Dominion Energy Inc. September 02, 2025.$D #DominionEnergy — Dominion Energy Inc. (NYSE:D) Insider Activity Report | Utilities | Utilities - Regulated Electric | USA | NYSE | September 02, 2025.

Overview: This report evaluates the recent open-market purchase of Dominion Energy (D) shares by its Chair, President, and CEO on August 27, 2025. Dominion, a leading regulated utility with a focus on transitioning to clean energy, is well-positioned amid surging electricity demand from data centers and renewable initiatives.

The insider activity, against a backdrop of solid Q2 earnings and strategic investments, suggests executive confidence in near-term value creation. This analysis is tailored for institutional investors seeking exposure to resilient utility plays with growth catalysts.

1. Insider Trading

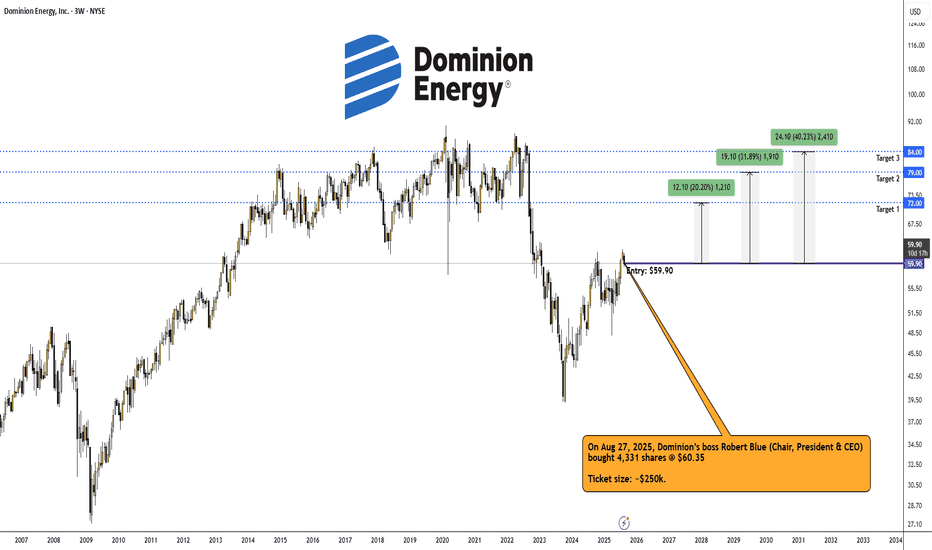

On Aug 27, 2025, Dominion’s boss Robert Blue (Chair, President & CEO) bought 4,331 shares @ $60.35.

Ticket size: ~$250k. (SEC Form 4)

www.sec.gov

Not huge for a $50B utility, but it’s his first open-market buy since Mar ‘24. No insider sales on record. That’s a confidence move.

2. Fundamentals

• Q2 EPS: $0.75 (beat by 8.7%). Revenues $3.5B (+3% vs est).

• FY25 EPS guidance reaffirmed at $3.28–$3.52.

• Dividend yield ~4.5% — not bad while you wait.

• $50B capex plan (2025–2029) focused on data centers + renewables.

• Offshore wind project facing cost bumps, but still on track.

3. Big Picture

• Utilities usually move slow, but AI/data-center demand is a real tailwind.

• Dominion already hooked up 15 centers (1,000 MW) in 2024, another 15 on deck this year.

• SCC hearings Sept 2 on rate adjustments — could unlock recovery on those heavy investments.

Charts:

