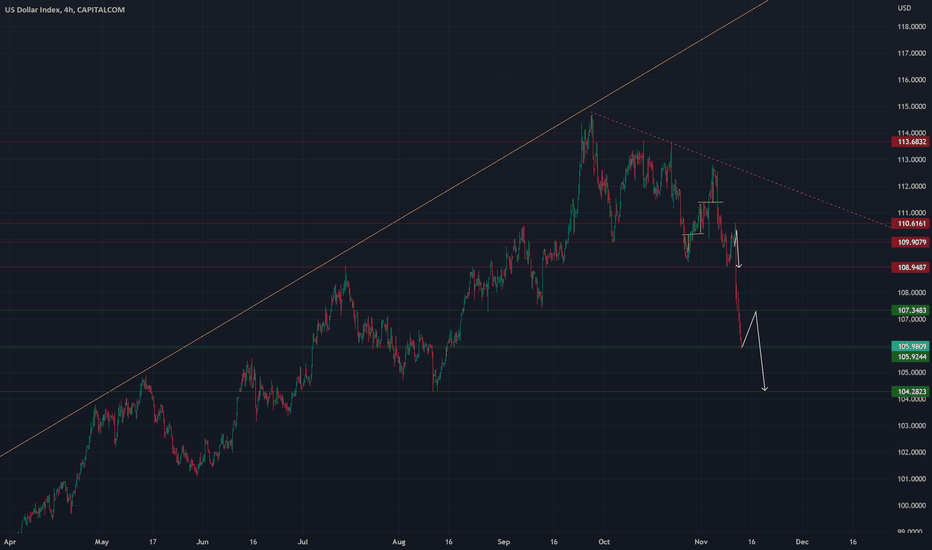

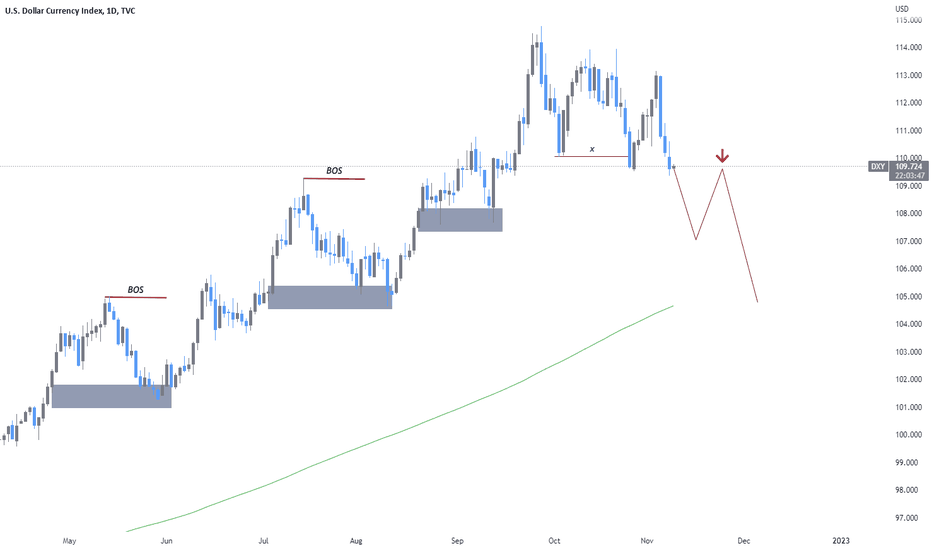

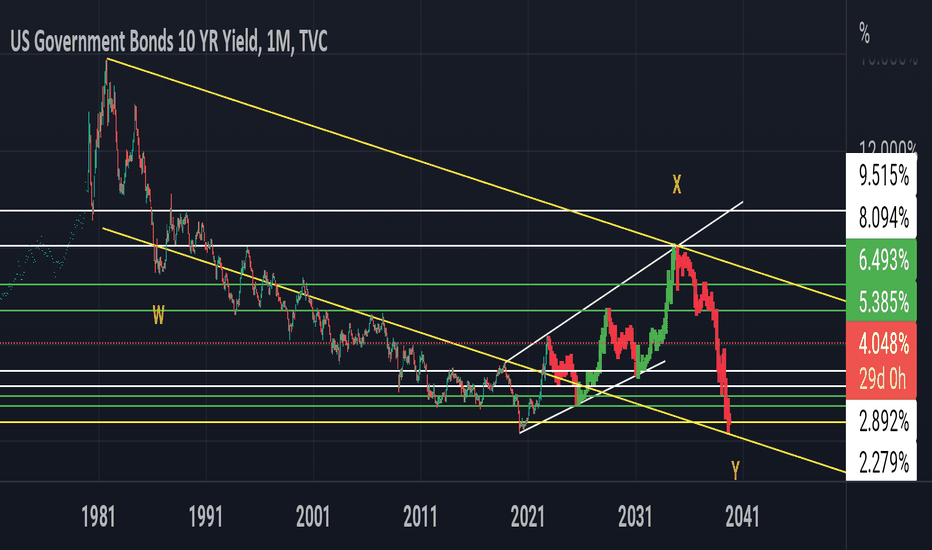

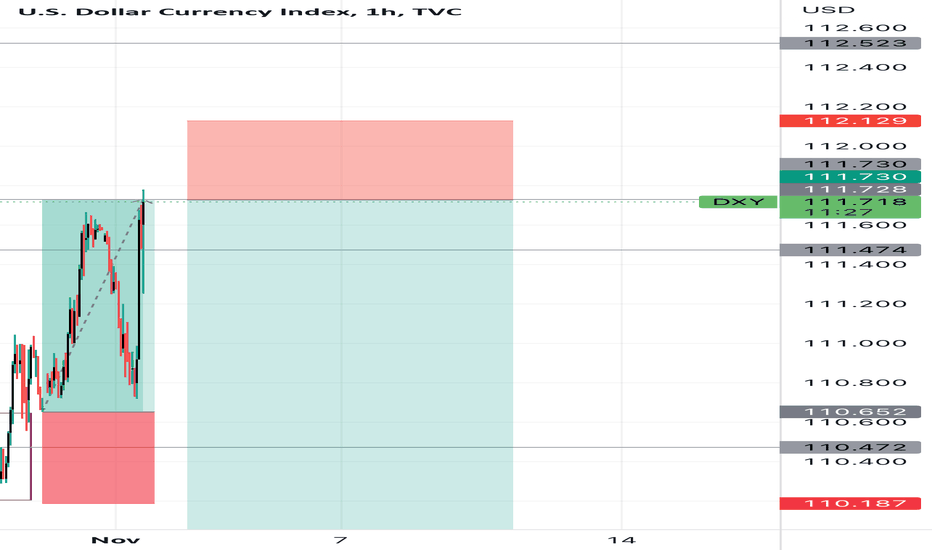

DXY/Dollor Analysis and Trade Idea 46th week 2022DXY collapsed on CPI news and still heading to downward.

But a short term correction is expected.

So I think for next week before going further down it will test 107.200-107.300 zone and then move further down.

