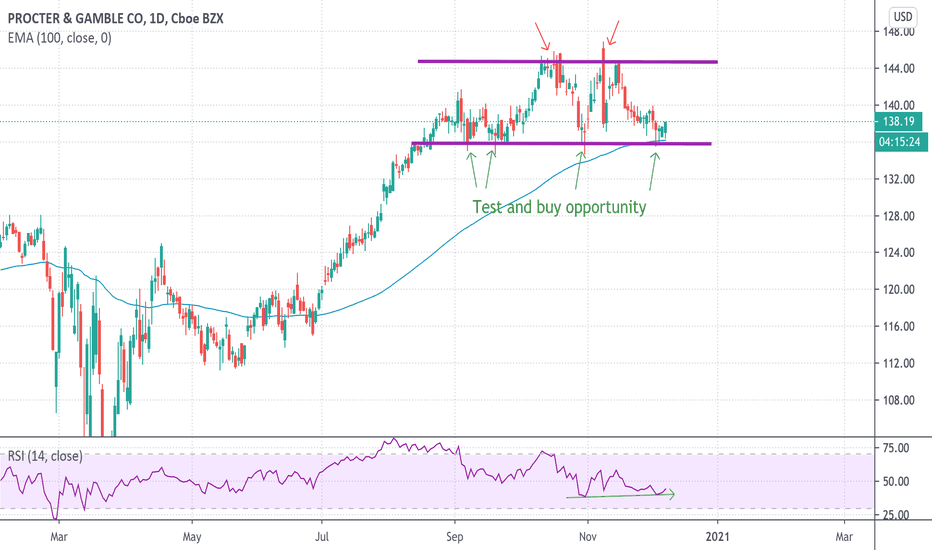

Procter & Gamble ~a safe gamble~The green arrow in the chart show the support being tested around $135.

The upside is around $144, and a stop-loss exit below the 100ema makes sense for at least 50% of the trade.

RSI has slightly improved, showing bullish intent.

PG is probably being used to collect dividend, so choppiness in the drawn channel isn't a negative thing.

Dividend

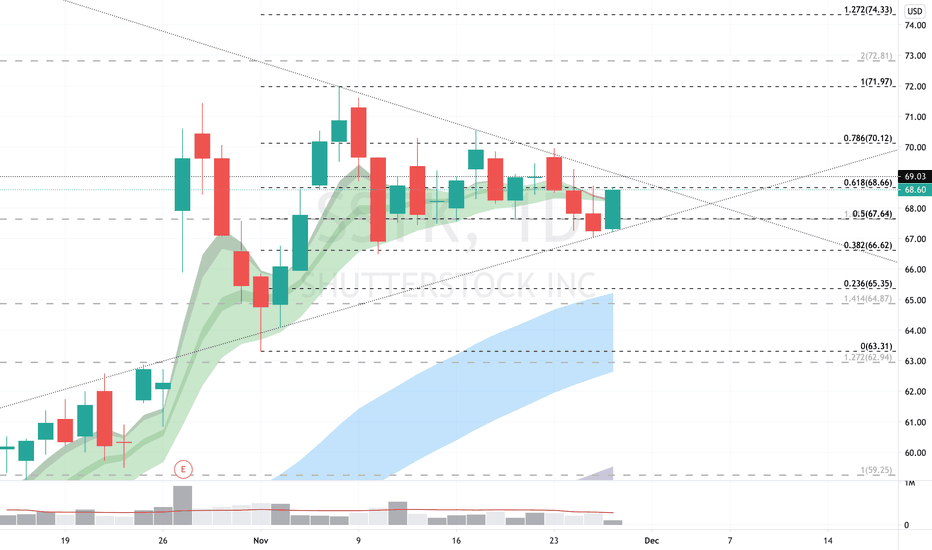

SSTK over 69.03 with 12/2 catalystTight price consolidation on this one with an upcoming ex-dividend catalyst on 12/16, although purchase on or before 12/2 is required to receive it. This means we should see some buying on and before that date. From Yahoo Finance: "If you purchase the stock on or after the 2nd of December, you won't be eligible to receive this dividend, when it is paid on the 16th of December.