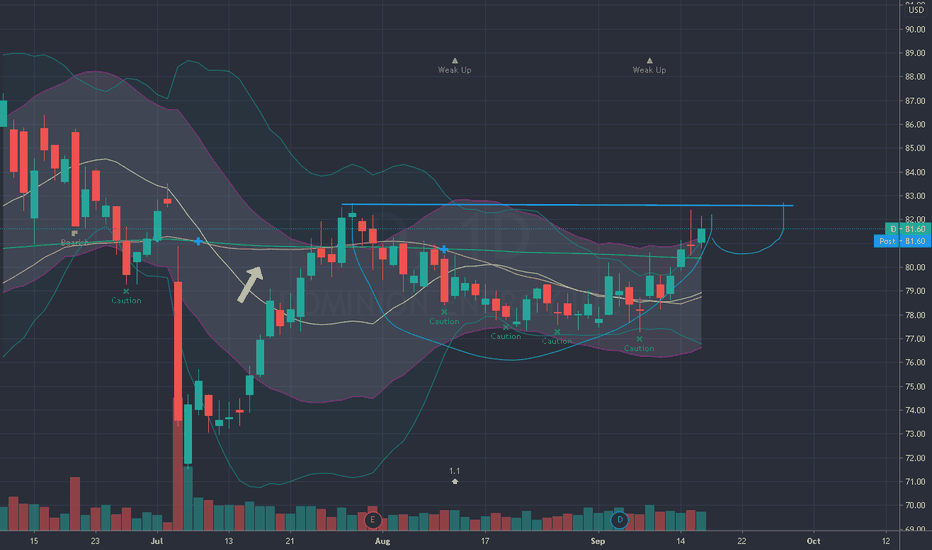

• (3W)

Insider Trades:

D Ownership:

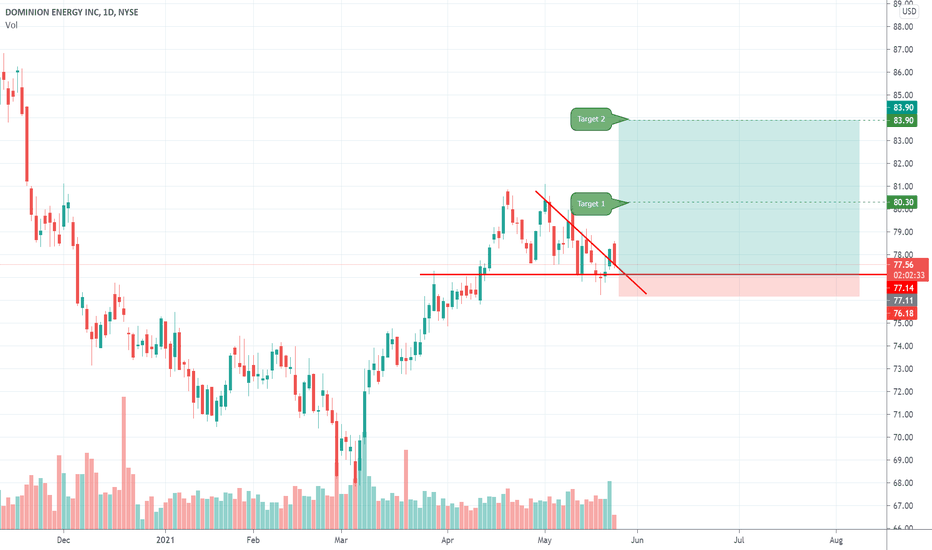

4. Trade Setup

Entry: $59.90–$60.35 (right around CEO’s buy).

Targets:

➡️ Short-term: $72.00

➡️ Mid-term: $79.00

➡️ Long-term: $84.00

Takeaway

CEO’s dipping into his own pocket right after an earnings beat + with data-center growth at his back? That’s not charity. That’s conviction.

For me, $D looks like a buy/accumulate here with 20–40% upside over 6–12 months. Worst case you clip the dividend while waiting — not the worst seat in the house.

