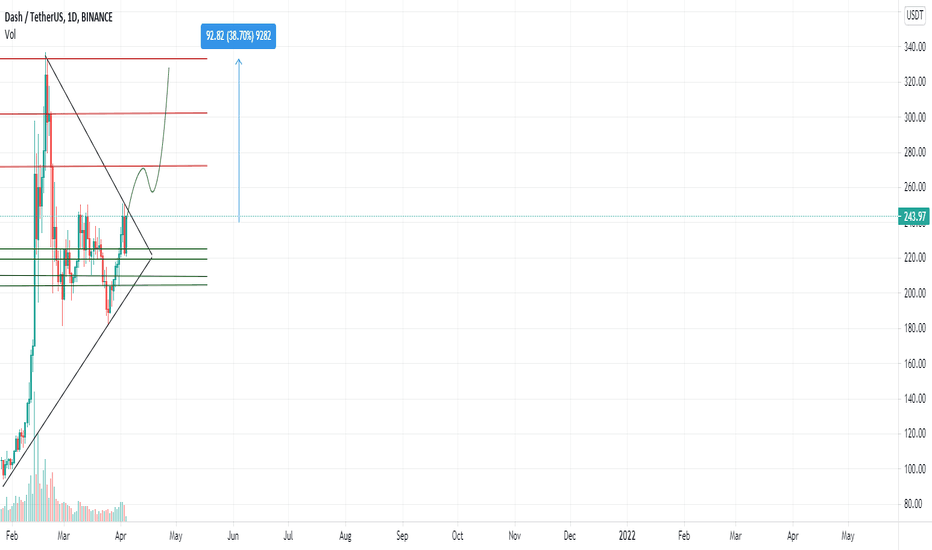

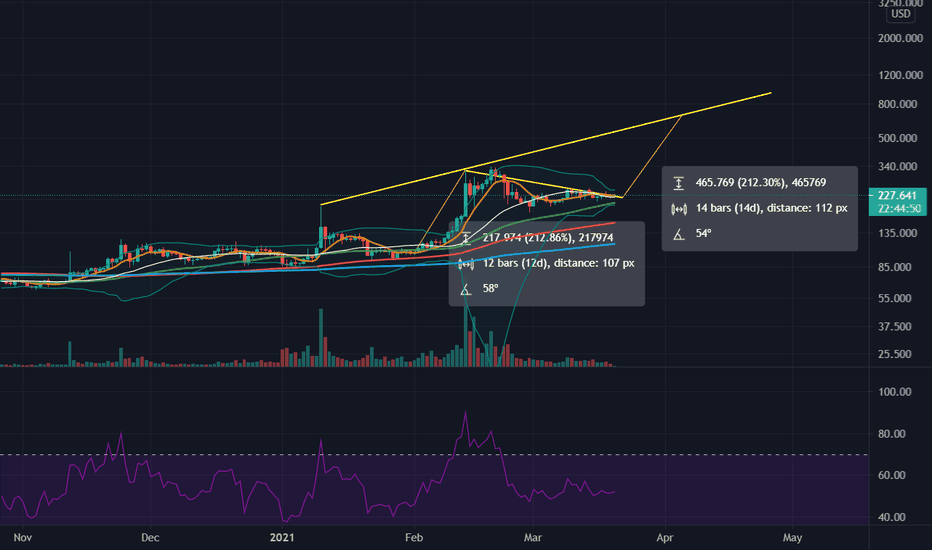

DASHUSDT

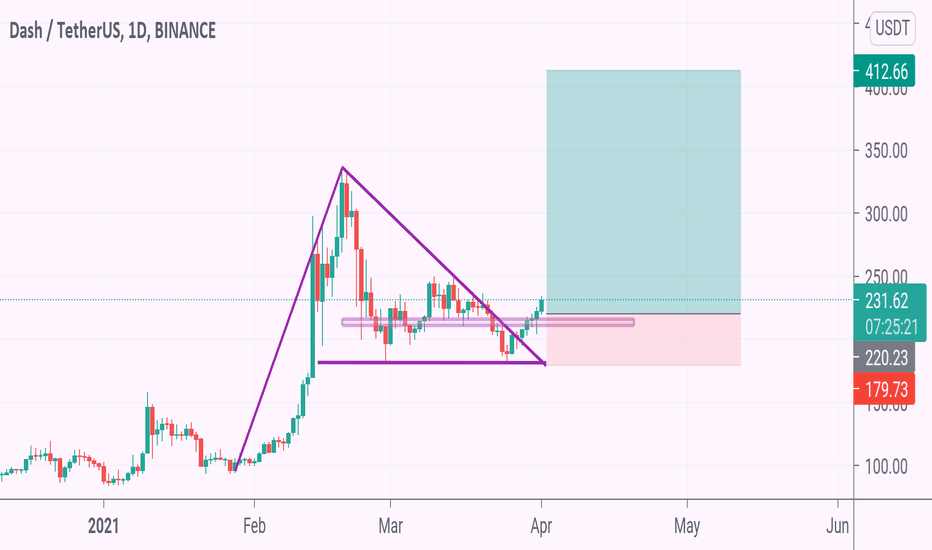

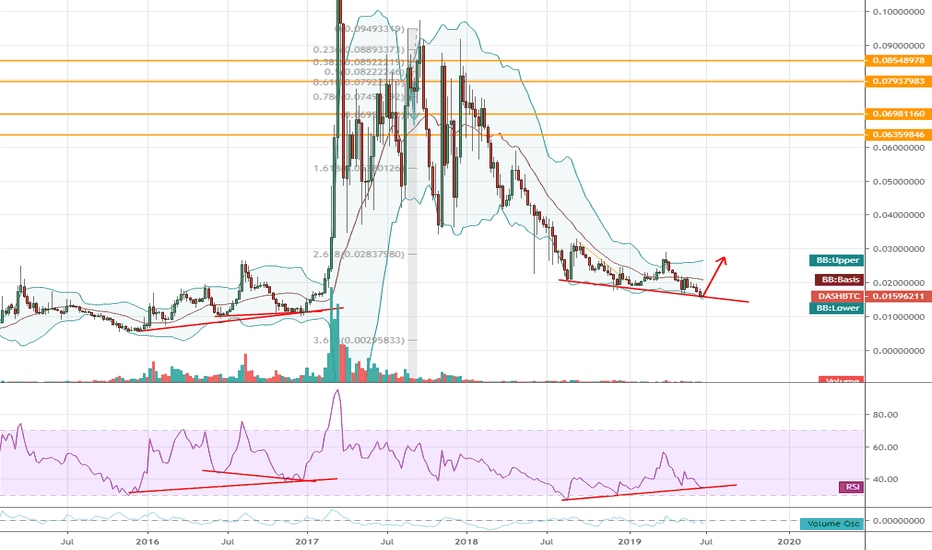

