Forex Market Depth Analysis and Trading StrategiesForex Market Depth Analysis and Trading Strategies

Forex market depth analysis offers traders a deeper understanding of currency market dynamics. It reveals the real-time volume of buy and sell orders at different prices, which is crucial for assessing liquidity and trader sentiment. This article explores how to analyse and use market depth for trading, discussing various strategies and their limitations.

Forex Market Depth Explained

Market depth meaning is the volume of buy and sell orders at different price levels. It's a real-time snapshot of the pair’s liquidity and depth of supply (sell orders) and demand (buy orders). Traders use this information to gauge the strength and direction of a currency pair.

This depth is typically represented through an order book, displaying a currency pair’s existing orders at various price points. This book lists the number of units being bid or offered at each point, giving us insight into potential support and resistance levels. For instance, a large number of buy orders at a certain price level may indicate a strong support area, suggesting that many traders are willing to purchase the currency pair at this price.

Understanding market depth is crucial in assessing the likelihood of trades being executed at desired prices, especially in fast-moving currencies or when trading large volumes. It may help in identifying short-term price movements, offering a more nuanced view of an asset beyond just candlestick charts.

How to Analyse Market Depth

Analysing order flow is a fundamental aspect of market depth trading, providing traders with valuable insights into the supply and demand dynamics of forex pairs. Forex market depth can be assessed using various tools and indicators.

One key tool is the Depth of Market (DOM), which shows the number of buy and sell orders pending at different prices. DOM offers a visual representation of the currency pair’s order book, highlighting potential areas where large orders are placed. We can use such information to identify significant support and resistance levels where the pair might experience a turnaround.

Another essential tool is Level II quotes. These quotes provide detailed information about the price, volume, and direction of every trade executed in real-time. By analysing Level II quotes, traders may be able to identify the pair’s momentum and potential trend shifts. For example, if there is a sudden increase in sell orders at a particular price, it may indicate a potential downward movement, prompting us to adjust our positions accordingly.

Strategies Using Market Depth Analysis

In forex trading, market depth analysis is a crucial tool for understanding and executing a depth of market strategy. Here's how traders can leverage this type of analysis in their strategies:

Scalping Strategy

By closely observing the DOM, scalpers can identify minor price movements and liquidity gaps. For instance, if the DOM shows a large number of sell orders at a slightly higher price, a scalper might open a short position, anticipating a quick downturn. This strategy relies on fast, short-term trades, capitalising on small price changes.

Momentum Trading

Momentum traders use the order book to gauge the strength of a trend. By analysing the order flow and volume, they can determine if a trend is likely to continue or reverse. For example, a surge in buy orders at increasing prices may signal a strong upward momentum, prompting a trader to enter a long position. Conversely, a build-up of sell orders might indicate a potential downward trend.

Support and Resistance Trading

Depth analysis is invaluable for identifying key support and resistance levels. Clusters of orders often act as barriers, influencing price movements. Traders may use these levels to set entry and exit points. For example, a large number of buy orders at a specific price may indicate a strong support zone, reflecting a potentially good entry point for a long position.

Breakout Trading

Traders seeking breakout opportunities can use market depth to spot potential breakout points. A significant accumulation of orders just beyond a known resistance or support level may indicate a potential breakout. If the pair moves past these areas with high volume, it could signal the start of a new trend, potentially offering a lucrative trading opportunity.

Integrating Market Depth with Technical Analysis

Integrating a depth chart trading strategy with technical analysis may enhance decision-making, combining the real-time insights of depth charts with the power of technical indicators. For instance, we can use market depth to confirm signals from technical analysis tools.

If a moving average crossover suggests a bullish trend, a corresponding increase in buy orders in the depth chart may reinforce the signal. Similarly, a significant resistance level identified through technical analysis, such as a Fibonacci retracement level, might be substantiated if there’s a large accumulation of sell orders at that price point.

Risks and Limitations of Market Depth Analysis

While market depth analysis is a valuable tool in forex trading, it comes with certain risks and limitations:

- Dynamic and Fast-Changing Data: Order book data is highly dynamic, often changing within seconds, making it challenging to base long-term strategies solely on such information.

- Lack of Centralisation in Forex: Unlike stock exchanges, the forex market lacks a centralised exchange. This decentralisation means depth data might not represent the entire marketplace accurately.

- Susceptibility to 'Spoofing': Large players might place and quickly withdraw large orders to manipulate market depth perception, misleading other traders. It’s worth noting that spoofing is illegal in many jurisdictions.

- Limited Usefulness in Highly Liquid Markets: In highly liquid pairs, the depth of market data may become less relevant, as large orders are quickly absorbed without significantly impacting prices.

- Dependency on Broker's Data: The reliability of order book data depends on the broker's technology and the size of their client base, which can vary widely.

