Weekly Trade Outlook | Lessons in Discipline, Risk & PerspectiveGreetings Traders,

In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions.

Whether you're struggling with emotional trading, inconsistency, or overtrading, this video will give you a fresh perspective on how structure, faith, and discipline can shape a sustainable trading approach.

Remember: respect your trading rules, pray over them daily, and ask God for the strength to remain disciplined—so you don’t become your own worst enemy in the market.

Let’s grow together,

The Architect 🏛️📈

Discipline

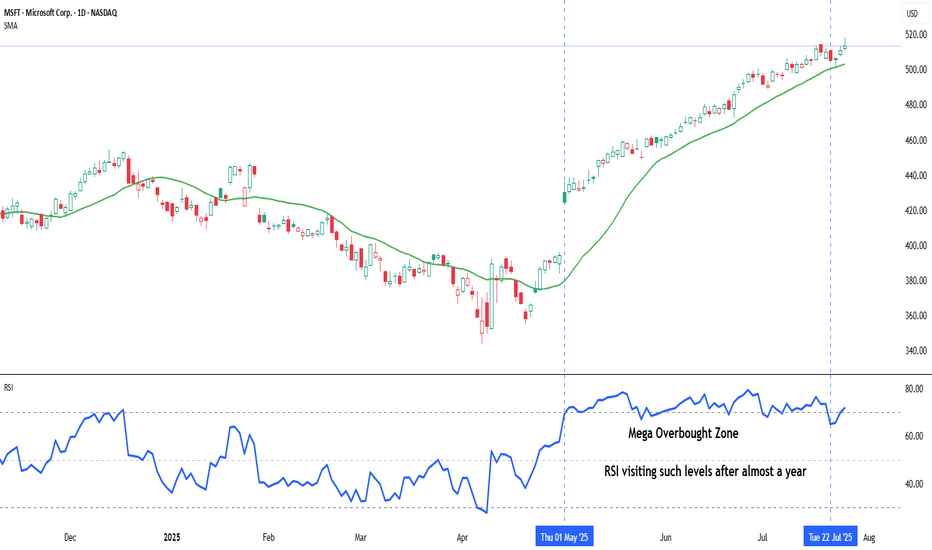

Indicator Decoded: RSI Mega Zones: Signals from the EdgeMost traders are familiar with the textbook RSI levels—70 indicating overbought and 30 indicating oversold. But markets, especially in strong momentum phases, do not always obey these boundaries. That is where the concept of Mega Overbought and Mega Oversold zones becomes vital. These are not fixed thresholds, but adaptive zones often beyond 80 and below 20, where the RSI reflects extreme strength or weakness. Rather than acting as reversal points, these levels often signal trend continuation.

A reading above 80 is typically seen during powerful uptrends or post-breakout rallies. It indicates not just buying, but unhesitating, aggressive demand, especially after key resistance zones have been cleared. Such RSI levels have often not been seen in several months—if not more than a year—making their appearance especially significant. Rather than a signal of exhaustion, this may be the start of a major trend, suggesting that the broader structure of the stock or index has shifted decisively. Traders who misinterpret this as a reversal signal often find themselves fighting momentum. Instead, price tends to grind higher, sometimes pausing briefly before further gains. This is why the chapter suggests using Mega Overbought zones as confirmation of bullish control, not a trigger for counter-trades.

The inverse applies to the Mega Oversold zone—RSI falling below 20. This is usually not a buy-the-dip moment, especially if the broader trend and chart structure are bearish. Such readings typically accompany panic-driven breakdowns, where sellers dominate without any counterforce. These extreme values are often rare and may not have appeared for months or even over a year, marking a moment where the market’s character may be undergoing a structural change. As with Mega Overbought, context is critical. If RSI hits such depths after prolonged distribution or a topping pattern, it does not indicate value—it confirms that the tide has turned, and a strong downtrend may be setting in.

Both Mega zones are best used in conjunction with structure—trendlines, volume shifts, anchored VWAP zones, or price patterns. The RSI alone is not enough. But when it aligns with other technical signals, a Mega Overbought or Oversold status becomes a momentum amplifier, not a contrarian prompt. In fact, your RSI chapter rightly warns that entering against such zones can be fatal unless clear divergences, climax patterns, or volume exhaustion are also present. Think of these extremes not as ceilings or floors, but as accelerators when backed by structure.

A word of caution: These signals are rare and often widely spaced. The real challenge lies in managing risk–reward, as strong momentum and shallow pullbacks can make it difficult to find entries with favourable R:R ratios.

Chart: Microsoft Corp. (MSFT) – Daily Chart with 20-DMA and RSI (as on July 25, 2025)

Microsoft continues its strong upward trajectory, with price action staying well above the rising 20-day simple moving average. The recent surge in RSI into the mega overbought zone marks a significant shift in momentum, as the indicator revisits such elevated levels after nearly a year—an occurrence that often coincides with extended bullish phases.

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

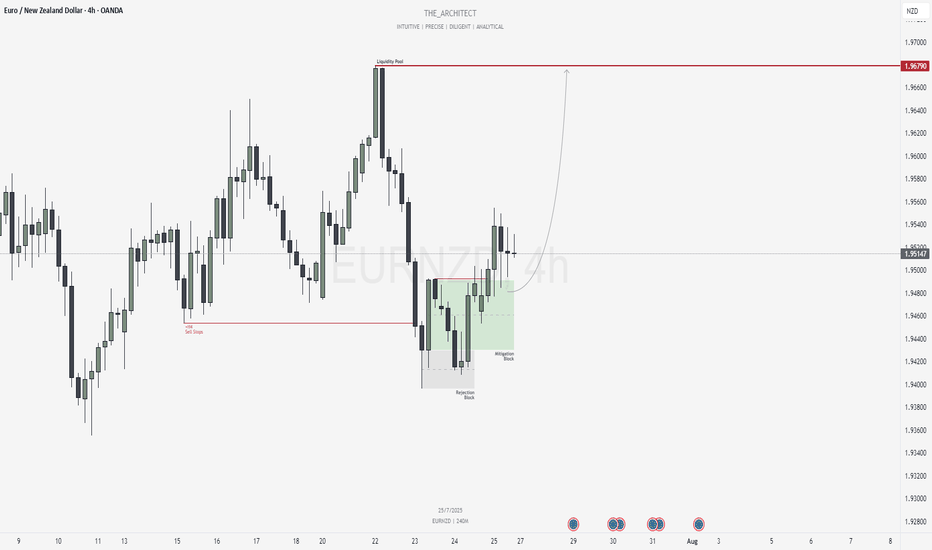

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.