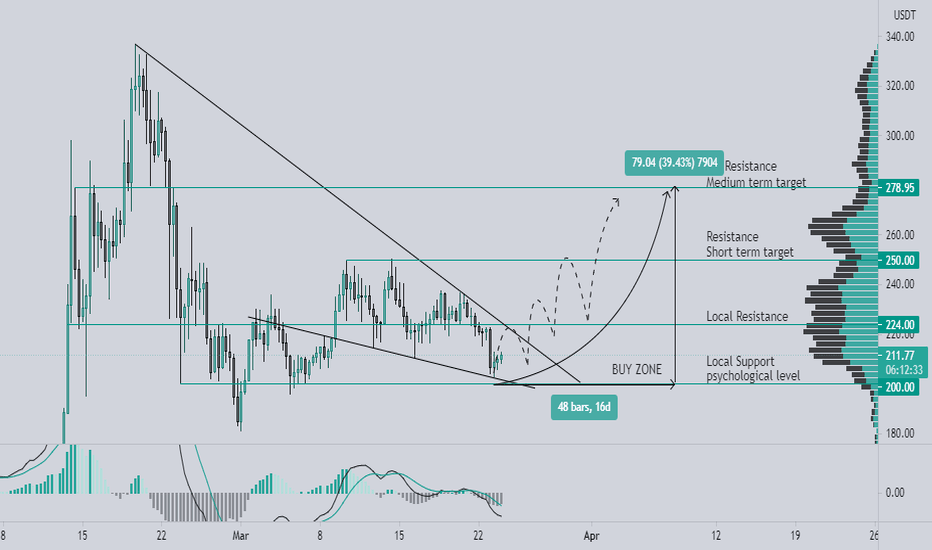

Dash Perpetual Futures Prepare for the 40 % Breakout Dash is currently Trading within a falling wedge

and rejecting at the POC on the 4HR TF .