Dxy will continue it's bearish trend and will hit 104.28 by Friday which is a very strong support zone.

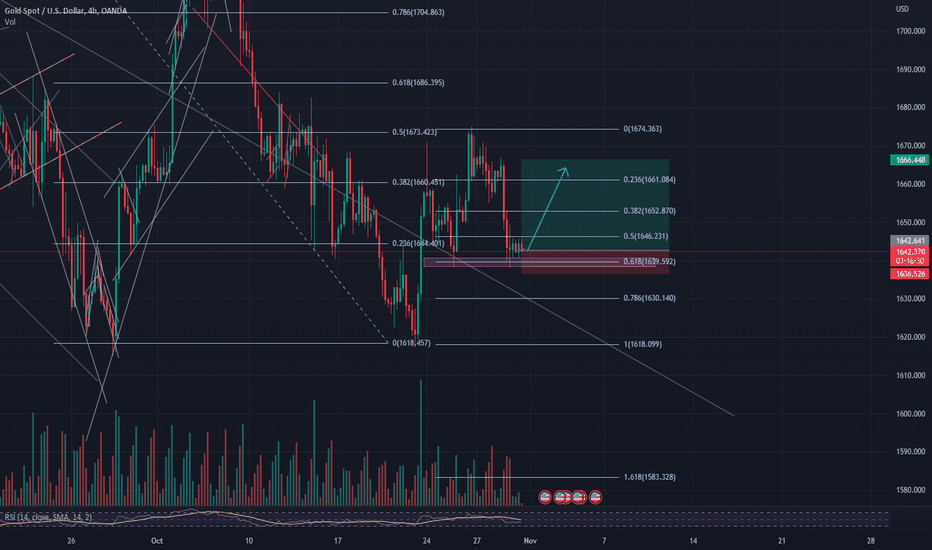

Further more Gold was bullish in last week and we are seeing a bullish relay in gold since 4th November it will also retrace sown and make a correction in price which is expected to 1740.00

Let's see how this week is going to be.