Dominionenergy

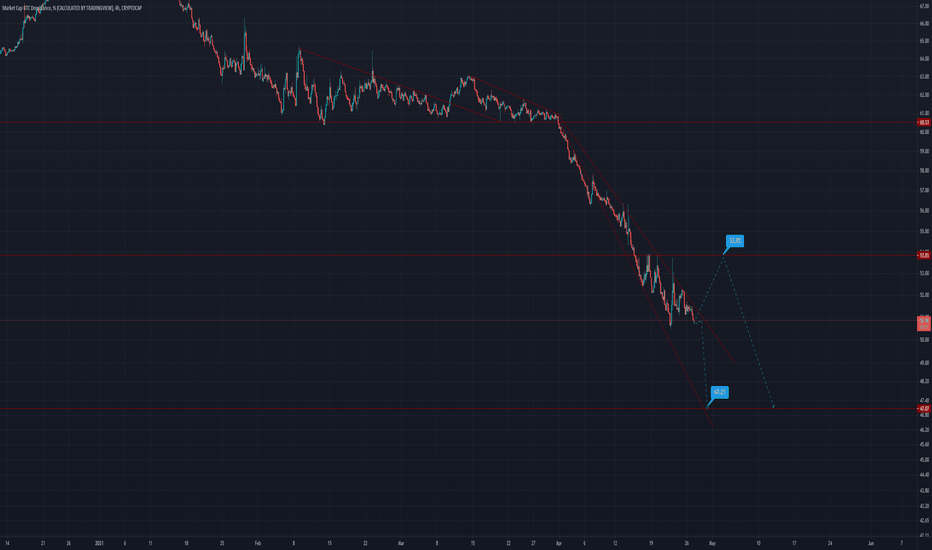

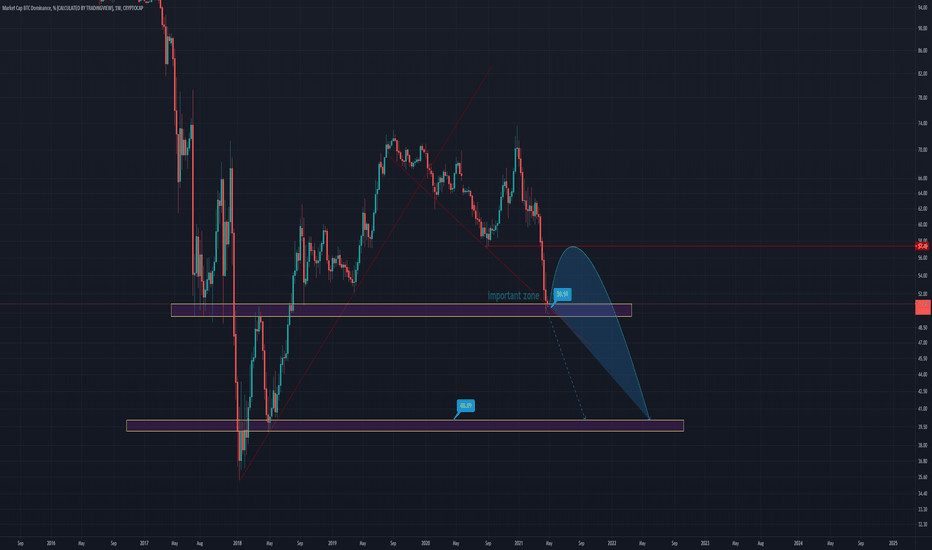

#BTC.D #4H #dominance #bitcoindominanceHi guys..its the latest analyze chart of btc.d in #4H time frame(folowers Requested analysis) .if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

#btc.d #15m #bitcoindominance #btcdominance #15mHi guys..its the latest analyze chart of #BTC.D(folowers Requested analysis) .if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

