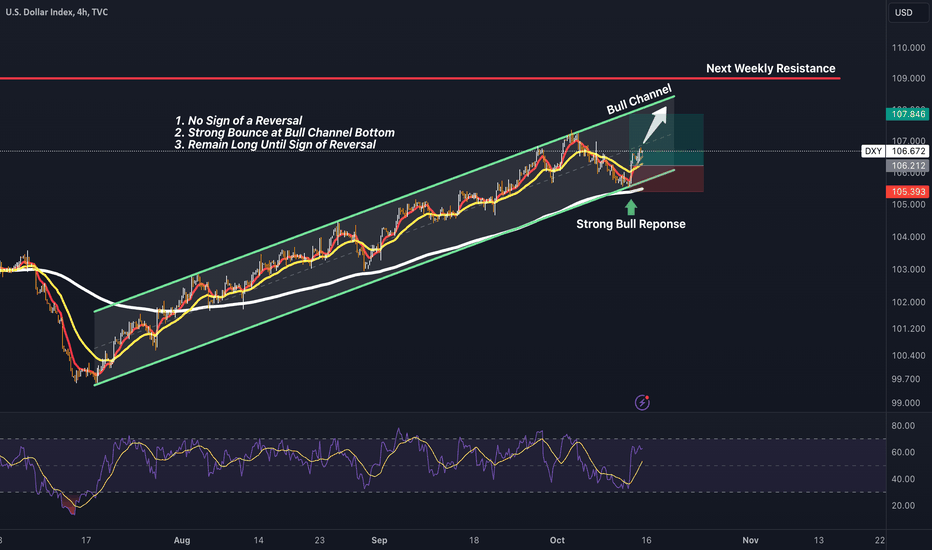

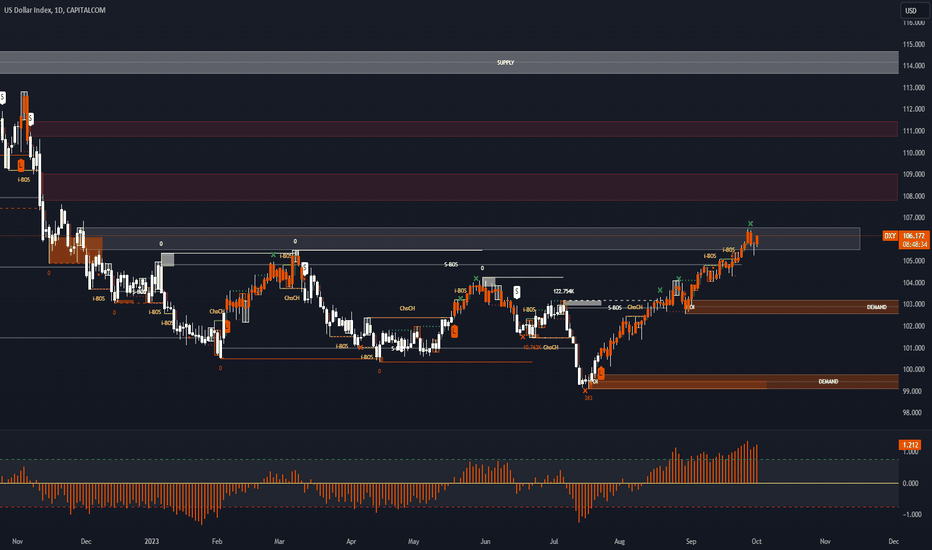

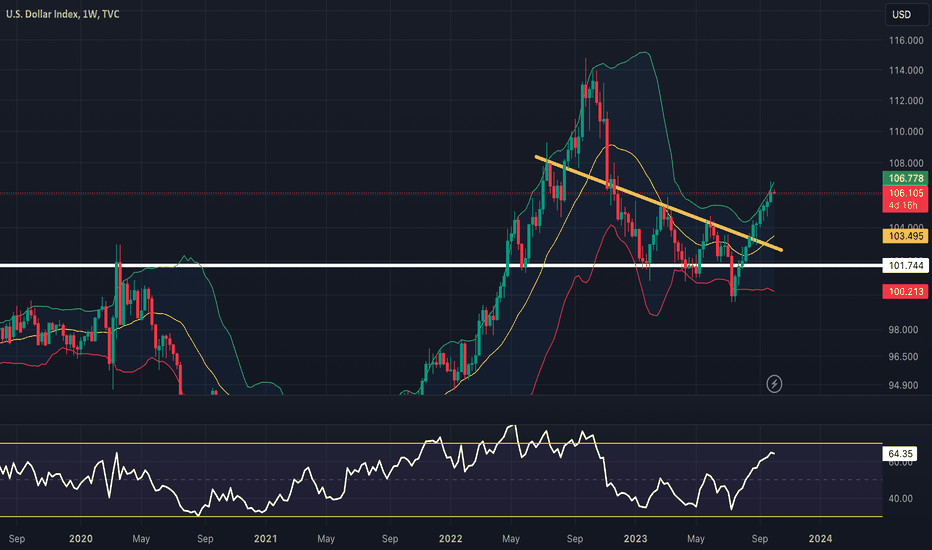

DXY 4HR Analysis - No Sign of a Reversal! Bull Channel ContinuesDXY refused to fall below 4HR 200EMA support last week and had a fantastic bounce to the upside. This bounce solidified the current bull channel we are in, with no sign of a reversal in sight. There is currently a gap between 106.672 and 109.000, which is the next weekly resistance zone noted from July 2022.

How do we trade this? Probability shows that breakouts are roughly 10% of price action on the charts. Until we see a bear breakout of this channel, we should remain long.

Trade Strategies:

Swinging

For a swing trade, long it if the price action is in the bottom 20% of this channel and place your stop loss a few pips below the 4HR 200EMA. This gives you at least a 1:2 Risk/Reward ratio where you can take partial or complete profits (depending on your strategy). I placed an example long in this chart, an opportunity that has already passed.

Scalping

You can also scalp your way to victory, but this requires you to lower your reward and increase your risk to gain probability of a profit. The proper stop of the 4HR chart is below the 200EMA or at least, below the bull channel bottom by a handful of PIPs. The further away you enter from that stop, the smaller your position size should be such that your total loss is the same as your 1:2 Risk/Reward ratio.

The Math

If we're applying the 2% rule in trading, meaning you cannot lose more than 2% of your total account equity on a single trade and your total equity is $10,000, then your maximum allowed loss is $200. Your position size should always be relative to your maximum loss which is determined by where your stop loss is placed.

