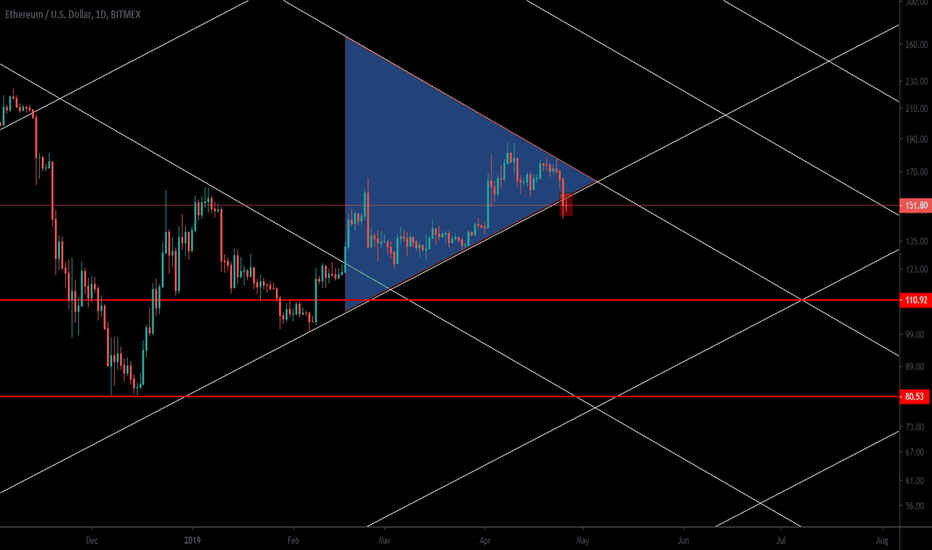

ETH/USD - very bearishTarget 1: 110

Target 2: 80

Blue triangle indicates the current range.

Red box is sell.

Red lines indicates t/p.

This is a log chart.

This is not financial advice. All charts shown on my page, including this one, are just for fun.

If you enjoy my ideas please give this post a like and follow my page if you would like to see future posts! :)

