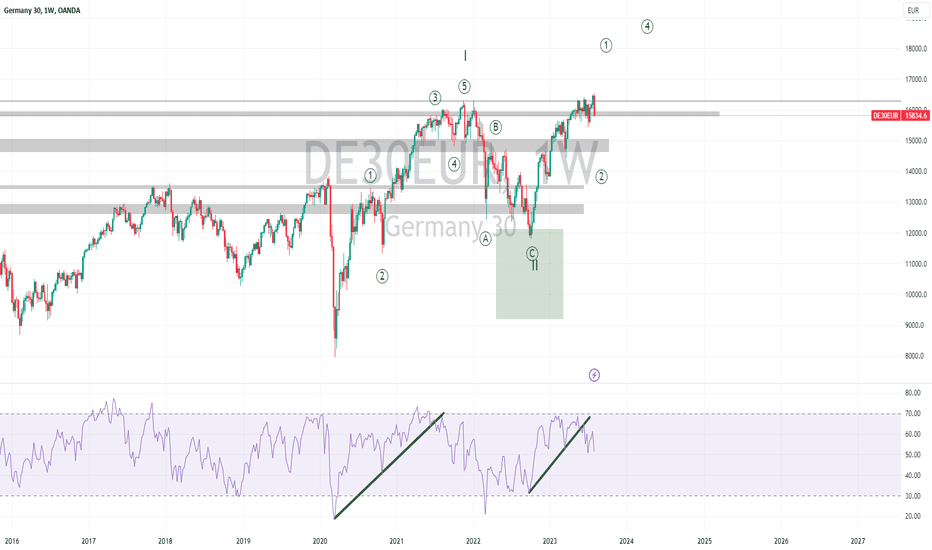

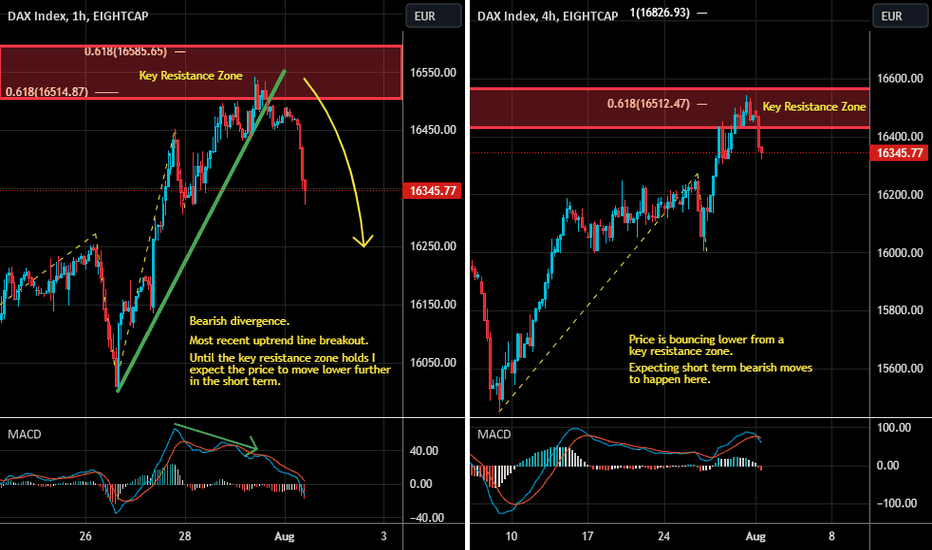

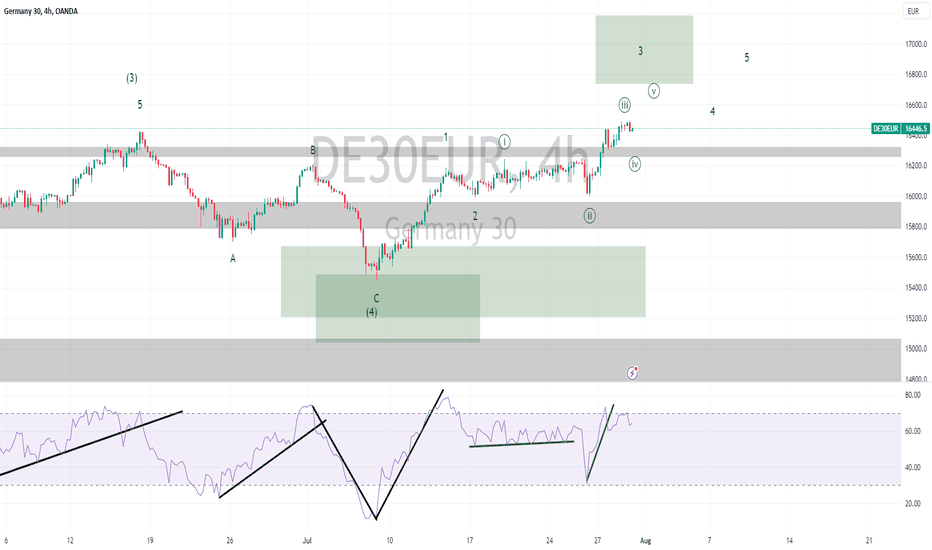

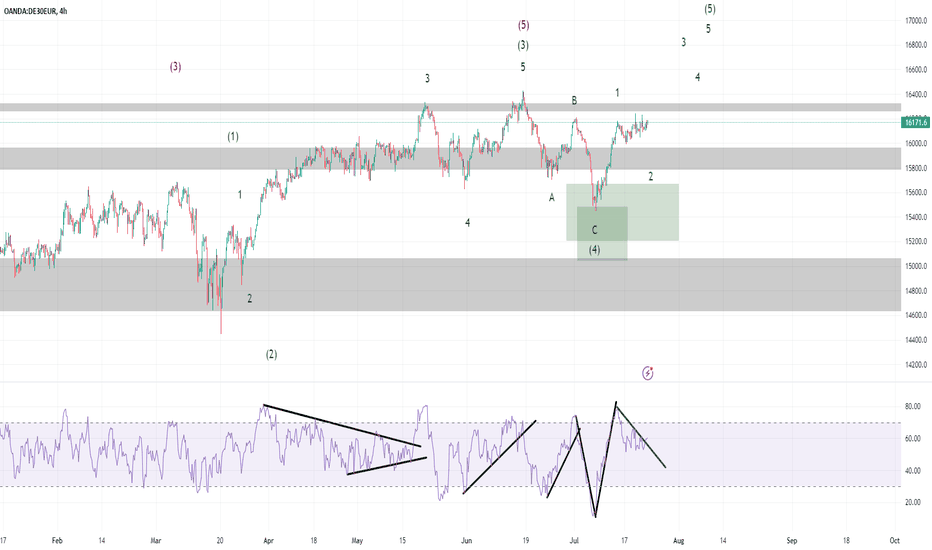

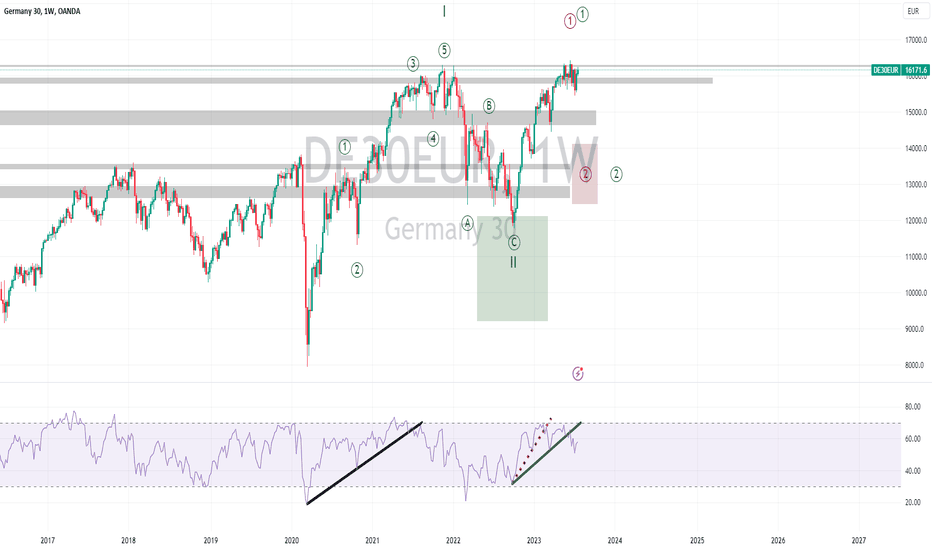

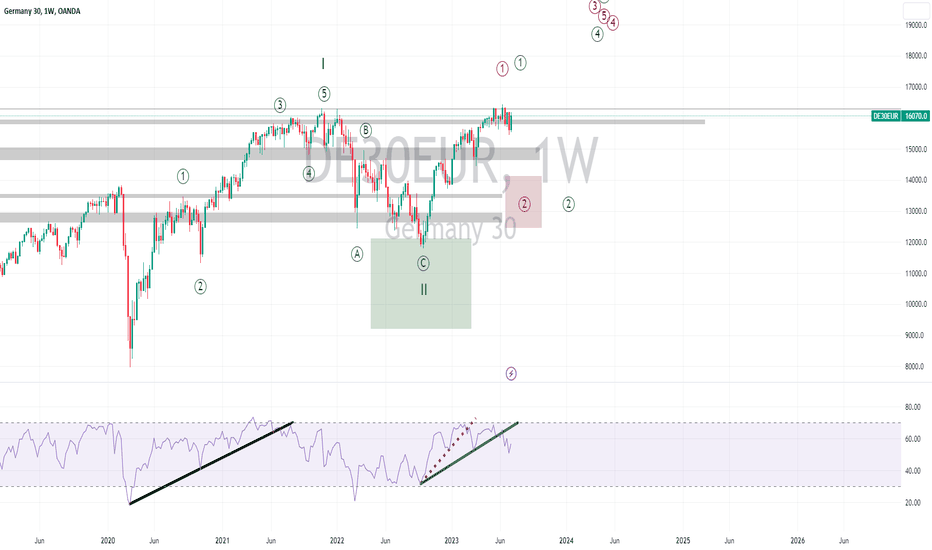

DAX Elliott Wave Analysis Higher Timeframe (06/08/2023)In our primary scenario we expect a bit more upside as a wave (5) to finish the higher level wave ((1)). For investors, we are in an area to take (partial) profits. Investors do not buy here as the data shows a bearish divergence. Investors should wait for a decent wave ((2)) pullback before buying again. Traders should analyze the lower timeframe.

