Dax40

GER40 to extend losses?GER40 - Intraday - We look to Sell a break of 14239 (stop at 14331)

Short term bias has turned negative.

The trend of higher intraday lows has also been broken.

Our outlook is bearish.

We look for losses to be extended today.

A break of yesterdays low would confirm bearish momentum.

20 1day EMA is at 14240.

Our profit targets will be 14012 and 13962

Resistance: 14330 / 14380 / 14450

Support: 14240 / 14150 / 14000

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

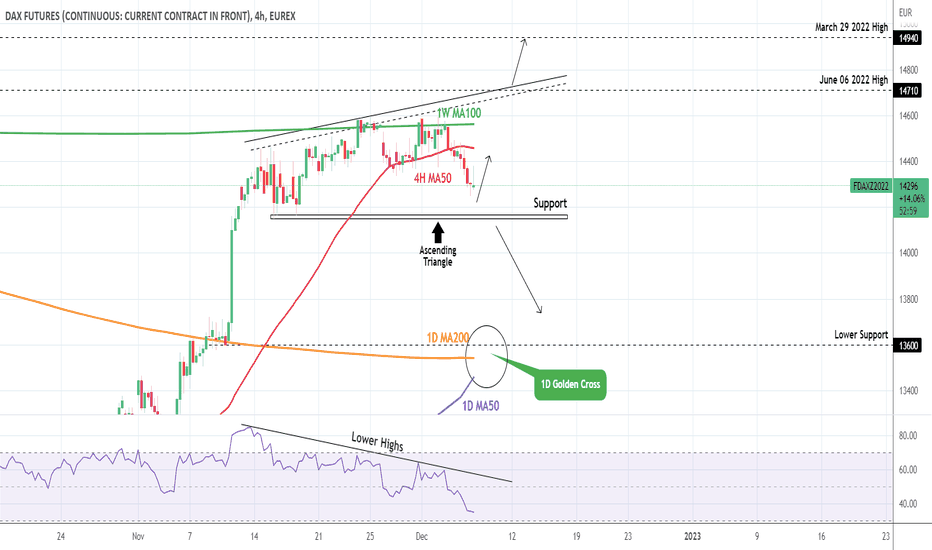

DAX: aiming at the Support below the 4H MA50.The price failed to break above the 4H MA50 (red) and dropped more to a new Low. This is getting closer to our 14,150 short-term target just above the 14,130 Support (formed from the low of November 15th). 4H is now close to oversold territory (RSI = 34.750, MACD = -47.400, ADX = 59.234) so we might see a short term rebound back to the 4H MA50 (14,446.70 and dropping) but with a break below 4,100 we will extend selling to the 4H MA200 (currently at 13,898.60). The 1D RSI remains bullish (57.430) though but we're only willing to buy as of this point if the price breaks above the 14,710 (June 6th 2022 High) Resistance and target the 14,940 (March 29 2022 High) Resistance.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

## Also DONATIONS through TradingView coins help our cause of increasing the daily ideas put here for free and reach out more traders like you. ##

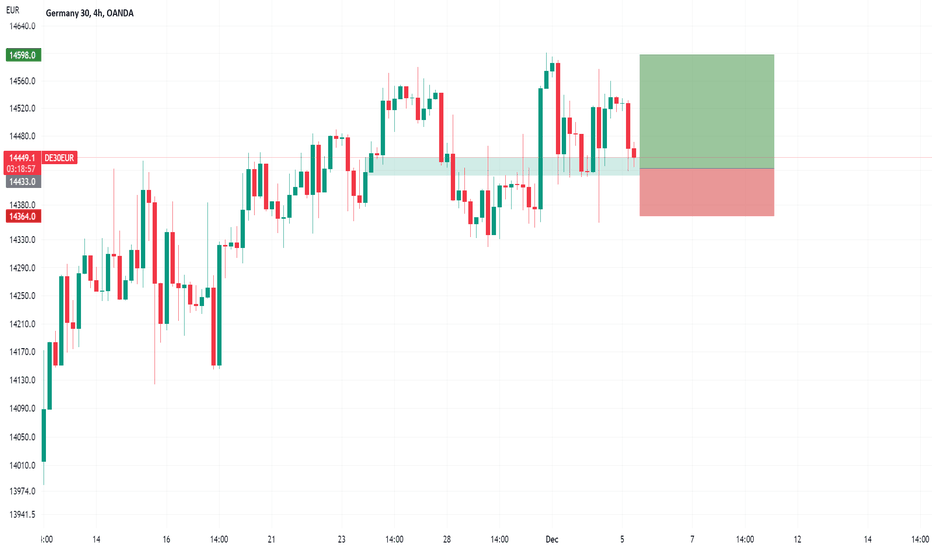

Buying DE40 close to market.GER40 - Intraday - We look to Buy at 14433 (stop at 14364)

Intraday signals are bullish.

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

The trend of higher lows is located at 14430. We look to buy dips.

