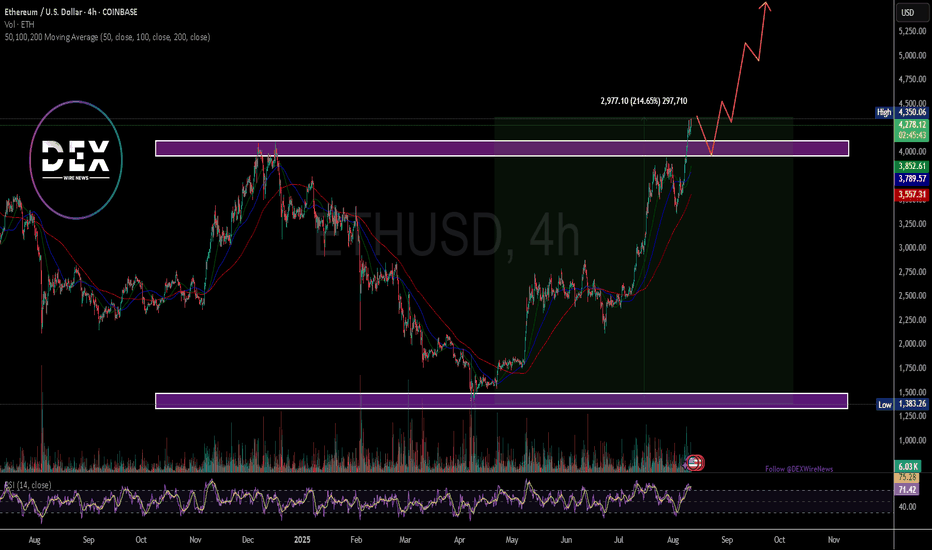

Breaking: Ethereum Is Set To Reclaim the $5k Price Pivot The price of the notable Altcoin- Ethereum ( CRYPTOCAP:ETH ) is set to reclaim the $5k resistance amidst growing interest and buying momentum.

For the past 3 months Ethereum ( CRYPTOCAP:ETH ) spiked 200+% breaking out from a cup and handle pattern amidst growing interest ikn the Ethereum chain.

Crypto Pundits on X, LinkedIn and Discord envisage the influx of memecoins on the Ethereum ( CRYPTOCAP:ETH ) chain- while most skeptics think the layer 1 blockchain is dead, Ethereum's sojourn to the $5k pivot is just days away as popular folks like Eric Trump the son of the present president of USA hints on investor's to buy Ethereum's dip.

As of the time of writing, CRYPTOCAP:ETH is up 0.58% already breaking the $4k resistance trading at $4276. With the Relative strength Index (RSI) at 71, CRYPTOCAP:ETH is on the verge of reaching overbought region. CRYPTOCAP:ETH might experience a respite before picking momentum up.

