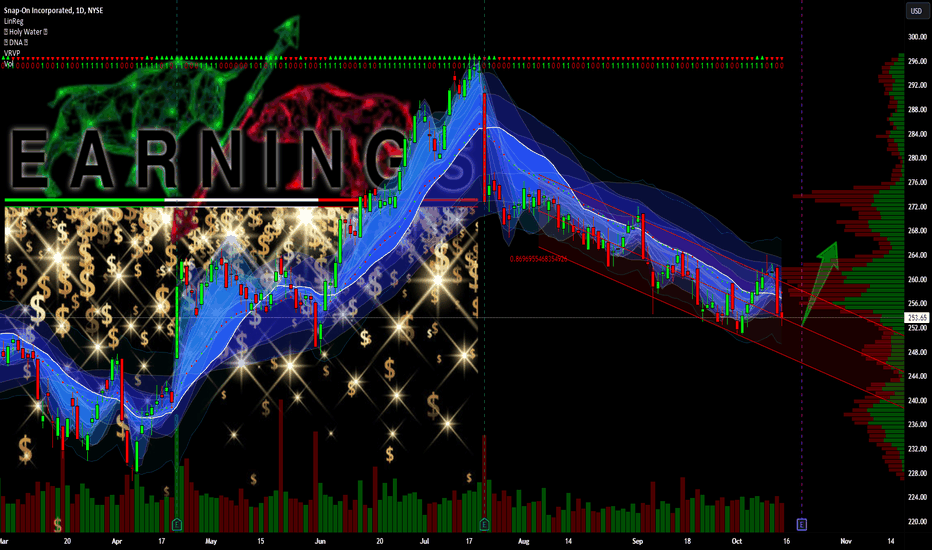

Earnings

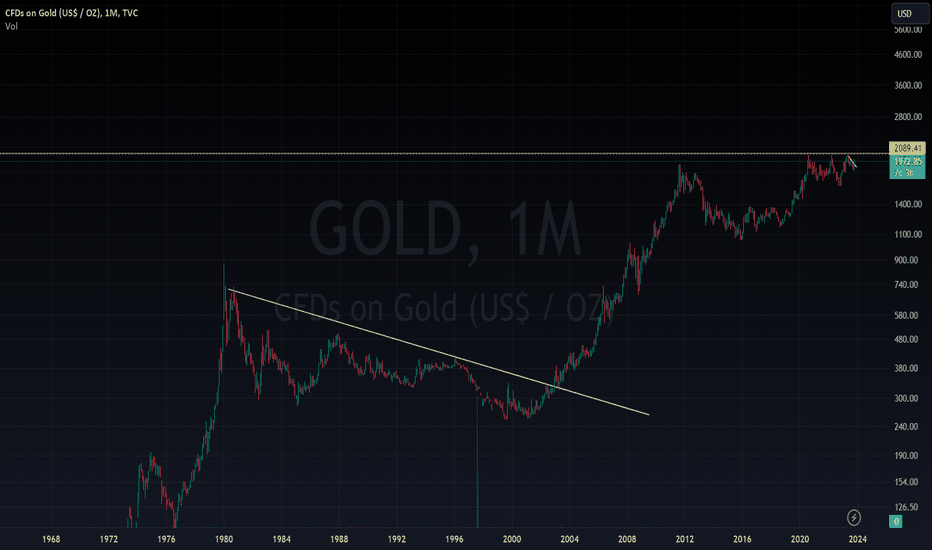

Gold- Is it the right time to buy some?Gold has been the go-to hedge against inflation and uncertain economic/political/social situations. But has it always given good returns? Not necessarily. There have been times when gold has been in a range or even in a downtrend for more than a decade. Eventually it might rise, sure, but will you be willing to wait for so long? Of what use is the profit if you cannot enjoy it in your lifetime.

That said, if timed well, gold has also given phenomenal returns. So, in my opinion, it all comes down to finding the most probable time to buy and percentage of funds allocated, which should not and cannot be more than 25 to 30 percent, no matter what Robert Kiyosaki says. There is a lot to learn from him and a lot of what he says makes sense, but betting everything on Gold and Silver? Probably not.