Dxyshort

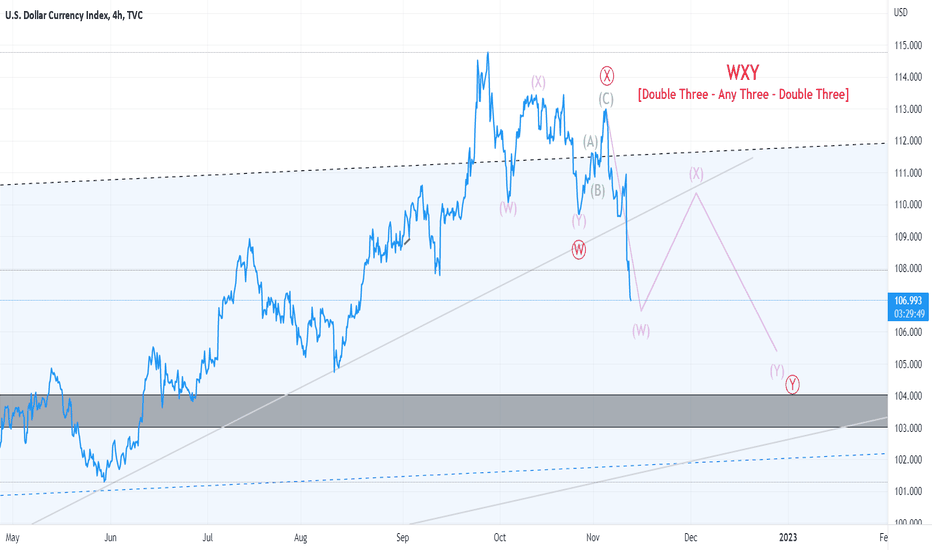

The dollar breaks an uptrend 👌Is the dollar trip over? Is it the beginning of the fall of the dollar?

- With the release of inflation data, which came contrary to what the dollar wished, and with what the trader wished.

the dollar fell nearly 300 points, heading towards the 107 support.

It reduces the rate to 50 percent by the end of this year, and if it continues in this manner, inflation may decline faster and at a higher rate than before.

- Everything may happen. We are on the cusp of an annual closure, so please be careful with your trading, and that greed does not take you and not manage risks towards the unknown, please.

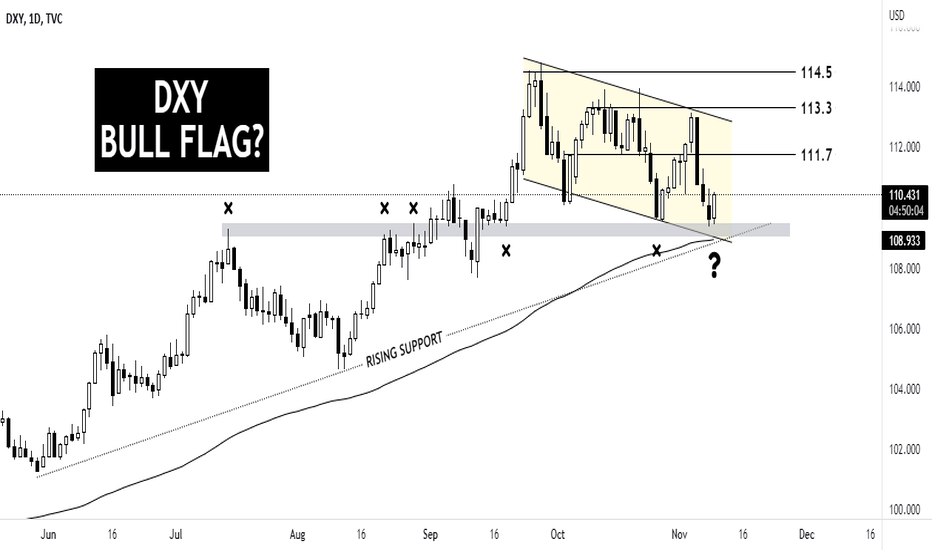

dxy next move2 scenarios can happen the dollar is bullish right now since it just recently broke a high now i would like a pull back but tbh it could just keep pushing up to the high b4 coming back down but once price gets to that high i will see how price action develops

this is just more confirmation on golds sells we are already in for the pull back