Did You Catch the Sweep & Shift on GBPAUD?Sometimes the market whispers its intentions before making a move — and this was one of those moments. This GBPAUD setup was built on the core principles of Candle Range Theory (CRT):

Sweep of the Previous Day’s Low (PDL)

Break of Structure (BOS) confirming a shift in momentum

Entry retracement into the Fair Value Gap (FVG)

What stood out here was the precision of the sweep and how price reacted cleanly after BOS, tapping into the FVG zone and immediately pushing toward the high-probability target.

No indicators, no noise, just clean market structure and smart money behavior.

The temptation to enter early was real, but the edge came from waiting for price to validate itself. A textbook example of how patience and plan adherence outweigh prediction .

NO TRADE? THAT IS THE TRADEToday, I took no trades and I’ll be honest, it was really tempting to break that discipline.

I stared at the chart longer than I needed to. My cursor hovered around the Buy and Sell buttons. My brain tried to convince me that “maybe” this candle meant something. Even though there was no valid sweep, no BOS, and no clean entry into an FVG , the desire to just “be in a trade” was strong.

But I reminded myself:

📌 No Setup = No Trade

📌 Your edge is your lifeline

📌 Discipline is what pays you, not activity

What I felt today is something every trader battles, setup hoping . It’s that mental trap where silence feels wrong, and boredom feels dangerous. But the truth is, boredom is part of being a consistently profitable trader. There are days where your best trade is the one you don’t take.

And I’m proud to say I did nothing.

No revenge trade.

No gambling.

No deviation from plan.

Instead, I observed. I journaled my emotions. I stayed in control. That’s the work behind the scenes: the mental reps that build longevity in this business .

So if you had a quiet session today too, and you resisted the urge to jump in without reason, celebrate that. You're training your mind to trust your system, not your feelings.

Sometimes, the most powerful trade you’ll ever take… is the one you never place.

Stop Hunting for Perfection - Start Managing Risk.Stop Hunting for Perfection — Start Managing Risk.

Hard truth:

Your obsession with perfect setups costs you money.

Markets don't reward perfectionists; they reward effective risk managers.

Here's why your perfect entry is killing your results:

You ignore good trades waiting for ideal setups — they rarely come.

You double-down on losing trades, convinced your entry was flawless.

You're blindsided by normal market moves because you didn’t plan for imperfection.

🎯 Solution?

Shift your focus from entry perfection to risk management. Define your maximum acceptable loss, stick to it, and scale into trades strategically.

TrendGo wasn't built to promise perfect entries. It was built to clarify probabilities and structure risk.

🔍 Stop chasing unicorns. Focus on managing the horses you actually ride.

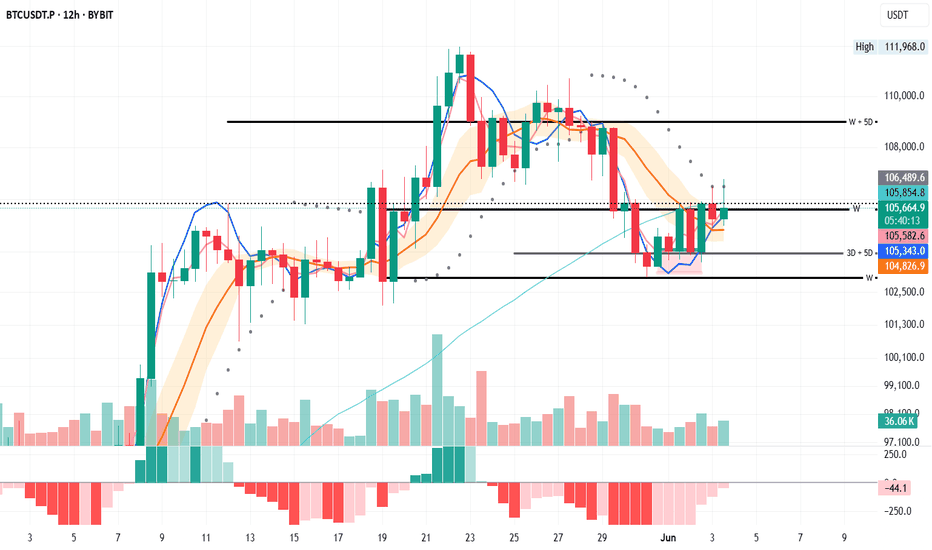

BTC 12H – Slightly Different Picture

The 12H chart tells a slightly different story.

From the PSAR point of view, price has tapped it twice, but that’s not enough for confirmation.

From the system perspective, price is trading above the BB center, with both MLR and SMA also above it—this could justify small scaling.

From the S/R view, price is currently testing weekly resistance and the dotted line marking the daily close. That’s a strong reason to apply proper risk management.

Let’s see how this unfolds.

Scaling in may be a valid option for those considering long exposure—if risk is managed properly.

Feel free to drop your thoughts in the comments—good or bad, all engagement is appreciated.

Take profits. Manage risk. Stay sharp.

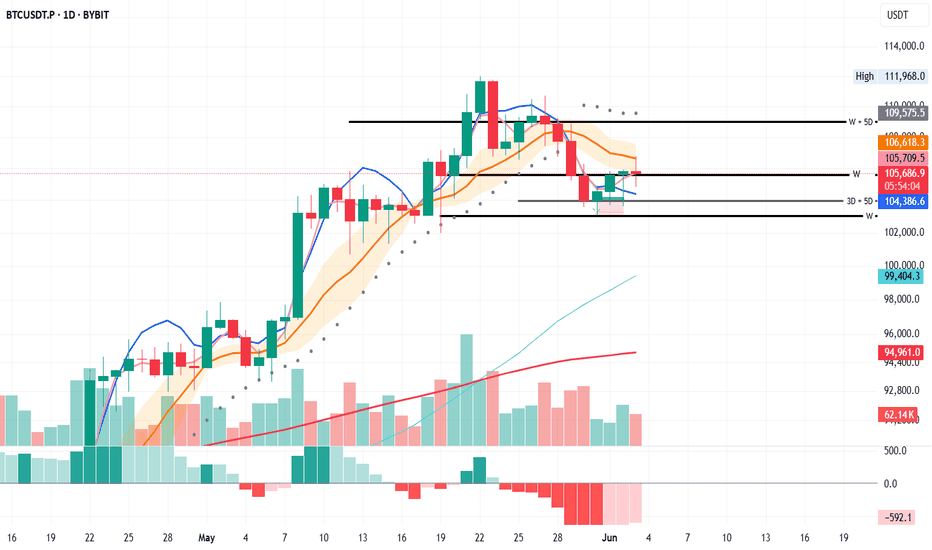

BTC Daily – Mixed Signals, Patience Required

From the PSAR perspective, BTC remains in a bearish phase. We need to wait for a PSAR flip to green before considering new long entries.

