D-DAX

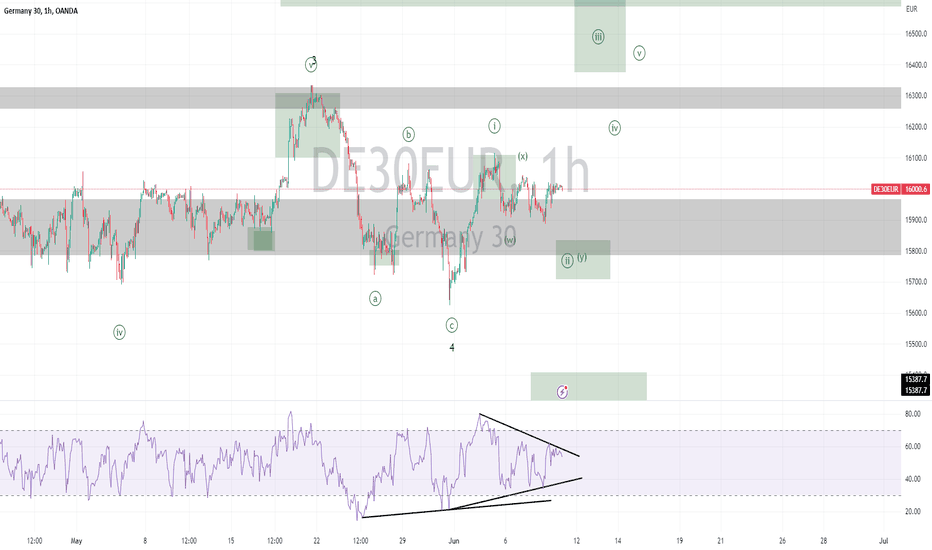

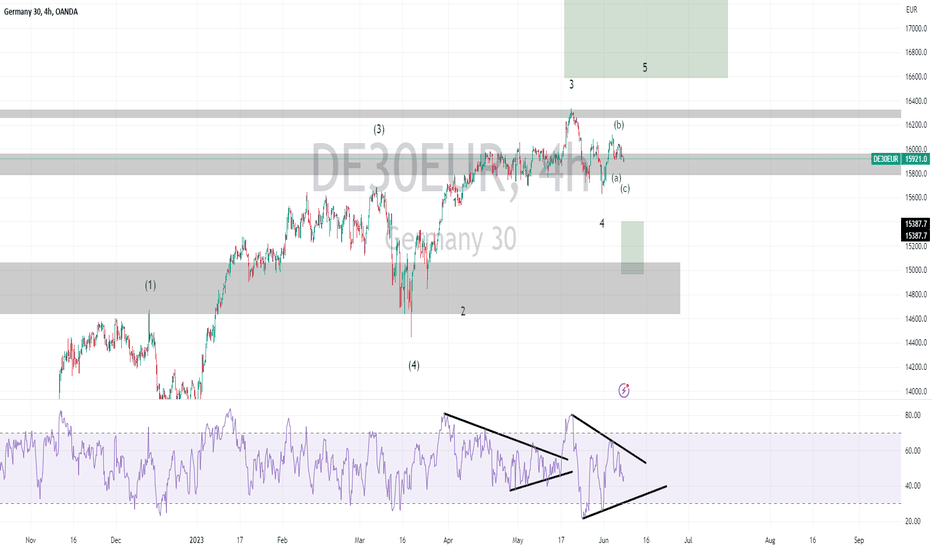

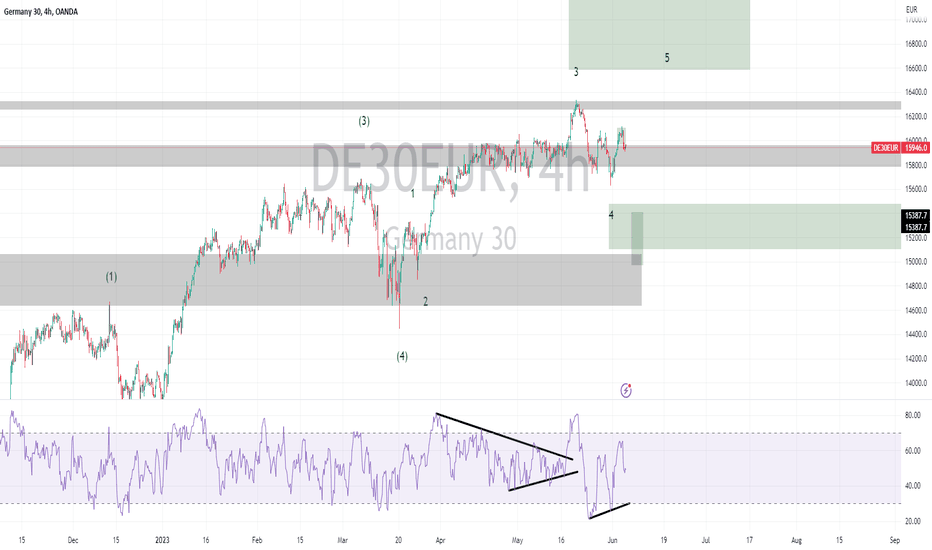

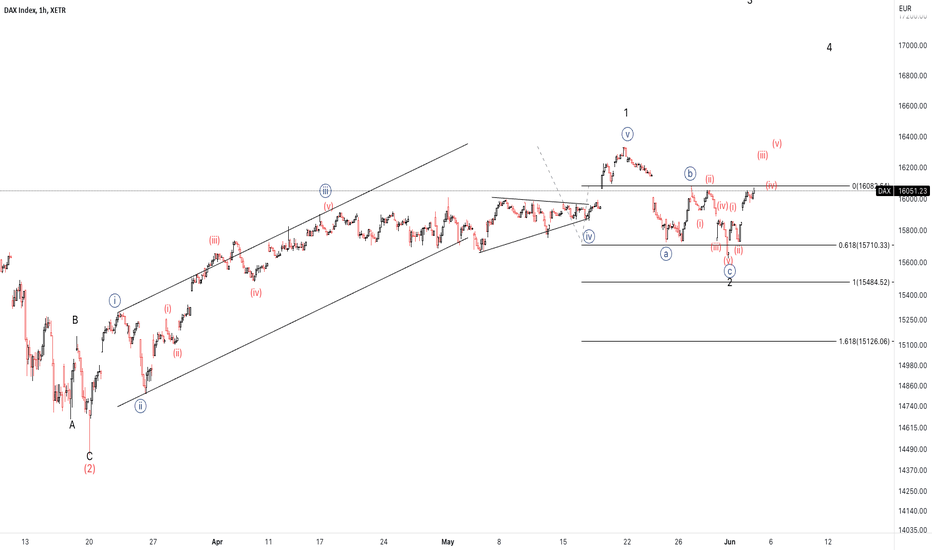

DAX Elliott Wave Analysis for Monday 12/06/2023Trading day preparation. Although pullback is expected in the higher timeframe, we might see some more upside in the lower timeframe. We discuss several scenarios that could play out. For today, depending on what the market gives us, we see an entry for both a long and short trade.

