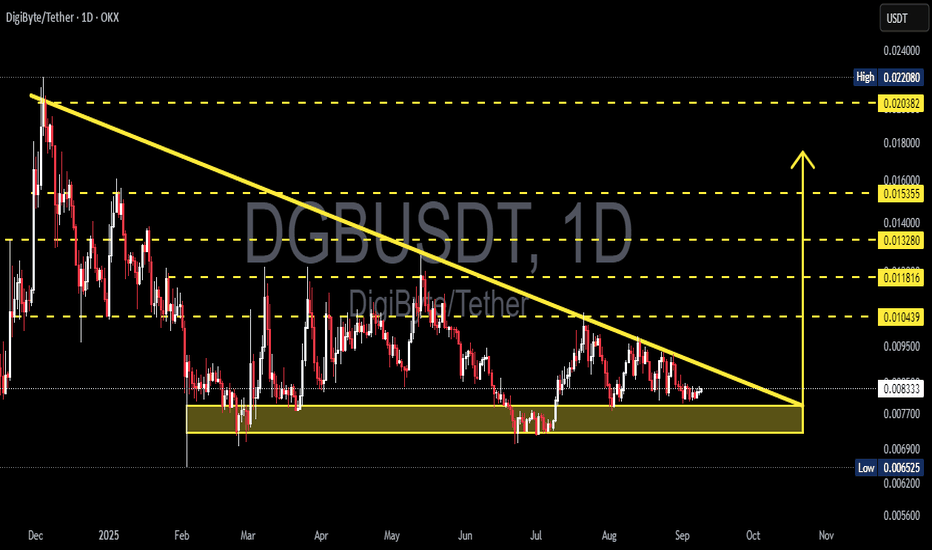

DGB/USDT — Descending Triangle at a Critical Demand Zone🔎 Technical Overview

On the daily chart, DGB/USDT is forming a descending triangle, with a clear downward sloping trendline acting as dynamic resistance and a horizontal demand zone around 0.0065 – 0.0077 USDT providing strong support.

This setup reflects a phase of accumulation or distribution, where the market is preparing for a decisive move: either a bullish breakout above the descending trendline or a bearish breakdown below the demand zone.

---

📊 Key Technical Levels

Current price: 0.008295

Demand zone (support): 0.0065 – 0.0077 (yellow box)

Upside resistance levels:

0.010439 → first breakout confirmation

0.011816 → secondary resistance

0.013280 → mid-term target

0.015355 → extended target

0.020382 & 0.022080 → major upside levels if momentum accelerates

---

🟢 Bullish Scenarios

1. Confirmed Breakout (conservative):

If the price manages to close a daily candle above the descending trendline and reclaim 0.010439, bullish momentum is likely to strengthen.

Targets: 0.0118 → 0.0132 → 0.0153

Key signals: rising volume, RSI recovery, strong daily green candle.

2. Bounce from Demand (aggressive):

If price retests the 0.0065–0.0077 zone and bounces, this area may serve as a strong accumulation point.

Stop loss: below 0.0063–0.0065.

Initial target: 0.0104, with extensions to higher resistances.

Risk-to-reward ratio could be highly favorable if the bounce holds.

---

🔴 Bearish Scenario

A daily close below 0.0065 would confirm the descending triangle breakdown.

This breakdown could trigger further downside with a target toward 0.0056 or lower.

After the breakdown, the 0.0065–0.0077 zone would flip into a supply zone (resistance).

---

📌 Pattern & Sentiment

Descending Triangle: traditionally considered a bearish continuation pattern, but in crypto markets, upside breakouts are also possible.

Historical Demand Zone: the highlighted yellow box has been tested multiple times since March 2025, making it a key psychological support.

Market Sentiment: the reaction around this zone and the ability to break the trendline will dictate the medium-term direction.

---

⚖️ Conclusion & Strategy

Bullish play: wait for a breakout above 0.0104 with strong volume (safer) or accumulate cautiously in the demand zone with a tight SL (riskier).

Bearish play: a daily close below 0.0065 signals breakdown and opens the door for deeper declines.

Risk management: always use stop loss and limit exposure to 1–2% risk per trade.

DGB is currently at a make-or-break point. Whether buyers can defend the demand zone or sellers push through support will define the next big move.

---

#DGBUSDT #DGB #DigiByte #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #CryptoTrading #SupportAndResistance #Altcoins