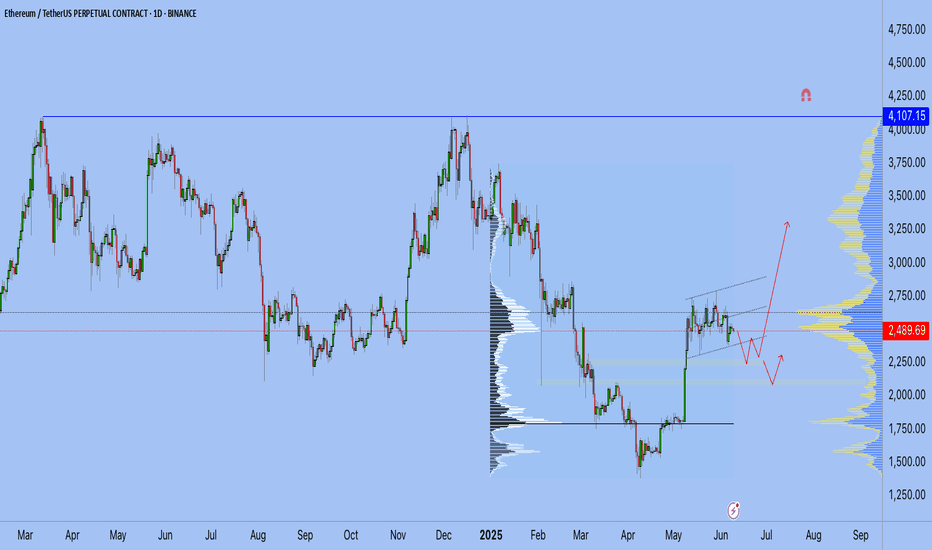

D-ETH

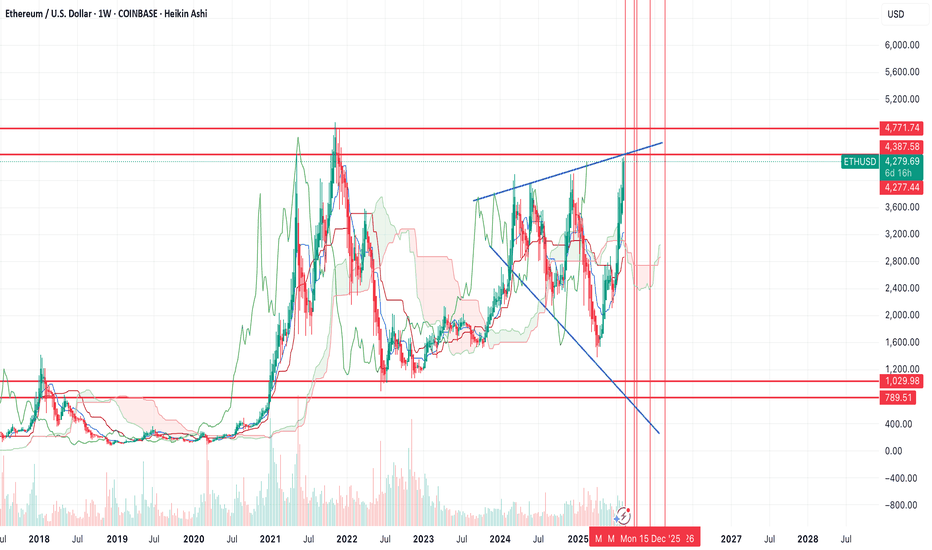

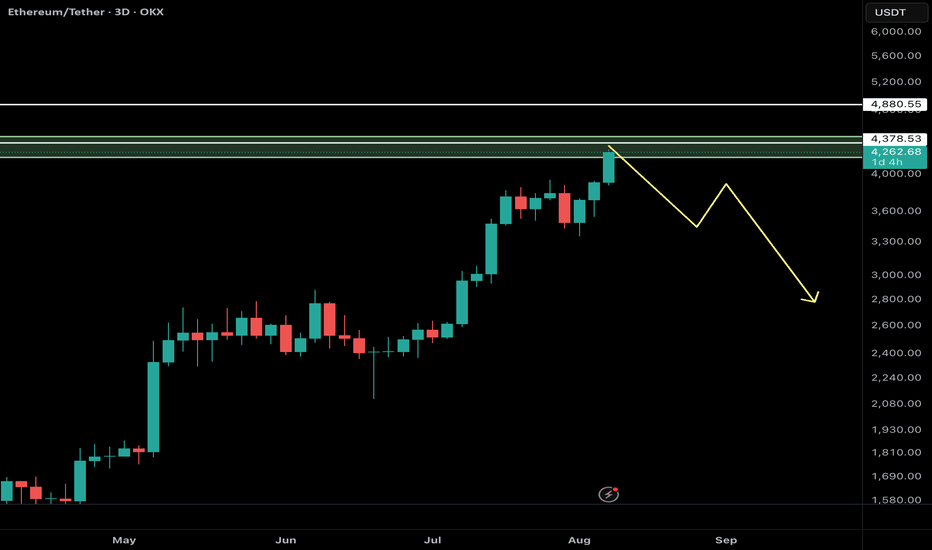

Was that it for $ETH this year?ETH just tapped the most important level to the upside $4300, and unless it can flip the $4387ish as support and continue higher, I think that's likely it for the year. Needs to take out the top resistance to be in a full bull trend.

I'm very bullish on ETH over the long term, however, in the short term the market looks extended here and I think we can see a major correction.

Will people longing here be stuck buying the highs like they were in Dec 2024 when everyone thought we were going to new highs? TBD. But I think they might be.

Here's why:

1. I think BTC has topped in the short term . If this corrects significantly, it's going to take all of crypto with it.

2. The reason why I think BTC miners haven't really run yet, is because the overall crypto market isn't bullish yet . We need to flip the $1.2T level on the chart for the entire crypto market to be in a bull trend.

3. The charts all look very similar to how they did right before the covid drop. I don't know what causes a large move down, but I can't ignore the signs.

If you're bullish here, you want to see the $4300 level get flipped as support. However, I think it's possible that we can see the lower supports get tagged before we see the resistances get taken out. Here is my long term chart of ETH (I think we go up to $18k+).

If you don't agree, all good, keep doing your thing.

Just want to provide an alternative perspective to the bullish narrative here because it seems like the entire market believes the exact same outcome is likely.

Also note: I don't plan on shorting ETH - I do not short the crypto market - I only aim to buy lower levels.

Good luck from here on out!

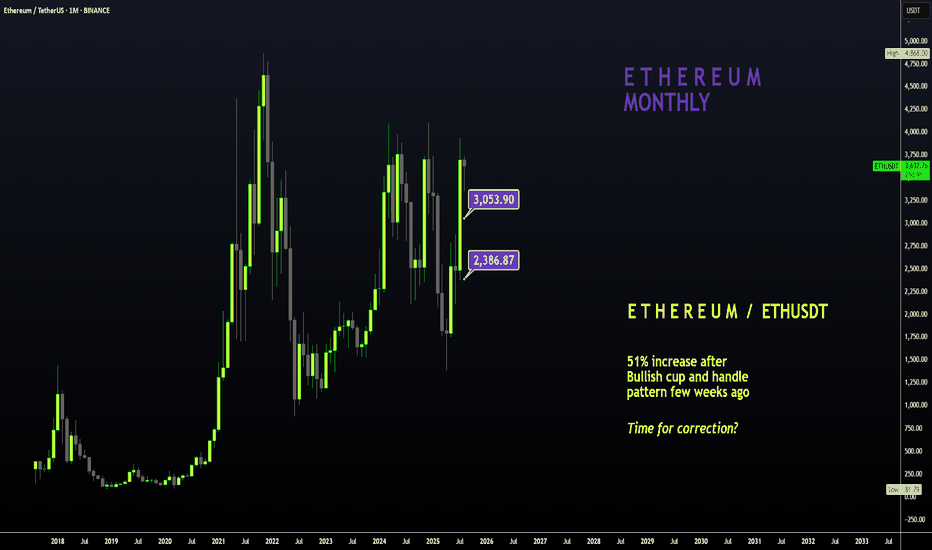

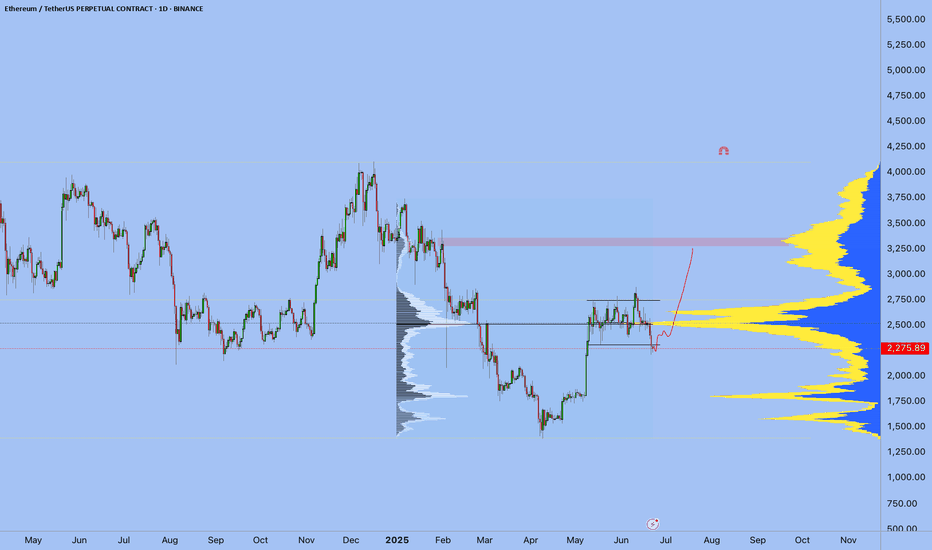

ETH | NEW ATH or DUMP ?Ethereum recently peaked at $3900. And allthough this is not a new ATH (close by a few hundred dollars), it is a local high for the year.

My last update was on an inverse Head and Shoulders pattern on ETH, which has since increased over 50%:

(The original idea here:)

The question now, is what's next for ETH - further increase, or are the increases over for the near term and is a correction more likely?

I'm going to say that the increases for ETH are over for now. This is because we correction is most definitely due after such a large increase in a fairly short timeframe. I'm not saying we're heading into a full out bearish cycle, but a 20-25% correction would be most normal at this point.

Additionally, XRP has also made it's peak and lost the high, now trading just under $3. This is a strong sign that the alts have likely already rallied, since XRP used to be the last to increase (if it increased at all, historically. (Thanks Jedd).

I was very lucky to call that top here:

Either way, buyers may use this correction to scoop up on smaller alts over the next few weeks. This ultimately depends on whether the market has ONE MORE pump, and if the correction will bounce back from a 20-25% pullback.

