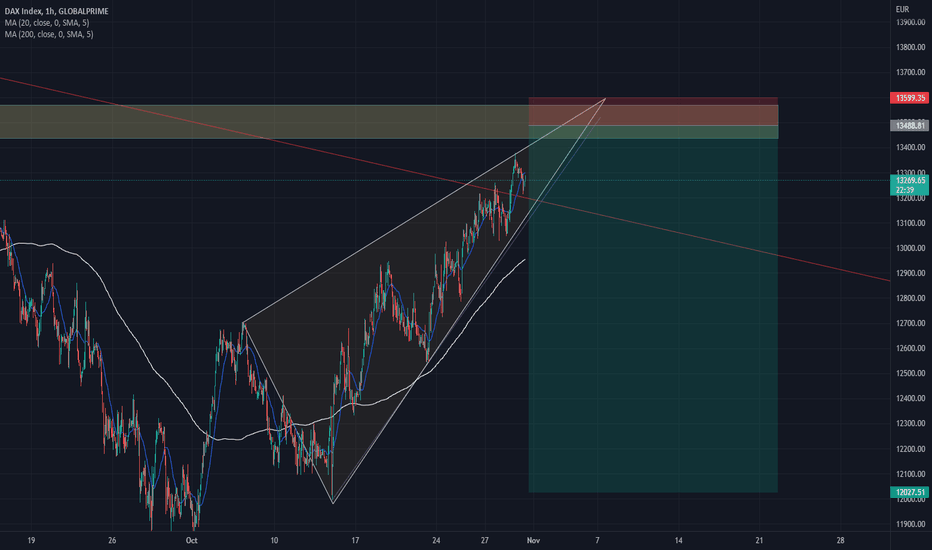

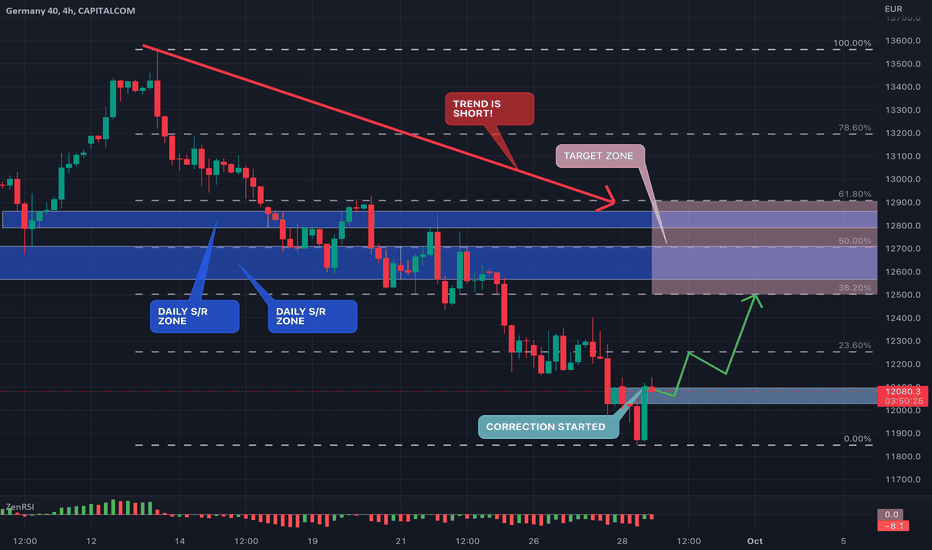

ger30 hasorderger30 has block order , on 4h timeframe . and its near to touch . lets watch and get decision about pos .