Defense

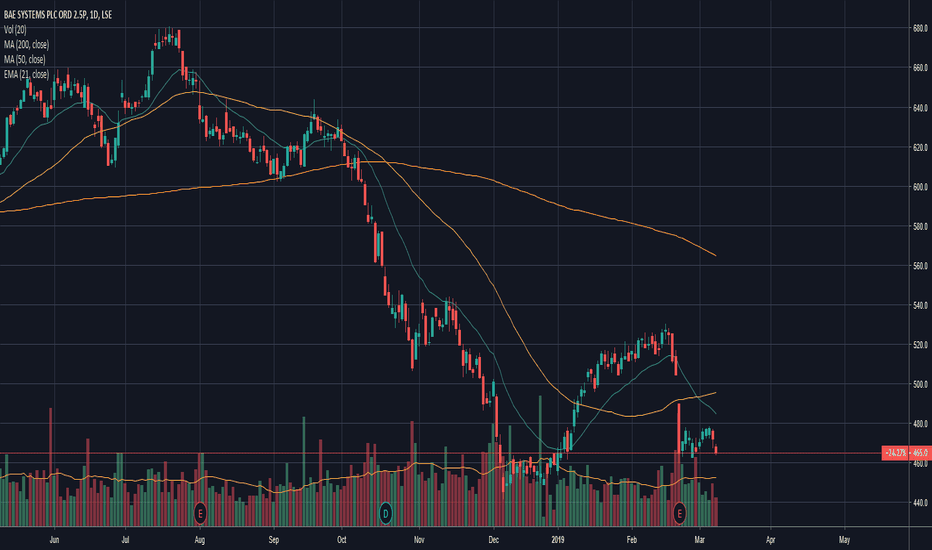

BAE (BA.) short One name that I think looks really attractive or scary depending on the way you look at it is BA., this defence giant since posting a new high in July 2018 has embarked on a decent steep enough to give the most ardent roller coaster enthusiast week knees. After the massive move down the stock finally found some support at 450 before a brief bounce and is now making its way back to that level but is taking a breather around 460 which is where we find ourselves today. I really like this set up, after a gap down the price has been moving sideways before we decide where were going next this is shown by the 10 day average volume being 19% below the 3 month average suggesting to me that people are waiting to see how this area plays out. My plan is to play for a break of the 461 level with my stop entry being set at 458.9 just past the low of the previous attempt at the level. the next major support should be found at 450 where I will trim a 3rd of my position. Past that 440 will be the next trim which will leave 1 third of my original position left to run freely using a weekly high trailing stop after the move down. I hope you enjoyed this post, if you share my views be sure to get in touch or if you have an other UK stocks you think are worth looking into ill be more than happy to chat to you about them. Happy trading.

Joe

LSE:BA.

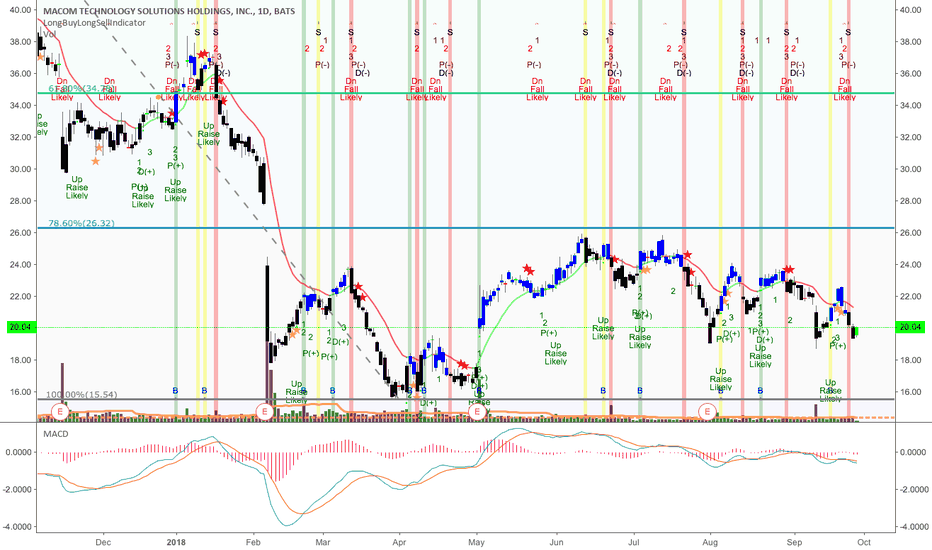

Mocom Technology Holdings - Galium fishingWhat's not to love. Buying into telecom/cellular, defense tech, big data processing with equal sectors. Self-driving cars will need,

but market still extremely small. 5 yrs. from now, not so much. Buy and hold.

Won patent suit in 2017 to protect GaN chips, which run 80-100x faster than silicone chips and they can make them for same cost.

STM needed to partner with them to prevent more patent litigation, so STM is now their distributor and making MTSI chips as well.

Fast chips will allow 5G cybersecurity improvements for all 3 arena's as newer chip technology.

Technical view: Below 786 fibretracement from recent drop after some BIG DOG $$$ got scared from US-CH trade wars. This is

almost as good as NVDA and AMD before their recent runs. Would love to see a double bottom here....

You're welcome on this one. Been looking for GaAs, GaN chip manuf. with patents and new partnership gives this. No seriously,

you're welcome. longbuylongsell @MarxBabu add Woody's CCI here on 4h chart with Fib Retracement (scroll back).