Our profit targets will be 14598 and 14648

Resistance: 14550 / 14605 / 14700

Support: 14430 / 14360 / 14300

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

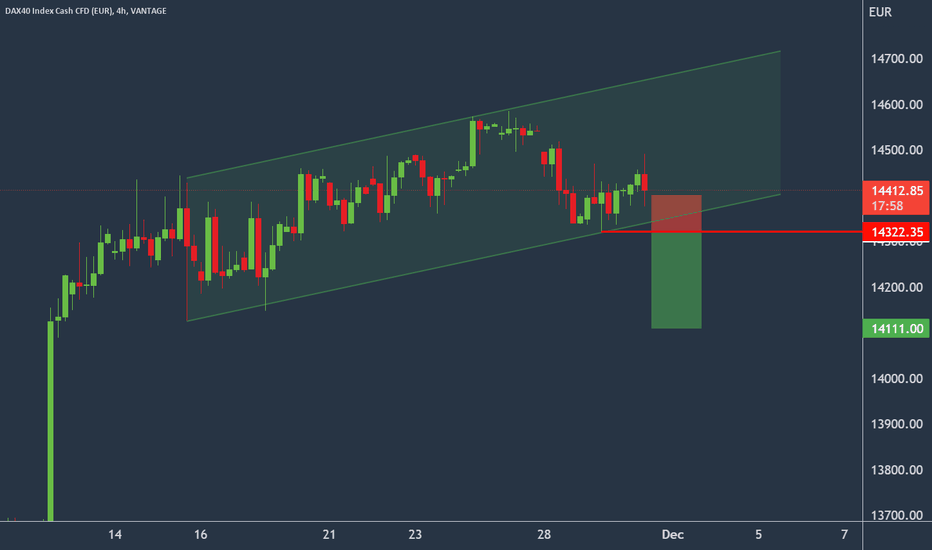

DAX40 - A break of yesterdays low would confirm bearish momentumDAX40 - Intraday - We look to Sell a break of 14319 (stop at 14401)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. Posted a Treble Top formation. A bearish Head and Shoulders is forming. A break of yesterdays low would confirm bearish momentum. Spikes (rejections) can be seen in both directions highlighting indecision.

