Dax40

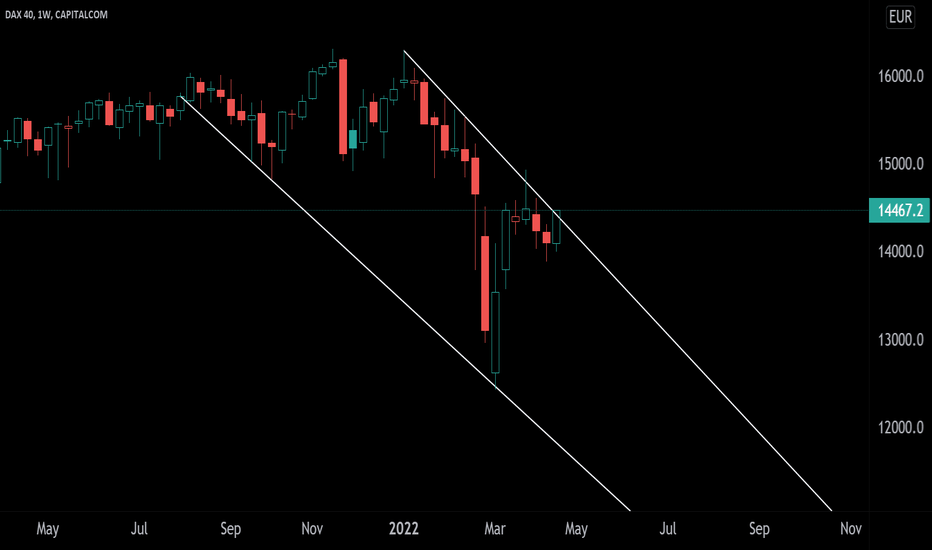

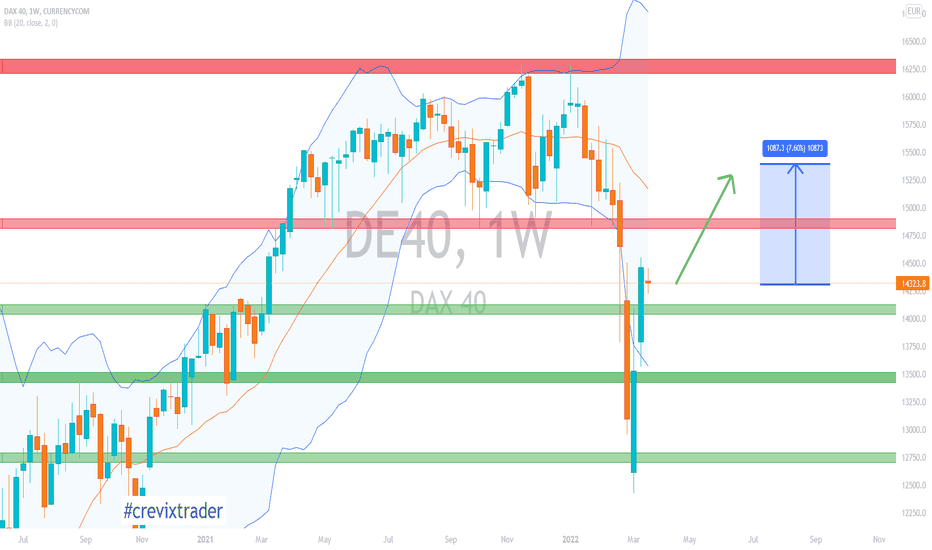

GER40 (DAX40) Weekly Gann Analysis. Will it BREAKOUT? CAPITALCOM:DE40 Falling Wedge Pattern (Weekly)

The index is testing resistance of the falling wedge once again for 5 weeks in a row.

Weekly candle close above 400 will indicate a breakout from the downward trend with a target of 16,200 if the breakout sustains.

Good Luck!

Potential Shark Forming 🦈🦈GER30 - Another shark (You see the trend)

Here i'm waiting for price to hit either the .886 of this shark or the demand zone below, with the current outlook across the stocks i'm looking for a bullish push before a retracement then continuations!

Let me know your thoughts!

* Disclaimer **

These ideas I never trade until the end target with my initial lots, I focused on high probable entries with higher lots and use a specific partial taking strategy giving me a very high win rate and take most of my profits very early, I only leave a small % of my capital to run the entire trade. On the flip side im constantly monitoring LTF momentum and will close early if things change, these analysis's are for research purposes only.