110.360-110-800 area where i see it pushing to

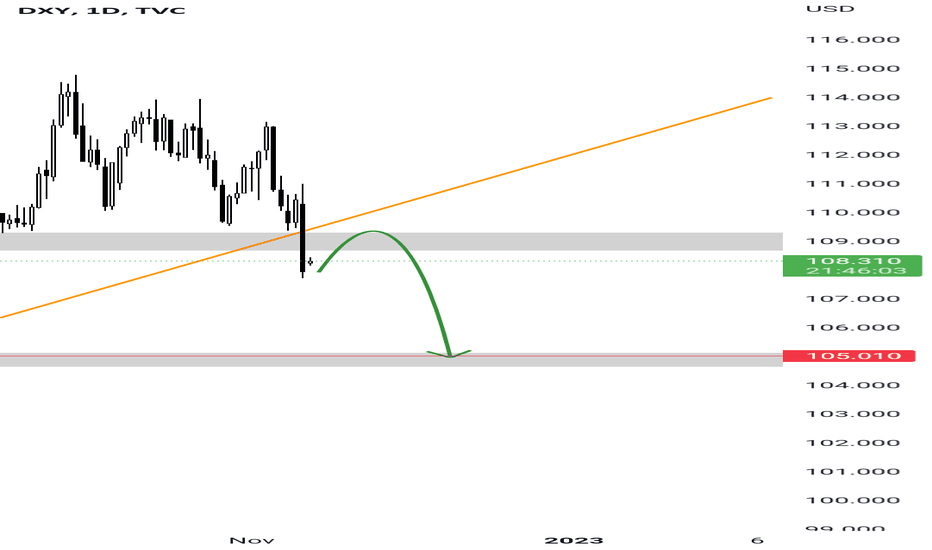

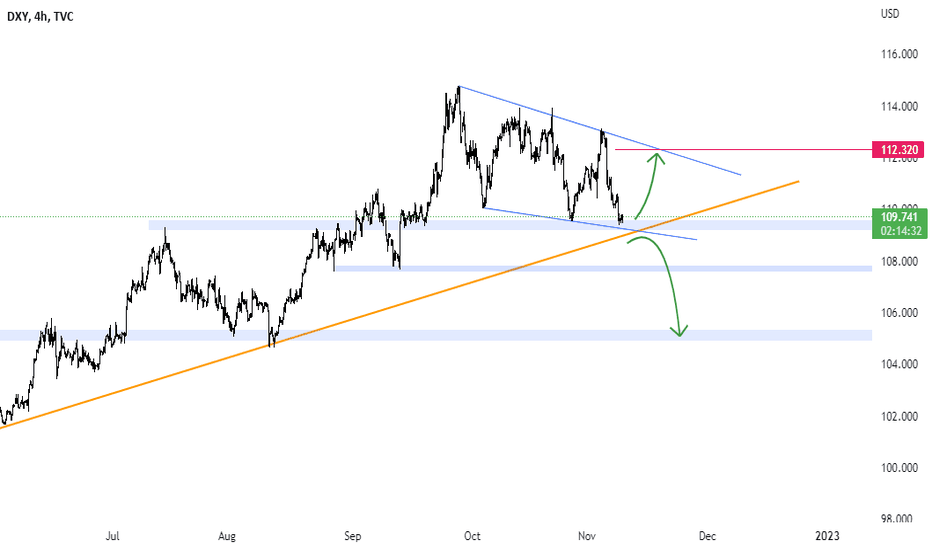

DXY - Dollar under pressureWith the anticipation of the inflation data that will be released on Thursday, the dollar is still under many selling pressures, but now it has reached pivotal areas, breaking it may lead it to lower levels, but if the data comes in its favour, it may regain its strength again.

Now the price is near a daily bullish trend and near buying areas (demand), as well as it is on the edge of the lowest descending channel on the 4 hour frame.

Everything will be revealed on Thursday, so please be careful in your trading until Thursday.

🔥💥 Like, Shared and subscription 💥🔥

Note: If you are a beginner trader, you should be aware of these rules:

1: Do not covet

2: Don't trade too much

3: Secure your positions after entering the profit

4: Enter contracts that fit your portfolio

5: Adhere to all recommendations

updateWould the dollar fall short from that support area?

Looking at the dollar from a technical view we are currently in & uptrend, we can see price is currently holding @ a major support area around $(109.69) area

if we see our H4 bar close below that support area we can potentially see price move back short into our 200 EMA.

if we keep hold of our support area we may potentially continue to go bullish however we can see sellers are strong in the market also we had some negative fundamentals against the dollar wish is why we saw that short move. at this point we need to have some patience with the DXY and lets see whats the next move for price.

