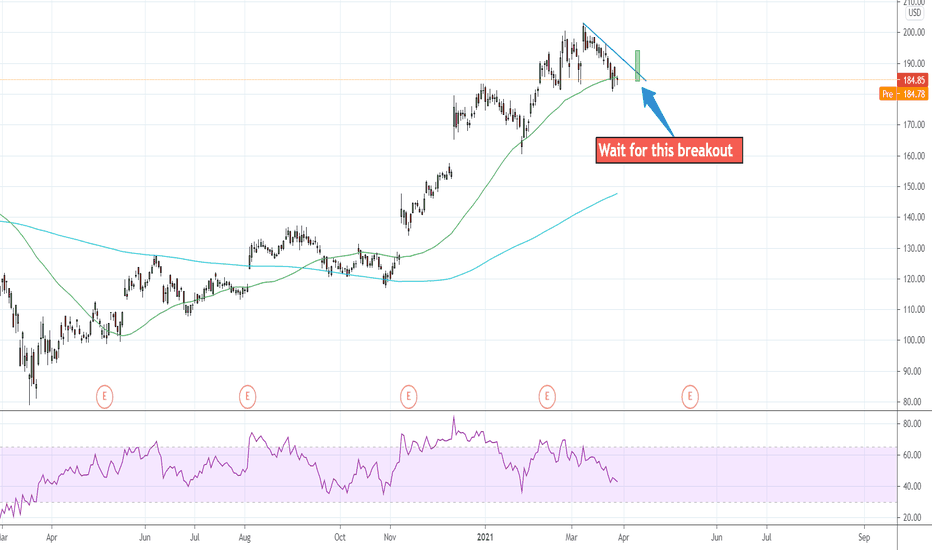

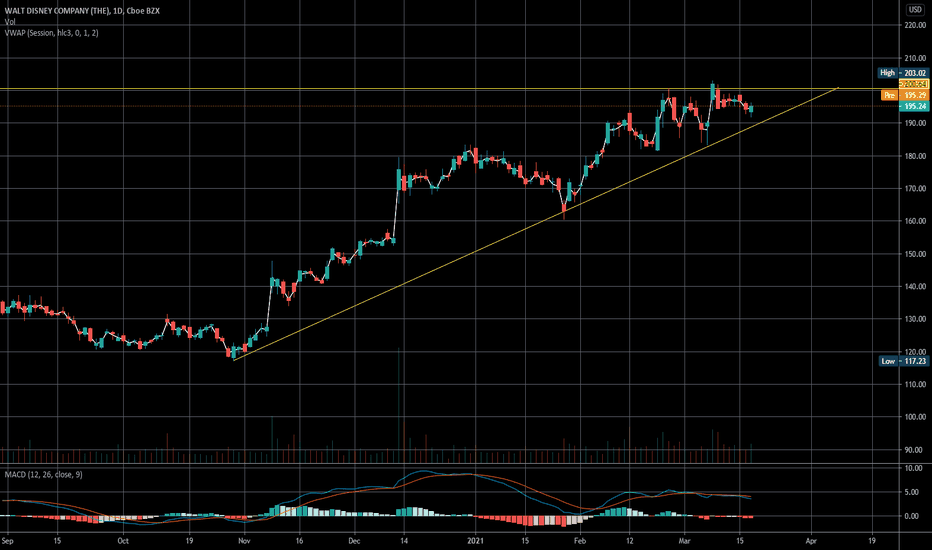

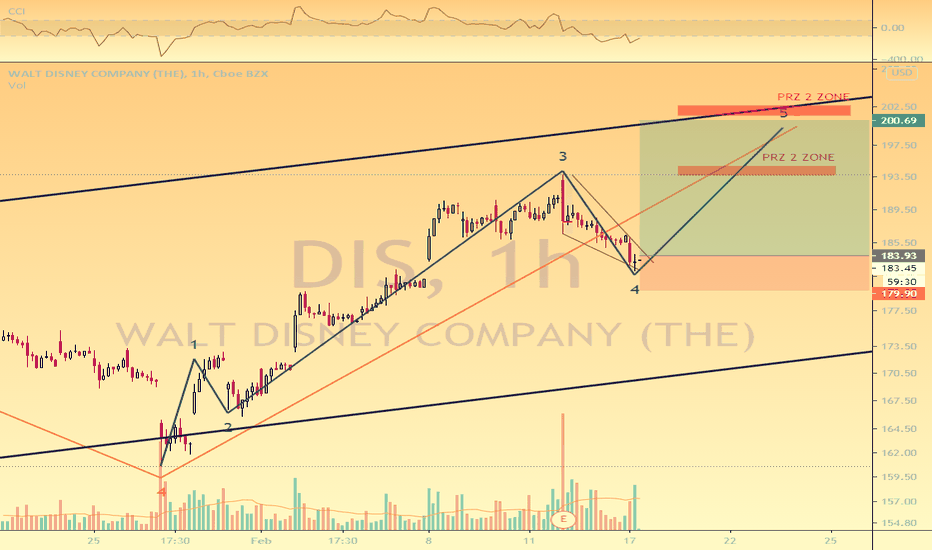

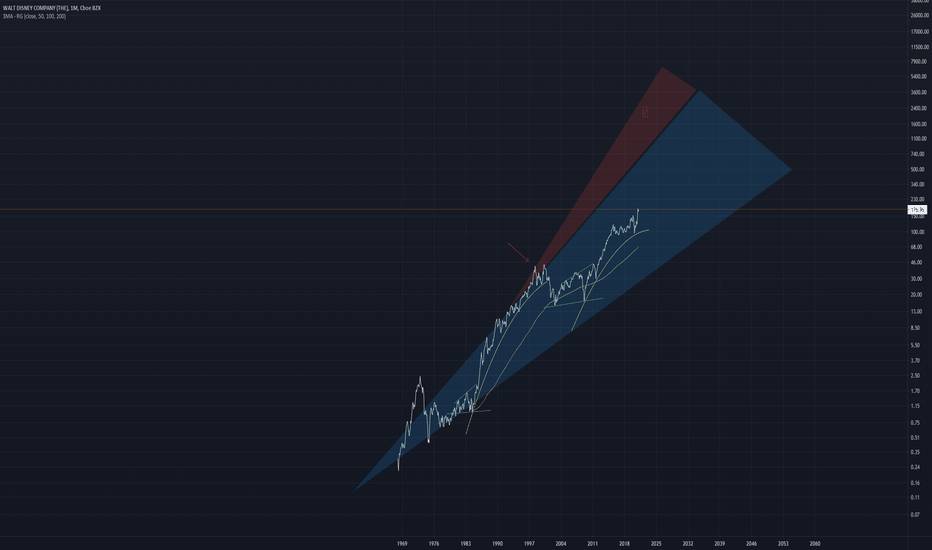

Walt DisneyThe overall trend is bullish. This company represents communication services sector which market weight is 10,78% according to Fidelity research and it is worth investing in. Right now price is in the correction phase which gives us a good opportunity to take advantage of. So, my recommendation for speculating purpose is to wait till price breaks this correction trendline and then buy, for investing purpose - wait for a deeper correction and buy low. Write in the comments below which company you'd like to see in my next analysis.