Dax40

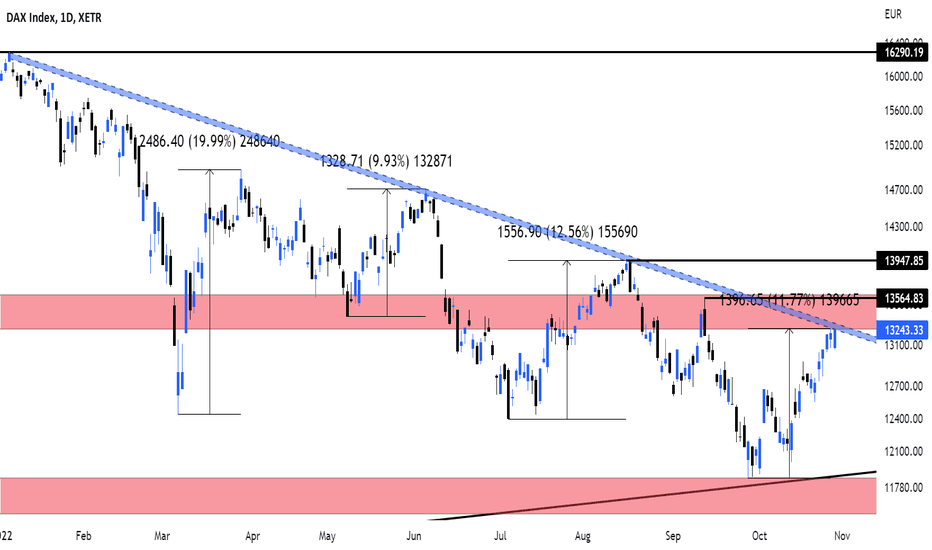

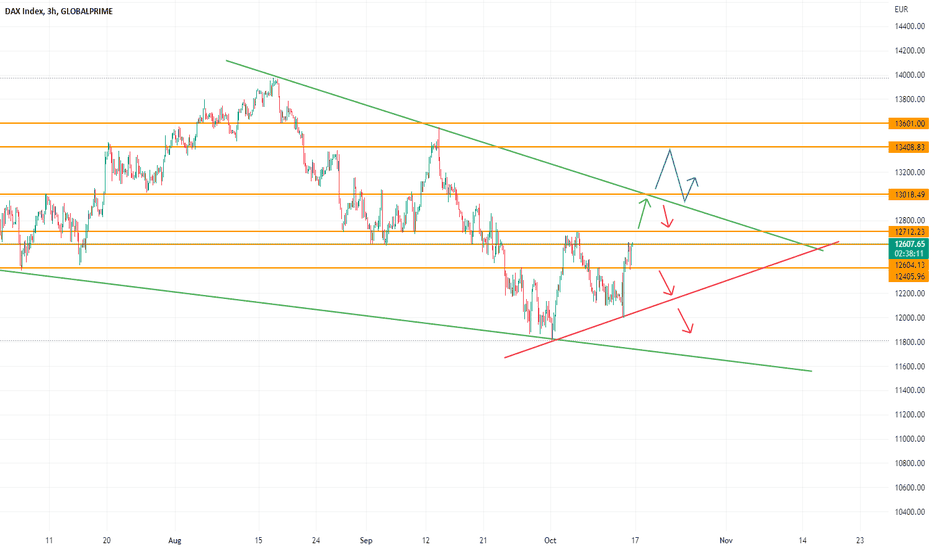

DAX Breakout or Breakdown?The DAX has rallied significantly since the end of September after touching a major support range at 11,550 - 11,850 - the area that price bottomed in November of 2020

It is now pressuring the downtrend extending from the yearly highs and could be poised to break higher

A convincing close above downtrend resistance would provide a great buying opportunity with near-term targets at 13,570 and 13,950

However, if trend resistance holds firm, a continued downside push looks likely, with a great opportunity to sell and chase price back to yearly lows

DAX 4hour : dax can reach 14500 , be careful from sellin coming hour dax little must go down but trend will remain up

in my idea when pinbar come pick buy and hold it 7-8 day to minimum EMA200 daily 13500

only under red allow we must pick sell after pinbar comes on 1hour or 4hour or daily chart

good luck

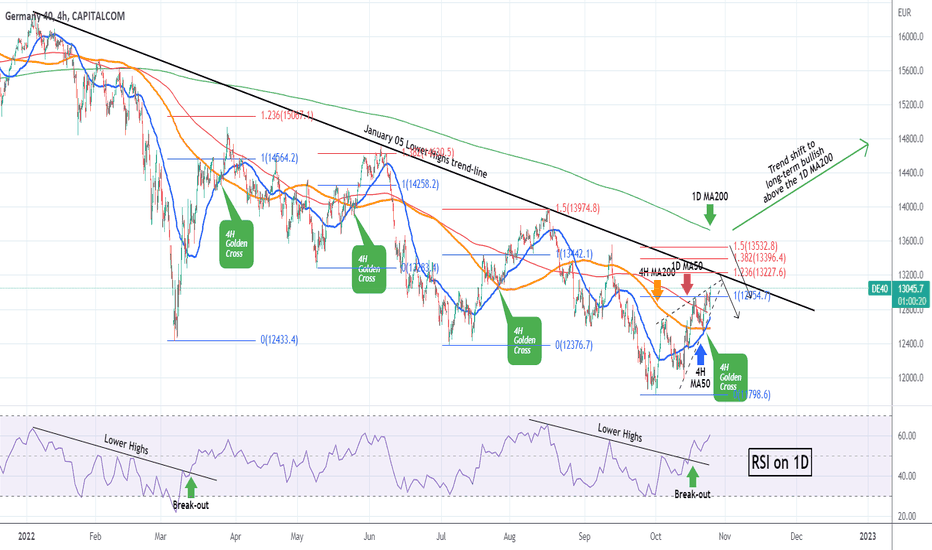

DAX Short-term bullish but heavy Resistance Zone ahead of ECB.The German stock index (DAX) has been trading within a Rising Wedge (dashed lines) since the October 02 bottom that is about to break. The 4H Golden Cross (4H MA50 (blue trend-line) crossing above the 4H MA200 (orange trend-line)) is a short-term bullish signal as the three times we had this pattern formed in 2022, the price rose more ranging from the 1.236 Fibonacci extension to the 1.5.

