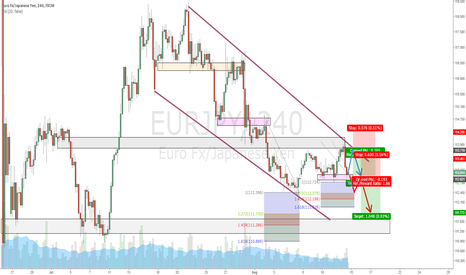

Double Bottom at previous ResistanceHi traders, today in my morning analysis i've spot this opportunity in AUDJPY. My analysis starts from higher timeframe. In this case we are sitting in a previous 4HR resistance that could become support. The trend is our friend and we want to hop on that as soon as it gives us a reason for entry.

So here we have a double bottom in 1HR with an engulfing candle (marked with the arrow).

In addition, we are also near to an even handle number (79,00) that usually makes the markets react and we can see RSI divergence.

My levels are:

Entry: 79.09s

Stop loss: 78,69s

Target1: 79,48s

Target2: to be evaluated

Hope you understand my reasons, for any question don't hesitate to ask.

See you soon!

Double

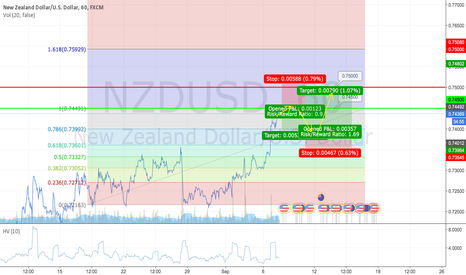

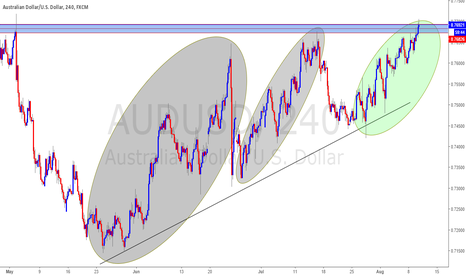

Quick short and a long afterWe can start with a quick short, the market seems to be going for a slight drop, it's probably going to have some problems going through the 0.74500 (TP: 0.73964 SL: 0.75080). After the currency drops significantly, i expect it will try to break the 0.74500 resistance line and go try the 0.75000. Long at 0.74012 (TP 0.74802 SL: 0.73545).

I will setup the second one as pending and good until the end of the day as i am not sure what the market will look like tomorrow and the long maybe kind of going too far.

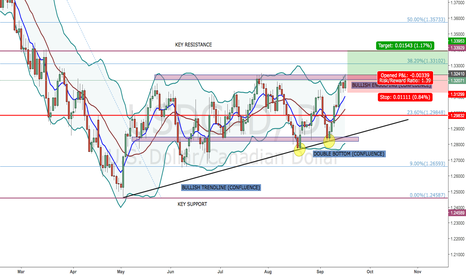

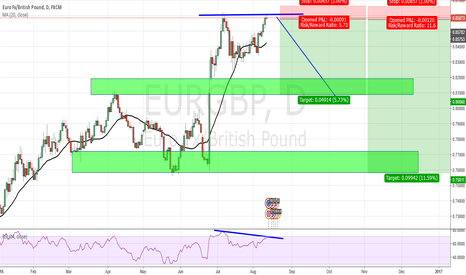

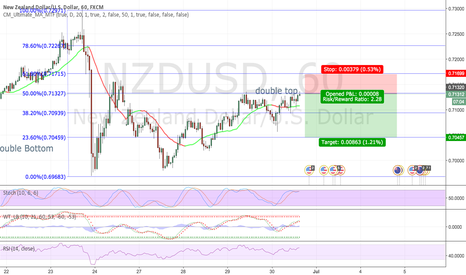

Long Term ShortThis is a trade with two entry areas. According to your risk tolerance, you can enter at the lower area which will in turn increase your chance of getting filled on this trade. On the other hand, the upper entry area reduces the overall risk of the trade but at the same time reduces the likely hood of getting filled. With the high probability nature of this particular setup, taking the lower level, personally, is the best option.

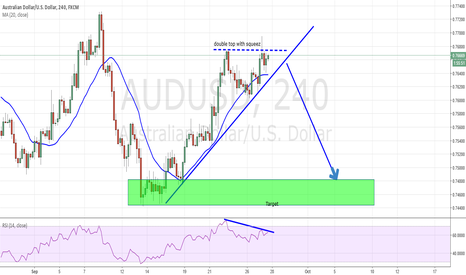

AUDUSD short due to 4hr double top. Near end of 618 retracementNot only do we have a double top in effect on the 4hr chart, but we are hitting resistance as well on the daily chart. The USDollar also looks like its hitting support on the 4hr, so i'm looking for a rally there to confirm the drop on AU. The 618 fibonacci buy retracement on the 4hr also looks like its coming to an end. AKA our 5th leg of Elliot Wave.

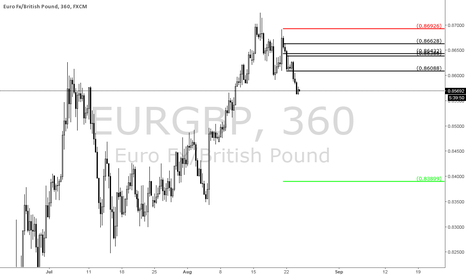

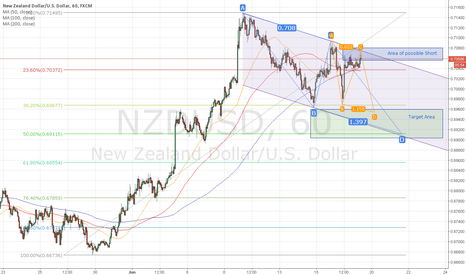

Potential downtrend on the DAXAfter the price couldn't break through the upside of the last high anymore a double top was formed and the price fall down below the trendline.

Now the price has retraced 76.40% and it seems that a lower high has formed. Normally I would watch for a good opportunity for a short trade here but because of the referendum tomorrow I will stay out of any trades for this week and wait until monday to trade again.

Eventually the referendum is helping to drop the price as I expect here but I think the risk is way to high to be stopped out in the next two days.

I wish everybody who is still trading good luck and nice profits.

Dennis

PS: I give no advice, I only share my opinion.