_________________

BINANCE:ETHUSDT

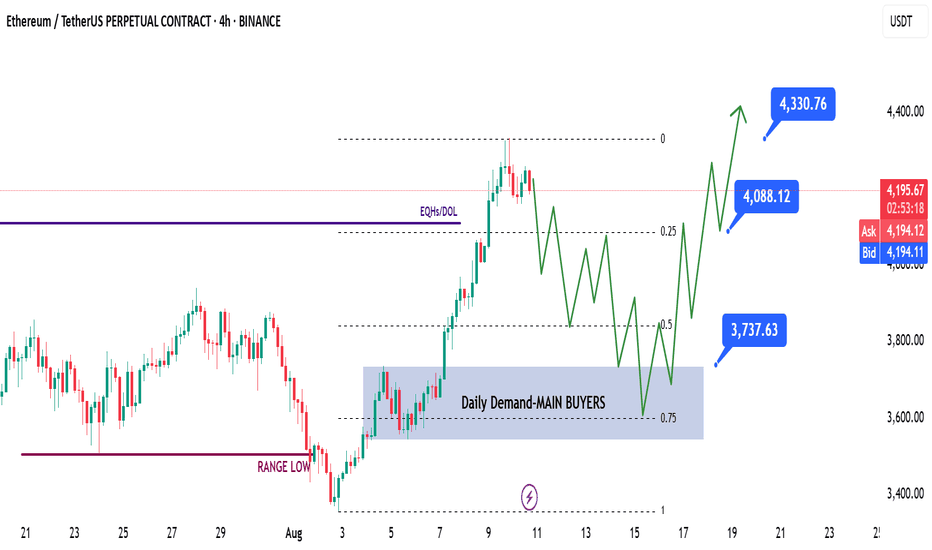

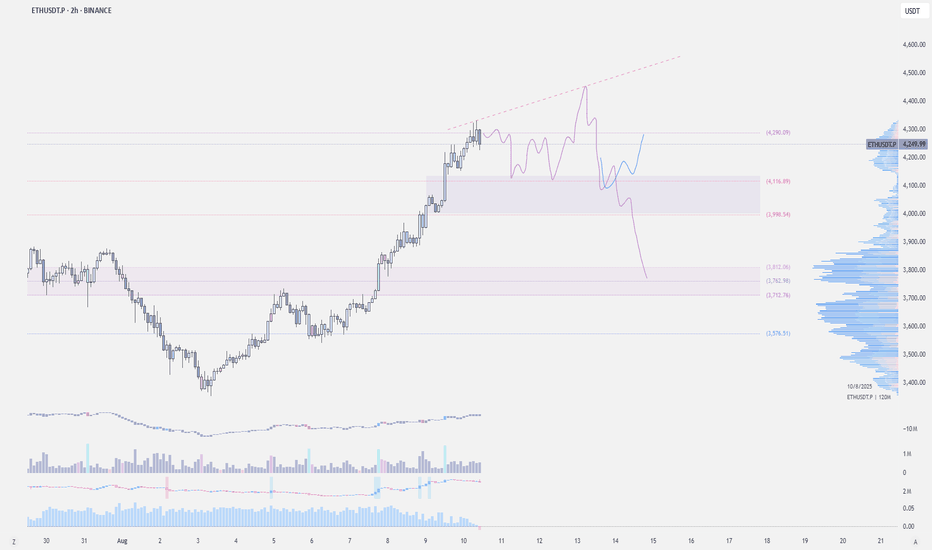

ETH | Swing Long IdeaETH | Swing Long Idea

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increased risk appetite across global markets are creating favorable conditions for further upside in crypto assets.

📈 Technical Analysis

Price has run the HTF liquidity level at $4100.

While the breakout above $4100 was aggressive, it appears price may require additional liquidity before pushing higher.

This idea focuses on a possible ETH retracement and continuation pattern over the coming days to weeks.

📌 Game Plan

If a deep retracement occurs, I’ll be watching the 0.5 Fibonacci discount zone and the 0.75 retracement level for optimal entries.

Key focus: daily demand zone at $3750 — ideally aligned with the 0.75 retracement.

I won’t wait for an exact touch of the 0.75 level; instead, I’ll watch for strength and a clear break of structure to trigger entries.

🎯 Setup Trigger

Look for a 12H–4H break of structure shift after the daily demand zone at $3750 is hit.

📋 Trade Management

Stoploss: 12H–4H swing low that caused the break of structure

Targets:

TP1: $4088

TP2: $4330

TP3: $5000 (possible swing point)

Will trail stops aggressively to secure profits as price moves in my favor.

💬 Like & follow if you found this breakdown helpful — more setups coming soon!

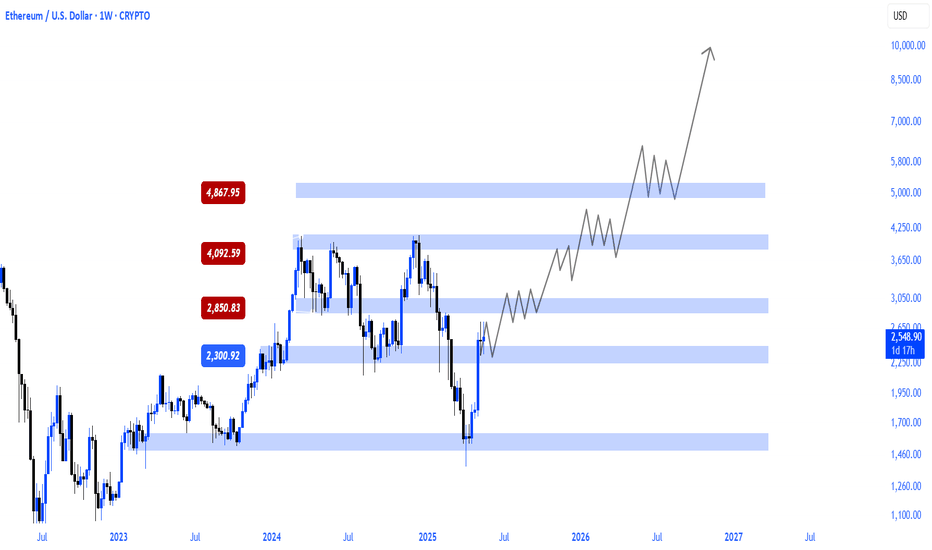

ETH update 9.06.2025Hello everyone, many of you asked me to publish my vision for ETH.

Here you go!

I believe that the previous impulse movement was only the first upward movement, and now we are in a sideways correction movement — call it what you will, but the fact is that the exit from this flat will be upward.