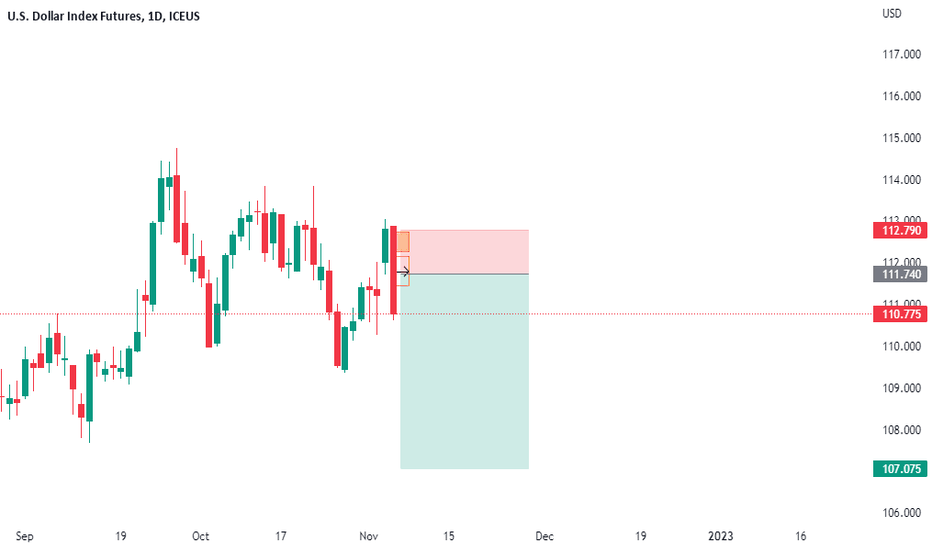

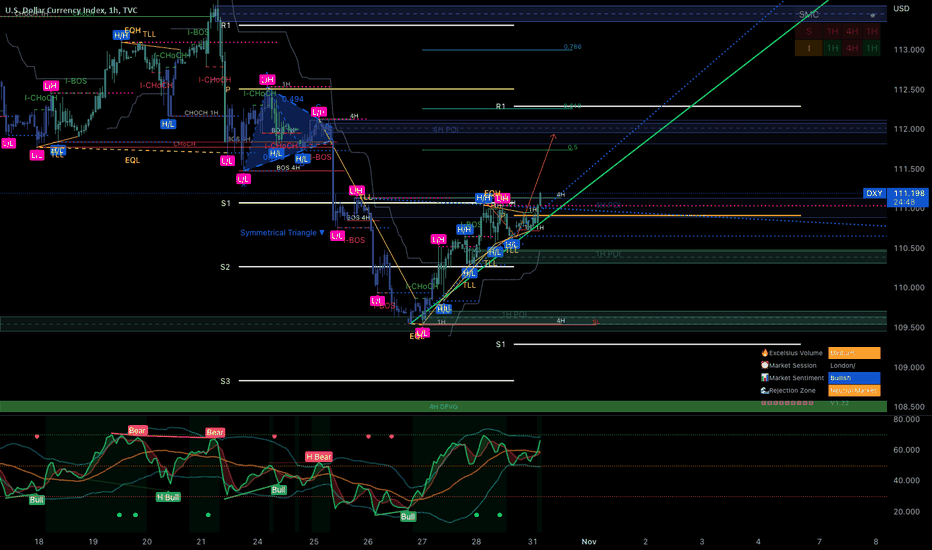

20 REASSON FOR SHORT DXY 🤑TOP DOWN ANALYSIS OVERVIEW🤑

🧐Eagle eye: structural Down

Monthly : structure bullish but there are lot of weakness in monthly candle patterns last month is inside bar 😲insidebar😲 current forming 👎doji😲

weekly : a big Imbalance after it prices are going down and down 🥺

so the bigger picture is not clear and in bear favor

1 Structure analysis time frame :DAILY bear

2 target time frame :DAILY

3 Current Move :IMPULSE

4 Entry Time Frame : H4

4.1 Entry TF Structure: BEAR

4.2 entry move : IMPULSE

5 Support resistance base :H4 BEAR ORDER BLOCK

6 FIB: TRIGGER EVENT

7 candle Pattern: DARK CLOUDS

8 Chart Pattern: DOUBLE TOP

9 Volume : EXTREAMLY HIGH

10 Momentum UNCONVENTIONAL Rsi: SUPER BARISH WITH LOUD MOVES

11 Volatility measure Bollinger bands: HEADFAKE BEARISH

12 strength ADX: WICKSAS BEAR

13 Sentiment ROC: BULLISH

14 final comment : SHORT AT RETRACEMENT

15 : decision : SELL

16 Entry: 111.790

17 Stop losel: 112.8

18 Take profit: 107.170

19 Risk to reward Ratio: 1:5

Excepted Duration : 10

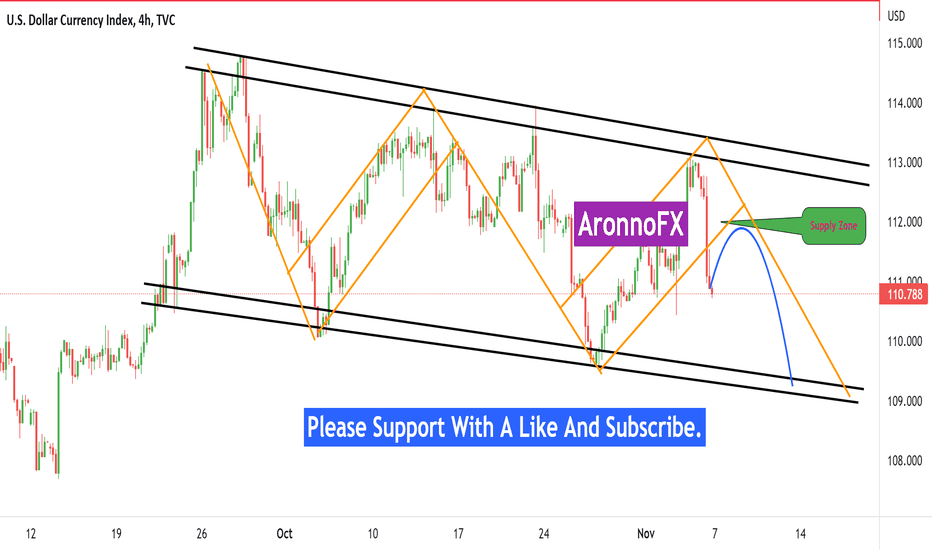

Dollar Index Chart Analysis....

