Defense

5 Defense stocks you might want to look at in WW3Here are 5 stocks that could profit from the Russia Ukraine Conflict!

Intro:

The Russian-Ukrainian conflict, which began on November 21, 2013, following the Ukrainian government's decision not to sign the association agreement between Ukraine and the European Union, is a diplomatic and military

conflict between Russia and Ukraine.17 The conflict was sparked by a series of large-scale demonstrations that led to the flight and subsequent removal of Ukrainian President Viktor Yanukovych, who was replaced by Oleksandr

Turchynia.

Large-scale demonstrations then broke out and led on February 22, 2014 to the flight and subsequent removal of Ukrainian President Viktor Yanukovych, who was replaced by Oleksandr Turchynov. A new government, led by Arseni

Yatsenyuk, is put in place.

In response, Crimea declared its independence and voted to join Russia, a move that was recognized by Russia, causing an international diplomatic crisis. Several other Ukrainian provinces with large Russian-speaking populations,

notably Donbass, experienced similar uprisings and in turn organized referendums on self-determination in order to separate themselves from the Ukrainian government in place. The later events led to the war in Donbass, with

Russia, the border country, being accused of providing military support to the insurgents by waging a hybrid war there.18,19

On July 17, 2014, a Malaysia Airlines flight carrying 298 passengers from Amsterdam to Kuala Lumpur was shot down in mid-air near the Russian border while flying over the Donbass. There were no survivors. The destruction of this

civilian plane amplifies the diplomatic crisis, the Ukrainian army and the pro-Russian separatists accusing each other.

On February 21, 2022, as part of the Russian-Ukrainian war of 2021-2022, in a televised address, Russian President Vladimir Putin announced Russian recognition of the independence of the self-proclaimed Donetsk and Lugansk

People's Republics and Russian armed forces invaded eastern Ukraine controlled by pro-Russian separatists.20,21 On February 23, Russian President Vladimir Putin announced that he was going to invade the eastern part of Ukraine

and that he was going to take over from the pro-Russian separatists.

On February 23, President Vladimir Putin announced the launch of a military operation in Ukraine. During the night of 23 to 24 February, the Ukrainian territory was bombed and Russian troops invaded the Ukrainian territory.

Stocks that could grow during WW3:

Lockheed Martin NYSE:LMT

Lockheed Martin is the world's leading U.S. defense and security company. Like its main competitors, it designs and produces a variety of products in which electronics and technology play a key role. In 2008, 84% of the company's sales were to the U.S. government, with the remainder primarily to other states.5 In 2010, of the 45.8% of the company's sales that were to the U.S. government, 84% were to other countries. In 2010, $17.3 billion of the company's $45.8 billion in sales came from contracts signed with the U.S. government ($10.9 billion in defense, $6.6 billion in civilian). The company products a large amount of combat planes and other defense engines, its role in ww3 would be very important and we could see the company benefit from diverse defense contracts in the future.

Boeing NYSE:BA

Boeing (official name: The Boeing Company) is an American aircraft and aerospace manufacturer. Its headquarters are located in Chicago, Illinois and its largest plant in Everett, near Seattle, Washington. This aircraft manufacturer specializes in the design of civil and private aircraft, but also in military aeronautics, helicopters and satellites and launchers with its Boeing Defense, Space & Security division. In 2012, it ranked second in military equipment sales worldwide5,6. The company is engaged in a commercial war in aeronautics with its main competitor, the European group Airbus Commercial Aircraft.

Boeing could be a discounted opportunity. The company is now playing a significant role in responding to Russian aggression via its RC-135 reconnaissance plane. While the monitoring of forces to provide real-world analytics is the primary goal, these flyovers serve a secondary purpose: Let the Russian military forces know that the eyes of the world are on them. It may not be the ultimate deterrent, but anything to help the situation from devolving into bloodshed is a positive.

L3-Harris Tech NYSE:LHX

When dealing with defense stocks amid tensions that could spill over into armed conflict, the natural instinct is to consider weapons systems and defensive platforms. Certainly, L3Harris Technologies features a broad range of air, land and sea-based solutions — even solutions that extend into space and the digital realm. However, communications is also a key component of warfare. Without the ability to coordinate offensive or defensive actions, a nation’s military force will not be utilizing its resources in the most effective and efficient manner possible. Considering that Ukraine will be grossly outnumbered in a hot conflict with Russia, efficiency is absolutely critical. Of course, the Russians are not unaware of this serious potential vulnerability. Inevitably, one of their actions in case of an invasion will be to cut off supply routes and disrupt communication lines. Therefore, the Ukrainian government’s relatively recent cooperation agreement with Harris Global Communications, a subsidiary of L3Harris, is significant. Irrespective of whether or not an armed conflict occurs in the coming days, the relationship between L3Harris and Ukrainian forces should grow closer.