The Bottom Line

Market depth analysis provides critical insights for forex traders, though it's vital to recognise its dynamic nature and limitations. Integrating it with technical analysis may create robust trading strategies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Depthchart

What is the Power in Buy and Sell WallsHello, dear @TradingView community! Welcome to another insightful educational topic focused on Buy and Sell Walls in the world of cryptocurrencies!

Understanding buy and sell walls is critical for any trader or investor in the cryptocurrency market. It provides access to the order book and valuable insights into the market sentiment of specific cryptocurrencies. This understanding can help forecast future price movements and develop more effective trading strategies.

In this article, we will delve into the concept of walls in crypto, explore how to identify and interpret buy and sell walls, and discuss their significance in the market.

What is a Wall in Crypto?

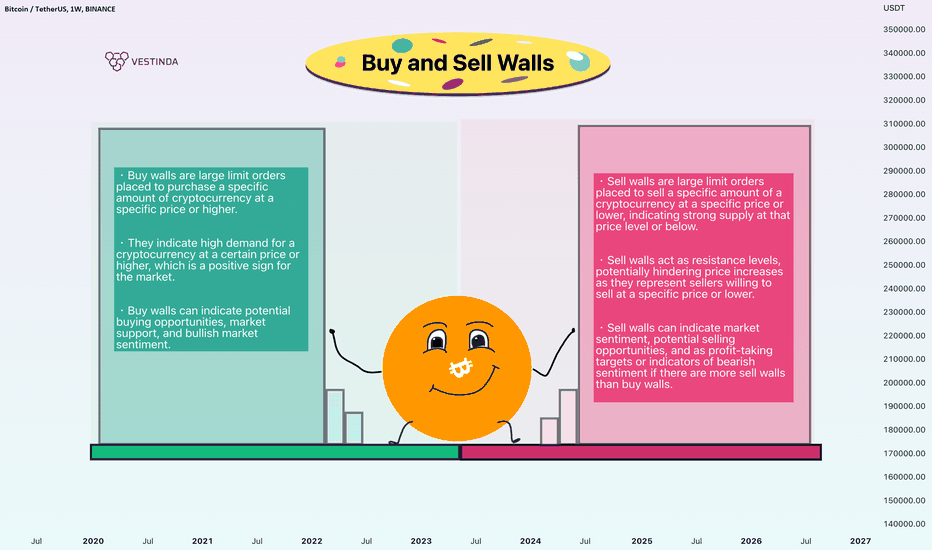

Understanding Buy Walls

Understanding Sell Walls

How to Identify Buy and Sell Walls

How to Interpret Buy and Sell Walls

What is a Wall in Crypto?

A wall refers to a large limit order placed on a cryptocurrency trading platform, often depicted as a huge block on the order book. Market makers, institutional investors, as well as individual traders, utilize these large limit orders to buy or sell substantial quantities of a specific cryptocurrency at a predetermined price.

Walls tend to have a significant market impact since they can influence the supply and demand levels of a specific cryptocurrency. These large limit orders, representing a considerable quantity of a cryptocurrency bought or sold at a specific price, have the potential to cause significant price fluctuations.

Understanding Buy Walls

Buy walls are substantial limit orders placed to purchase a specific amount of a cryptocurrency at a particular price or higher. They can be formed by large market makers, institutional investors, or individual traders seeking to buy a significant amount of a cryptocurrency at a specific price or lower. Buy walls can serve to profit from price movements or accumulate a large quantity of a cryptocurrency at a lower price.

A buy wall indicates strong demand for a specific cryptocurrency at a certain price or higher, which can be seen as a positive sign for the market. It suggests that buyers are willing to pay the specified price or more, potentially leading to a price increase.

Additionally, a buy wall may indicate that a large market maker or institutional investor has faith in the future price of a coin or a token. By investing a substantial sum, they express confidence that the cryptocurrency's price will rise in the future.

Traders can utilize the presence of a buy wall to gauge market sentiment and identify potential buying opportunities. Buy walls can also serve as support levels and act as stop-loss points.

Understanding Sell Walls

Sell walls, on the other hand, consist of large limit orders placed to sell a specific amount of a cryptocurrency at a particular price or lower. Similar to buy walls, sell walls can be formed by market makers, institutional investors, or individual traders looking to sell a substantial amount of a cryptocurrency at a specific price or higher. These limit orders are utilized to profit from price movements or liquidate a large quantity of a cryptocurrency at a higher price.

A sell wall indicates a strong supply of a specific cryptocurrency at a particular price or lower, which could suggest overvaluation. It signifies that sellers are willing to sell at the specified price or lower, potentially leading to a price decrease.

Furthermore, a sell wall can indicate that a large market maker or institutional investor holds a bearish outlook on the future price of a cryptocurrency. By selling a significant sum, they imply their belief that the cryptocurrency's price will fall in the future.

Traders can leverage the presence of a sell wall to assess market sentiment and identify potential selling opportunities. Sell walls can also act as resistance levels for a cryptocurrency and serve as target price points for profit-taking.

