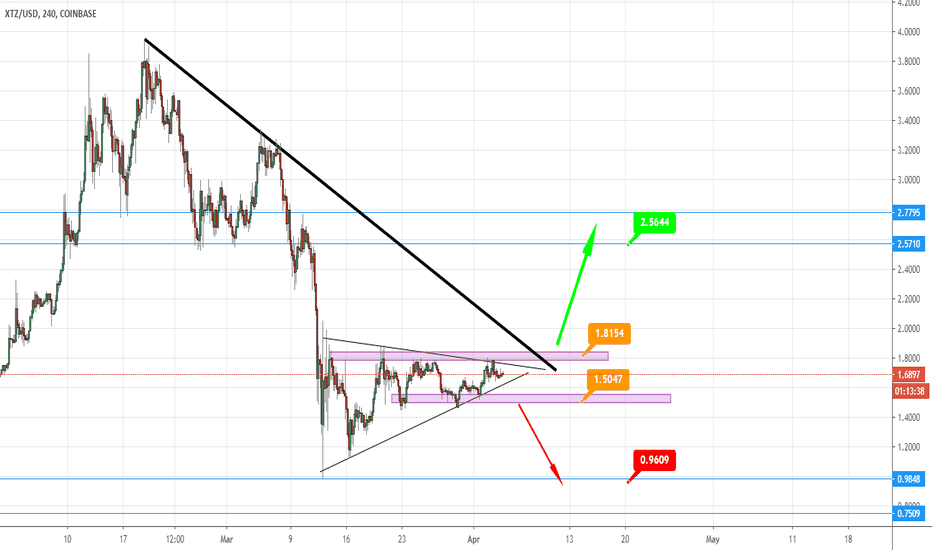

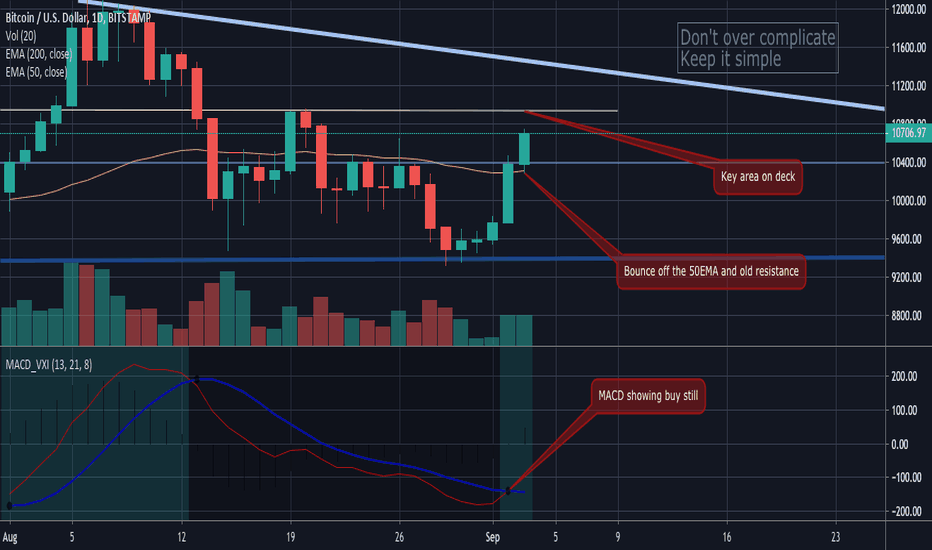

BTC Entering AugustNot financial advise, entertainment purposes only, my opinon~~~

Don't think I need to go into heavy deets here, coming to the end of my cycle prediction on the low end, 3rd retest of fib support, then we need to crack the 12.3k resistance, probably two more tries in quick succession. Next target is around $15,570 before retrace to $12.3k support/fib line. Failure there, 30% correction to 10,899 for a choppy September. Small possibility of hitting $21-22k in August could easily race off to $45k, or sink back to ~$5k if the parabola breaks. The more steadily we can get there, the less harsh corrections/bubble bursts like that should be. Retests of ATH possible in August, new ATH November.