Northrop Grumann NYSE:NOC

The U.S. government has already shipped weapons systems to Ukraine and authorized its European partners to send their own shipments. Now, Ukrainian forces have even more resources with which to defend themselves. Given this dynamic, tensions may rise higher. That’s where Northrop Grumman could come into play with its MQ-4C Triton drone. Specializing in real-time intelligence, surveillance and reconnaissance, the Triton can provide valuable information while keeping servicemembers away from harm.

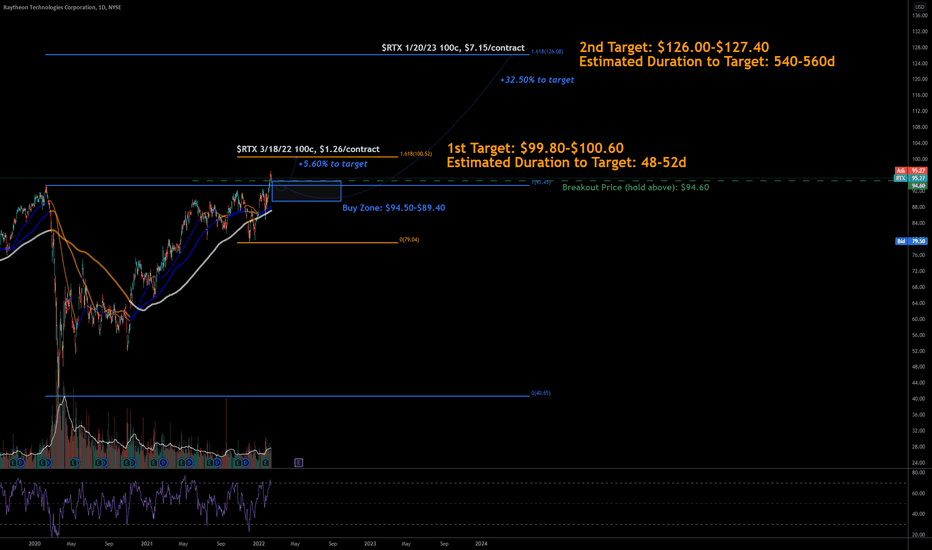

United Tech - Raytheon Technologies NYSE:RTX

United Technologies Corporation (UTC) was an American multinational conglomerate headquartered in Farmington, Connecticut. It researched, developed, and manufactured products in numerous areas, including aircraft engines, aerospace systems, HVAC, elevators and escalators, fire and security, building automation, and industrial products, among others. UTC was also a large military contractor, getting about 10% of its revenue from the U.S. government. Gregory J. Hayes was the CEO and chairman. It merged with the Raytheon Company in April 2020 to form Raytheon Technologies. Raytheon has partnered with Lockheed on the Javelin Weapon System, the missile of the hour.

Marketed as an “anti-tank guided munition that can be carried and launched by a single person,” the Javelin offers serious implications for how the Ukrainians can defend themselves against a much larger enemy.

Credits to - xtekky -

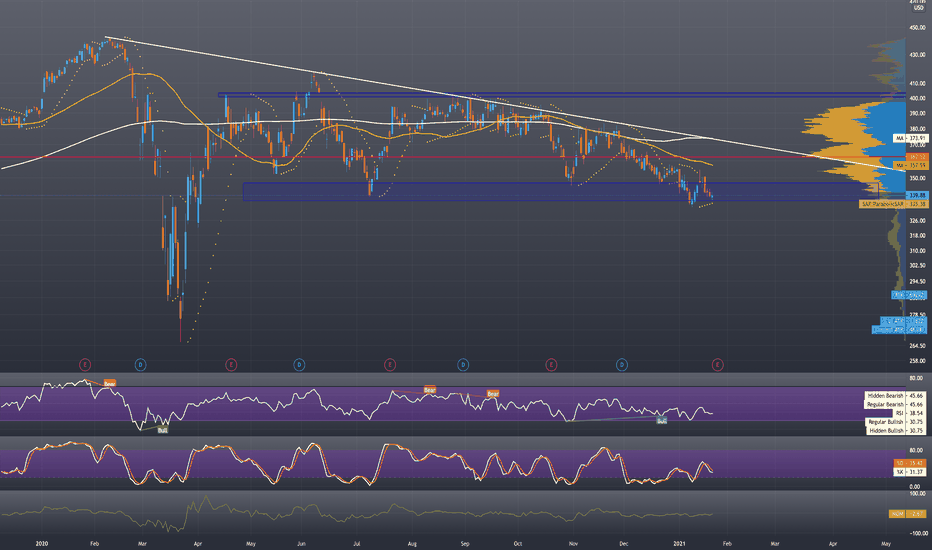

2/13/22 RTXRaytheon Technologies Corporation ( NYSE:RTX )

Sector: Electronic Technology (Aerospace & Defense)

Market Capitalization: 142.598B

Current Price: $95.27

Breakout price: $94.60 (hold above)