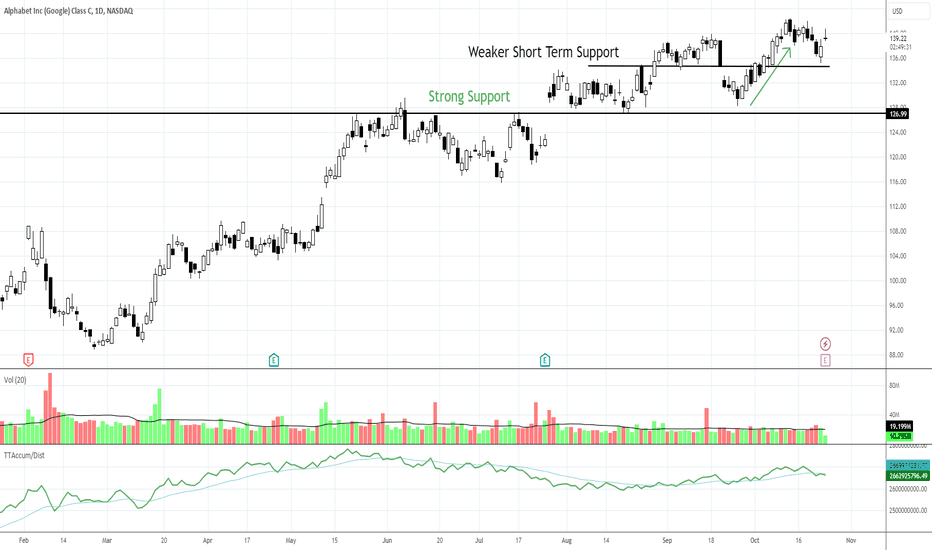

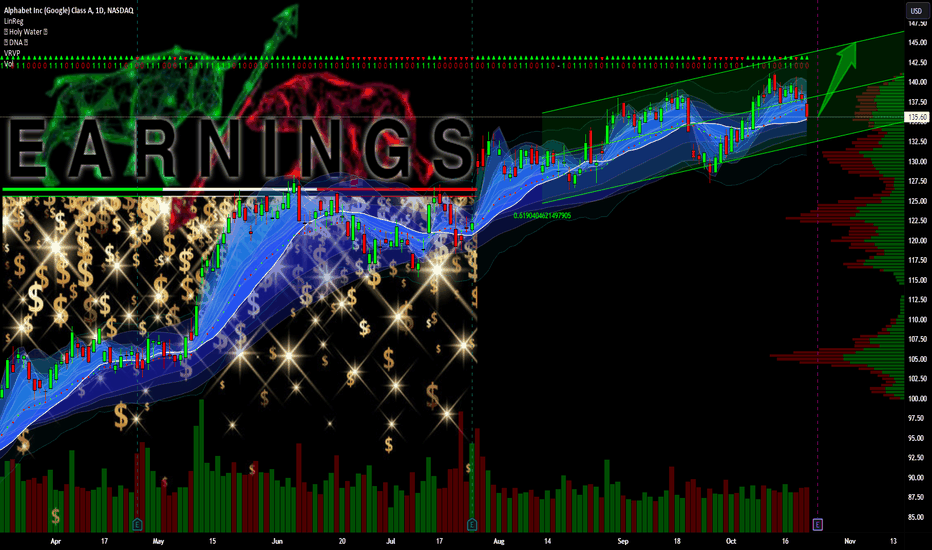

GOOG Sympathy Move Ahead of Earnings TodayThe run down to Monday was a sympathy run. It doesn't mean that NASDAQ:GOOG is headed for a bad report. Rather, retail investors are selling ETFs or moving money out of stocks into safe havens, or other adjustments to portfolios and 401(k)s. The selling dug into the most recent weak support level.

However, NASDAQ:GOOGL has not sent out any advisor in recent weeks regarding its earnings report. Any company this size, and as a veteran company of the stock market, would warn if earnings were going to miss the retail-side analyst estimates. So this is a sympathy move merely because the retail-side selling is moving big-name companies down at this time.

If it has a great earnings report, which the previous runs suggest , then the HFTs may trigger a gap up at open tomorrow. Alphabet had improvement in its quarterly report last quarter. Yearly revenues have been up for 4 years but earnings are up and down as it invests hugely in AI.

