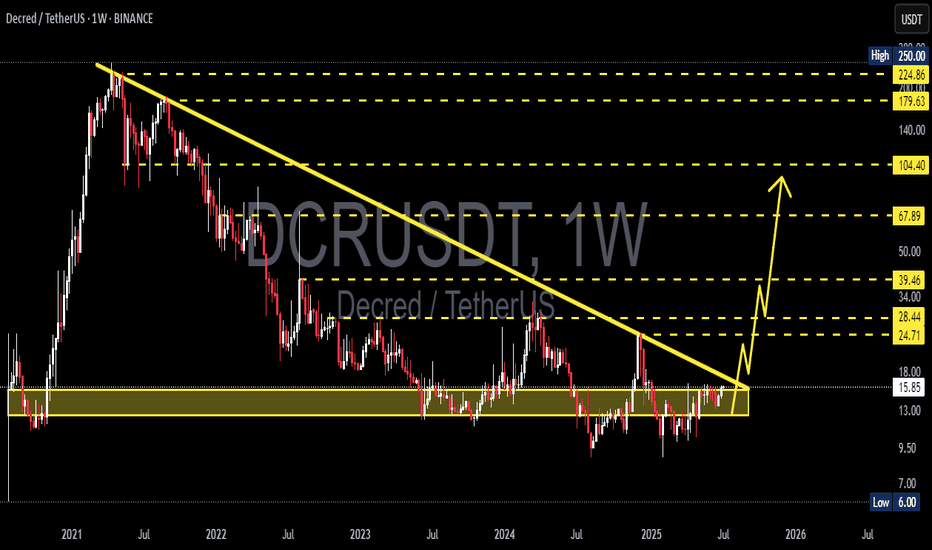

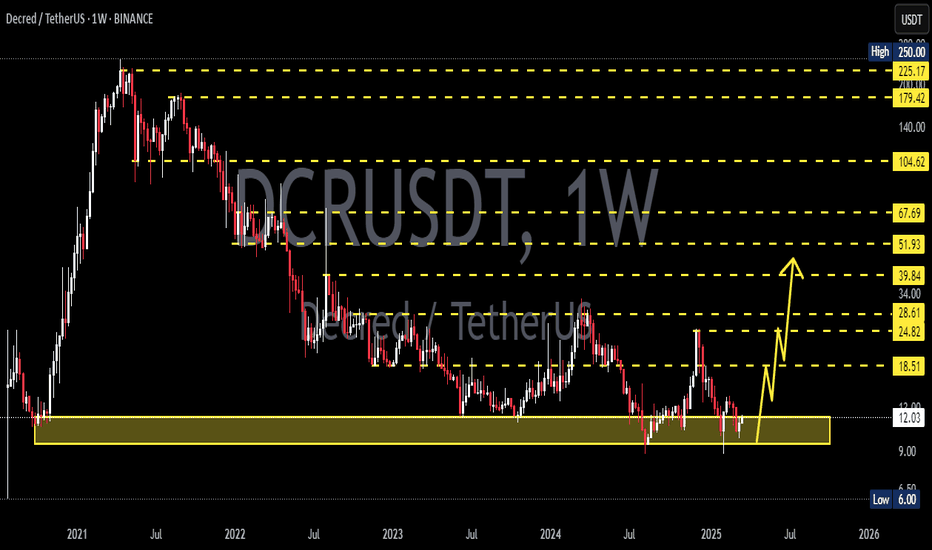

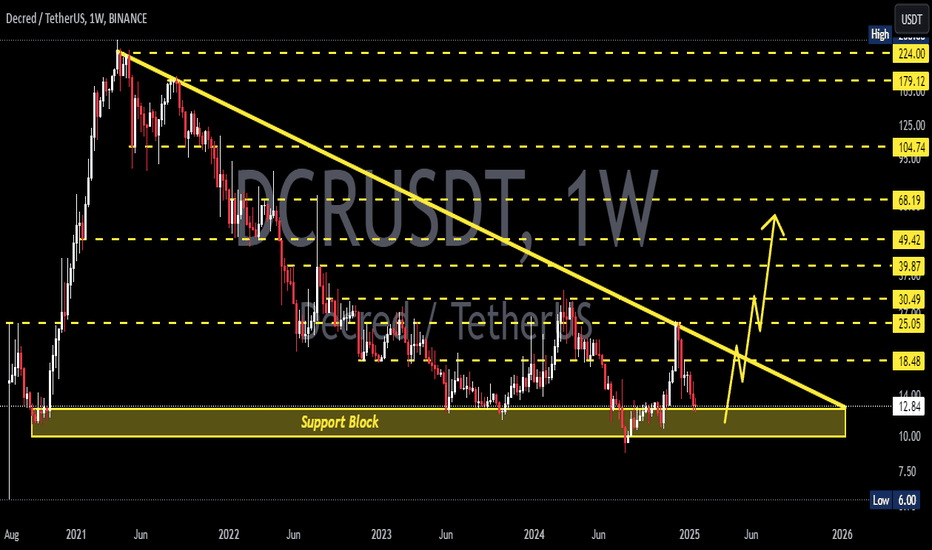

DCR/USDT Breaks 3-Year Downtrend – Macro Reversal in Motion📍 Macro Overview:

After being trapped in a multi-year downtrend since early 2021, Decred (DCR) has now shown signs of a major breakout from the long-term descending trendline. This moment could mark a pivotal shift from accumulation to expansion, offering a strong bullish macro setup.

🧠 Technical Pattern & Structure Analysis:

🔸 Dominant Pattern:

A long-standing descending triangle has formed, with a solid demand zone between $11.00 - $13.00, tested multiple times over the past 2 years.

While traditionally a bearish pattern, breaking to the upside here signals a reversal structure and the start of bullish momentum.

🔸 Breakout Confirmation:

Price has now clearly broken above the long-term downtrend line originating from the 2021 top.

This breakout implies a macro trend shift, opening the door for a series of higher highs and higher lows.

🔸 Strong Accumulation Zone:

The yellow zone ($11–$13) has proven to be a high-conviction demand area, likely indicating institutional accumulation.

✅ Bullish Scenario (High Probability):

If the breakout holds and volume confirms:

📌 Key Upside Targets:

1. $24.71 → First major resistance

2. $28.44 → Psychological level and historical S/R flip