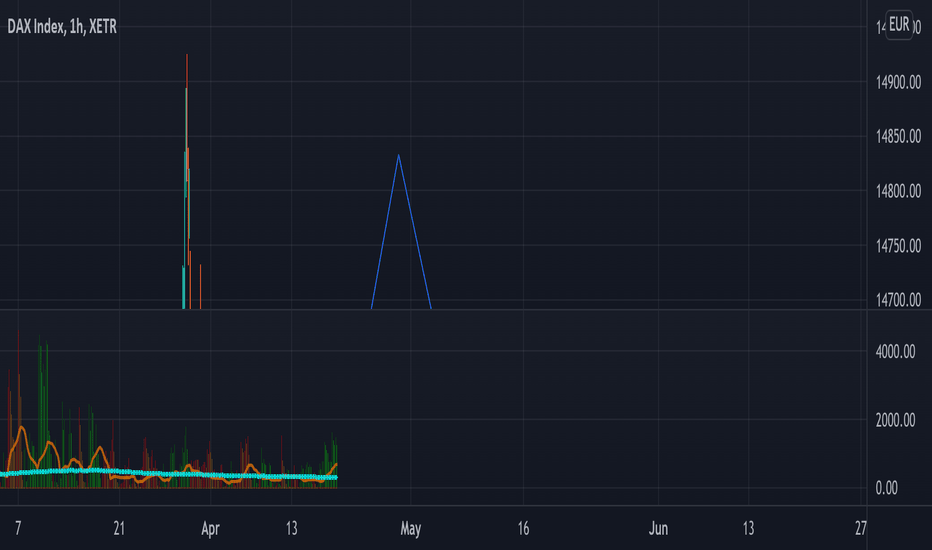

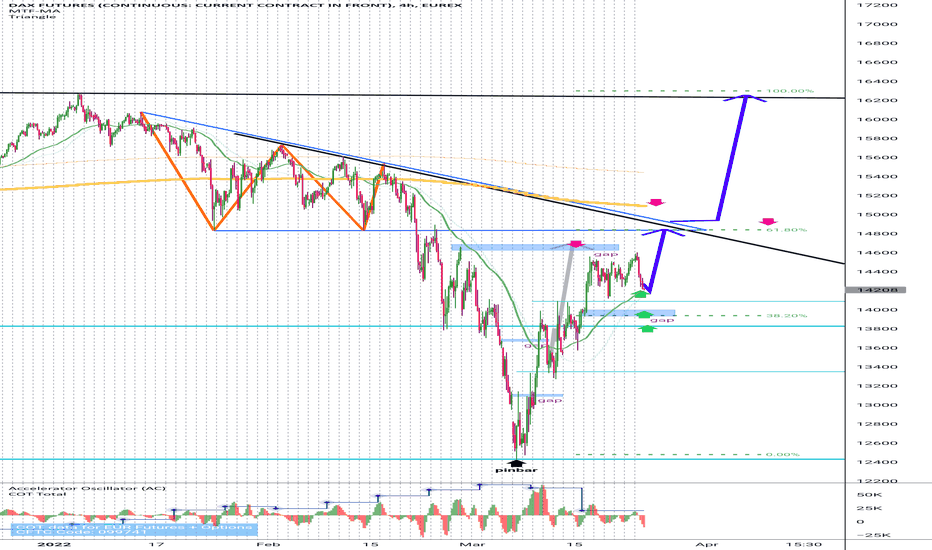

DAX can reach 14770 gap ( cash xetra dax gap)as predict 2-3 days ago , DAX ,DOW ,Nasdaq have powerful buy so looking for buy in 15min chart deep

ALERT = dont pick sell on dax , dax ,dow,nasdaq easily can fly up and back to high ( if you want sell under green arrow , pickvery very low sell with SL=40 point , never remove it )