Our profit targets will be 14111 and 14061

Resistance: 14450 / 14500 / 14583

Support: 14340 / 14250 / 14150

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

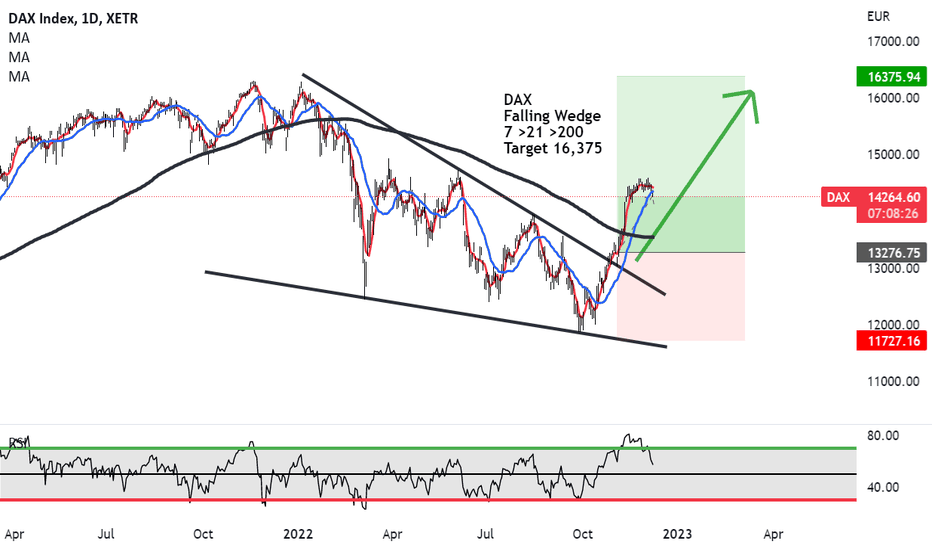

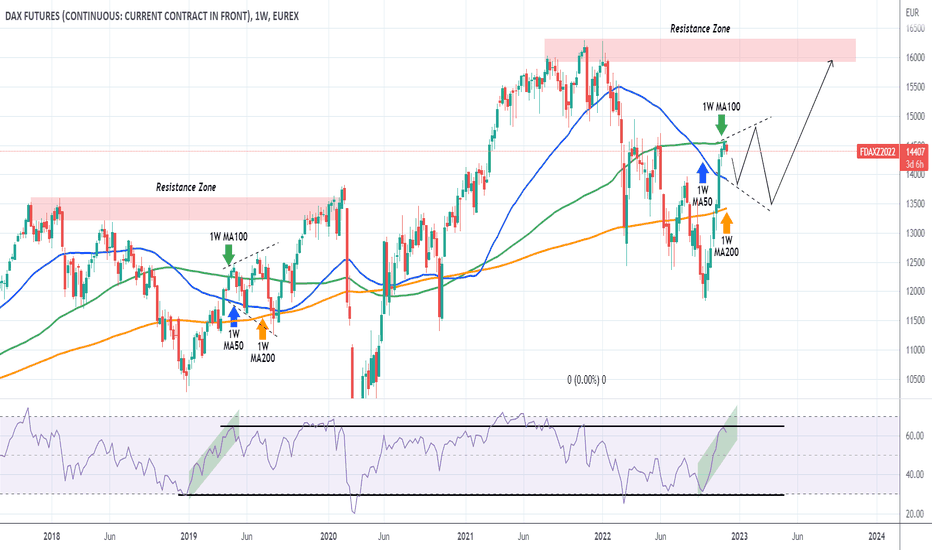

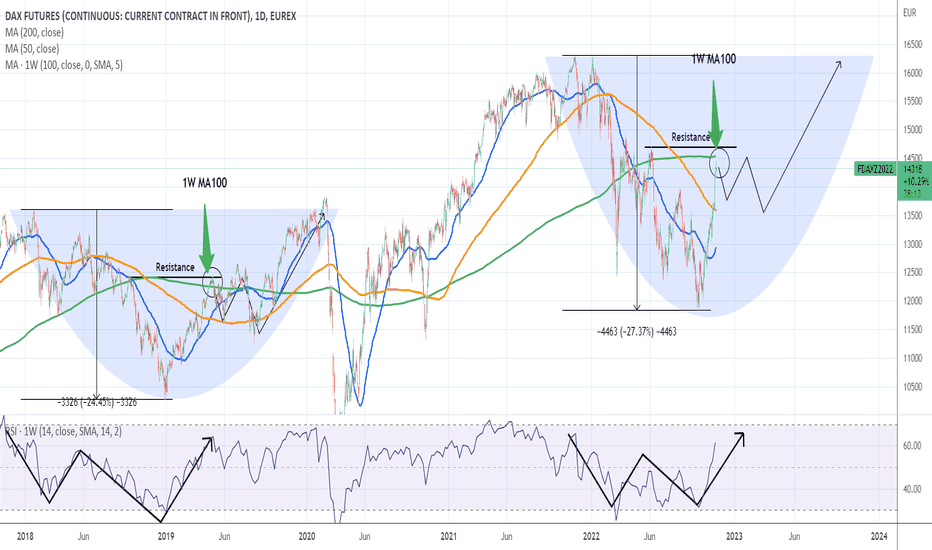

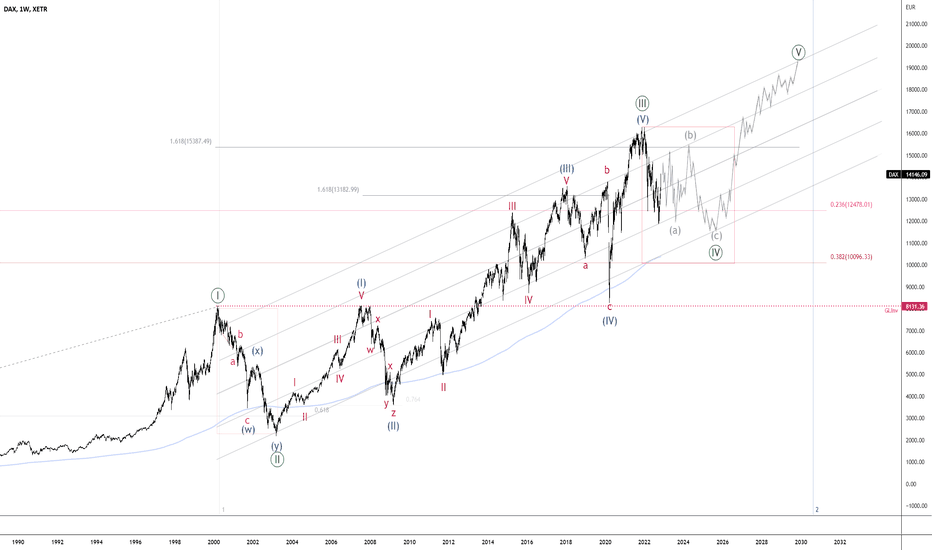

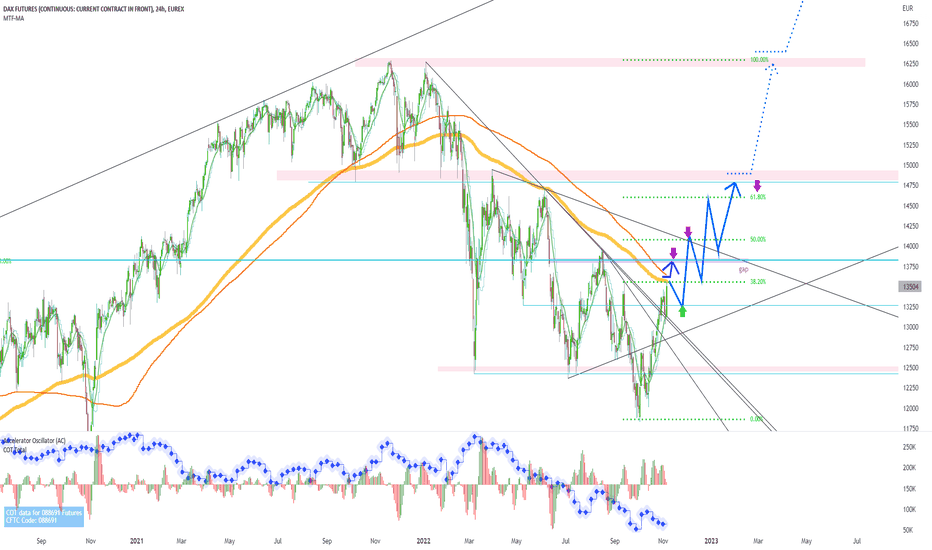

DAX 's incredible 8 straight green week rally may come to an endThe German Index (DAX) hit last week its 1W MA100 (green trend-line) and early this week, the 1W candle is pulling-back in red. If it closes this way, it will be the first week of loss (red) since late September, running an amazing streak of 8 straight green ones.

With the 1W RSI almost reaching 65.000 for the first time since November 15 2021 (a whole year ago), a potential 1W MA100 rejection can draw comparisons with the post U.S. - China trade war recovery early in 2019. As shown on this chart, DAX pulled-back on the 2nd week after breaking above its 1W MA100 and the pull-back broke marginally below the 1W MA50 (blue trend-line).

A megaphone pattern of Higher Highs and Lower Lows took the price just below the 1W MA200 (orange trend-line) before recovering and post a strong rally that broke slightly above its Resistance Zone from the previous All Time Highs.