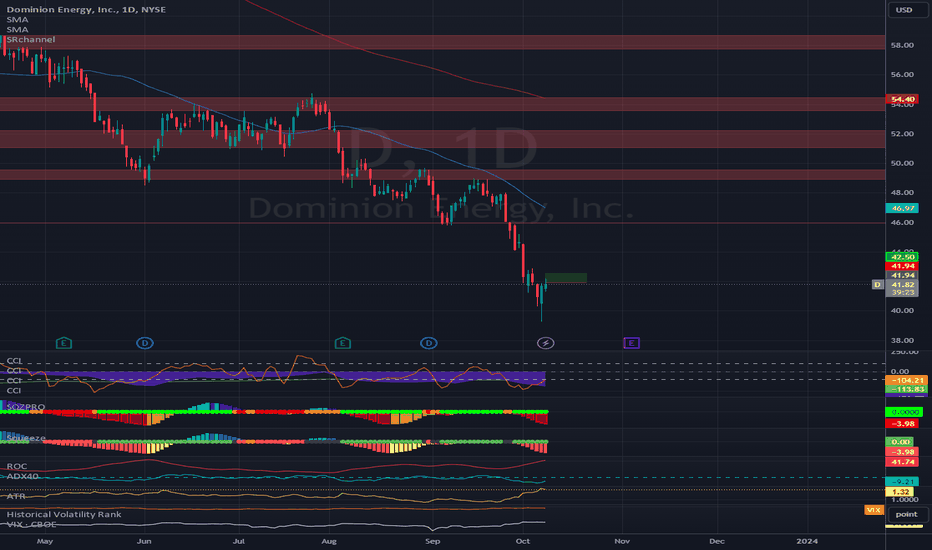

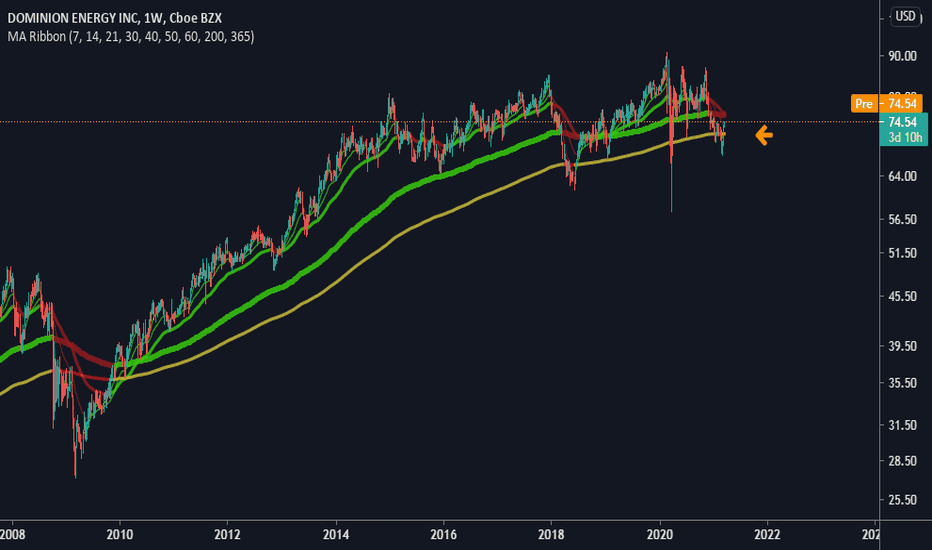

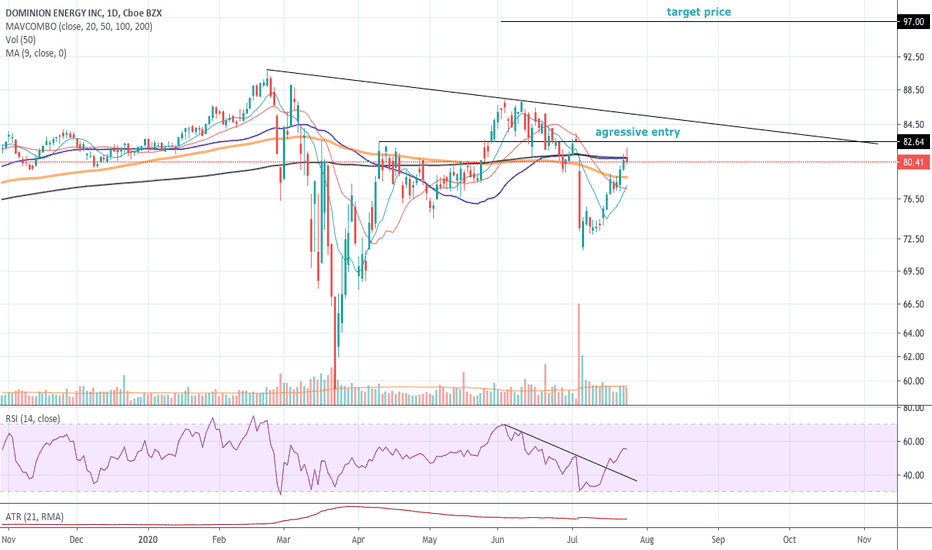

Dominion Energy $D$D broke the rsi downtrend line out and tries to break 50SMA. worth to watch this stock. We may get in if holds above $82.67