From the second system view, we’re also still in bearish territory. The setup will shift once MLR crosses above the SMA and BB centre. Currently, price is holding the SMA as support and has paused at the BB centre.

Looking at S/R levels, we’ve seen a solid bounce from the 3D + 5D support and are now holding at the weekly support zone.

Let’s see how this unfolds.

Scaling in may be a valid option for those considering long exposure—if risk is managed properly.

Feel free to drop your thoughts in the comments—good or bad, all engagement is appreciated.

Take profits. Manage risk. Stay sharp.

Impatience Tax in Trading: The Costs of Clicking Too SoonHave you ever thought that maybe some of your losses don’t come from bad trades? Rather, they come from good trades, timed badly?

You see the setup, the signal’s almost there, the MACD is leaning in, the candle is flirting with support — and boom, you click. Early. Too early.

Price dips a bit more and then shoots upward like a rocket. Your stop gets triggered — you just paid the impatience tax.

Welcome to the place where you get taxed for being impatient — a very real, very expensive fee traders pay when their fingers move faster than their reasoning.

🤫 The Impatience Tax — A Silent Killer Dressed as Urgency

The impatience tax doesn’t appear on your statement. You won’t see it listed in your commissions, or under slippage, or labeled in red ink like a realized loss. But rest assured, it’s there — nibbling away at your P&L every time you front-run your own strategy.

And the worst part? It feels productive. You’re taking initiative, showing conviction, being bold. Except what you're really doing is lighting good setups on fire because you couldn’t wait for one more candle to close.

🧬 The Anatomy of an Early Click

Here’s how it usually goes:

You spot a setup.

You get excited.

You skip the checklist.

You enter on the 3rd candle instead of the 5th.

The market fakes out.

You get stopped out.

The market then does exactly what you expected — without you.

Every trader has lived this story. And it hurts more than a loss from a bad trade. Because this wasn’t a bad idea. It was a good idea butchered by bad timing.

🤝 Impatience Loves Company (And Volatility)

Impatience tends to thrive in fast markets. When the price is moving, you feel like you need to act. You notice some breaking news that moves markets, charts start to jiggle and tickers flash — suddenly your FOMO glands kick in.

You’re not waiting for confirmation. You’re reacting — to price, to emotion, to fear of missing out.

It’s not just beginners either. Even seasoned traders occasionally get sucked in. Why? Because the brain is wired to avoid missing opportunities more than it’s wired to avoid losses. We want in. Now. Before it's “too late.”

But here’s a pro secret: the markets tend to always give second chances. You just have to be around to take them.

⏰ Why the Best Traders Wait

Let’s talk about patience. Not the zen-monk, meditate-in-a-cave-for-years kind. The market kind.

The kind that says: “Nope, not yet.”

The kind that closes the platform until the London session starts.

The kind that lets a trade go because it didn’t meet all the criteria — even if it was close.

Top traders aren’t paid for activity. They’re paid for precision. The entry is 90% of the battle. If you win there, the rest is just management.

🧐 How to Identify an Impatience Habit

Want to know if you’re paying the impatience tax regularly? Try this:

Look at your last 10 triggered stop loss orders: How many were within a few ticks of reversal?

Count your trades per day: Are you averaging more than your strategy demands?

Review your entry notes: Did you say things like “close enough” or “looks good”?

If the answer is yes, you’re a tax-paying member of the Impatience Society.

👷♂️ Build a Buffer: Taming the Trigger Finger

So how do you stop paying the Impatience Tax?

Start with structure:

Use time-based confirmations. Wait for the candle to close. A candle halfway formed is a lie detector test mid-question.

Have a rule-based checklist. If a trade doesn’t meet every item, you don’t take it. No exceptions.

Use alerts , not entries. Let the price come to you. Your job is to hunt, not chase.

Trade fewer setups, better. Less is more when each trade has meaning and clarity.

And when in doubt? Wait. The worst that happens is you miss one trade. The best that happens is you finally stop losing money edge by edge.

💵 Impatience Is Expensive. Patience Is Profitable.

The market is designed to reward discipline, not urgency. Speed might help you scalp news reactions, but even that requires planned execution. Unchecked impatience is just impulse with a brokerage account.

It's important to always remember that you’re not trying to win this trade. You’re trying to win this game for the long run.

And winning the game means surviving long enough to let your edge play out — with patience, not panic.

💎 Final Thoughts: Don’t Confuse Action with Progress

The financial markets are a cruel place for dopamine seekers. They offer constant motion, flashing lights, and infinite temptation to click before thinking.

But progress isn’t about how many trades you take — it’s about how many good ones you wait for.

So next time your mouse finger twitches, ask yourself: Is this the plan? Or is this impatience disguised as opportunity seeking instant gratification?

Because every early click is a donation to someone else’s P&L.

👉 Your turn : What’s your best (or worst) story of jumping the gun? How have you built patience into your process — or are you still wrestling with the trigger? Let us know in the comments!

Discipline in Trading: The Indicator That Works 100% of the TimeEvery trader has that one folder — “Winning Indicators,” “Secret Scripts,” or the iconic “Final Strategy v12_REAL_THIS_ONE_WORKS.” It's where we hoard indicators like Pokémon, convinced the next RSI+MACD+SMA combo tweak will finally reveal the holy grail of trading.

Spoiler: it won’t. Because the real indicator that works — actually works — isn’t on your chart. It’s not in a TradingView script. It’s not even on your screen.

But it’s there — etched into your trade history, tattooed into your losses, and reflected in your ability (or inability) to stop yourself from clicking “buy” because Elon Musk tweeted a goat emoji.

It’s called discipline . And it’s the only thing in trading that has a 100% hit rate… if you let it.

Let’s talk about why discipline isn’t just a virtue — it’s the foundation of every successful trader you admire. And why, ironically, it’s forged in the moments you want to throw your monitor out the window.

👋 Everyone’s a Genius — Until the Market Slaps You

When things are going well, discipline feels unnecessary. You enter a trade on a hunch, it flies. You skip the stop loss, and price reverses right where you “felt” it would. You’re up three trades in a row, so clearly you’ve transcended markets and deserve your own hedge fund. Right?

Until you don’t. And the one time you triple down on a loser “because it always bounces”… it doesn’t. And suddenly you're not a genius — you’re Googling how to recover a blown account and wondering if that crypto bro who offered signals still has his DMs open.