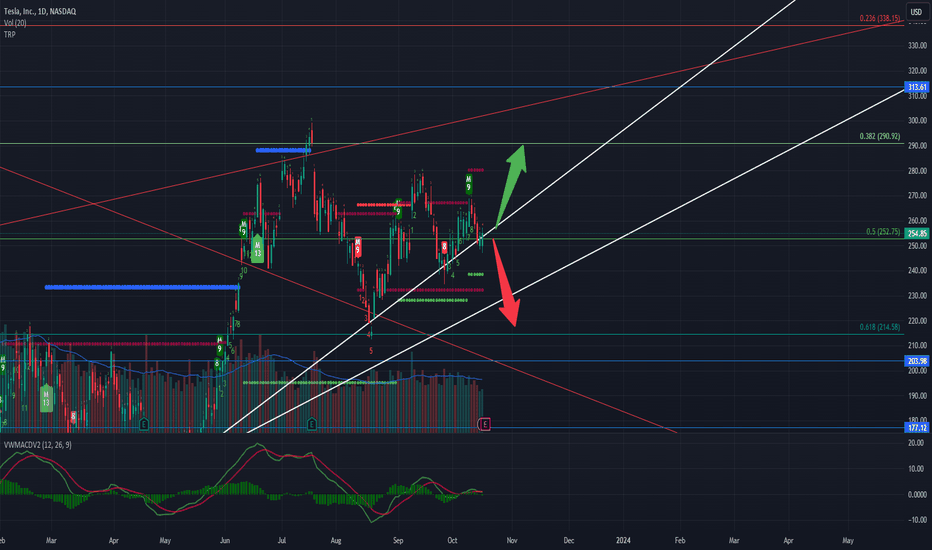

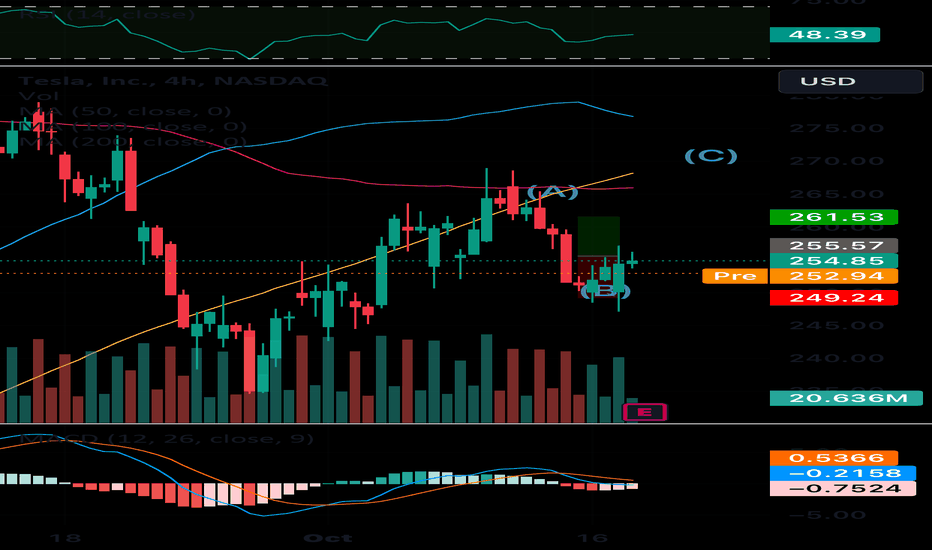

TSLA - Before earning report this eveningThere is a 2 possibility in my opinion:

Green arrow : Go to 290 in a short term, if the EPS will be over 0.78$ - 0.80$ and strong financial results.

Red arrow : down to 214 in a short term, if the EPS will be down to 0.70$ and not a satisfying financial results.

Let's wait today's report then decide what to do .

This is not invesment sugesstion , just my ideas in my brain :)

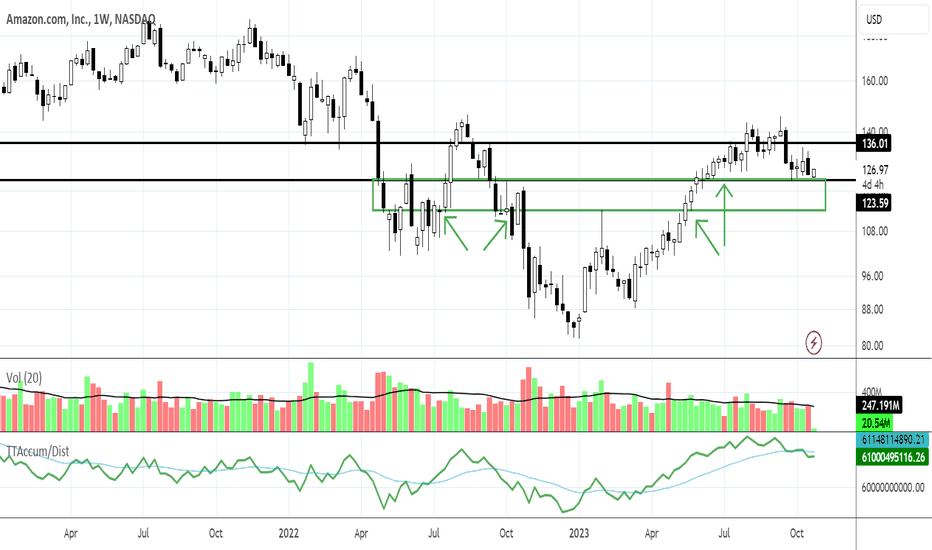

Think Before You Short: AMZN EarningsTraders need to check weekly charts when considering selling short stocks at this time. Many times there are strong support levels close to the current sold down price action.

The weekly charts also provide more data for day and swing traders to determine the all important RUN GAIN POTENTIAL. This must be calculated before any trade to determine the Risk versus Profit Potential for that trade, regardless of whether the hold time is a few minutes or several days for swing trading.

For many stocks, the recent selling down is not due to weaker earnings expectations but due to an overall reaction to retail news regarding international conflicts, US government uncertainties and regional wars.

The key element for trading stocks short-term is to understand where support will kick in and halt a sell short trade. Understanding the functionality and the strength or weakness of a support level is crucial to attaining a high-profit trade.

It is also a factor if you are waiting on the Dark Pool Buy Zone levels for getting into the stock for a run up from support levels.

Below is a chart of AMZN, which reports earnings on Thursday this week after the market close.

It shows that support is strong near the current price level. This indicates that the Dark Pool Buy Zone is within that technical price range. Selling short is inherently higher risk as the support level is a long-term trend strong support.

Why is it so strong?

1. There is a several-week price range that held the stock up.

2. Highs are a support mechanism when the stock market is not in a long-term downtrend. ALL

traders should know that this is not a bear market. Indexes are in a Trading Range.