Buy Zone (Top/Bottom Range): $94.50-$89.40

Price Target: $99.80-$100.60 (1st), $126.00-$127.40 (2nd)

Estimated Duration to Target: 48-52d (1st), 540-560d (2nd)

Contract of Interest: $RTX 3/18/22 100c, $RTX 1/20/23 100c

Trade price as of publish date: $1.26/contract, $7.15/contract

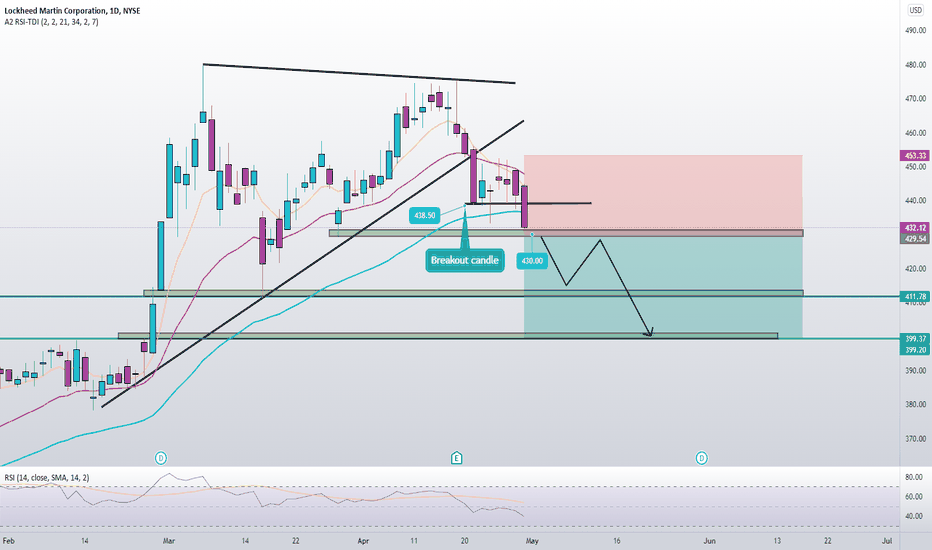

2/13/22 LMTLockheed Martin Corporation ( NYSE:LMT )

Sector: Electronic Technology (Aerospace & Defense)

Market Capitalization: 107.893B

Current Price: $396.19

Breakout price: $396.00 (hold above)

Buy Zone (Top/Bottom Range): $384.80-$369.85

Price Target: $416.00-$420.00 (1st), $434.00-$442.00 (2nd)

Estimated Duration to Target: 103-110d (1st), 211-221d (2nd)

Contract of Interest: $LMT 6/17/22 400c, $LMT 9/16/22 400c

Trade price as of publish date: $19.40/contract, $25.30/contract

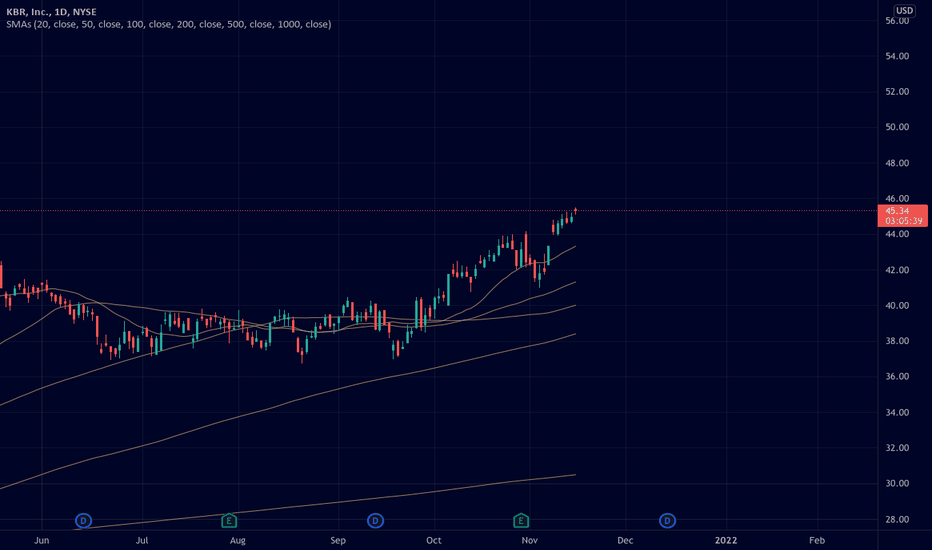

ENG Fuel Handling Contract from Defense Logistics AgencyENGlobal Corporation (ENG) has been awarded a $4.4 million contract by the Defense Logistics Agency (DLA) to provide Automated Fuel Handling Equipment support.

This is quite bullish news for a stock that has a Market Cap of only 42.602Mil.

My price target for this year is the $3.5 resistance.

