DIS

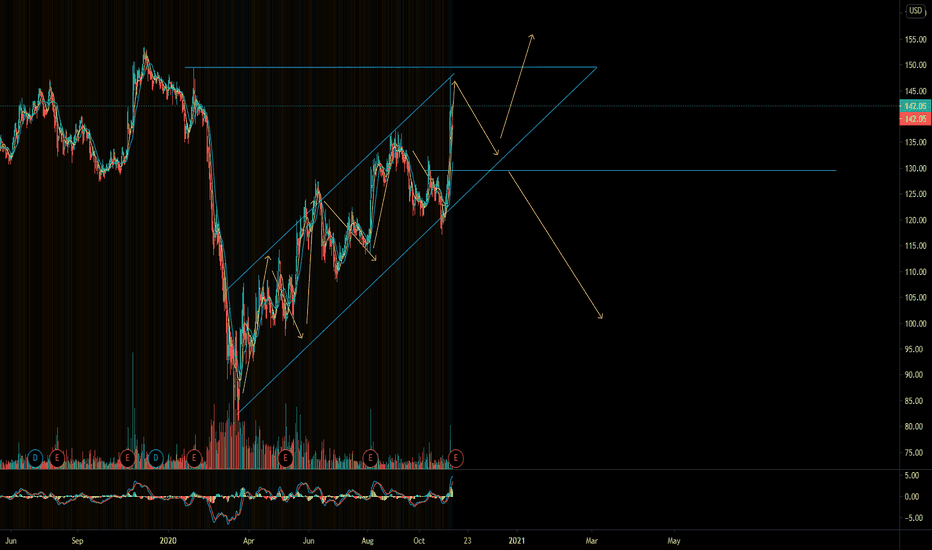

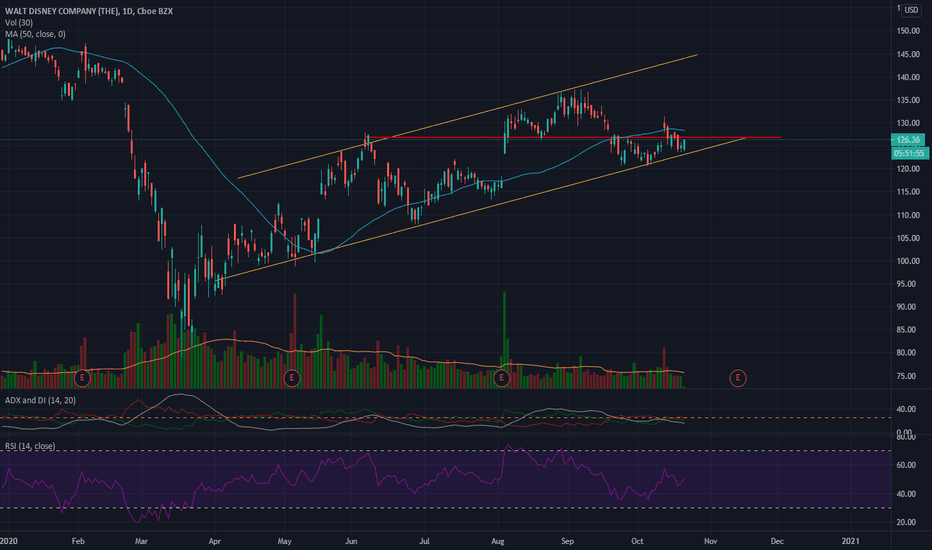

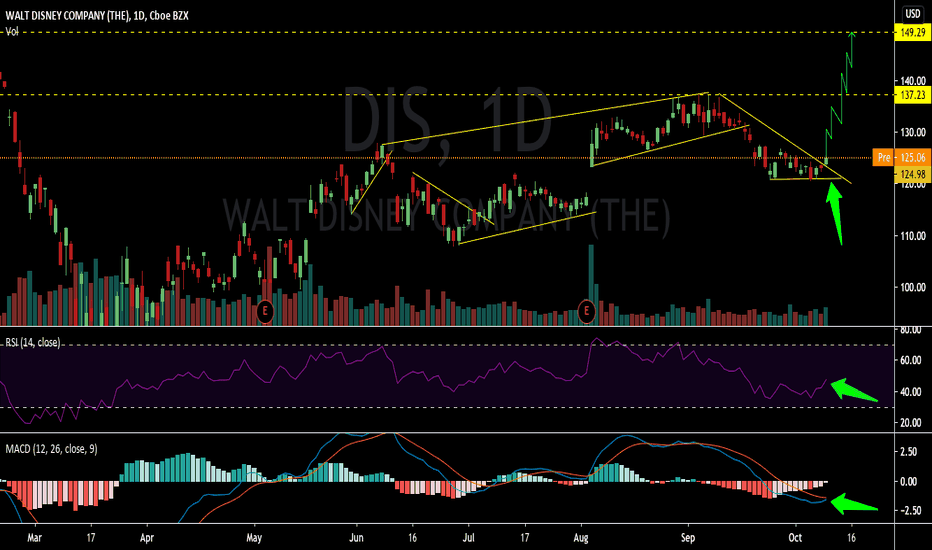

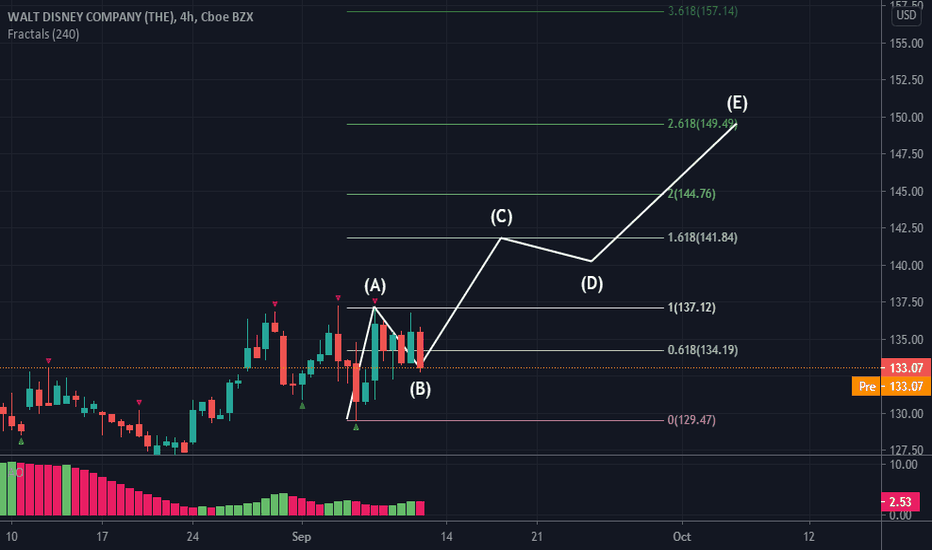

Clear bullish potential for The Walt Disney Company Today we will explain the reasons we see a clear path for DIS towards the All-time highs zone.

a) We can see an ascending trendline that has been respected

b) Currently, we see a corrective structure (sideways movement composed by an ABC)

c) Remember that corrective structures are a continuation pattern when being preceded by an impulse

d) If we have a breakout of the corrective structure (yellow line) we expect a continuation movement towards the all-time highs zone

e) Also we know that any forecast can go wrong and we have an invalidation level (red line). If the price reaches that zone we will assume that we were wrong and we will cancel any pending setup

f) Remember: Protect your capital, and trade safe!