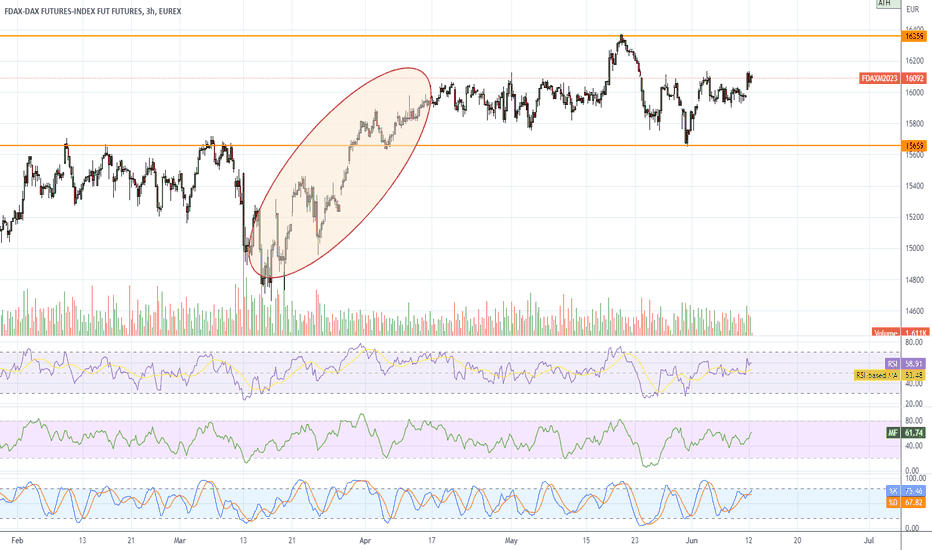

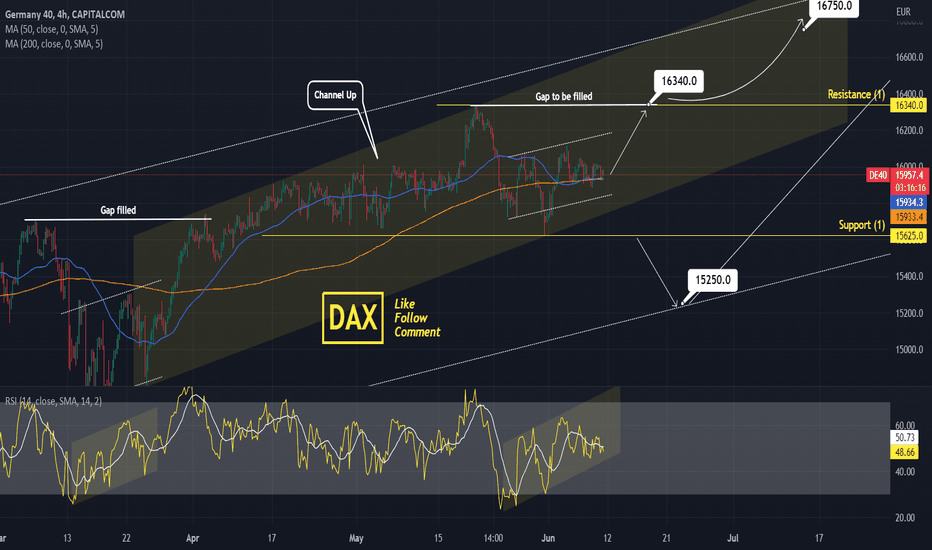

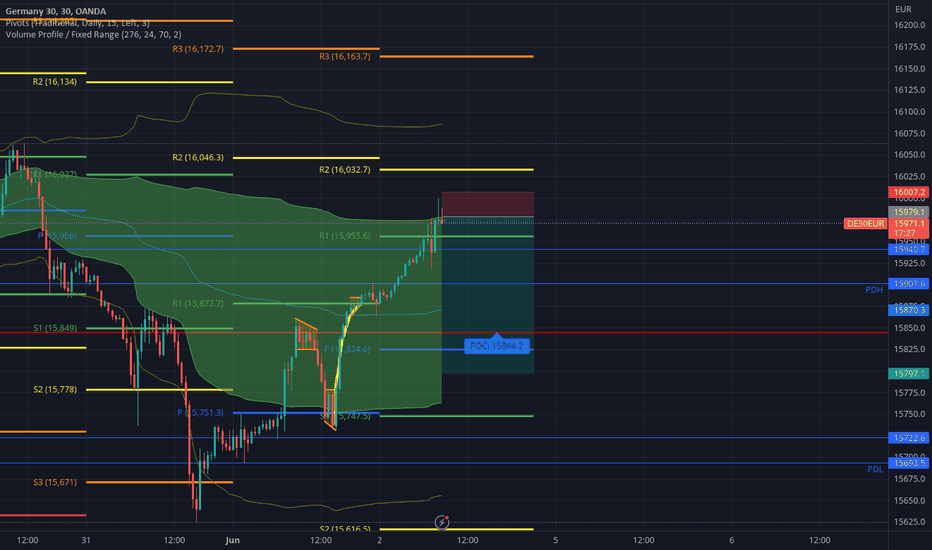

DAX Channel Up and Inverse Head & Shoulders pushing for Gap fillDAX rebounded at the bottom of the Channel Up, forming Support (1) at 15625.

By doing so it completed the formation of an Inverse Head and Shoulders.

This is a twin bullish signal same with the March bottom.