This means a scalp at a 2:1 Risk/Reward ratio provides a profit of $100 at risk of losing $200. In a bull channel, the probability is on your side. If you took 10 trades scalping and won 8 out of 10 trades using this math, you would be up $400.

Using the Swing strategy, your probability is lower at the bottom of the channel, but your potential reward is greater, and your risk is lower($200 Reward and $100 Risk). If you won 5 out of 10 trades, you would be up $500.

As always, trade at your own risk, you are responsible for your trades, and I hope this information was helpful.

Trade wisely and let us know what you think in the comment section below!

Dxyanalysis

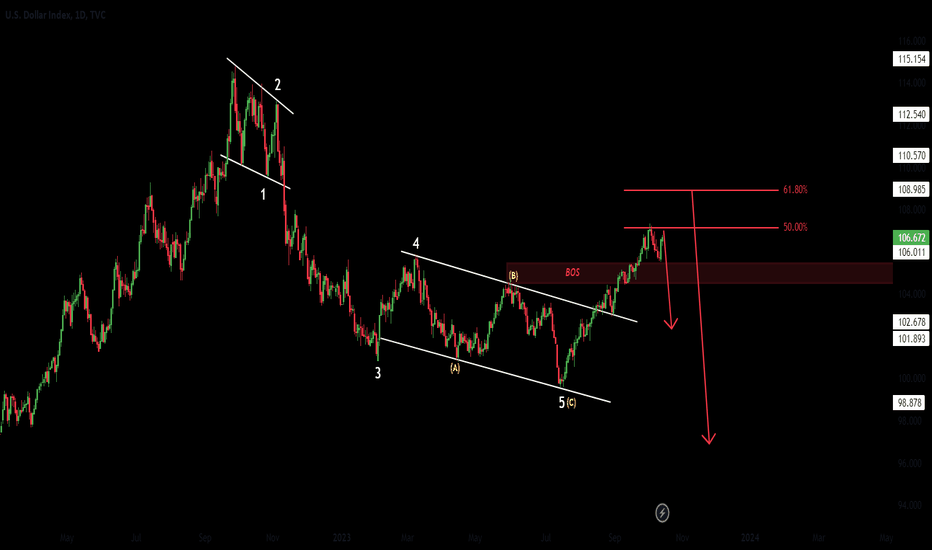

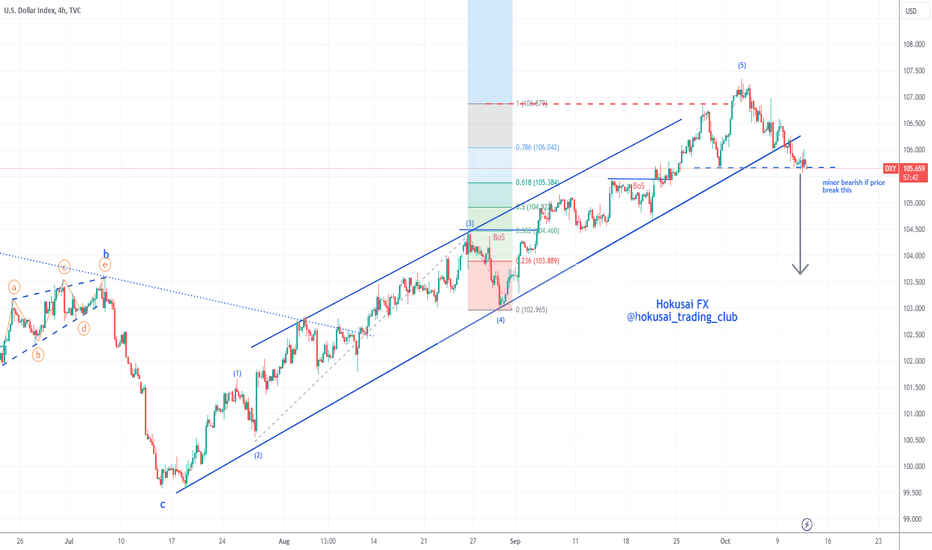

DXY Index New Week MovePair : XAUUSD ( Gold / U.S Dollar )

Description :

Impulsive Waves " 12345 " and Corrective Wave " A " Completed. We have Break of Structure with the Retracement , It can Reject from Fibonacci Level - 50.00 / 61.80%. Bearish Channel in Short Time Frame it will Complete its Retracement and will Complete its " B " Corrective Wave

Entry Precautions :