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GER40 to extended losses from engulfing.GER40 - Intraday - We look to Sell a break of 14319 (stop at 14401)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Posted a Treble Top formation.

A bearish Head and Shoulders is forming.

A break of yesterdays low would confirm bearish momentum.

Bearish engulfing has been posted on last candle.

Our profit targets will be 14131 and 14081

Resistance: 14450 / 14500 / 14583

Support: 14340 / 14250 / 14150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

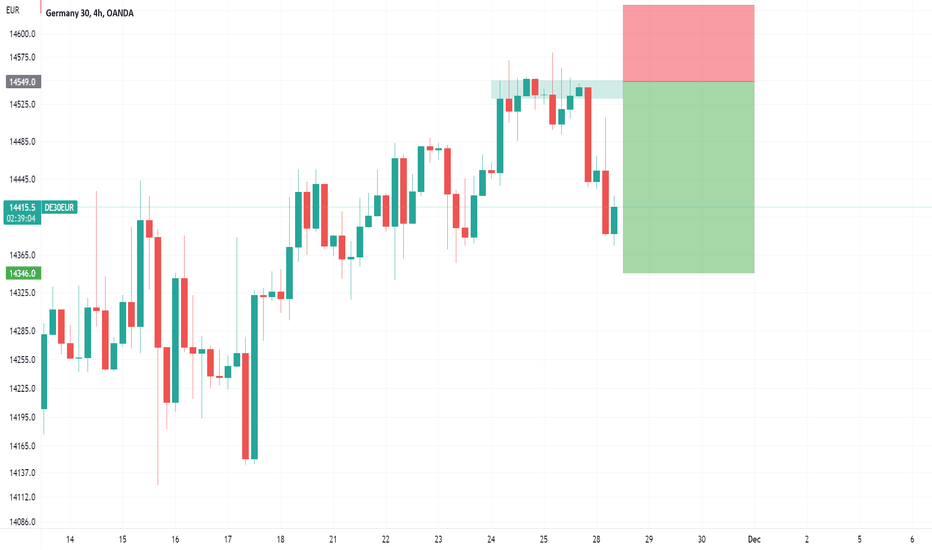

DE40 posted a treble top.GER40 - Intraday - We look to Sell at 14549 (stop at 14631)

We are trading at overbought extremes.

Posted a Treble Top formation.

Rallies should be capped by yesterday's high.

We look for a temporary move higher.

Bearish divergence is expected to cap gains.

Our profit targets will be 14346 and 14306

Resistance: 14500 / 14550 / 14583

Support: 14440 / 14380 / 14300

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

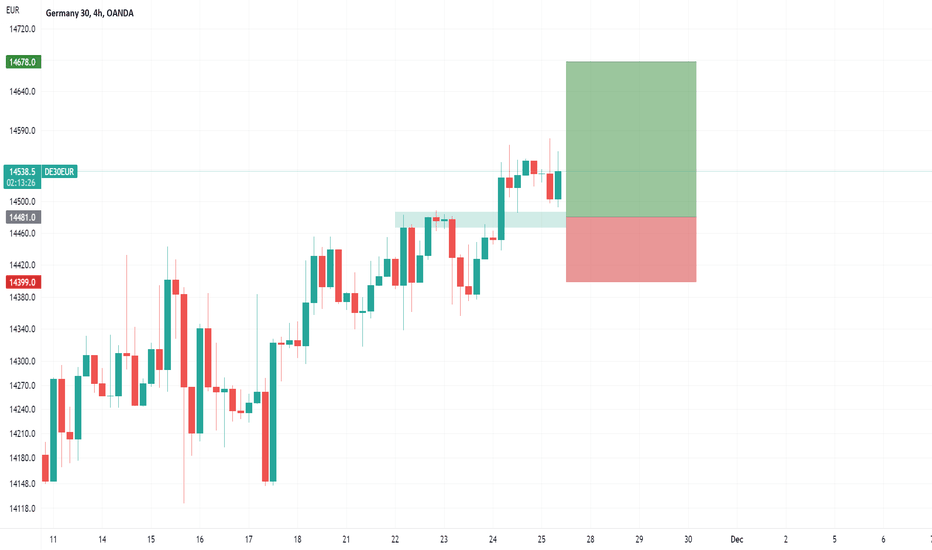

Buying DE40 at previous resistance.GER40 - Intraday - We look to Buy at 14481 (stop at 14399)

We are trading at overbought extremes.