Moreover, the 1D RSI broke above its Lower Highs trend-line, adding more buying pressure. The 1.236 Fib is located exactly on the January 05 Lower Highs trend-line, which is basically the Resistance dictating the 2022 Bear Market, while the 1.5 is just below the 1D MA200 (green trend-line). That trend-line has been unbroken since February 02, so we are willing to buy (on the long-term) again only if the price breaks above it and target the previous Lower Highs. Until then, selling the Fib extensions on tight SLs is our approach, targeting the 4H MA200.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

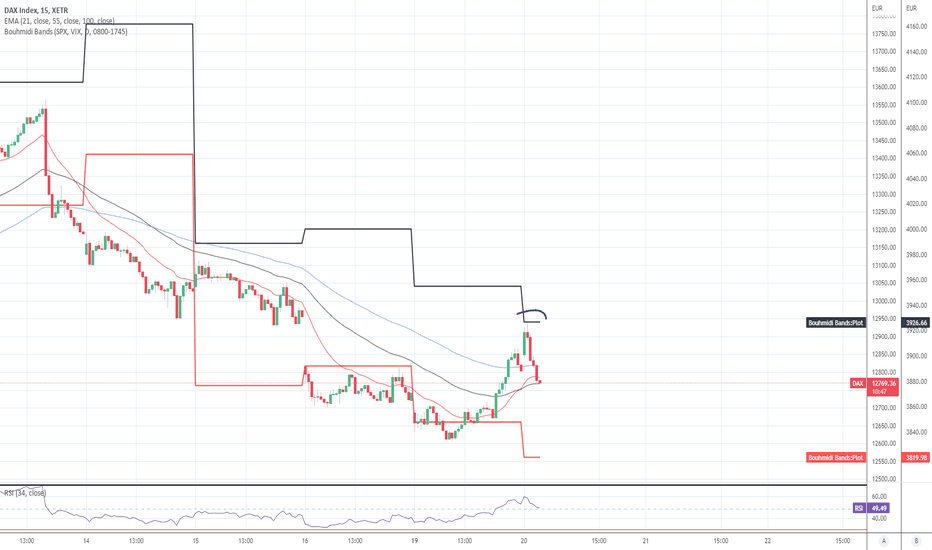

Joe Gun2Head Trade - More downside for DAX?Trade Idea: Selling NASDAQ

Reasoning: Bearih pressure likley to continue

Entry Level: 12644

Take Profit Level: 12350

Stop Loss: 12767

Risk/Reward: 2.38:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

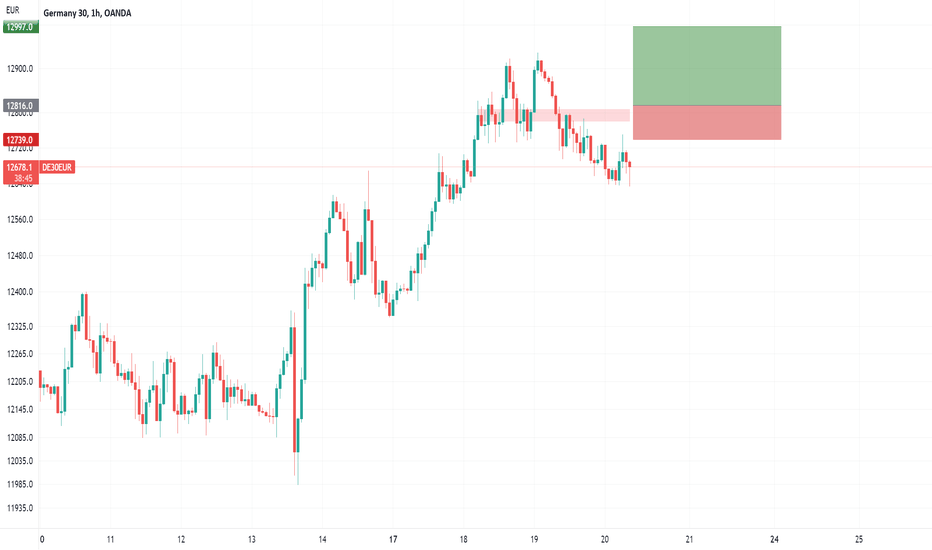

GER40 to break higher?GER40 - 13h expiry - We look to Buy a break of 12816 (stop at 12739)

Short term bias has turned positive.