On the 1D TF we can see clearly whats happening

after ATH was printed we are now moving between

S/R .

I anticipate that we make our way down to

print another LL with support and confluences

at the support line of the wedge with the .786 fib

and the 100 EMA and a

Volume profile match to give us a bounce off the support.

With a close outside of the Resistance for a Long and SL placed

below the last swing low for a potential 40 % gain .

This is determined by measuring the wedge opening .

As demonstrated in the chart ...

Follow and Like For More Setups and or Trading Questions

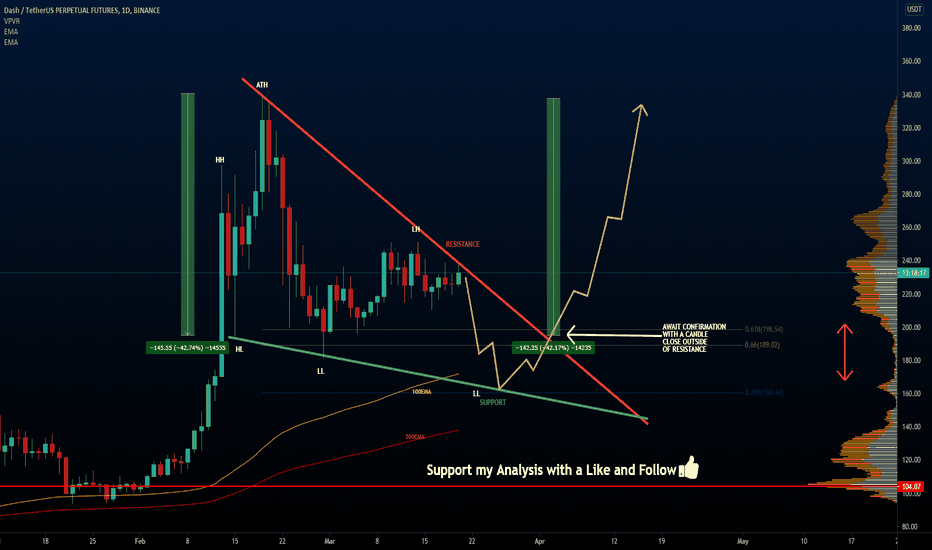

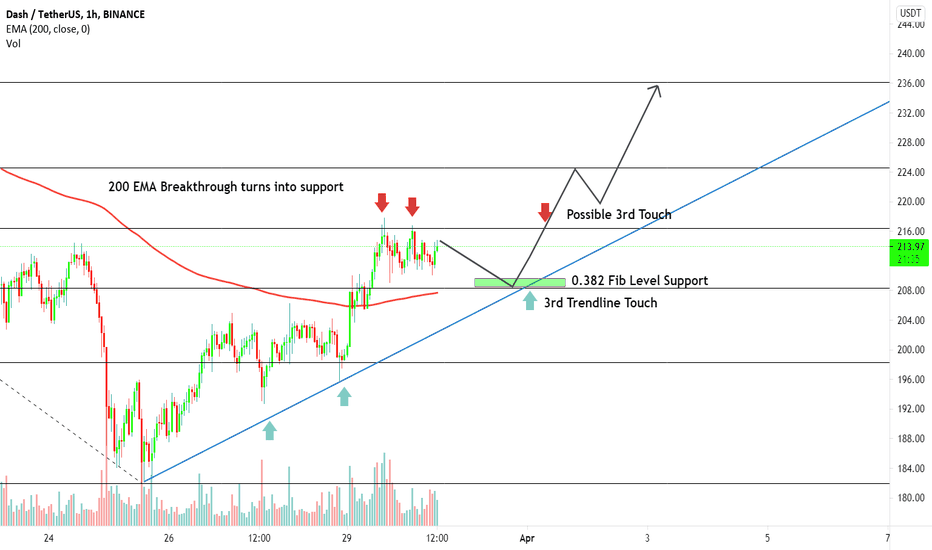

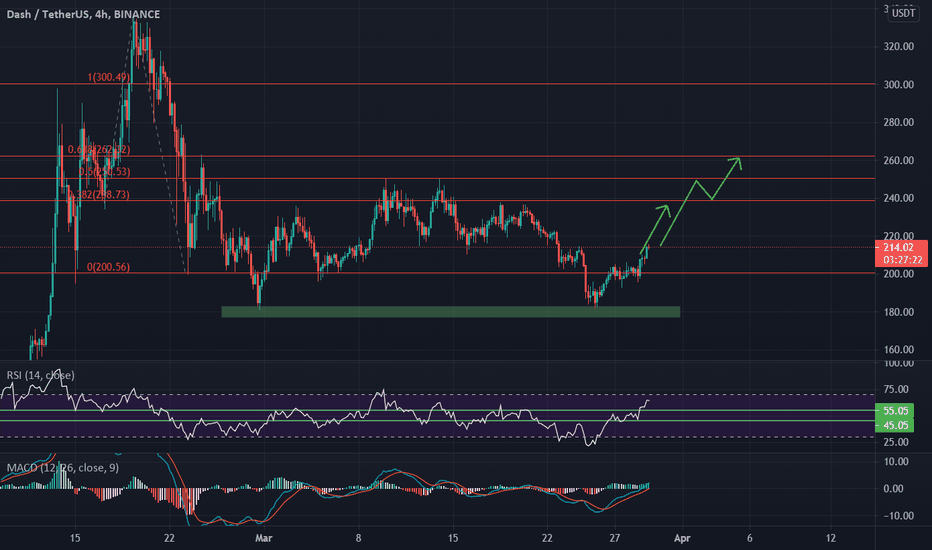

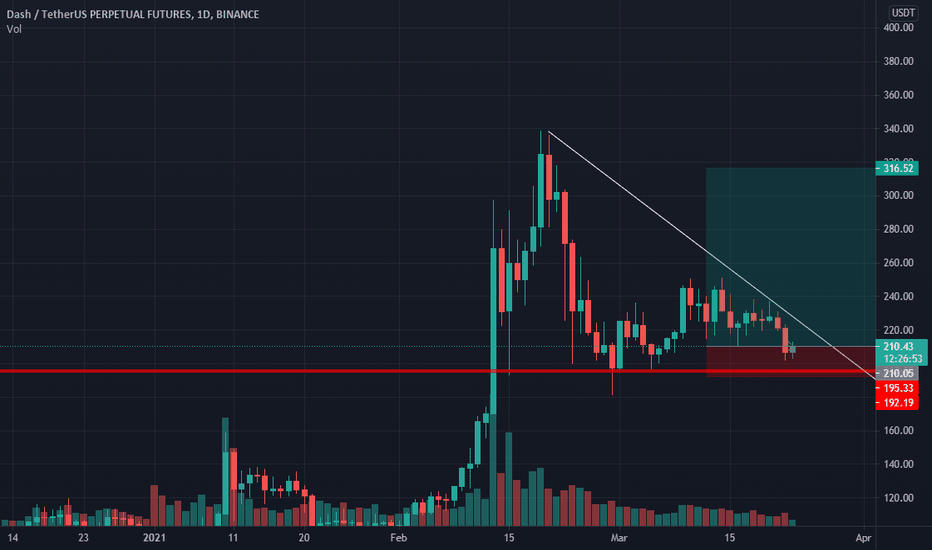

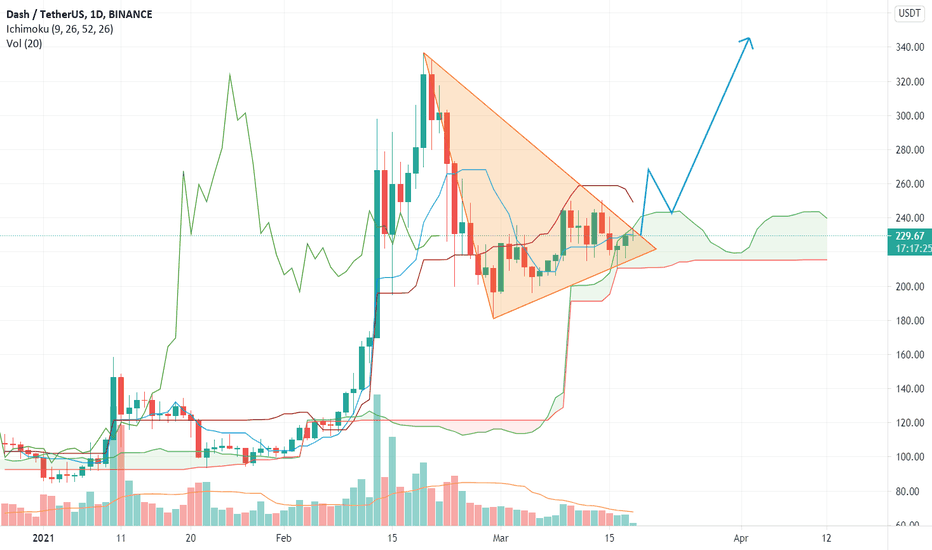

DASH/USDT - potential 42% setupHello, Traders!

