Dollar_index

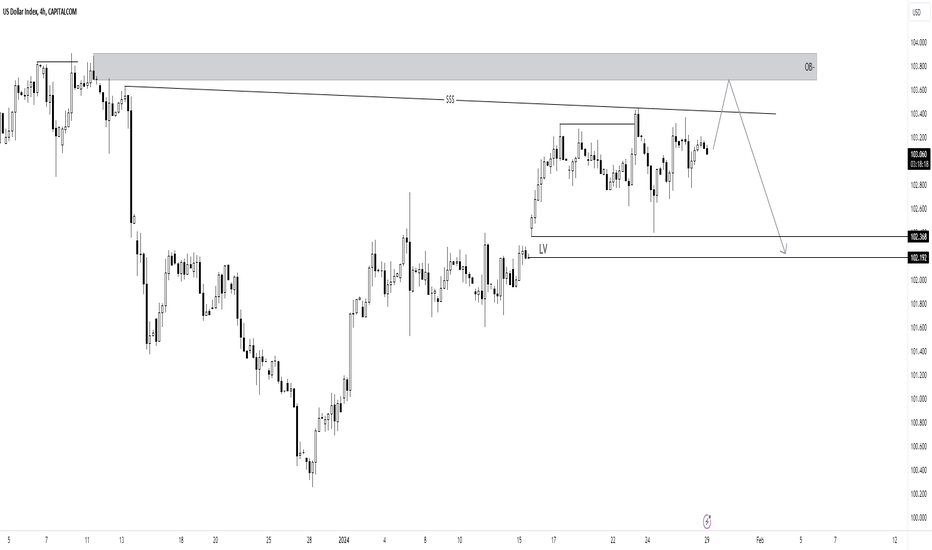

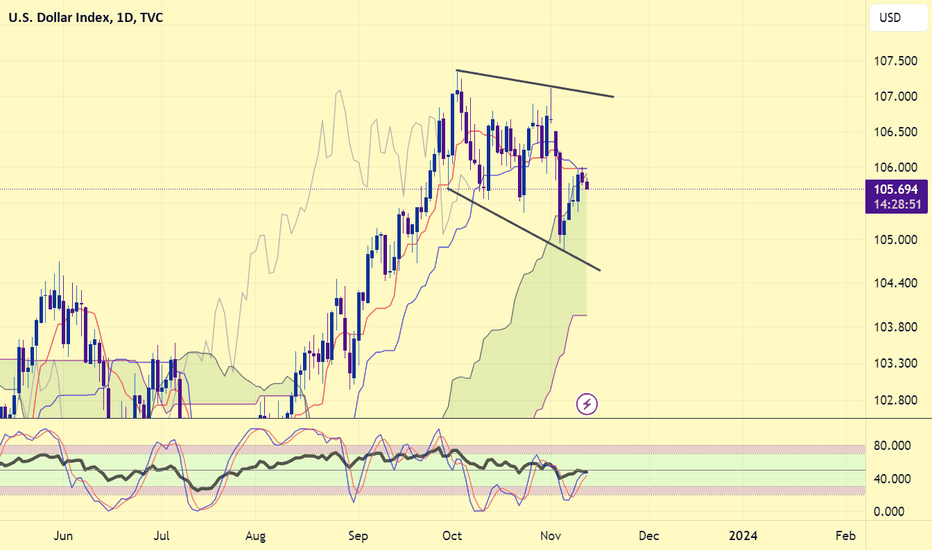

DXY (Dollar index):🔴It looks bearish.By examining the 4-hour chart, we can see the liquidity formed above the current price and below the bearish order block.

So we can expect the price rise to collect the liquidity and start the bearish move from the order block to the liquidity void.

💡Wait for the update!

🗓️29/01/2024

🔎 DYOR

💌It is my honor to share your comments with me💌

EURUSD (A huge Earthquake is Coming)

Hello my friends, how are you doing?

I hope you will fulfil your ambitions ❤️❤️❤️

Today, I want to talk about EURUSD.

What a chart! wow.

Before that, I want to remember It's not financial advice. so, just see and think about it.

I'm just sharing my view and opinion of the chart. Please do your own research.