The reality is that everyone trades well in good times — bulls make money in rising markets and bears make money in falling markets. But real traders are made in the bad times. That’s where discipline is forged.

🧐 No Pain, No Gain

Here’s the deal: discipline is not something you're born with. It’s built, brick by painful brick, on the smoldering ruins of your worst trades.

The overleveraged EUR/USD short you held through an ECB rate hike? Discipline.

The meme stock you bought at the top because your barista mentioned it? Discipline.

The four back-to-back trades you entered on revenge mode after getting stopped out? Discipline — with a side of therapy.

These moments suck. But they’re also where the learning happens. You don’t develop discipline from your wins. You develop it from losses that leave a mark. The kind of mark you think about while brushing your teeth. The kind that whispers: “maybe follow the plan next time.”

🤝 Success Leaves Clues

You’ve probably heard the phrase “plan your trade and trade your plan” so many times it’s lost all meaning. But it’s the foundation of discipline. Not because rules are fun, but because rules are the only thing that can protect you from… well, yourself.

Let’s be honest — if left to your own devices, you run the risk of:

Entering too early because “it looks like it’s going to move.”

Exiting too late because “it might come back.”

Increasing the leverage because “I’m due for a win.”

Successful traders are those who follow a disciplined, rule-based approach to trading. Discipline says no. It says “this is the plan” and makes you stick to it — even when your ego is telling you to wing it. Discipline doesn’t care about your feelings. It cares about consistency. And that’s what makes it powerful.

🎯 Hedge Fund Bros Who Didn’t Win by Binge-Clicking

Let’s talk about those who actually did launch a fund — and didn’t blow it up in three months. Stanley Druckenmiller, former lead portfolio manager for George Soros’s Quantum Fund who later went on to launch his own Duquesne family office, famously said:

“The key to making money in markets is to have an opinion and to bet it big. But only when the odds are heavily in your favor.”

Notice what he didn’t say: “Click as many buttons as possible and hope it works out.”

Druckenmiller didn’t trade because he was bored. He waited. He watched. And when his setup came, he struck with discipline. Not with fear. Not with greed. With process.

If one of the greatest macro traders of all time had the patience to wait for his edge, maybe you don’t need to scalp every green candle on the 1-minute chart.

Ray Dalio — the one who built Bridgewater into a hedge fund juggernaut — doesn’t sugarcoat it: trading is hard. And mistakes are inevitable. Discipline, Dalio says, is what turns mistakes into evolution. His famous mantra?

“Pain + Reflection = Progress.”

He built a company culture (and a personal philosophy) around radical transparency — writing down every mistake, analyzing every trade, and building systems that override ego.

Most traders experience pain. Very few pause to reflect. Fewer still build processes to avoid making the same mistake twice. So next time you get stopped out for the third time in a row, don’t curse the chart. Open your journal. Write it down. Check what you missed. That’s what turns amateurs into professionals.

👀 Discipline in Trading: How It Actually Looks

Discipline isn’t glamorous. You won’t post it on Instagram (maybe it's good for LinkedIn, though). But here’s what it looks like in the wild:

Passing on a trade that doesn’t check all the boxes — even though you’re “pretty sure it’ll work.”

Taking a small win and moving on, even when your gut says to hold and “let it ride.”

Staying flat on FOMC day because you know news candles have a personal vendetta against your stop-losses.

Journaling a bad trade and owning the mistake. No excuses. Just honesty.

💪 How to Build Discipline

Building discipline isn’t about becoming a robot. It’s about creating a process that works even when your emotions don’t.

Here’s how to start:

Journal everything : Not just your trades, but your thoughts before and after. Discipline grows in awareness.

Have a checklist: Make it stupidly simple. If a trade doesn’t check every box, don’t take it.

Pre-set your risk: Before the trade. Not after. You’re not negotiating with yourself mid-trade.

Set trade limits: Three trades per day. One setup per session. Whatever keeps you from spiraling.

Take breaks: If you’re chasing losses, walk away. The markets will be there tomorrow. Will you?

📌 Final Thought: Why Discipline Works

You can have the best tools, the slickest chart setup, and the strongest trade ideas. But if you can’t follow your own rules, you won’t go far.

Discipline isn’t flashy. It doesn’t promise 1,000% returns or viral content. It just works. Quietly. Relentlessly. Predictably.

And when the market turns — because it always does — discipline is what will keep you standing.

Because it’s not the indicator that matters. It’s the trader using it.

So, be honest—where has discipline made (or broken) your trading? And what’s your best tip for sticking to the plan when your brain wants to do anything but?

Different Shades of DisciplineIn my decade of trading experience I've come to realize through huge number of trials and errors that discipline in trading is a rather unique and not always universal beast.

While there are definitely broad categories of discipline trading like taking high-quality setups, correctly managing risk, taking profits, and so on; There are also many unique underlying reasons and mind-tangled cognitive dissonances that can become the cause of these lapses.

What I understood in my experience is that discipline seems to be transferrable from 1 area to another. Addicted to smoking? Perhaps, quitting can be beneficial to one's trading. However, not necessarily as some traders smoke (and can't quit that habit) for a different underlying reason and thus quitting for them might NOT be as beneficial for the former one. The devil seems to be in the details. Why one smokes? Is it a coping mechanism for stress, or is it a little ritual that one employs to consciously recalibrate themselves?

The key seems to be in action and number of trials and experiments. Attempting to try the routine of other people might not yield the best results for the expended effort. One person may run for many miles and enjoy that time, for another it will be excruciating agony to do that. The discipline required in that example would obviously be vastly different, and thus the effect that action produces also - different.

At the end of the day - the most important thing in trading is consistency, but coupled with PERSONAL unique discipline is something that gives us edge in the markets.

