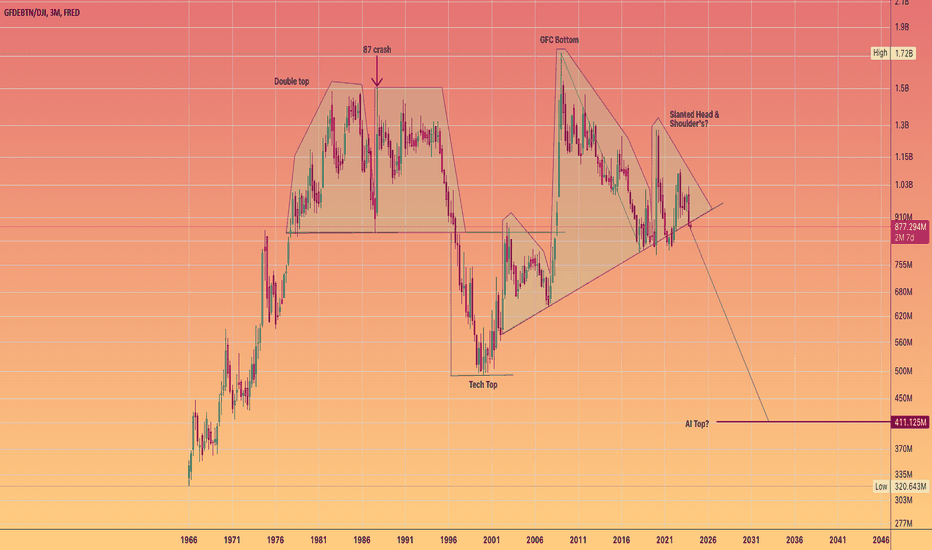

FEDERAL DEBT priced in the DOW JONES is too HIGH!Those dollars that the US government owes must be inflated away!

As paying back 33 Trillion dollars is not feasible in today's version of dollars.

So they must be paid in even more worthless dollar currency units.

If the US government stops spending they will send the US economy into a recession.

They must continue to pump money into the economy and the stock market.

The con job that inflation is under control is a lie.. and we will continue to see higher prices the rest of the decade albeit at a slower rate.

BUT even 2% annual inflation compounded will erode purchasing power quickly as we have seen in the past. And I have charted before.

I believe we will continue to see the stock market ramp up the next two quarters before taking a summer break.

The underlying hidden to most, inflation trend, will continue to inflate revenues and earnings for most stocks going forward.

The bottom line is that Inflation is a FRAUD perpetuated on the people by the Government.

They print and spend the money first, and then the workers get it after beingTAXED and after prices have gone up.

Then they TAX you on the gain in asset prices! :)

So if u can invest in assets that are in wrapped up Tax free vehicles --- seek those out.

#Crypto can be a way to supercharge your returns for periods of time,

but come with inherent, built in volatility ---

most people walk away with, what could have been stories -- rather than life changing returns

Debtgdp

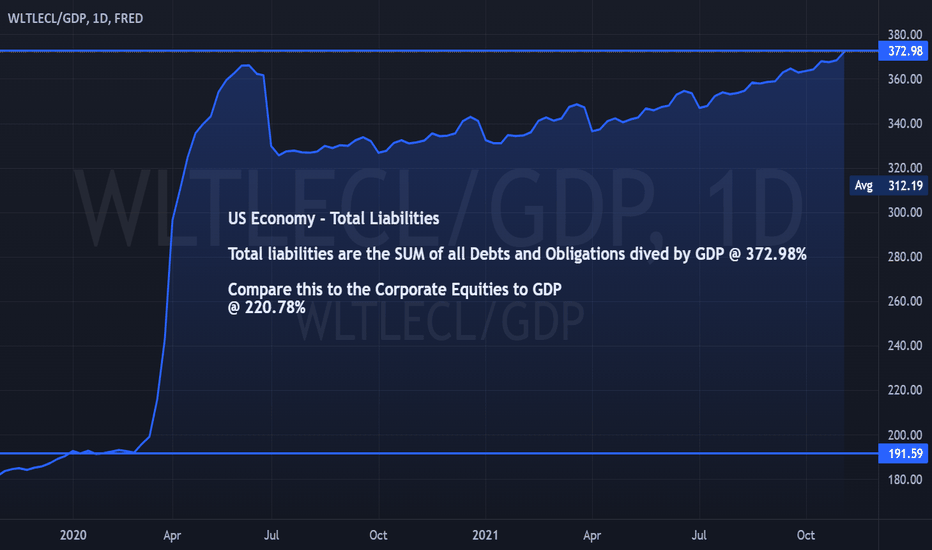

Total Liabilities : GDP / Macro Review 01The Ratio Expansion is unprecedented in US HIstory.

A clear pattern emerges after the initial Apex - the

gentle stair-step higher into higher and higher Highs.

Debt itself remains the Life-Support of the US Economy.

The Debt to GDP ratio is the Probability of a Nations

ability to Pay Its Debts.

____________________________________________

Corporate Equity to GDP has reached ~220% - in 2008

it peaked at ~150%.

The Equity Complex remains the Center of the

US Economy and GDP.

____________________________________________

Credit Cycle Expansions eventually return to the Mean

after extreme periods of dislocation in Debt Markets begin

to Fail to Settle.

The 30 Yr Bond Auction's Failure is a late-stage warning

sign the appetite for Debt at present Rates of Yield is

unacceptable.