Don't waste time and Let's go into details 🌺🌺🌺

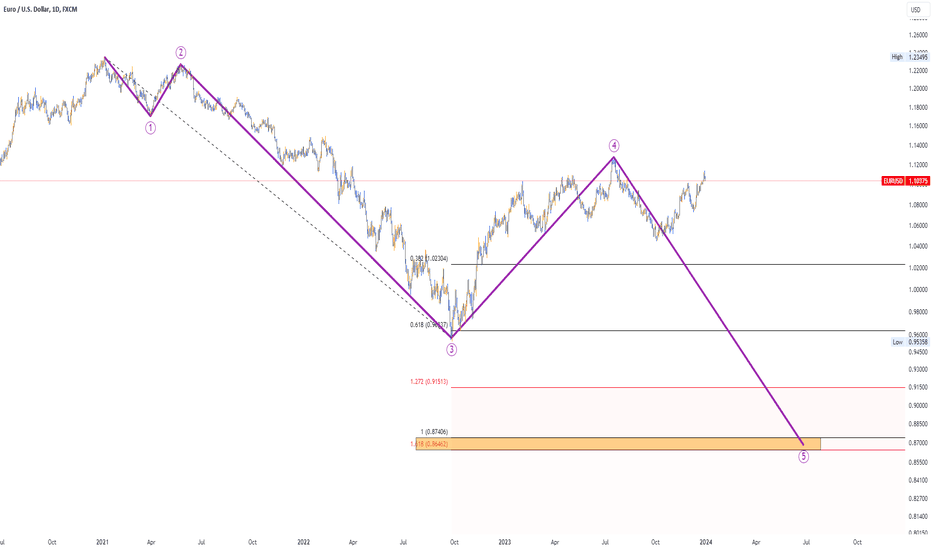

Based on the Elliot wave, we can count waves. each wave includes 5 microwaves and today I want to count the waves at EURUSD.

That's all we do. there is a very very important point in this chart and I want to tell you that.

Based on Elliot's theory, the second wave can retrace the first wave to a maximum of 0.618 Fibonacci. and if this retracement takes longer, we would expect to see an extended third wave.

Exactly, in EURUSD we see this situation.

Please check the first photo 👆👆👆

The second wave retraced the first one till 0.886 Fibonacci and it's so dangerous. so we expect to see an extended third wave.

in this case, we see the third wave moved to 4.618 Fibonacci. and it sounds strange. it's happened. exactly such as I said.

Please check all these photos.

And the Fourth wave can retrace to a maximum of 0.618 Fibonacci of the 3rd wave and the last wave (the fifth wave) will begin.

Now, it's time to calculate the last PRZ for the end of the fifth wave.

I did it for you guys.

And I expect the fifth wave to drop to 0.85-0.88.

it means that the worth of EURUSD drops to a zone between 0.85-0.88 and if this happens, all markets will drop soon.

please, for God's sake, watch the market. the situation is so complicated. don't forget to save your profit.

SP500, BTC, NDX and so on will drop soon more than you think.

✔️ ✔️ it was my duty to warn you about this earthquake.

I'm sure you are confused right now. But it's ok and there is no problem. Time Proves Everything.

If you have any questions, or if you need to know more details please don't hesitate to contact me.

🙏🙏 Please don’t forget to like 👍, follow ✌️, and share 👌 this analysis with your friends. Thank you so much for your attention and participation 🙏🙏