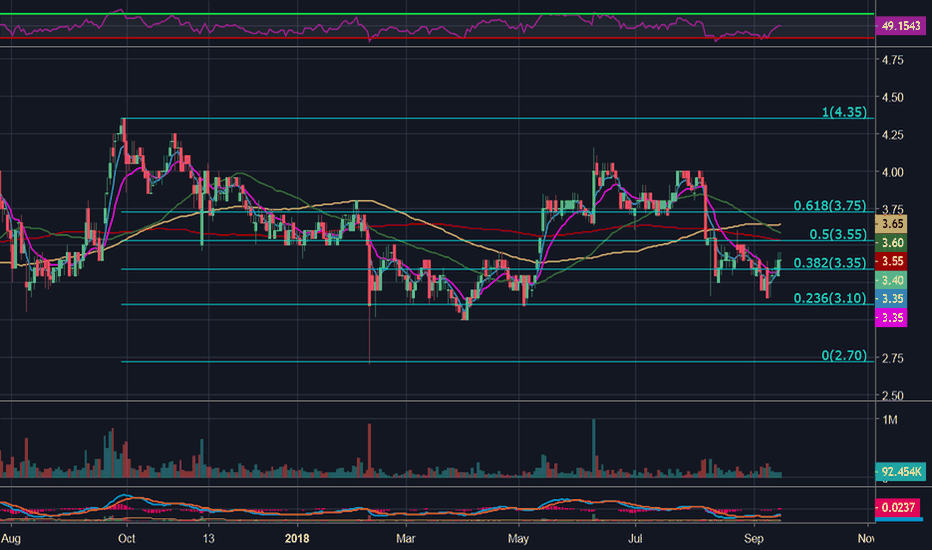

Drones and Virtual Reality - A Spec PlayShares of ARTX look interesting as a speculative play for longer-term investors. The company is in the fields of drones and virtual reality, with recent contract wins with the US military.

At 3 dollars and change, it's a cheap way to play on the long-term growth in those areas, which are bound to see strong growth for some time.

Immediate support lies at $3.35, with additional support below at $3.10 and then $2.70. Upside targets are $3.75 and then the highs at $4.35, or +10% and +28%, respectively from today's close.

I jumped in via calls, specifically the February 2019 $2.50's (currently I.T.M.), paying $1.15 for them. Breakeven comes at $3.65, or 7.4% higher from here... and being so far out, there's plenty of time for this to work.

It may grow in to an investment after I can dig in deeper to fundamentals. I'll update this as more info is known to me. For now, consider it for a spec play or at least keep it on the radar!

Happy trading!

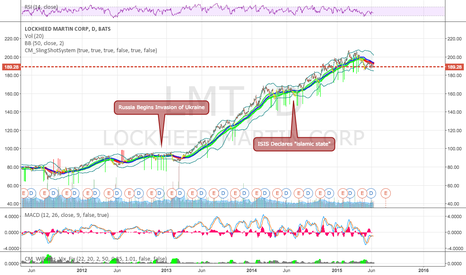

LMT - crushed by massive Defense sell-offThe last time I published an idea on Lockheed, I had a price target of $360. That target was hit very briefly before a massive Defense sell-off. BA, LMT, NOC, RTN all announced earnings recently and were all hit hard.

LMT is approaching oversold territory (some may argue that it is already in) according to RSI - something we've not seen since the end of 2016. This is a good short-term long opportunity. My target will be $320.

Lockheed - long the post-dividends dipLMT really took off (pun intended) in the days leading up to and following their last earnings report, only to return to the landing strip again before taking another shot at $360. It is now back to home base and looks to be refueling before trying $360 again.

On Friday, LMT scored a sizeable contract with the USAF for training support, and with no shortage of F35 orders, Lockheed looks to be a solid long term play, as well. Especially since they pay dividends.

RTN Tracing a "V"? - Price at Support, Combat Springs Eternal.Nations and states won't stop fighting and will always need security, so defense stocks are always an intriguing sector.

But let's focus on the short-term.

Raytheon has been hit hard with some bad news. Despite reporting good earnings on April 26, easing Korean tensions and anticipated delays on big deals for Raytheon's technology are among some of the purported reasons RTN has tumbled.

Thanks in advance for lending me your attention!

Is RTN 's stock primed to rise in price as quickly as it's fallen this last week?

We can see from the chart Raytheon is wobbling in an area of strong support with very high relative volume. RTN sold off on news, but the fundamentals and technicals are both attractive. Many traders are saying it's time to buy the dip.

Could Raytheon trace out a "V" pattern here and provide for some quick and tidy profits for buyers of the stock and\or call options?

Please like, follow, and share, and maybe we can have fun and do great things together.

Thanks again!

