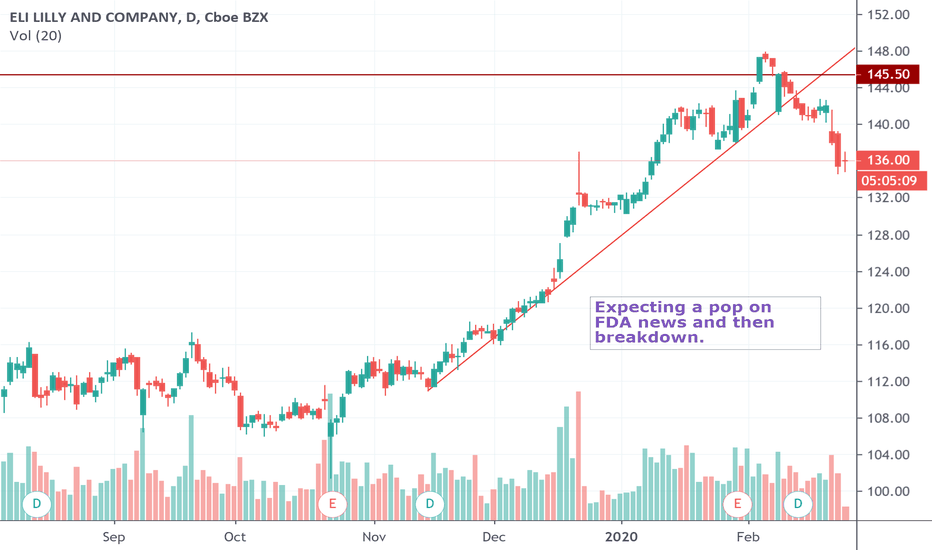

LLY Sell the RallyMy dowsing method suggests LLY gets their FDA approval, and the stock will pop, but that in the longer term, this stock is going to breakdown; probably with the entire market.

I'm getting that the resistance will be around that $145-46 zone, which would also be a test of the uptrend line from below. Good luck!

Dowsing

ESPR FDA burn it down?BE CAREFUL!!

I'm getting bad vibes on the news for tomorrow in this one. This is based on my dowsing work and it suggests a drop of 38%. That would rock it down to about $42.50

FYI I don't know anything about the fundamentals or background on this pending approval, and I really don't know anything about the company, nor do I care.

I'm not super confident yet in estimating percent moves, and this is only my second FDA prediction, so we'll see.

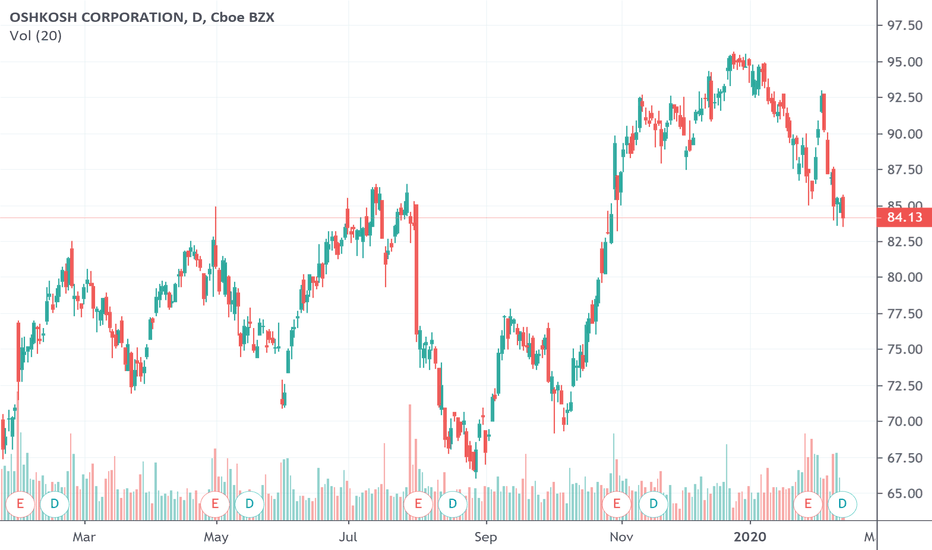

OSK BTD off Symmetry SupportThis came to me in meditation, and this is a good thing, usually. The chart is ugly with no great trend, but this is what I'm given. I do technicals and then a "reading" with my pendulum and cards.

What I'm seeing:

- weekly timing just counting bars, and it appears to be in a weekly timing window.

- 200 EMA at $83.42, 50 week MA $82.45, weekly ATR trailing stop just above there and Symmetry support at $81.76

- I like the zig zag pattern down.

- The "reading" indicates we expect to dip below last week's low ($83.62) and reverse. I feel good about the message and the way it lines up with the technicals. I'm looking for a 5% gain this week ($86.55 from entry) and then I'm out.