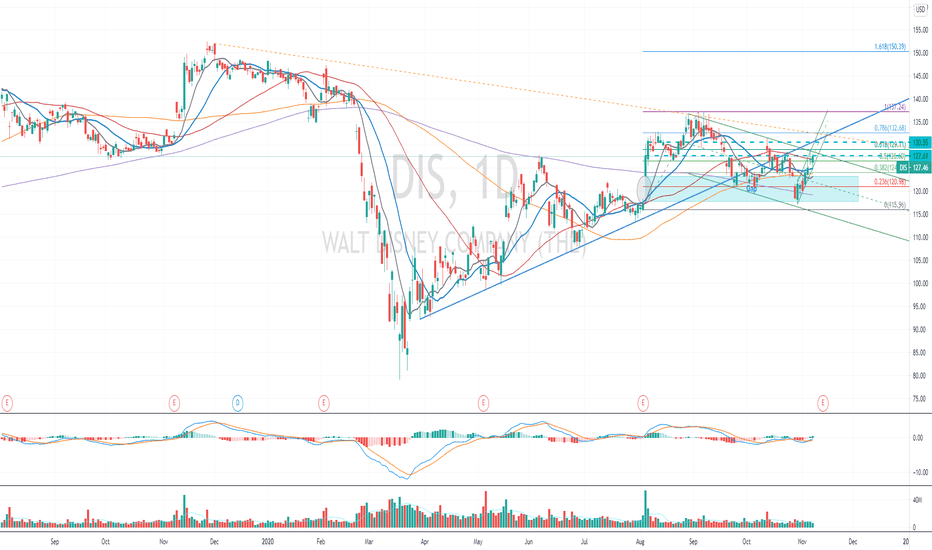

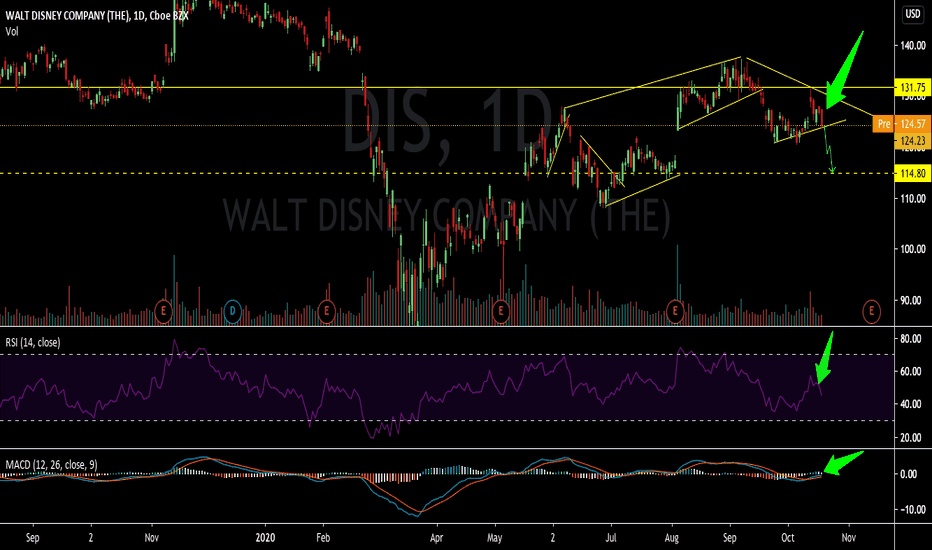

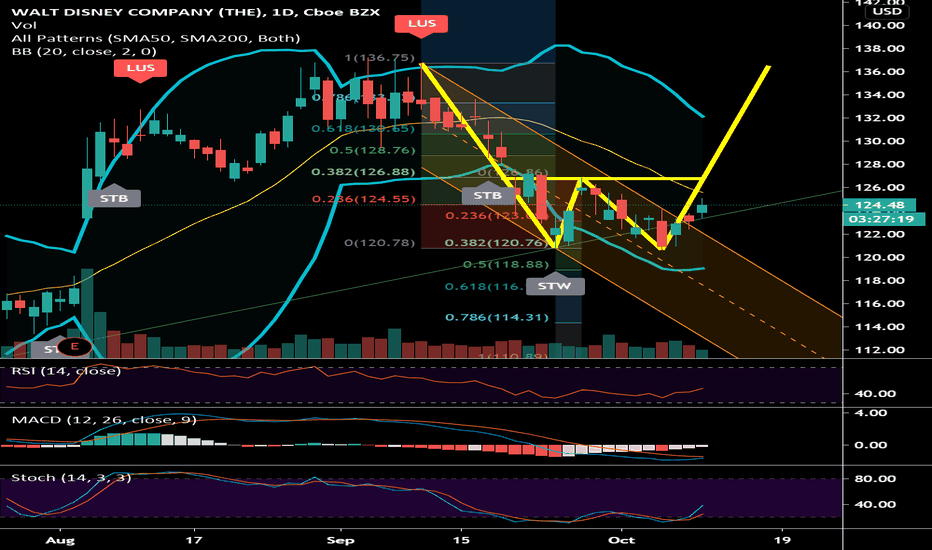

Previous level of resistance returning for DISDIS has crossed below a previous level of support at $120 that existed for about a month (Sept 24 to Oct 26). That level acted as resistance for a month and a half June 16-August 5 2020. MACD is below indicator line and below midline. RSI is below 30%, so we're probably looking at a pullback to the upside as I write this. Whether this will be a rebound or a pause before continued decline remains to be seen, but based on the MACD and the price action, I'm anticipating the latter.