Trading Plan:

1. Buy on the current market price.

2. Sell if it crosses Support 1 (15625).

Targets:

1. 16340 (Resistance 1 and Gap fill as per the March fractal).

2. 15250 (bottom of long term Channel Up).

Tips:

1. The RSI (4h) is also forming a Channel Up like March indicating that we might be exactly before the breakout to the gap fill.

Please like, follow and comment!!

Notes:

Past trading plan:

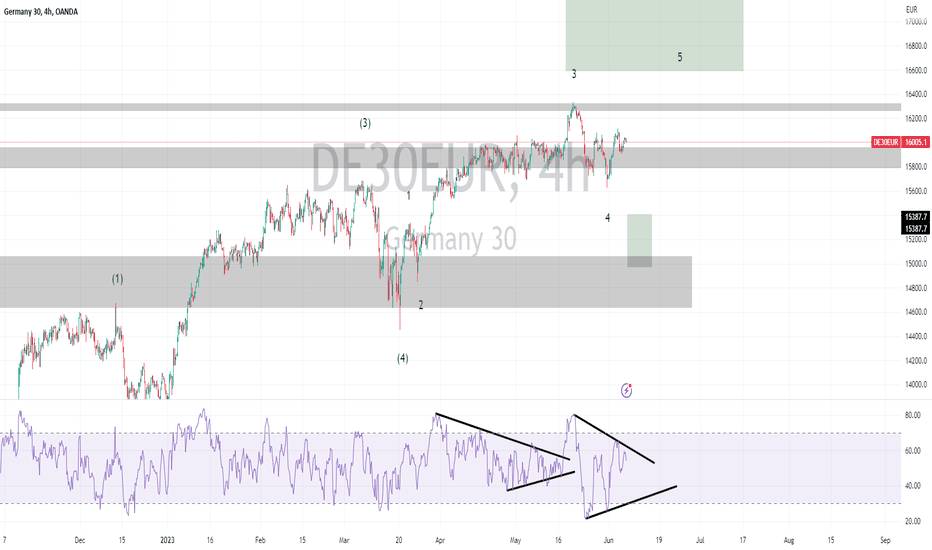

DAX Elliott Wave Analysis for Friday 09/06/2023Trading day preparation. Although pullback is expected in the higher timeframe, we might see some more upside in the lower timeframe. We discuss several scenarios that could play out. For today, depending on what the market gives us, we see an entry for both a long and short trade.