Because of Israel / Palestine War Market can make false move so be careful

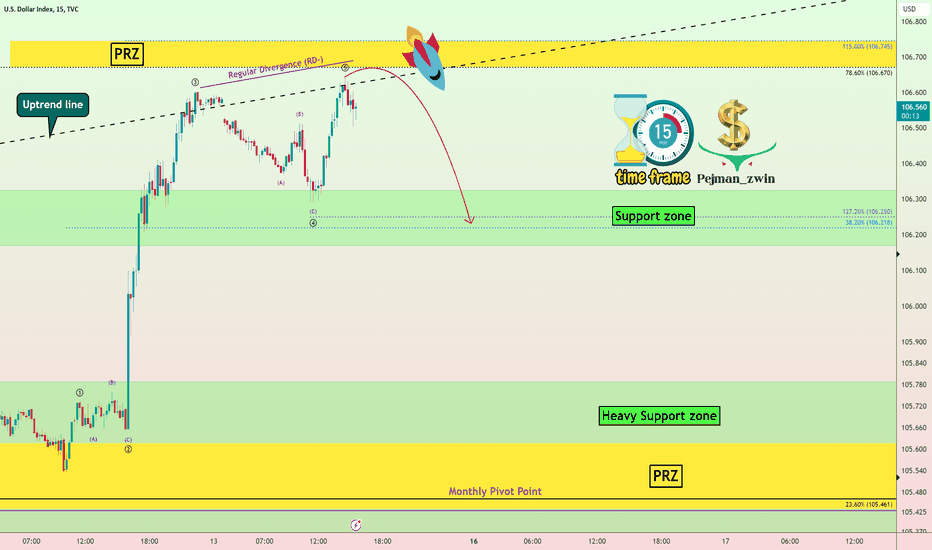

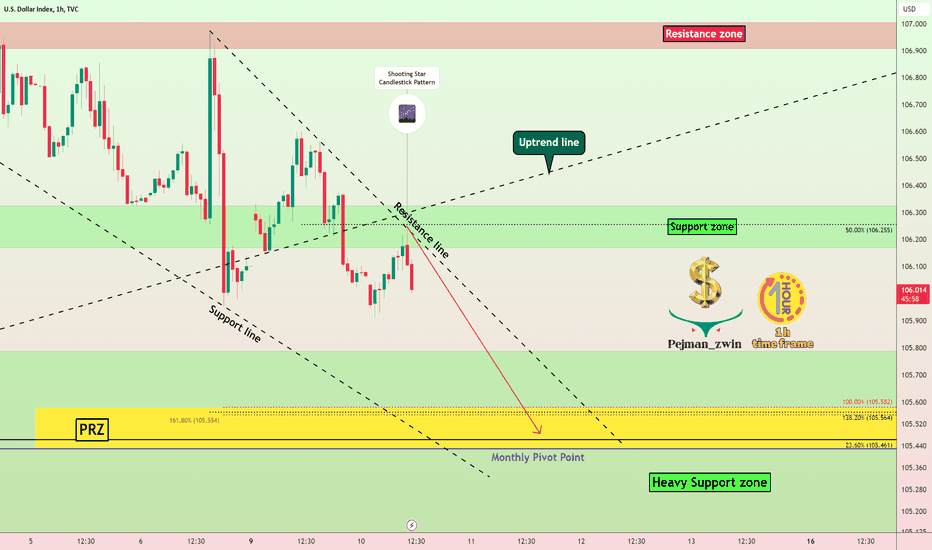

⚠️DXY will Go Down again⏰(15-Min)⏰⚠️DXY Index is running near the Uptrend line and 🟡 Price Reversal Zone(PRZ) 🟡.

According to the theory of Elliott waves , the DXY index has succeeded in completing its 5 ascending waves near the 🟡 Price Reversal Zone(PRZ) 🟡.

💡Also, we can see Regular Divergence(RD-) between two consecutive peaks.

🔔I expect the DXY Index to trend lower in the coming hours and at least go down to the 🟢 Support zone($106.330_$106.160) 🟢.

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 15-minute time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

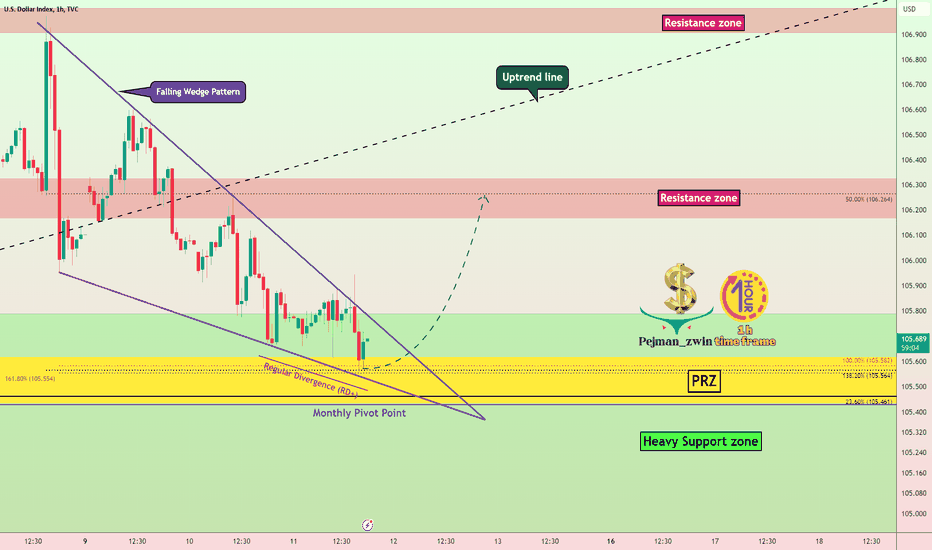

💸DXY Index💸 will Go Up by Falling Wedge Pattern⏰(1-Hour)⏰✅The DXY Index has completed a Falling Wedge Pattern in the 🟢Heavy Support zone($105.80_$104.530)🟢 and 🟡 Price Reversal Zone(PRZ) 🟡.

💡Also, we can see Regular Divergence(RD+) between two consecutive valleys .

🔔I expect the DXY Index will go UP after breaking the upper line of the Falling Wedge Pattern to the 🔴 Resistance zone 🔴.

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 1-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The dollar suddenly increased after favorable news for America'sThe Fed has raised interest rates 11 times since March 2022, but inflation remains well above target and U.S. central bank officials are taking more aggressive action than in the past. This is thought to be due to a lack of monetary policy adjustment.

When Federal Reserve officials say their long-term inflation target is 2%, they are referring to the percentage growth in the Core Personal Consumption Expenditures Price Index (Core PCE) compared to the same period last year.

The more popular and often cited inflation figure is the year-over-year growth rate of the Consumer Price Index (CPI).

In fact, from May 2023 to the present, the six-month Treasury yield has been consistently above 5.3% and even above 5.5%. Additionally, approximately $1 trillion has been withdrawn from the reverse repo facility since May.

In other words, the U.S. federal government is pumping trillions of dollars previously siphoned out of the financial system by the Fed back into the economy through bonds with attractive yields.

The higher the yield, the more money flows into the financial system. This is one of the strange phenomena in the fight against inflation. The clearest evidence is that M2 money supply fell to a two-year low in April 2023, then stopped declining and even increased slightly in the following four months. Without a reduction in the money supply, it will be difficult to reduce inflation. The Fed tried to tighten monetary policy by raising interest rates and withdrawing money, while the U.S. government increased debt and injected more money into the economy to cover budget deficits. No matter how strong your hands are, you cannot clap loudly. No matter how hard the Fed tries, it will be difficult to control inflation if monetary policy runs counter to monetary policy.

The dollar fell before the US released inflation dataThe US dollar fell in early European trading on Thursday, hovering near a two-week low ahead of the release of key US inflation data.

At 03:15 ET (07:15 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.2% lower at 105.377, just above its lowest level in day, the weakest level in two weeks.

DXY still shows no signs of breaking out of the trendlineThere has been little change in the market since the minutes of the Fed's monetary policy meeting were released in September. This highlighted concerns about U.S. economic growth and caused the Fed to become cautious about raising interest rates.

Dallas Fed President Rory Logan and Fed Director Christopher Waller have argued that rising U.S. Treasury yields in recent months could prompt the Fed to hold off on raising interest rates. Waller said on October 11 that higher market interest rates could help the Fed control inflation and allow policymakers to consider whether further rate hikes are necessary.