Wish you the best 🧞♀️

Sincerely Yours 🙏🙏

Ho3ein.mnD

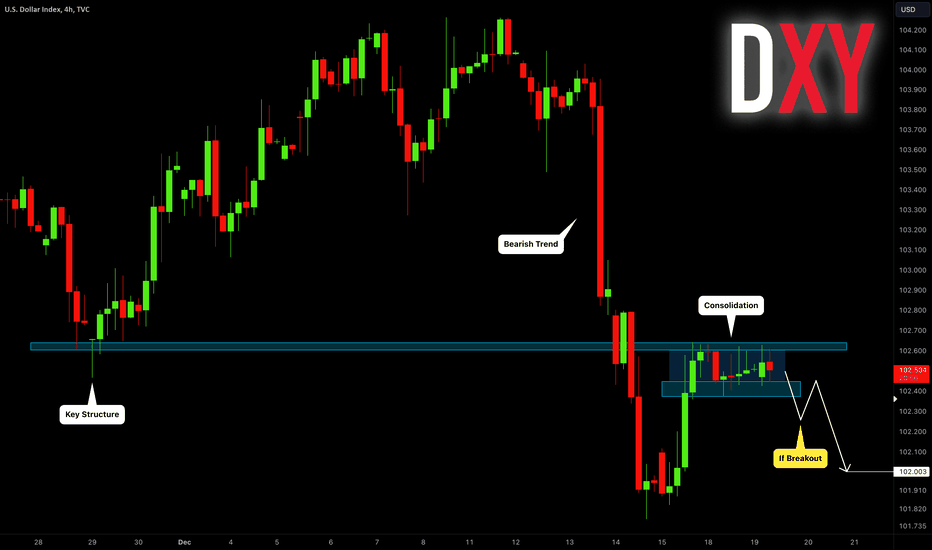

Dollar Index (DXY): Your Trading Plan 💵

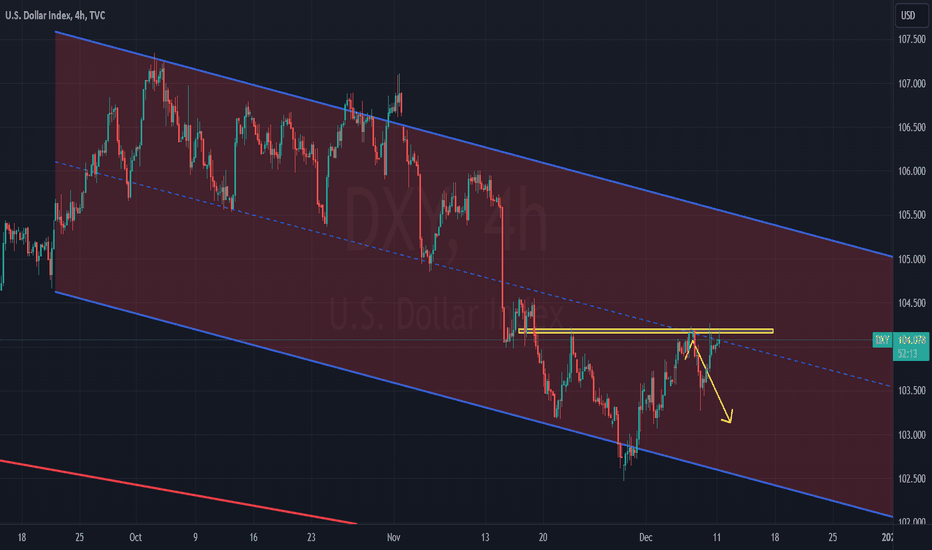

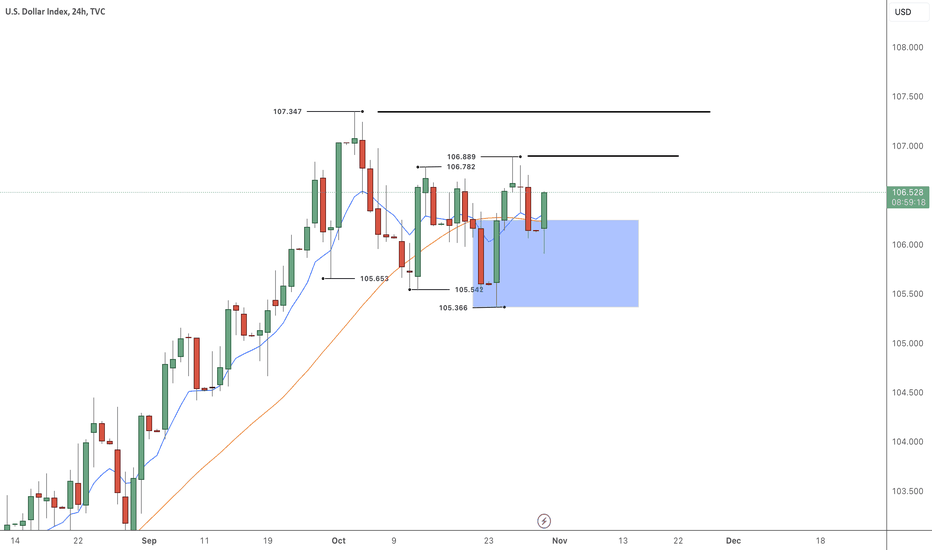

After a massive selloff, Dollar Index retraced to a key horizontal resistance.

We can see that the market is currently consolidating within the underlined blue area.

To short the market with a confirmation, let the price break the support of the range.

4H candle close below 102.37 will confirm the violation.

A bearish continuation will be anticipated at least to 102.0 level then.