Daxanalysis

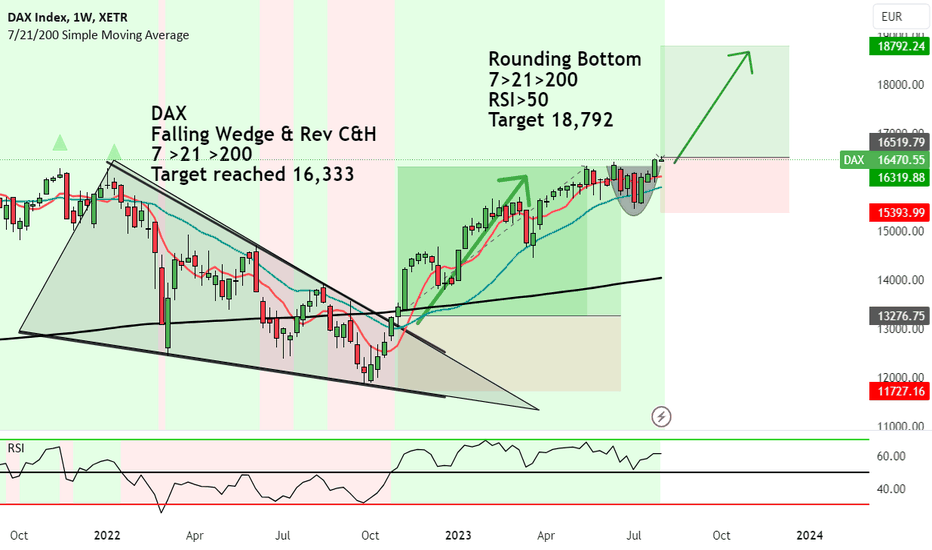

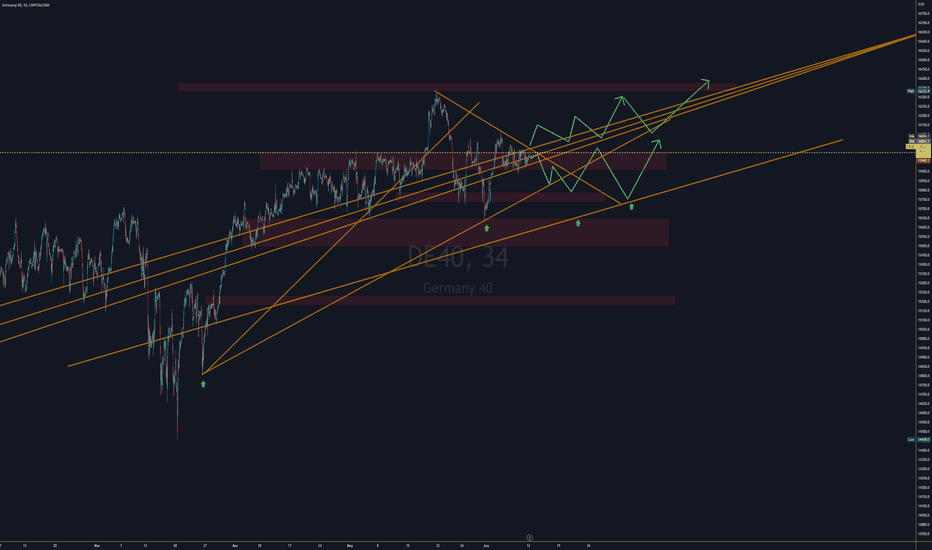

Scallop on DAX with new upside target to 18,792From the previous trade analysis on DAX, it hit our target of 16,333.

This was due to a Falling Wedge along with a Reverse Cup and Handle pattern.

Since then, the price has moved into a consolidation period where the price was fighting between the bulls and bears.

And guess who is winning? The bulls again.

There has been a smaller pattern form called a Rounding Bottom or a Scallop formation.

Now that the price has broken above the neckline, means we can expect upside to come to the next target.

Other indicators confirm upside momentum including:

