Why Now is the Time to Buy Cytokinetics ($CYTK) Stock

In the dynamic landscape of the stock market, investors are constantly on the lookout for hidden gems that offer promising returns. Cytokinetics ( NASDAQ:CYTK ), a biopharmaceutical company dedicated to developing muscle activators, is emerging as a compelling investment opportunity. This Idea delves into the factors that make Cytokinetics an attractive prospect for buyers, exploring the company's innovative pipeline, strategic partnerships, and potential for future growth.

1. Revolutionizing Muscle Biology:

Cytokinetics has positioned itself at the forefront of muscle biology research, focusing on developing therapeutics that enhance muscle function and mobility. The company's dedication to addressing unmet medical needs in diseases related to muscle weakness sets it apart in the biopharmaceutical industry. With a robust pipeline featuring novel compounds, Cytokinetics is poised to revolutionize the treatment landscape for various neuromuscular disorders.

2. Omecamtiv Mecarbil - A Potential Game-Changer:

At the heart of Cytokinetics' success lies Omecamtiv Mecarbil, a cardiac myosin activator currently in advanced clinical trials. Positive data from earlier stages of development suggest that this drug has the potential to be a game-changer in the treatment of heart failure. As the trials progress, investors are eagerly anticipating further validation of Omecamtiv Mecarbil's efficacy, with successful outcomes likely to drive substantial value for NASDAQ:CYTK shareholders.

3. Strategic Partnerships Fueling Growth:

Cytokinetics has strategically forged partnerships with key players in the pharmaceutical industry. Collaborations with global giants, such as Amgen and Astellas, not only provide financial support but also validate the company's innovative approach. These partnerships also enhance Cytokinetics' ability to navigate the complex regulatory landscape, potentially expediting the development and commercialization of its groundbreaking therapies.

4. Addressing Unmet Medical Needs:

NASDAQ:CYTK is uniquely positioned to address unmet medical needs in diseases characterized by muscle weakness. The company's research and development efforts target conditions such as amyotrophic lateral sclerosis (ALS), spinal muscular atrophy (SMA), and hypertrophic cardiomyopathy (HCM). By addressing these underserved therapeutic areas, Cytokinetics is not only contributing to patient welfare but also opening up significant market opportunities.

5. Financial Stability and Growth Potential:

Cytokinetics has demonstrated financial stability, with a strategic allocation of resources to support its research and development initiatives. The company's revenue growth, coupled with prudent financial management, bodes well for investors seeking long-term stability and potential returns. As Cytokinetics advances its pipeline and secures regulatory approvals, the growth potential for NASDAQ:CYTK becomes increasingly promising.

Cytokinetics ( NASDAQ:CYTK ) stands on the cusp of transformative success in the biopharmaceutical industry. With a pioneering approach to muscle biology, a promising pipeline, strategic partnerships, and a focus on addressing unmet medical needs, Cytokinetics is capturing the attention of investors seeking opportunities in the healthcare sector. As the company progresses through clinical trials and potential regulatory approvals, NASDAQ:CYTK has the potential to deliver substantial returns to investors who recognize the value of innovation in improving patient outcomes and addressing critical healthcare challenges.