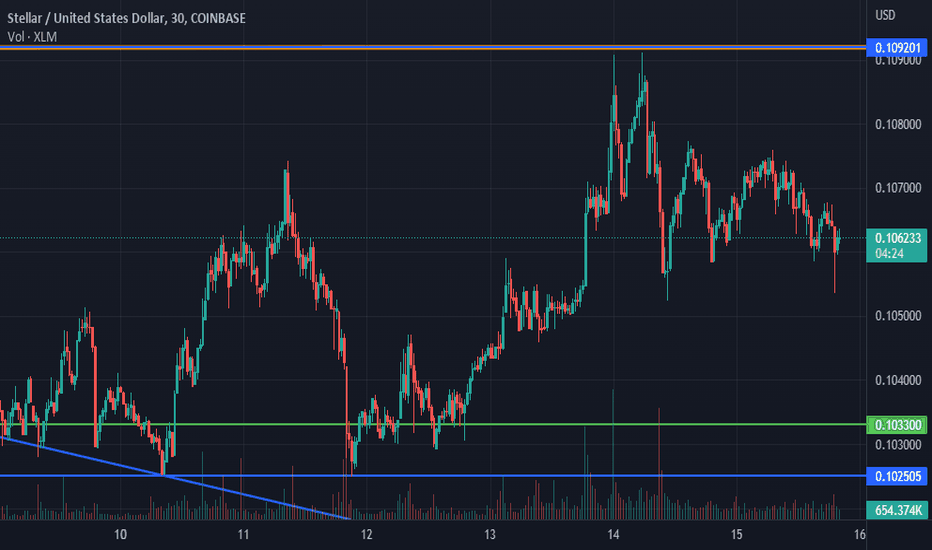

How to Identify Buy and Sell Walls

Buy and sell walls can typically be found in the depth chart of order book on a cryptocurrency trading platform. They are often represented as conspicuous, large blocks, easily identifiable by traders. While some trading platforms provide graphical representations of the order book, this feature is not available on all platforms.

When identifying buy and sell walls, it's crucial to consider the context surrounding them, including current market conditions and the specific cryptocurrency being traded. Market conditions can change rapidly, so staying updated and understanding the current market environment is essential for making informed decisions.

It's worth noting that larger buy or sell walls tend to have a greater impact on the market compared to smaller ones. A large wall could indicate the involvement of a significant market maker or institutional investor, which can potentially influence the price of a specific cryptocurrency more significantly.

How to Interpret Buy and Sell Walls

By examining both buy and sell walls, traders can gain insights into the supply and demand levels for a specific cryptocurrency. A large buy wall suggests strong demand, while a large sell wall indicates substantial supply. When used together, these walls provide a comprehensive view of market sentiment and the supply-demand dynamics of a cryptocurrency.

Combining buy and sell walls can also help identify potential buying or selling opportunities. For example, if there is a significant sell wall and a large buy wall at the same price level, it may indicate a state of equilibrium in the market, presenting an opportunity for traders to enter or exit positions.

The presence of a buy wall typically indicates a bullish sentiment, while a sell wall suggests a bearish sentiment. A market with more buy walls than sell walls tends to exhibit bullish market sentiment, while a market with more sell walls than buy walls suggests a bearish sentiment.

It's important to note that the absence of buy or sell walls may indicate a lack of market activity or market uncertainty. It can also imply a period of consolidation or a lack of liquidity, which can impact trading conditions and market volatility.

Buy and sell walls can serve as potential entry and exit points for trades as well. A buy wall at a specific price can be seen as an opportunity to enter a long position, while a sell wall at a particular price may indicate a suitable exit point for a short position.

Conclusion

Buy and sell walls represent significant limit orders placed on cryptocurrency trading platforms, offering insights into the supply and demand levels for a specific cryptocurrency. They are used by market makers, institutional investors, and individual traders to profit from price movements or accumulate/liquidate substantial amounts of a cryptocurrency.

Understanding buy and sell walls is instrumental in making informed buying and selling decisions, as they display supply and demand levels and provide insights into market sentiment, which can serve as a reliable predictor of market trends.

Analysing the impact of buy and sell walls on the market can help traders develop effective trading strategies, identify potential opportunities, determine entry and exit points, and assess market sentiment accurately.

By mastering the concept of buy and sell walls, traders can enhance their ability to navigate the cryptocurrency market with greater precision and confidence.

We put a lot of effort into researching and writing this piece, and we would love to hear your thoughts and feedback.

Have you found the information in the article helpful and informative? Did it provide you with valuable insights into understanding market sentiment and trading strategies? Is there anything you would like to expand upon or clarify further?

Your feedback is greatly appreciated and will help us improve future articles. Thank you in advance for taking the time to read and share your thoughts.

Happy trading!

@Vestinda