Micron Technology (MU) – Powering the AI Memory SupercycleCompany Overview:

Micron NASDAQ:MU is a crucial player in the AI infrastructure stack, providing advanced DRAM, NAND, and NOR flash memory solutions that fuel everything from data centers to mobile edge devices.

Key Catalysts:

AI-Driven Memory Demand ⚙️

High-Bandwidth Memory (HBM) adopted in AI accelerators from Nvidia, AMD, Broadcom, and Marvell.

Positions Micron at the core of the AI supply chain, reducing exposure to chip cycle volatility.

Data Center Surge 📈

Data center DRAM revenue tripled YoY in Q2 2025, driven by hyperscaler AI infrastructure upgrades.

Strengthens revenue diversification and margin profile.

Technology Leadership 🔬

Launch of 1-gamma DRAM node and LPDDR5X samples enhances mobile, cloud, and auto capabilities.

Keeps Micron on the cutting edge of memory innovation.

Investment Outlook:

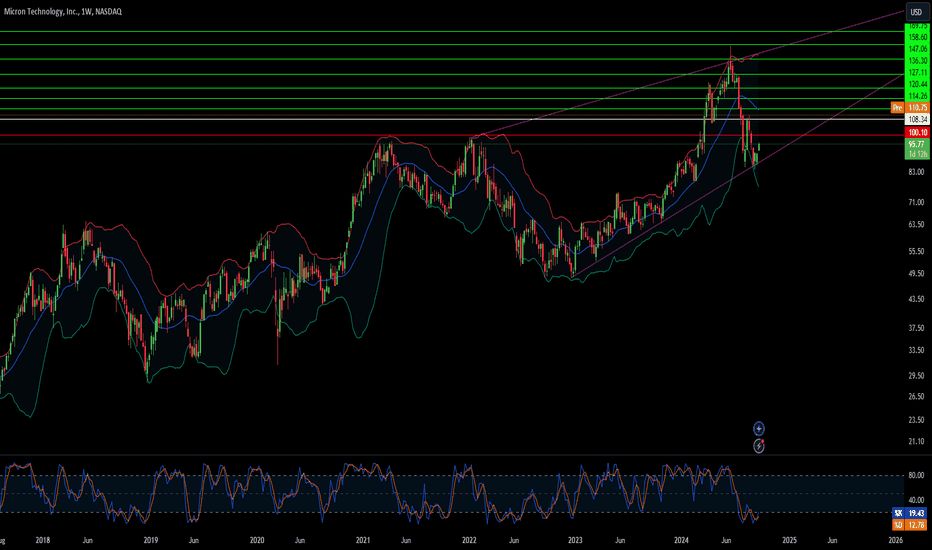

Bullish Case: We remain bullish on MU above $95.00–$97.00.

Upside Target: $155.00–$160.00, supported by AI compute growth, hyperscale momentum, and next-gen product launches.

💡 Micron is not just riding the AI wave—it’s building its memory core.

#Micron #MU #Semiconductors #AI #HBM #DataCenter #DRAM #NAND #Nvidia #AMD #Hyperscalers #TechLeadership

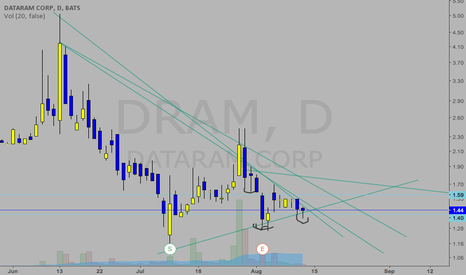

DRAM

What Lies Beyond the Horizon of Memory?In the ever-evolving landscape of technology, the horizon of memory has been pushed back further than ever before. Micron Technology, a pioneering force in the semiconductor industry, has once again redefined the boundaries of what is possible. Their recent financial performance, driven by the surging demand for AI-powered memory solutions, is a testament to their unwavering commitment to innovation.