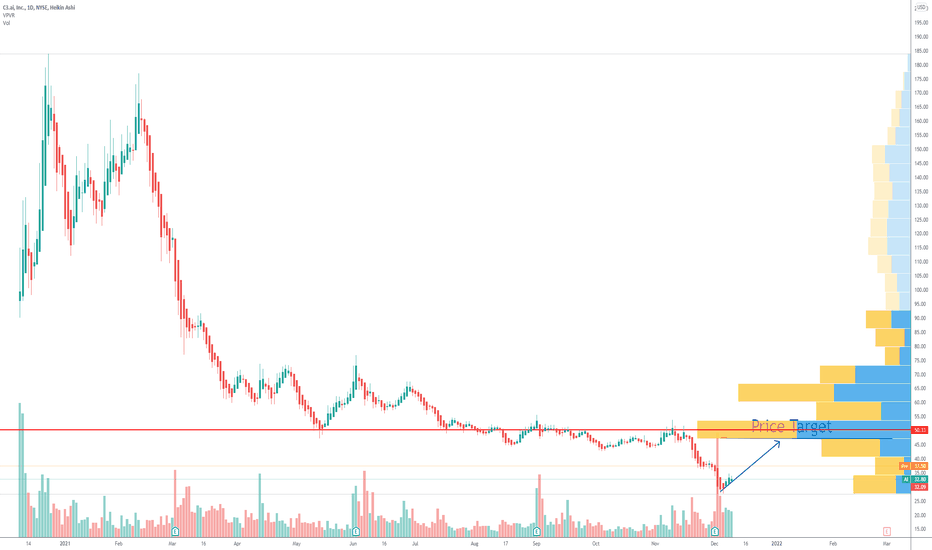

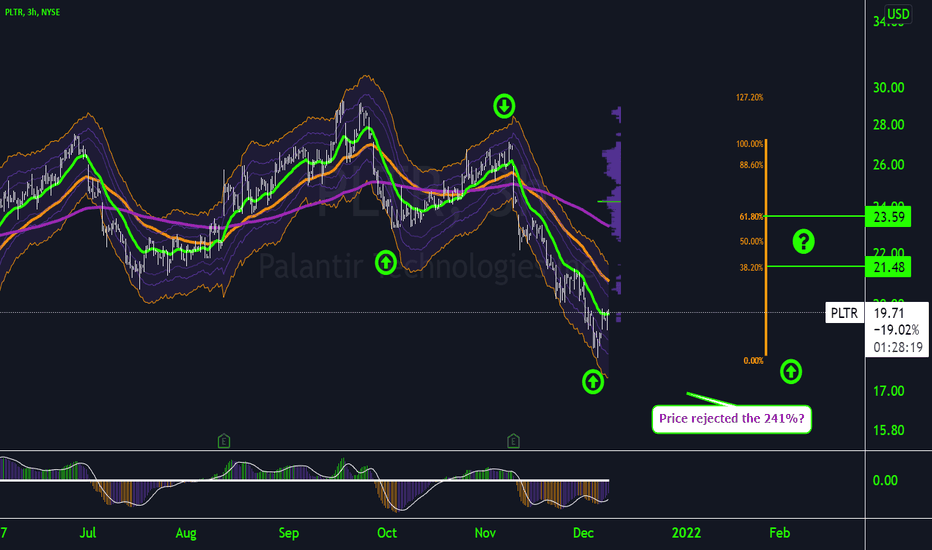

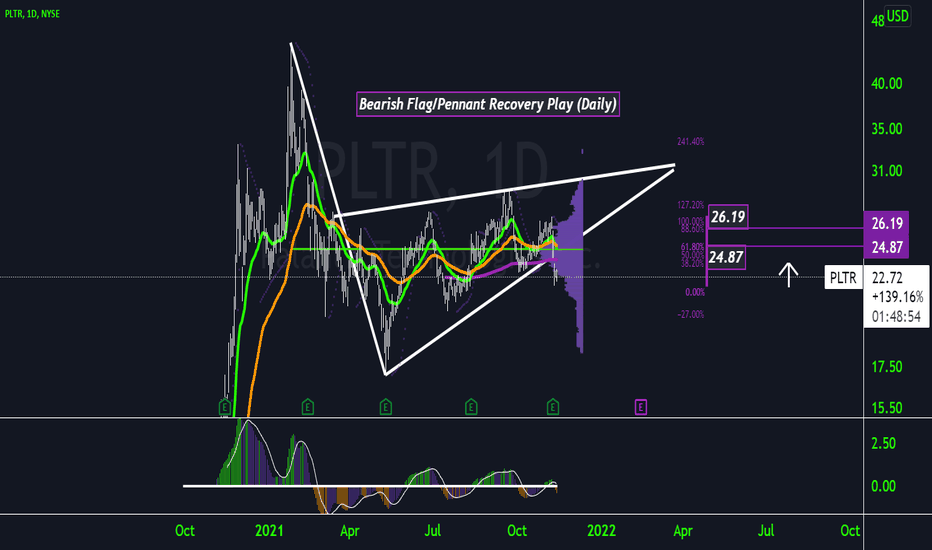

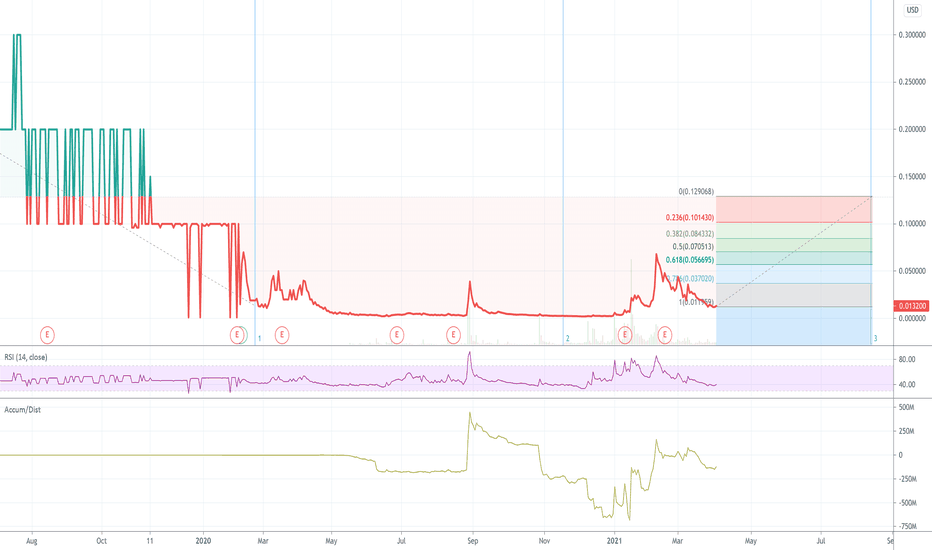

Palantir (Update)Keeping it short here, PLTR has been getting government contracts recently. Defense and supply chain efforts are important to alot of things right now. A price of $22 would be a bit above 38% retracement of the previous high. Let's see what happens! We are still in a good are price wise and has given us more of a discount I believe since my most recent post. Not advice.

PalantirPalantir engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. It offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. Its products include Palantir Gotham and Palantir Foundry. (Via Robinhood). I'm big on the defense sector and knowing how much the government trusts this company I need to take a deeper look. The main thing that impressed me with Palantir outside of their general scope of business was the attractiveness of the Hedge Funds that has this in their portfolio. I normally don't bank on things like this. However, Vanguard (5%), Blackrock (4%), and State Street (1%) has this in portfolio. I do need to do more research on this company I will admit, but I'm confident that we are at a good price now for a good profit down the line (1 year or more out). Looking at the chart, looks like we on a retracement to the upside with a recent bear flag breakout. On the 15 min TF (This is the daily) there is a gap that needs to be filled around $23.66 It also seems as if price wants to break past the 20/50 ema if it does reach that gap which would be a good thing for shareholders. As I do more research, I will up my consideration!

What do you think?

Like, Follow, Agree, Disagree!