Alternatively, a bullish breakout of the resistance of the range will

extend the correctional movement at least to 102.86

❤️Please, support my work with like, thank you!❤️

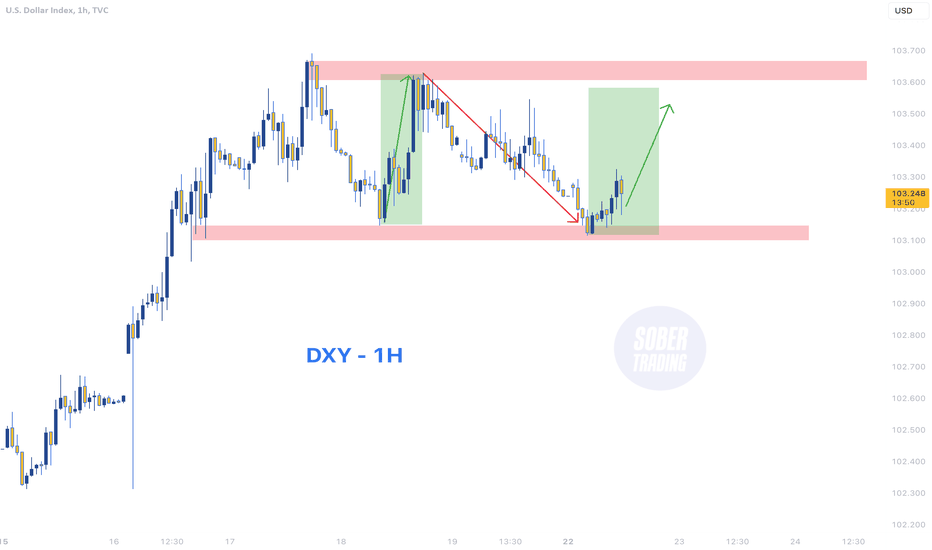

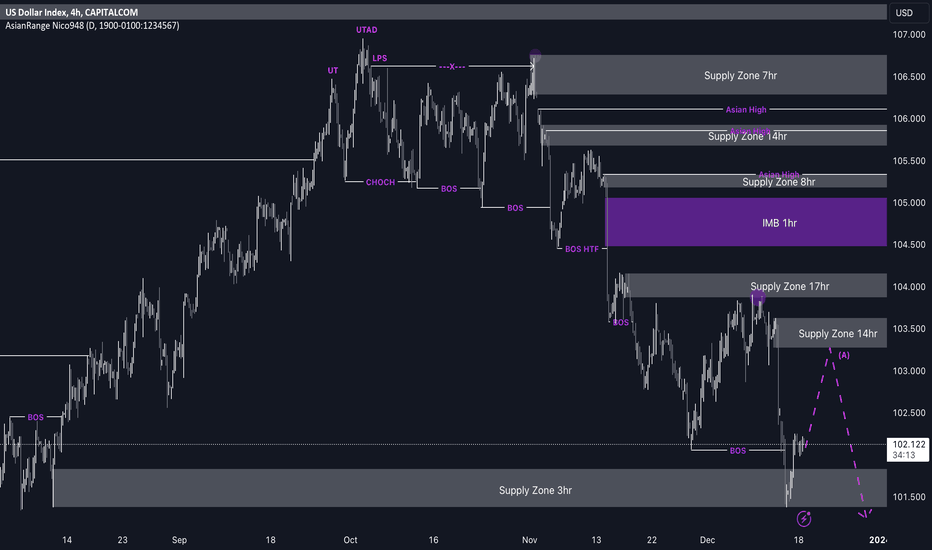

DXY (Dollar Index) Shorts from 103.300 down towards 101.500My bias for the dollar this week remains bearish, leading me to seek pro-trend trades from any proximate valid supply zones. With the recent reaction from my prior 3-hour demand, I anticipate the price to continue its ascent to address the imbalances above.

Subsequently, my expectation is for the price to undergo distribution within a supply zone identified on the 14-hour chart, providing opportunities for selling positions on the way down. While acknowledging the possibility that the price may not ascend as high and instead continues to drop, I am prepared to wait for a new demand zone to seize potential buy opportunities in such a scenario.

Confluences for DXY Shorts are as follows:

- Price broke structure to the downside on the HTF, confirming a bearish bias.

- There's lots of liquidity left below in the form of trend line liquidity and asian lows.

- There's a clean 14hr supply zone that has caused the impulsive move to the downside in which I expect price to react from next.

- Since there are imbalances beneath the supply, it's probable that once the price addresses them, a bearish reaction will ensue from the supply.

P.S. My bearish stance on the dollar persists, prompted by the recent structural break observed on the higher time frame (HTF). This strengthens my inclination toward bearish positions, making me more inclined towards considering long positions for pairs like GBPUSD and EURUSD. If you guys have another take on this market I would love for you guys to leave a comment!