In this situation DXY chart Long tarm create bullish rectangle pattern.So, market

first buy correction @ 111:315 and 111:950 resistance level. Then sell to 109.400 support

zone. If breakout 113.080 resistance level, then market Buy UP to 115.250 resistance level.

AronnoFX will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals.

If you like this idea, do not forget to support with a like and follow.

Traders, if you like this idea or have your own opinion about it,

write in the comments. I will be glad.

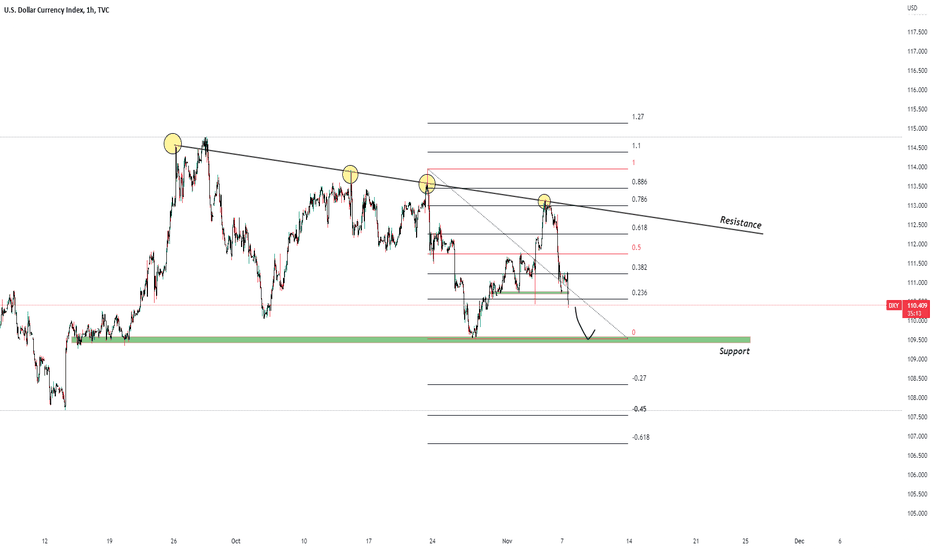

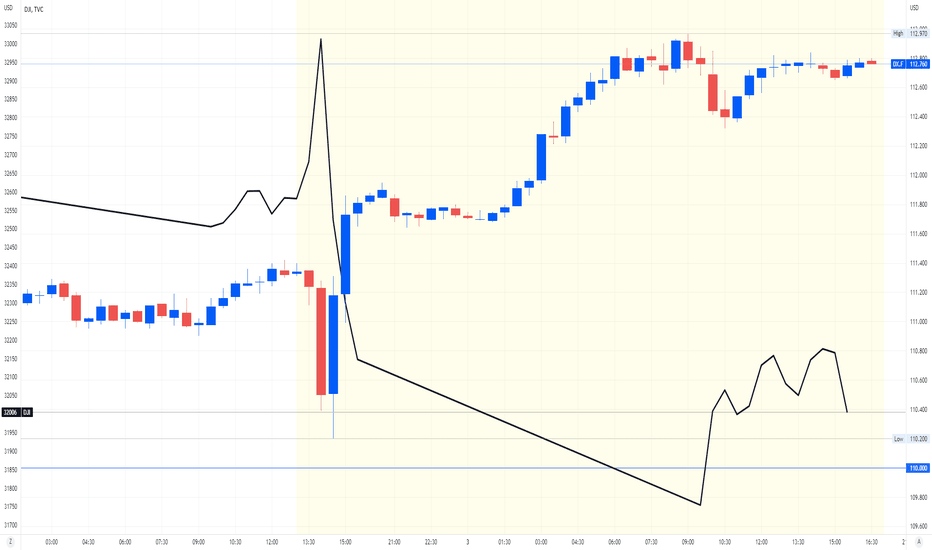

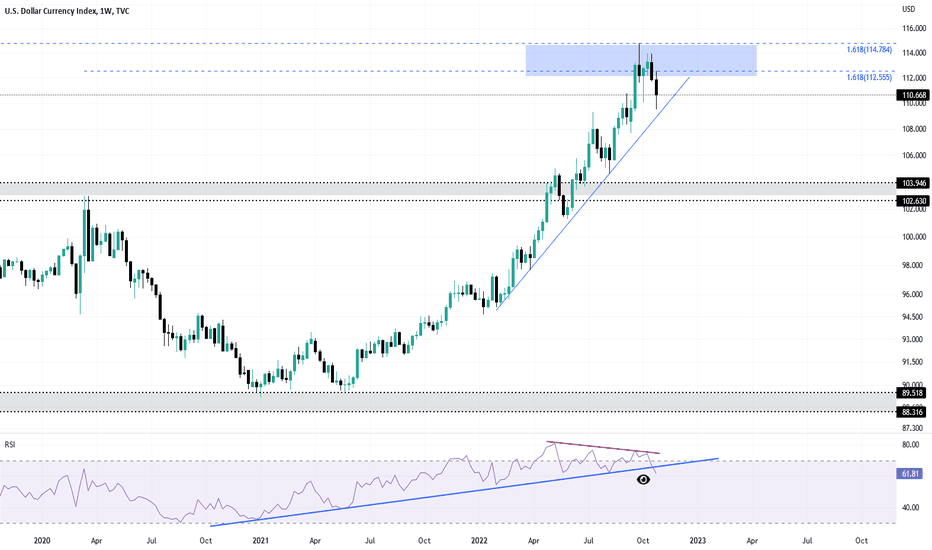

The aftermath of the feds fourth 75bps hike; DXY and DOW JONESIt's now official; the US Federal Reserve has enacted its fourth consecutive 75-basis-points rate hike, bringing its benchmark rate to the 3.75% - 4.00% range, which is the highest it has been since January of 2008.

The markets reacted quite mildly to the rate hike at first, due to it aligning with exactly what the market was expecting for the past few weeks. Expectations strengthened for another 75-basis-points (typically an outsized hike) after September's hotter-than-expected inflation reading that arrived in October.

The mild reaction soon gave way to volatility, as US Federal Reserve Chairman Jerome Powell began to deliver his address that customarily follows an interest rate decision. Investors were intensely curious about this address as it is an opportunity to glean information about why the decision was made and how the bank is thinking about future hikes. What they were specifically looking out for included statements concerning the intensity and pace of rate hikes moving forward, concerns held for the state of the US economy, and responses to recent data drops.