1. End of the year

2. ETH is accumulating on the Onchain

3. Liquidity overflow from BTC can be seen on the ETHBTC chart, and the overflow began at the very bottom

4. What else can large conservative players accumulate?

5. We are going after liquidity from above and should break 4100 by September

Best Regards EXCAVO

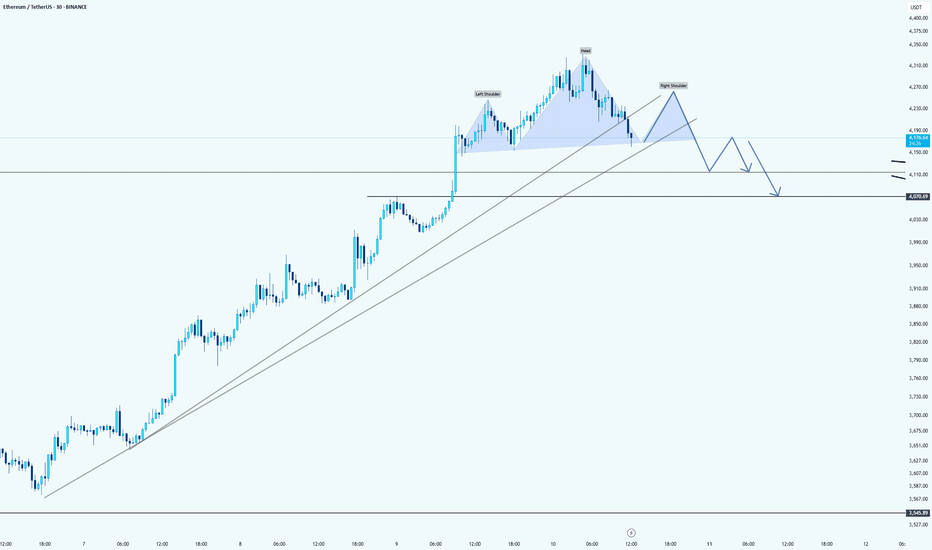

Ethereum: just a little bit correction hereHello guys!

Chart Pattern: Head and Shoulders

The chart shows a Head and Shoulders pattern forming on the Ethereum price action. The trendline drawn across the neckline of the pattern is a crucial support level to monitor.

Potential Breakdown:

If Ethereum fails to hold above the neckline (around $4,130), we might see a pullback and potentially a breakdown from the pattern. This suggests a bearish outlook for ETH in the short term.

Target:

A possible target for this bearish move could be around th e $4,050 - $4,100 range , where the price could find support from the upward trendline (in light gray). The price may retrace towards these levels before deciding whether it will continue higher or confirm further downside.

Uptrend Support:

Ethereum remains in an overall uptrend, as indicated by the sloping upward trendline beneath the price action. If the price pulls back to this trendline and holds, there could still be bullish potential.

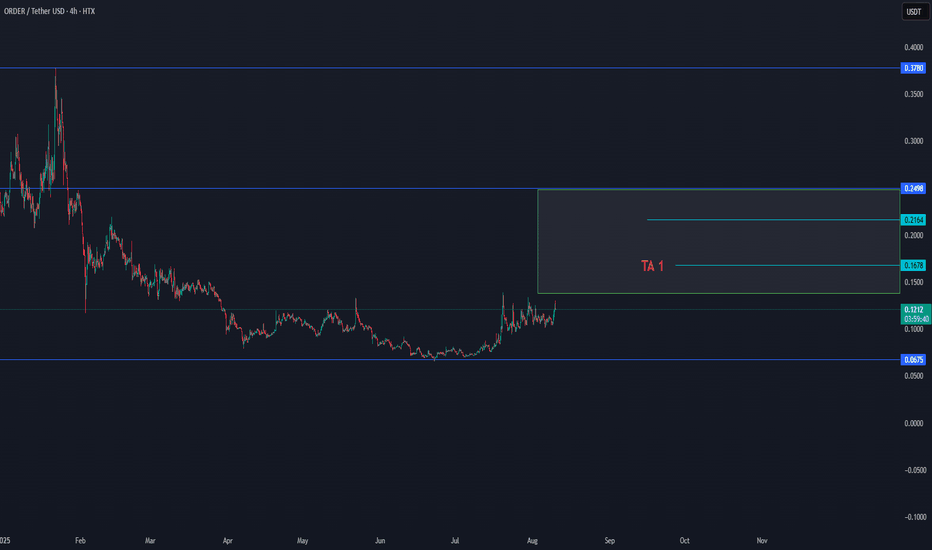

ORDER/USDT NEW TREND VOLUMEThe order shows a new trend in volume, which can be confirmed in the coming hours.

We will follow this coin for the coming confirmation flow.

Order/usdt started from $0,1072 with a new confirmed volume, which has now paused since $0,1214. The trend can stay here for a time, stable and build new uptrend volume to up $0,16 as the first target. As long as the coin stays up $0,09, the trend is healthy.

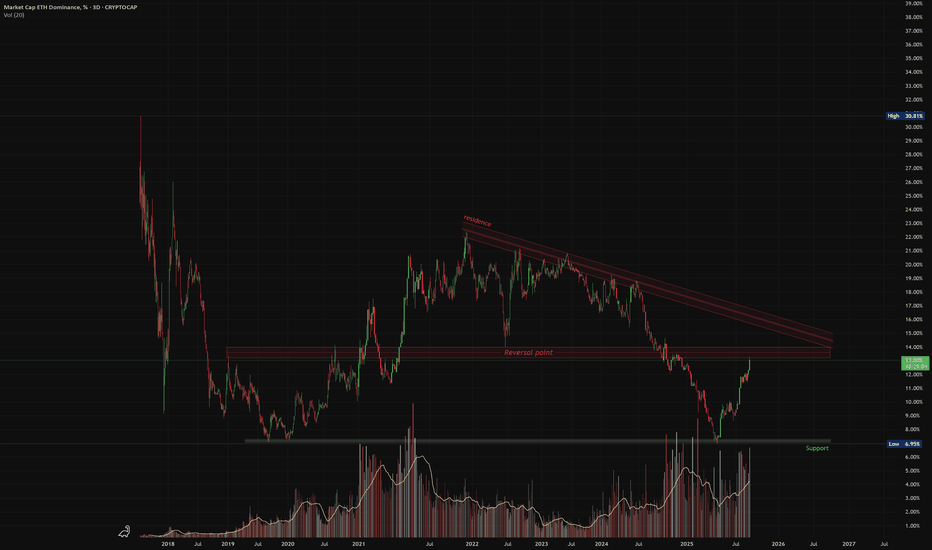

ETH Dominance – Possible Pullback at Key ResistancePair: ETH Market Cap Dominance (%)

Timeframe: 3D

Structure: Descending Trendline + Horizontal Resistance

Volume: Rising on approach to resistance

📉 What’s happening?

ETH dominance has rallied from support and is now approaching a historically strong resistance zone marked by multiple rejection points. Price is also near the long-term descending trendline, which has acted as a ceiling for over a year.