3. The length of the candles is significant and relevant to the strength of the support.

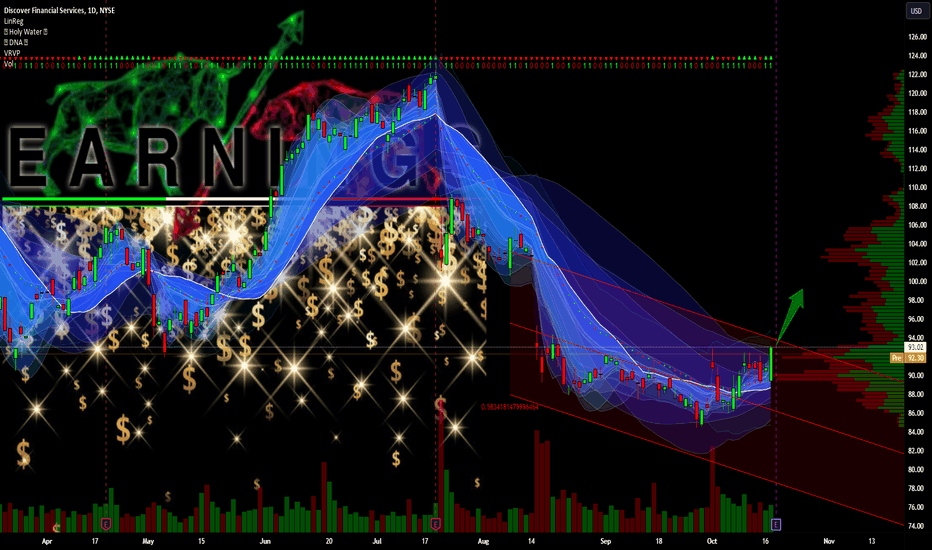

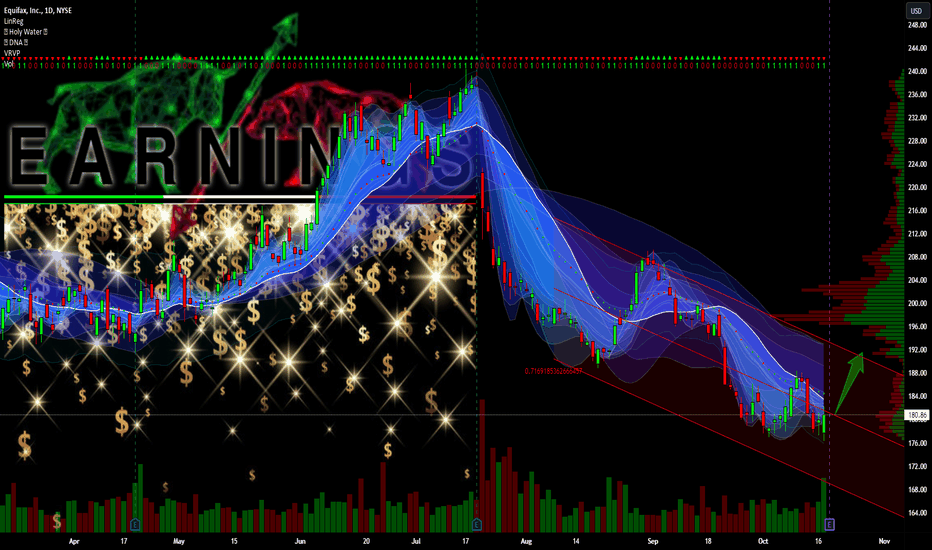

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: positive swing to resistance.

Next Wave: buy wave to the deviation.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/24 BMO

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #5

Revenue 2-Year Trend: the company trend in Revenues is negative.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #5

EPS 2-Year Trend: the company trend in EPS is negative.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press, I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus, I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

