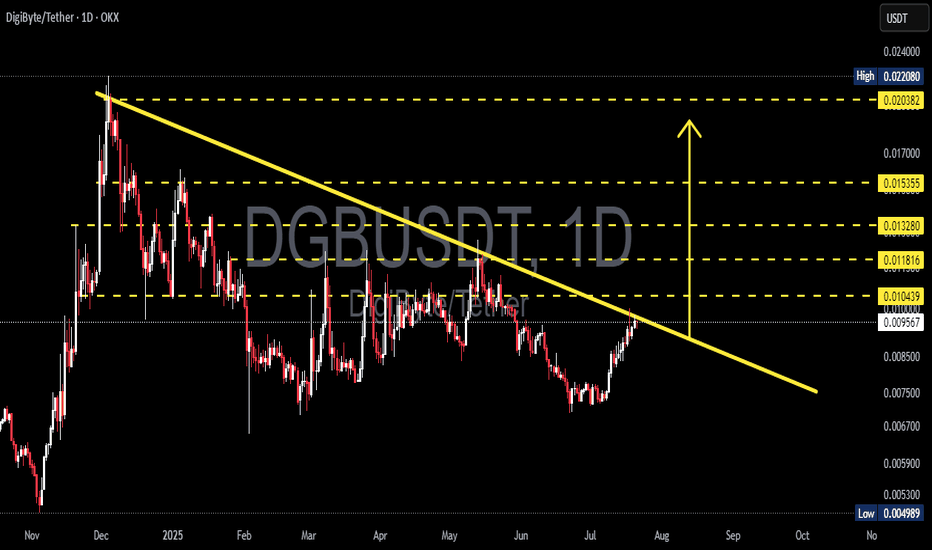

DGBUSDT Ready to Explode? Major Breakout from 7-Month Downtrend📉 Pattern: Falling Wedge / Descending Triangle Breakout

DigiByte (DGB) is currently showing a high-probability breakout from a descending trendline that has held price action in check since December 2024. This structure hints at weakening selling pressure while buyers have started forming higher lows, suggesting potential momentum shift.

🔍 Chart Structure & Key Technicals:

Descending Trendline Resistance (yellow line): Tested multiple times since December 2024. The more often a level is tested, the more likely it breaks.

Breakout Zone: Price is now breaking and retesting the key breakout zone between 0.0095 - 0.0104.

Volume: Gradual increase in volume hints at accumulation by bulls and supports the breakout scenario.

🐂 Bullish Scenario: Breakout Confirmation Could Trigger 100%+ Rally!

If price closes decisively above 0.0104, it would confirm the breakout and open up multiple upside targets:

Target Price Level Notes

🎯 Target 1 0.0118 Minor resistance — initial profit zone

🎯 Target 2 0.0132 Previous structure resistance

🎯 Target 3 0.0153 Major Fibonacci and psychological level

🎯 Target 4 0.0203 Key breakout level from early 2025

🎯 Target 5 0.0220 (High) Full breakout target based on historical high

➡️ A confirmed breakout from this 7-month trendline could trigger a powerful mid-term bullish run.

🐻 Bearish Scenario: Rejection = Downtrend Still Intact

If DGB fails to hold above 0.0095–0.0104 and gets rejected:

Price could fall back toward support zones at 0.0075, then 0.0060

A breakdown below 0.0050 (historical low) could lead to deeper selloffs

Lack of volume on breakout = potential fakeout / bull trap

🧠 Market Psychology & Pattern Context:

Falling Wedge Pattern: A classic reversal pattern signaling that sellers are losing control while buyers prepare for a breakout.

Volume Confirmation: Valid breakouts are almost always accompanied by rising volume. Watch this closely!

Psychological Price Levels: Zones like 0.01, 0.015, and 0.02 often act as magnet levels and take-profit targets for institutions or swing traders.

⚠️ Summary & Strategy:

DGB is currently at one of its most critical levels in 2025

Bullish breakout could deliver 50%–120% upside for swing traders

Rejection = caution, don’t FOMO into resistance

Ideal SL (stop loss) below 0.0090 for breakout entries

📢 Final Tip:

> "Breakouts are only as strong as the volume and candle closes behind them. Wait for confirmation — don’t chase shadows."