There is no clear indication that the upward move is coming to an end.

Daily signals are bullish.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

20 4hour EMA is at 14478.

Our profit targets will be 14678 and 14708

Resistance: 14575 / 14700 / 14800

Support: 14500 / 14430 / 14350

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

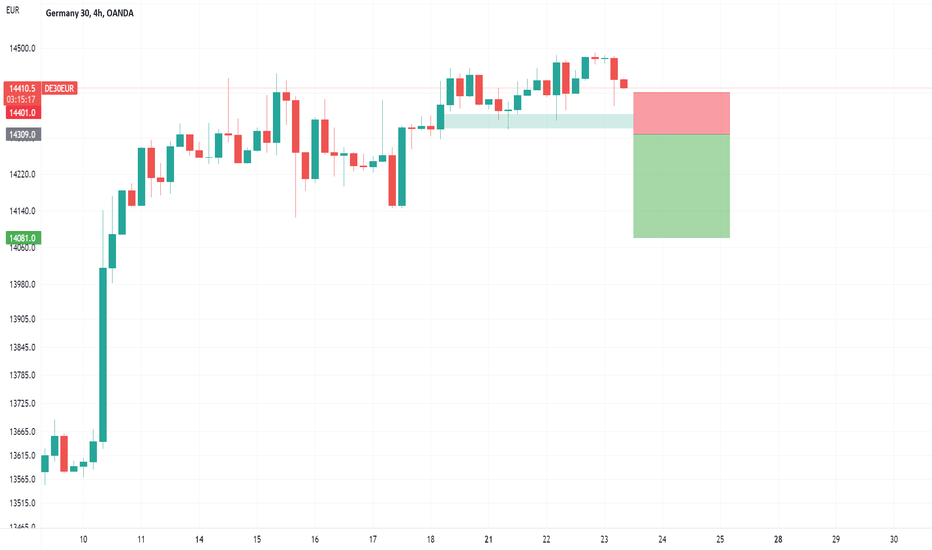

DE40 to breakdown?GER40 - Intraday - We look to Sell a break of 14309 (stop at 14401)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

A break of the recent low at 14319 should result in a further move lower.

We are trading at overbought extremes.

A Doji style candle has been posted from the high.

Our profit targets will be 14081 and 14021

Resistance: 14500 / 14600 / 14700

Support: 14400 / 14310 / 14150

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

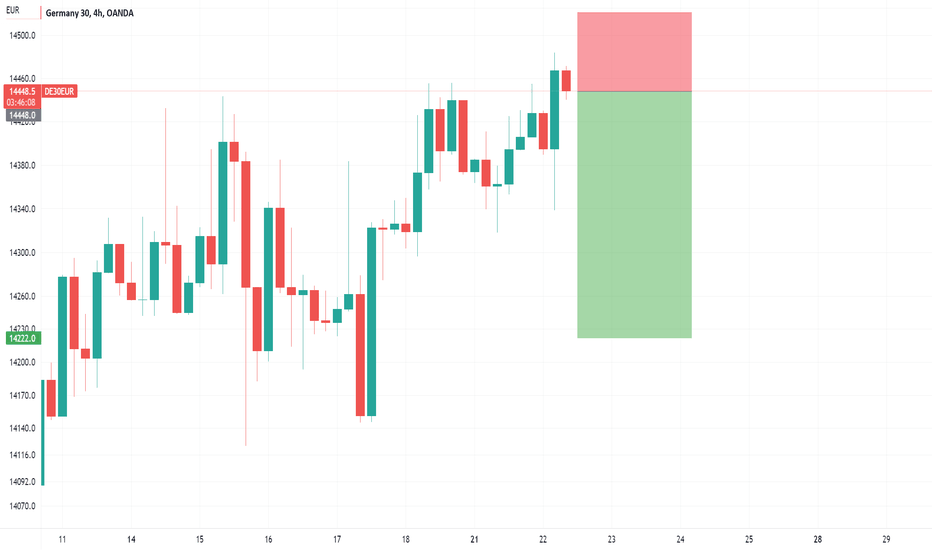

Selling DE40 at market.GER40 - Intraday - We look to Sell at 14439 (stop at 14521)

We are trading at overbought extremes.

Bearish divergence is expected to cap gains.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

We look for a temporary move higher.

The bearish engulfing candle on the 4 hour chart is negative for sentiment.