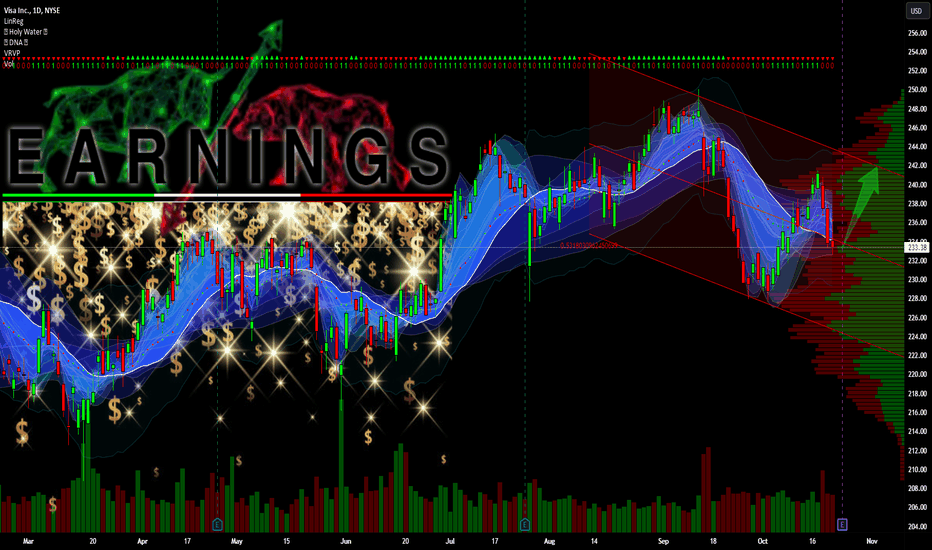

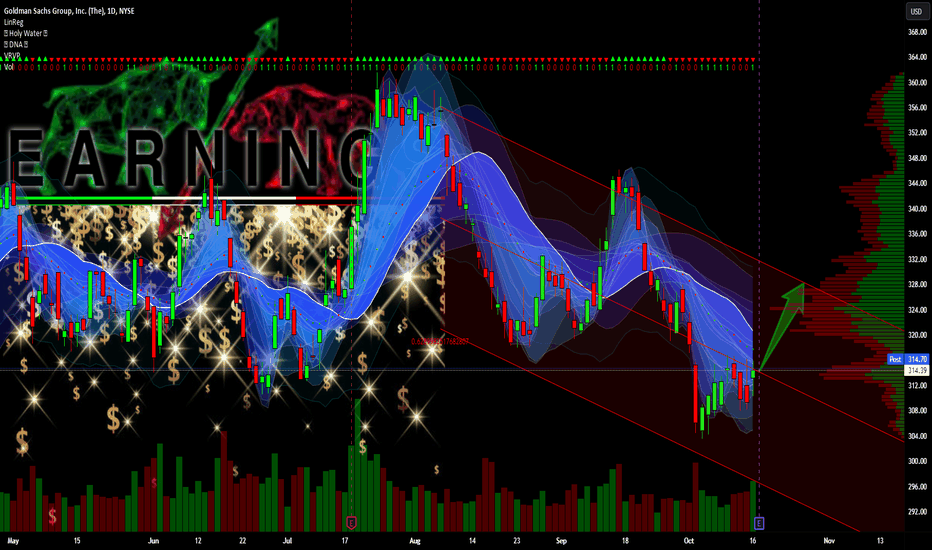

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: positive to resistance.

Next Wave: buy wave to the ceiling.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/24 AMC

Quarter: FQ4'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #7

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #7

EPS 2-Year Trend: the company trend in EPS is positive.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press, I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus, I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: sideways/holders/neutral.

Next Swing: neutral swing of volatility.

Next Wave: buy wave to the ceiling.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/24 AMC

Quarter: FQ1'24

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #4

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #5

EPS 2-Year Trend: the company trend in EPS is positive.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press, I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus, I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: long/buyers/positive.

Next Swing: neutral swing of volatility.

Next Wave: buy wave to the ceiling.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/24 AMC

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #3

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #5

EPS 2-Year Trend: the company trend in EPS is positive.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪BUY: If the earnings report is released with complicating press, I expect the market will buy the surprise instead of investing in alternative securities.

🔴BUY: If the earnings report is below the Wall Street consensus, I expect the market will buy the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

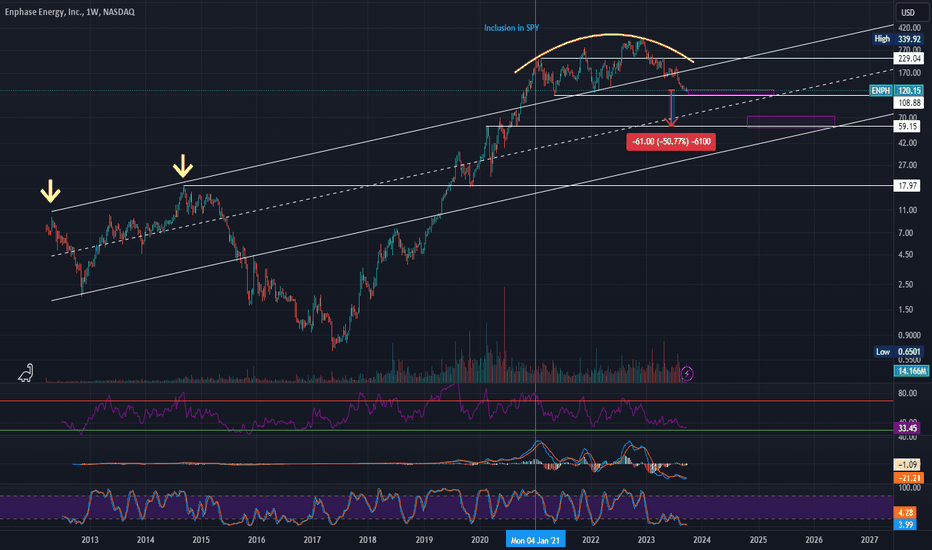

$108 or $59 support. 10% or 50% more down until bottomENPH is facing headwinds from multiple directions.

After a few years of sky high valuations, it is being looked at with fundamentals. Current PE of 30, so we could reasonably fall to a PE of 20 if the broader market crashes or if the CleanTech bubble (continues to) pop.