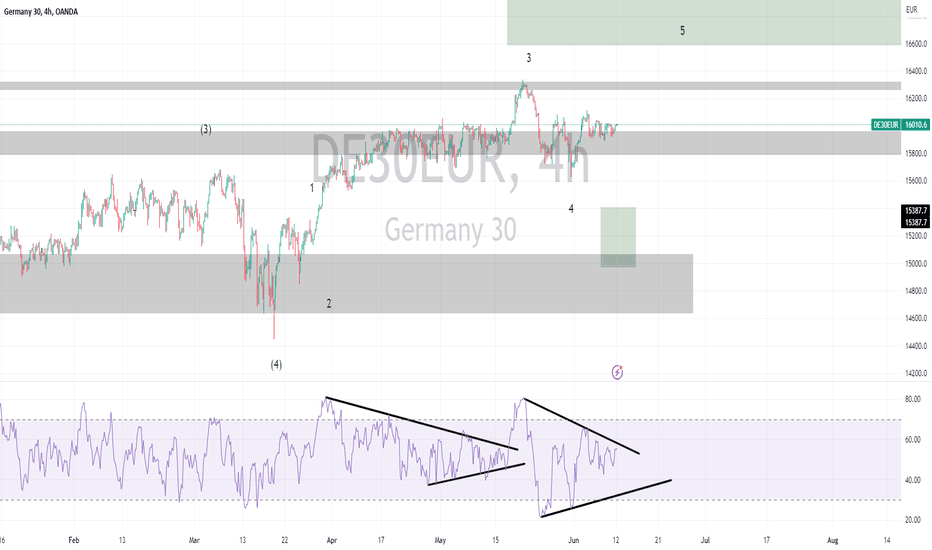

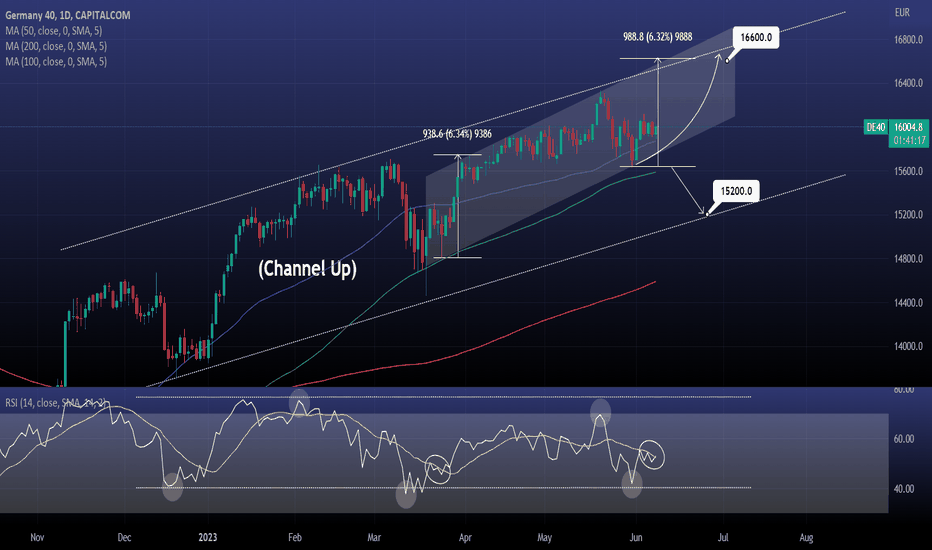

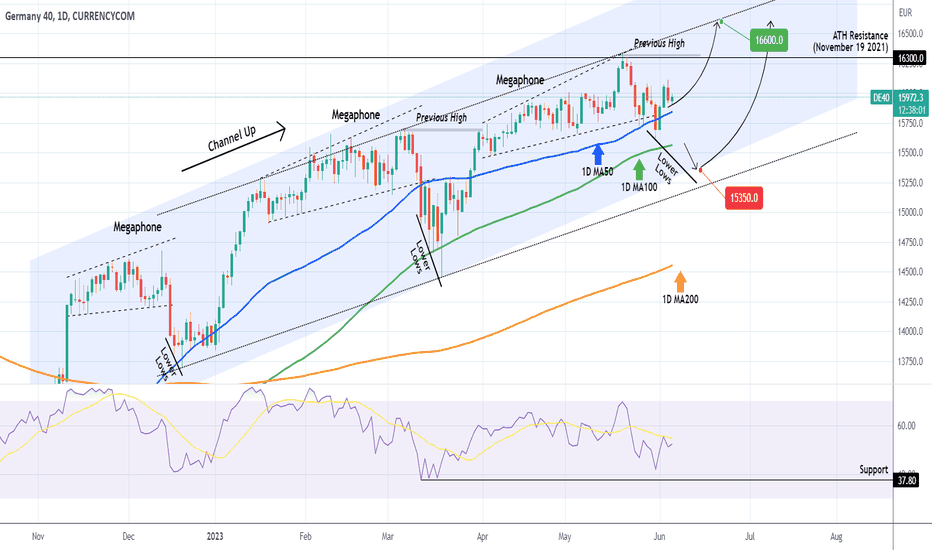

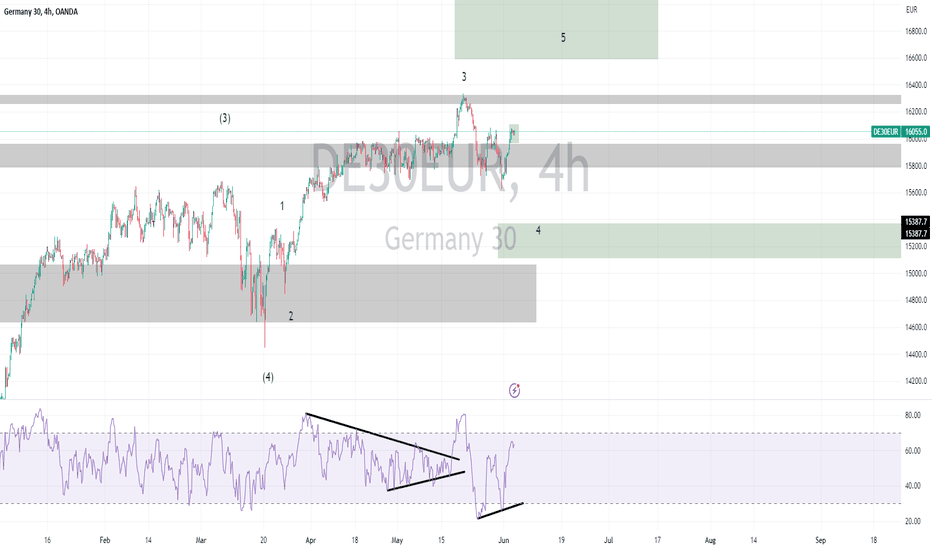

DAX holding the 1day MA50, ready for a rally.DAX is holding the 1day MA50 Support for the 5th candle in a row. This keeps the Channel Up intact, with the price near its bottom.

The 1day RSI is on a consolidation under the MA trendline same with late March.

That was the same price consolidation after a Channel Up bottom. The price rallied by +6.34% from that level.

Buy and target 16600. If the 1day candle though closes under the 1day MA100, sell and target 15200.

Previous chart:

Follow us, like the idea and leave a comment below!!

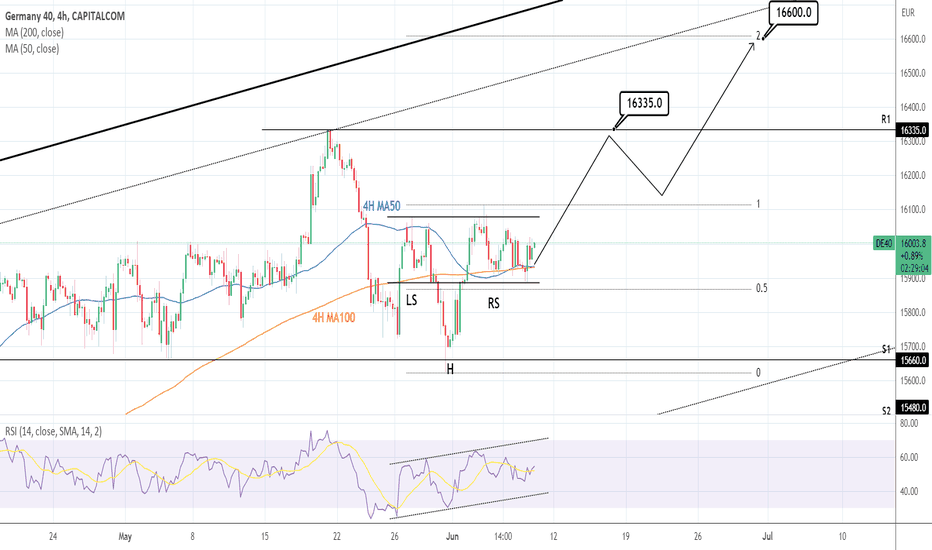

DAX: Inverse Head and Shoulders aiming for a new All Time High.DAX is trading around the 4H MA50 and 4H MA200 with technicals naturally neutral (RSI = 52.802, MACD = 10.300, ADX = 21.396) as on any consolidation. The pattern that was completed (inside the long term Channel Up) is an Inverse Head and Shoulders. Technically such formations target the 2.0 Fibonacci. Our plan is to traget the R1 initially (TP1 = 16,335) and then buy any pull back given and aim at Fibonacci 2.0 (TP2 = 16,600).

It is important to mention that the 4H RSI has been trading inside a Channel Up during the formation of the Inverse Head and Shoulders, giving an early bullish signal.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

DAX Elliott Wave Analysis for Thursday 08/06/2023Trading day preparation. Although pullback is expected in the higher timeframe, we might see some more upside in the lower timeframe. We discuss several scenarios that could play out. For today, depending on what the market gives us, we see an entry for both a long and short trade.

DAX Elliott Wave Analysis for Wednesday 07/06/2023Trading day preparation. Although pullback is expected in the higher timeframe, we might see some more upside in the lower timeframe. We discuss several scenarios that could play out. For today, depending on what the market gives us, we see several options to enter a trade.