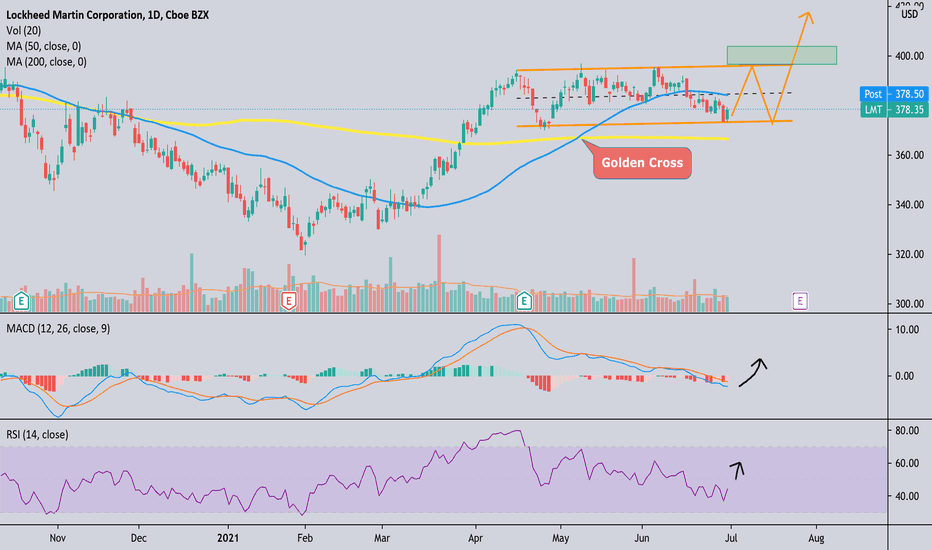

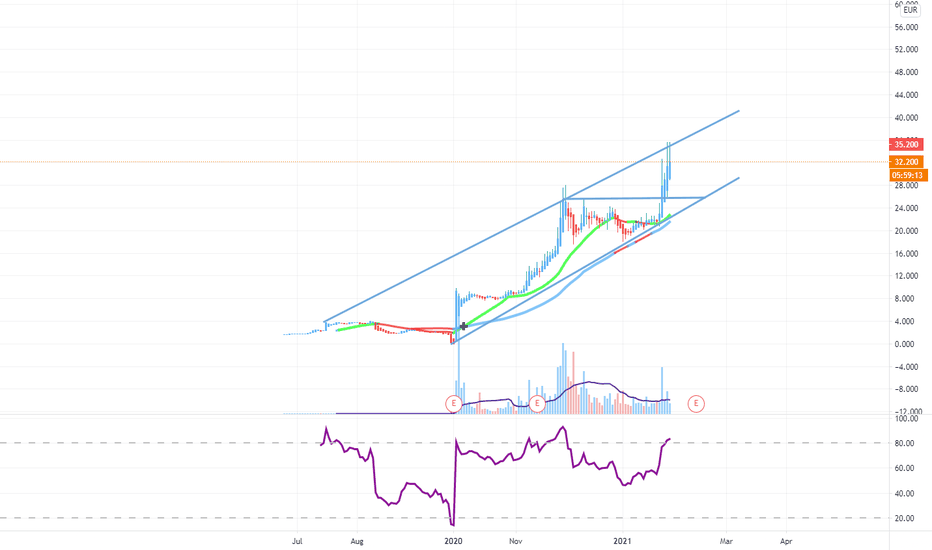

Go long LMTTrading in a channel with some healthy consolidation. 50 day SMA passed through 200 day SMA (Golden Cross)

Trading at a discount with only a 15 P/E ratio.

Fair Value Estimate from Morningstar: $436

Implied Upside from Last Close: 15%

Lockheed just landed a big sale to Switzerland of their F15 jets beating out Boeing

UAVsAeroVironment, Inc. is an American defense contractor headquartered in Arlington, Virginia, that is primarily involved in unmanned aerial vehicles (UAVs) (Wikipedia)

I have been eyeing the military industry for some time, but the stocks have never reached the price I would take. Anyway, AeroVironment looks among the best in the sector from both technical and fundamental perspectives.

The technicals:

There is a double top pattern that developed itself into a triangle. The bottom is specified by two significant lows exceeding a round number 100.0 to the downside. The most significant gap is in the location too.

I expect a lot of liquidity below the yellow rectangle. If we ever reach there without an overall market crash, I'll create the entry there. It's probably the last line of DEFENSE against the bear market. Remember, that the big players need that extra liquidity to open a significant position.

The fundamentals:

The drones were used in recent conflicts against both a professional army and militia/guerrilla force with great success. Even though, the army makes it clear that UAVs are not a replacement for any part of the military, the spendings on both the research and the development increases over time (Statista).

However, the coronavirus might cause some material issues, and increases in spending might be halted (Ibisworld), it is a kind of technology the US will not want to fall behind in. Well, it has already started to fall behind as Turkey develops the first 'dronecraft carrier'. I think the cuts are rather to hit other parts of the defense sector.

I like AeroVironment specifically because, with its focus on UAVs, it is likely to fight for the contracts in this category most hard and the price is as a result derived mostly from this growing part of the sector.

The crash:

The question is if there is enough time for the buying opportunity to develop & profit from before the markets crash. I will be looking for an opportunity between 95-100$, but might not decide to invest at all in the end.

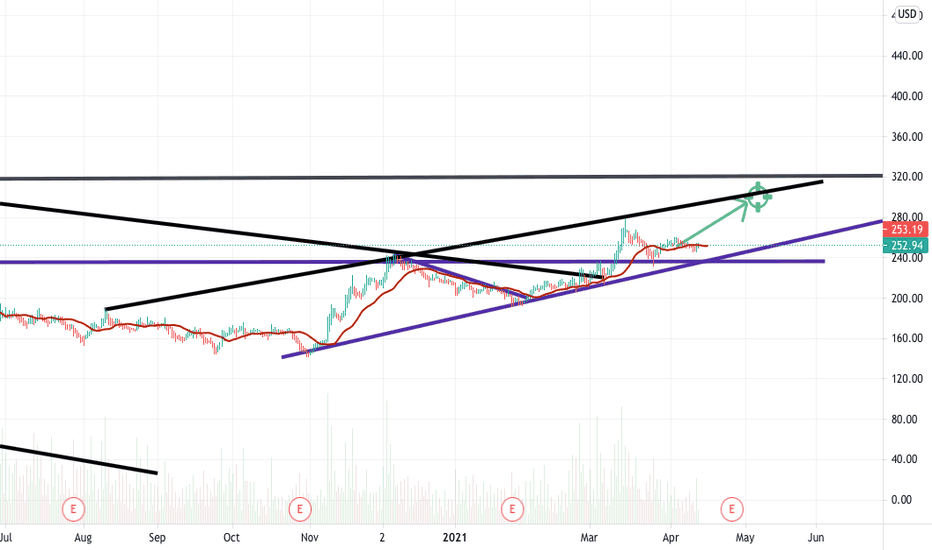

Boeing In Clear Ascending ChannelBoeing Current Price - $253.15 Price Target - $320.