What we learned from Powell’s address

Stocks actually spiked at the onset of Powell’s address, buts quickly gave up gains when it became apparent that Powell is not seriously considering a slowdown in the pace of its rate hikes just yet, like that which has been seen in Canada and Australia. It will be interesting to see where US stocks head in November after recording huge bumps in October, which in part has been attributed to an expectation that the Fed might slow its pace. For one, The Dow Jones Industrial Average recorded its best month since 1976, climbing more than 13%. Powell noted that he expects to start talking about slowing the pace with his colleges within the next two meetings. The special note that it could be within the next ‘two’ meetings is what lent it a veil of non-urgency.

Perhaps the most important note of the address, Powell confirmed that the bank has revised up its expectation for peak interest rates from 4.6% to 5.0% after digesting the data that had been released in October. This note has helped put the US dollar index (DXY) back on track to its 20-year high of 114.00 recorded in September. Much like stocks, the DXY’s reaction reversed its direction drastically after the market caught wind of the Feds revised terminal rate. Before the reversal, the DXY was on its way down to 110.00, before spiking to almost 112.00.

dxy #1this is a turning point for dxy it did create a lower high last week close also opened with a gap

also has a lot of trend line liquidity resting below and the external trend is still down

now on the flip side there is equal highs and also dxy could push up to the 112 area which would be a nice discounted move