****This information is presented for discussion only and does not represent advice to buy or sell a security.*****

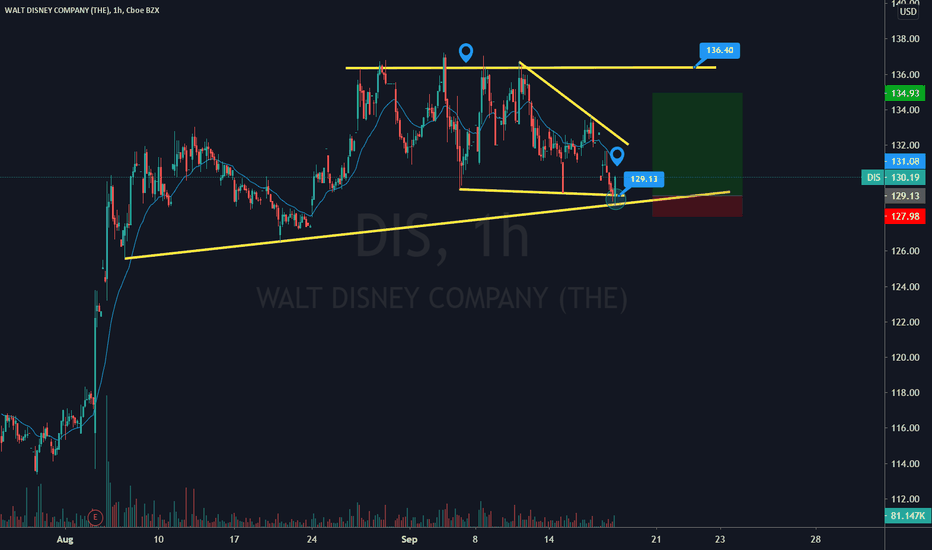

DIS double bottom within wedge. Big breakout possible.Looking at a double bottom about to go up. If it goes through, it could also pass through a big descending wedge.

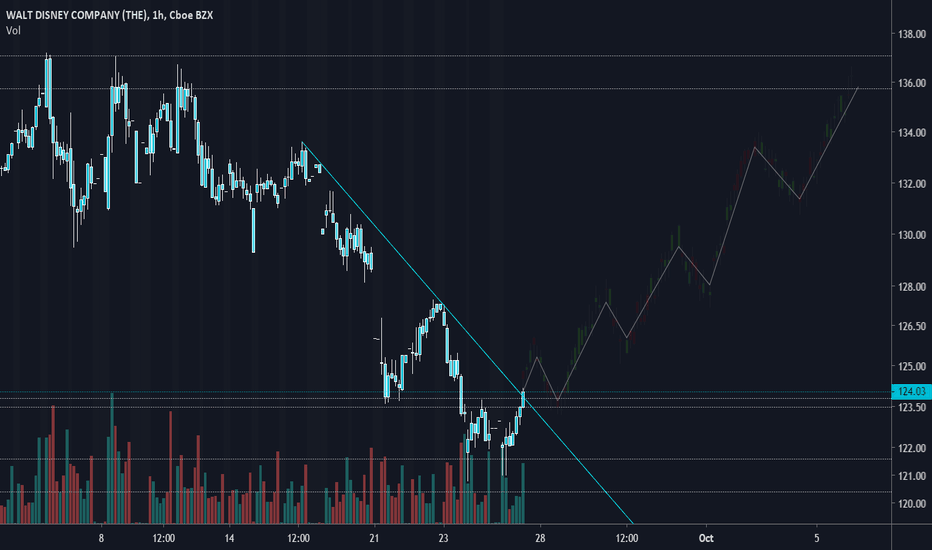

With SPY also currently breaking out of a channel and heading for a flag breakout itself (see last post) its a good sign DIS will do well today.

DIS - SWING ANALYSISDIS - As per the daily chart it's about to break the support zone and expected to fall further.

Key levels ;

Sell at the current price 124.23

Maintain stop loss around 131

Potential downside target 114.80

Follow the levels as mentioned.

Hit the like button & write in the comment section. Thanks

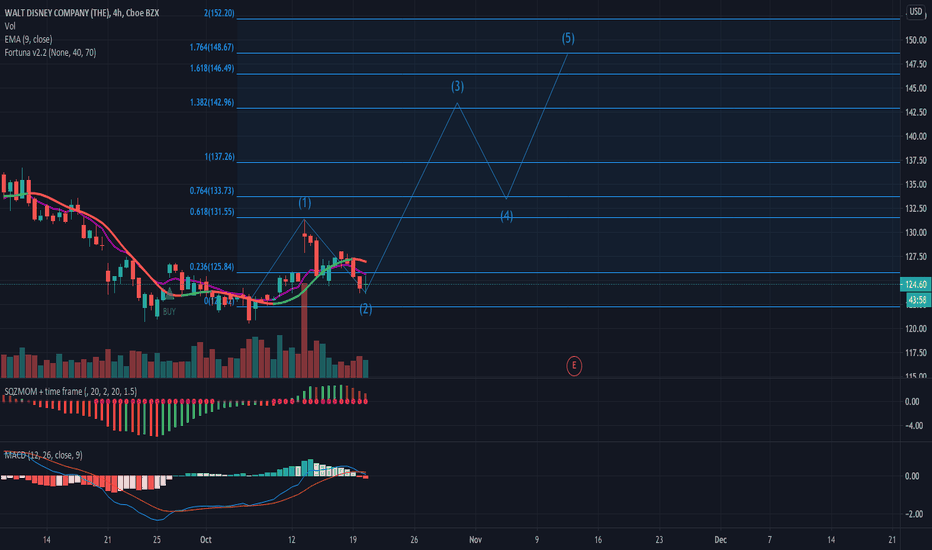

DIS Double BottomDIS is now showing an indication that it will form Double Bottom pattern. Since the candle was going outside the bearish channel, and it tends to follow the bullish trendline, then there is a strong possibility that it will form the Double Bottom pattern. Don't forget to set your stop loss.