The CDC is now saying once you get vaccinated you dont need to be quarantined to travel. They even said you can travel with a vaccine at “low risk” this is huge for aviation sentiment which was already strong and growing. With consumer saving rates at an all time high and the green light to travel from the CDC expect Boeing to roar next week. Orders for American Airlines & Alaskan Air last week is just the start of new orders for Boeing, after this news more airlines will be looking to make investments into aviation. The recent engine issues that grounded some planes is a minor fix and wont seriously impact Boeing.

BAH a tailwind into a Cup and Handle With recent cyber security hacks plaguing the US online infrastructure, a company like $BAH will have no problem meeting expectation. Given this bullish tailwind, I went looking for a pattern formation I could trade on. I opened up an old favorite book The Encyclopedia of Charts and looked up the parameters of a Cup and Handle (a tradition favorite). What I read was primarily that a good Cup and Handle starts with a 30% "Bump and run" as seen in the blue highlighted box. The book stated a U shape cup with a 5-30% rounded bottom is ideal, like that in the highlighted red box. For a proper Cup and Handle (40% potential rise after the handle) I would need to see the right lip get near (lower is better) the price of the left lip. Followed by a rather dramatic handle formation during the following two weeks.

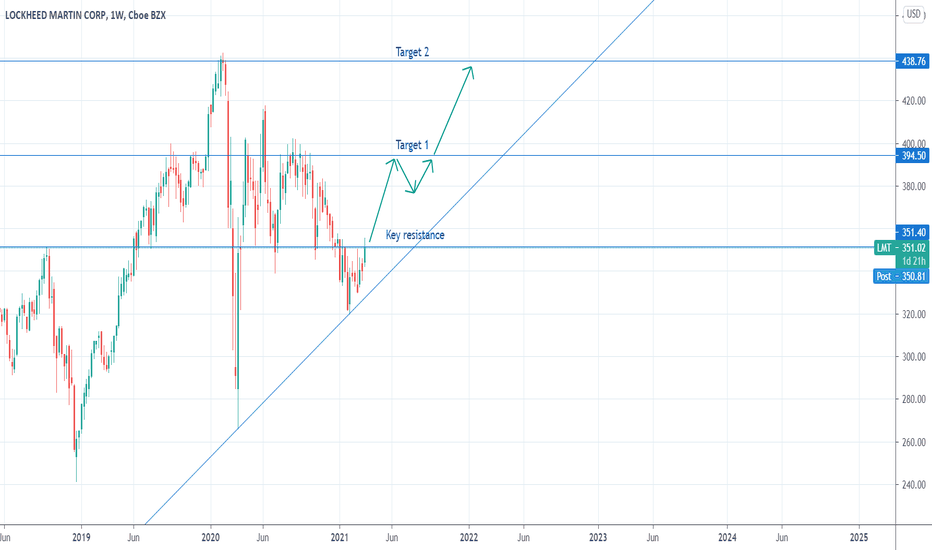

Lockheed profit target 25%I picked up some Lockheed Martin today, because both value and sentiment on the stock are looking too good to resist.

Value

I estimate Lockheed's forward P/E at about 12.5, which is really cheap for a megacap. Forward P/S is 1.5, and forward dividend yield is over 3%. I estimate Lockheed's PEG ratio at about 2, with the annual earnings growth rate sitting near 4%, the sales and dividend growth rates closer to 2.5%, and the free cash flow growth rate near 5%. These are pretty great numbers. Lockheed has about 23% upside to its median price multiple of the last 4 years. Its main competitor, Boeing, has been hemorrhaging money like a catastrophic head wound hemorrhages blood. Meanwhile, Lockheed's been enjoying tailwinds from recovery of TSA throughput numbers, proposed acquisition of Aerojet Rocketdyne, and announcement of a large UK military budget this year.

Sentiment

Analysts give Lockheed an average rating of 7.8/10, a solid "Buy." This rating has recently improved a few points. S&P Global gives Lockheed's fundamentals an average score of 77.25/100. Its ESG score is about average for its industry. Open interest from options traders is in very bullish territory, with a 30-day put/call ratio of 0.5. TradingView's technicals-o-meter is flashing "buy." The average analyst price target for Lockheed is more than 15% above the current price.