Cytokinetics

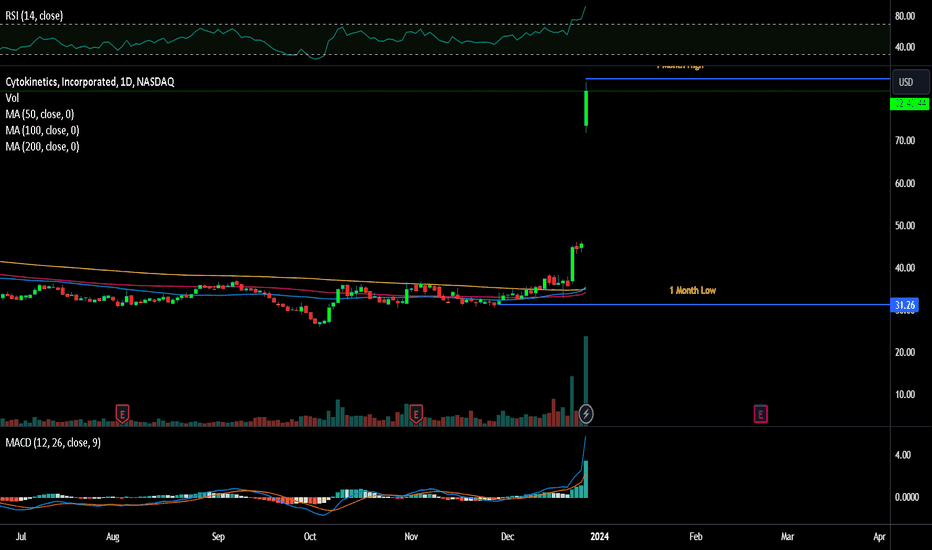

New Highs & Levels For CYTKCYTK put in a fresh high today which was rejected HARD almost immediately after. This came after the company announced positive topline results from 2 cohorts in its REDWOOD-HCM Phase 2 clinical trial of CK-3773274 (CK-274). This is the company’s investigational treatment targeting hypertrophic cardiomyopathy.

“The combined data from Cohorts 1 and 2 in REDWOOD-HCM met our high expectations for this trial of CK-274 in patients with obstructive HCM, given the observed onset of response to initiation of treatment, magnitude and breadth of response, reversibility of LVEF decreases, and favorable tolerability profile,” said Fady I. Malik, M.D., Ph.D., Cytokinetics’ Executive Vice President of Research & Development.

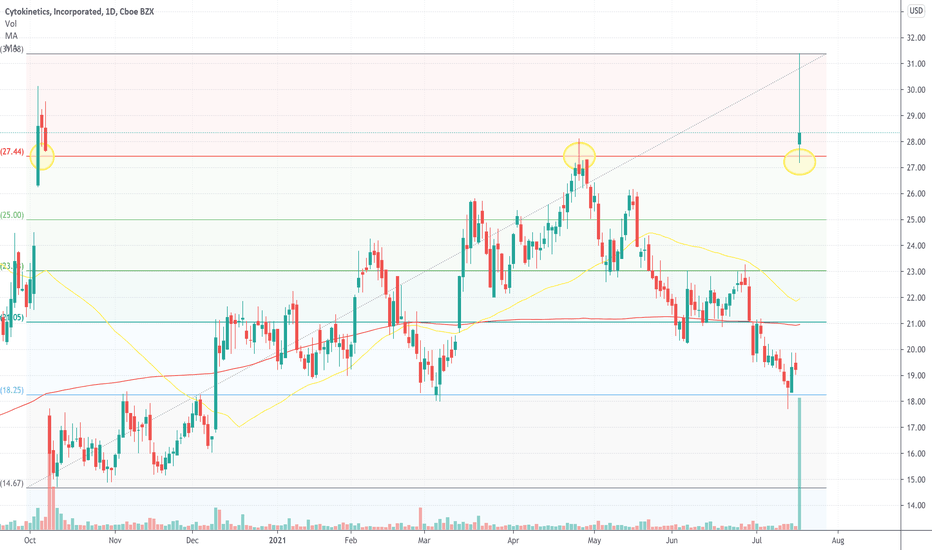

Looks like the 236 fib line - using lows from the major gap down - has been a pivot over the last year or so. CYTK tested that level on July 19th and bounced during the morning session. The big question is can it maintain this as a new support level or is it looking at another breakdown following this huge move?

"Thanks to these results, Cytokinetics expressed its anticipation of what its Phase 3 trial could bring to the table. Let’s put this into perspective. CYTK wasn’t any of the penny stocks that broke out last year. However, its valuation was a fraction of what it is today. Last October, CYTK stock was trading around $15 a share; more than 50% less than its value on July 19th. With that, attention is certainly on smaller biotech stocks right now."

Quote Source: Small-Cap Stocks To Watch After CYTK Sheds Spotlight On Biotech