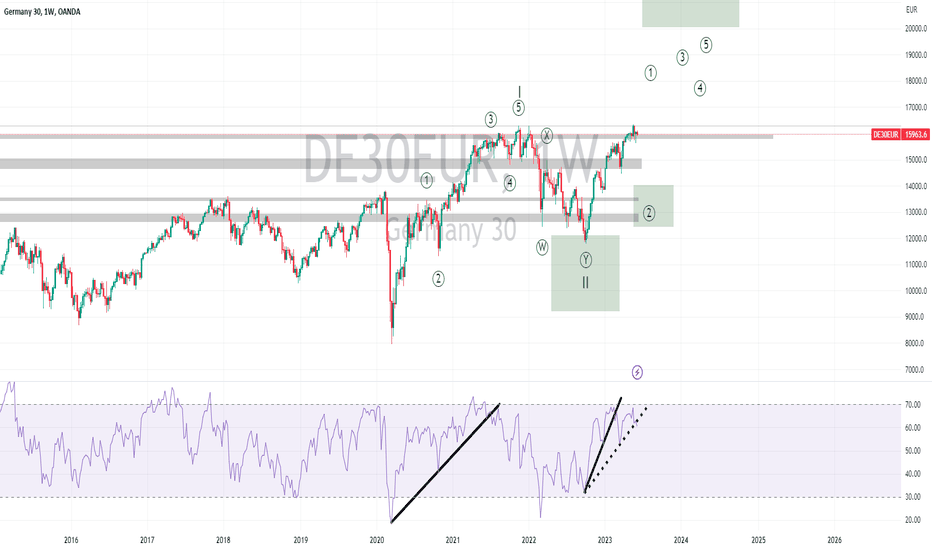

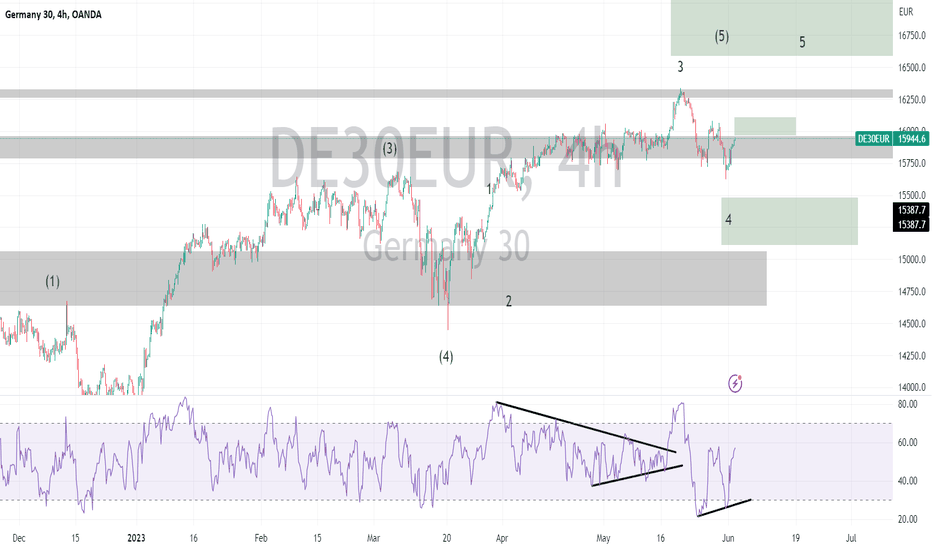

DAX potential pull-back.DAX had an excellent run since our buy signal (see chart below) more than two months ago (March 21) but after it broke above the former All Time High (ATH) on May 19, it has formed a top and is pulling back:

As long as the price is closing the 1D candle above the 1D MA50 (blue trend-line), it will be a buy opportunity targeting the top of the (dotted) Channel Up at 16600. If however it breaks below the 1D MA100 (green trend-line) we will quick sell towards the Channel's bottom at 15350 and add a new buy there. In either case, the target remains intact at 16600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DAX Elliott Wave Analysis for Tuesday 06/06/2023Trading day preparation. Although pullback is expected in the higher timeframe, we might see some more upside in the lower timeframe. We discuss several scenarios that could play out. For today, depending on what the market gives us, we see several options to enter a trade.