DASH is consolidating in the $184 - $212 range before moving further.

Entry into the position can be sought between $204 - $212

Stop-loss can be placed under the lower boundary of the consolidation range - the level of $184

The targets are the following price levels:

$240

$260

$290

Good luck and watch out for the marekt!

P.S. This analysis is created for educational purposes only and shall not be considered financial advice

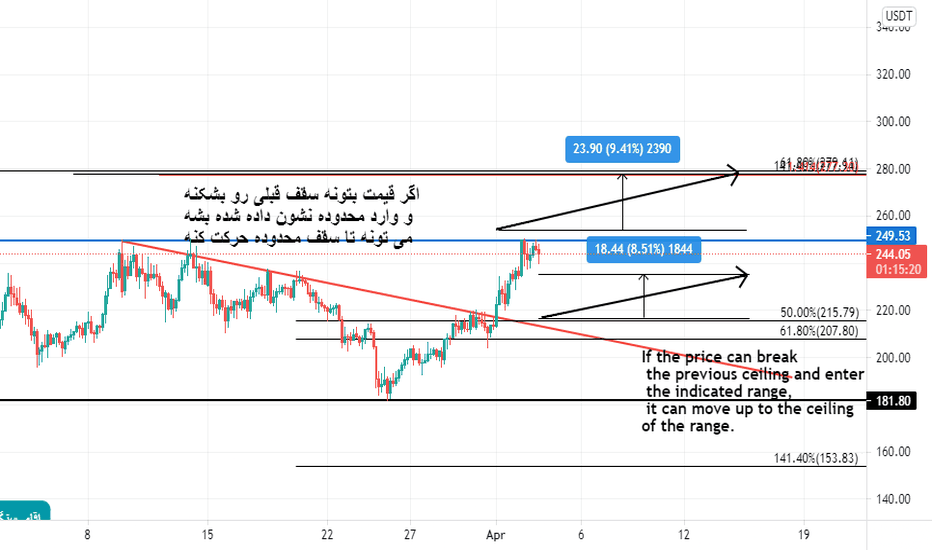

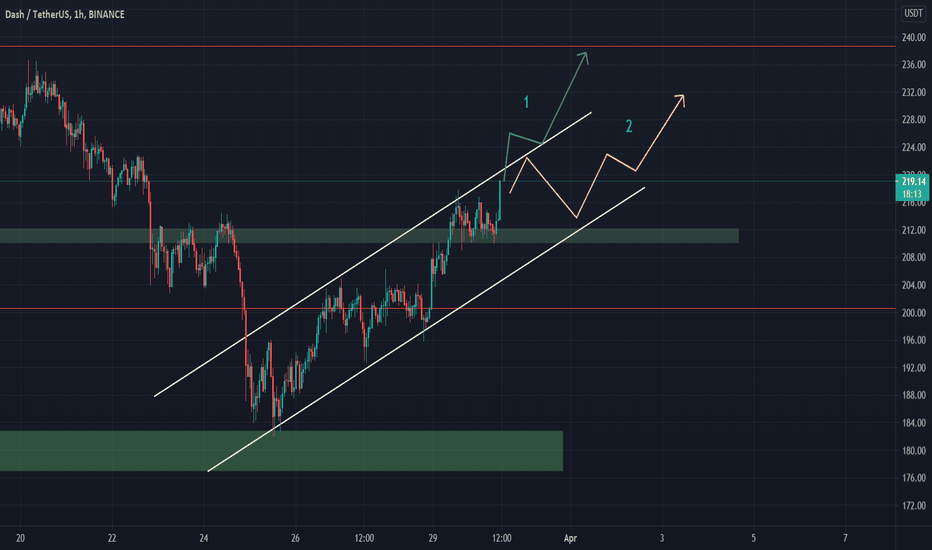

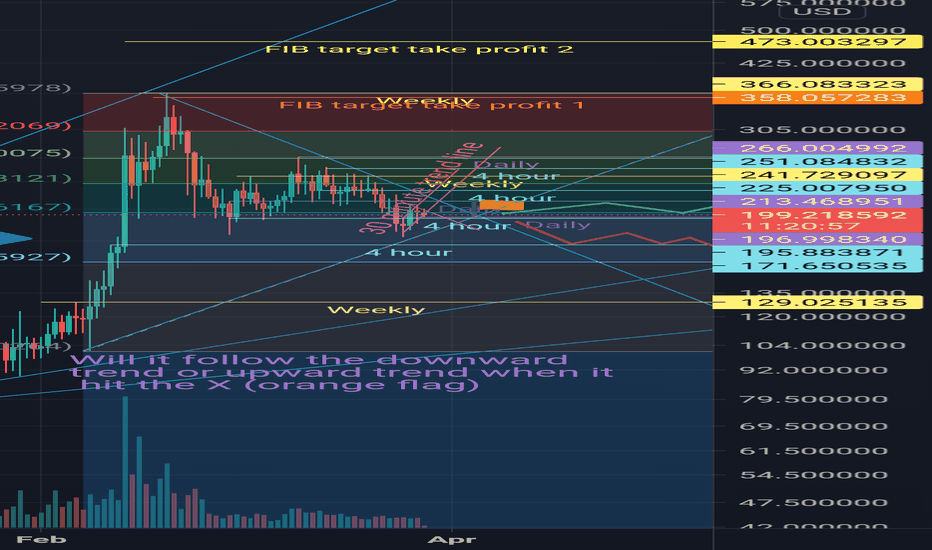

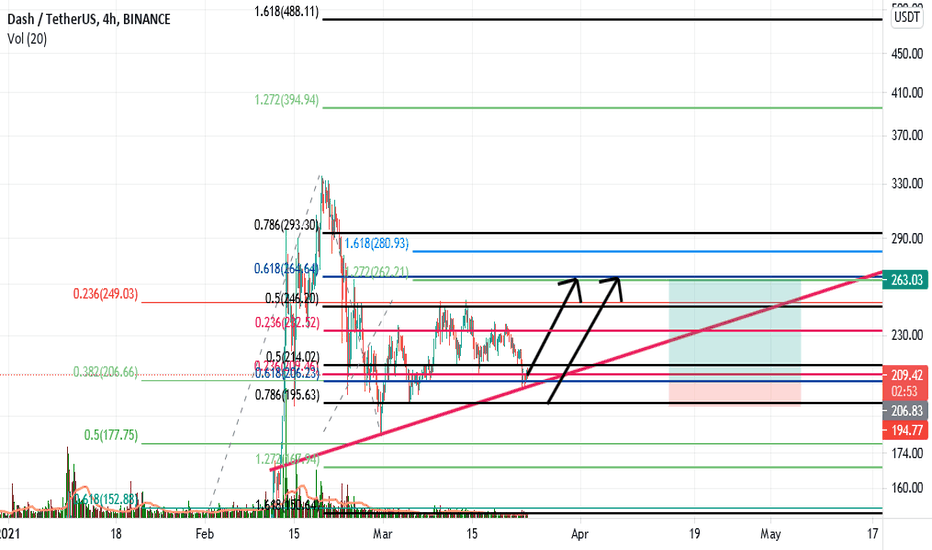

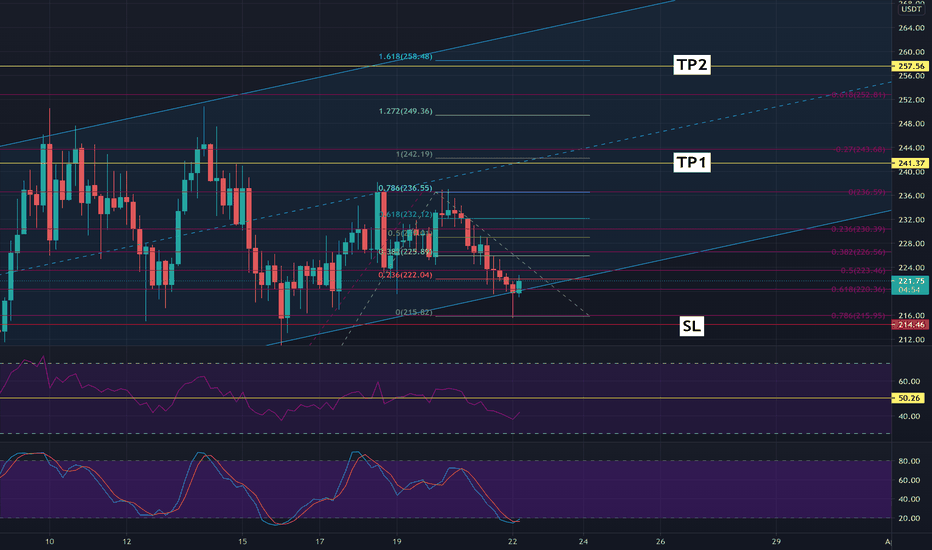

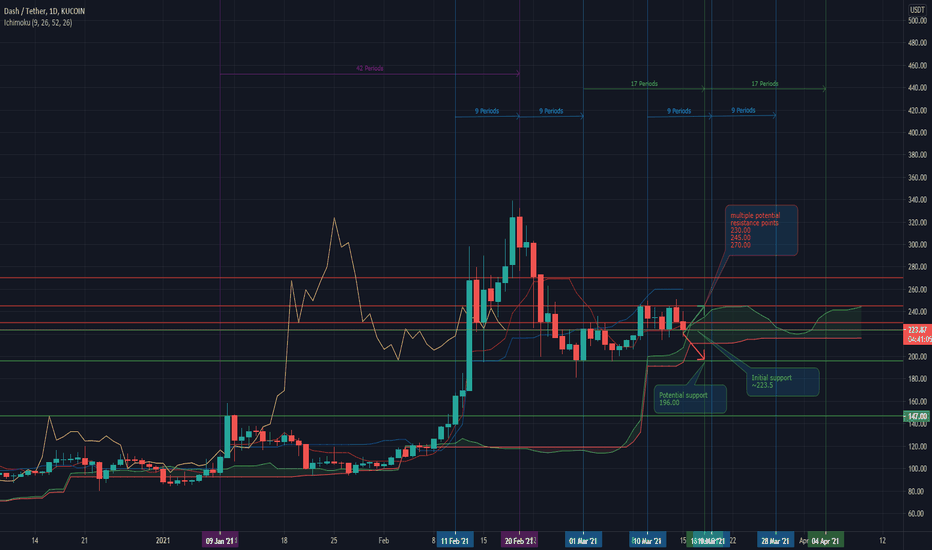

DASH on Daily. Retracements and targets.Blue trend lines, fib retracement and fib targets set on daily. 30 min purple trend lines added. Support and resistance lines set on weekly, daily, 4 hour. I see 3 different potential outcomes. If dips any further, more than likely to find support in the 0.618.

Buy in alert added.