"Overall, the minutes indicate that Fed officials are increasingly concerned about recession risks to the U.S. economy," said Carl Schamotta, chief market strategist at Kopay in Toronto.

The recent weakness in the US dollar is due to a decline in US Treasury yields, with bond prices rising due to the Fed's "loose" stance on future interest rate hikes. Investors are now awaiting the release of the main inflation report today, October 12th, for further guidance on the future direction of interest rates. Additionally, the market is closely monitoring the conflict between Israel and the Islamic organization Hamas.

Conversely, the euro rose to $1.0634, its highest level since September 25th. Meanwhile, the pound rose to a three-week high of $1.2337.

Dutch central bank board member Klaas Nott said on October 11 that the ECB has made "important progress" in bringing inflation down to its target level, but there is still a long way to go and rules out the possibility of inflation rising. He said he could not. Interest rates may rise further in the future.

DXY 12Oct2023DXY confirmed this week that its price has been bearish and is currently attempting to break through the reversal area. If the reversal line is successfully penetrated, it will confirm the bearish trend, although there is a possibility of a temporary bullish correction. The initial bearish target is 103.500

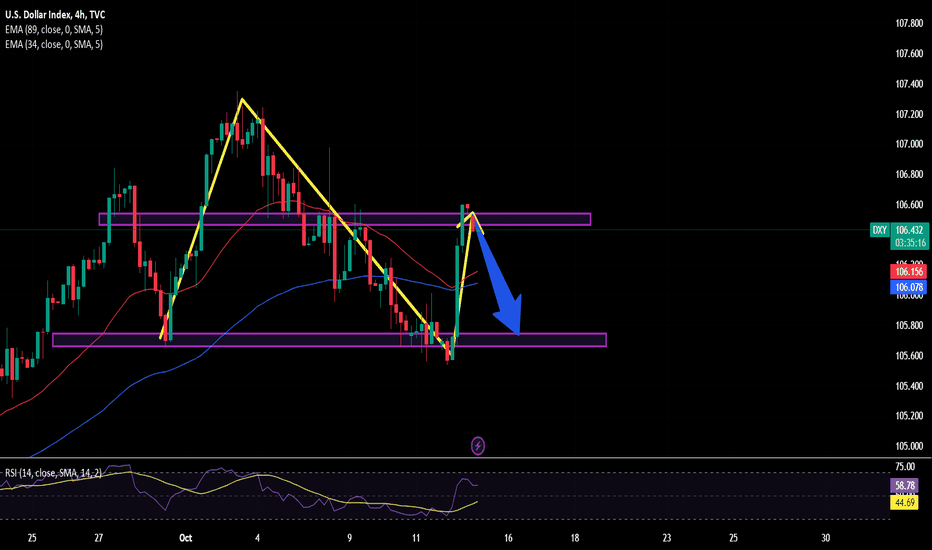

DXY Index will Go Down to 🟢Heavy Support zone🟢(1-Hour)⏰✅The DXY index managed to break the Uptrend line and 🟢 Support zone 🟢.

💫Currently, DXY reacted well to the Resistance line and formed a 💫Shooting Star Candlestick Pattern💫 near this line in the 1-hour time frame ⏰.

🔔I expect the DXY to trend lower in the coming hours , enter the 🟢 Heavy Support zone 🟢, and fall to at least the 🟡 Price Reversal Zone(PRZ) 🟡.

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 1-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

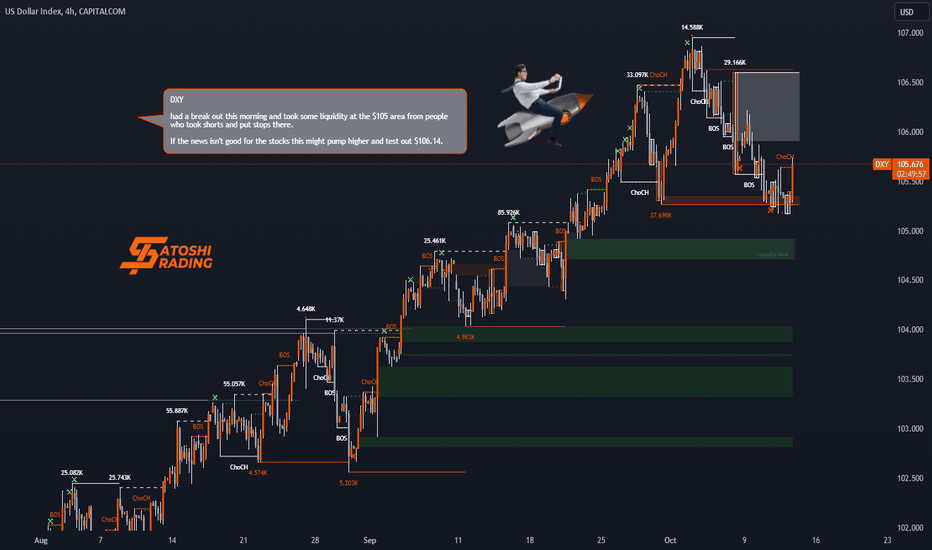

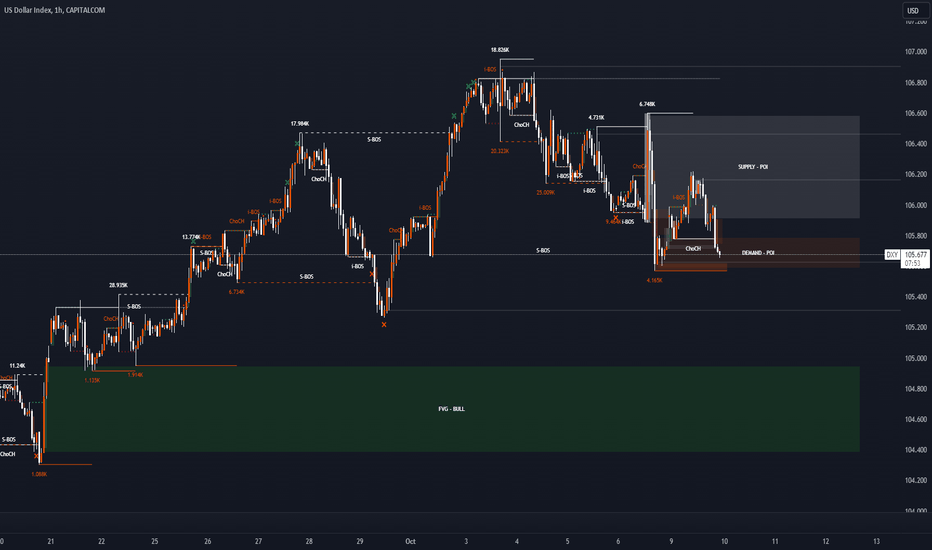

DXY - 09/10/23DXY- 09/10/23

**Trade setup:**

If the DXY falls here the crypto might pump, but the wars going on will not help the markets and does not look like it's on the fall side of the V now from the push up from $104.20, there is a lot of supply in the way of this and demand its in the middle of now, so will keep my eyes on it.

