DIS Call Option Loading – $117 Breakout Imminent?## 🎯 DIS Weekly Call Setup – 117C by Friday? Institutions Are Betting Big! 💥

**🧠 Summary of Smart Model Consensus (2025-08-06)**

> ⚖️ *Mixed Momentum, But Bullish Flow Stands Out*

---

### 🔍 5 AI Models – Here's What They're Seeing:

**📈 Grok/xAI:**

✅ *Bullish Weekly Flow* (Call/Put ratio: 2.54)

✅ *Institutional Accumulation* on high volume

⚠️ *Daily RSI still bearish*

⚠️ *High Gamma Risk* – short expiry window

**🔻 Gemini/Google:**

🔻 *Bearish RSI across daily/weekly timeframes*

📉 *Heavy Sell Volume* = Distribution

💬 *Bullish flow might be retail noise*

**🔄 Claude/Anthropic:**

✅ *Oversold RSI* = Possible Relief Rally

✅ *High Call Flow & Favorable Volatility*

⚠️ *Momentum Weak* – proceed cautiously

**📊 LLaMA/Meta:**

⚖️ *Mixed Signals* – leaning Bullish

⚠️ *Gamma Risk* critical with only 2 DTE

📈 *Support/Resistance Levels Must Guide Entry*

**🔻 DeepSeek:**

🔻 *Weak momentum, institutional selling*

⚠️ *Contrarian Bearish Position*

🎯 Targets breakdown support

---

### 🧠 Model Consensus:

💡 *Mixed Signals* → **Cautious Bullish Bias**

✅ *Institutional Flow + Oversold RSI*

⚠️ *Gamma + RSI Risk = Manage Entry & Exit Tightly*

---

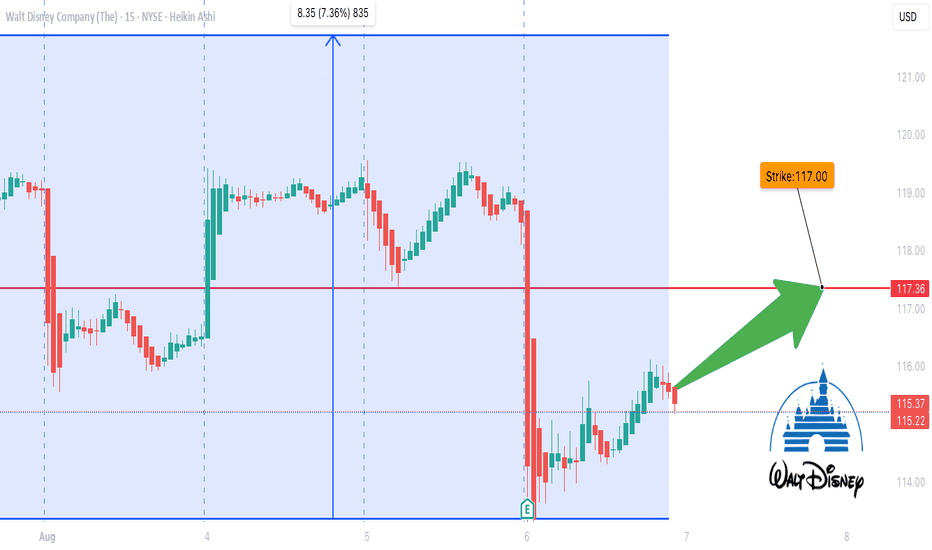

## 📈 Recommended Trade Setup:

| 🔧 | DETAILS |

| ---------------- | --------------------------- |

| 🎯 Instrument | `DIS` |

| 🎯 Direction | **CALL (LONG)** |

| 💰 Entry Price | **\$0.72** |

| 📌 Strike | **\$117.00** |

| 📅 Expiry | **Aug 8, 2025 (2 DTE)** |

| 🎯 Profit Target | \$1.25 – \$1.80 *(75–150%)* |

| 🛑 Stop Loss | \$0.36 *(50% premium)* |

| 📈 Confidence | **65%** |

| ⏰ Entry | **At Market Open** |

---

### ⚠️ Key Risks:

* 🧨 **Gamma Risk:** Volatility can cause price to explode or implode quickly

* 📉 **Bearish RSI trend** still in play – this is a **speculative short-term trade**

* 🎢 Only **2 Days to Expiry** — manage actively

---

### 🧠 Final Thoughts:

This is a **tactical high-upside, short-dated bet** on a potential bounce in \$DIS. Institutions are positioning early — retail might be late to this move. Risk tightly, but reward could be explosive.

---

**📌 TradingView Hashtags:**

`#DIS #OptionsAlert #WeeklyOptions #CallOptions #GammaSqueeze #UnusualOptionsActivity #TradingStrategy #SmartMoney #TechnicalAnalysis #SwingTrade #HighRiskHighReward #BullishFlow`

Disneyanalysis

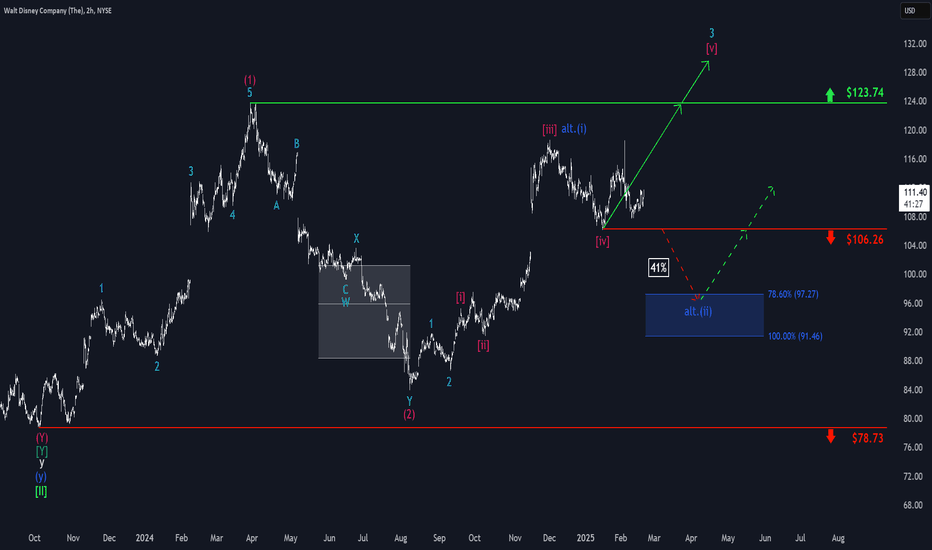

Disney: Recovery?!Disney appears to have stabilized after its recent sell-off, holding above the $106.26 support level. From here, the price should push beyond the $123.74 resistance during the turquoise wave 3. However, if it drops below $106.26 (41% probable), it will trigger our alternative scenario, signaling a move into our blue Target Zone between $97.27 and $91.46. After the wave alt.(ii) low in that range, the stock would quickly resume its upward trajectory.