A break of bespoke resistance at 12800, and the move higher is already underway.

There is no clear indication that the upward move is coming to an end.

Our profit targets will be 12997 and 13047

Resistance: 12800 / 12900 / 13000

Support: 12700 / 12600 / 12500

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Buying DE40 at market.GER40 - Expires in 11 hours - We look to Buy at 12721 (stop at 12636)

Our short term bias remains positive. 12705 has been pivotal.

Bespoke support is located at 12700.

We look to buy dips.

Good risk reward to buy at market.

Our profit targets will be 12925 and 12985

Resistance: 12900 / 13000 / 13100

Support: 12800 / 12700 / 12600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Buying DE40 on dips.GER40 - Intraday 9pm UK expiry - We look to Buy at 12534 (stop at 12444)

Short term bias has turned positive.

A lower correction is expected.

Bespoke support is located at 12500.

We look to buy dips.

Our profit targets will be 12744 and 12794

Resistance: 12900 / 13000 / 13100

Support: 12800 / 12700 / 12600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

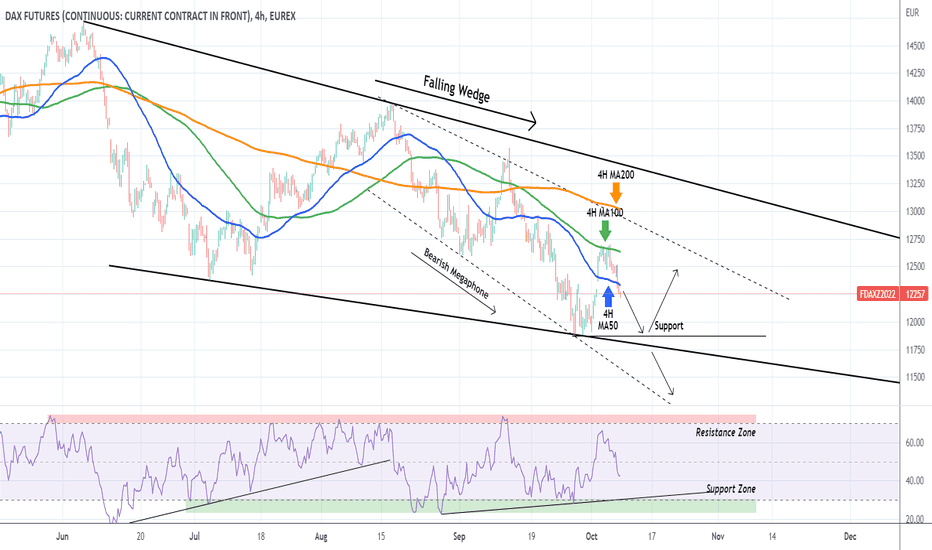

DAX Broke the 4H MA50. Bearish extension.The German stock index (DAX) broke below its 4H MA50 (blue trend-line) on Friday after failed to break and being rejected on the 4H MA100 (green trend-line) earlier this week. This keeps the price inside both the short-term Bearish Megaphone pattern and the longer term Falling Wedge pattern.

That break is a major sell break-out signal and targets directly the 11875 Support. Below that we can only take an extension if DAX makes a closing below the bottom (Lower Lows trend-line) of the Falling Wedge. Otherwise as the price approaches the 11875 Support, it becomes a buy opportunity towards the 4H MA200 (orange trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

