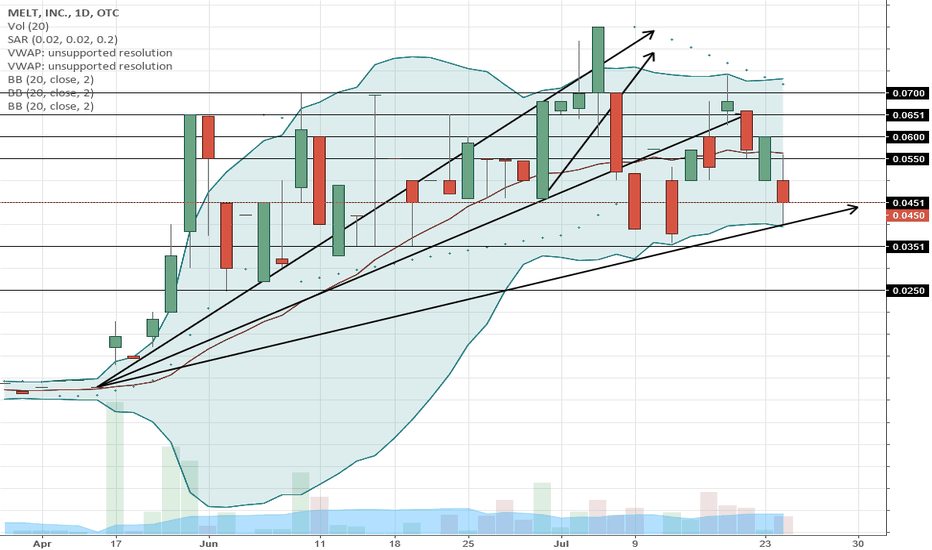

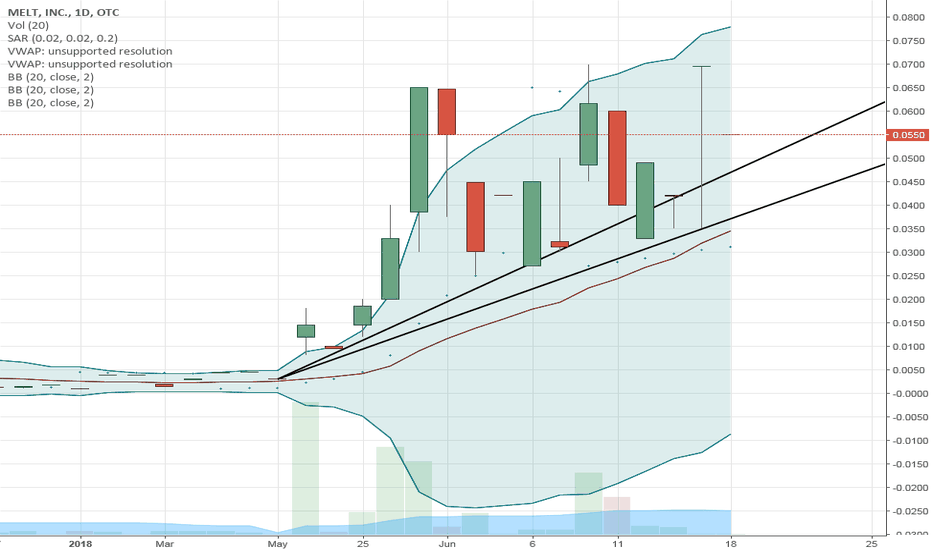

$MLTC Low Volume Takedown + Updates To Hit Soon$MLTC Has been a steady stock until today when a low volume takedown occurred, with the ask now way higher than the HOD, which tells me this could have been somebody who had been sitting on the ask and finally sold. Should see higher highs starting tomorrow, Long term hold with major catalysts coming imo.