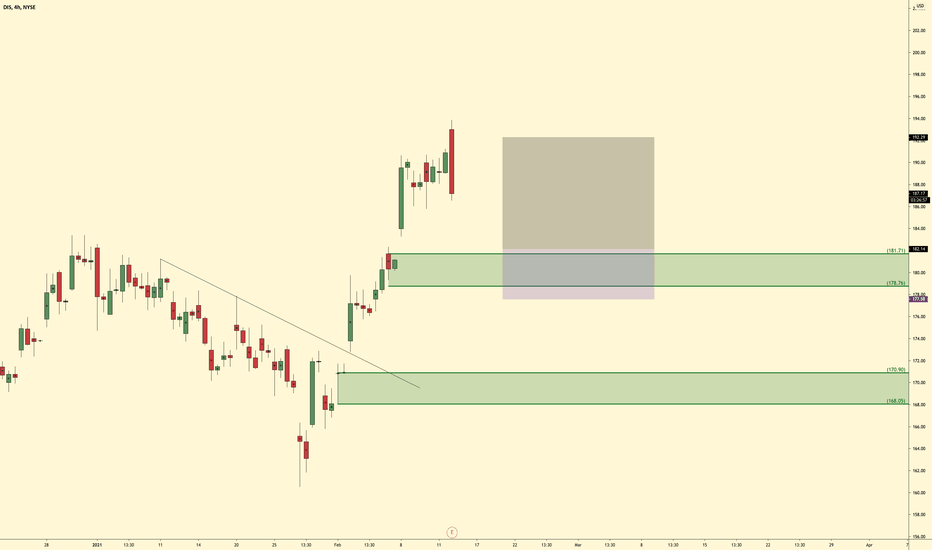

DIS

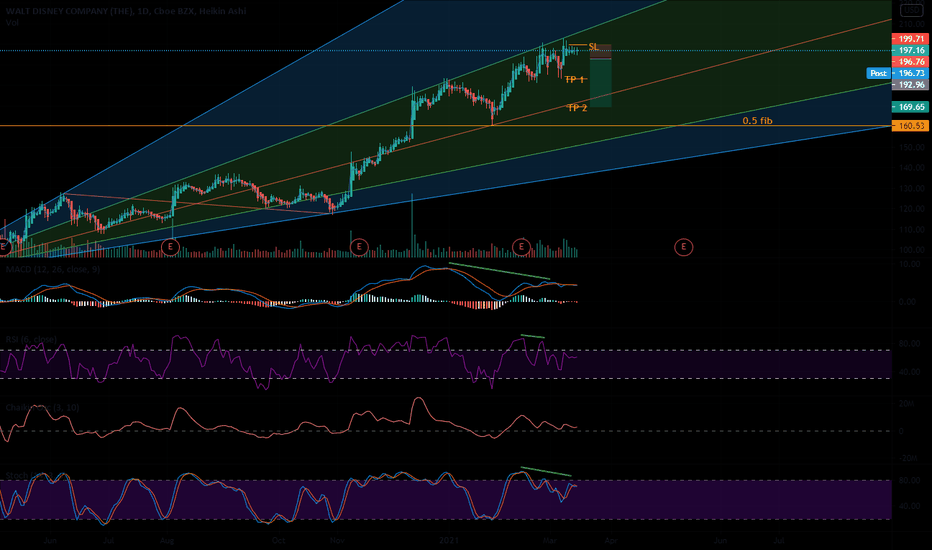

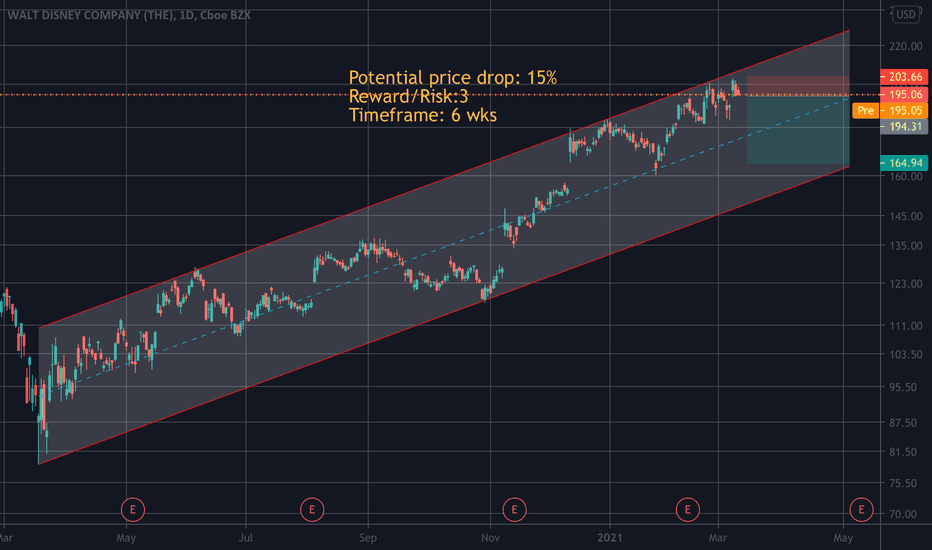

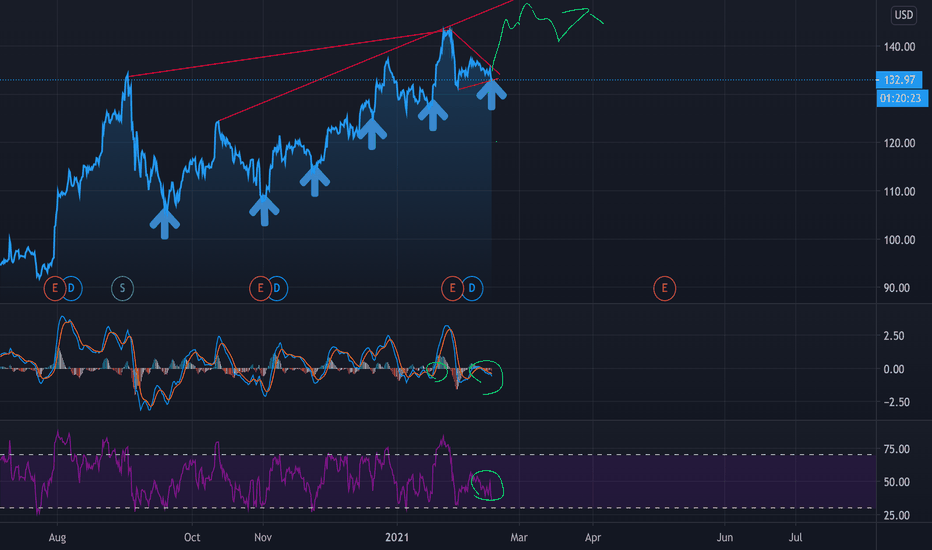

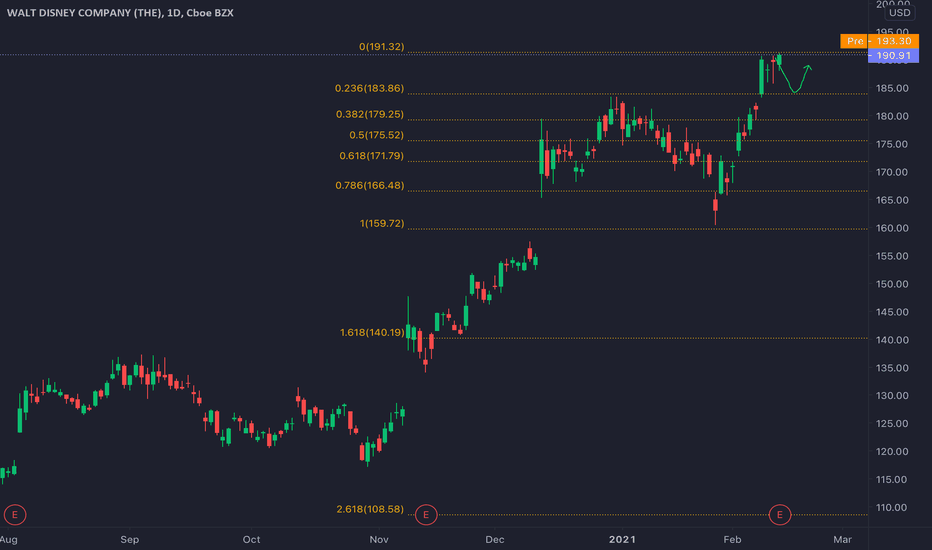

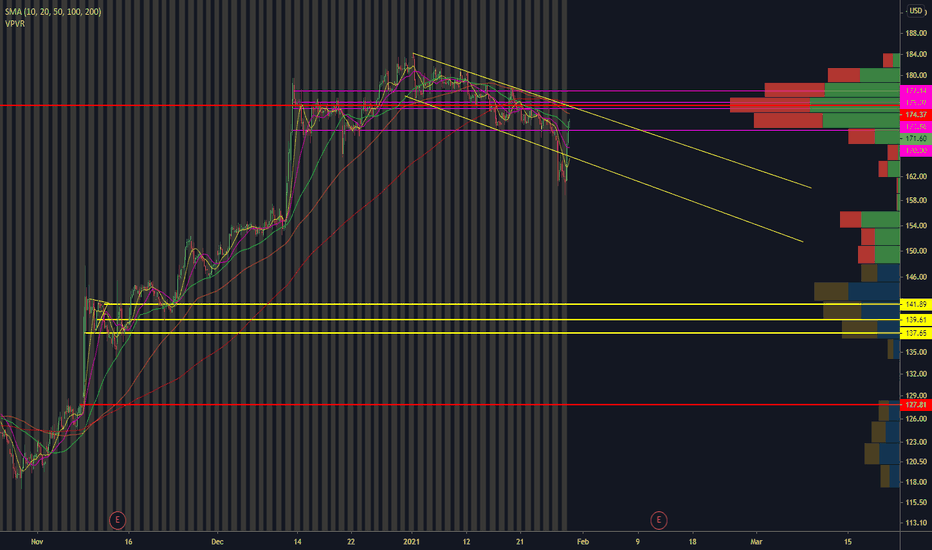

DISNEY BEARISH DIVERSIONDisney reached the pitchfan resistance once again and could retrace >10% .

MACD , RSI and STO all indicate bearish diversion.

Take profits at fib levels.

Long term I don't think Disney will fall too much, I think the lowest it will go is the 0.5 fib line before returning bullish (and a potential long entry).