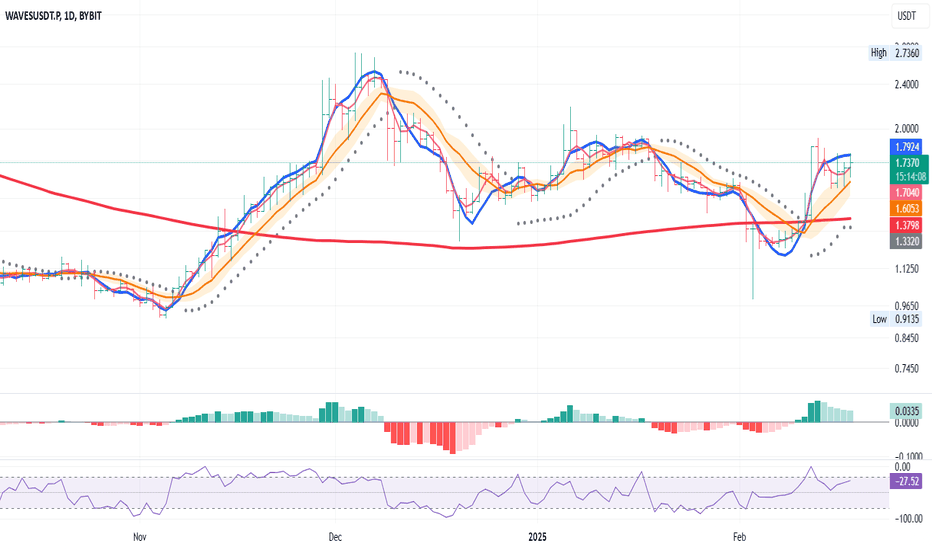

Long Entry on WAVESUSDT with PSAR Stop LossBased on the daily chart for WAVESUSDT on Bybit, we've identified a bullish setup for a long entry:

Indicators Used:

MLR (Moving Regression Line) in blue

SMA (Simple Moving Average) in pink

BB Center Line (Bollinger Bands Center Line) in orange

PSAR (Parabolic SAR) in black dots

200-period SMA in red

Entry Conditions Met:

The MLR is above the SMA, indicating a short-term bullish trend.

The MLR is above the BB Center Line, further confirming bullish momentum.

The PSAR dots are under the price, signaling a bullish trend.

The price is above the 200-period SMA, supporting a long-term bullish trend.

Entry Strategy: Enter a long position on WAVESUSDT given these bullish signals.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots. This ensures that if the price reverses and hits the PSAR level, your position will be closed to minimize losses.

Risk Management: Adjust your position size according to your risk tolerance.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

Thank you !

Long Entry Signal for XEM/USDT

Based on the daily chart for XEMUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Price vs. SMA 200: The price is above the 200-period SMA (red), supporting a long-term bullish trend.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price, price above SMA 200), you might consider entering a long position.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

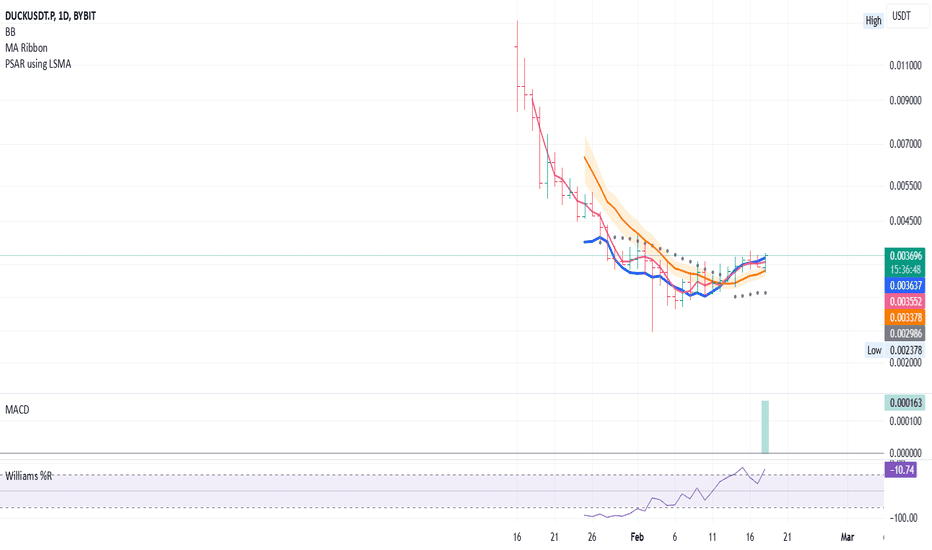

Long Entry Signal for DUCK/USDT - Trading System Confirmation

Given the daily chart for DUCKUSDT and the specified indicators:

MLR vs. SMA: MLR (blue) is above SMA (pink), indicating a bullish trend.

MLR vs. BB Center: MLR is above the BB Center Line (orange), suggesting bullish conditions.

PSAR: PSAR dots (black) are under the price, confirming a bullish trend.

Exception: Since the 200-period SMA is not available, we're making an exception by proceeding without this long-term confirmation.

Current Strategy: With the entry conditions met (MLR above SMA, MLR above BB Center Line, PSAR under price), we are ready to enter a long position despite the absence of the 200 SMA for long-term trend confirmation. Proceed with caution and closely monitor for any changes or additional confirmations.

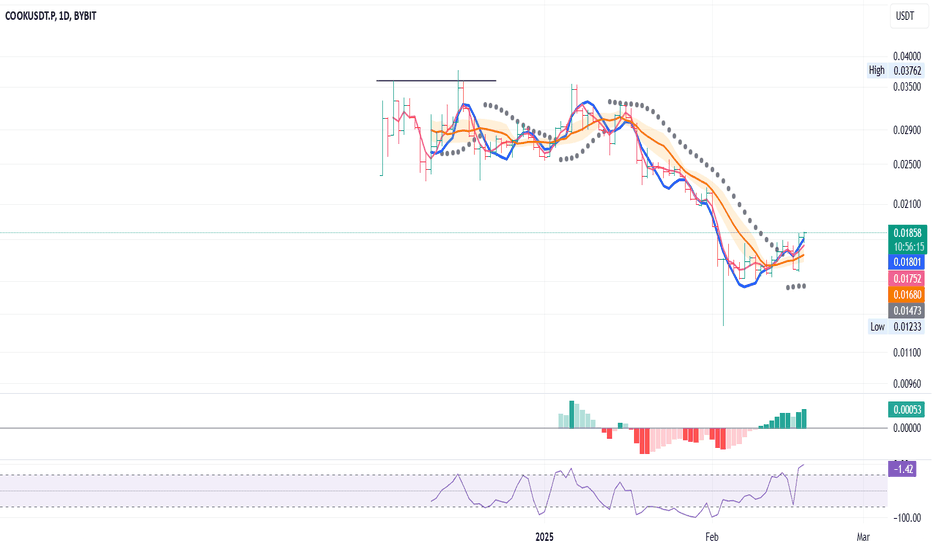

Long Entry Signal for COOK/USDTBased on the daily chart for COOKUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Exception: There is no 200-period SMA available to guide us on the long-term trend, so proceed with caution.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price), you might consider entering a long position.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