Our profit targets will be 14222 and 14162

Resistance: 14400 / 14470 / 14600

Support: 14350 / 14300 / 14250

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

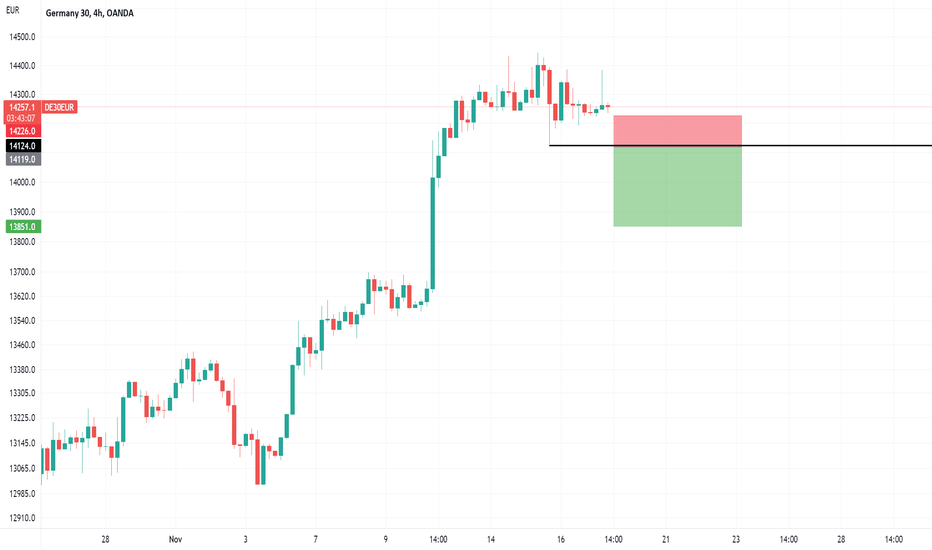

GER40 with stalled bullish momentum.GER40 - Intraday - We look to Sell a break of 14119 (stop at 14226)

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Spikes (rejections) can be seen in both directions highlighting indecision.

We are trading at overbought extremes.

A higher correction is expected.

A break of the recent low at 14123 should result in a further move lower.