on dax AC indicator(accelator occilator) on 4hour and 30min is very important

good luck

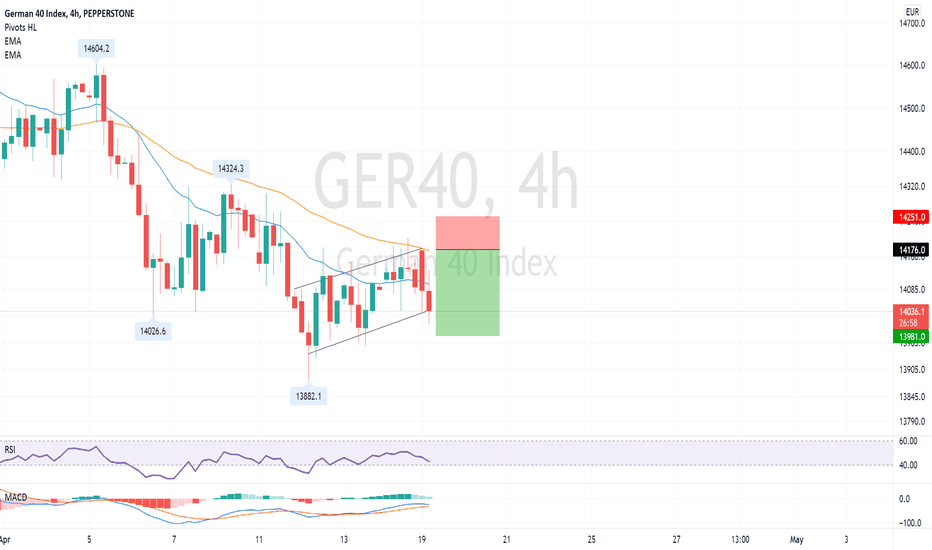

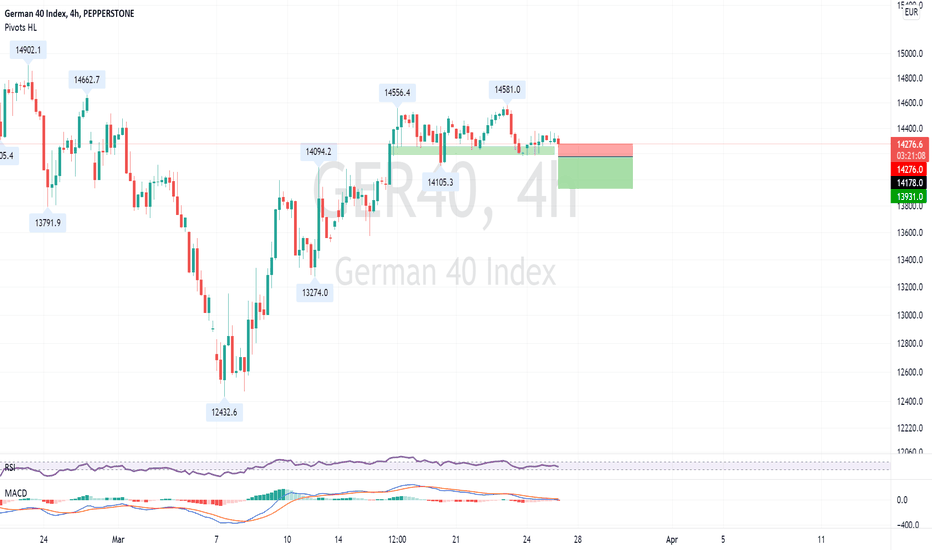

GER40 Sell the channel trend line.GER40 - Intraday - We look to Sell at 14176 (stop at 14251)

Daily signals are mildly bearish.

50 4hour EMA is at 14175.

Trading within a Corrective Channel formation.

Trend line resistance is located at 14175.