Either 10% down from here ~$108 or 50% down from here ~$59 are plausible IMO.

I like what these guys do, but I'm going to be cautiously on this one.

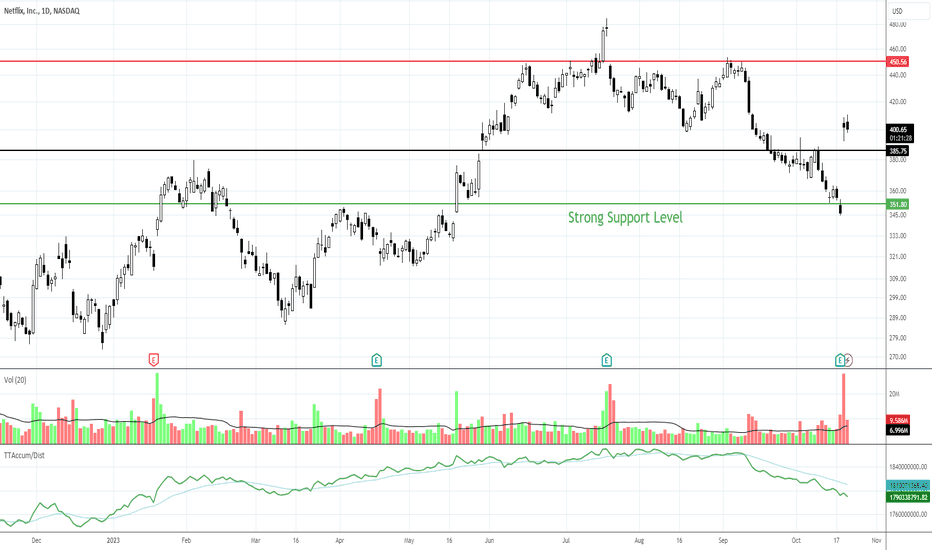

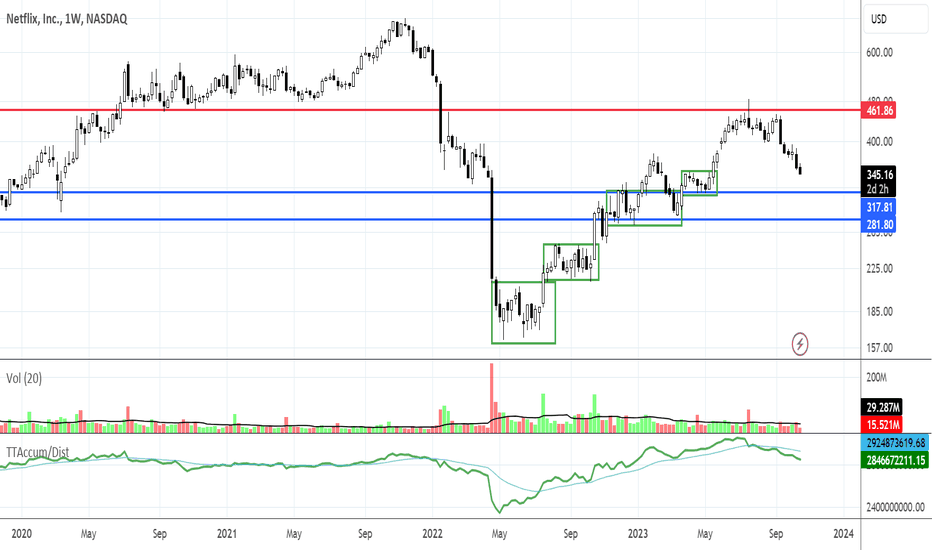

Positive Earnings Gaps Seldom Fill: NFLXTo follow up on my analysis of NFLX from Wednesday ...

Despite the market moodiness and selling, NASDAQ:NFLX reported well above estimates.

HFTs triggered a huge gap up on heavy pre-open order flow yesterday. Volume was also huge, so smaller funds' VWAPs triggered and retail traders chased the stock while Pro Traders and HFTs made some big profits.

Gaps up on positive earnings seldom fill completely. There is a strong support level at $350 which the gap up now confirms.