Our profit targets will be 13851 and 13801

Resistance: 14320 / 14400 / 14440

Support: 14200 / 14123 / 14000

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

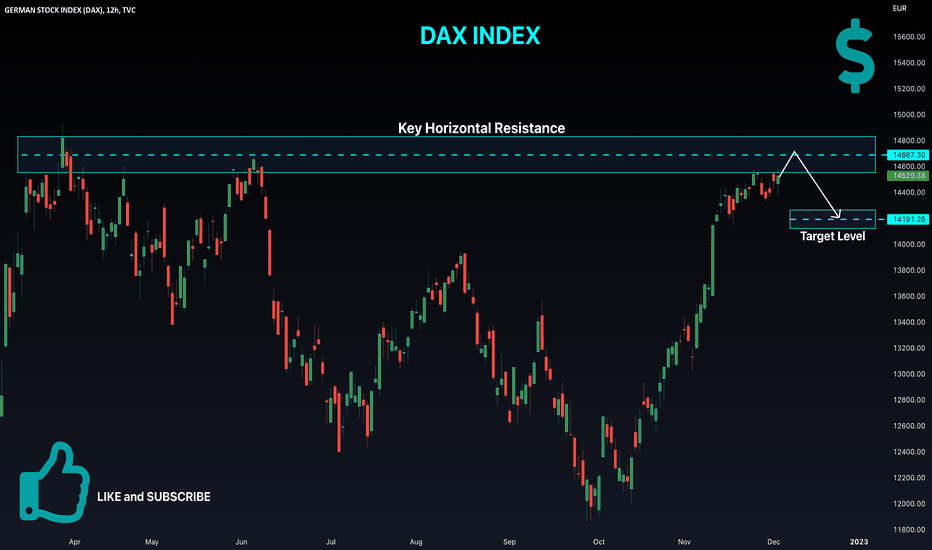

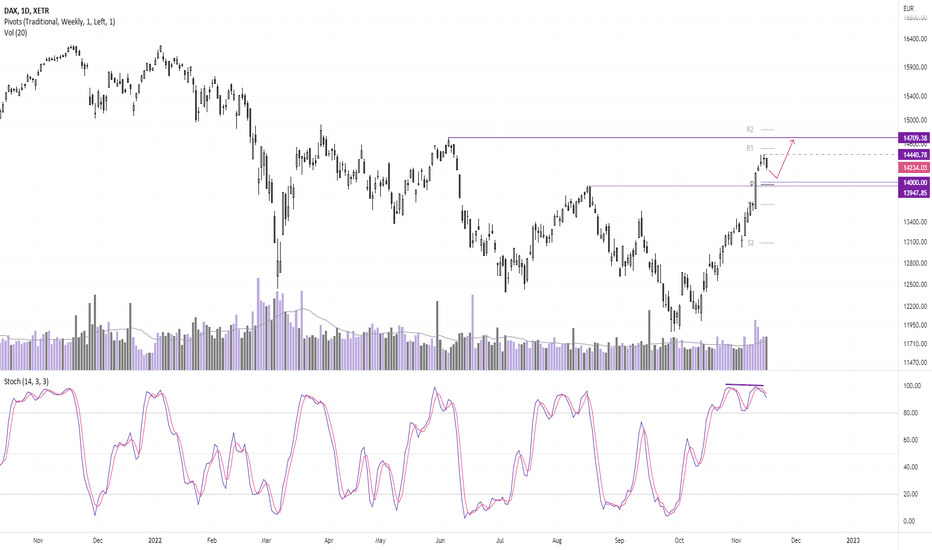

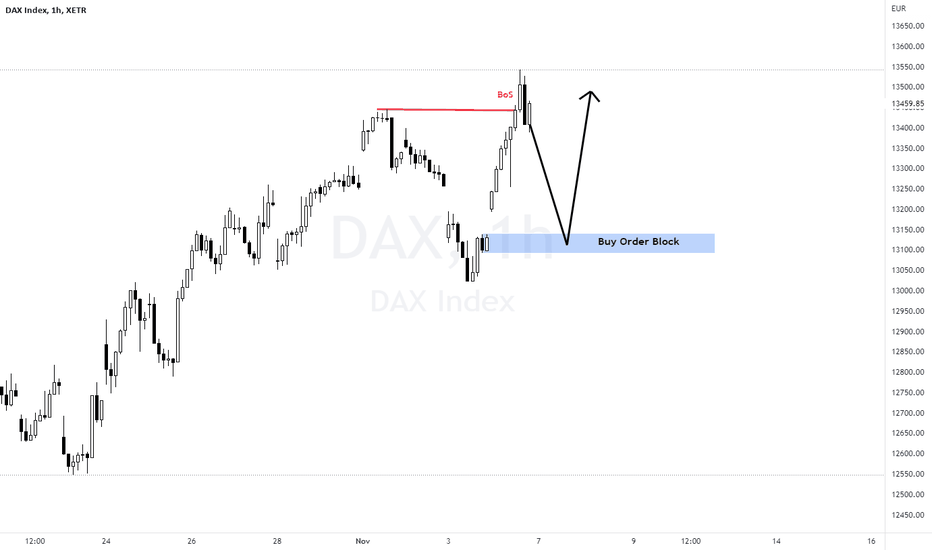

The DAX could retrace further from its ‘bull market’ thresholdThe DAX entered a technical bull market on Tuesday by closing just over 20% higher from its September low. I have lost count the amount of times I have seen a market pull back from the 20% threshold (which is based on no logic that I can see, other than being a nice round number) – so that is just the first clue that the DAX could pull back further.

But we also saw two Doji candles leading into the high, prices were rising on lower volume, and a bearish divergence has formed on the stochastic oscillator. Therefore, the bias is for a retracement towards the 14,000 area whilst prices remains beneath 14,440. At which point we can re-evaluate its potential for a move up to the 14,709 high. A break above this week’s high assumes bullish continuation.

DAX recoverd but approaching a strong Resistance similar to 2019Very interesting fractal repetition for DAX so far. As the price is approaching the 1W MA100 (green) a typical Support in Bull Markets and Resistance in Bear Markets, we have spotted striking similarities with the 2018/2019 correction. There is a flat Resistance just above the 1W MA100, which in April 2019, as the index recovered from that multi month correction, pushed it back to the 1D MA200 (orange).

Swing traders can wait for the next big entry there, if the pattern continues to repeat that Cycle. The RSI so far tends to agree and shows that weve just started a new multi month recovery phase.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

## Also DONATIONS through TradingView coins help our cause of increasing the daily ideas put here for free and reach out more traders like you. ##

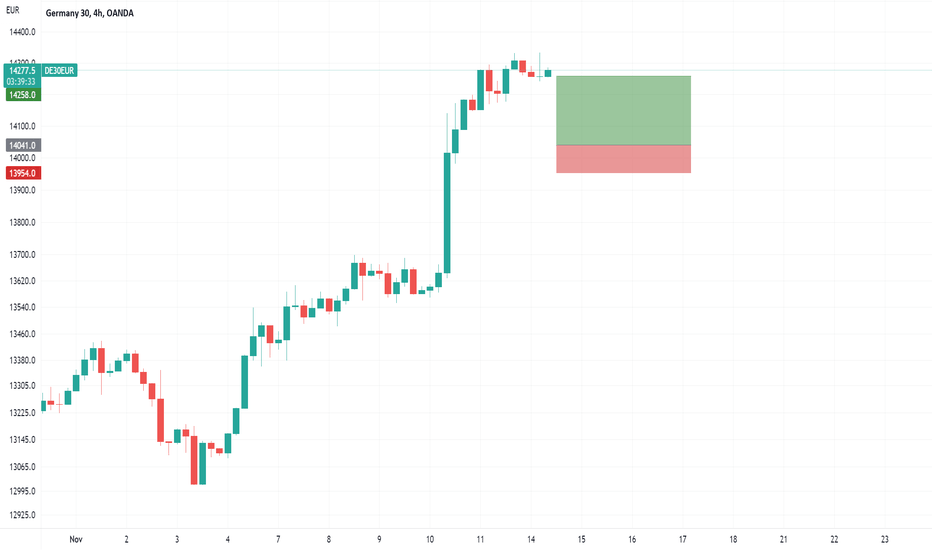

GER40 to dip?GER40 - 11h expiry - We look to Buy at 14041 (stop at 13954)

Our short term bias remains positive.