7>21>200

RSI>50

My next target will be up to 18,792

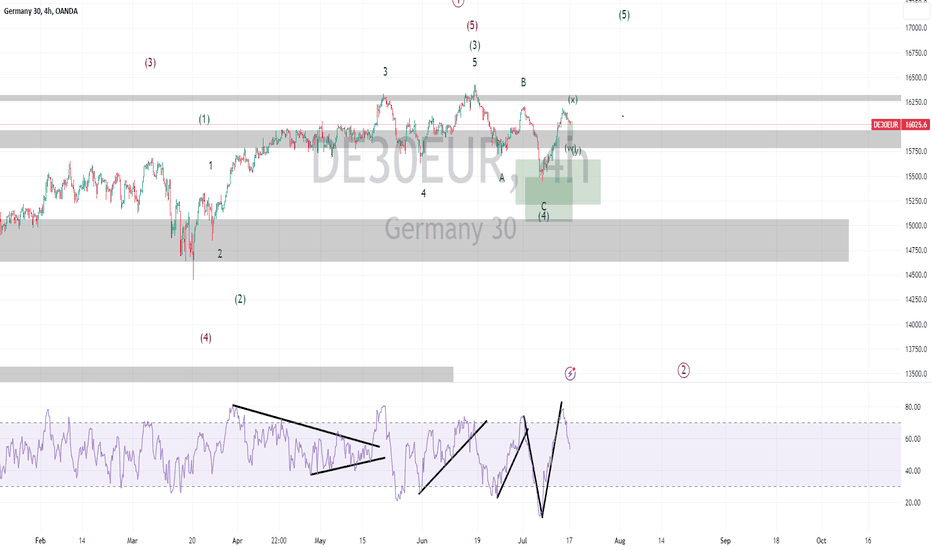

DAX Elliott Wave Analysis Higher Timeframe (29/07/2023)In our primary scenario we expect a bit more upside as a wave (5) to finish the higher level wave ((1)). For investors, we are in an area to take (partial) profits. Investors do not buy here as the data shows a bearish divergence. Investors should wait for a decent wave ((2)) pullback before buying again. Traders should analyze the lower timeframe. We see opportunities for both short and long trades next week.