🔻 Caution Zone:

Resistance between 18.5%–19.2%

Historical reversal area (marked as “Reversal Point”)

📌 Pullback Triggers:

Bearish candle formation at resistance

Declining volume on further push up

Failure to close above the descending trendline

Bias: Short-term pullback likely unless ETH dominance breaks and closes above resistance with strong volume.

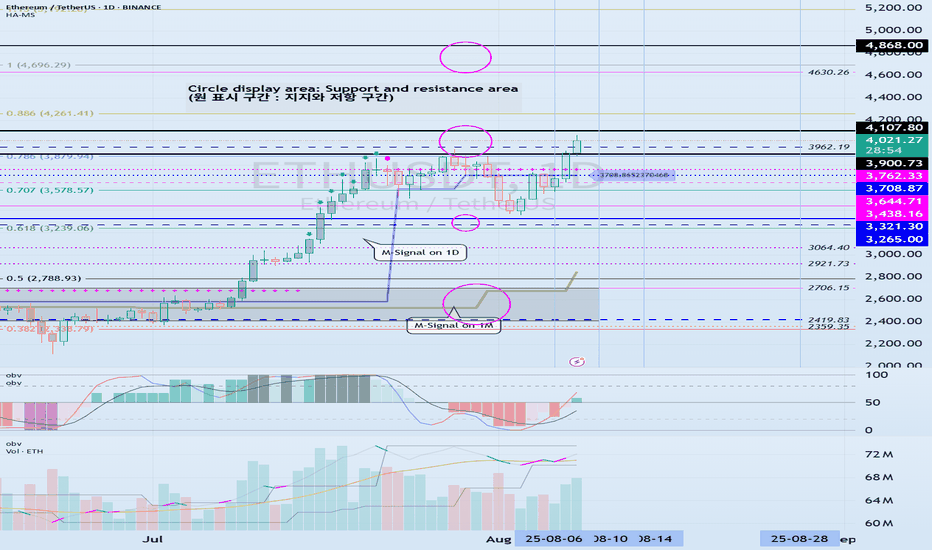

The key is whether the price can hold above 3900.73-4107.80

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

(ETHUSDT 1D chart)

This period of volatility is expected to last from around August 6th to 14th (maximum from August 5th to 15th).

The key question is whether the price can find support and rise above the 3900.73-4107.80 range after this period of volatility.

The next period of volatility is expected to occur around August 28th, so we need to see if the price can hold until then.

If the price declines, we need to check for support around the HA-High ~ DOM (60) range of 3708.87-3762.33.

If not, there's a chance it could fall below 3265.0-3321.30.

-

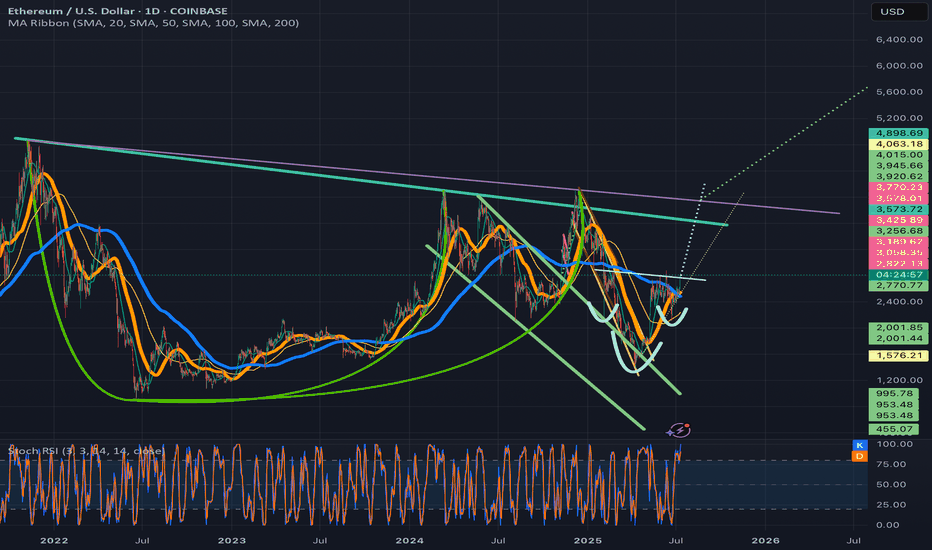

(1M Chart)

The TC (Trend Check) indicator has risen above 0, suggesting a high possibility of further upside.

Therefore, the key point to watch is whether it can rise above the 4630.26-4868.0 range.

For an uptrend to continue,

- The StochRSI indicator must remain upward with K > D.

(If possible, it's best to avoid K entering the overbought zone.)

- The On-Board Volume (OBV) indicator of the Low Line ~ High Line channel must remain upward.

(If possible, it's best to maintain OBV > OBVEMA.)

- The TC (Trend Check) indicator must remain upward.

(If possible, it should remain above 0.)

If the above conditions are met, the uptrend is likely to continue.

To sustain an uptrend by breaking above key support and resistance levels,

- The StochRSI indicator must remain below the overbought zone and remain above D.

- The On-Board Volume (OBV) indicator of the Low Line ~ High Line channel must rise above the High Line and remain upward.

- The TC (Trend Check) indicator must remain upward. (If possible, it should remain above the 0 point.)

When the above conditions are met, there is a high probability that the price will rise after breaking above important support and resistance levels.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more in detail when the bear market begins.

------------------------------------------------------

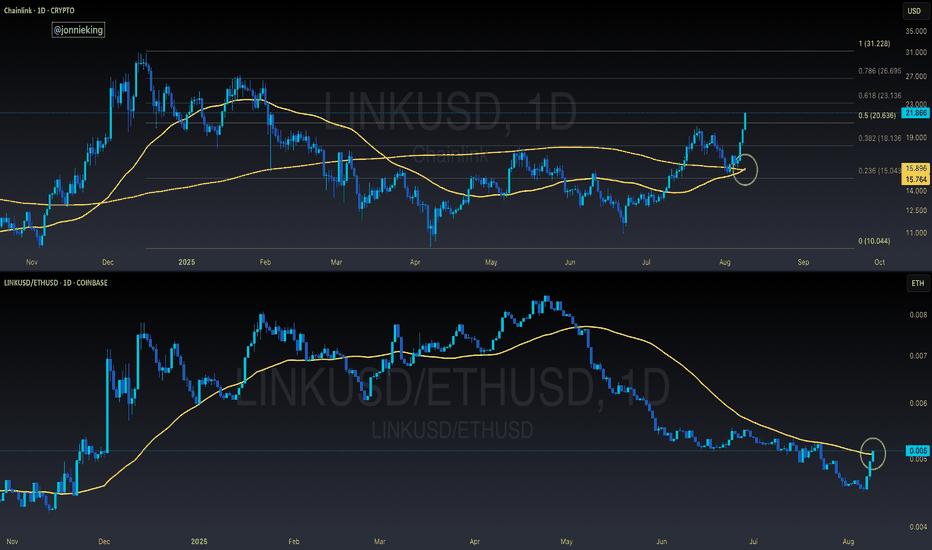

$LINK Golden Cross Confirmed on DailyChainlink is looking extremely bullish here.