Shutterstock's upcoming dividend is US$0.17 a share, following on from the last 12 months, when the company distributed a total of US$0.68 per share to shareholders."

Note it is a stock that trades on lower volume and has some illiquidity in the options chain.

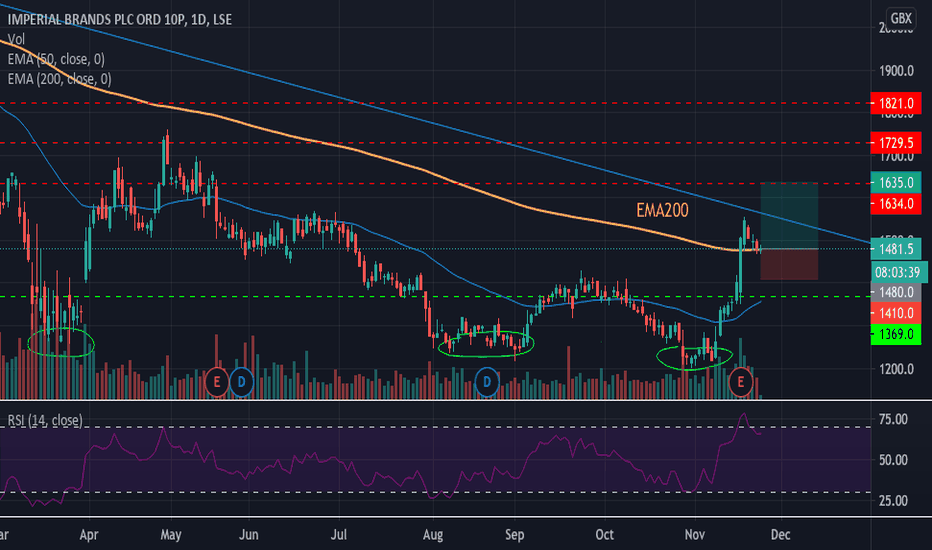

#IMB Long at 1480 ahead of ex-dividend dateEnough is enough.

Tobaco is not in favour these days but #IMB has just cleared its EMA200 (long-term resistance).

Good setup emerged for the Long trade: Buy 1480, TP1 1635, TP2 1730, TP3 1820, SL 1410.

Additional reward is ex-dividend date on 26/11 (adds 48 per share).