If you like my idea, then please click Like, Follow, and Comment.

Cheers.

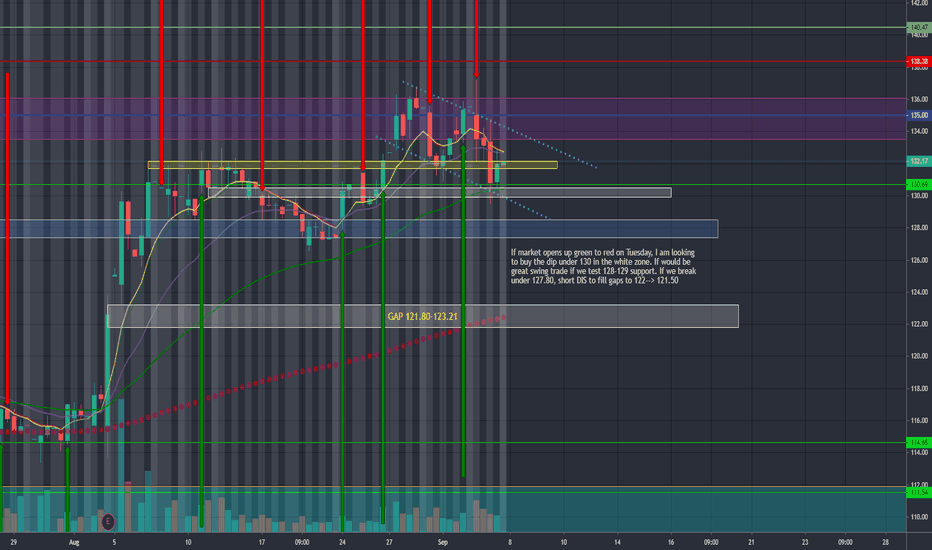

$DIS Bulls 3-Press In To Support$DIS had a bit of a stumble dipping down but, to unsuspecting bears (so far), buyers were waiting for the right time to strike. The massive one-two punch of a 3-Press Low Pattern dipping in to rising support was good enough but if anyone doubted them, the bull bar closed out super strong. Either the buyers rip this higher or this is a final stand and we get a strong break down.

