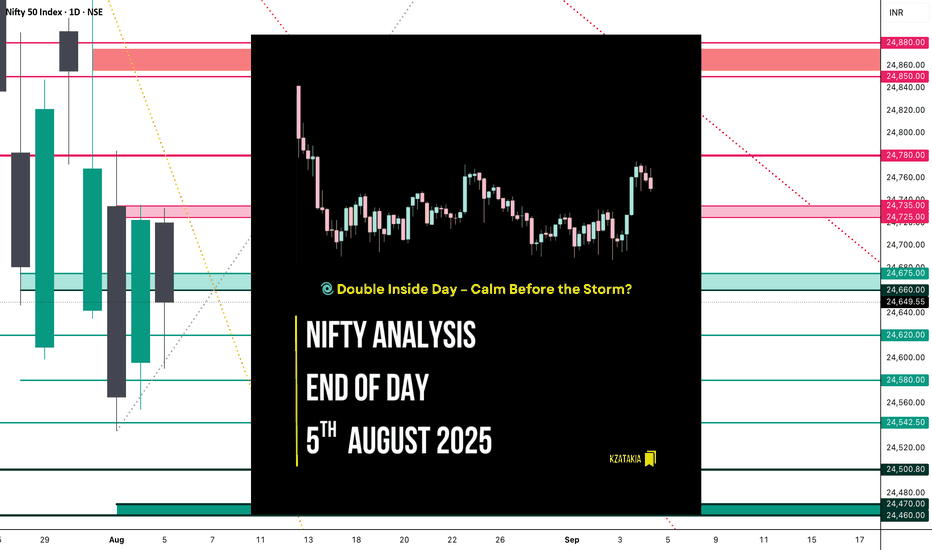

Nifty Analysis EOD – August 5, 2025 – Tuesday 🟢 Nifty Analysis EOD – August 5, 2025 – Tuesday 🔴

🌀 Double Inside Day – Calm Before the Storm?

📊 Nifty Summary

In the wind of negative news, yet Nifty starts neutral at the resistance zone of 24,725 ~ 24,735 but was unable to hold there and fell 140 points within the first 45 minutes.

After this initial sell-off, Nifty found support around 24,590, which coincided with yesterday's Fib 0.786 level, R1, and Previous Week Low (PWL).

These levels were well-defended throughout the session. Near the end, the index recovered ~80 points and closed at 24,649.55, close to yesterday’s Fib 0.5.

Can we consider today's move a retracement or a pullback of yesterday's move?

Same as Monday, today’s action stayed inside the previous session’s range, forming an Inside Bar. Now it appears as a Double Inside Bar on the daily chart.

📉 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,720.25

High: 24,733.10

Low: 24,590.30

Close: 24,649.55

Change: −73.20 (−0.30%)

Candle Structure Breakdown:

🔴 Red Candle (Close < Open):

24,720.25 − 24,649.55 = 70.70 points

🔼 Upper Wick:

24,733.10 − 24,720.25 = 12.85 points

🔽 Lower Wick:

24,649.55 − 24,590.30 = 59.25 points

Interpretation:

After a flat open, the index tried to move higher but faced resistance near 24,730, then reversed.

Buying interest was seen near the 24,590 zone, but sellers remained in control.

It closed below the open with a decent lower wick, indicating some buying support but overall weakness.

Candle Type:

🕯 A pullback candle with a moderate real body and long lower wick – suggests buyers attempted to support the fall, but sellers dominated.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 202.71

IB Range: 139.95 → 🟠 Medium

Market Structure: Balanced

Trade Summary:

❌ No entry triggered by system

📌 Support & Resistance Levels

🔼 Resistance Zones:

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

🔽 Support Zones:

24,675 ~ 24,660

24,620

24,542 ~ 24,535

24,500

24,470 ~ 24,460

🧠 Final Thoughts

Today's double inside bar structure signals contraction and indecision — markets are waiting for a decisive breakout.

“The tighter the coil, the bigger the breakout.”

Keep an eye on these tight ranges. Patience before power!

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Doubleinsidebar

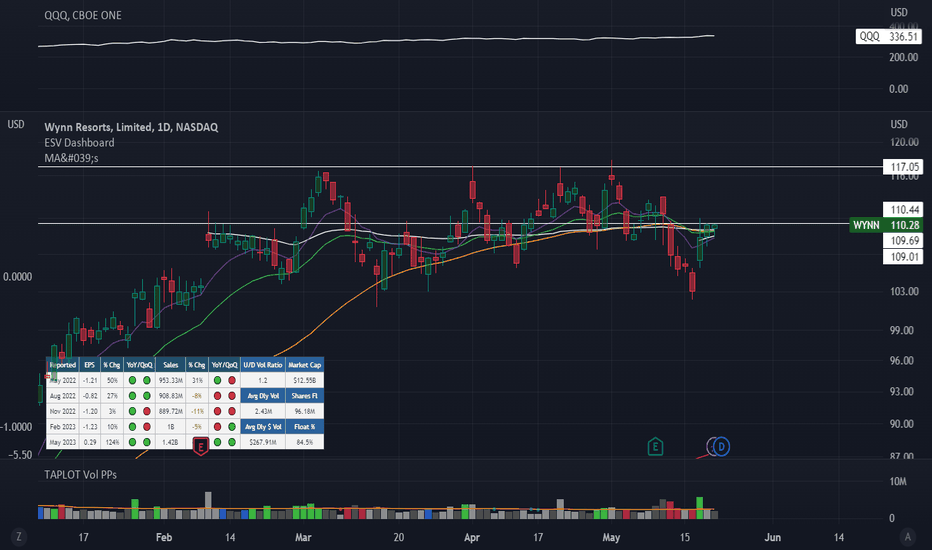

$WYNN - Double inside day & Launchpad setupSince the market seems to be in a 'confirmed' uptrend (HH & HL + increase in breadth), it's time to be bullish again!

Top idea for next week: Wynn Resorts ( NASDAQ:WYNN )

Buy with break of the High of the day c. 110.4

Reasons:

- Double inside day in the upper wick of a positive High Volume candle (analyst upgrade and positive news) + confluence of 10,21 and 50 day ( launchpad )

- Tight consolidation with shakeout since the beginning of february

- Bullish momentum since november

- Positive Earning momentum + good fundamentals (EPS q/q & sales >30%)

Stop-loss:

- Low of the second inside day 108.98

- If breakout happens, stop loss could be 10day MA or AVWAP of HV day

PT:

- First area of resistance ca. 117 (partial)

- Fibs: 125

- Or following the 10/21 MA

Follow price and volume + fundamentals !

No investment advice