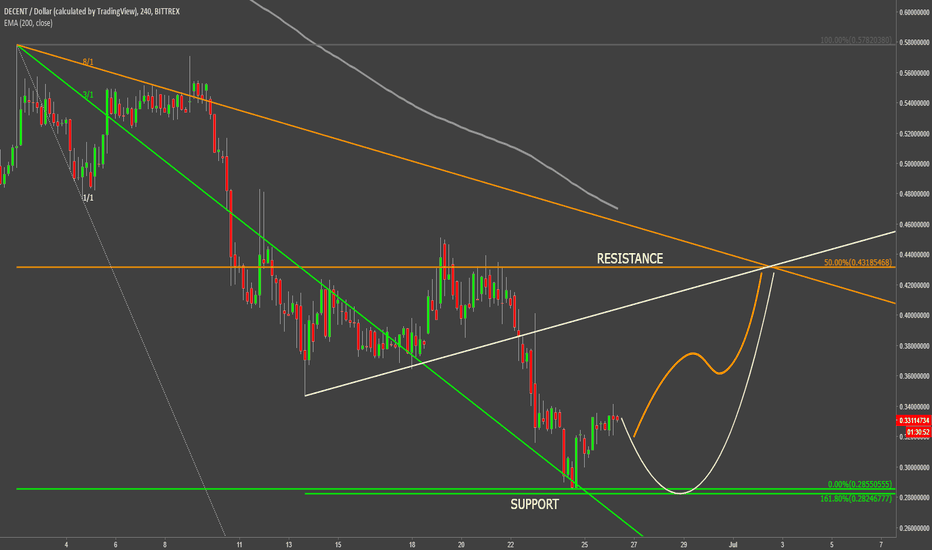

Decent Corrective Wave UpDecent has formed the low at $0.285 where it has rejected the 3/1 Gann Fan trendline. Price has almost reached, but not touched, the 161.8% Fibs applied to the last corrective wave up.

Possibly DCT/USD is getting ready for a correctional move upwards, but yet, it could still go back down to $0.28 to form a double bottom and test the 161.8% Fibs at $0.282. As long as price stays above $0.28 correction upwards has high probability and could send price up to $0.43 area, that is confirmed by the 50% Fibonacci retracement level and 8/1 Gann Fan.

This is a key resistance area, that should give information whether Decent is only correcting or reversing to the upside. Break above that level should result in a much stronger growth, while rejection might result in a downtrend continuation.