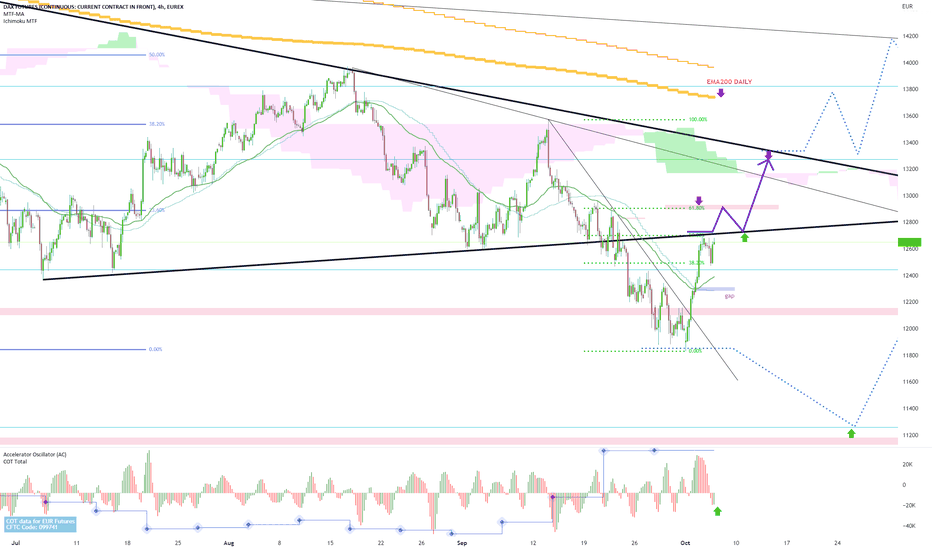

DAX going to EMA200 daily in my idea and technical analyse : dax frist going to fibo 61% 12900 then going to EMA200 dailky then fibo 161 nera 14600(can take month)

advice : 90% looking for buy and be careful from sell put SL (only under red arrow pick sell after sell pinbar apear)...dax easily can move 2000 point in up side move

keep monitor AC indicator on 4hour chart

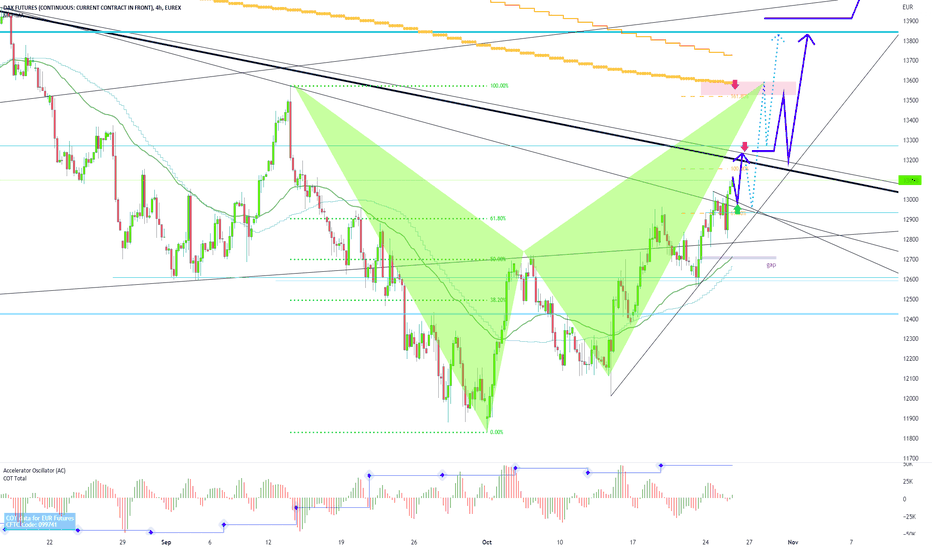

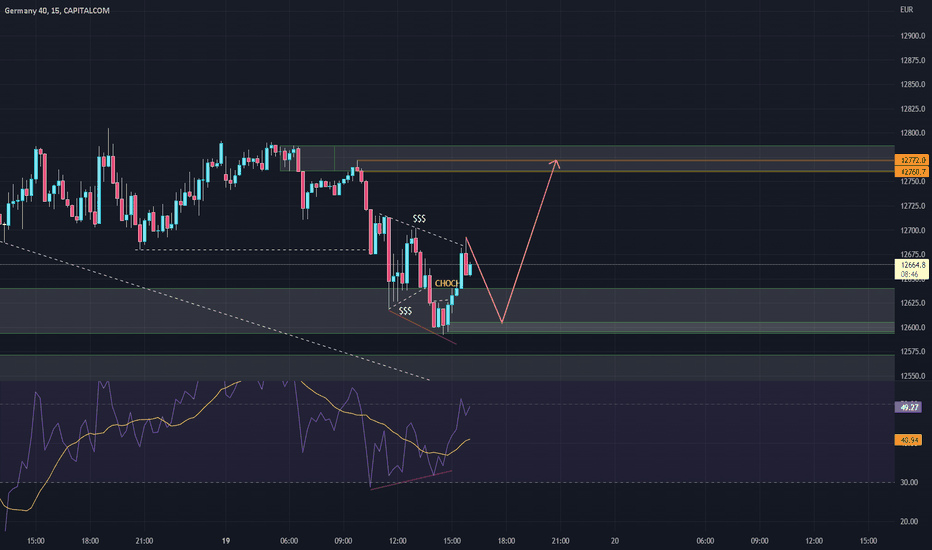

Correction has started on DAXHi Everyone!✋🏽

H4 has closed above the recent peak, meaning in my analysis, that the correction has started. Maybe it's better to wait some waves to build up a real countertrend, then targets are marked on the chart.