#DGB #DGBUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #FallingWedgePattern #BullishSetup #BearishScenario #CryptoTrading #TrendlineBreakout

Dgbusdsignal

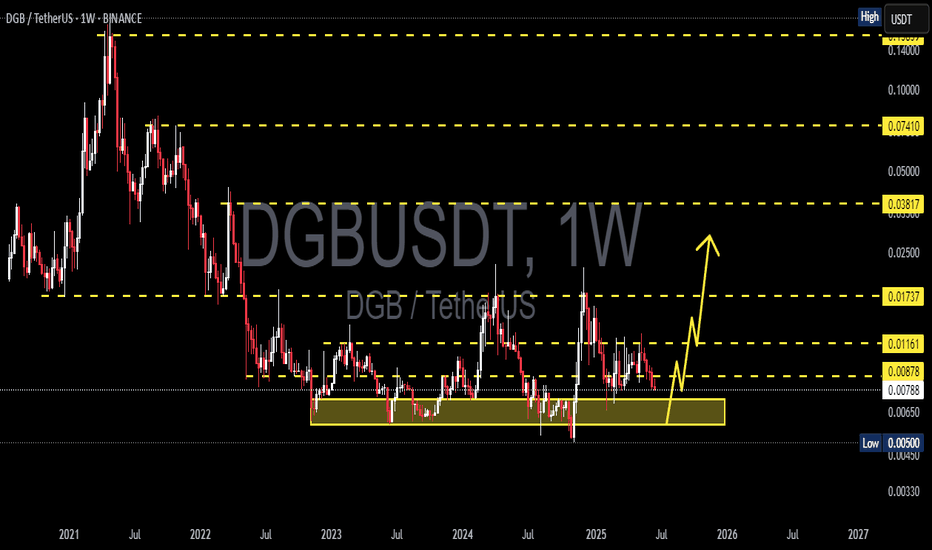

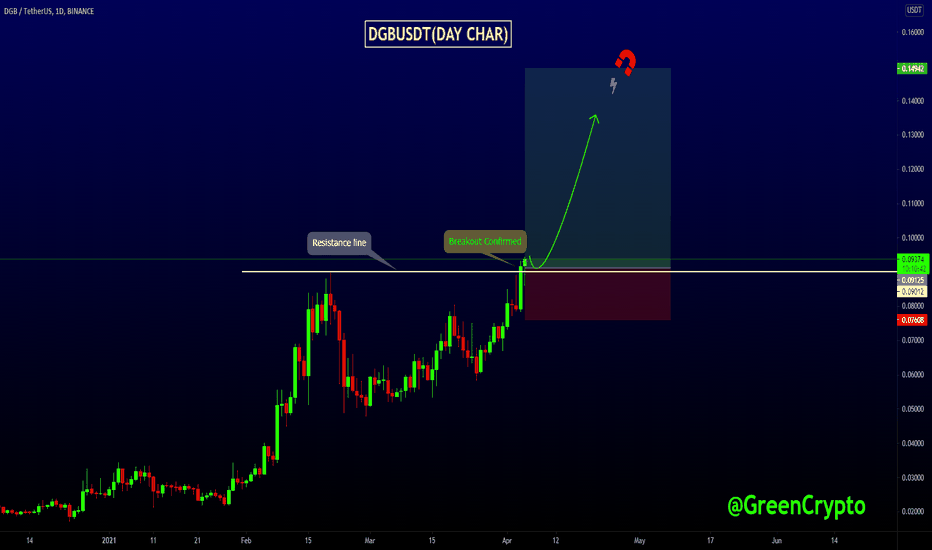

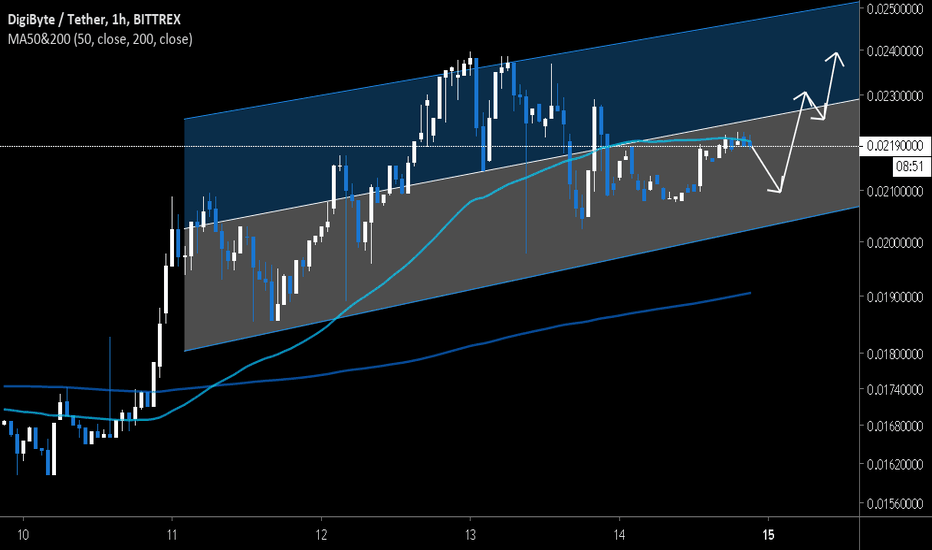

DGBUSDT Breakout Confirmed!! DGBUSDT (Day CHART) Technical Analysis Update

Resistance Breakout in day chart

DGB/USDT currently trading at $0.093

Buy-level: $0.090 -$0.094

Stop loss: Below $0.075

Target 1: $0.110

Target 2: $0.125

Target 3: $0.135

Target 4: $0.150

Max Leverage: 2X

ALWAYS KEEP STOP LOSS...