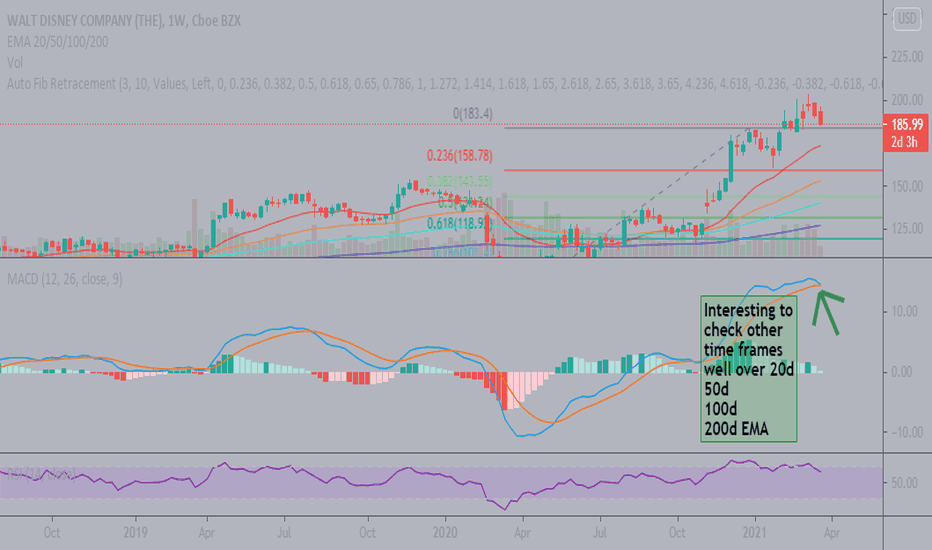

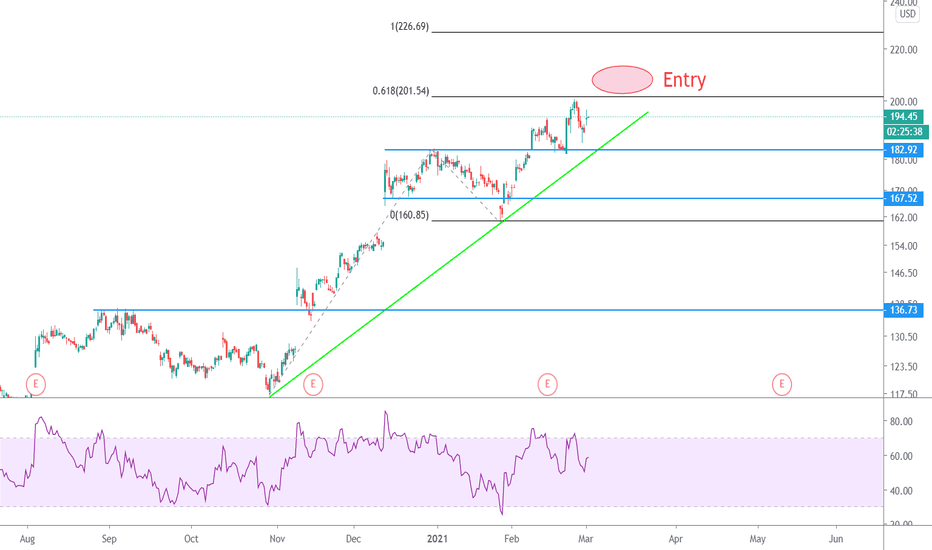

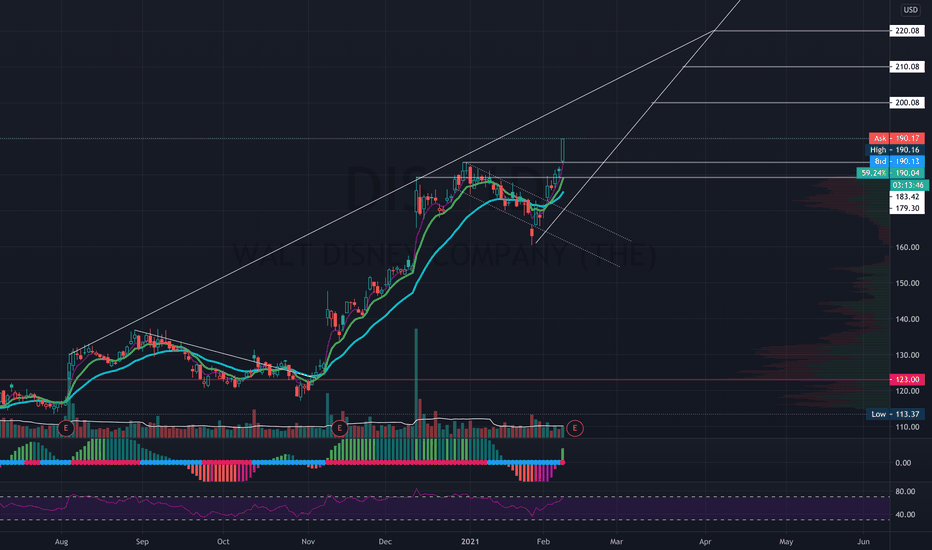

Warning for DISNEY!This rising wedge is looking scary.

A possible break to the downside is imminent (within the next several days).

We might get some support and bounce upwards, but we are close to crossing below the 50d MA.

Also a bearish divergence in the RSI is making me lean more towards bearish overall.