3. $34.00 → Local top from recent past

4. $39.46 → Strong horizontal resistance

5. $67.89 → 2022 resistance and bullish confirmation level

6. $104.40 → Mid-term parabolic extension target

📈 Likely structure: Breakout → Retest → Multi-wave rally upward.

> Strategy: Ideal for Buy on Retest or Swing Long setups.

❌ Bearish Scenario (Low Probability – Risk Management):

If the breakout fails and price dips back below $13:

Expect potential pullback to $11.00 - $10.00 support

Worst-case bearish continuation could revisit $6.00 (macro support)

Would signal a false breakout and continuation of the bearish trend

> Risk Strategy: Watch the volume – weak volume could imply a fakeout.

🔍 Supporting Technical Signals:

📊 Volume: Strong volume confirmation is essential for breakout validity

📈 Indicators Supporting Bullish Bias:

Weekly RSI hovering at neutral-bullish zones

Potential for a weekly EMA crossover (golden cross)

OBV shows signs of increasing accumulation pressure

🧭 Conclusion & Strategy Insight:

This chart is signaling a high-conviction macro opportunity.

Breaking out from a 3-year downtrend is a rare technical event that has historically led to exponential moves. The key is confirmation through volume and healthy consolidation above the breakout line.

> "The longer the base, the stronger the breakout."