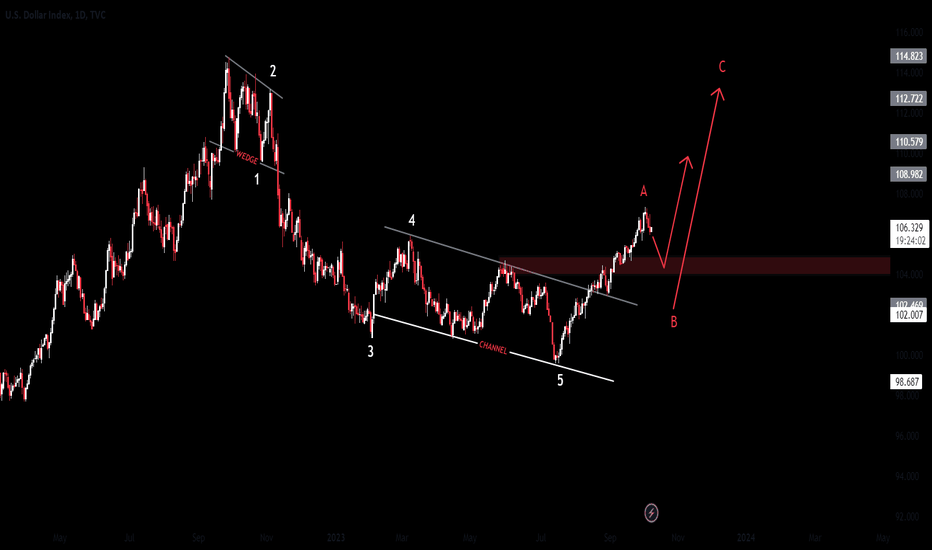

DXY Index New Week MovePair : DXY Index

Description :

Falling Wedge as an Corrective Pattern in Short Time Frame and Breakout of the Upper Trend Line and Retracement. Completed " 12345 " Impulsive Waves and " A " Corrective Wave. We have Strong Divergence and Break of Structure

Entry Precautions :