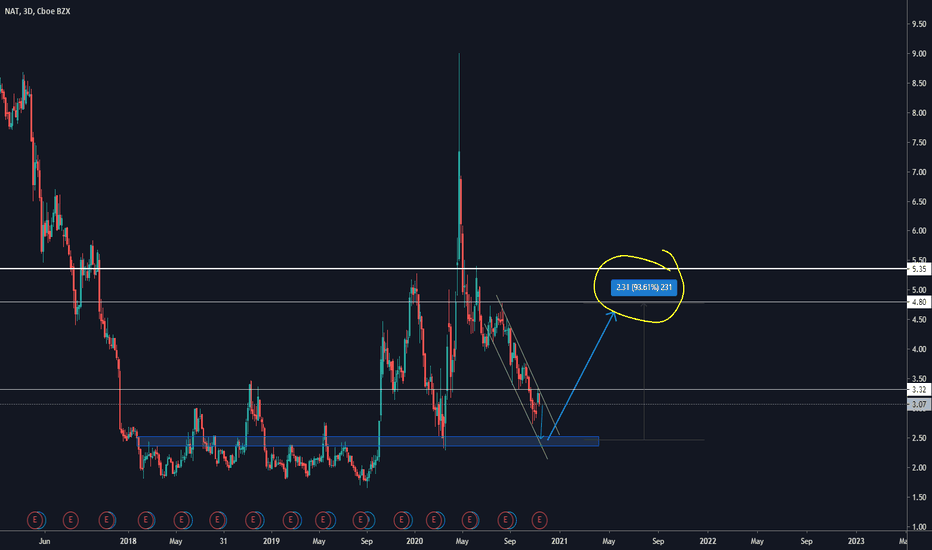

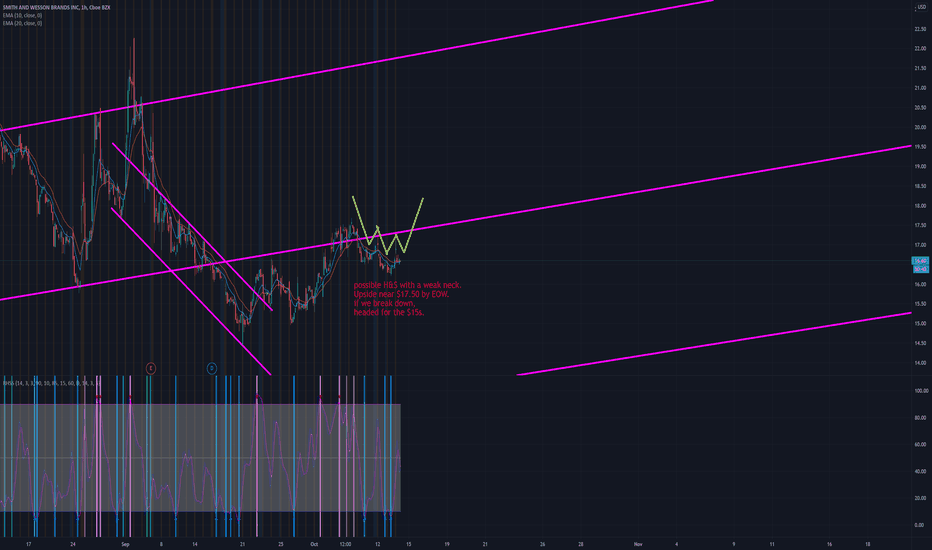

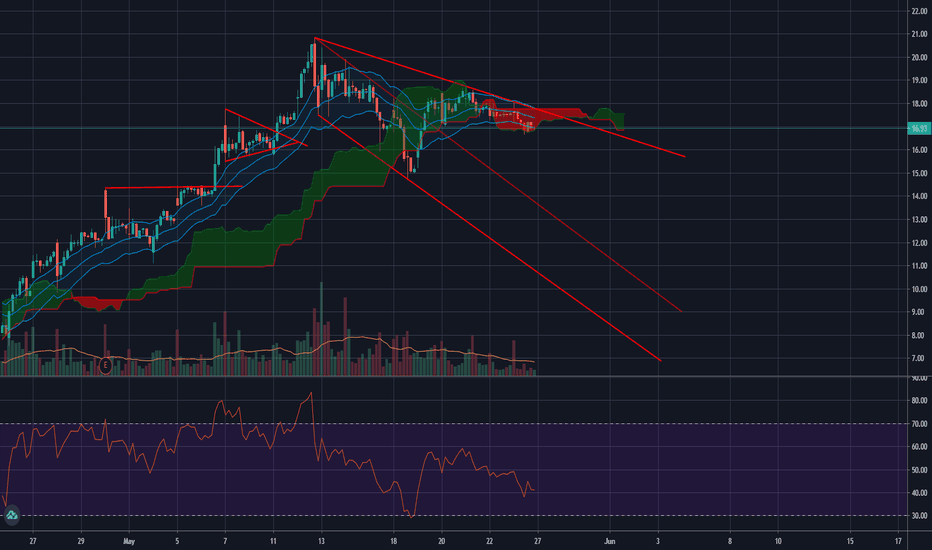

INTERESTED IN BUYING NAT? WATCH THIS ANALYSIS (93% profit?)NAT has been falling drastically in price for the last 6-7months, after it was hyped up through March and April for the record low oil prices. After the oil prices started to rise again, NAT has just been going DOWN, showing no strenght what so ever.

Many people are interested in this stock because of the high dividend it's paying out which currently sits at stunningly 24%! If this is good or bad for the company can be discussed.

Now let's look at the technical of this stock. NAT are currently in a long lasting descending channel. Price is currently at 3.06, and as you can see price got rejected at the horizontal and trendline resistance. Its not ready to break out yet. I think we will have another leg down to about 2.30-2.50, where the blue box is placed. This level is probably the best place to enter NAT if the price resumes up. Because of the horizontal and trendline support at the 2.30-2.50 zone.