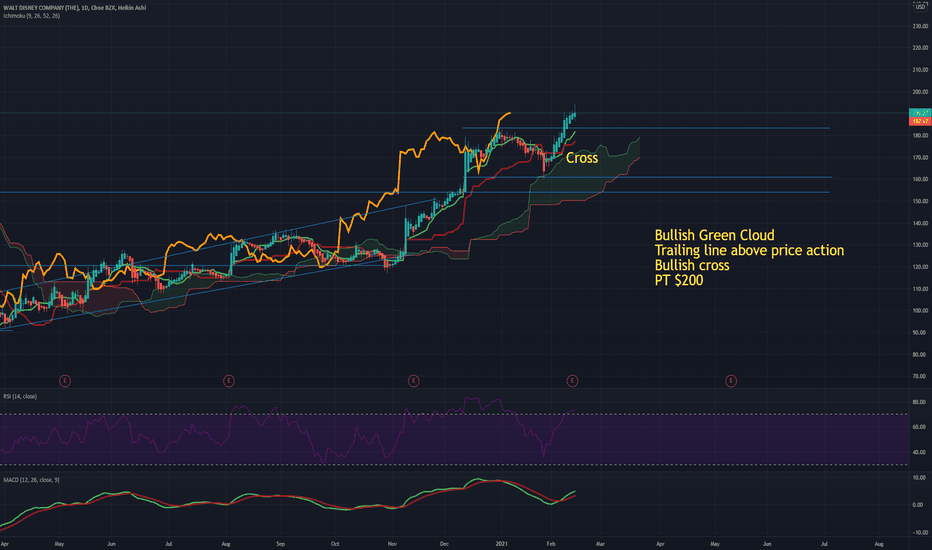

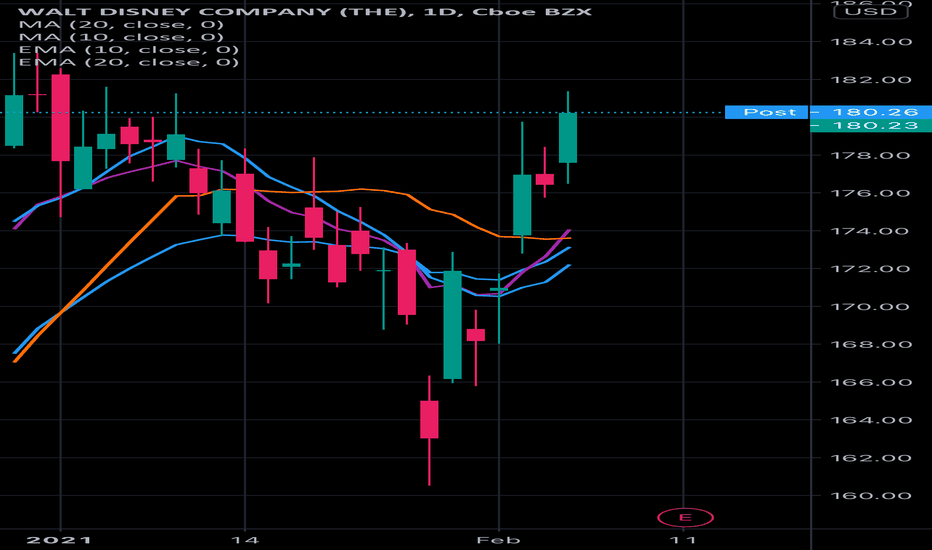

Disney failed to get out of the channel.This is just my technical view, neither a fundamental comment,nor a recommendation to trade..!

Please review my track record and calculate the odds for yourself..!

You’re likes and comments encourage me to continue this.

Stay tuned great live stream and quality content videos coming soon..!

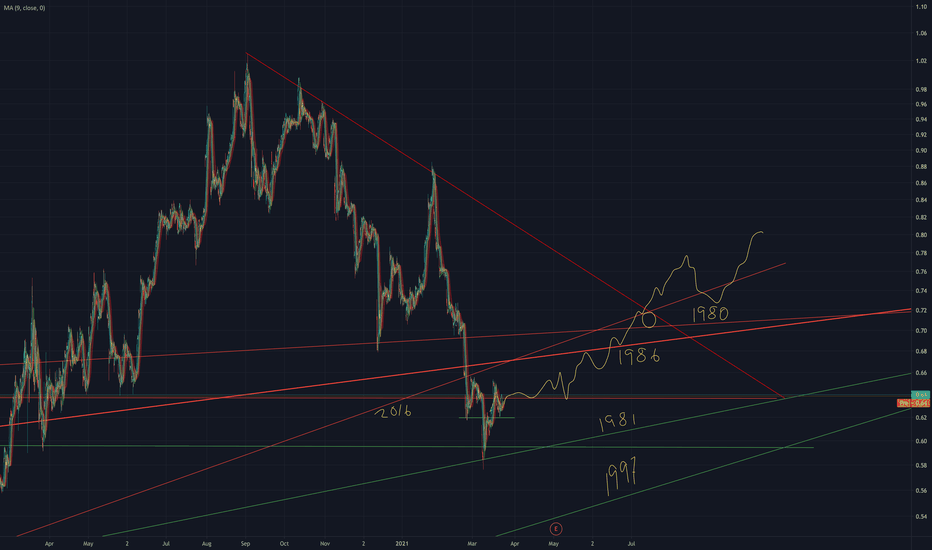

DIS (NYSE) - Be Carefull for changing in trendGreetings

Humbled, we would like to thanks for your support who has already liked, commented and followed us. Your support, strengthens us, to help in analyzing the market. If you have any questions, do not be hesitant to send us message (inbox). Our Service : Signal recomendation, Trading Course, Portofolio Consultation for multi asset such as Stock, FX, Derivative, Crypto, etc