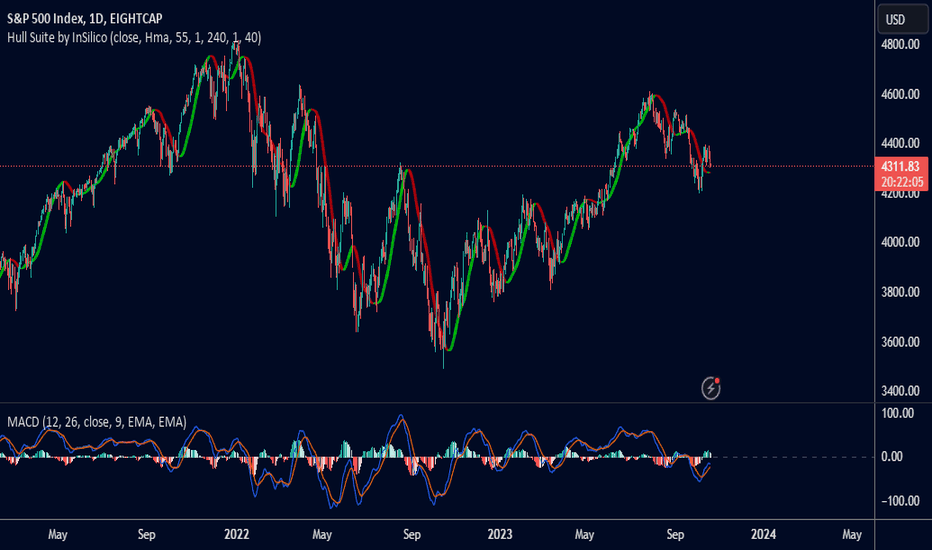

Market Meltdown: Wall Street's Shocking Symphony Unveiled!In the heart of financial dynamics, where numbers narrate tales and markets hum a melody, we stand on the cusp of a riveting chapter. The surge in bond yields, the resonance of conflict in Gaza, and the corporate crescendos echo through Wall Street, crafting a narrative that captivates and challenges.

As we step into this unfolding saga, each market movement becomes a note in a symphony—a symphony where every rise in bond yields, every geopolitical tremor, and every corporate revelation plays a crucial role. Join me as we unravel the Overture of Wall Street, decoding the melodies that shape the financial landscape and beckon us into the intriguing world of global finance.

Bond Yields Surge: Unraveling the Threads of Economic Sentiment

The recent surge in the benchmark 10-year U.S. Treasury yield, cresting above 4.9%, serves as a seismic event with far-reaching implications. Traditionally, higher yields spell caution for equity markets, diminishing the allure of stocks in comparison to the safety of fixed-income assets. The market's reaction, characterized by a 1.3% dip in the S&P 500, underscores the anxiety stemming from heightened borrowing costs for both corporations and households.

This surge in bond yields is not merely a statistical blip; it's a harbinger of a delicate dance between the Federal Reserve and the broader economic landscape. The specter of swelling U.S. debt looms large, and as Bloomberg Economics warns, the increase in yields could act as a drag on economic growth, akin to the impact of a Fed rate hike.

Geopolitical Turmoil: A Catalyst for Market Volatility

The geopolitical tableau adds a layer of complexity, with the Gaza conflict acting as a catalyst. The deadly explosion at a Gaza hospital and the subsequent cancellation of a summit with Arab leaders have injected fresh uncertainties into the market psyche. Beyond the tragic human toll, the conflict reverberates through financial markets, notably elevating oil prices.

Oil, the lifeblood of economies, rose nearly 2% to $91.50 a barrel. The Israel-Hamas conflict and optimistic outlooks for Chinese demand became twin engines propelling oil's ascent. Investors, already grappling with bond yield tremors, now face the added challenge of navigating an energy market rife with geopolitical uncertainties.

Corporate Performance: A Tapestry of Triumphs and Tribulations

Against this backdrop, corporate performances play a pivotal role in shaping market trajectories. Morgan Stanley's stock stumbled after reporting a drop in quarterly net income, emblematic of challenges within the financial sector. Simultaneously, Procter & Gamble's shares surged as the company reported a quarterly profit boost, underlining the impact of strategic pricing decisions in an inflationary environment.

The corporate stage is set, with companies wielding the power to either fortify or erode market confidence. In the case of United Airlines, a 7% early decline in shares following a cut in year-end earnings forecasts exemplifies the tightrope walked by companies in a tumultuous market environment.

Market Performance: A Symphony of Red and Green

As the final notes of the market day resonated, the S&P 500, Nasdaq Composite, and Dow Industrials bore the weight of a 1.3%, 1.6%, and 1% decline, respectively. The Russell 2000, reflecting smaller companies, faced a more substantial 2.1% dip. This symphony of red underscores the impact of mixed corporate reports and the tightening grip of rising Treasury yields.

The decline is not confined to domestic shores; the MSCI World index echoes the sentiment, falling in tandem with its U.S. counterparts. The markets, in their collective wisdom, are sending signals of caution, reacting to the interplay of global and domestic variables.

Deciphering the Market's Sonnet

In conclusion, Wall Street's current state is akin to a sonnet, weaving together verses of bond yield surges, geopolitical tumult, and corporate performances. Each stanza contributes to the larger narrative of market sentiment, reflecting the delicate balance between risk and reward. Investors must read between the lines, understanding that every rise in bond yields, every geopolitical tremor, and every corporate report shapes the verses of the market's sonnet.

As we navigate these turbulent waters, an agile and discerning approach is paramount. The future remains unwritten, and while challenges abound, opportunities await those who can decipher the intricate melodies emanating from Wall Street's financial symphony.

NFLX Falling into a Dark Pool Buy Zone?While we all wait on the highly anticipated NASDAQ:NFLX earnings report at the close today, let's study the weekly chart to study the downside potential since the stock gapped down today on expectations of a weak report.