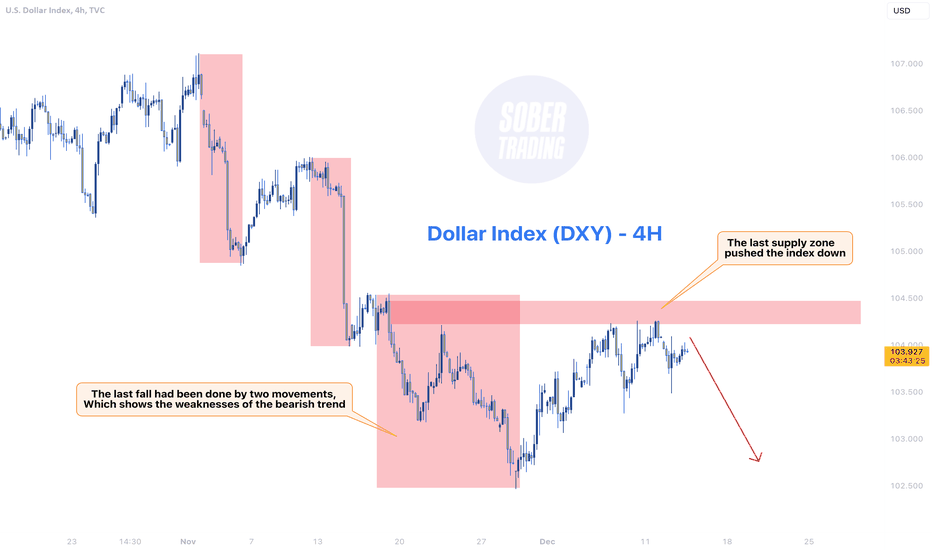

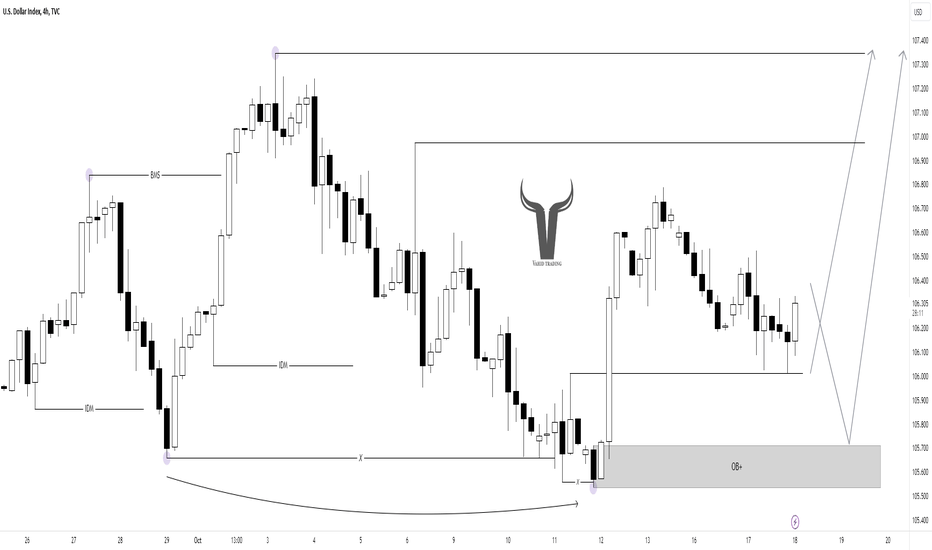

DXY - 4H Selling opporunityAnalyzing the DXY, we've seen the last bearish phase executed in two distinct movements, hinting at an underlying weakness in the downtrend. The recent supply zone has indeed nudged the index downward. My projection? The DXY is likely to descend to, or even beyond, the previous low. Stay tuned for updates.

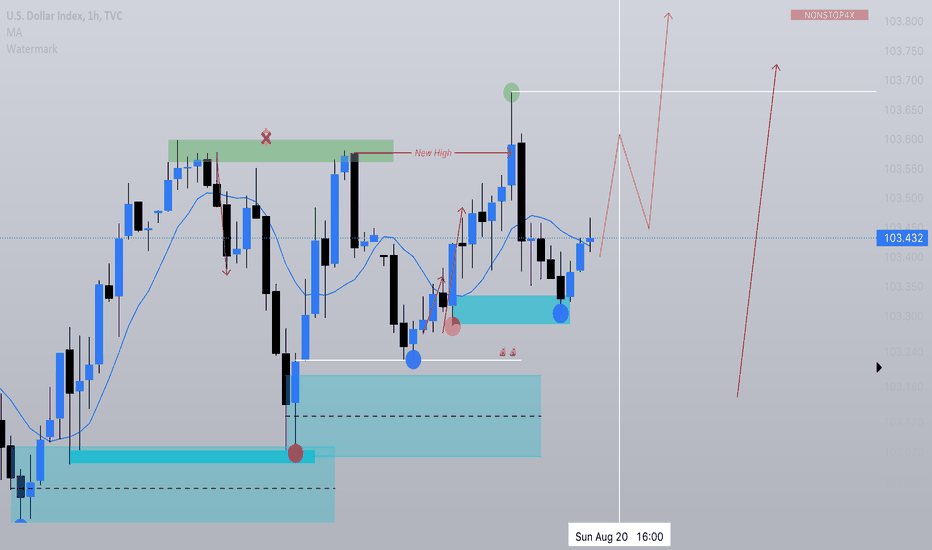

DXY Dollar Index Bullish Continuation Scaling into 1H timeframes for possible intra-day trades for Monday - Tuesday...

We've been in a healthy uptrend creating Higher Highs and Higher Lows.