Strategy

- Please care for Money Management

- Have a good psychology

- Do not be hurry to open position

- Evaluate and upgrade your trading plan

Analysis

DIS (NYSE) - Be Carefull for changing in trend

AAPL's Bull case and Bear case.This is going to be different this from my other posts, are gonna be more unbiased and diving deeper into AAPL. As you can see from the arrows, it showed when the stock broke out of either downward wedge pattern or consolidation or continuation pattern. Both of these are considered bullish with the continuation cases like AMZN consolidating then broke off and also in this case too, AAPL, which broke to new all-time highs a month past today. Currently, AAPL is in both a short continuation pattern and also a downward wedge. If AAPL holds this position and does not fall threw below the 130s, it has formed a double bottom pattern. This is also a bullish signal in it itself. The MACD diverges again and again, which is also bullish. Now as I am always talking about being bullish, let us talk about the bear case or why it will fall. AAPL currently is depending on iPhone sales for the company to grow, which is a disadvantageous position as if AAPL makes a bad iPhone, expect it will drop 5 or 10% after earnings. As AAPL is attempting to diversify into the services sector, it has hurdles to overcome like in the streaming sector, it is trying to break through into it but the current dominator in that space are Netflix and Disney. While with both its pros and cons, I believe that AAPL is an amazing company to invest in as rest assured, the odds that AAPL will go bankrupt are lower than you getting struck by lightning than getting slapped in the face by a middle school student, who is wearing heels and just ate Japanese food, which came from a gas station. It has a lot of cash in hand or $195.57 billion in cash on hand. Big companies like Berkshire Hathaway and other tech companies invest in it so rest assured, you will not lose all your money if you put it in aapl. In conclusion, I am bullish on apple and will continue doing so and continue investing in it, even if the markets are a tad overvalued. Warning! I am not a financial adviser and take this with a grain of salt. Happy trading and investing and make sure to hit follow and like and comment on this post to get this out to more and more people! Good luck on all future endeavours everyone

!!!