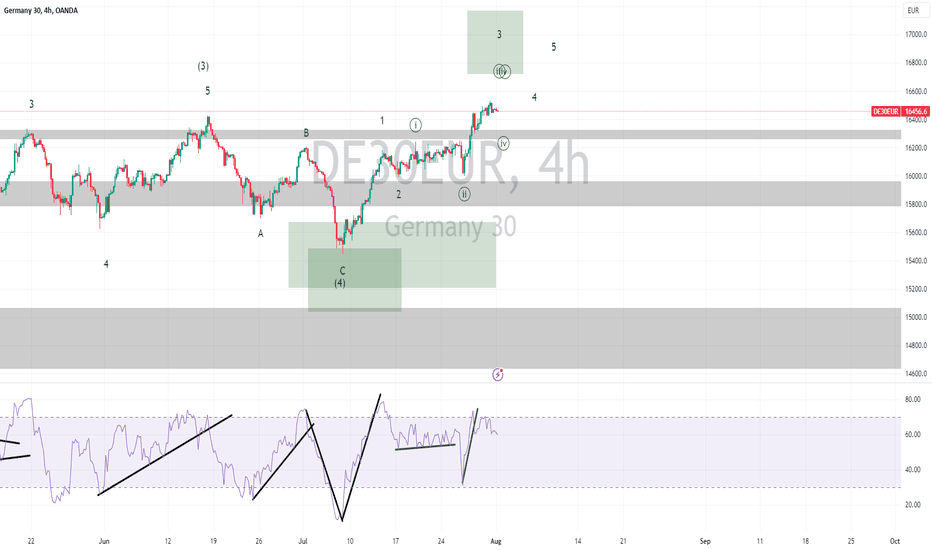

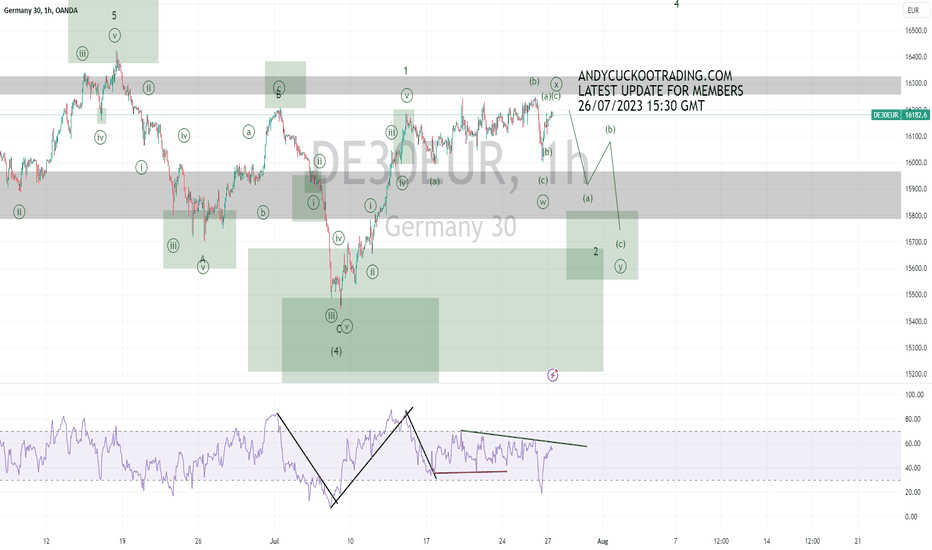

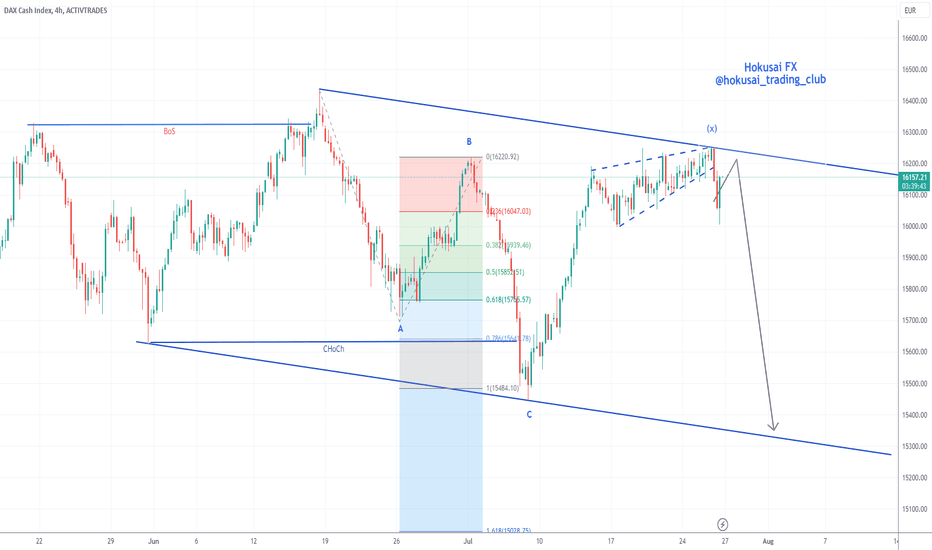

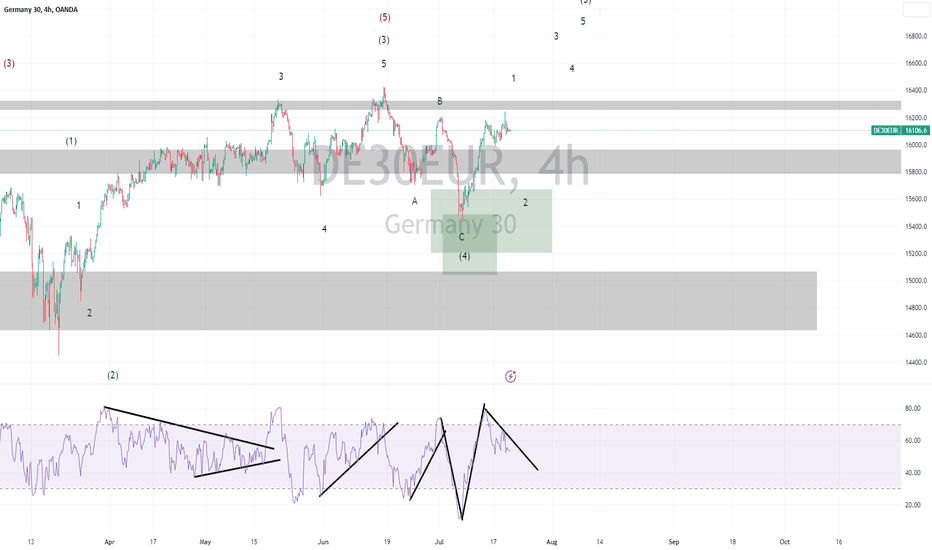

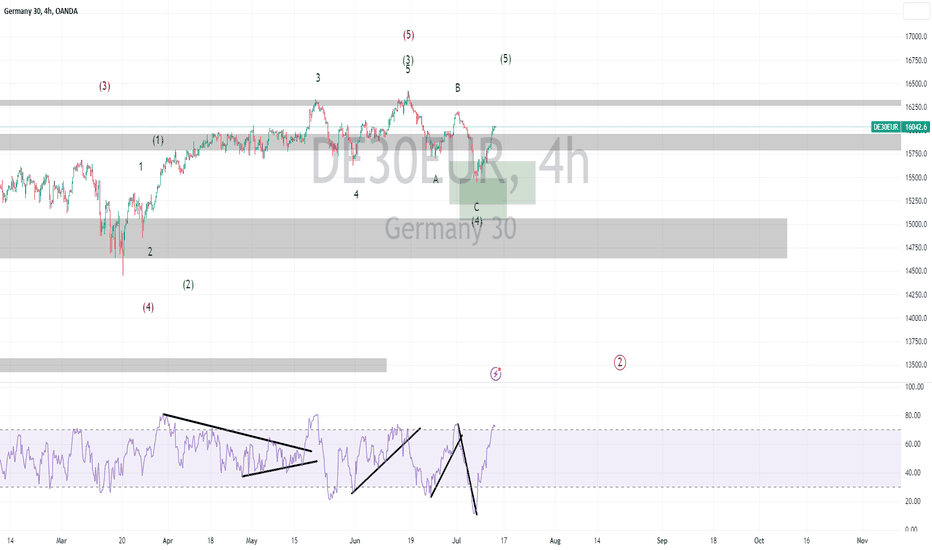

GER40 / DAX Analysis 26July2023Ger40 / Dax entered the initial correction period. If you see Wave A has the same length as Wave C, then the possibility that is happening at this time is the formation of Wave (X), after Wave (X) occurs, the price will return to the target with the target up to the trendline below. There is a possibility that the price drops not to the trendline area, by forming complex correction.