No signs or breaks of structure to switch sides and look for sells.

2 areas i'm looking for potential entries on correlating pairs such as GBPUSD & EURUSD

US Dollar Faces Supports: Potential Double Bottom Signals MarketUS Dollar Faces Supports: Potential Double Bottom Signals Market Dynamics

Major currency pairs continue their range-bound movement on Monday as investors refrain from making significant directional bets. The market sentiment is cautious due to escalating concerns, with investors eyeing key inflation data releases from both the United States (US) and the Eurozone later in the week.

Early Monday, Asian markets saw declines, influenced by the People’s Bank of China's (PBOC) lack of detailed information on stimulus measures for private firms and rising respiratory illnesses in China. The ongoing decrease in China’s Industrial Profits, coupled with uncertainty surrounding major central banks' interest rate outlooks, further contributed to the subdued market mood.

The return of US traders after the Thanksgiving holiday break is awaited, and the US S&P 500 futures, considered a risk barometer, indicate a 0.30% decline on the day.

Despite the cautious market sentiment, the US Dollar experiences selling pressure as it hovers around the 103.200 zone. Notably, there's potential for a Double Bottom formation, suggesting a strong recovery for the USD. The existence of a Fair Value Gap (FVG) around $105.000 becomes noteworthy, serving as a potential target point in the event of a market reversal.

Our Preference

Above 102.600 look for further upside with 104.2150 & 105.000 as targets.

DXY 2 senario with detailhi dear trader

this price action for dxy with detail

It is near the end of the year, institutions want to put a stop to the money for the Christmas celebration and take it out now... be careful.... My personal opinion is that he may not pay attention to the conversation this year, but this year he will fill the conversation with news of a war with something, but in any case, two scenarios should be considered... My personal opinion is that he will complete scenario 1 later. From the diamond pattern

good luck

mehdi

Can The Dollar Push Higher? Hey traders, welcome back.

The dollar is increasing heavily to the upside as I make this video.

Now we don't know how price will close but it is important to watch how she closes today.

If price continues this could affect the major currency pair market in a mighty way.

All Base dollar pairs could continue to increase while Quote dollar pairs could continue to decrease.

It's a patience game right now, but may be one to play if you have the right hand.

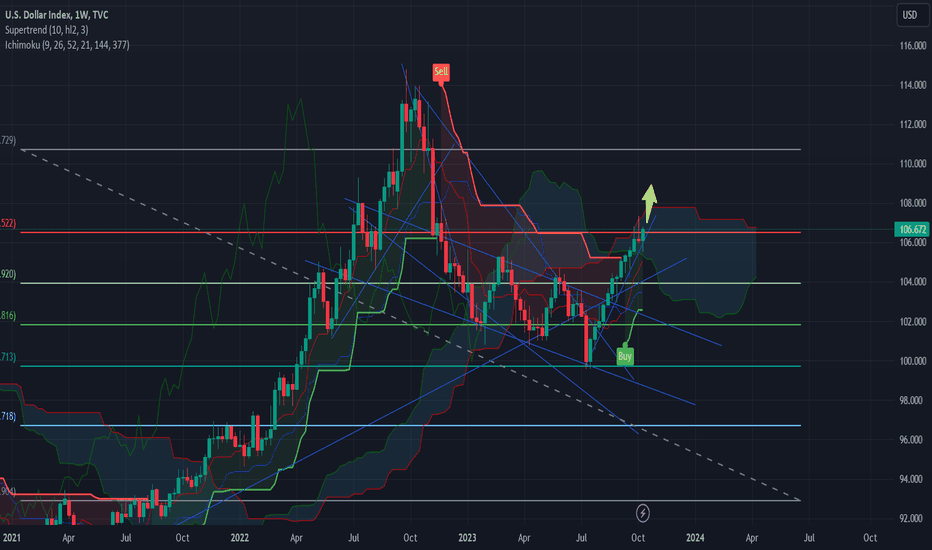

US Dollar Soaring with US Yield - Let's Long DXY!US dollar is currently on the rise, dancing in perfect harmony with the surging US yield!

The US dollar has been flexing its muscles lately, gaining strength against several major currencies. This upward trajectory has been propelled by the impressive rise in US yields, which have been climbing to new heights. It's a fantastic opportunity for us to capitalize on this bullish trend and potentially reap some significant rewards.

Now, you might be wondering how we can make the most of this incredible situation. Well, my dear traders, I would highly encourage you to consider going long on the US Dollar Index (DXY). By taking a long position on DXY, we can align ourselves with the current market sentiment and potentially maximize our profits.

Here's why I believe this is a golden opportunity:

1. Strong US Economy: The US economy has been showing remarkable resilience, with positive economic indicators and robust recovery efforts. This strength is attracting investors, leading to increased demand for the US dollar.