Our profit targets will be 13981 and 13921

Resistance: 14100 / 14200 / 14250

Support: 14030 / 13960 / 13900

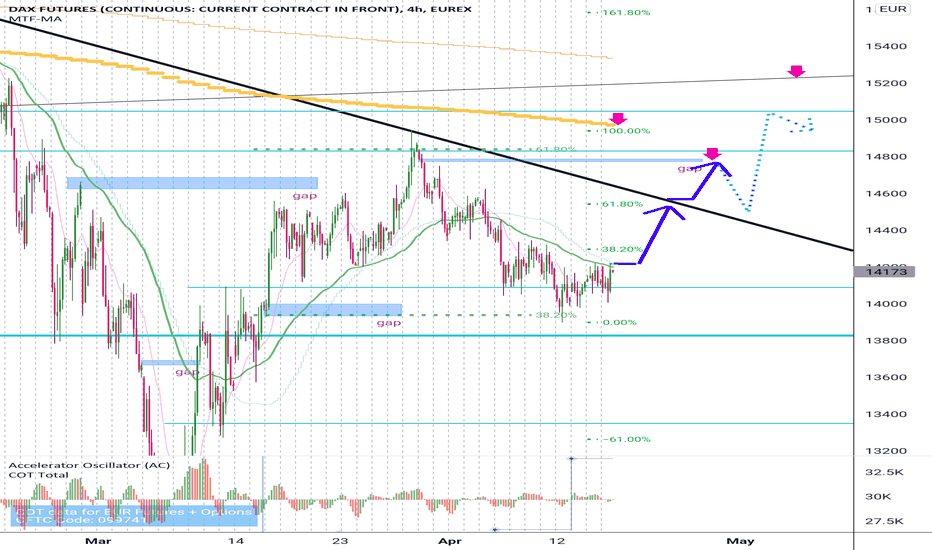

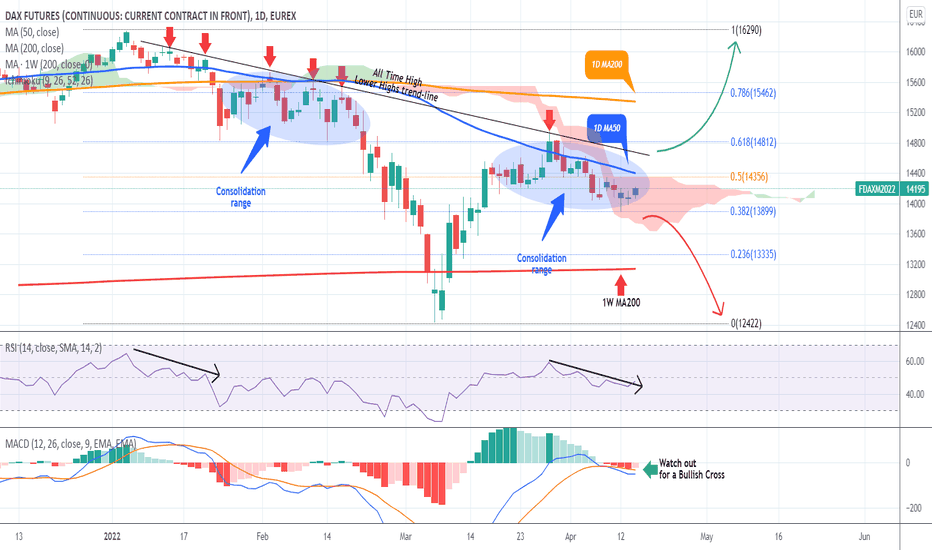

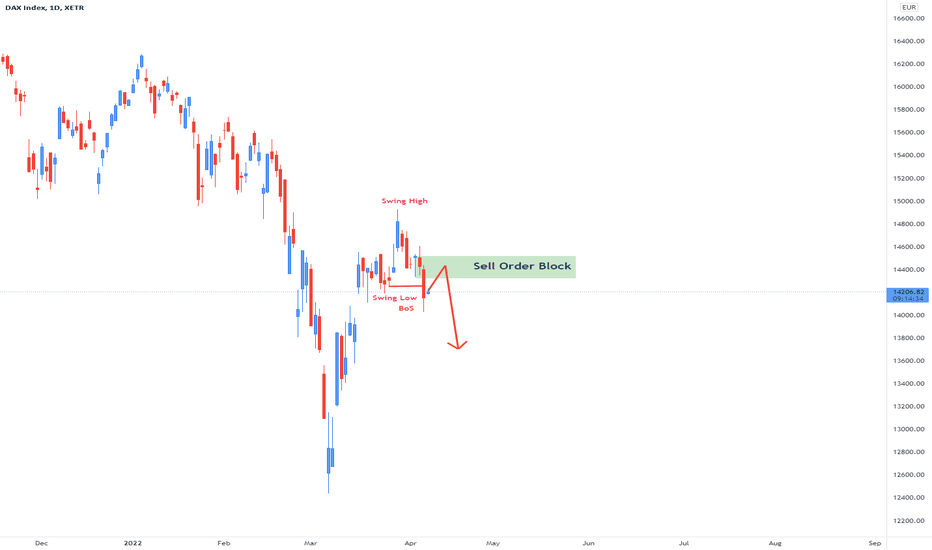

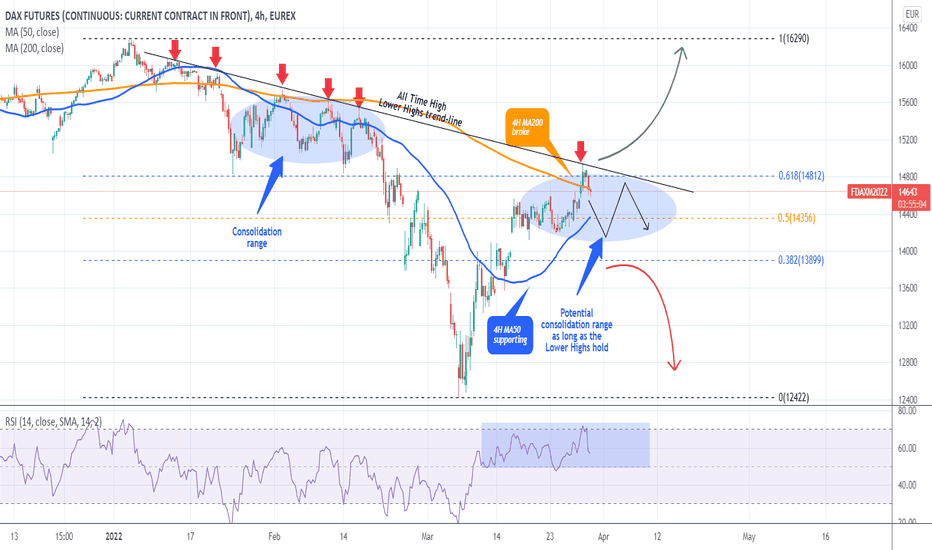

DAX Still consolidating. Trade the break-out.Not much have changed on the German stock market (DAX) as the price is still consolidating within the All Time High Lower Highs trend-line of January (Resistance) and the 0.382 Fibonacci retracement level (Support).