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

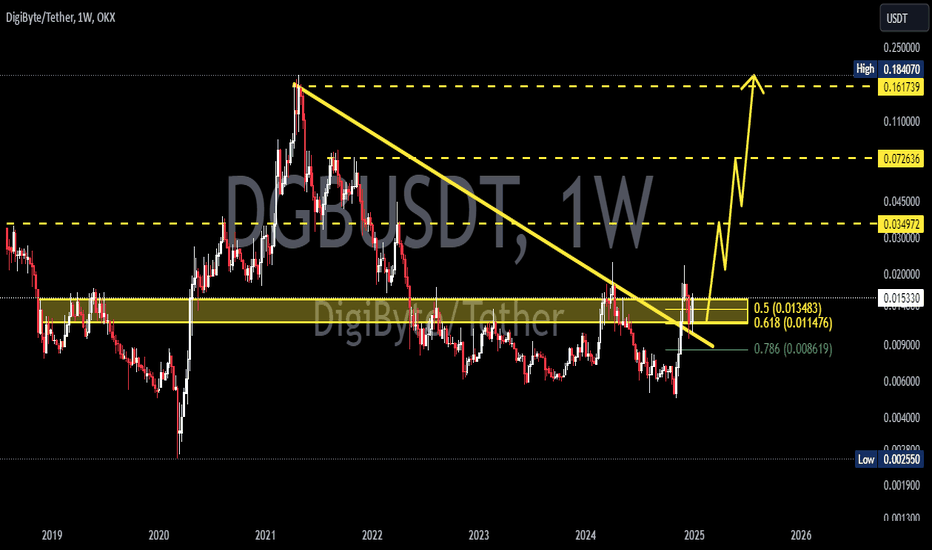

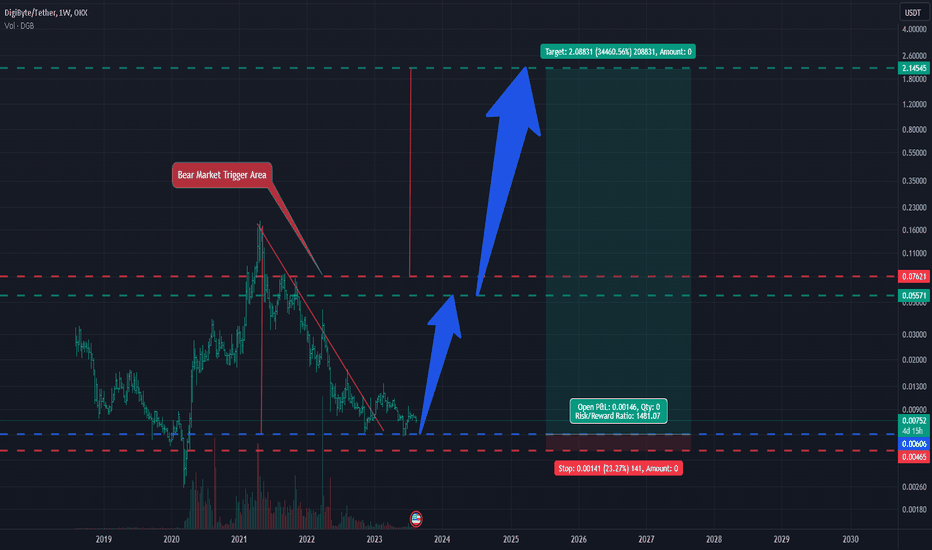

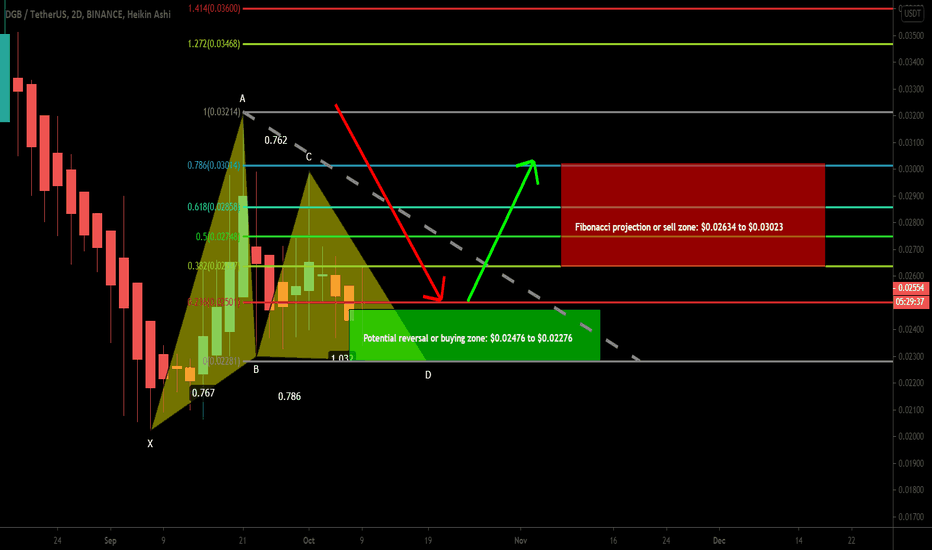

DGBUSDT formed bullish Gartley | Upto 32% move expectedThe priceline of Digibyte (DGB) has formed bullish Gartley on the 2 day chart, the targets as per Fibonacci sequence of Gartley are:

Potential reversal or buying zone: $0.02476 to $0.02276

Fibonacci projection or sell zone: $0.02634 to $0.03023

Regards,

Atif Akbar (moon333)