Don't Enter until its Rejects from Previous Support or Complete its Retracement

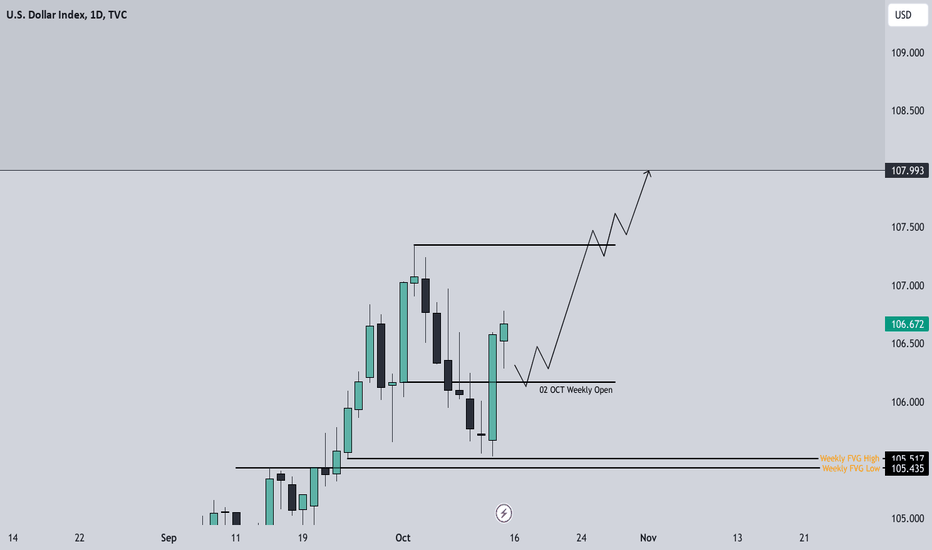

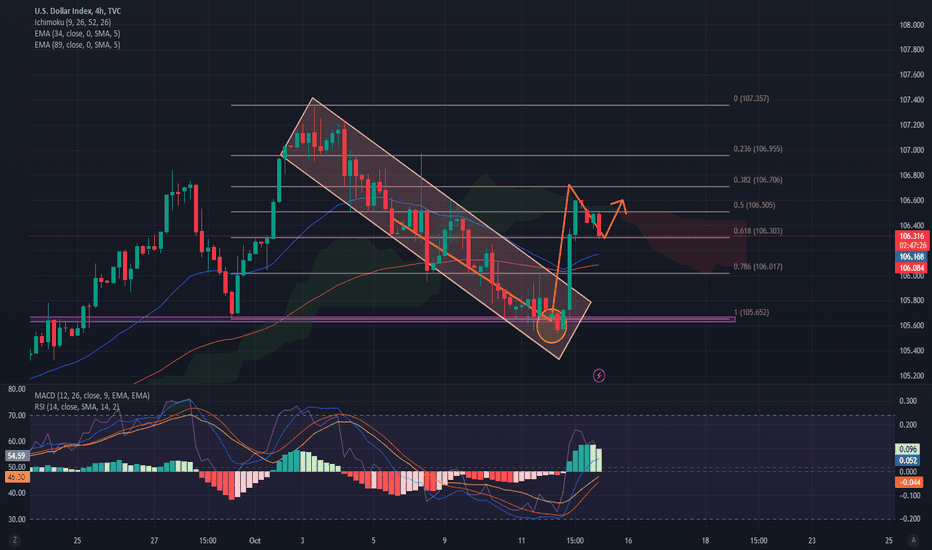

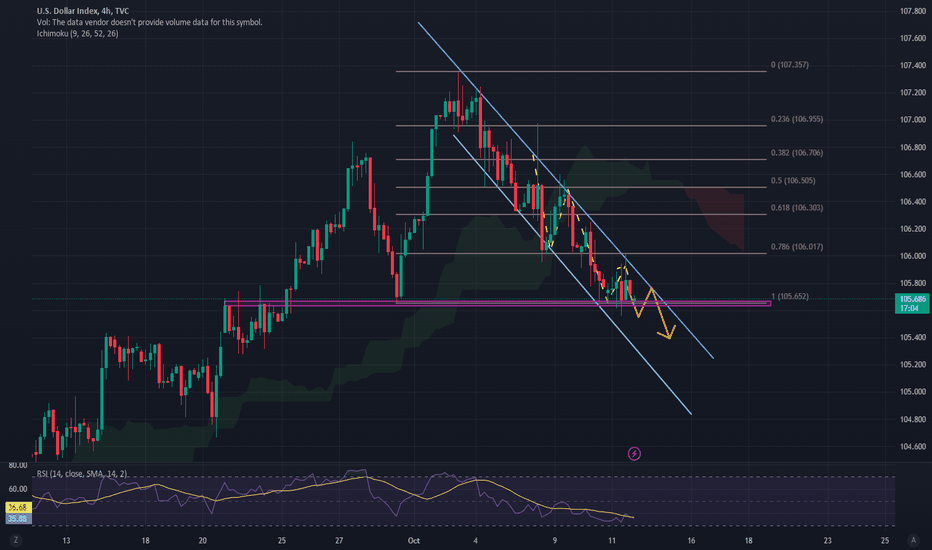

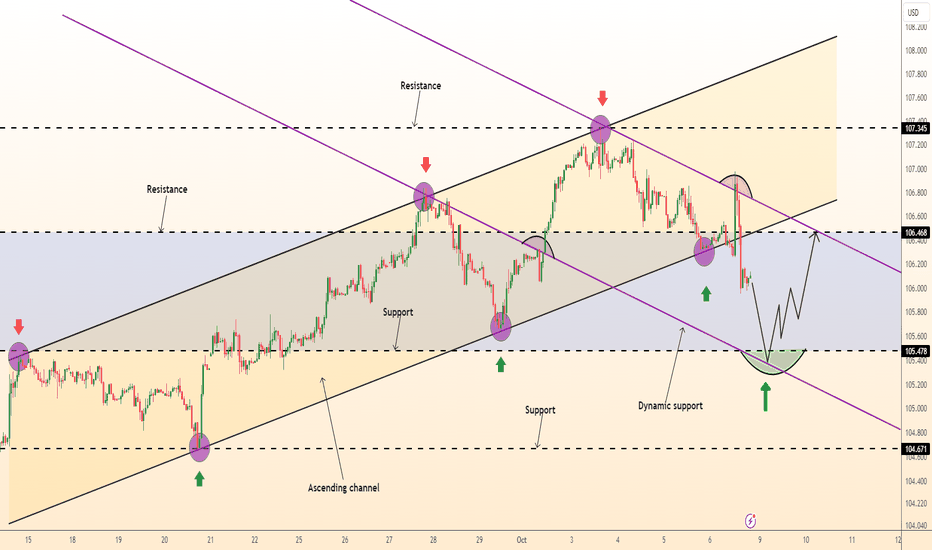

DeGRAM | Dollar index. Long to resistanceDXY broke the ascending channel and moved lower. However, the trend is bullish.

Price action is slowing as it approaches support.

We expect the price to go lower from the previous low because we don't have a proper higher high, and in order to make new highs, the price has to go lower.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

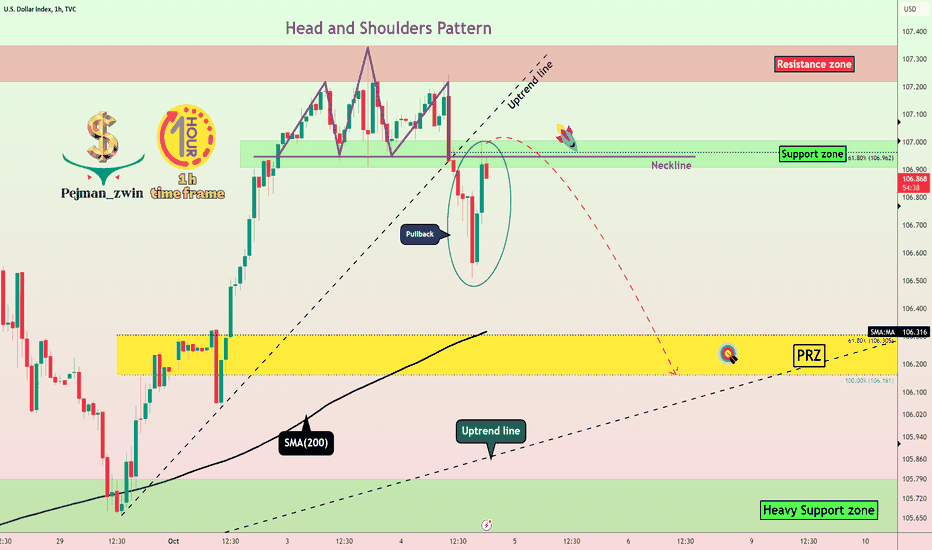

DXY will Fall by Head and Shoulders Pattern⏰(1-Hour)⏰✅The DXY Index has managed to form a Head and Shoulders Pattern in the 🔴Resistance zone🔴.

🔨DXY broke the 🟢 Support zone 🟢 and Neckline hours ago.

🔔I expect DXY to start falling again to 🟡 Price Reversal Zone(PRZ) 🟡and Uptrend line after completing the pullback to Neckline .

U.S.Dollar Currency Index ( DXYUSD ) Analyze, 1-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Potential for Continued Rise in US Dollar as Bond Yields SpikeBond yields have been on the rise lately, and this trend may continue in the near future. As a result, it is crucial to approach the situation with caution and consider the potential opportunities it presents.

The correlation between bond yields and the US dollar is well-established. When bond yields increase, it often attracts foreign investors seeking higher returns, leading to an appreciation in the value of the US dollar. Given the recent spike in bond yields, it is reasonable to anticipate a continued rise in the US dollar's value.

However, it is important to note that market dynamics can be unpredictable, and various factors can influence currency movements. Therefore, I encourage you to exercise prudence and conduct thorough analysis before making any trading decisions. Here are a few factors to consider:

1. Monitor Economic Data: Keep a close eye on economic indicators such as inflation rates, employment figures, and GDP growth. These data points can provide insights into the overall health of the US economy and its potential impact on the currency.

2. Central Bank Policies: Stay informed about any shifts in monetary policies by the Federal Reserve. Changes in interest rates or quantitative easing measures can significantly influence the US dollar's trajectory.