#DCR #Decred #AltcoinBreakout #MacroReversal #CryptoChartAnalysis #BullishSetup #CryptoTechnicalAnalysis #TrendReversal #AltcoinSeason

Dcrusdsignals

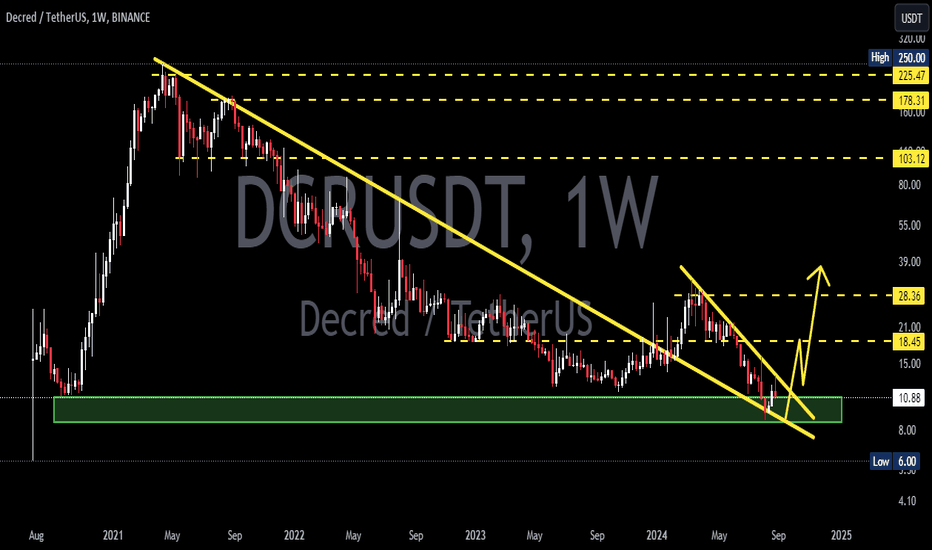

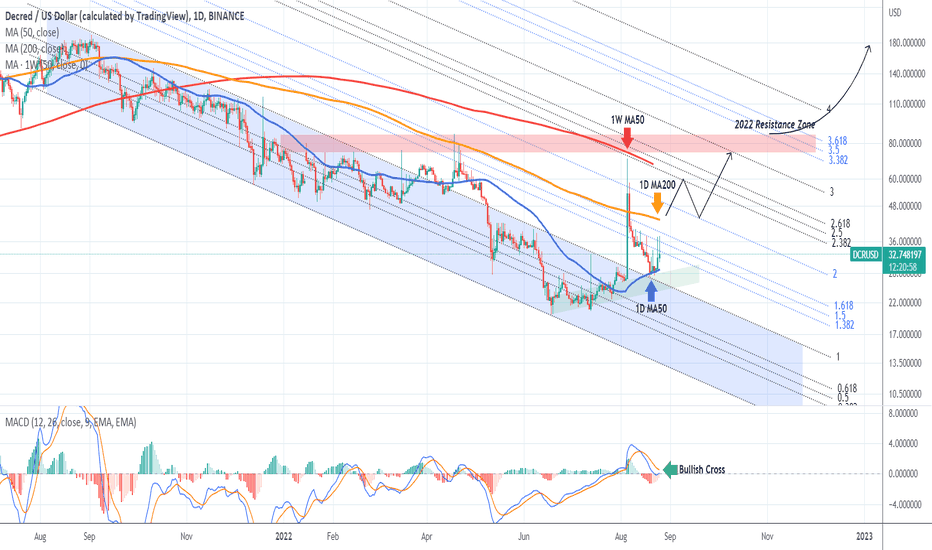

DCRUSD held the 1D MA50. Path to the 2022 Resistance Zone.Decred (DCRUSD) is staging a short-term rise after holding the 1D MA50 (blue trend-line) as a Support since the August 19 pull-back. The 1D MA200 (orange trend-line) is the first Resistance but this has already been broken on the August 05 spike, which was though rejected near the 1W MA50 (red trend-line).

Those are basically the next pivot levels with the ultimate test being the 75.6500 - 86.4000 Resistance Zone, which has been holding for the majority of 2022.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------