See it on the site: holsturr.com/category/markets/charts/

** For speculative and research purposes only - good luck! **

Where will Calian go?It would only be safe to assume that CGY it is going to test ~32.40 again at the 0.5 Fibonacci retrace for confirmation. There is some seriously heavy resistance, indicated by the dashed red line at this mark though. If it can hold above for a few bars, I do believe that there is some buyer conviction coming through. but we will see where we end up after today's conference in Ottawa on security and defense.

ITA Possible Trump x NK TradeWith the mess in NK still creating market tension. This could be a possible trade on ITA that could play out due to the speculation of war.

Follow for more trade ideas including stocks, options, and cryptos!

Feel free to comment if you have any input or a subsequent chart contrasting my analysis.

Thnx.

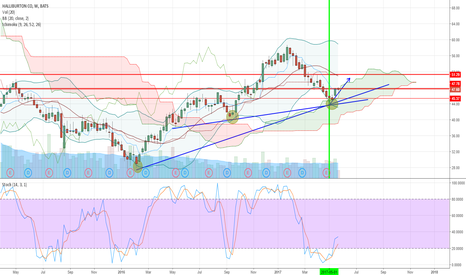

HAL Daily chart viewHalliburton ($46.51) looks like maybe it is reversing trend for the summer; the russia-saudi deal helped I believe (which may have led to the spike in volume); the stock is bumping up on support and broke through resistance at 46.38... I think it is safe to look for a move above $50-$53 if the stock breaks its next resistance at 47.79; I think I am taking the bet

$RTN Defense is where my money is!$RTN Defense is where my money is! We have all been watching Fox news and by now know that we put 59 Tomahawk missiles in Syria's lap. Those 59 have to be replaced....right?

The next couple of days are entangled with questions. What if.....and if so then what? With all the unknowns I think the market may be a little bearish in most industries. Except for one.DEFENSE!

I would be willing to wager (Ha) that the defense market will see a move that we haven't seen since November, or heck, maybe, longer!

How much does a Tomahawk Missile Cost?

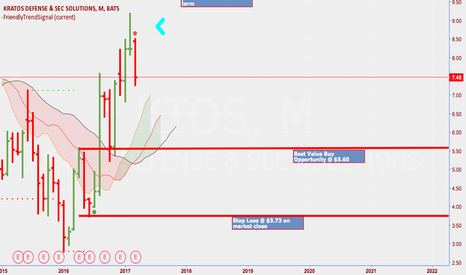

$KTOS Best Value Buy Opportunity PotentialKTOS has gotten a lot of attention on television lately, but we don't think it's buy at the moment. Fundamentally, the company's exposure in Unmanned systems as well as Directed Energy makes them a contender long-term, as these are the two fastest growing subsectors within future defense capabilities. The latest news exposure and positive earnings news last quarter blew the stock up, but we maintain the opinion that major profit taking on a relatively risky stock will drive the price downward in the short term and allow for a buy opportunity for a long term hold.

Short NOC (and the defense industry in general)The whole Defense industry is extremely overbought in all time frames, even in monthly. Stocks are reaching important long term Fibo projections.

NOC is making no exception, showing RSI bearish divergence and declining volume in parabolic rise. % waves completed, has reached the top of its risisng channel.

Excellent risk/reward on the short side, target near $167, even $135 possibly.

Short NOC (and the Defense sector in general)The whole Defense industry is extremely overbought in all time frames, even in monthly. Stocks are reaching important long term Fibo projections.

NOC is making no exception, showing RSI bearish divergence and declining volume in parabolic rise.

Excellent risk/reward on the short side, target near $167, even $135 possibly.

Global Mitary Events Fuel LMT GrowthUnrelated to any sort of technical analysis but I've noticed that any large-scale global military event seems to be a catalyst for growth in LMT as shown by the markers indicating the dates that the respective events began, which are followed by a long uptrend. Although LMT holds no contracts within Russia, Ukraine or Iraq, these military events create unrest globally and fuel defense spending. Keeping an eye on the news, especially with the recent ending of the Russia/Ukraine cease fire. Long LMT.