Thank you1

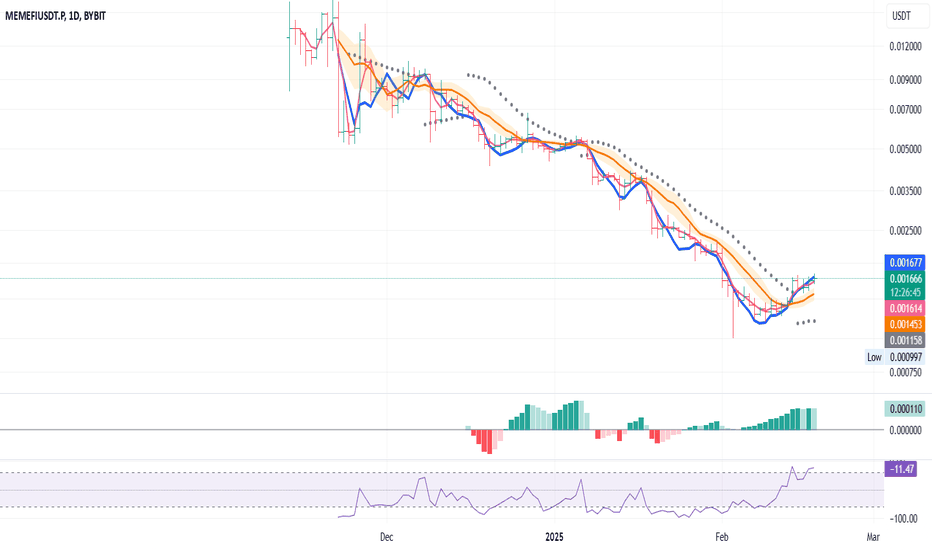

Long Entry Signal for MEMEFI/USDT

Based on the daily chart for MEMEFIUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Exception: There is no 200-period SMA available to guide us on the long-term trend, so proceed with caution.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price), you might consider entering a long position.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

Thank you1

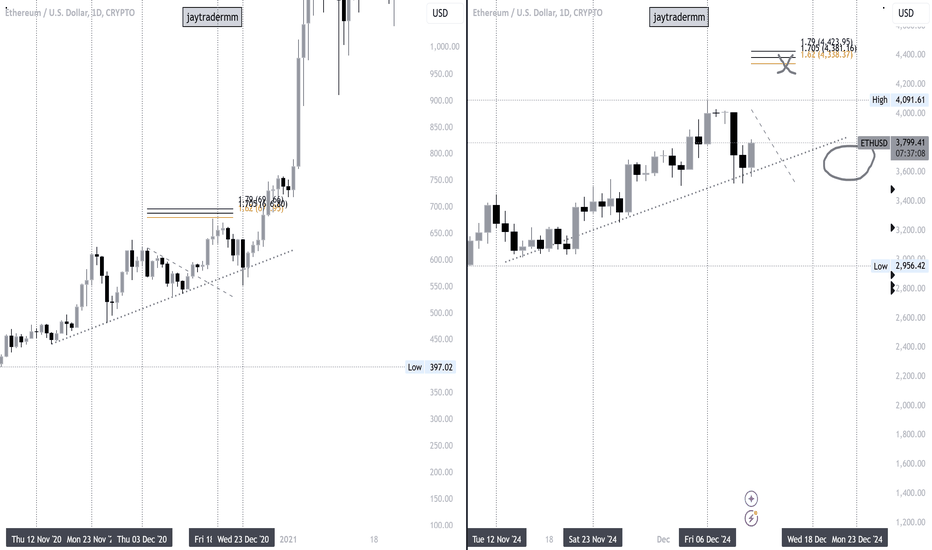

ETHEREUM - BULLISH AFEthereum: A Technical Masterpiece with a Psychological Challenge

Ethereum's price action showcases remarkable technical precision. However, the real test lies in managing emotions: impatience and impulsive decisions often lead traders to quick losses.

📈 Projection:

Expect a steady climb toward $4,300 until around December 17–18. At that point, a correction of -15% to -30% is likely, though the exact scale will depend on market conditions.

📅 Key Date:

By December 23, ensure your positions are set. As the market evolves, navigating increased difficulty will require discipline—this phase is not for the unprepared.

📊 Comparison:

The current price movement mirrors Ethereum’s 2020 trend, proving that while history doesn’t repeat, it often rhymes.

⚠️ Plan Ahead:

Approach the market with a clear strategy. Maintain well-defined entry and exit plans, and avoid emotional decision-making. Recklessness has no place here.

🚀 Looking Ahead:

January promises explosive growth, likely peaking around mid-month. This period demands focus and resilience—those who stay disciplined stand to benefit the most.

💡 Takeaway:

Ethereum’s journey is more than just price action; it’s a test of patience and strategy. Stick to your plan, trust the process, and let the market work for you.

💼 Upcoming Trade:

I’m about to open a new trade, which I’ll share with you here—just like the one I posted at $3,100. Now’s the time to make money and stay laser-focused. Don’t hesitate to follow me and keep an eye out for updates!

Stay sharp, stay grounded, and may the odds be in your favor.

God bless you.