- Entry ~ $82.43 near 50% retracement

- Stop is a daily close below $81.76 (sym. support)

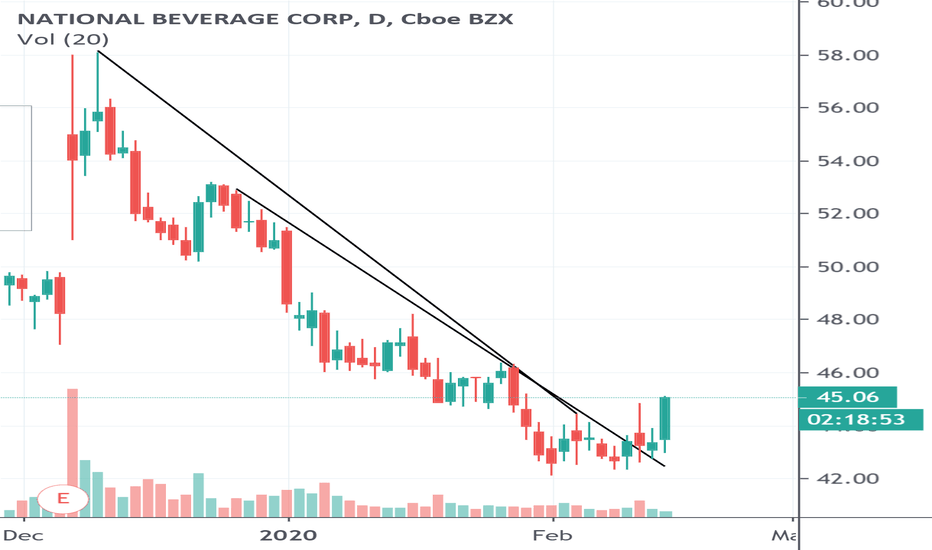

FIZZ back to buoyant?First post here. FIZZ keeps catching my eye, so I notice today it's broken some bearish symmetry resistance. I'm not even an Elliott wave novice, but it looks like 5 waves down and breaking the downtrend lines.

The dowsing I do suggests a trend reversal in the works.

Symmetry resistance coming up at 45.28. Wouldn't be surprised at a slight retrace around there.

At the moment (2/14 1:30) symmetry support is at $43.91 and $43.44 and that would be a good entry zone if it holds. Stop out if it's going to close the day below $43.

Hold time is ~5.5 weeks with target of $51.33

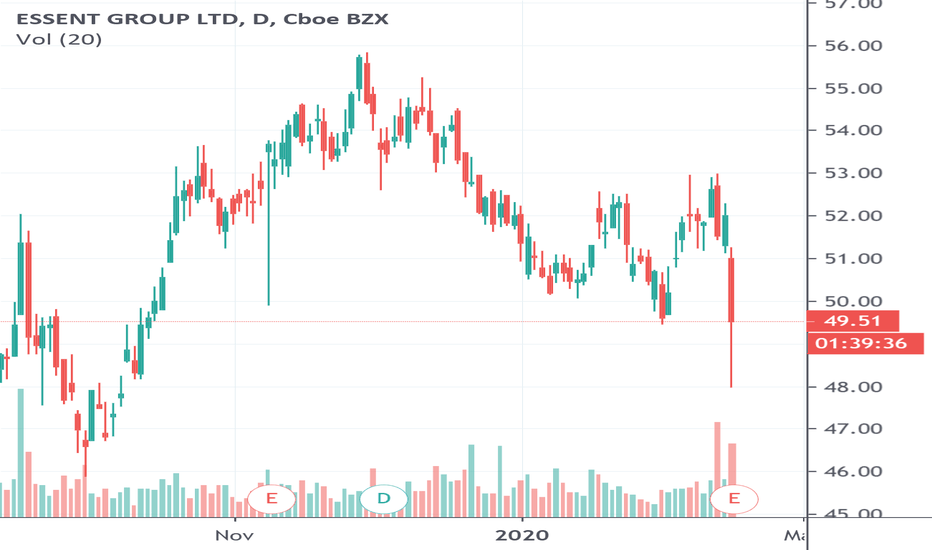

ESNT more like, DSNTLooks like break of a neckline on a weekly and daily chart. A sloppy head and shoulders. Symmetry support held at $48.15 this morning after earnings, but my dowsing suggests selling rallies with a trend reversal, and that ESSENT is in DESCENT.

2 Bar daily squeeze likely to fire short, and I expect downward pressure on indexes, so this looks like the beginning of a downtrend.

I wouldn't want to see it close above it's 20 period daily MA (now at 51.30), but stop at $52.

Entry anywhere under there.

Hold ~9 weeks. Target $34.38 area