ANYWAY, a lot of Qs about the direction of the price. But it doesn't matter. WE JUST REACT!

Happy trading! ⚪️⚫️

----------------------------------------------------------------------------

Thanks for reading my analysis!🤘🏽

Remember that trading is a risky business.

SIZE your TRADES according to your risk aversion!

----------------------------------------------------------------------------

Please remember to support the idea with a BOOST or COMMENT

with your highly appreciated opinion!

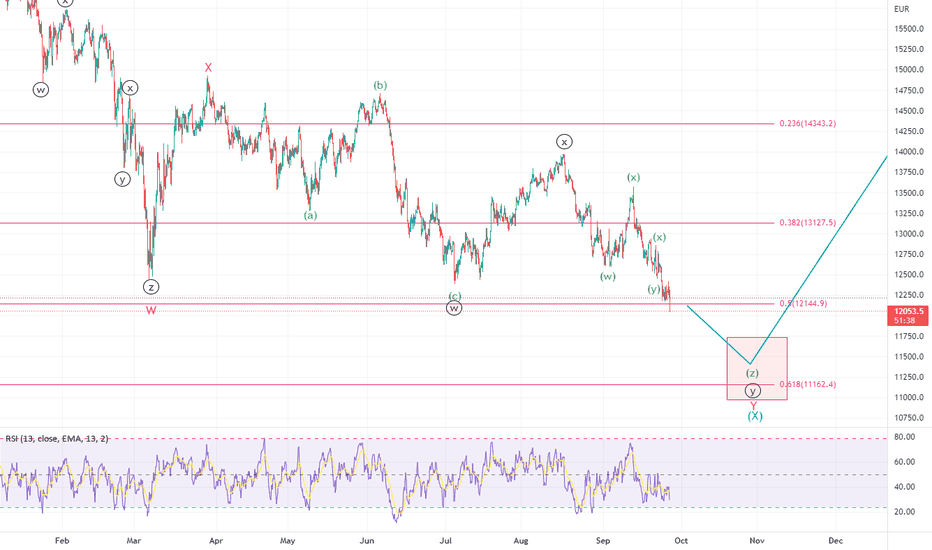

DAX may easily slip into a countertrendHi Everyone!✋🏽

DAX has reached two important target levels (D FIBO 138.2 and W FIBO 200), and the last peak on H4 was bought back by the buyers. It means that there is a chance that a long countertrend may form. Trading in the countertrend is more risky than in an impulse wave, so maybe it's better to stay out. You decide. What do you think?

ANYWAY, a lot of Qs about the direction of the price. But it doesn't matter. WE JUST REACT!

Happy trading! ⚪️⚫️

----------------------------------------------------------------------------

Thanks for reading my analysis!🤘🏽

Remember that trading is a risky business.

SIZE your TRADES according to your risk aversion!

----------------------------------------------------------------------------

Please remember to support the idea with a BOOST or COMMENT

with your highly appreciated opinion!

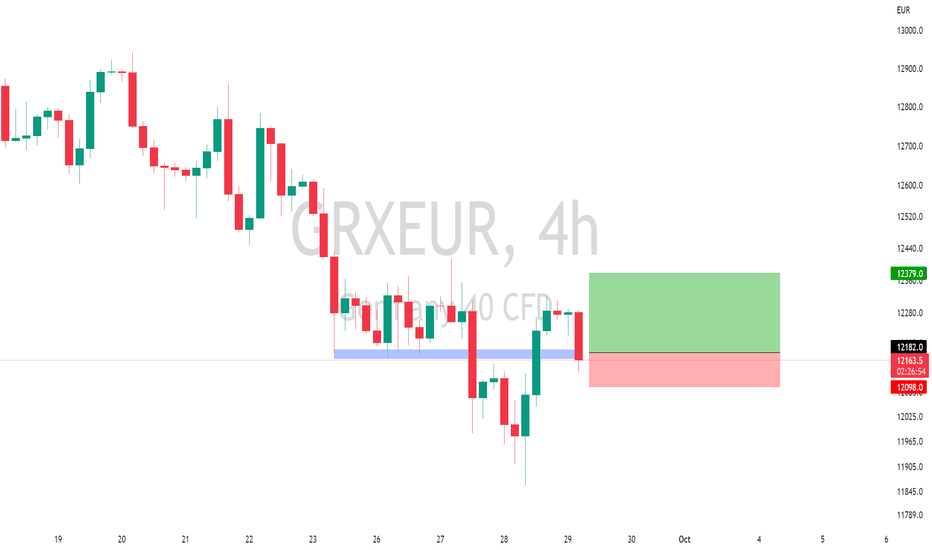

GER40 in possible head and shoulders.GER40 - Intraday - We look to Buy at 12182 (stop at 12098)

With signals for sentiment at oversold extremes, the dip could not be extended.