Davidlazar

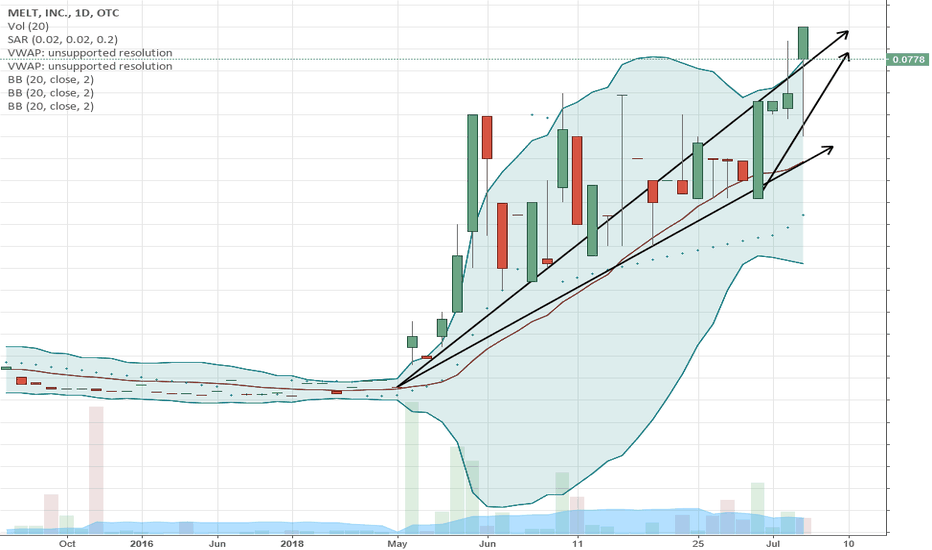

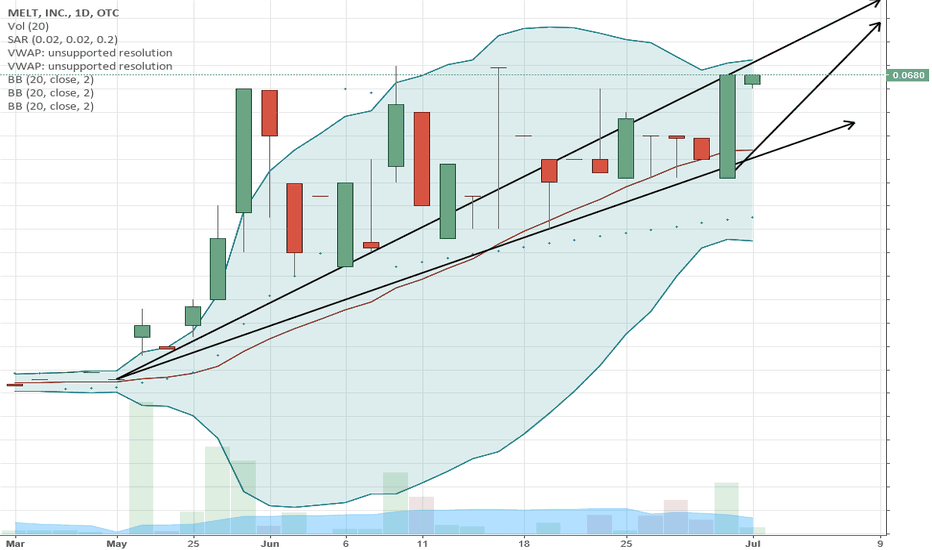

$MLTC Continues Upwards for next NVSOS FilingsChart showing signs of breaking past the .08s and into the .10s

$MLTC Confirmed David Lazar Play Through NVSOS Smallest S/S$MLTC Known Formally by its prior business model as Melt Inc. was confirmed through the NVSOS website to have been given custodianship to David Lazar who is a reknown OTC Business Reverse Merger expert. What's different about this shell however from past Lazar plays is its fundamentals. Having had a previous very successful business Melt Inc. grew to 19 physical locations nationwide with over 40 active franchise contracts. It had only accumulated $3.5 Mil debt total by the time the company had gone dark (Which has probably been taken care of by now as I've seen absolutely no dilution on L2 over the last few weeks since I discovered his company was taking it over) and stayed that way for many years. The company has only had one R/S of 1:10 back in 2002 and the A/S confirmed by NVSOS has remained 100 Mil for over 10 years. The O/S is one of the smallest if not the smallest of any shell I've seen recently acquired by David Lazar or the other equally famous R/M expert Joseph Acaro. Also this is the fastest I've seen a shell go from court to the NVSOS being updated which tells me there is probably a R/M candidate waiting to be inserted into the company given its past success and current share structure and fundamentals.

No convertible notes, small accumulated debt that debt holders have more than likely collected already, no dilution, continued accumulation, smallest S/S I've seen of a shell and possible R/M candidate already in the works = a recipe for massive explosion upwards when the time is right. I anticipate $10 is very possible by EOY given the A/S, O/S and Float of the stock.

$MLTC Continues Sideways and Up Ahead of Custodianship News$MLTC David Lazar play will continue accumulating into the granting of the custodianship.

$MLTC Latest David Lazar Play with Smallest S/S to date!!!$MLTC Is currently undergoing a petition for Custodianship through Custodian Ventures LLC.

After doing research I found that David Lazar is the Manager of Custodian Ventures LLC through his business entity Zenith Partner International LLC

See below screenshots and link for confirmation from a recent custodianship filing with $OWVI which was recently granted custodianship by the courts to David Lazar through Custodian Ventures LLC.

promotionstocksecrets.com

Keep in mind however that $OWVI has nothing on $MLTC the comparison is stark

$OWVI S/S: 3,500,000,000 A/S 3,500,000,000 O/S 2014 and a 400,000,000 Float as of 2009 and tons of debt and converts on the books.

While

$MLTC S/S: 100,000,000 A/S 2018 21,290,000 O/S 2010 (Possibly 50,000,000 now) and an Unknown Float (Possibly 20,000,000) with little to no converts ($3 Mil in Accumulated debt that has probably been converted by now or no longer can be collected on since the company has been dark for so long.)

David worked as an account manager at V-Stock Transfer, where he specialized in sales and marketing. After leaving V-Stock Transfer, David Lazar began his Zenith Partners International venture.

David Lazar is mentioned for his contribution to this article about reverse mergers:

"Quote: Many thanks to David Lazar of Zenith Partners International, for his insights."

About the Author:

"Quote: John Lowy is the founder (in 1990) and senior partner of his law firm www.johnlowylaw.com, and the founder (in 1993) and CEO of Olympic Capital Group, Inc. (www.ocgfinance.com), both based in New York City. John is a highly-respected and acknowledged expert in reverse mergers, capital formation, financial consulting and initial public listings of all types."

stocknewsnow.com

David Lazar's LinkedIn: www.linkedin.com

He has become one of the most famous recent Reverse Merger experts along with Joseph Acaro

It is my understanding that he is acquiring custodianships of several companies to reverse merge them into applicable revenue making business entities under the guidance of mentors (one being his own father which has reverse merged several companies) who have been guiding him.

Since most of his custodianships have been this year and most have been granted by the courts it is in my opinion that later this year we will see the fruits of those reverse mergers once everything has been ironed out.

$MLTC itself has had a profitable and successful past before high overhead and franchise disagreements brought it to where it is now. It will now be up to David Lazar to bring it to a successful and profitable future.