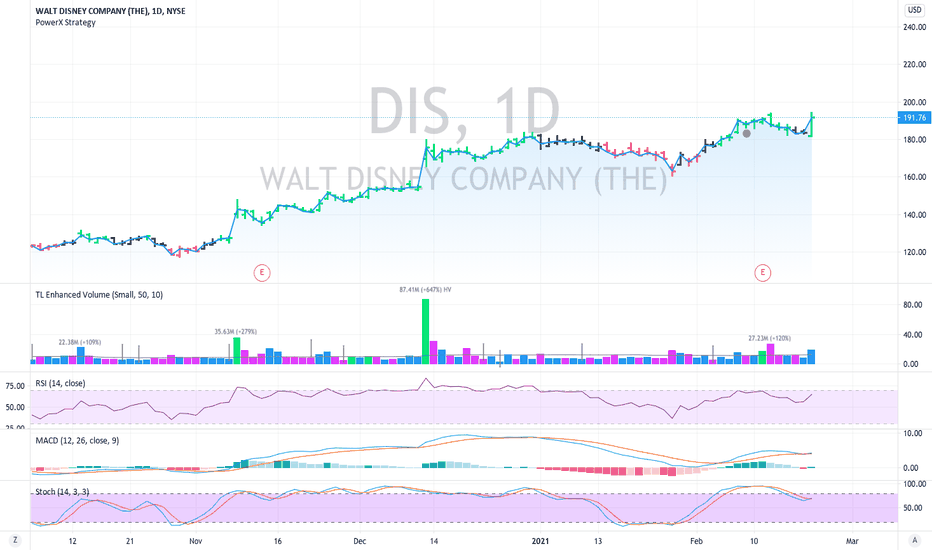

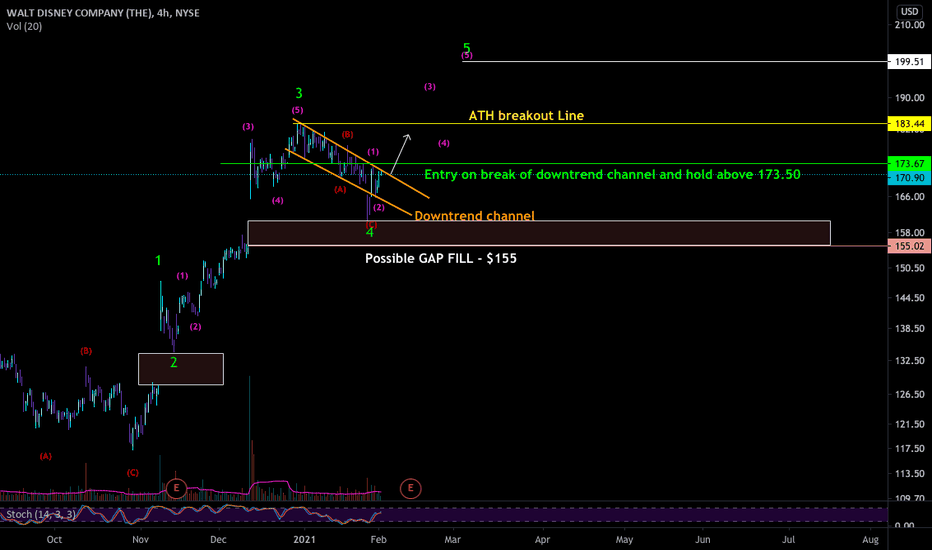

DIS - LongI believe we're seeing breakout heading into Earnings, and am expecting a monster move forward. Targeting 220 by early April.

i am long with vertical spreads and 200 shares.

Disney + could be a monster, and propel this stock forward in a way DIS has never seen. (Mini netflix with theme parks, and A+++ IP )

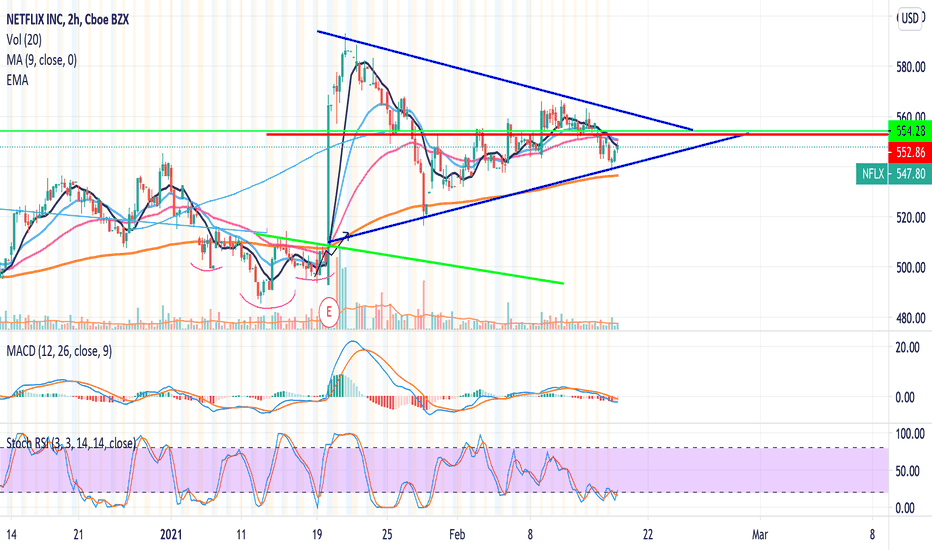

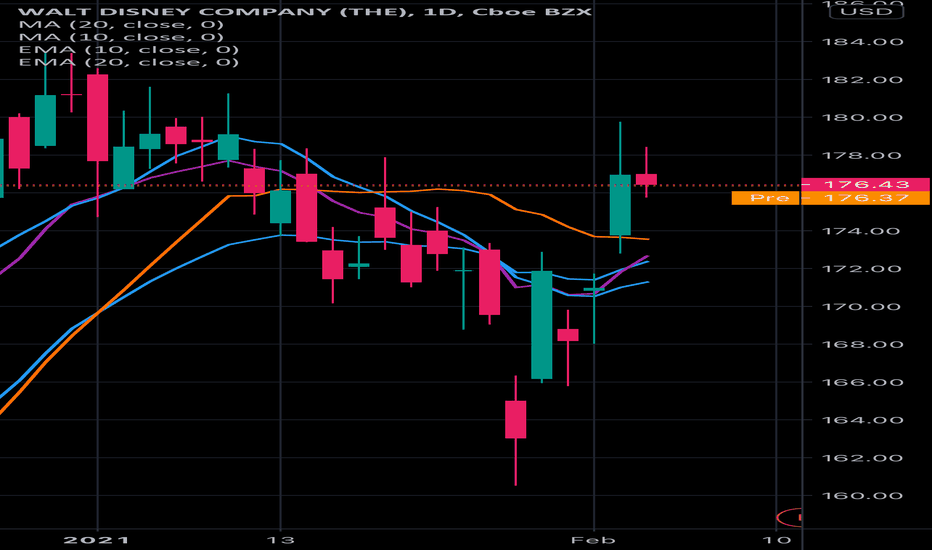

DIS ER run up DIS ER run up ... after a month long correction, Disney is getting close to breaking out of this downtrend channel and looking to make a push back to ATH. Watching for a clean break of the downtrend with an increase in volume and a hold above 173.50 to confirm reversal. With Strong growth in the streaming service and as they continue to push out great news with new film plans (marvel, star wars, etc) I'm very optimistic on DIS er!

For option contracts I am Looking at 180C for 2/19. (liquid contract: medium risk/ high reward)