Worst case- giant bull trap and going back to $1k :(

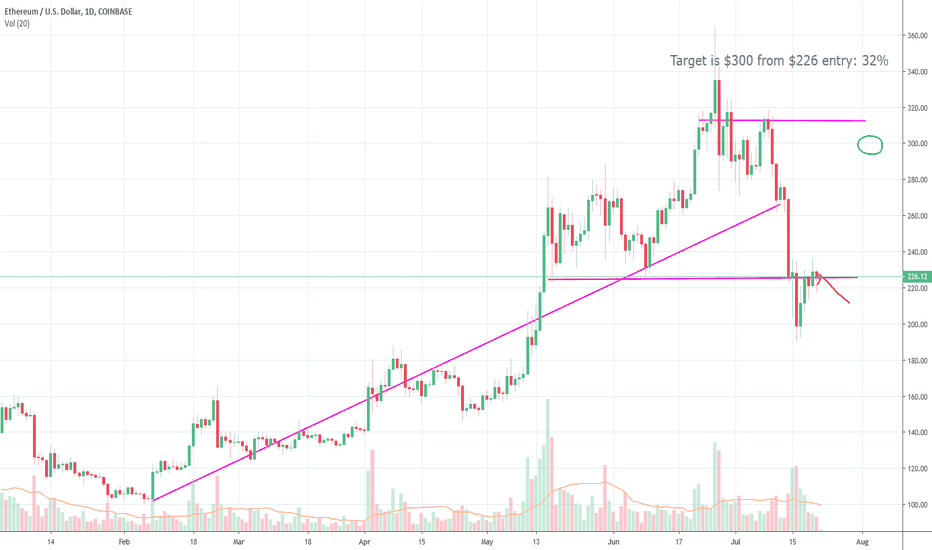

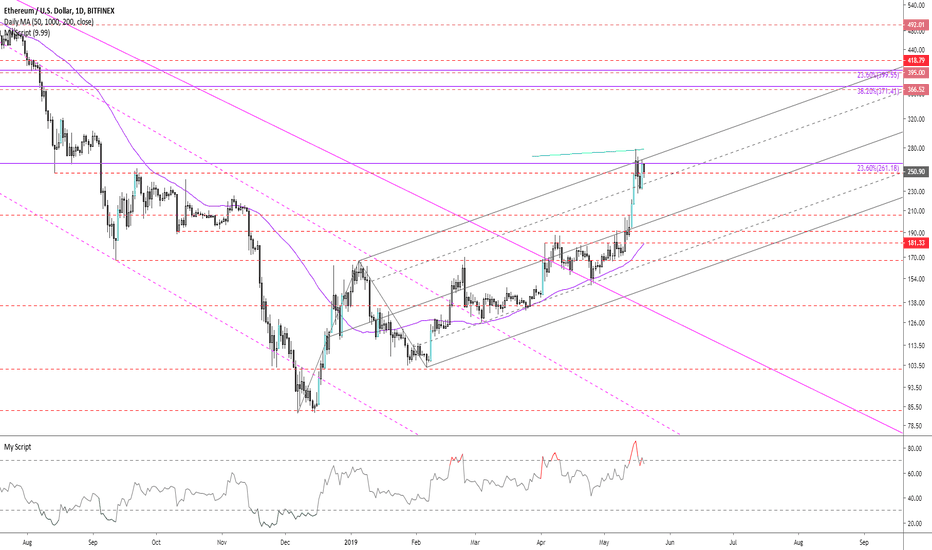

Eth Bounce Im looking for an Eth bounce off a support level strengthened by multiple touches with some volume. I think Eth is garnering some FA attention atm and if BTC runs back to the 12K range (which I think it might need to do to complete the wedge) we could see some large gains on this chart.