Being below the 1D MA50 (blue trend-line) as well, scalpers may find some value trading the 1D MA50 - 0.382 Fib Zone but a lower risk trade lies on the break-out, either above the Lower Highs trend-line (bullish targeting the 1D MA200 (orang trend-line) and then the All Time High) or below the 0.382 Fib (bearish towards the 0.236 Fib/ 1W MA200 (red trend-line) and then the March lows.

While the 1D RSI favors the downside, keep an eye on the MACD for a Bullish Cross, which will shift the sentiment upwards. Also on a longer-term horizon, this looks like an Inverse Head and Shoulders on a declining trend with the ATH Lower Highs trend-line as the Resistance to break. And that is typically a bottom pattern calling for a trend reversal to the upside.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

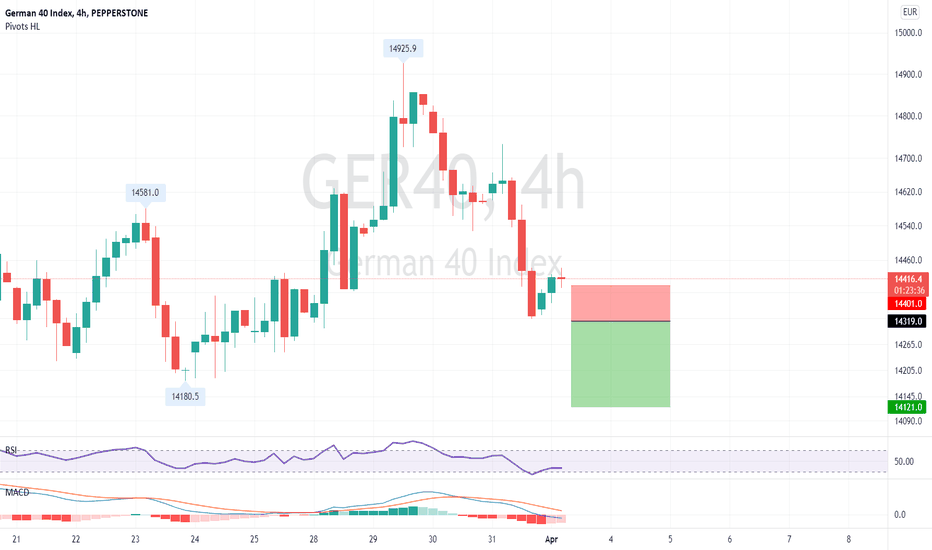

GER40 Buy the 50EMA.GER40 - Intraday - We look to Buy at 14474 (stop at 14394)

Short term bias is bullish.

There is no clear indication that the upward move is coming to an end.

50 4hour EMA is at 14460.

We look to buy dips.