So how high do I think the price will go from there? My target is around 4.82. That's the zone where the price started to go into a descending channel and we also got strong support up there.

This is the absolute best and safest place to enter NAT in the following weeks/months, If the price breaks below this level price will probably enter a consolidation like January 2018-September 2019.

If you like this analysis and find it helpful, please leave a like! Appreciate any feedback, and sorry for bad English :3

$MGK Pullback Buyers Hunting For The Entry$MGK has had a great run higher doubling in value from the lows. This move higher did get quite overextended creating an overshoot on the highs. When a market blows through a level (in this case the channel highs) and overshoots it, the response is very important. In this case, the response was immediate bear pressure which caused the bulls to fail hard. Now that we have seen the overshot high failure, it is expected to see an overshot on the lows too to equalize. Buyers are lying in wait for the best dip opportunity to jump back in this monster.

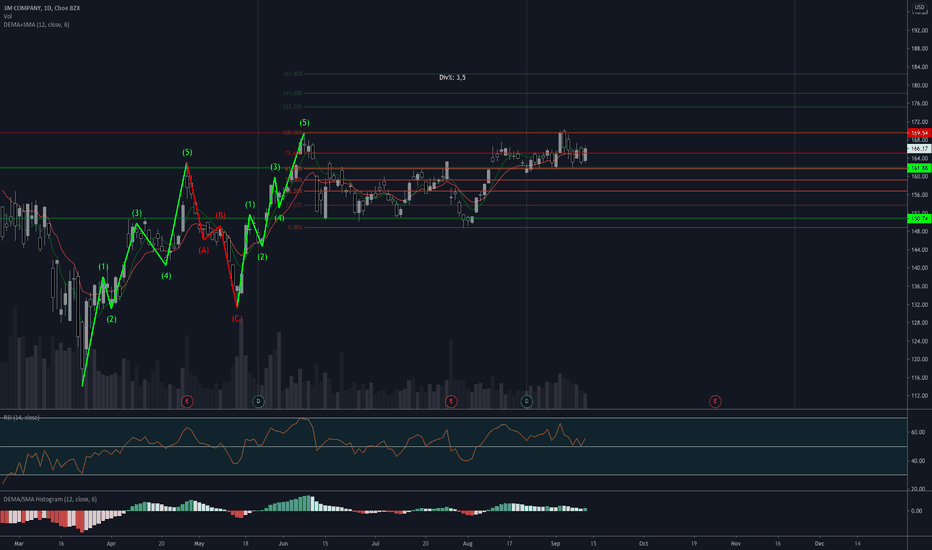

3m - Dividend Star - Long TradeHey everyone,

3m is one of the most suggested stocks when it comes to dividends. But also for traders there are decent opportunities atm. The stock goes along the support area, the RSI is on the buy side but not overbought but the trend aims up. The dividend is 3.5% and the company raised their dividend since the past 62 years. One could say, you can buy it now no matter what kind of investment style you have <3

Buy: Now / 162$

( Stop: 159$ )

( Take Profit: 182$ )

Much fun with that trade / invest!

Leave a follow please, my goal is 200 :)

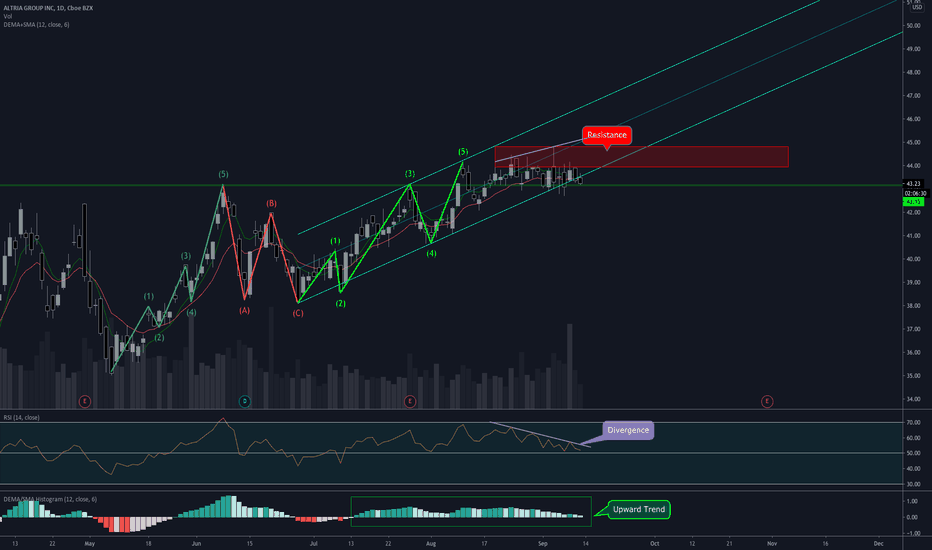

Altria with mixed feelingsHey everyone,

atm i got Altria on the screen with mixed feelings in terms of technical analysis. The green line gives good support while the red box is a huge resistance. The Trend points upwards while the RSI got a divergence. There is also a chance for wave 3 in this current consolidation.

You could buy that stock as a dividend position (7,9%) and buy more f the stock goes down. You could also buy with a tight stop included. I will go with the dividend position though.

Buy: now / 43.15$

( Stop: 42.50$ )

Goal: ?

Much fun with that trade!

Leave a follow please, my goal is 200 :)

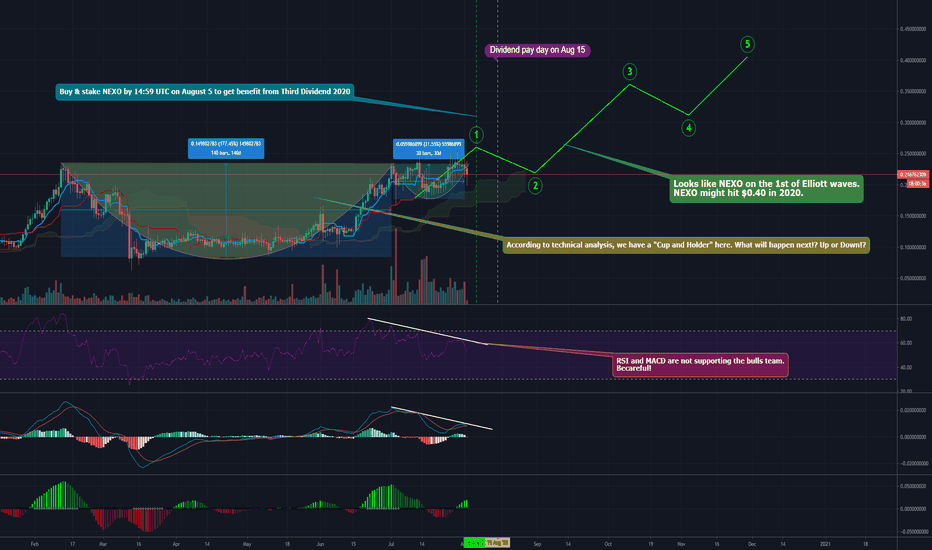

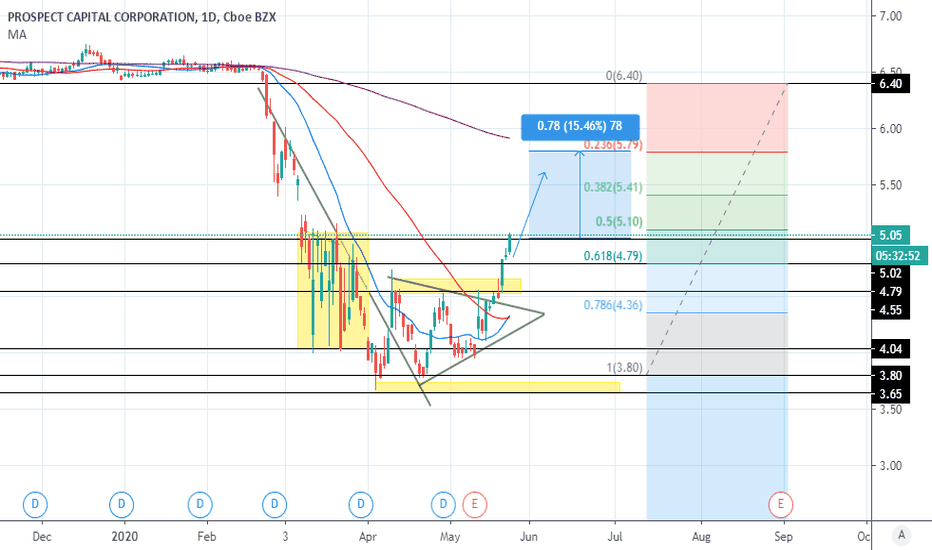

NEXO in Aug 2020: Long or ShortIt's rare to find a good cryptocurrency project among hundreds of failed, scam projects.

NEXO is one of those, for those who have followed NEXO from first days, it will not be hard to see the possibility of their success in the future.

The Crypto Market 2020 seems to be getting back on track. Can Bitcoin break the old peaks or can Ethereum successfully update to version 2.0? All of which can affect to NEXO's price.

Technically, the ability of NEXO growth in 2020 is entirely possible, fundamental analysis also supported this.

I'm looking at $0.40 in the next 6 months to 1 year.

This analysis is for reference only. Not an investment advice. Disclaimer!

Good luck guys!

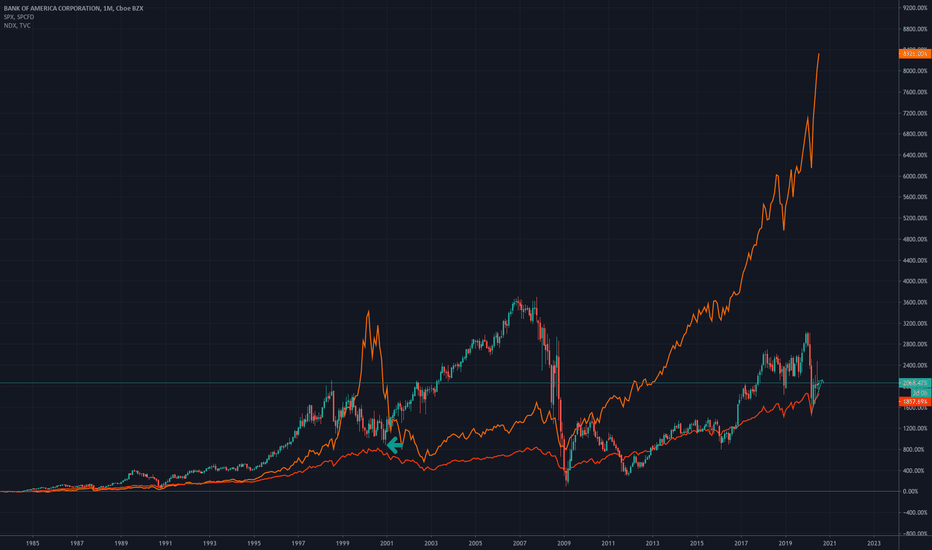

BAC compared to SPX and NDX: Dot com top and bottomBerkshire Hathaway bought 33.9 million shares of the banking giant between Monday and Wednesday. That increased Berkshire's stake in Bank of America by $813.3 million to more than $24 billion. BRK holds 11.5% of BAC now.

BAC chart compared to S&P500.

Observe the top of both the NASDAQ and S&P

BAC started bottoming when the 2 indices started falling.

2008 was a banking crisis which directly impacted BAC and it fell relatively harder than the indices. In 2020, Banks are well capitalised and backed by the FED, so chances of a banking crisis are slim.

Add to that, NASDAQ is clearly overcooked at the moment(Check the historical chart. Top of the major trendline. That said, it Could also break up)

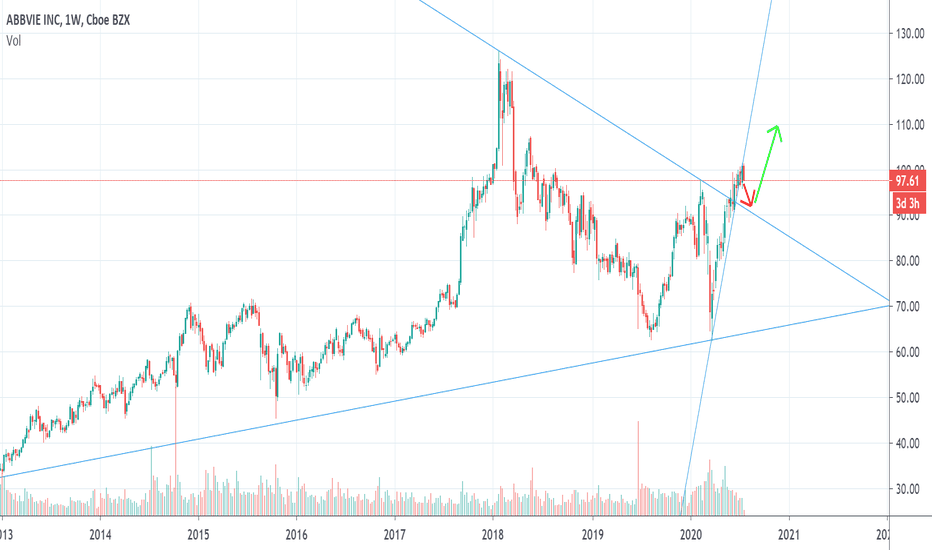

ABBV buy the dip ahead of pharma seasonAbbvie's volume has slackened somewhat after its recent triangle breakout, and it has broken its steep upward trendline. We may see a small correction late this month as Abbvie pulls back toward triangle top. However, if healthcare and pharmaceutical sector earnings continue to deliver this month (as they have so far), then Abbvie should get some buying volume along with the rest of the sector.

And then in August, a period of seasonal pharmaceutical strength begins. In The Stock Traders' Almanac, Jeffrey Hirsch makes an extensive study of seasonal stock market performance by sectors. His third-best-performing seasonal trade by average 10-year return (16.8%) is to go long biotech from early August to early March. I believe that's because this is the busy season for FDA drug application reviews.

The pharma sector does have an unusual level of political risk this year. Democrats have traditionally been hard on the pharma sector, and they look poised this year for a sweep. If the polls remain strongly blue, then we might see pharma underperform this year.

That said, I think a lot of the political risk is already priced in. Whereas most of the stocks I look at are at the very top of their 3-year valuation range in terms of forward earnings and sales, pharmaceutical companies like Abbvie and Merck are trading in the bottom quartile of their 3-year valuation range. With forward PEG ratio around 2, forward PSG ratio around 0.5, and a whopping 5% dividend, Abbvie looks really attractively valued. I've been doing a lot of deal-hunting lately, and this is one of the only stocks I've seen with both a strong growth story and a valuation I really like. The analysts and options traders like it too; Abbvie has a 9.9/10 Equity Starmine Summary Score, and near-dated options positions are heavily skewed toward calls.

APLE Probability of price movement and good MONTHLY DIVIDENDSAPLE took my attention .

Could be a very good long term investment for its dividends but we have to pay attention on Balance Sheet and other factors that can give an idea about the good standing of the company.

Wish you all the best .

Thank you .

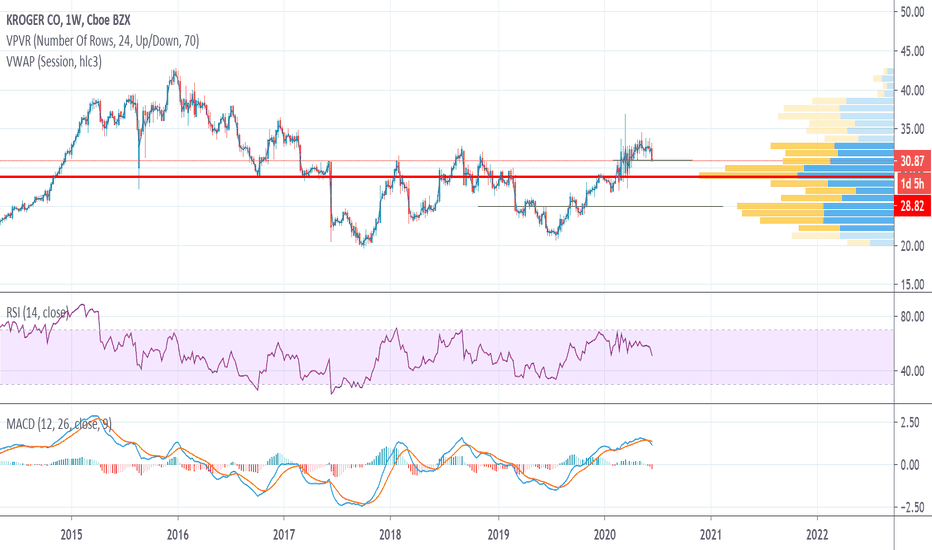

Wrong-way earnings play on Kroger offers opportunity to buyKroger reported blow-out earnings and sales today, handily beating both the Wall Street and Estimize consensuses. The stock is moving down, however, perhaps because this quarter's earnings were a blip and next quarter's earnings are expected to be in a more normal range. I could see the stock selling off over the next month or so as the "Covid-19 bump" goes away.

However, some increased demand will remain over the next few quarters as consumers remain too scared to eat at restaurants. Next quarter's estimates are lower than the current quarter, but still quite a bit higher than 2019 YoY. Also, Kroger's increased cash flow this quarter will get reinvested into the business, leading to higher earnings in the future. Based on Zacks estimates of Kroger earnings for 2021, I estimate the stock's fair value at around $37 per share.

We've got a support around $31 per share today, but the reality is that we probably will break that support and continue downward toward the volume support at $28.50. And since it's the slow season, I wouldn't even be surprised to see Kroger hit secondary volume support at $25. I will be scaling in as the stock falls, because I think Kroger is an attractive, dividend-paying investment for a recessionary environment.

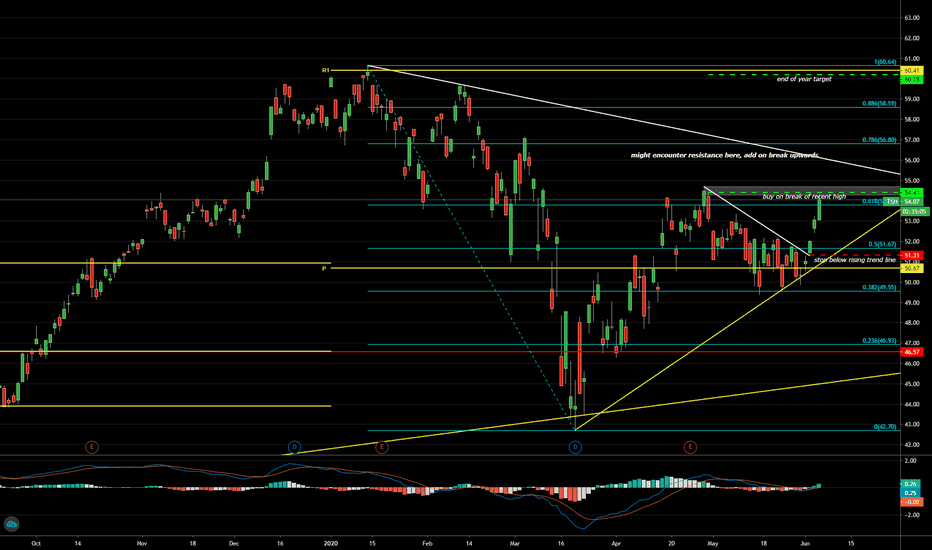

TSM - 10% Potential by EOY PLUS DividendsIf price breaks above the local high (look at green dotted line), we might have a runner back to ATH. My stop will be a close below the rising trend line and will move accordingly with price.

If you found this to be insightful or helpful, please show appreciation by hitting that like button. If you want more ideas I invite you to follow as well! I try to be here for all of my followers with any questions they might have. Feel free to shoot me a DM or comment below to start a conversation!

Overstock broadening wedgeNASDAQ:OSTK broadening wedge forming. I think it will go up eventually.

Related names: OTC:OSTKO COINBASE:BTCUSD KRAKEN:XTZUSD NASDAQ:EBIZ AMEX:ONLN NYSE:W