12 months Consensus Price Target: $82

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

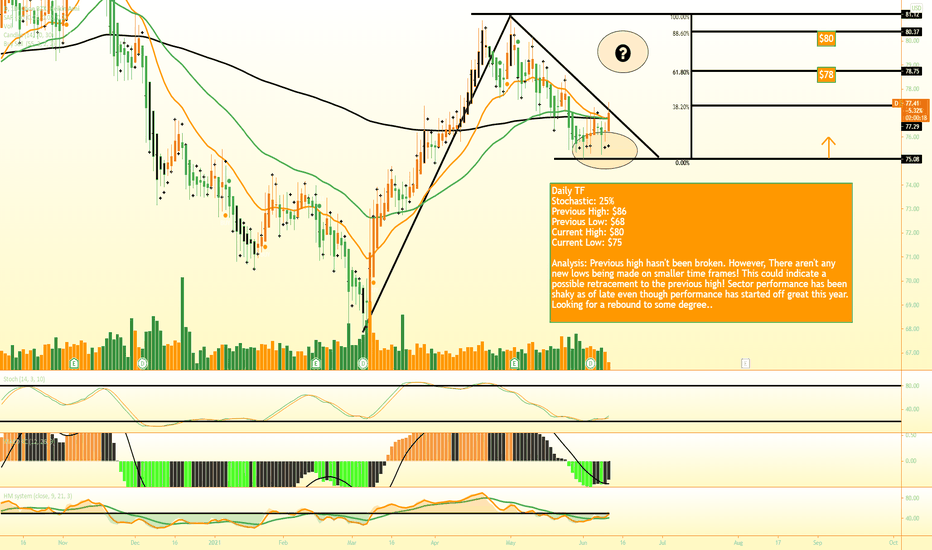

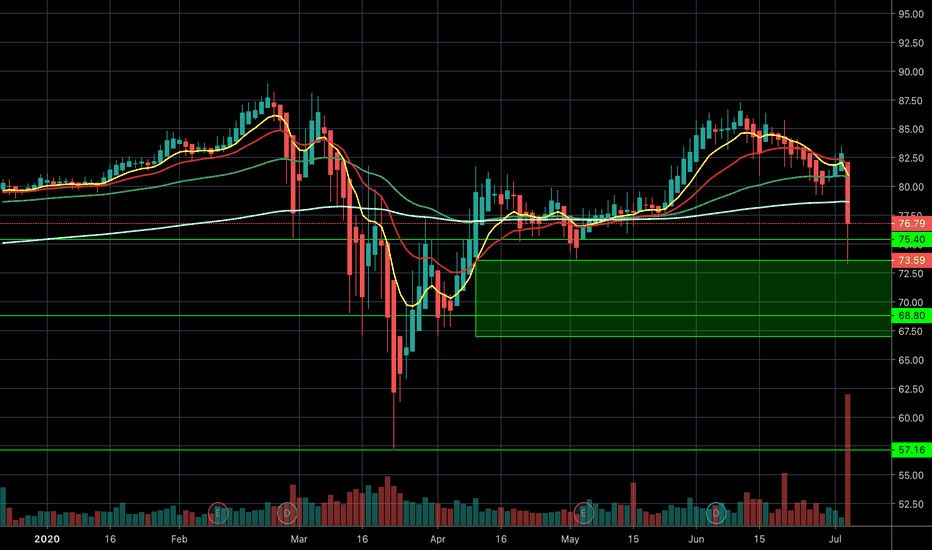

$D Buffet Falling Off ShortNYSE:D with $XLE looking like a rocket ship to downside. I was not expecting this horrible of a move on the Berkshire news. But there is one thing for certain (possibly two):

1. 2020 is off to a bumpy start w/ selling the airlines before fed intervention.

2. Market seems to do opposite of what buffet does. POTUS/Fed making a statement? (Opinion) 🤨😂

Have a good day everybody and good luck! Will try to post ideas more often.