A bullish reverse Head and Shoulders is forming.

Bespoke support is located at 12000.

We look to buy dips.

The bullish engulfing candle on the daily chart is positive for sentiment.

Our profit targets will be 12379 and 12419

Resistance: 12300 / 12400 / 12500

Support: 12200 / 12100 / 12000

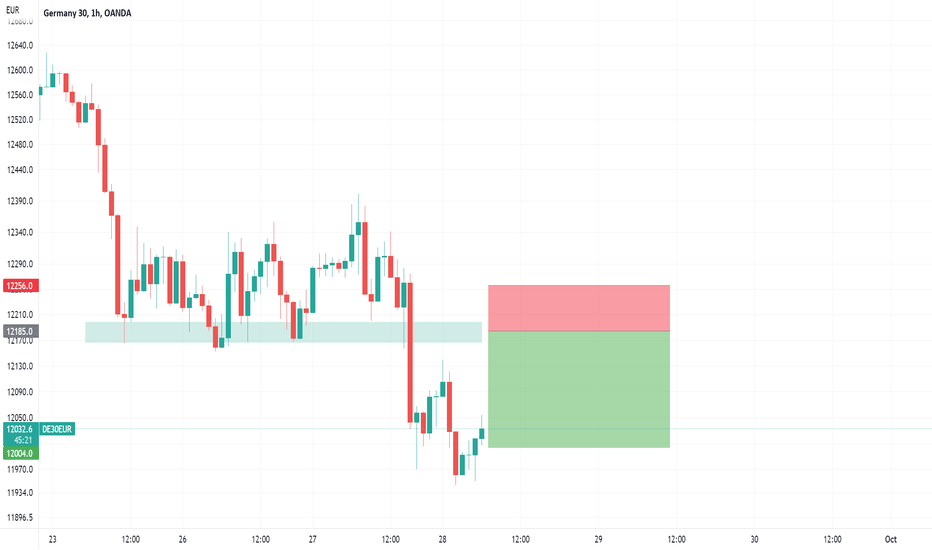

Selling previous GER40 support.GER40 - Intraday 9pm UK expiry - We look to Sell at 12185 (stop at 12256)

Daily signals are bearish.

Our bespoke support of 12200 has been clearly broken.

Previous support at 12200 now becomes resistance.

Preferred trade is to sell into rallies.

Our profit targets will be 12004 and 11964

Resistance: 12000 / 12100 / 12200

Support: 11900 / 11800 / 11700

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GER40 midterm outlook The German benchmark index should not have reached its low yet. I expect that the downward trend should find its end in the area between 11044 and 11449 and from here, at least for the moment, a strong correction should begin, if not new record highs could be reached from here.

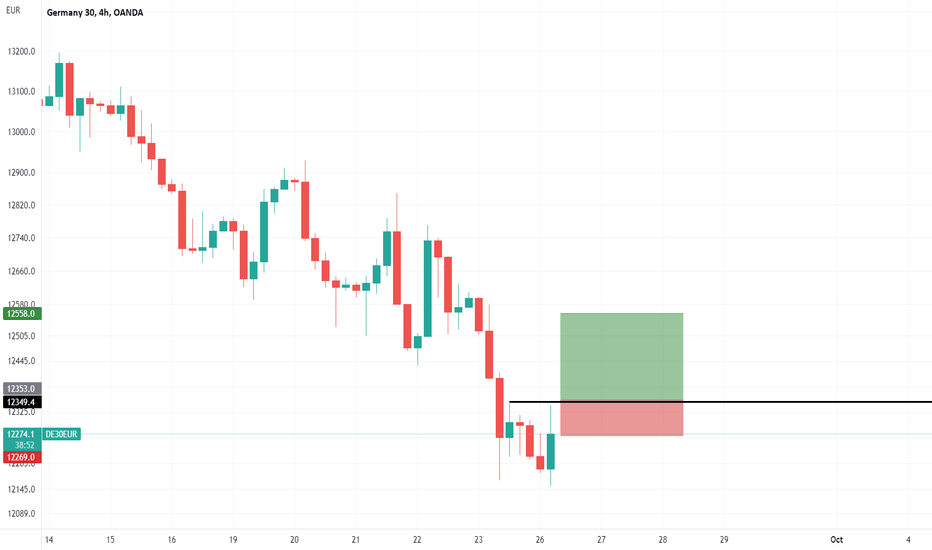

GER40 Buy a break of recent high.GER40 - Intraday expiry 9PM UK - We look to Buy a break of 12353 (stop at 12269)

We are trading at oversold extremes.