—Jay

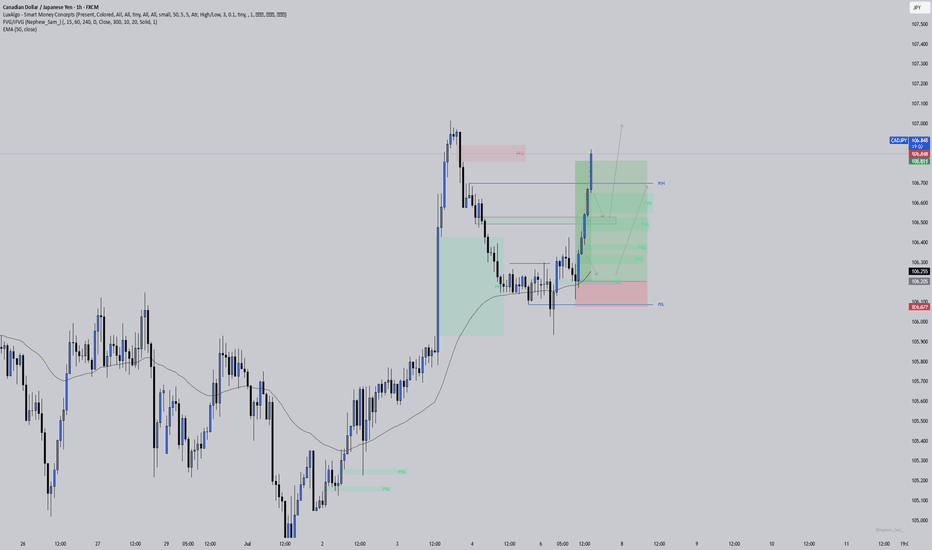

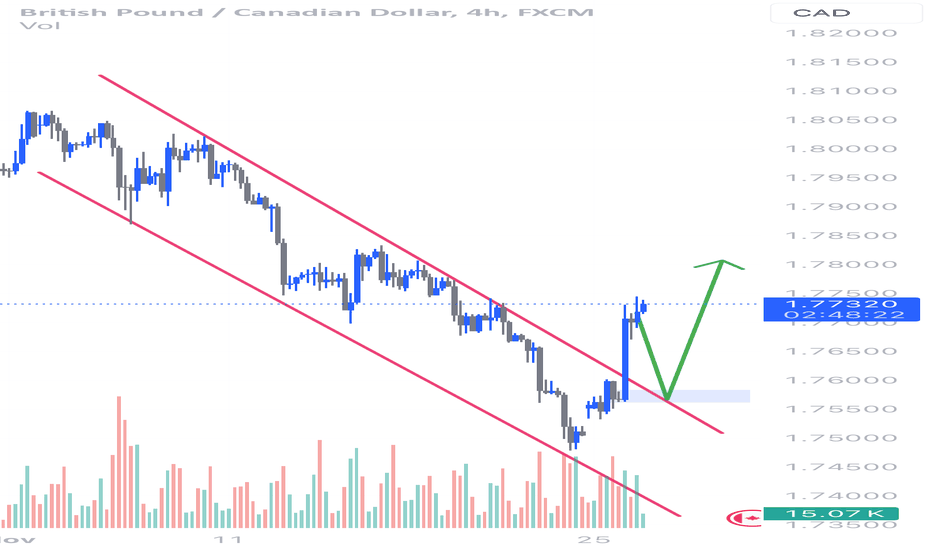

Mastering Patience in Trading: A Key to Success🔑 Trading is not just about setups and signals; it's about discipline and patience.

🕒 Sometimes, the best trade is no trade at all. Waiting for the market to come to your level, like in the chart shared earlier today, is what separates amateurs from professionals.

🎯 Remember:

Rushing leads to mistakes.

Patience ensures precision.

Your edge lies in your ability to wait.

How do you cultivate patience in your trading journey? Share your thoughts below!

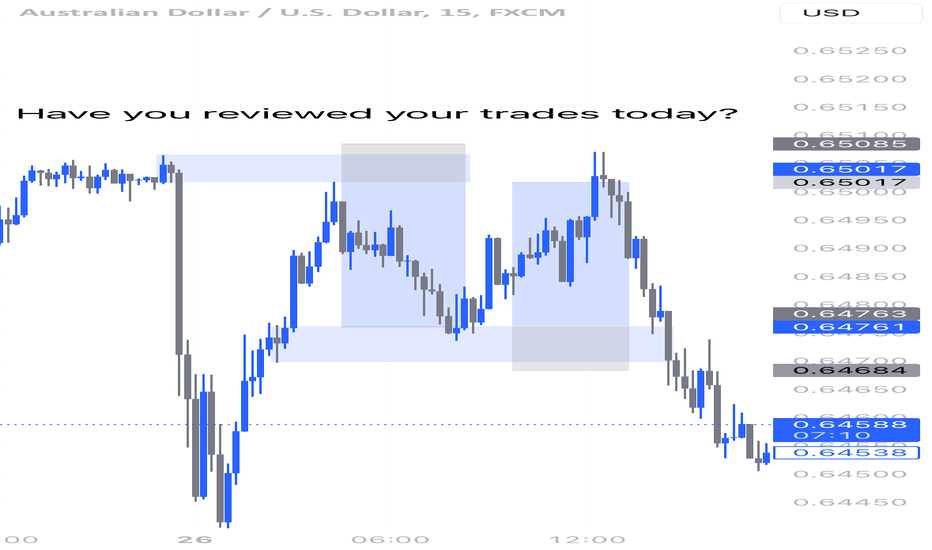

End-of-Day Trading Reflection📊 "Have you reviewed your trades today?"

🔑 Key points to consider before closing your trading day:

Did I follow my trading plan without deviations?

Was my risk management on point?

What could I have done better, and what did I learn from today?

Trading is not just about placing orders; it's about constantly refining your process and mindset.

Remember, every day in the market is a lesson – embrace it!

Discipline Over MotivationSuccess in trading doesn't come from motivation—it comes from discipline.

Motivation will get you started, but

discipline will keep you consistent, even on the tough days."

In trading, emotions often try to take control. Fear of missing out, revenge trading, or overconfidence can lead to poor decisions.

Discipline means following your plan no matter how you feel.

Consistency is the bridge between your trading plan and long-term results. Without it, even the best strategies can fail.

How to Stay Disciplined?

Define Your Rules: Have a clear entry, exit, and risk management plan before you trade.

Track Your Performance: Use a journal to review trades—both wins and losses.

Take Breaks: A tired mind leads to impulsive decisions.

Detach from Outcomes: Focus on the process, not on winning every trade.

Remember: The best traders aren't the most motivated—they're the most disciplined.

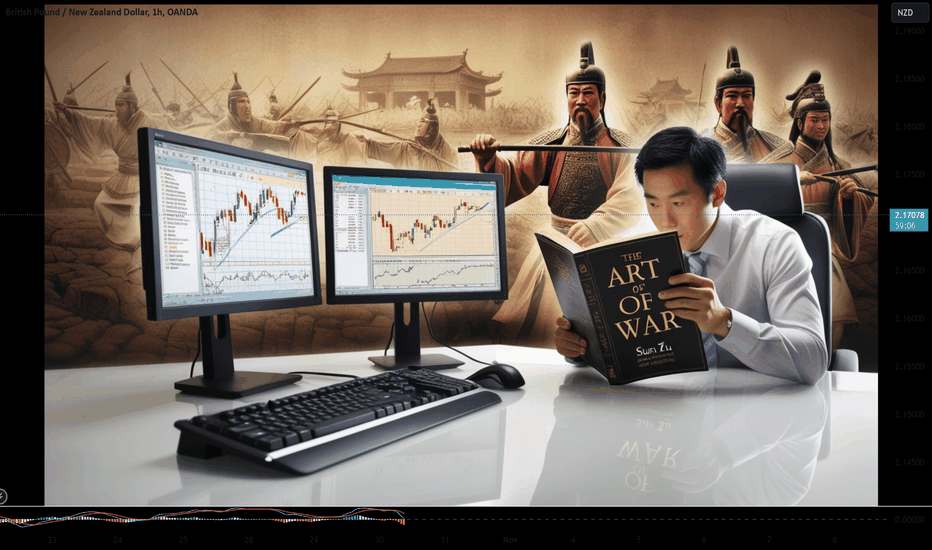

The Art of War for Traders: Sun Tzu's Timeless Lessons on MarketI recently revisited "The Art of War by Sun Tzu", and I was struck by how directly its timeless wisdom applies to the world of trading.