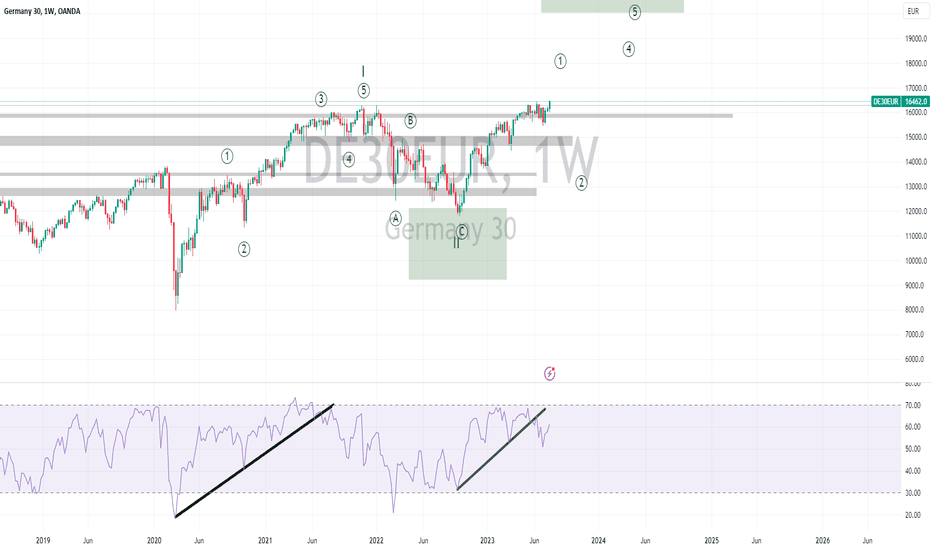

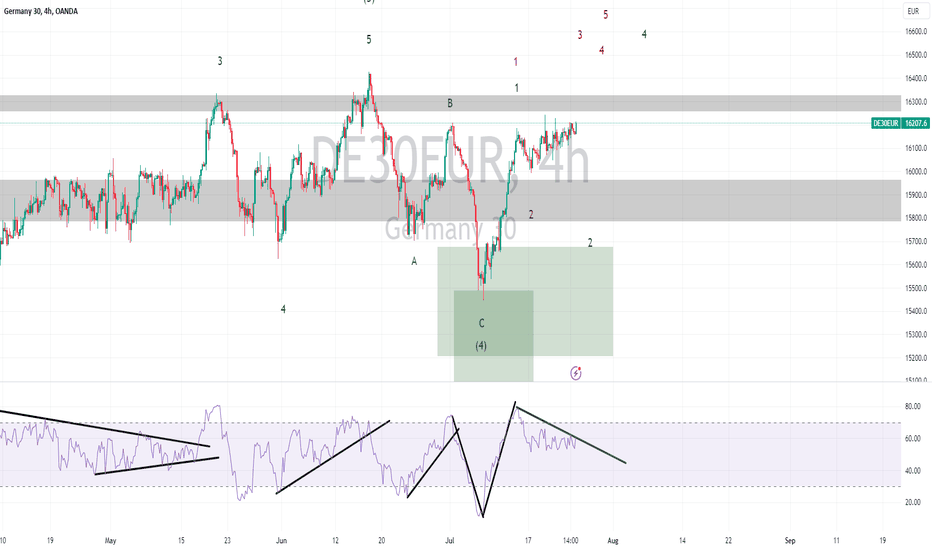

DAX Elliott Wave Analysis Higher Timeframe (22/07/2023)In our primary scenario we expect a bit more upside as a wave (5) to finish the higher level wave ((1)). In our secondary scenario, the high might be in and the pullback might have started. For investors, we are in an area to take (partial) profits. Investors do not buy here as the data shows a bearish divergence. Investors should wait for a decent wave ((2)) pullback before buying again. Traders should analyze the lower timeframe. We see opportunities for both short and long trades next week.