3. Global Events and Geopolitical Risks: Consider geopolitical developments and their potential impact on the US dollar. Factors such as trade tensions, political instability, or unexpected events can create volatility in the currency markets.

Considering the potential for the US dollar to continue its rise, it may be prudent to explore long positions on the currency. However, I strongly urge you to conduct thorough research and consult with your financial advisors before making any investment decisions. Remember, trading involves inherent risks, and it is crucial to carefully assess your risk tolerance and financial goals.

As always, it is essential to stay updated with the latest market news and trends. By staying informed and adopting a cautious approach, you can navigate the currency markets more effectively.

Wishing you successful trading ahead!

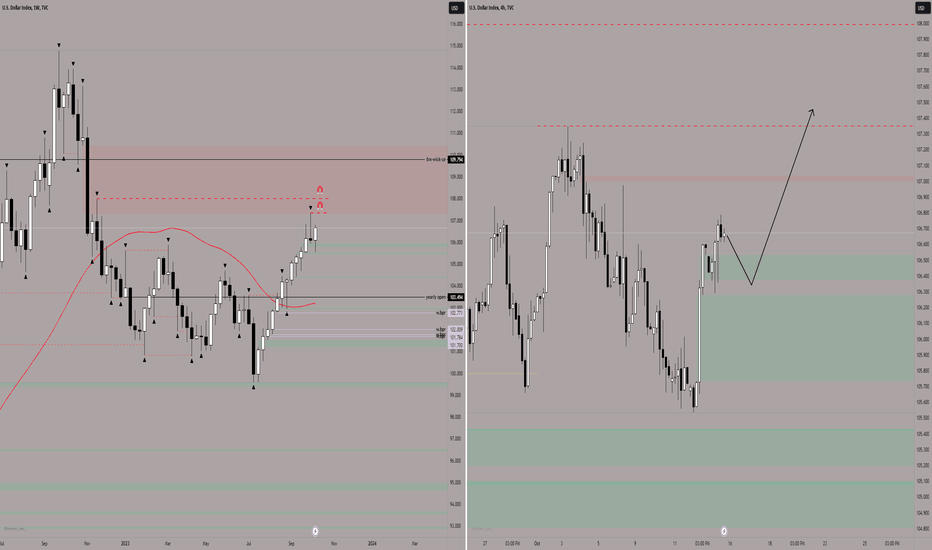

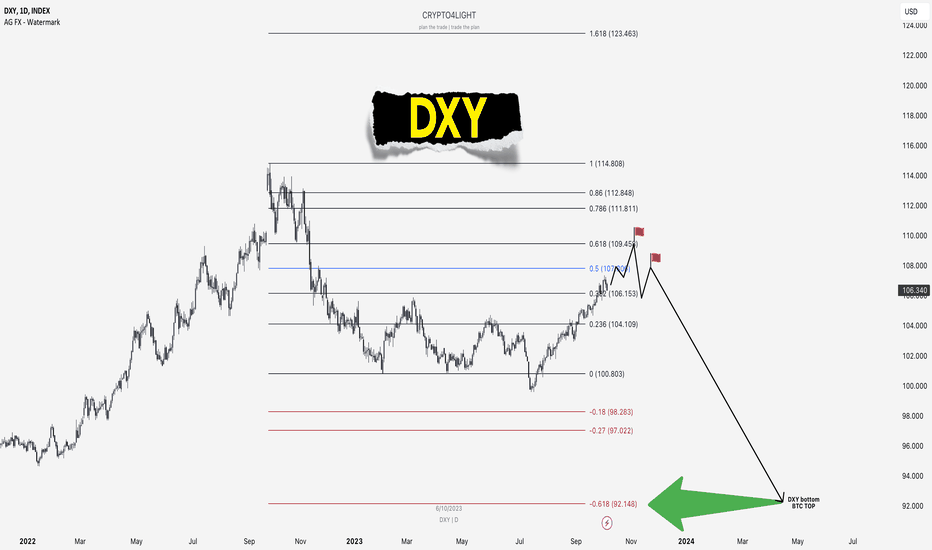

DXY index bottom and BTC topINDEX:DXY

Possible Targets and explanation idea

➡️weekly (even yearly) FIB top for DXY now we are in a downtrend

➡️last move on DXY will be around 107-109 than down till 2025-2026

➡️Bottom for DXY will be around 92

➡️The same time historically its will be the new high (not for sure ATH) for BTC

➡️After that we will start new bear market in crypto

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Celebrating the Bright Future of the US Dollar! 🌞I bring you fantastic news that will surely make your day even brighter. The upcoming job report expect to have an impressive addition of 150,000 new jobs, coupled with a lower unemployment rate. This remarkable achievement will set the stage for an exciting journey ahead for the US dollar!

The US economy continues to demonstrate its resilience and strength, and these latest figures are a testament to that fact. With each passing day, the US dollar is becoming an even more attractive investment opportunity. As traders, it is essential to recognize and seize the potential this brings to our portfolios.

So, what does this mean for you? It's time to consider a long position on the US dollar! The positive job report signals a favorable market sentiment and reflects the growing confidence in the US economy. By taking advantage of this upward trend, we can position ourselves to reap the benefits of a strengthening US dollar.

Here are a few compelling reasons why you should consider going long on the US dollar:

1. Economic Growth: The addition of 150,000 new jobs indicates a robust and expanding economy. This growth is likely to fuel increased consumer spending and business investments, further bolstering the value of the US dollar.

2. Lower Unemployment: The decrease in the unemployment rate signifies a healthier labor market, which translates into higher wages and increased consumer confidence. As disposable incomes rise, so does the demand for goods and services, ultimately benefiting the US dollar.

3. Global Safe Haven: In times of uncertainty, the US dollar has historically been a safe haven for investors. With its strong economic fundamentals and stable political environment, the US dollar is likely to attract capital flows, driving its value higher.

Now is the time to act! As traders, we have the opportunity to capitalize on this positive news and optimize our investment strategies. By going long on the US dollar, we position ourselves to potentially unlock substantial gains in the future.

Remember, successful trading requires staying informed and making well-informed decisions. Keep a close eye on market trends, economic indicators, and geopolitical events that may impact the US dollar's performance.

Let's embark on this exciting journey together, riding the wave of optimism and prosperity that lies ahead. Long live the US dollar!

What about DXY and the effect on BTC?There are several factors that could contribute to a sharp increase in the value of the US dollar in the future:

Strong economy: If the US economy is doing well compared to other economies, it can boost confidence in the US dollar and attract investors. Strong GDP growth, low unemployment, high investment and innovation may be factors contributing to increased demand for dollars.