Of course, it could just as easily break the support and correct back to the $180 level... where I'll be buying :)

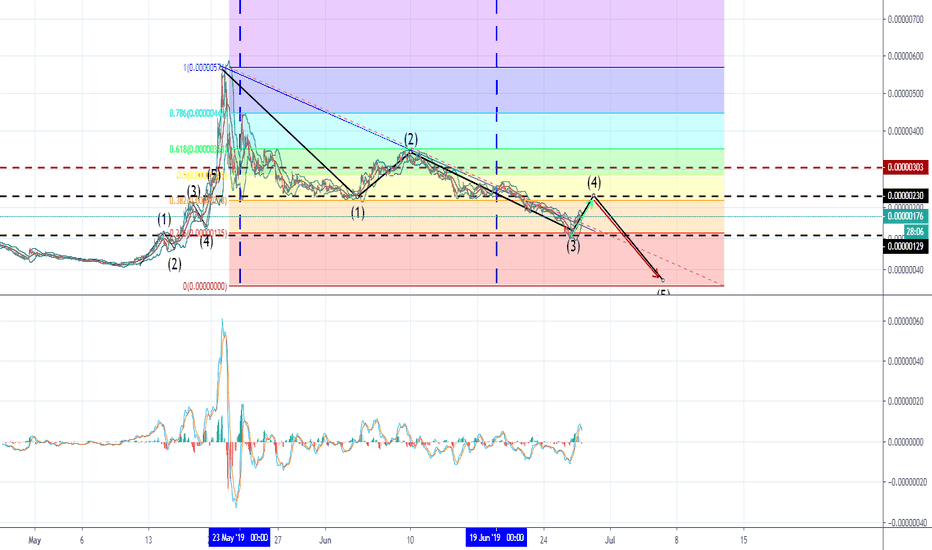

MATIC vs BTC: Breakout or Bull Trap?Blah Blah Blah MY opINioN, enterTAINment ONLY, not financial ADvise.

If we get back to the 200s, I'm getting out for my break even. Thought it was bottoming out there, but continued to fall to the next fib. Are we at the end of a correction wave or wave 4 of reverse impulse elliot? If we break past next resistance fib and crack the .5, we may have a chance of seeing the .618 or ATH. Really isn't enough history with this coin to know. Not even bothering with a stop loss because I don't have much into it and IF IT DIES, IT DIES.

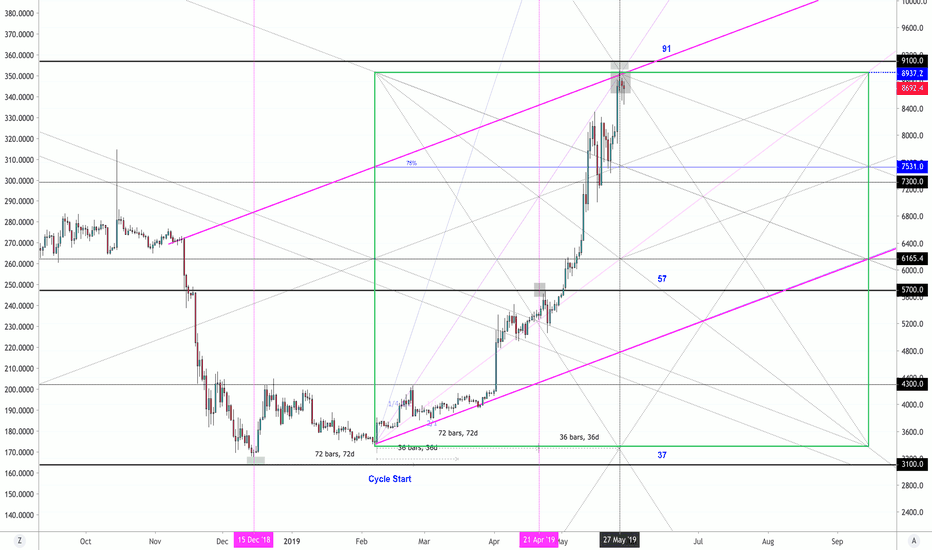

BTC: Might have Completed a Growth PhaseBitcoin has completed a couple cycles around the it's Square in price. The time counts also have been accurate with 1-2 days. Right now both the price growth spiral and the time count of 36 days (SQ144) have met at a perfect nexus. It looks like we've completed a cube perfectly in Price and Time. While I say short, this doesn't mean short yet . We've had the ending of a price and a time cycle but there has not yet been real confirmation. I mostly trade off lower low into lower high entry, you need to see the market prove that it's rotating and that new counter motion has begun. If we close above 91, there could be a bigger growth spiral in play. So with that said, the market is at it's peak right where Price and Time have balanced. This is a junction point where reversals can occur unless new energy is added into the system