2. Rising US Yield: The surge in US yields has been grabbing attention worldwide, making US bonds more attractive to investors seeking higher returns. This influx of capital further bolsters the US dollar's position.

3. Technical Indicators: By analyzing technical indicators, we can see a bullish pattern emerging in the US dollar. This pattern, combined with the positive fundamentals, reinforces our confidence in the potential success of a long position on DXY.

So, my dear traders, let's seize this opportunity and ride the wave of the rising US dollar together! I urge you to carefully evaluate your trading strategies, assess the risks involved, and consider initiating a long position on DXY to potentially capitalize on this exciting market movement.

Remember, success in trading often comes from recognizing opportunities and acting upon them swiftly. The US dollar's ascent, coupled with the soaring US yield, presents us with a chance to make profitable trades and elevate our trading portfolios.

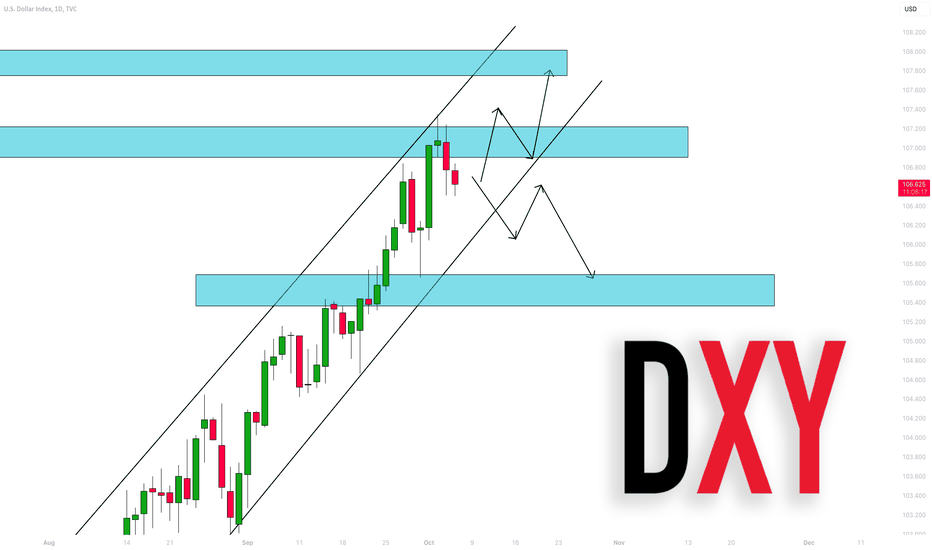

DXY(Dollar Index): 18/10/2023: Possible scenarios As you can see, the market structure is bullish so we expect higher prices will be seen.

Since the price collected liquidity below 105.5 and then had a bullish reaction we mentioned Order Flow and Order block as support that can cause the price to move higher for creating a higher high.

💡Wait for the update!

🗓18/10/2023

🔎 DYOR

💌It is my honor to share your comments with me💌

DXY (Dollar Inde) - Bullish ZoneAs per our analysis, it is predict on weekly time frame, that the next target of DXY 107.83, We can take a long position from the level of 106.60, with tight Stop Loss of 105.20, For more trade and info and timely analysis like, boost and share our post and follow us that.

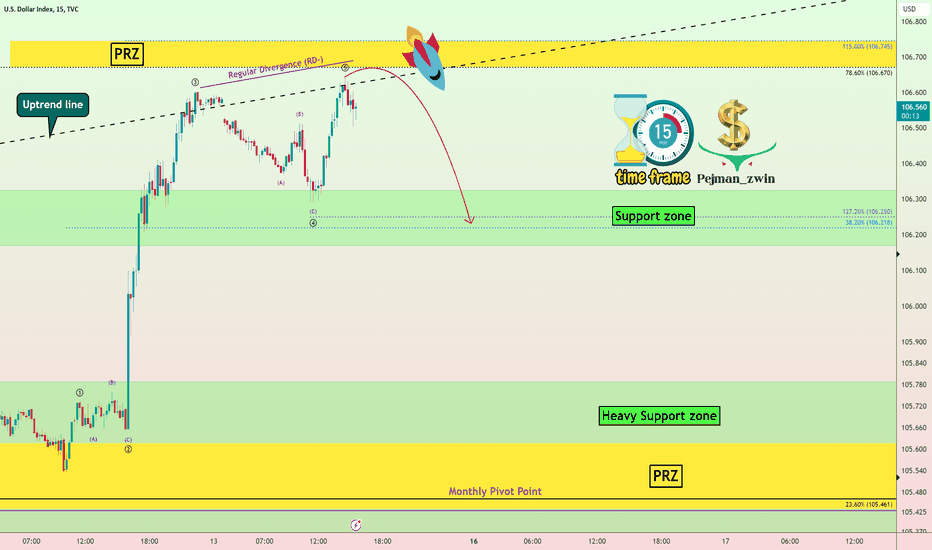

⚠️DXY will Go Down again⏰(15-Min)⏰⚠️DXY Index is running near the Uptrend line and 🟡 Price Reversal Zone(PRZ) 🟡.