Written over 2,500 years ago, this classic on strategy offers lessons every trader—from beginners to seasoned pros—can apply in the markets to improve discipline, timing, and decision-making.

The Art of War is often seen as a manual for military generals, but its insights go far beyond the battlefield. Sun Tzu’s advice on strategy, patience, and self-discipline is surprisingly relevant for traders.

In many ways, trading is a battle—one fought not only with the market but also with our own emotions and impulses. Here are some key takeaways from The Art of War and how they can help elevate your trading game.

1. Know Your Enemy and Know Yourself

Sun Tzu’s advice, “If you know the enemy and know yourself, you need not fear the result of a hundred battles,” is invaluable in trading. For traders, the “enemy” is the market itself, filled with unpredictable movements, different participants, and countless psychological traps.

But perhaps the most important part is knowing yourself—your strengths, weaknesses, risk tolerance, and emotional triggers.

Trading Insight: Self-awareness is crucial for consistent success. By understanding your own psychology, you can prevent impulsive decisions, recognize patterns in your behavior, and develop a trading plan that works in harmony with your strengths. The better you know yourself, the better you can handle whatever the market throws at you.

2. Strategize Rigorously, But Act Flexibly

Sun Tzu stresses the need for detailed planning but also emphasizes the importance of adapting to changing conditions. In trading, a plan is essential—it gives you structure and discipline. But markets are fluid and can shift without warning, meaning flexibility is equally important.

Trading Insight: Create a well-defined trading plan that includes entry and exit strategies, position sizing, and risk management. At the same time, be ready to adapt if the market changes direction.

Many successful traders know that the best plan is one that’s firm yet flexible, allowing for adjustments as new data comes in.

3. Timing is Key

Patience and timing are central to Sun Tzu’s teachings. He emphasizes waiting for the perfect moment to strike. In trading, this principle cannot be overstated. Good timing separates profitable trades from losses; a premature entry or exit can wipe out gains or magnify losses.

Trading Insight: Success in trading often comes from waiting for high-probability setups, rather than forcing trades when conditions aren’t ideal.

The best opportunities require patience. Rather than feeling pressured to trade constantly, seasoned traders know that waiting for the right conditions is a form of discipline that pays off over time.

4. Position Yourself Wisely

Positioning is at the core of The Art of War. Sun Tzu advises placing troops in positions of strength, not vulnerability, which translates directly to trading. Positioning wisely means knowing where to enter and exit, as well as how much risk to take on any trade.

Trading Insight: Position sizing and strategic entry/exit points are essential for managing risk. Set stop-losses to guard against heavy losses and choose setups where you have a statistical edge.

Success comes from positioning yourself to gain while limiting potential losses—whether you’re a day trader or a long-term investor.

5. Discipline and Self-Control

Sun Tzu repeatedly emphasizes the importance of discipline and self-restraint. A general who cannot control himself will struggle to control his troops, and the same goes for traders. Without discipline, a trading plan is just words on paper.

Trading Insight: In trading, self-discipline means sticking to your plan, managing your risk, and resisting impulsive decisions driven by emotions. This is a skill that separates successful traders from those who struggle.

Discipline keeps you from chasing trades, overtrading, or taking unnecessary risks. It’s the backbone of consistency.

6. Exploit Market Weaknesses and Protect Your Own

Sun Tzu teaches the value of observing and exploiting the weaknesses in the enemy while concealing your own. In trading, this might mean identifying overbought or oversold conditions, weak trends, or moments of market irrationality.

Trading Insight: Recognize when the market is at extremes and leverage these moments for high-probability setups. At the same time, protect your portfolio by diversifying and using stop-losses, ensuring that if a trade doesn’t work out, it doesn’t do significant damage.

Trade with your strengths and protect against your weaknesses.

7. Beware of Deception and False Signals

One of Sun Tzu’s core principles is the use of deception, creating the illusion of weakness or strength. Markets can often create similar illusions through false breakouts, price manipulations, and fakeouts, which can easily lead to poor decisions.

Trading Insight: Avoid falling for obvious “traps” in the market. False breakouts and fake signals are common, especially in highly volatile markets.

Experienced traders look beyond surface movements and analyze underlying trends to verify signals. Being cautious and vigilant can prevent costly mistakes.

8. Use Resources Efficiently

Sun Tzu cautions against prolonged battles that drain resources and morale. In trading, this equates to overtrading or letting emotions lead to excessive losses.

Trading Insight: Efficiently allocate your capital and avoid trading more than necessary. Protecting your capital allows you to stay in the game for the long run.

If a trade setup doesn’t meet your criteria, move on. Wasting resources on low-quality trades is like fighting unnecessary battles.

9. Calculated Risk and Risk Management

Sun Tzu emphasizes knowing when to engage and when to hold back. For traders, this is the heart of risk management. Taking calculated risks is essential for capturing profits, but knowing when to step away is just as important.

Trading Insight: Risk management is fundamental to long-term success. Use tools like stop-losses, position sizing, and risk-to-reward ratios to control losses.

Accept that not every trade will be a winner and cut your losses when needed. This protects your capital and keeps you from getting overly attached to individual trades.

10. Seize Opportunities with Confidence

Sun Tzu believes in the importance of seizing opportunities when they arise. In trading, this means acting decisively when a setup aligns with your strategy and conditions are favorable.

Trading Insight: Hesitating can lead to missed opportunities, while decisive action—grounded in a solid strategy—can yield significant profits.

When the conditions align with your analysis, trust your instincts and execute your plan. The ability to recognize and seize opportunities is what distinguishes successful traders from the rest.

The Art of War has taught me that trading, much like warfare, is a game of patience, discipline, and strategy. Sun Tzu’s principles remind us that success doesn’t come from battling the market but from managing our responses to it.

Every trade is a test of how well you can plan, adapt, and stay disciplined under pressure.

As you navigate the markets, remember Sun Tzu’s timeless advice. Approach trading as a strategist would approach battle—prepare thoroughly, act wisely, and remain adaptable.

Success in trading is not just about making profits; it’s about managing yourself, seizing opportunities, and protecting your resources for the long run.

Let me know your thoughts below