Micron's Q4 results were nothing short of extraordinary. Revenue soared by an astonishing 93%, fueled by the insatiable appetite for data center memory chips that power AI applications. The company's strategic positioning as a leading supplier of High-Bandwidth Memory (HBM) has proved to be a masterstroke. HBM, a critical component in AI servers, has become a cornerstone of Micron's success, securing long-term contracts and commanding premium pricing.

Beyond HBM, Micron's diversified memory portfolio ensures a sustainable growth trajectory. The company's dominance in DRAM and Nand flash memory, essential components for personal computers, servers, and smartphones, positions it to capitalize on the ongoing surge in device shipments and the increasing integration of AI functionalities.

Micron's competitive edge is further solidified by its strategic investments in capacity expansion, including a new fabrication site in New York. This expansion not only reinforces Micron's position as a leader in the memory chip industry but also paves the way for future innovation and growth.

As the AI revolution continues to unfold, Micron's unwavering commitment to pushing the boundaries of memory technology remains steadfast. Their ability to anticipate and address the evolving needs of the market has positioned them as a key player in shaping the future of AI and beyond. The question that lingers is: what lies beyond the horizon of memory?

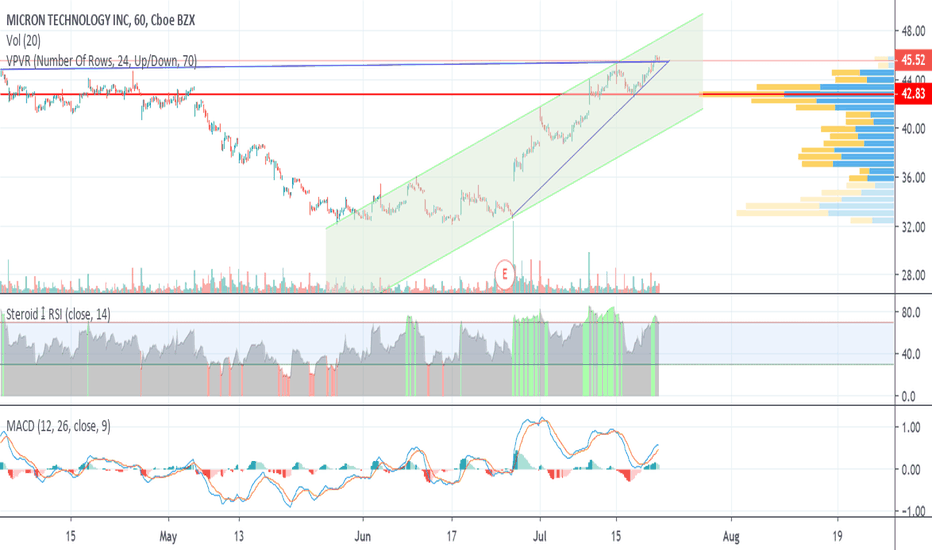

Micron upgrade, call activity, and ascending triangle breakMicron (MU) got an upgrade to "strong buy" over the weekend from Zack's, the best-performing analytics firm. It also got some huge options volume today, targeting $49 and $55 per share. That's probably on the strength of both the Zack's upgrade and the stock's ascending triangle break. The triangle break implies an upside of about $6 per share from the current level.

Micron pops on non-GAAP earnings report gimmickMicron has been looking bearish in what appeared to be an emerging downward channel. However, after hours today it popped two and a half dollars per share on the basis of a supposed earnings beat. News outlets are reporting that earnings "crushed" estimates. The problem is that the analyst estimates are for GAAP earnings, and Micron's GAAP earnings missed by several cents per share. By disclosing non-GAAP earnings, Micron used a common gimmick to appear to have beaten estimates that doesn't reflect actual strength in the company's fundamentals. Whether investors will notice this is another matter, however. The stock may stay up tomorrow regardless. But I personally wouldn't invest in it.

To Micron's credit, it did slightly beat estimates of GAAP revenue even though it missed on earnings.

i really want to go long here.I really want to go long here but it seems to risky, any help would be appreciated. Sorry for the messy chart its one of my worse