Higher interest rates: An increase in interest rates by the US central bank (Federal Reserve) may increase the attractiveness of the US dollar. Higher interest rates can attract capital from other countries and boost demand for dollars, which could lead to dollar growth.

Geopolitical instability: In the event of political or geopolitical uncertainties, such as conflicts, trade disputes or global crises, the US dollar can be seen as a safe haven. In such situations, the demand for dollars could increase, which could result in an increase in its value.

Dominance of the dollar in the international market: The US dollar is still the most used reserve currency in the world and the main currency for international trade. If this dominance continues, it may strengthen the dollar's position and contribute to its growth.

A rise in the value of the dollar can affect the price of cryptocurrencies, including Bitcoin (BTC), in several ways:

Inverse relationship: There is a tendency for the value of the dollar and the price of cryptocurrencies to have an inverse relationship. This means that if the value of the dollar increases, it can result in a decrease in the price of cryptocurrencies, including Bitcoin. This is because investors may turn to stronger traditional currencies such as the dollar and leave riskier assets such as cryptocurrencies.

Currency Pairs: If the dollar strengthens against other currencies, it may affect trading between cryptocurrencies and those other fiat currencies. For example, if the value of the dollar increases against the euro, then the value of Bitcoin in the BTC/EUR exchange rate may decrease.

Global Economic Factors: A rise in the value of the dollar may be a result of a strong US economy, which may signal the risk of lower volatility and less uncertainty. This may cause some investors to prefer traditional assets such as the dollar instead of cryptocurrencies, which are considered riskier.

So what friends? are you still going to feed this money machine?

Try my indicator for trading and generally keep an eye on things

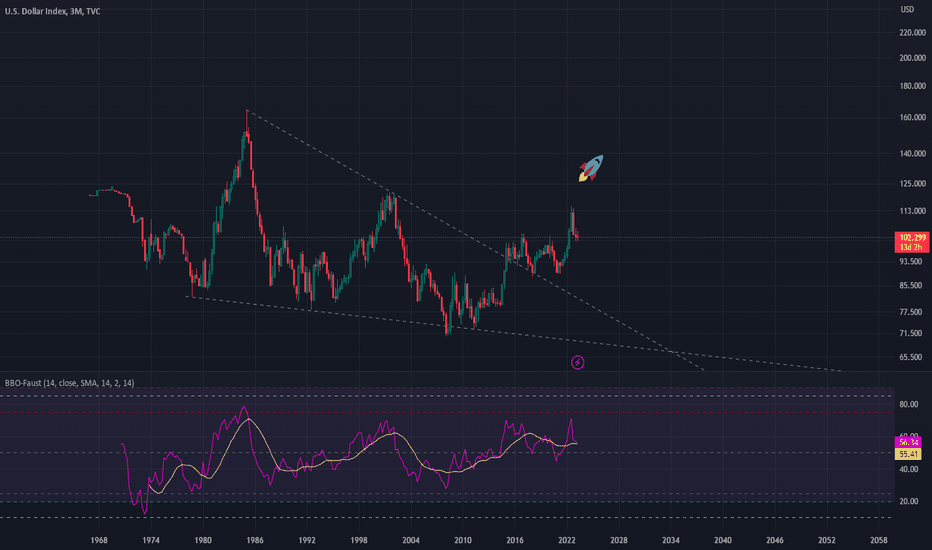

DXY (Dollar Index) is ready for a downfallHi Everyone

The DXY is the back bone for all the investments including crypto

The DXY and the USDT domination is showing weakness confirmed by mathematical modules and analysis, I expect a rise for all major markets (Commodity, stock and crypto)

I hope you Enjoy the ride

Good luck Everyone

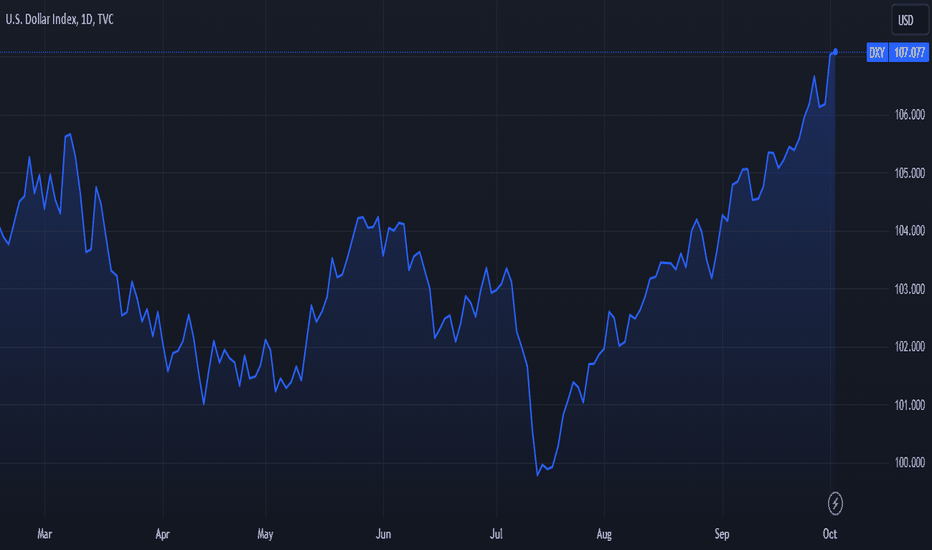

DXY - 02/10/23TVC:DXY - 02/10/23

**Trade setup:** Still looks very bullish, but the X in green is telling me the trend is getting weaker!

Coming into a SUPPLY zone made in DEC so were getting stopped here but looking to break out of it on the day chart!

If we can get above here it will take out the two red imbalances from last NOV and try the high at $114, this is running with BTC atm so a pullback here will probably mean worse for BTC!

I will be looking for the high to be broken to trade higher here and looking for a pullback!

Now the targets are below:

**Bullish target:** $109 then $111 to clear out imbalance if broken at $106

**Bearish target:** $103 if we fail to make a new high and break above $106

**Supply and Demand**: The nearest Demand to keep us up is $100. The next Supply is $114.

$DXY Quarter 3 (Q3) AnalysisThe U.S. Dollar Index had a bullish Q3 and has been bullish month after month. There is a bullish bounce off the EMA ribbon with $101 acting as a strong support level. I believe DXY is headed towards the top of the Bollinger Band with wicks forming above at approximately $112-114 (marked by the white circle).