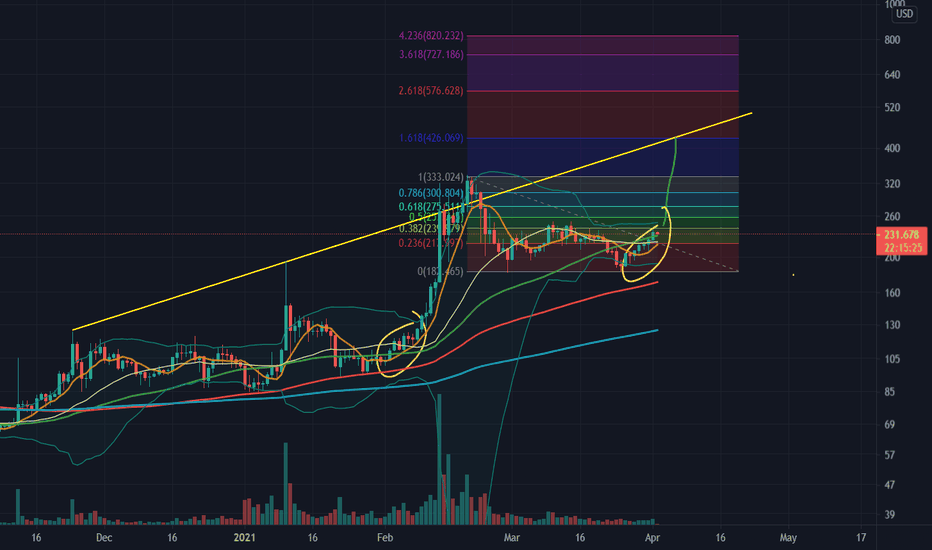

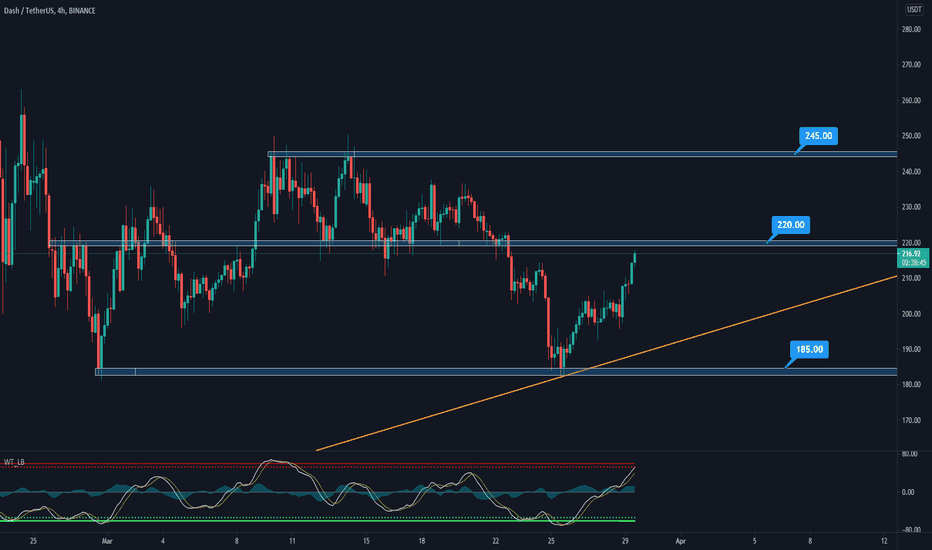

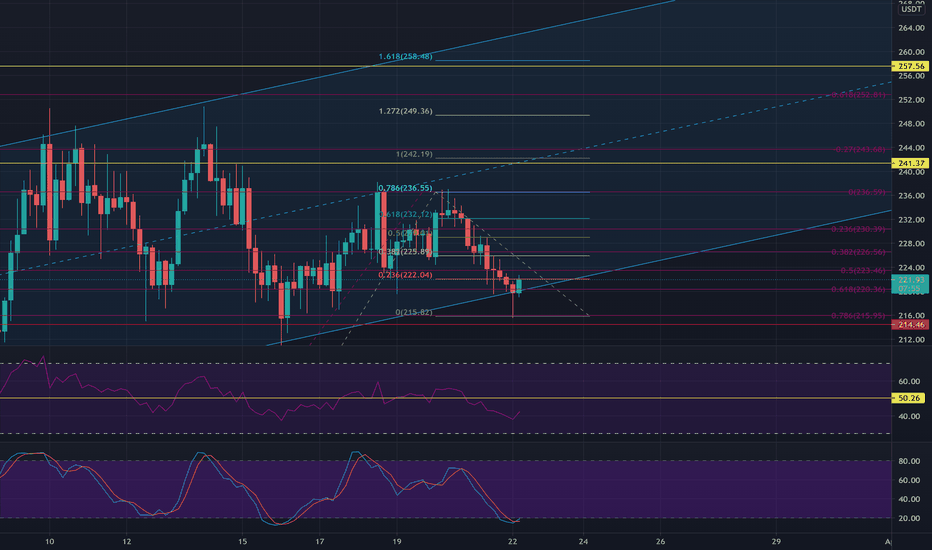

Dash Potential MovementFebruary gave Dash a lot of gains and a lot of pull-back toward the end of the month with March showing slight gains (compared to Feb movement) and consolidation a couple of times so far. As of now it is testing the support area around 223.5 as we approach a 17 and 9 period potential Kihon Suchi reversal area. If the support holds there are a significant amount of resistance areas to the north, particularly around 230, 245, and 270.

If the support around 223.5 does not hold and price breaks down through the Kumo, there are supports around 205 and again potentially around 196 with not much to hold it up after that until around 147.

Ichimoku indicates a bearish trend right now, with the Senko span crossing the price-line and the Tenkan/Kijun crossover.

As always, comments and ideas are welcome!

This information is not trading advice, only my personal opinion on potential market movements, and is for educational purposes only.

KUCOIN:DASHUSDT