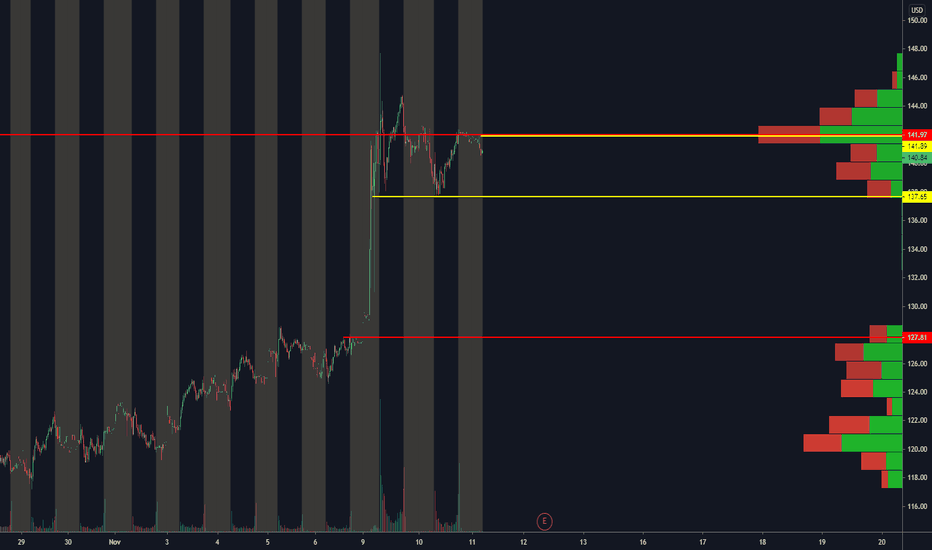

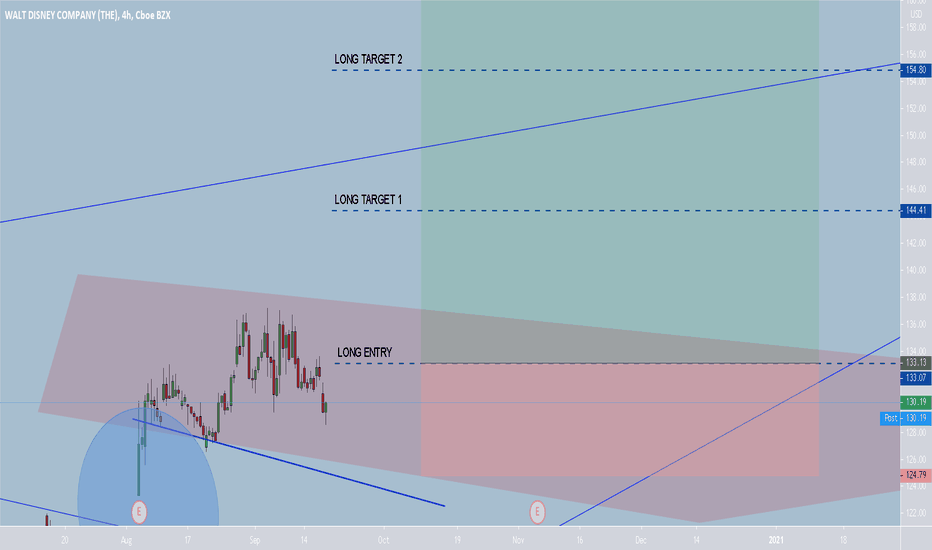

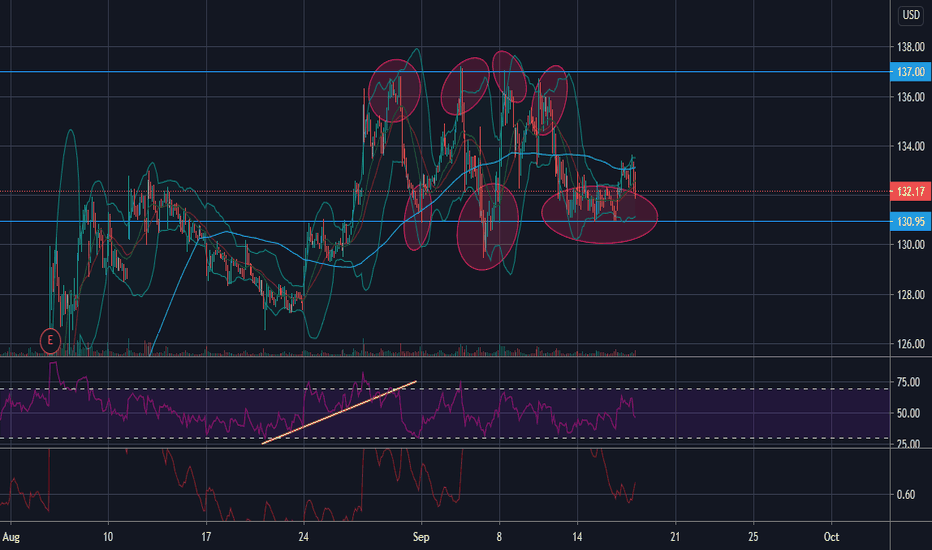

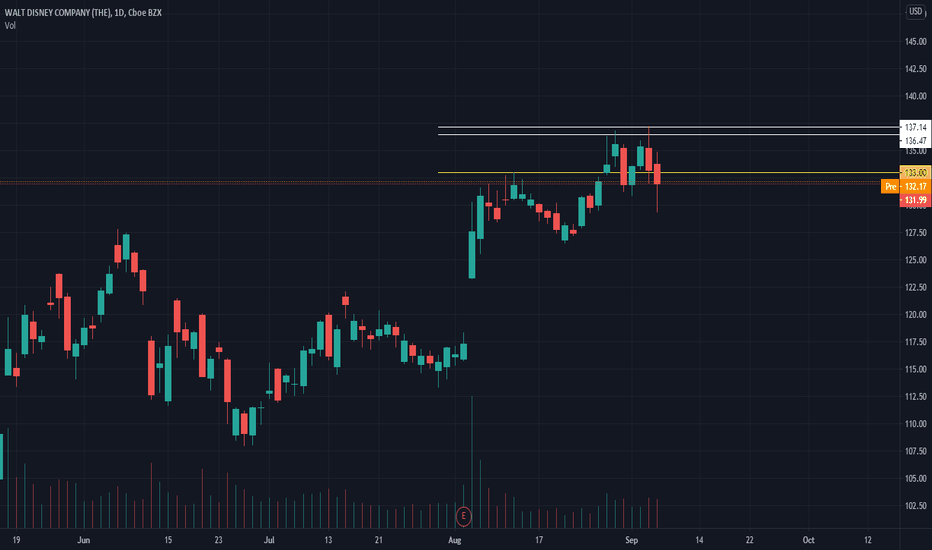

Disney starting to trade in a channel Disney over the last week or two seems to have formed multiple tops and bottoms at about 137 and 131 respectively. At least in the short term I'm expecting that to continue. I dont think I need to state the obvious on when to go long/short, but watch the RSI/volume and should this trend be broken, consider either of these points could flip to be a resistance/support.

