DuPont (DD) Upgraded to 'Overweight' by KeyBancDuPont de Nemours (NYSE: $ DD) shares rose 2.38% to $61.54 today, adding $1.43 amid broader concerns for the U.S. chemicals sector. The stock has traded 8.24 million shares so far, reflecting increased investor interest following a notable analyst upgrade.

KeyBanc Capital Markets recently upgraded DuPont to "Overweight" with an $81 price target despite cutting 2025 EBITDA estimates across the chemicals sector by an average of 5%. The firm specifically highlighted DuPont's "world-class" electronics and water businesses, describing them as secular growth franchises rarely available at current valuation levels.

This optimistic assessment comes against a challenging backdrop for chemical companies. The sector faces multiple headwinds including new U.S. tariffs, weakening global demand, and falling prices for key raw materials like ethylene and propylene. KeyBanc identified worrying demand signals beginning in March that likely continued into April.

The upgrade appears particularly significant considering DuPont shares have fallen 21% since March. Analysts view the company's strong balance sheet as a key advantage during uncertain economic conditions. The $81 price target implies a 12.8x 2025 EV/EBITDA multiple.

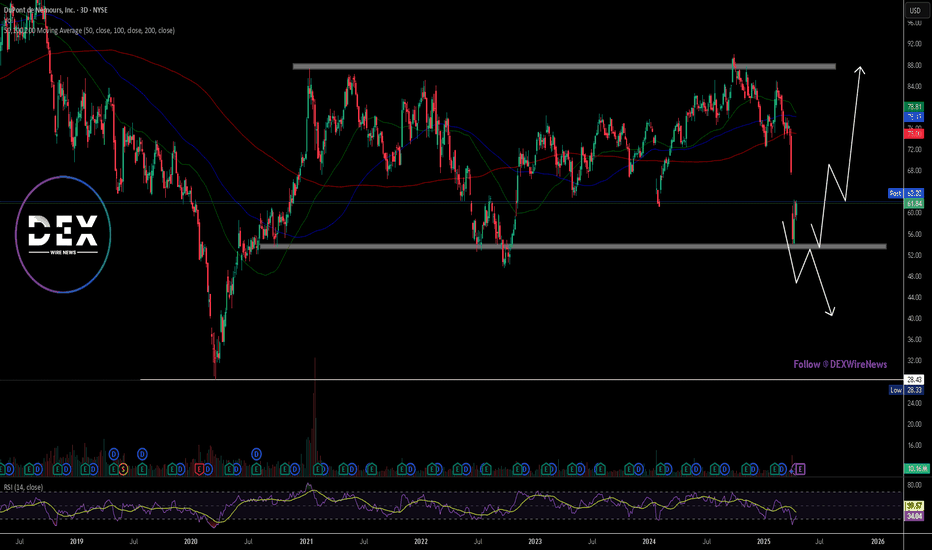

Technical Analysis

DuPont's stock is trading at a critical juncture after a significant decline from 2024 highs near $90. Currently priced at $61.54, DD has bounced from recent lows but remains below all major moving averages. The 50-day moving average (76.80) and 200-day moving average (78.00) both loom overhead as resistance levels.

The price action shows a clear rejection from the horizontal resistance zone around $88, which has capped advances multiple times since 2021. The RSI indicator at 39.92 shows neither extreme oversold nor overbought conditions.

Looking forward, potential price paths include both bullish and bearish scenarios. A recovery above $64 could target the 50-day moving average near $76.80, while failure to hold current levels might risk testing the 2020 pandemic low of $28.33.