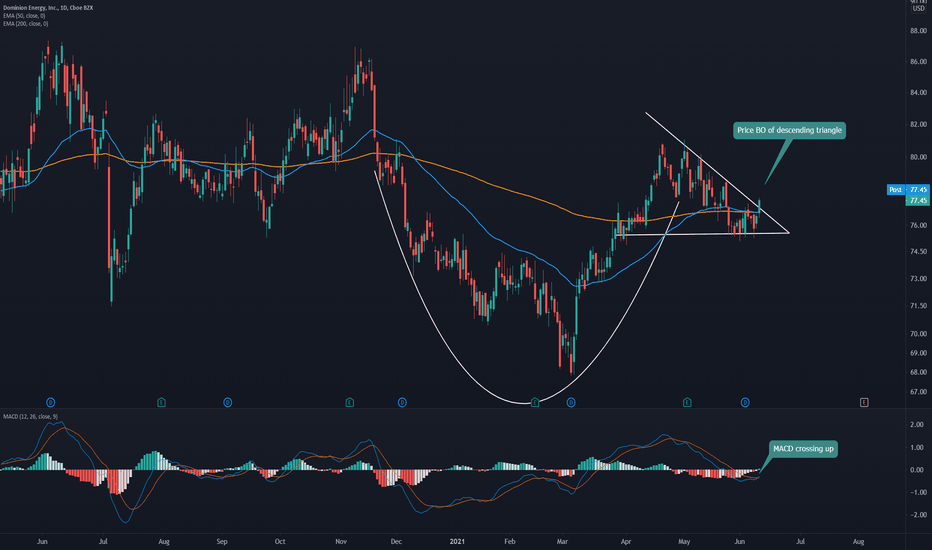

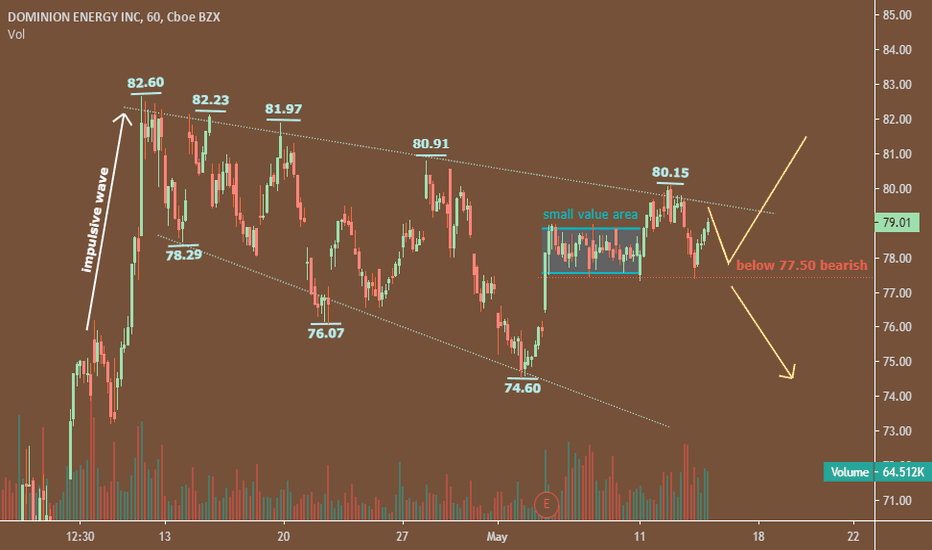

Demand of Dominion Energy....!Buyers are active in the current price, and if the volume increase the price will break the resistance level and go beyond the resistance.

If the prices come lower level and breaks 77.50 level it is predicted that it will move do down direction.

----4 hour chart----

In 4 hour time frame price is creating a value area,

if The buyers are more active then the sellers, price will break the value area and it will go up-direction. And if not the price will continue its move zig-zag formation.

I'm Bearish on D: < $70First off, please don't take anything I say seriously or as financial advice. As always, this is on opinion basis. That being said, let me get into a few points. I am bearish on Dominion Energy given many analyst are giving it a sell rating, I don't expect it to likely have had a positive earnings call this time period. If it isn't so flat, much improvement wouldn't likely have been seen. That is why I think it will go down to at least the $70 price point quite soon.