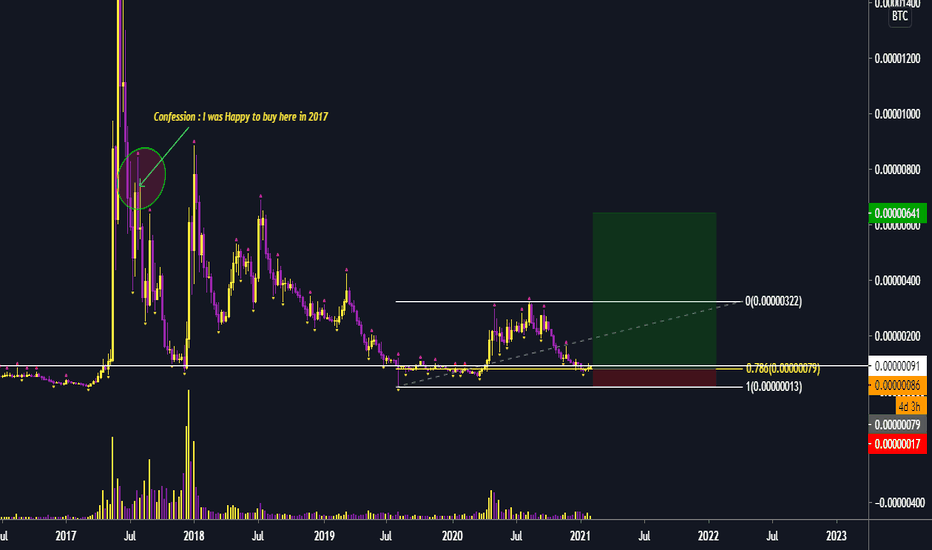

Digybte

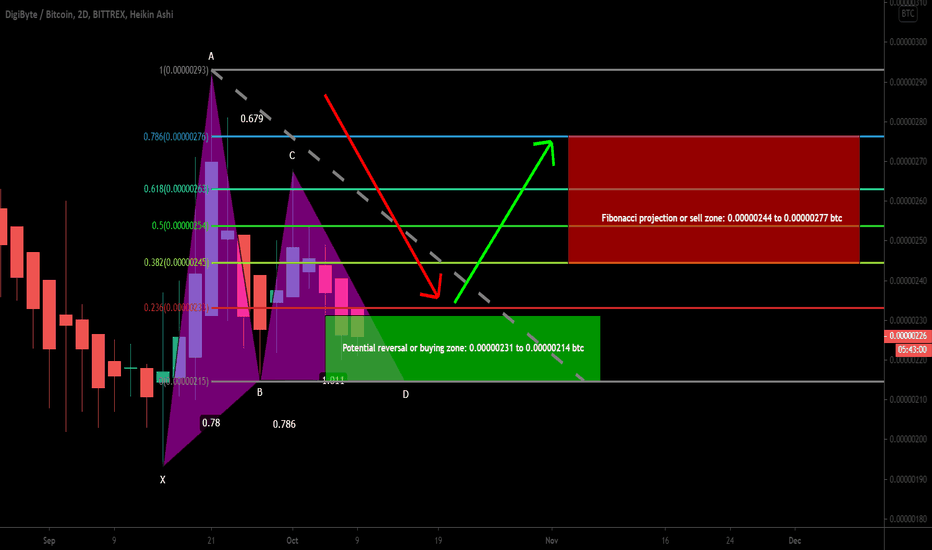

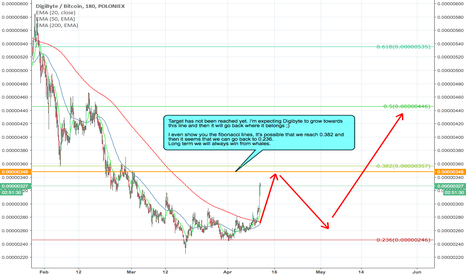

DGBBTC formed bullish Gartley | Upto 29% move expectedThe priceline of Digibyte (DGB) has formed bullish Gartley on the 2 day chart, the targets as per Fibonacci sequence of Gartley are:

Potential reversal or buying zone: 0.00000231 to 0.00000214 btc

Fibonacci projection or sell zone: 0.00000244 to 0.00000277 btc

Regards,

Atif Akbar (moon333)

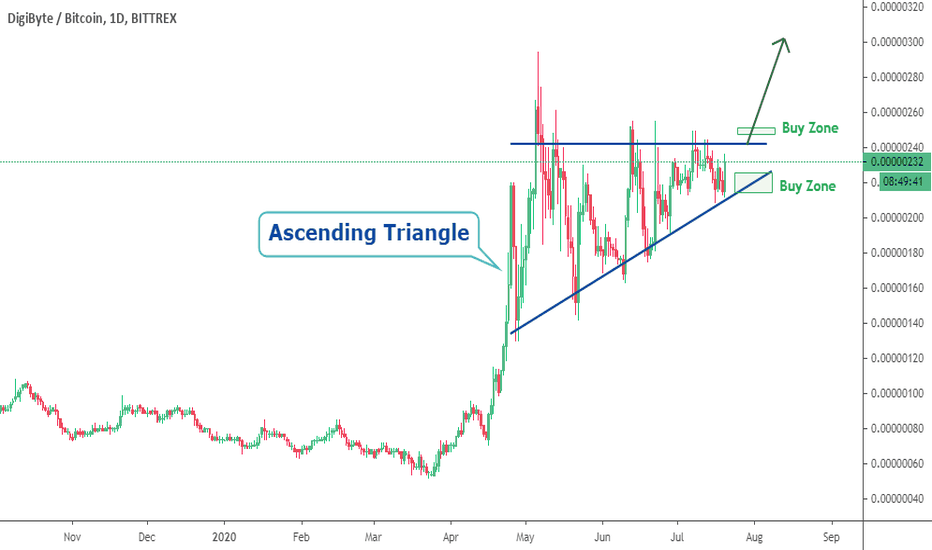

Digibytes break out confirmed? Not yet.

Digibyte has been pumped by some whales who gave a sign and the sheeps followed their signs.

Due to their sign there was a massive buy by the followers of these groups and they will massively dump when Digibyte reach 349 satoshi.

Be aware of these kind of 'traders'. I expect Digibyte to reach the fibonacci level when it's not dumped to much and after it will correct towards a lower fibonacci level. If it does not decrease lower than where we started we will see the third wave of Elliot and we will have a bullish trend confirmed.

Peace out.