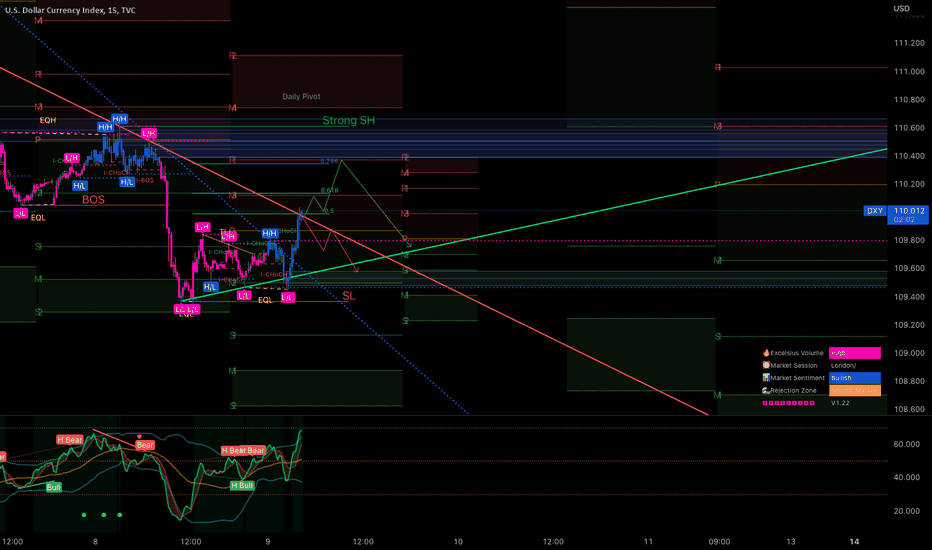

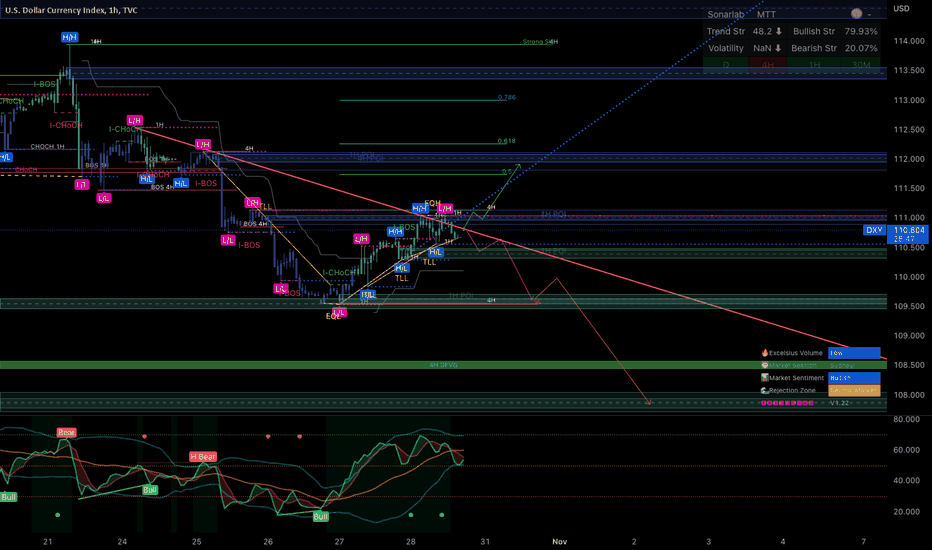

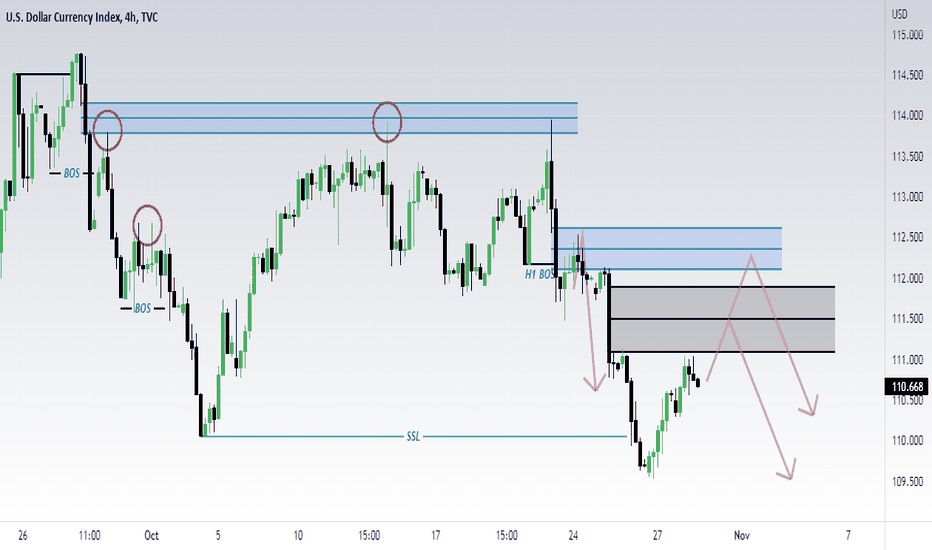

20 REASON FOR SHORT DOLLER INDEX1 Structure analysis time frame DAILY

2 target time frame :DAILY

3 Current Move : IMPULSE

4 Entry Time Frame : H4

4.1 Entry TF Structure: BEARISH

4.2 entry move : RETRACEMENT

5 Suppot resistence base : H1 ORDER BLOCK BLOCK

6 FIB: DISCOUNTES AREA

7 candle Pattern: MOMENTUM ENGULFING

8 Chart Pattern: RISING WEDGE BREAKOUT

9 Volume : DRIED

10 Momentum UNCONVENTIONAL Rsi: SIDEWAYS

11 Volatility measure bollinger bands: POSSIABLE DIVERGENCE MOVE

12 strength ADX: BEARISH

13 Sentiment ROC: STRONG BUT ITS A DAILY CORRECTION

14 final comment : GOING DOWN FOR A FINAL TARGET

15 : decision SELL

16 Entry: 110.540

17 Stop losel: 111.090

18 Take profit: 108.260

19 Risk to reward Ratio: 1:4

Excepted Duration : 4 DAYS