We look to buy dips.

20 4 hour EMA is at 14033.

Our profit targets will be 14258 and 14298

Resistance: 14330 / 14400 / 14500

Support: 14170 / 14100 / 14000

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

dax daily long term view : dax can start big +up trendline dax find a shape can start +up trend ...strangly advice above 13000 dont pick sell ... .90% looking for buy

in 2023 we can see dax in 19000 (fibo 161%)

secret : when dax go above EMA200 daily (big orange line), this mean +up trend start and pick sell is stupid

good luck

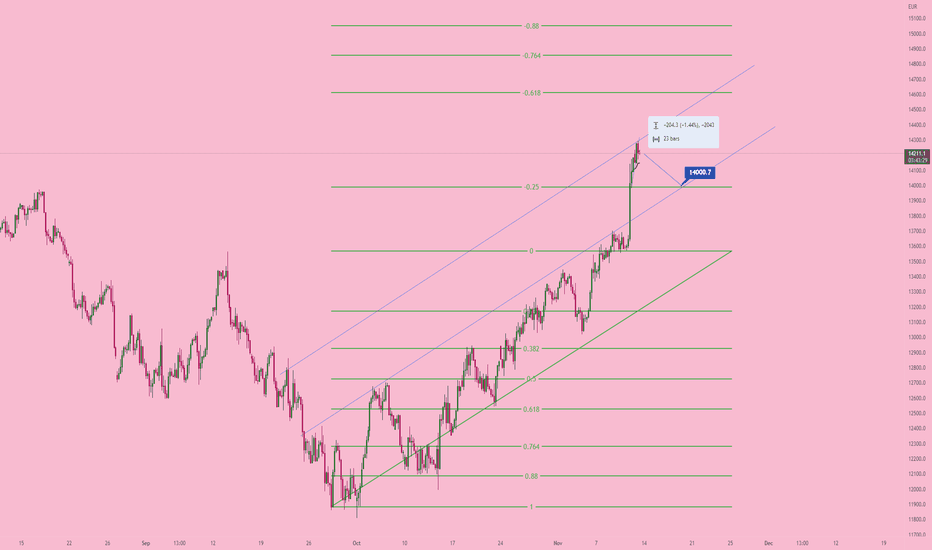

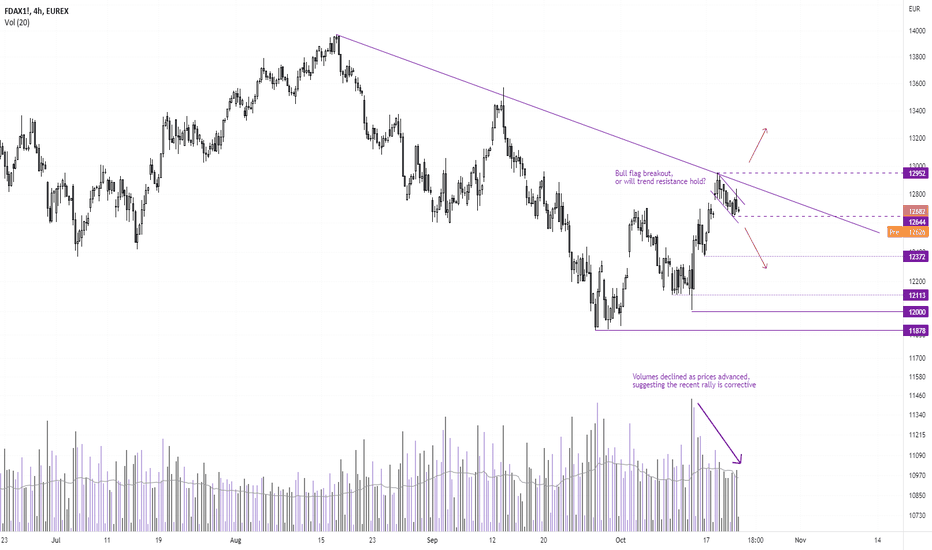

DAX: Bull flag breakout, or has the high been seen?The DAX is set to open lower, but there are two potential scenarios to monitor; a bullish breakout from a bull flag – or the swing high has already been seen around trend resistance.

The DAX has rallied from the September low in three waves, which could either be part of a new bullish trend or part of a 3-wave retracement. If we look at price action alone, the rally from 12,000 has been strong and a potential bull-flag is forming. Should we see prices break above 13,000 then we’ll assume the bullish trend is set to continue.

But there are two potential flies in the ointment which could scupper such a break higher. The rally has been seen on declining volumes, which suggests the ‘rally’ is corrective and not impulsive. Furthermore, the bull flag remains stuck beneath trend resistance. And given we recently saw a -bar reversal on the four-hour chart within the supposed bull flag, we are on guard for a break beneath yesterday’s low to assume bearish continuation.