Closed above the 50% Gann Level and just had a GOLDEN CROSS.

Normally we see a pullback once this happens, but no sign of slowing down yet from CRYPTOCAP:LINK

Also worth noting LINK is breaking above the 50DMA against ETH.

This was added confirmation for the breakout with ETH / BTC.

Remember the rotation for Alt Season:

BTC > ETH > LARGE CAPS (pending) > Mid Caps > Micro Caps

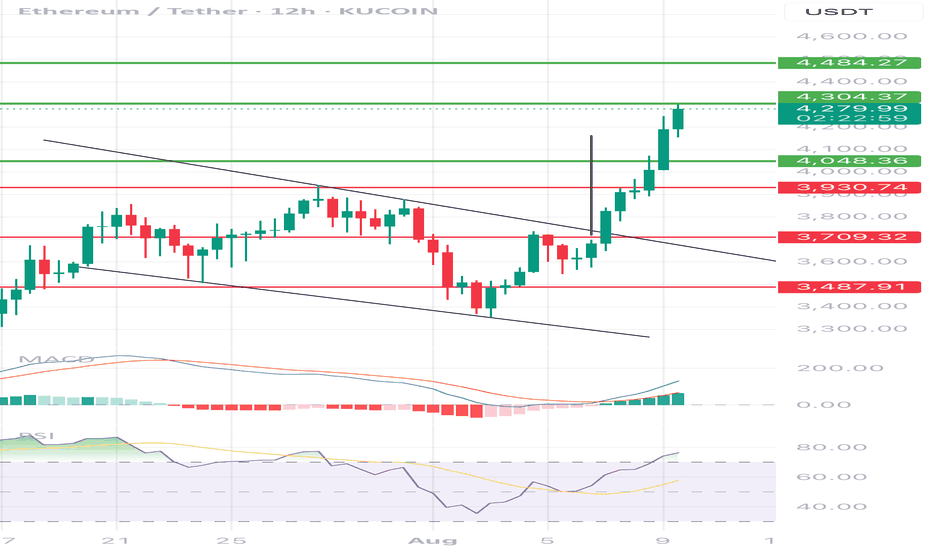

ETHUSDT 12H chart uptrend1. Breaking out of the downward channel

• Black lines show an earlier inheritance channel.

• The course struck the mountain and it is quite dynamically, which is a strong upward signal.

2. Current price

• ETH is around USD 4,274, just below the resistance at USD 4,304.

• Another resistance is 4,484 USD (potential target if the upward trend persists).

3. Support

• The next support: 4,048 USD - if the course is corrected, then there may be the first "test".

• stronger support below: USD 3,930, $ 3,709, $ 3,487.

4. Indicators

• MacD: MacD line strongly above the signal, the histogram is growing - confirms the upward trend.

• RSI: around 75 - close to the purchase zone, which can mean a short -term correction, but with a strong RSI trend can stay high for a long time.

5. Scenarios

• Bull: Punction and maintenance above USD 4,304 can open the road to 4,484 USD and possibly higher.

• Bear: rejection from USD 4,304 and a descent below 4,048 USD may cause a deeper correction in the direction of $ 3,930 or even $ 3,709.

📌 The short -term market is warmed up, so a small pullback is possible, but the structure looks very bullshit after this burst from the downward channel.

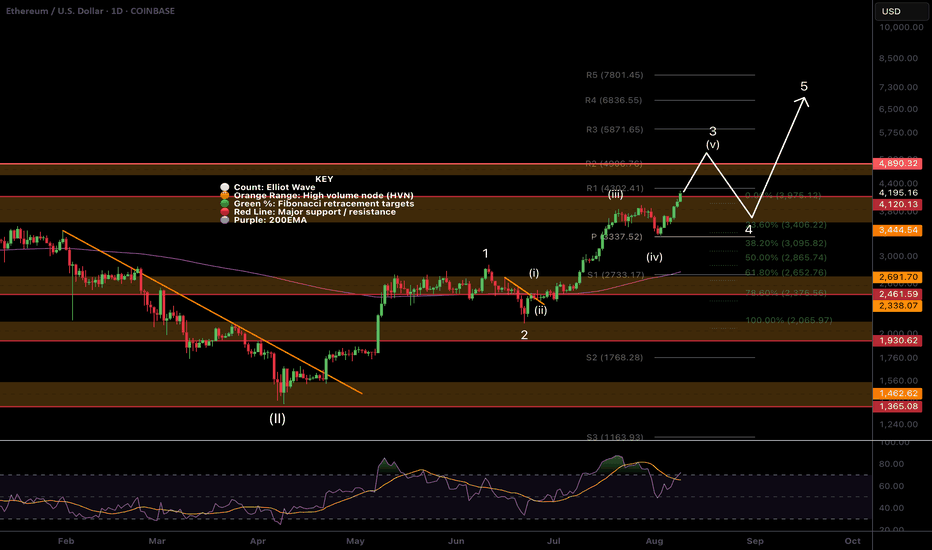

$ETH All Time High Soon?CRYPTOCAP:ETH wave 3 is still underway and its the only news you've been hearing about for 2 weeks! The hype is real making the potential top of this move much closer as institutions will be selling into the FOMO soon. There is no better way to trap newbies than a poke above all time high before a savage retracement!

Retracement targets are the daily pivot and rising 200EMA at $3337 the .382 Fibonacci retracement from the wave 2 bottom, just above the weekly pivot point. Daily RSI has huge bearish divergence.

Secondary retracement targets are the weekly 200EMA and S1 weekly pivot sitting at $2250 which could present an incredible buying opportunity before the real alt season!

Analysis is invalidated below $2122

New long signals are building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very good profits lately in these markets!