A break of the recent high at 12350 should result in a further move higher.

A higher correction is expected.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Our profit targets will be 12558 and 12598

Resistance: 12200 / 12350 / 12500

Support: 12100 / 12000 / 11900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Buying DE40 Weekly pivotal levels.GER40 - Intraday - We look to Buy at 12452 (stop at 12359)

With signals for sentiment at oversold extremes, the dip could not be extended.

Weekly pivot is at 12426.

Weekly pivot is at 12374.

Bullish divergence can be seen on the daily (the chart makes a lower low while the oscillator makes a higher low), often a signal of exhausted bearish momentum, or at least a correction higher.

Bullish divergence can be seen on the 4 hour chart (the chart makes a lower low while the oscillator makes a higher low), often a signal of exhausted bearish momentum, or at least a correction higher.

Support could prove difficult to breakdown.

We look to buy dips.

Our profit targets will be 12678 and 12758

Resistance: 12600 / 12700 / 12800

Support: 12500 / 12450 / 12400

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

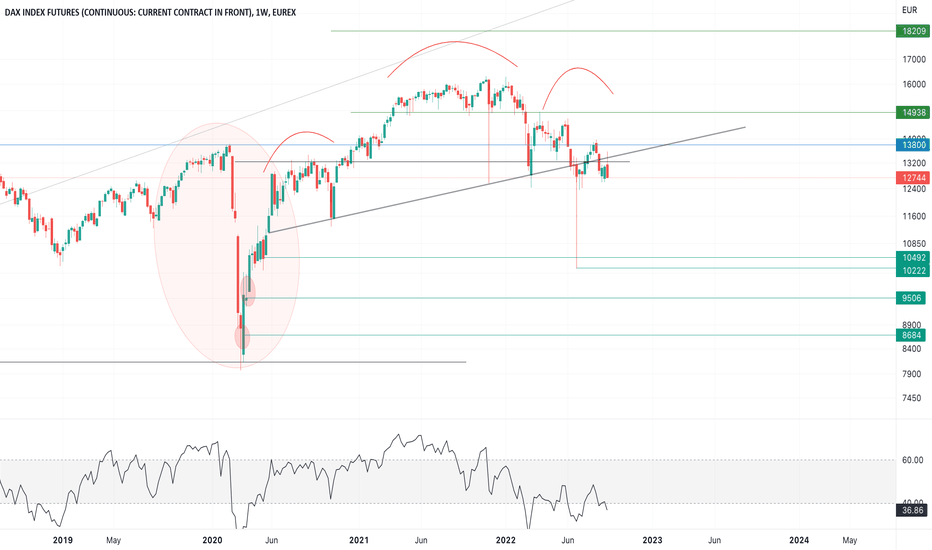

DAX Testing the March Support. Potential Triple Bottom.The DAX futures index (FDAX1!) followed exactly what we pointed out on our last analysis more than a month ago, as it got rejected on the All Time High Lower Highs trend-line (1) and is now approaching the Support Zone that started after the March 07 Low:

As you see, that Support Zone has so far made a Double Bottom (March 07 and July 05) and along with the Lower Highs trend-line (1) have formed a massive Descending Triangle that is on the verge of breaking out. With the 1D RSI on Higher Lows since March 07, a bullish break-out is quite likely and it should target the 1D MA200 (orange trend-line) around the 0.382 Fibonacci retracement level. Note that the 1D MA200 has been untouched since February 02. However no further buying can be engaged with as the price will still be limited to the Lower Highs trend-line (2). In our opinion, only a break above the 1W MA50 (red trend-line) can restore the bullish sentiment on DAX on the long-term.

If on the contrary the 12360 Support breaks, we expect aggressive selling that can target the -0.236 Fibonacci extension around 11435.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

Selling into previous swing high DE40.GER40 - Intraday - We look to Sell at 12866 (stop at 12941)

Our short term bias remains negative.

Preferred trade is to sell into rallies.

50 4hour EMA is at 12871.

Risk/Reward would be poor to call a sell from current levels.

Our profit targets will be 12688 and 12648

Resistance: 12700 / 12800 / 12900

Support: 12600 / 12500 / 12400

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Ready for a big short, target 10492Following weekly chart.

Marked H&S setup in the chart and we got a clear confirmation with the last week's candle.

War in Europe and recession expectations are supporting the trend.

If formation works, we have a formation target in 10273.

The rest of them are potential ones for which we have gaps in the post-covid bull run.

TP1 10492

TP2 10273

TP3 9506

TP4 8694

SL 14000