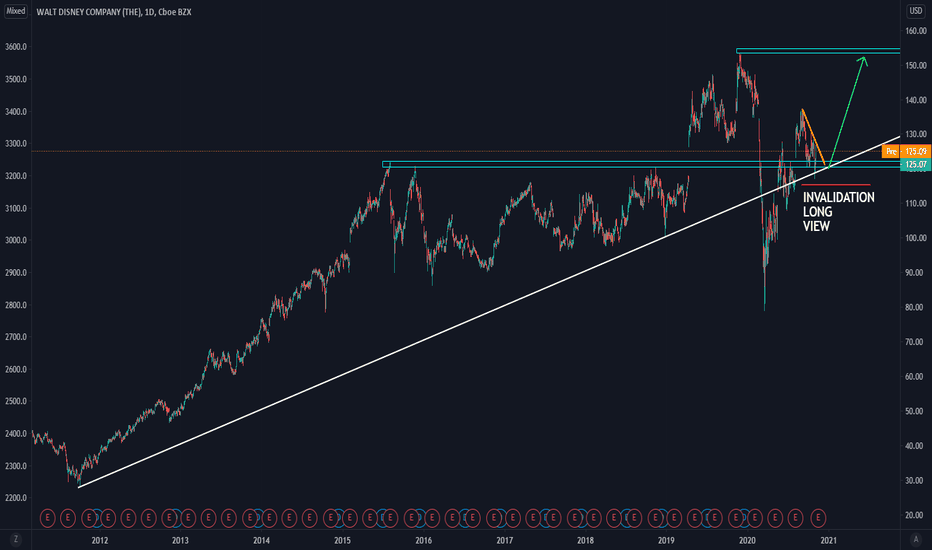

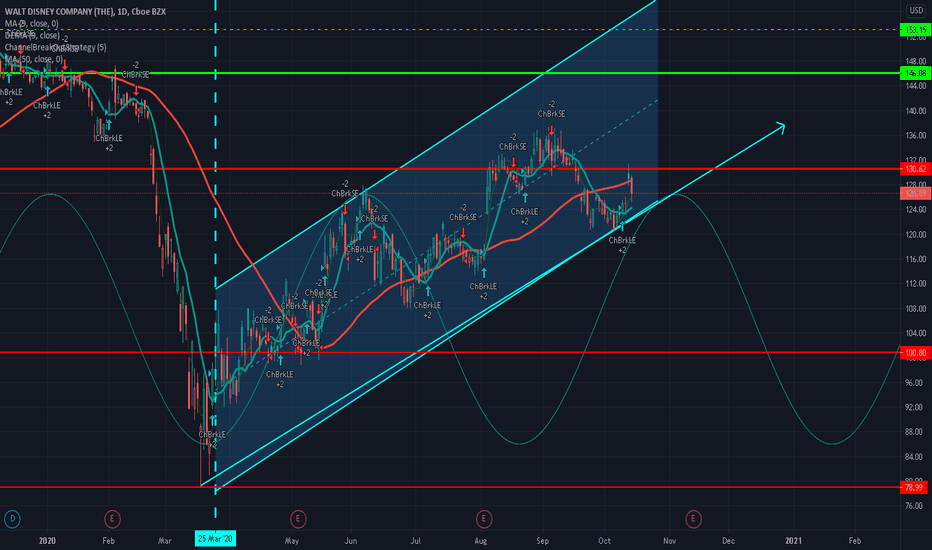

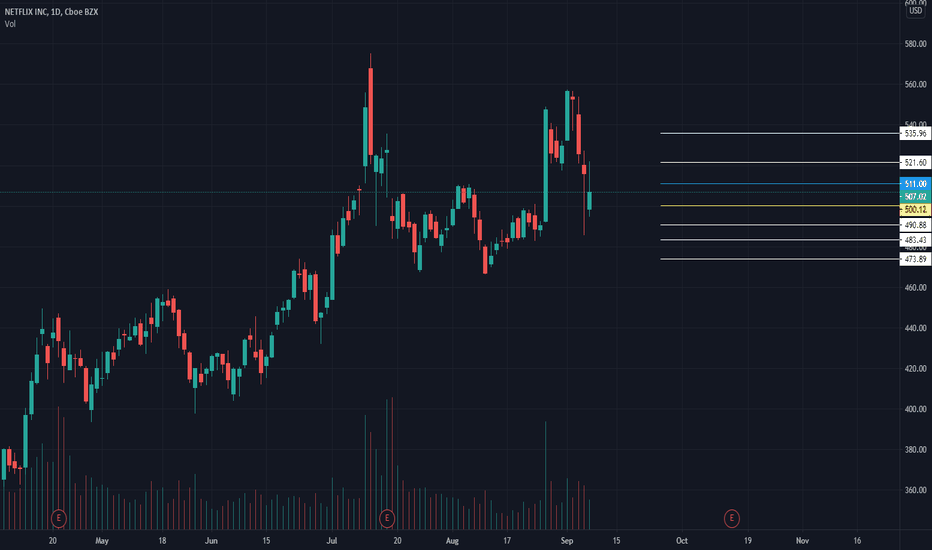

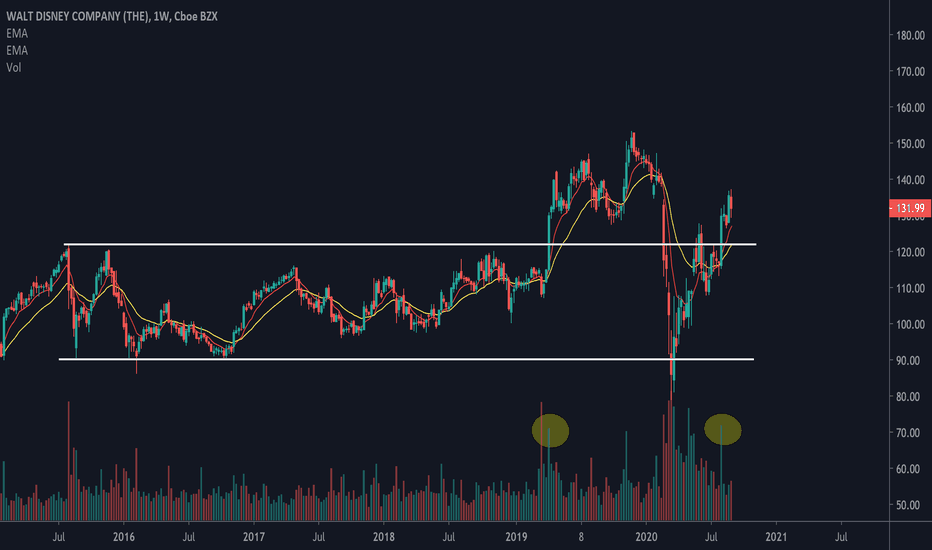

$DIS holding up well (potential value play)This is the weekly chart for $DIS.

In April '19, a huge volume spike propelled the stock out of its multi year trading range. It went on to trade as high as $153 a few months later, before falling back to its range.

Early last month, we see a similarly huge volume spike out of its trading range. Prices held, just like what it did back then; more importantly, the recent sell off in tech