Safe trading

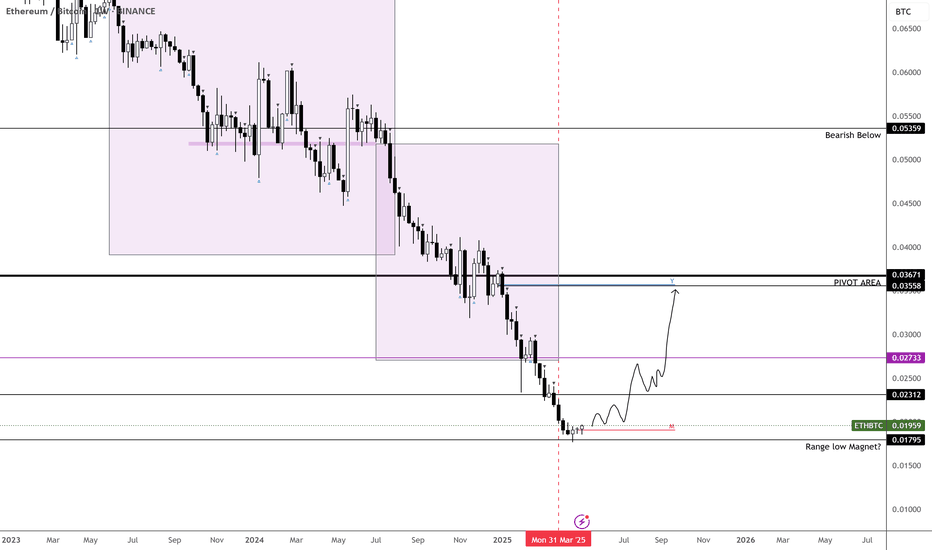

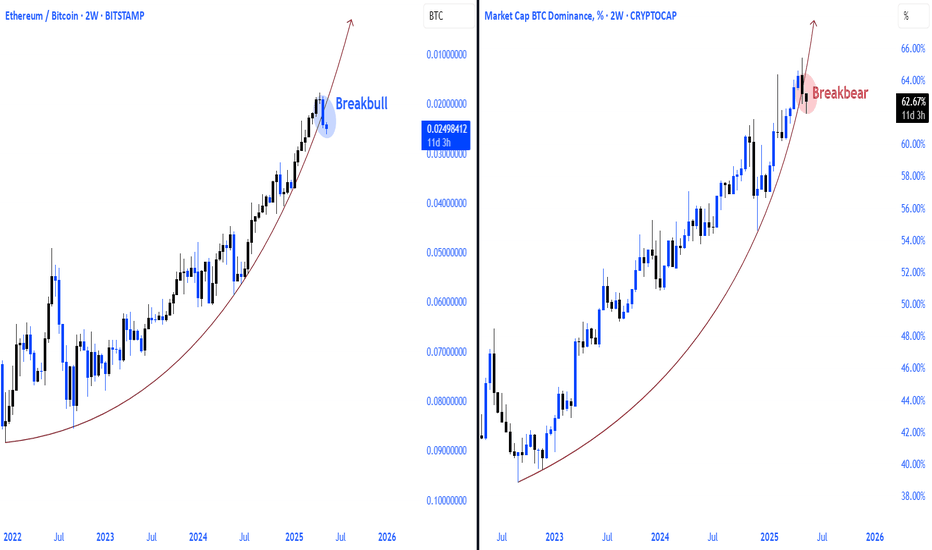

ETHBTC – Bottom Likely In!Finally stepping in to say it—ETHBTC has likely bottomed.

April marked the final month of its bearish phase, and it just tapped the impulse zone from the last major move, which also lines up with a key range low we haven’t seen since December 2019.

The weekly is starting to show early signs of strength, adding weight to this being a pivotal area.

From a risk/reward standpoint, this is arguably the best BINANCE:ETHBTC setup in a long time.

Time to act accordingly—this could be the moment many have been waiting for. I expect BTC dominance to give alts some room over the next couple of weeks. The real test comes in July.

MARKETSCOM:ETHEREUM BINANCE:ETHUSDT

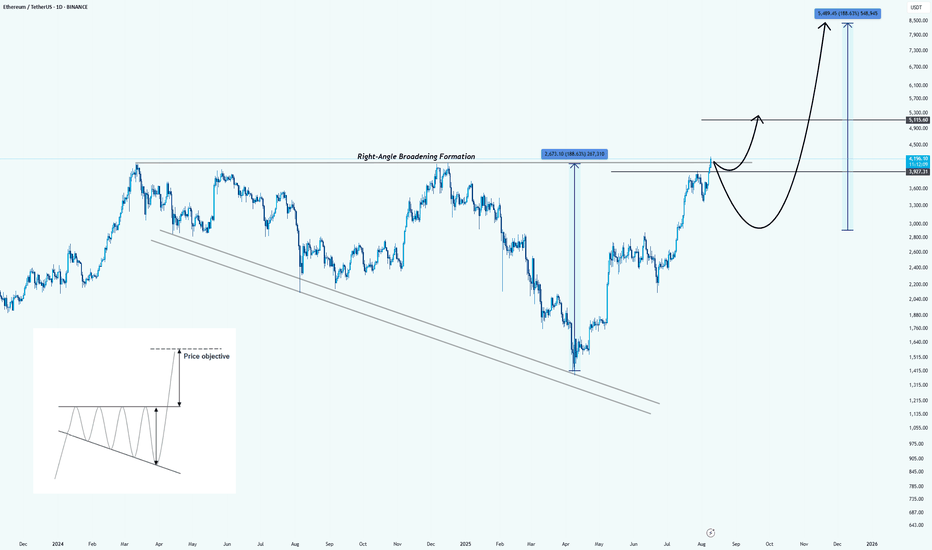

Ethereum: Formed a Right-Angle Broadening FormationHello guys!

Pattern Identified:

This is a Right-Angle Broadening Formation (characterized by a flat resistance level at the top (around $4,200 – $4,300) and a rising lower trendline). It shows increasingly volatile swings upward while repeatedly testing the same ceiling.

Technical Implication:

RABFs are typically bullish continuation patterns. The flat top acts as a breakout trigger, while the rising base indicates consistently higher lows and aggressive buyer support.

Price Objective:

According to the pattern’s measured move principle, the breakout target is projected by the vertical height of the formation, added to the breakout point:

Height : $2,070

Breakout point : $4,300

Target : $6,370 (first objective)

Extended bullish run could reach $8,500 if momentum sustains.

Key Levels:

Resistance: $4,200 – $4,300 (breakout trigger)

Support: $3,700, then $3,200

First measured target: $6,370

Extended target: $8,500

Bullish Scenario:

Strong daily close above $4,300 with volume could kickstart a rapid move toward the first target, possibly with only a brief consolidation at $5,100 before continuation.