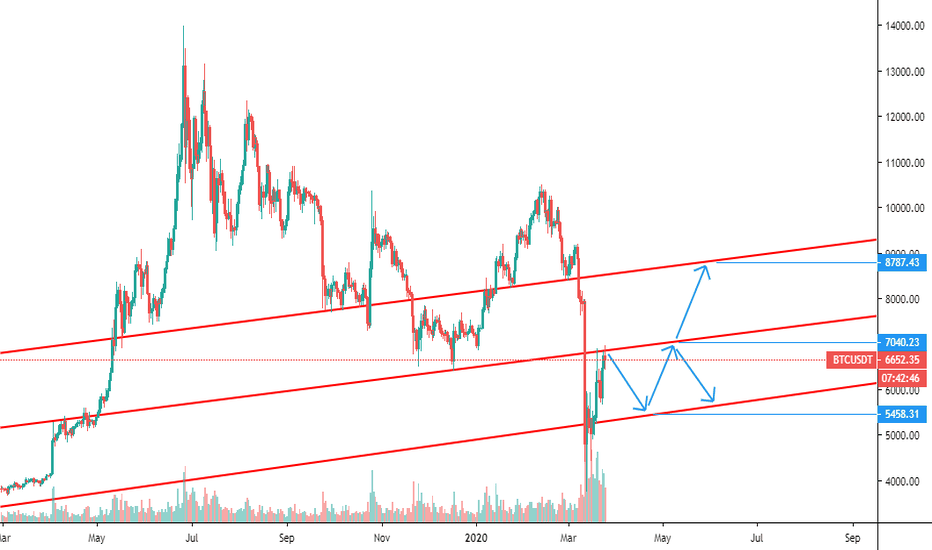

BTCHi

This is my over view on BTC if you also check the market caps you will see volume is rising and the potential is also favouring BULLISH expectations

However this does not mean to BUY BUY BUY it just means to watch for the rite flags and dips to buy into...plan ahead for the moves to come not buy now and plan later !!!

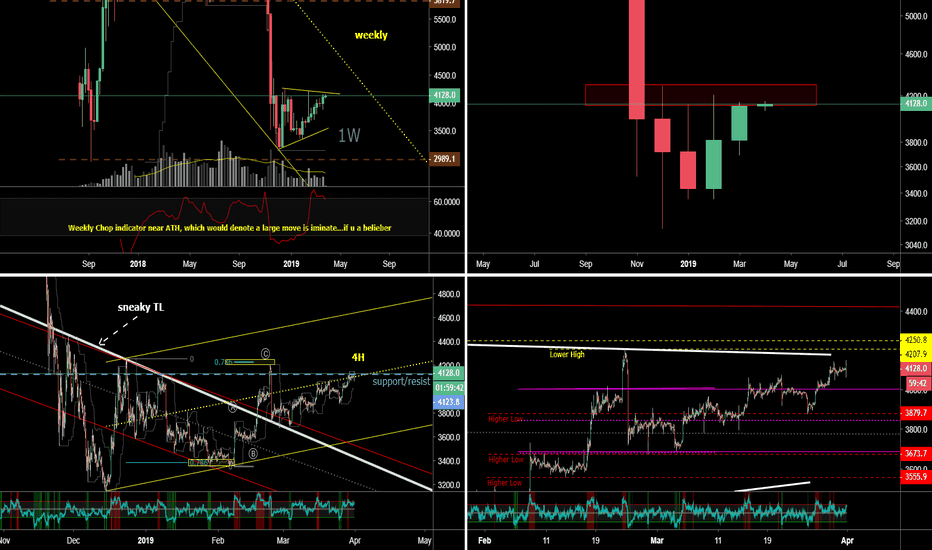

$BTC 31mar @cryptoKnee notes and channel watchSo BTC, Vol is meh weekly and monthly close Monthly candle has not closed in the range showed , 4100ish, since DEC...Weekly the last time the weekly had a higher close was in DEC possible coming up to some local resistance, based off 2 touch, so we will see. 4hr, still grinding that median line, may need a retainer..1hr, last update I posted that a LH was in, I was wrong and now we are nearing the last LH, for sure its a LH...Pretty sure..its been putting in many HL