did not hit other industries as hard -- this is possibly a sign of sector rotation towards value stocks.

I have a small position in $DIS and am looking at a target of around $150

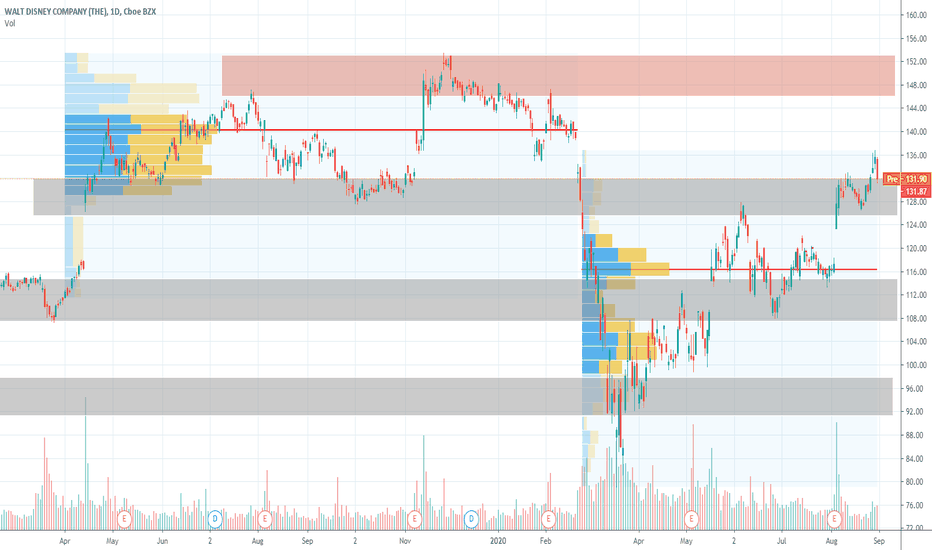

DIS - Walt Disney buy support zonesHello traders,

Description of the analysis:

Walt Disney Company ( DIS ) support zones ideal for timing long positions (gray). Trade what you understand, trade carefully and sparingly according to the business plan.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (over $4.000.000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob