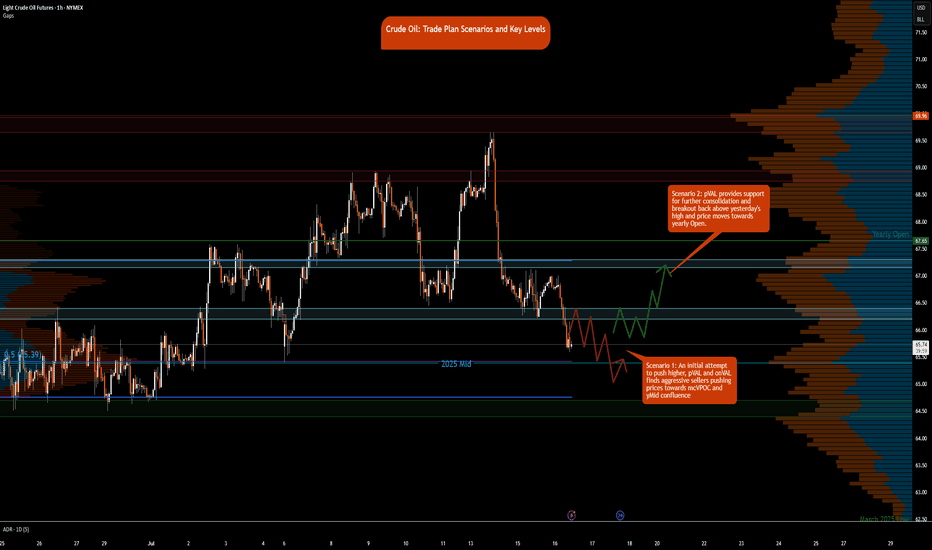

Crude Oil Trade Plan Scenarios and Key Levels

NYMEX:CL1!

It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll tool . The chart shows that rollover is about 70% complete, and CLU25 has higher open interest. Note, the front-month August contract is still trading at higher volume.

What has the market done?

Crude oil is in a multi-distribution profile since the peak witnessed during the Iran-Israel conflict. Crude oil formed a strong base above the 64s and traversed towards the 69s. Prices were rejected at these highs and have since reverted back towards the monthly Volume Point of Control, monthlyVPOC.

What is it trying to do?

The market is in active price discovery mode and has formed multi-distributions since June 23. The market has been consolidating after prices at highs were rejected.

How good of a job is it doing?

The market is active and is also providing setups against key levels. Patience to take trades from these higher time frame levels is what is required to trade crude oil currently. Otherwise, there is a lot of volatility and chop that can throw traders off their plan.

Key Levels:

• Yearly Open: 67.65

• Neutral zone: 67.15–67.30

• 2-Day VAL (Value Area Low): 66.40

• Neutral zone: 66.40–66.20

• 2025 Mid-Range: 65.39

• Key Support: 64.40–64.70

What is more likely to happen from here?

Scenario 1: An initial attempt to push higher, pVAL and onVAL finds aggressive sellers pushing prices towards mcVPOC and yMid confluence

Scenario 2: pVAL provides support for further consolidation and break back above yesterday's high and price moves towards yearly Open.

Glossary:

pVAL: Prior Value Area Low

onVAL: Overnight Value Area Low

yMid: 2025 Mid-Range

mcVPOC: Micro Composite Volume Point of Control

Doe

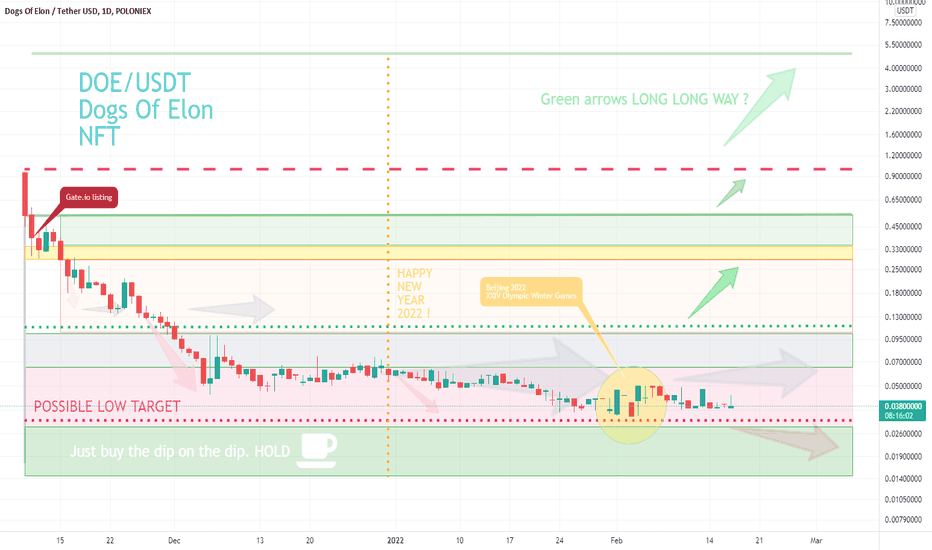

DOE USDT"The Dogs of Elon – An NFT for the moonshot trader.

Created 10,000 unique NFTs featuring everybodies favourite K-9. Containing special sub collections with 30 Elons and 70 zombies Doges." source CMC

Circulating Supply: 192,111,677.09 DOE ,19%

Max Supply: 1,000,000,000

Total Supply: 940,000,000

17.2.2022 Market Cap: $6,996,067

This is my idea about next way DOE USDT / Dogs Of Elon, LONG.

1 target downtrend reached 0,1600 $.

2 target downtrend reached 0,0600 $.

3 target downtrend reached 0,0300 $. (0.034 Gate)

4 target downtrend 0,00800 $ ???

My very long term sell target is 3.333 $ or 4,777 $ in bull run. Just Hold. We'll see what the new DOE team can do. There is a risk in this NFT. Be careful.

Please comment.

This is not financial advice !! Warning! The price may fall more !

Please do your analysis and consider investing !!!

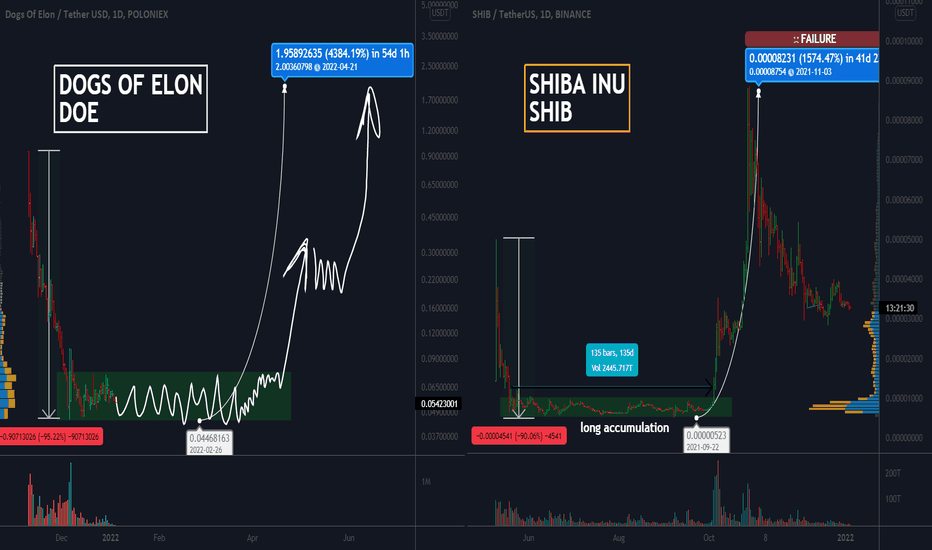

In what case can the DOE coin repeat the success of the SHIBA???A lot of guys ask us about the DOE (Dogs Of Elon) coin. It's hard to analyze a coin that doesn't have enough history.But we will show in which case this coin can repeat the history and success of SHIBA INU.

After listing on the exchange, SHIBA INU coin has corrected by 90%. After that the coin was in accumulation for a very long time (135 days). As the result of breakout of this range, the price skyrocketed and rose by 1500%.

DOE also corrected by 95%. This is a very strong fall. In case of long accumulation and breakout, this coin can also repeat the success of SHIBA INU.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade.

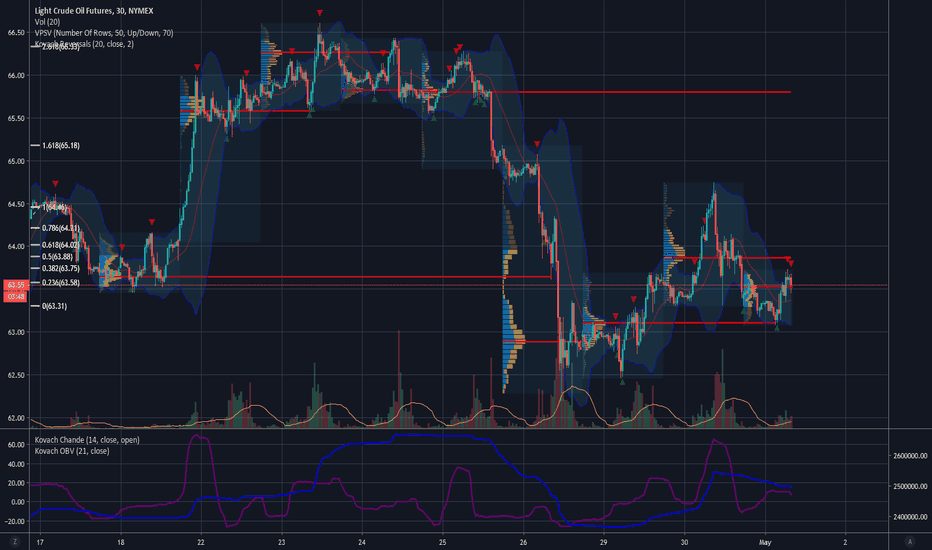

DOE Day Long OilDOE oil inventories are released today. We turn to yesterday's API to see a large build, which was broadly inline with expectations so it didn't move oil too much. The trade would be a surprise draw, just keep in mind that oil has been squeezing like crazy after DOE lately, sometimes nearly 100 ticks which is crazy (even for oil). Prices still seem to be beaten down from the Trump tweet, but with the situation in Venezuela, there isn't much to support any bearish outlook on oil prices.

The Kovach Momentum Indicators show a solid bull trend long term, broken only recently by Trump's recent tweet about oil prices. If we have a surprise build, this could give us a nice chance to enter a long trade, just watch the squeezes.