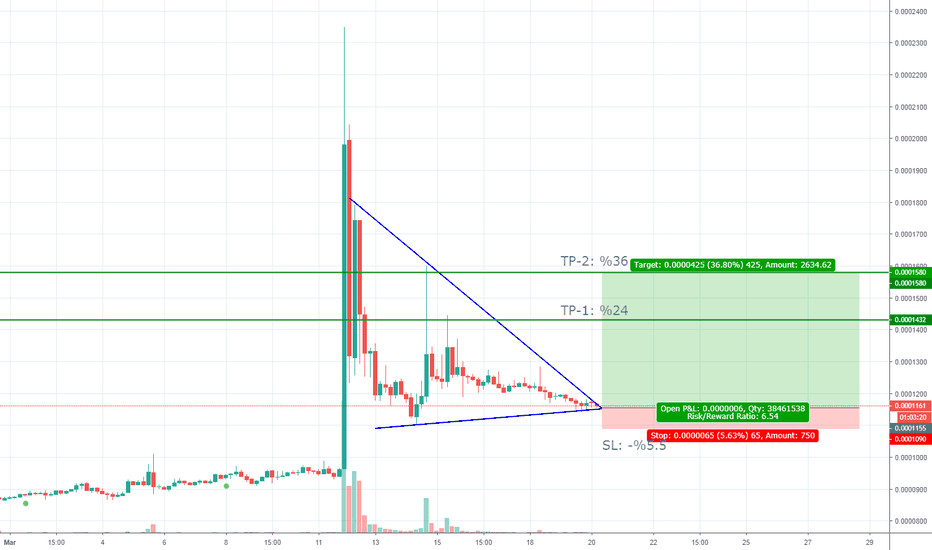

VIABTC Long Idea & Huge ProfitVIABTC forming symetrical triangle on 4hr.

Profit targets and SL level is on the chart..

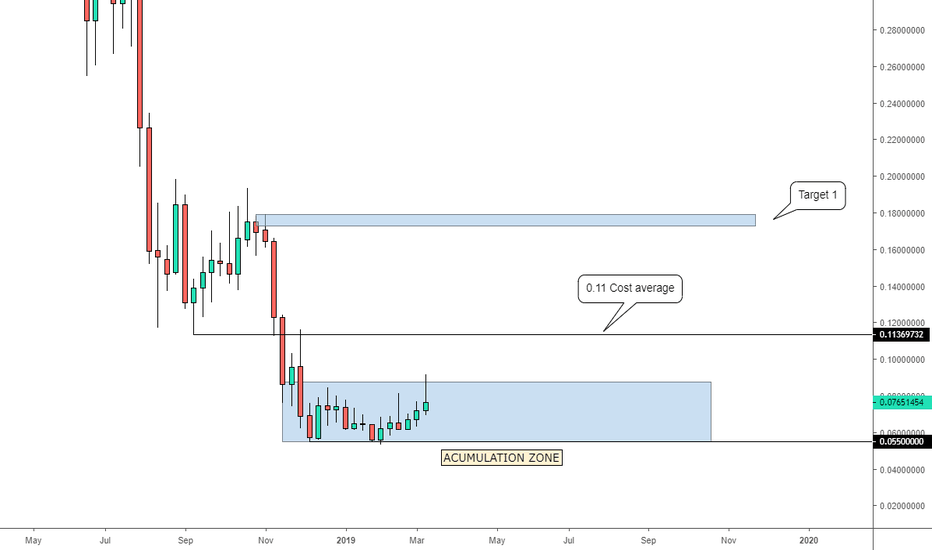

Golem GNT/USD in accumulation zone. Perfect time for buying. Time to accumulate some tokens for this next bull continuation. Gnt excellent price right now.