Our profit targets will be 14674 and 14714

Resistance: 14700 / 14800 / 14900

Support: 14600 / 14500 / 14400

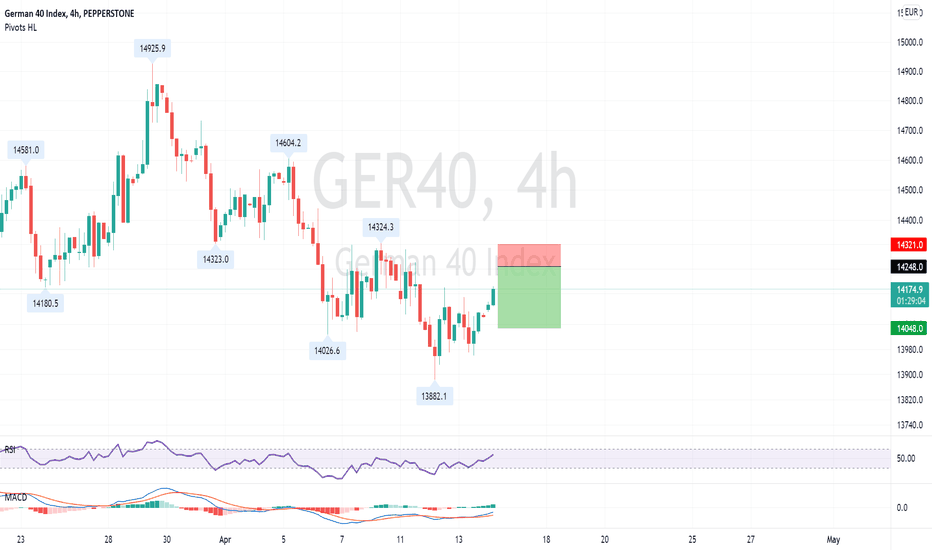

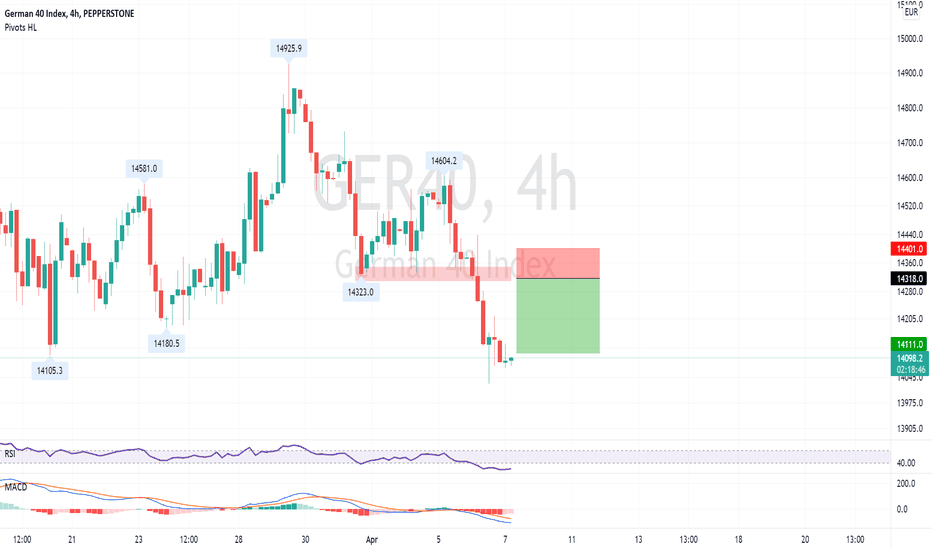

GER40 Sell a break of yesterday low.GER40 - Intraday - We look to Sell a break of 14319 (stop at 14401)

Short term bias has turned negative.

A break of yesterdays low would confirm bearish momentum.

A lower correction is expected.

Short term momentum is bearish.

Our profit targets will be 14121 and 14081

Resistance: 14500 / 14600 / 14700

Support: 14250 / 14180 / 14100

GER40 Sell the previous support.GER40 - Intraday - We look to Sell at 14318 (stop at 14401)

Short term bias has turned negative.

Previous support at 14300 now becomes resistance.

We look for a temporary move higher.

20 1day EMA is at 14316.

Our profit targets will be 14111 and 14061

Resistance: 14150 / 14200 / 14300

Support: 14000 / 13900 / 13800

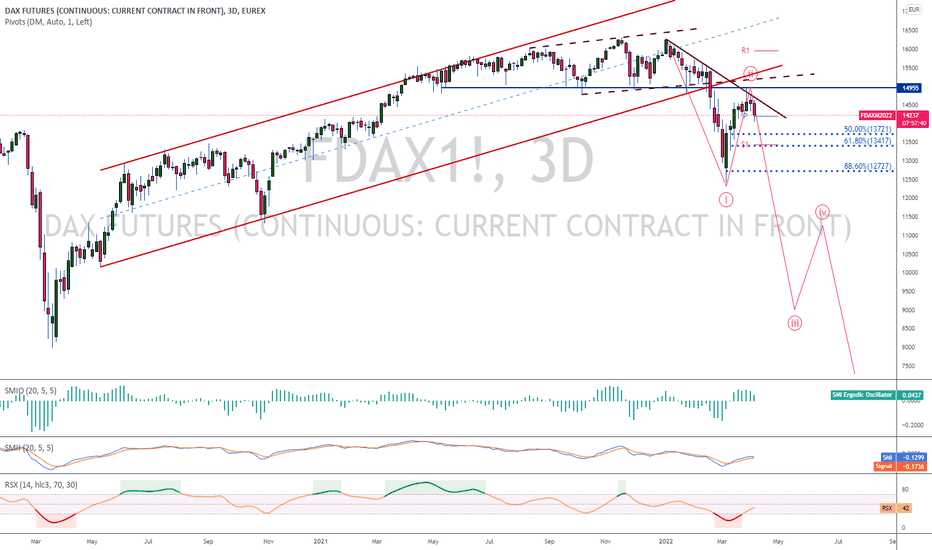

$DAX to target 13500$DAX is testing 14000. A break below 14000 is needed for the downside reversal of the recent short-term upside trend and a continuation of the downtrend that has been triggered by a rejection from 16500. This would be the beginning of the second impulsive downside wave which should be the most violent and would lead to a break below the recent low.