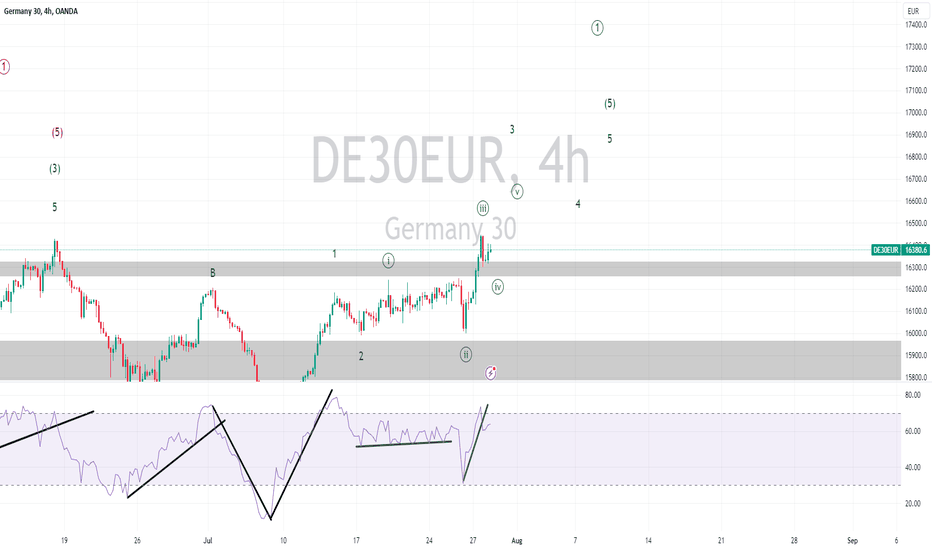

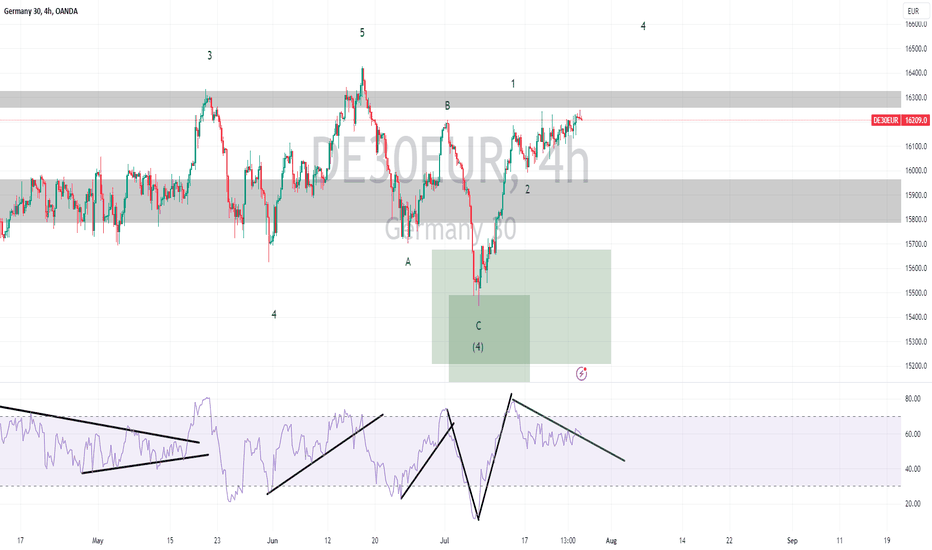

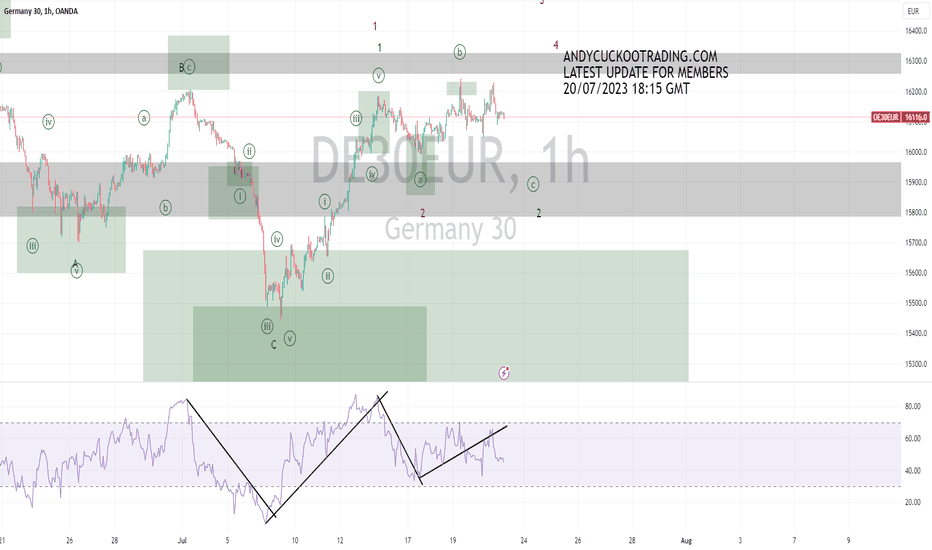

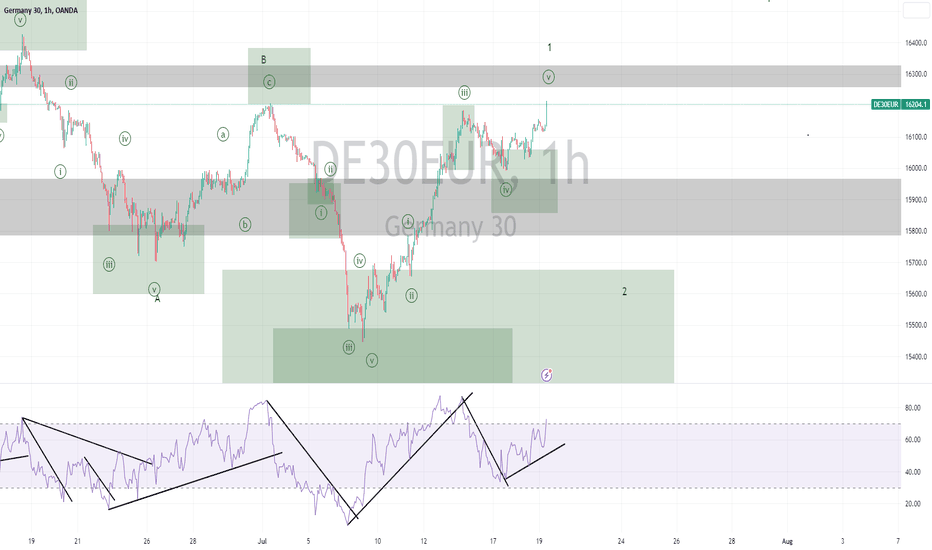

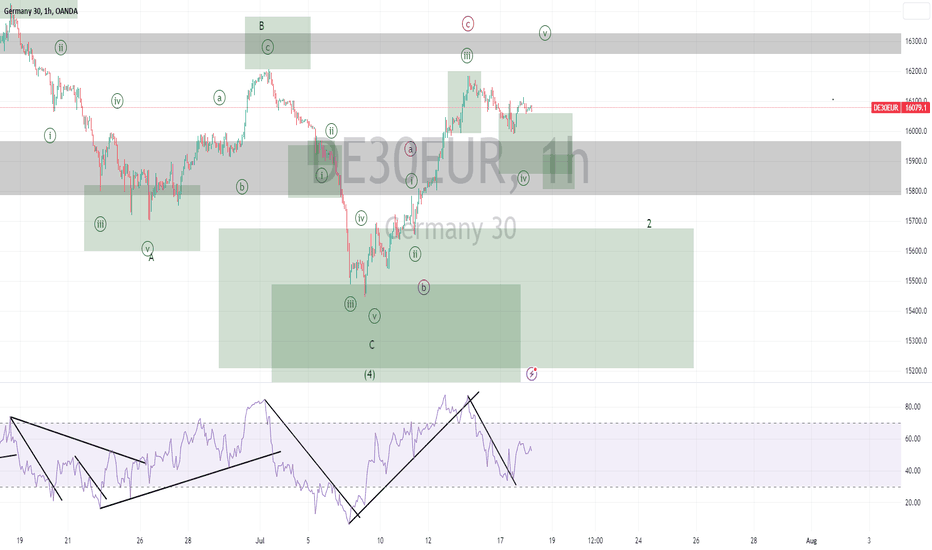

DAX Elliott Wave Analysis for Tuesday 18/07/2023We discuss three scenarios that could play out today. We reached the area where the wave ((4)) can end. In case of a single correction, we should start to see an upside movement. In case of a double correction, wave ((4)) can retrace deeper. Finally, we also might see no wave ((4)) if the preceding three waves up are part of a larger WXY correction. In that case, a new wave 4 low in the higher degree cannot be excluded.

DAX Elliott Wave Analysis for Monday 17/07/2023We discuss three scenarios that could play out today. We reached the area where the wave ((4)) can end. In case of a single correction, we should start to see an upside movement. In case of a double correction, wave ((4)) can retrace deeper. Finally, we also might see no wave ((4)) if the preceding three waves up are part of a larger WXY correction. In that case, a new wave 4 low in the higher degree cannot be excluded.

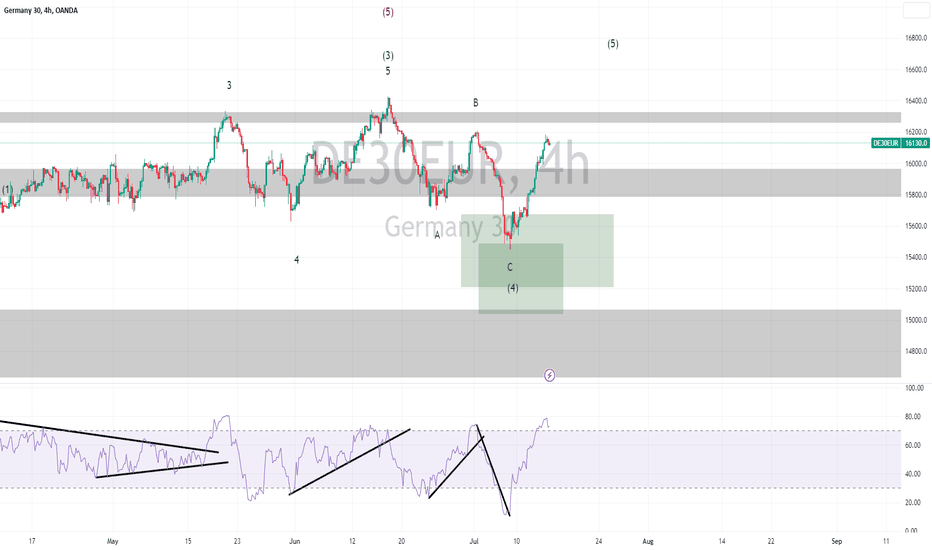

DAX Elliott Wave Analysis Higher Timeframe (15/07/2023)In our primary scenario we expect a bit more upside as a wave (5) to finish the higher level wave ((1)). In our secondary scenario, the high might be in and the pullback might have started. For investors, we are in an area to take (partial) profits. Investors do not buy here as the data shows a bearish divergence. Investors should wait for a decent wave ((2)) pullback before buying again. Traders should analyze the lower timeframe. We see opportunities for both short and long trades next week.

DAX Elliott Wave Analysis for Friday 14/07/2023We need a bit more data but traders can prepare for a short trade. In case of an impulse, we wait for 5 waves up that end with divergence. Keep in mind that we do not necessarily need the 5 waves up, 3 waves in the form of an ABC is also possible. If we stick with the three waves, a new wave 4 low cannot be excluded.

Dax40 Long turned down, but first support can be nearDax has been trading higher since October 2022 but five waves up from that low suggested that bulls are done for now and that correction is in play. In fact, we have seen a nice reversal down recently, through the trendline support on the 4h chart so the corrective phase is here, but with three waves down from the top, we may start observing some of the support for wave (C). An interesting level for a new price stabilization can be at 15300-15400 area.