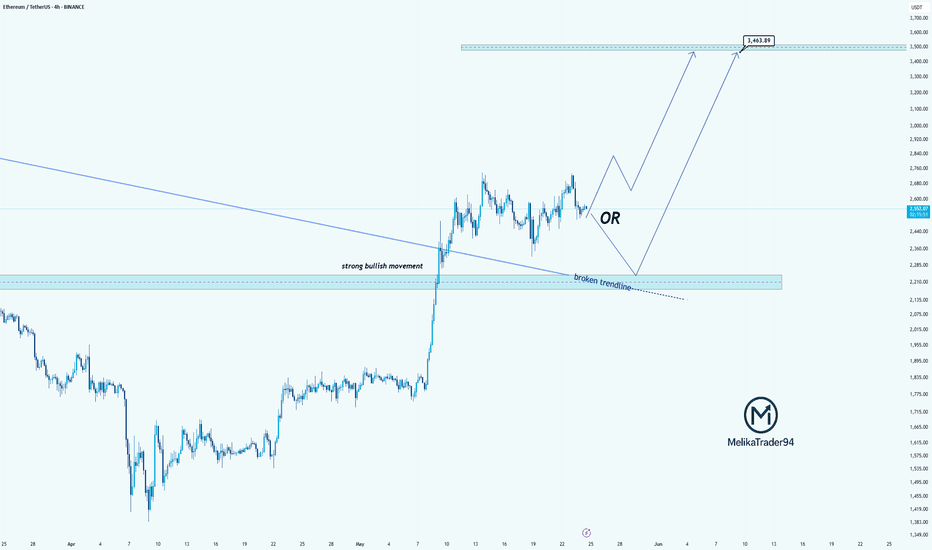

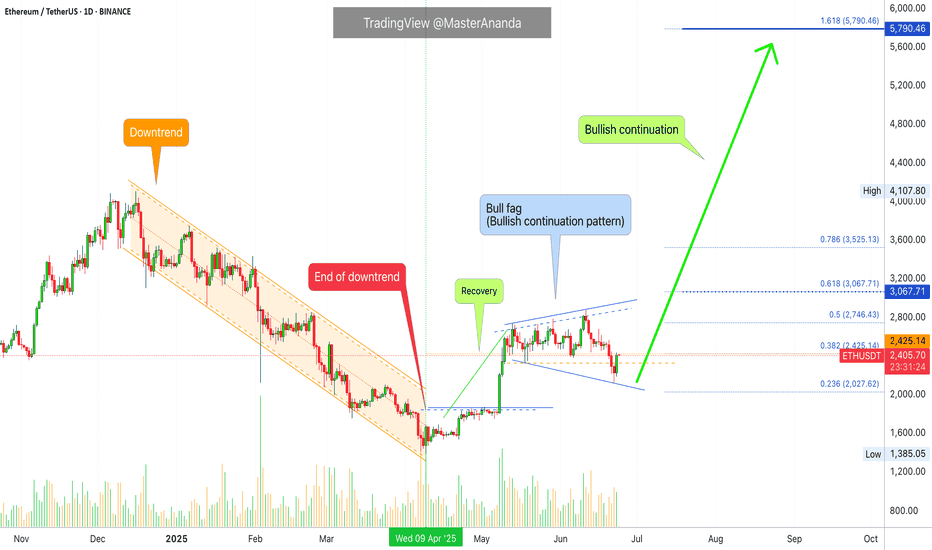

ETH Continues Bullish Momentum Above Broken TrendlineHello guys!

Ethereum has shown a strong bullish rally, breaking through a long-standing descending trendline with significant momentum. Currently, price action is consolidating above the broken trendline, which may now act as a support zone.

🔹 Scenario 1 (Bullish Continuation): If ETH holds above the current range and confirms the broken trendline as support, we could see a continuation toward higher resistance levels around $3,500 and beyond.

🔹 Scenario 2 (Deeper Retest): Alternatively, a pullback toward the $2,200–$2,300 area (highlighted zone) could offer a better accumulation point before the next bullish leg resumes.

This setup suggests that as long as ETH remains above the key support levels, the bullish structure remains intact.

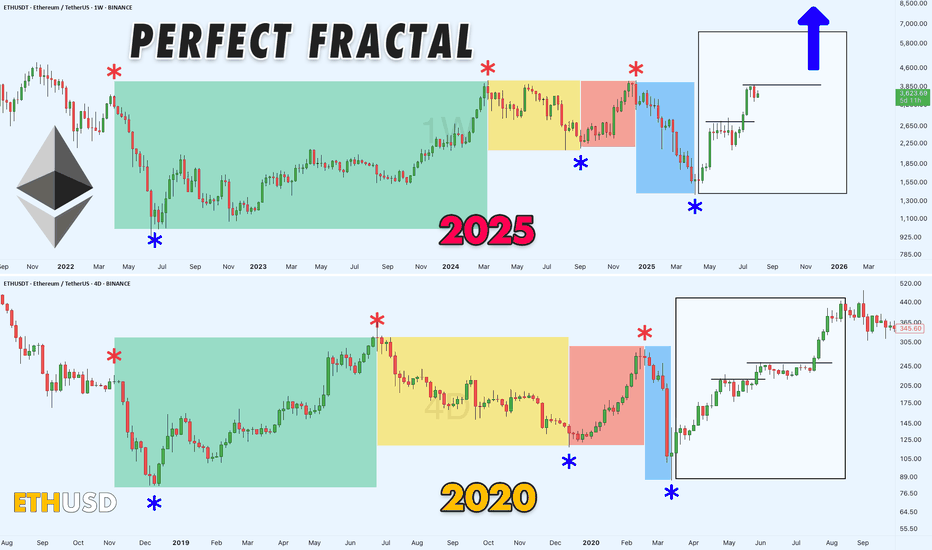

Haven't Posted in a Bit, Here's a Solid Chart for You All!Alright, been a while, but here's the deal: still no altseason in sight.

Meanwhile, ETHUSDT dropping some serious hints of a wild bull run on this fractal chart. It s got that 2020 vibe, though the timing s a tad off especially when you factor in Bitcoin s cycles.

Gonna be a blast watching this play out!

Ethereum vs Small Cap. & The 2025-26 Cryptocurrency Bull MarketThe last three days ended up being a very nice flush, a strong one but the action quickly recovered above the 18-May low.

Ethereum was trading above $2,300 since mid-May and always stayed above this level. It broke suddenly below, out of nowhere, but the action is bullish again. We can say that this was a stop-loss hunt event, a bear-trap and nothing more or else we would see a continuation of the bearish action rather than a strong inverse reaction, a bullish jump.

It is not only Ethereum of course that is experiencing this type of bullish action, some altcoins are going nuts. Really crazy right now producing so much momentum that people are still wondering if the market is going down... Or is it going up?

It is obviously up, just look at the 7-April low.

Ethereum hit a low of $1,385 on 7-April. The higher low yesterday ended at $2,111.

You see what I mean?

The market is ultra-bullish because the last low is so far away. It is impossible that it will be tested even less possible for it to break. Ok, so a market shakeout we agree but now that the shakeout is complete what is supposed to happen next?

Watch the smaller altcoins.

Thank you for reading.

Namaste.

Ethusd breaking above invh&sEthusd chart has a similar set upas the total2 chart, a cup and handle that is breaking up from a smaller inverse head and shoulders that will complete the handle to the cup. Ethereum actually has two potential to trendlines for its cup and handle and I wouldn’t be surprised if both are valid. The breakout target for the inverse head and shoulder pattern will take price action above both of them. Once we solidify the top trendline for the cup and handle patterns as support the breakout target for it is $7161. Ethereum just recently had a golden cross on the daily which adds to the probability the inverse head and shoulder pattern breakout will be validated. *not financial advice*