GER40 Sell a break of pivotal value.GER40 - Intraday - We look to Sell a break of 14319 (stop at 14404)

Daily signals are mildly bearish.

14323 has been pivotal.

A break of the recent low at 14323 should result in a further move lower.

Short term bias has turned negative.

Our profit targets will be 14111 and 14071

Resistance: 14400 / 14500 / 14600

Support: 14300 / 14180 / 14105

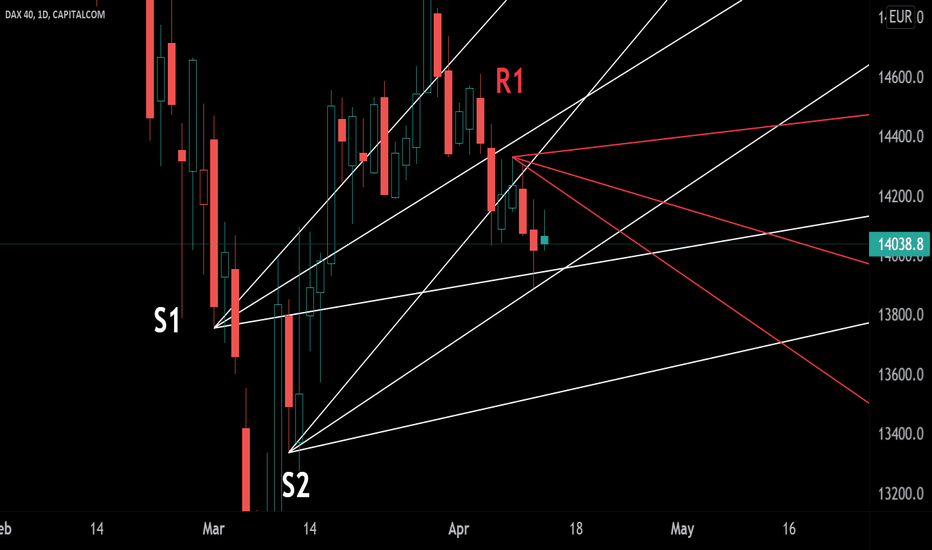

DAX rejected on Lower Highs. Unless broken, consolidation ahead.DAX broke and closed yesterday above the 4H MA200 (orange trend-line) for the first time since January 20. Despite this bullish development, the index failed to break above the long-term Lower Highs trend-line of the correction, which has been holding and rejecting the price (6 rejections including yesterday's) since after the All Time Highs.

The last time that happened, DAX consolidated for more than 2 weeks (February). As a result, as long as it fails to break above the Lower Highs, it is more likely to see a consolidation within roughly 14800 - 14100, which as you see is within the zone of the 0.618 - 0.382 Fibonacci retracement levels.

A break (and 1D candle closing) above the Lower Highs, should be enough to extend this bull run all the way to the 16290 All Time Highs. Similarly a break below the 0.382, could restore the bearish sentiment back to the 12420 March low.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

GER40 Sell a break setup.GER40 - Intraday - We look to Sell a break of 14178 (stop at 14276)

Daily signals are bearish.

A break of yesterdays low would confirm bearish momentum.

50 4hour EMA is at 14230.

The bearish engulfing candle on the daily chart is negative for sentiment.

Our profit targets will be 13931 and 13841

Resistance: 14380 / 14500 / 14580

Support: 14180 / 14100 / 14000

dax 4 hour : 3 place we must buy with SL=40 pointAccelator occilator AC 4hour do it's job well

despite yesterday mini crash , still we see daily chart trend + up

dax next target 🎯 is 14800(sellimit possible with SL above support)

if you have sell , advice you close it near 14000 and pick buy and hold it 8-10 day to 14800 or above (don't close sooner)

ALERT = for dax ( check your broker , dax symbol property,, if size is 10 contract) don't open Big size on dax ( per 1000$ balance you have , dont open above 0.01 lot , SL must be max -10$ ) dax easily can move in 1 day 1000 point (on 10k account max 0.1 lot)

if your broker dax contract = 1 so per 1000$ balance use 0.1 lot

note = in down side we have green line = EMA200 1hour (ema200 is very very important on full time dax on 15min, 1hour and daily chart ) and open gap (comes from cash extra dax) ( powerfull buy place, next low for next 30 day)

DAX (Alım Fırsatı)İnceltilmiş bölge, 14020 seviyesi olan taban talep bölgesinden başlamakta olup

test ve tepki sonrası alım fırsatını değerlendirebilirsiniz.

