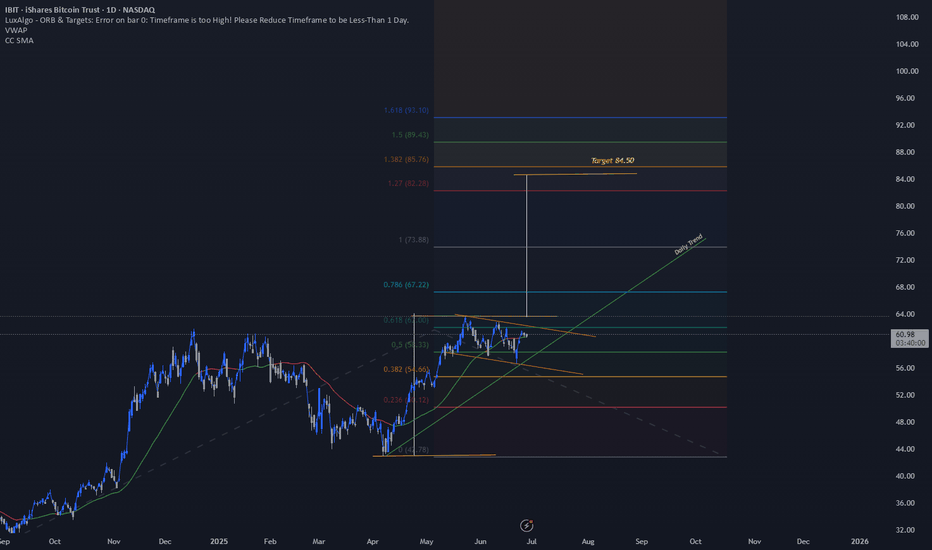

IBIT – Bull Flag + Trend-Based Fib Targets Lined Up🔍 Price Action Setup

IBIT is forming a tight bull flag just beneath key resistance at $64 after a strong impulsive move off the $42.75 base. Structure remains bullish with price holding above the 20 EMA, and volume compression setting the stage for a breakout.

📈 Trend-Based Fibonacci Extensions

If this flag breaks, here's how the upside unfolds based on the trend-based Fib extension:

1.27 – $82.50

1.382 – $85.75 (Measured Move Target)

1.50 – $89.50

1.618 – $93.00 (Full Extension)

These levels align with the prior flagpole projection and market structure above. If bulls step in on volume, $85.75 becomes the logical first destination.

🌊 ETF Inflows Confirm the Narrative

IBIT has pulled in roughly $3.3B in recent inflows, leading the pack during a 12-day net inflow streak across spot Bitcoin ETFs. Institutions are clearly still positioning, and that's reflected in the tape. Tuesday alone brought $436M+ into spot Bitcoin ETFs.

₿ BTC Leading the Way

Bitcoin is holding strong above prior resistance and pushing higher. IBIT looks like it’s just waiting on a breakout confirmation to follow.

📌 Key Trade Levels

Breakout Trigger: Close above $64

Target Zone: $85.75 first, then extended to $93.00

Invalidation: Break below $56 structure

—

🧠 This is not financial advice — just a look at structure and flow through the DC Trading lens.

📲 Follow the journey on IG: @dc_trading_journey