According to the theory of Elliott waves , the DXY index has succeeded in completing its 5 ascending waves near the 🟡 Price Reversal Zone(PRZ) 🟡.

💡Also, we can see Regular Divergence(RD-) between two consecutive peaks.

🔔I expect the DXY Index to trend lower in the coming hours and at least go down to the 🟢 Support zone($106.330_$106.160) 🟢.

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 15-minute time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

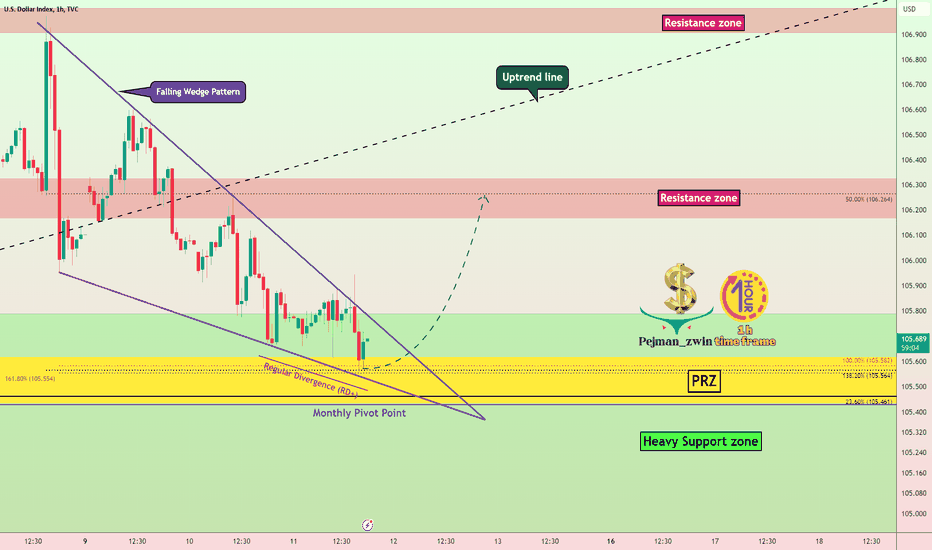

💸DXY Index💸 will Go Up by Falling Wedge Pattern⏰(1-Hour)⏰✅The DXY Index has completed a Falling Wedge Pattern in the 🟢Heavy Support zone($105.80_$104.530)🟢 and 🟡 Price Reversal Zone(PRZ) 🟡.

💡Also, we can see Regular Divergence(RD+) between two consecutive valleys .

🔔I expect the DXY Index will go UP after breaking the upper line of the Falling Wedge Pattern to the 🔴 Resistance zone 🔴.

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 1-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Potential for Continued Rise in US Dollar as Bond Yields SpikeBond yields have been on the rise lately, and this trend may continue in the near future. As a result, it is crucial to approach the situation with caution and consider the potential opportunities it presents.

The correlation between bond yields and the US dollar is well-established. When bond yields increase, it often attracts foreign investors seeking higher returns, leading to an appreciation in the value of the US dollar. Given the recent spike in bond yields, it is reasonable to anticipate a continued rise in the US dollar's value.

However, it is important to note that market dynamics can be unpredictable, and various factors can influence currency movements. Therefore, I encourage you to exercise prudence and conduct thorough analysis before making any trading decisions. Here are a few factors to consider:

1. Monitor Economic Data: Keep a close eye on economic indicators such as inflation rates, employment figures, and GDP growth. These data points can provide insights into the overall health of the US economy and its potential impact on the currency.

2. Central Bank Policies: Stay informed about any shifts in monetary policies by the Federal Reserve. Changes in interest rates or quantitative easing measures can significantly influence the US dollar's trajectory.

3. Global Events and Geopolitical Risks: Consider geopolitical developments and their potential impact on the US dollar. Factors such as trade tensions, political instability, or unexpected events can create volatility in the currency markets.

Considering the potential for the US dollar to continue its rise, it may be prudent to explore long positions on the currency. However, I strongly urge you to conduct thorough research and consult with your financial advisors before making any investment decisions. Remember, trading involves inherent risks, and it is crucial to carefully assess your risk tolerance and financial goals.

As always, it is essential to stay updated with the latest market news and trends. By staying informed and adopting a cautious approach, you can navigate the currency markets more effectively.

Wishing you successful trading ahead!