DAX Index Timeframe: Medium Term, Technical: Bullish <15400#DAX Index

#Weekly

#Technical Analysis

#crevixtrader

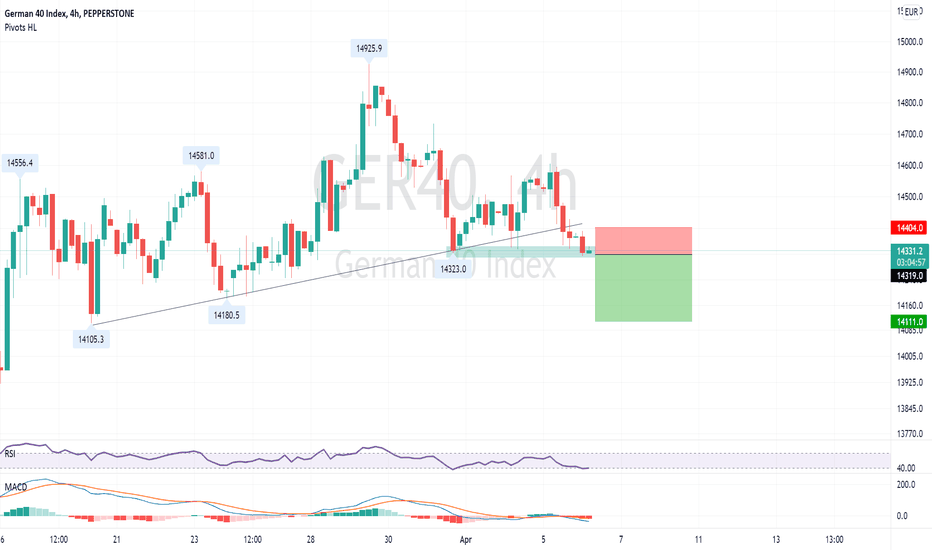

GER40 Buy a break setup.GER40 - Intraday - We look to Buy a break of 14561 (stop at 14469)

Short term bias is bullish.

14556 has been pivotal.

A break of the recent high at 14556 should result in a further move higher.

There is no clear indication that the upward move is coming to an end.

Our profit targets will be 14788 and 14848

Resistance: 14400 / 14550 / 14800

Support: 14250 / 14100 / 14000

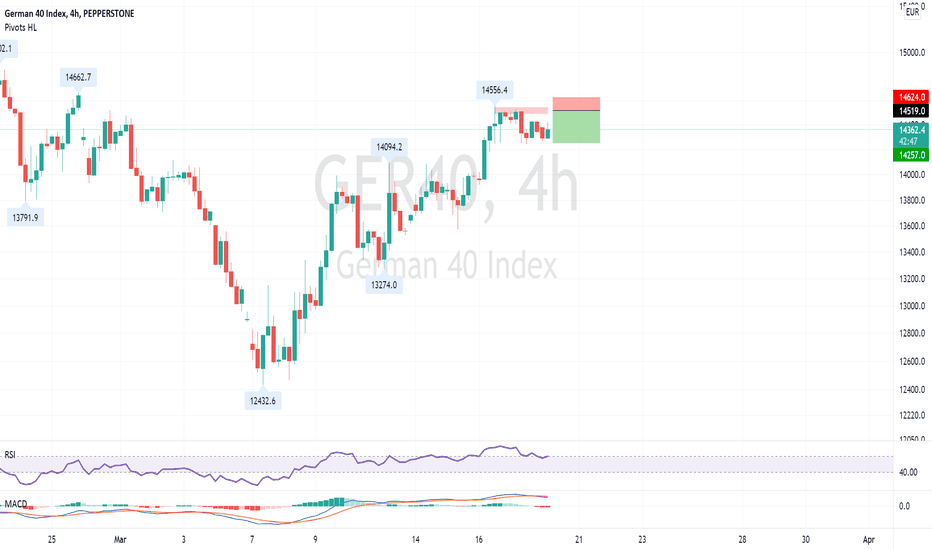

GER40 Sell into a rally.GER40 - Intraday - We look to Sell at 14519 (stop at 14624)

Price action has stalled at good resistance levels and currently trades just below here (14500).

We look for a temporary move higher.

Daily signals are bearish.

Preferred trade is to sell into rallies.

50 1day EMA is at 14520.

14556 has been pivotal.

Our profit targets will be 14257 and 14207

Resistance: 14500 / 14600 / 14800

Support: 14300 / 14100 / 14000