Trading plan

I sketched out a tentative view on how Lockheed might move from here. We're sitting right at a resistance and hopefully about to break out. If we get through resistance here, I'm looking for a fairly decisive move to about $394.50. From there, I'm thinking we dither for a while. A lot will depend on conditions in the larger economy, but with vaccinations, stimulus checks, and geopolitical tensions, I suspect Lockheed will eventually break out toward its all-time high. If it hits my second target, the profit from the trade will be about 25%. I'm hoping it gets there by the end of 2021.

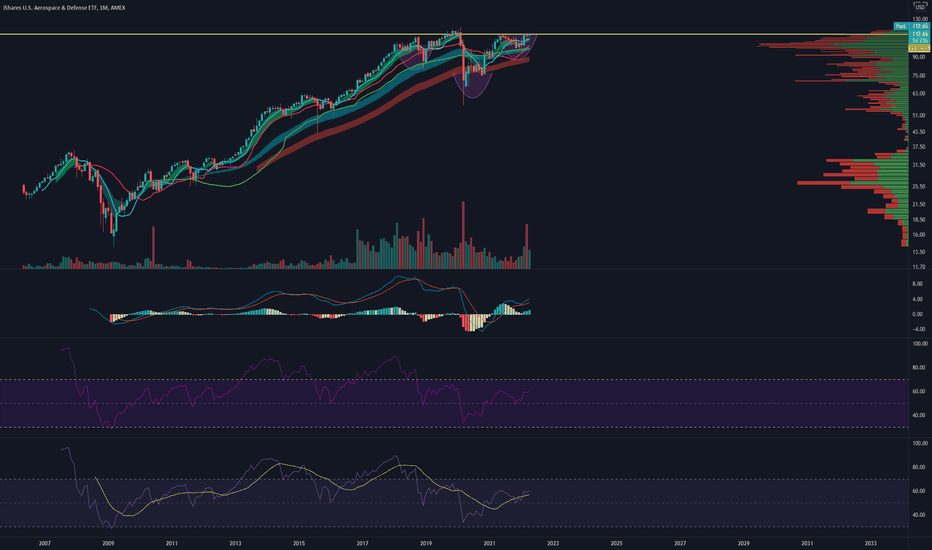

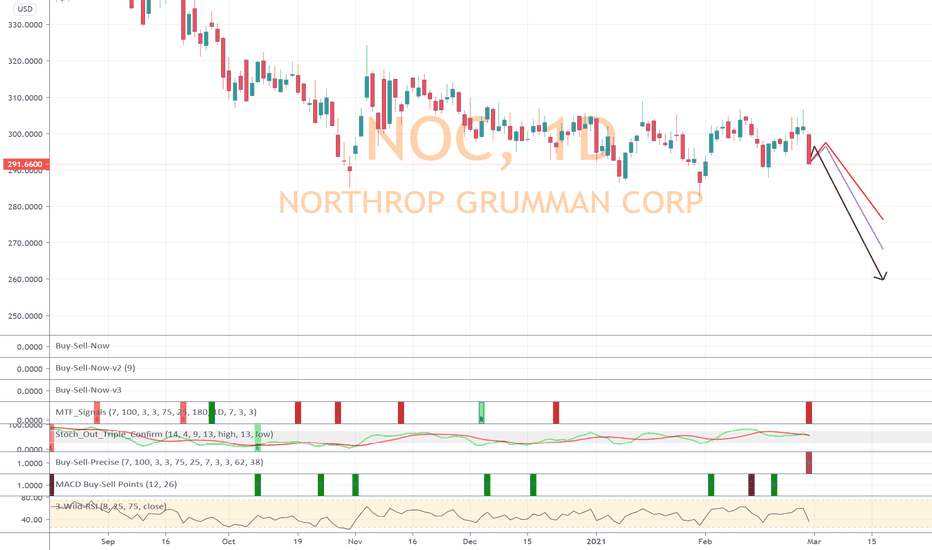

Is something about to happen in the Defense Industry?The algorithms, specifically, the Precise Signal is at it again. The signal is a SELL for Northrup Grumman. Historically, the Precise Signal indicating a SELL sees the stock move down an average of 10%. In fact the minimal drop for this signal with NOC is 7%. Considering Friday saw the stock drop 3% off its high, another 7% (or more) would be huge.

My MTFs also signaled SELLs, but since the Precise is built off of them this a not a surprise. For you technical junkies, the full analysis with each target is at my site for free as always

Lockheed Martin - Great Buying Opportunity LMT is getting pressure downwards however I am bullish on the company and stock. I believe the stock is currently undervalued considering the Biden administrations policies and what it would mean for defence stocks. This price level has supported the stock price and I believe it will breakout upwards from the descending resistance line. Either way, considering the support line, it is a good reward for risk to buy the stock with a SL below the support zone.