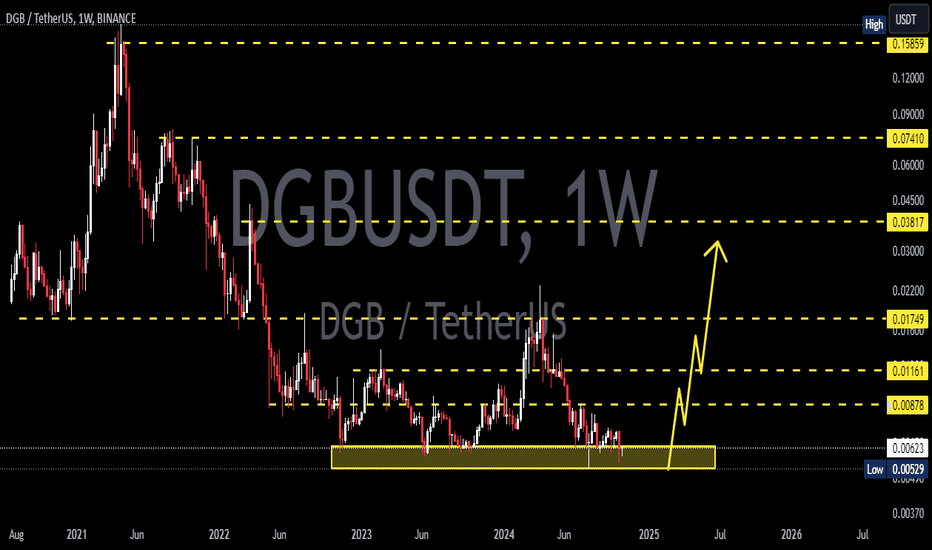

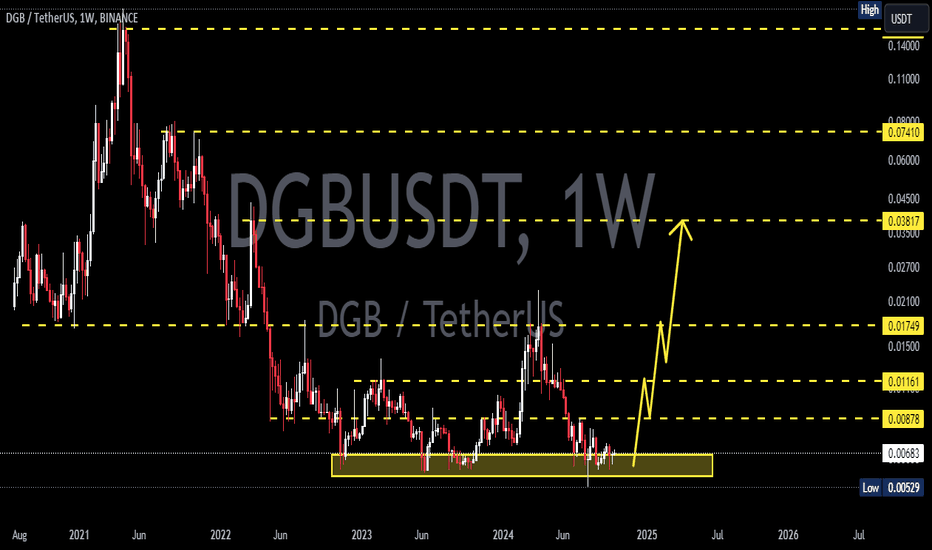

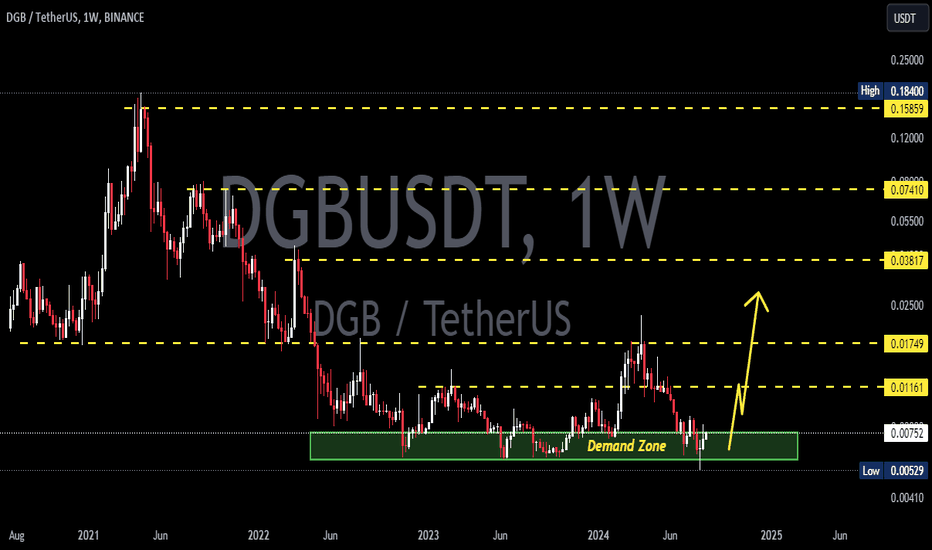

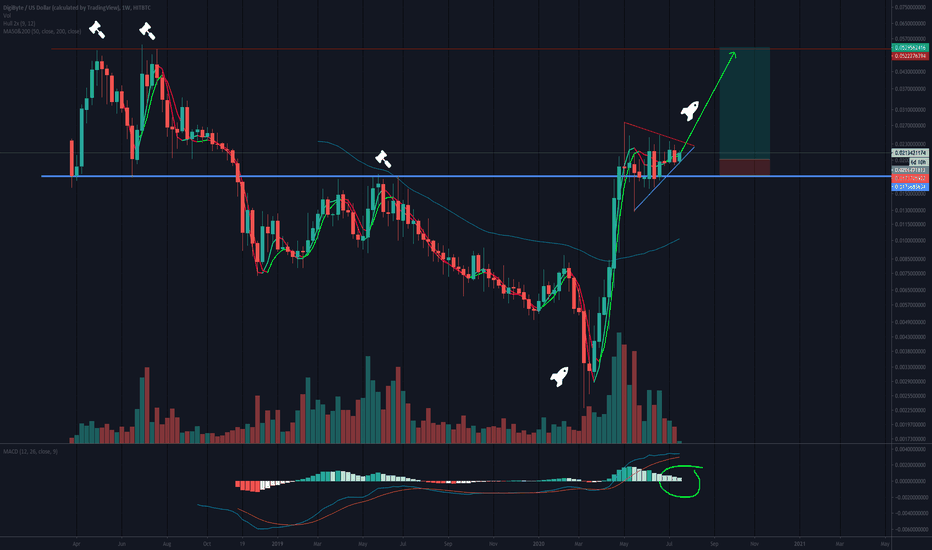

DigiByte Weekly ReviewOverall chart suggests DGBUSD is consolidating above a significant horizontal, with current price action leaning up.

The 50 MA is now pointing up after the long correction since previous ATH.

MACD is still pointing down however, so perhaps this week will see DGBUSD building pressure against the top of the triangle, with next weeks momentum turning up strongly enough for a decisive breakout towards the 160% target we previously set.