Netflix’s percentage of shares held by institutions has recovered to a respectable 79%, which is more consistent with a company that is in favor with the Buy Side Institutions. There has been accumulation going on since the lows of 2022.

Selling Short is problematic due to the support levels not far down from the current price and the risk of a hidden Dark Pool Buy Zone starting at the highs of the U-shaped bottom formation.

The current run down is at a technical support level, which is where pro traders often nudge the price to trigger HFTs. Beware of the risk of an extreme reaction at the open tomorrow. During earnings season with a report at the close, pro traders often take profits either in the final minutes of the day to avoid the risk of a surprise, or shortly after the open to capitalize on the reaction to the report.

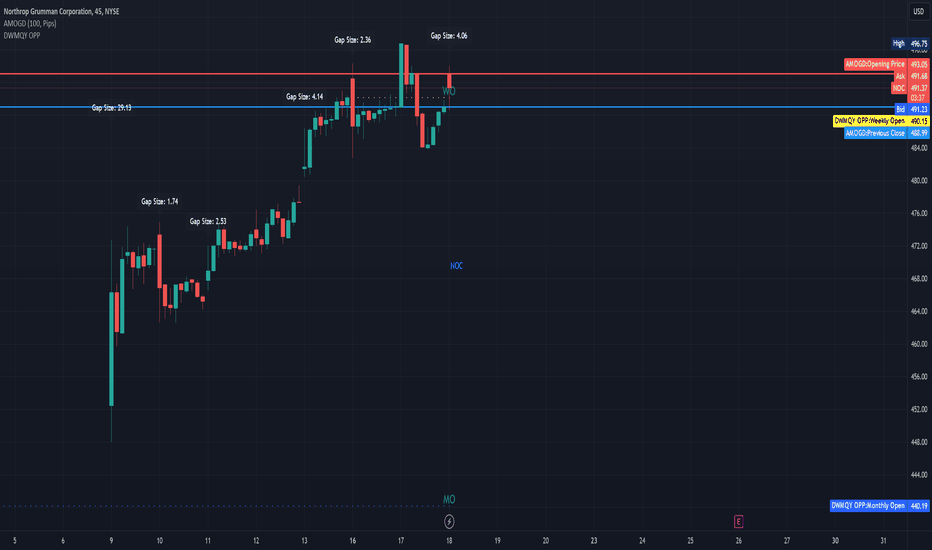

Northrop Grumman Corporation (NOC) October 2023 to April 2024

Northrop Grumman Corporation (NOC)

Fundamentals:

Market Cap: $73.996 billion

EPS (Earnings Per Share): $30.13

P/E Ratio: 16.232

Book Value: $102.293

Operating Margin (TTM): 11.49%

Profit Margin: 12.27%

Return on Assets (TTM): 8.45%

Return on Equity (TTM): 31.91%

Wall Street Target Price: $504.33

Revenue (TTM): $37.881 billion

Gross Profit (TTM): $7.474 billion

Recent Earnings:

Q2 2023: Actual EPS of $5.34 vs. Estimated EPS of $5.33 (Surprise: +0.1876%)

Q1 2023: Actual EPS of $5.5 vs. Estimated EPS of $5.09 (Surprise: +8.055%)

Q4 2022: Actual EPS of $7.5 vs. Estimated EPS of $6.57 (Surprise: +14.1553%)

Technical Indicators:

52 Week High: $547.6509

52 Week Low: $414.56

50-Day Moving Average: $436.8846

200-Day Moving Average: $453.325

Beta: 0.437 (indicating the stock is less volatile than the market)

Dividends:

Forward Annual Dividend Rate: $7.48

Forward Annual Dividend Yield: 1.53%

Payout Ratio: 29.72%

Performance Metrics:

YTD Return: -9.27%

1-Year Return: 4.55%

3-Year Return: 17.6%

5-Year Return: 11.52%

10-Year Return: 19.05%

Analysis:

Northrop Grumman has demonstrated a solid financial performance with a healthy profit margin and return on equity. The company's earnings have been consistently beating estimates, indicating strong operational efficiency. The stock's P/E ratio is relatively moderate, suggesting it might be fairly valued. The company also offers a decent dividend yield, making it attractive for income-seeking investors. However, the stock has underperformed YTD, which might be a concern for short-term investors. Given its industry positioning and financial metrics, it seems to be a stable investment for those looking at the defense sector.

Tesla could be on the verge of a strategic pivotWall Street analysts are focused on the company's gross margin levels after it implemented several price cuts, as well as any commentary on its outlook for demand in both the US and in China.

The EV maker already reported third-quarter deliveries of 435,059, which was below Wall Street expectations of 451,000 vehicles. Tesla said downtime at its factories in Shanghai and Dallas led to a slight decline in vehicle production during the quarter.

From an earnings perspective, here's what Wall Street expects from Tesla, according to data from Bloomberg:

Revenue: $24.9 billion

Adjusted earnings per share: $0.91 per share

Gross margins: 18.2%

Other items that will be on watch by investors is any update related to the company's planned launch of its Cybertruck, the impact its vehicle price cuts have had on demand, and the earnings potential of its EV charging network after it struck deals with a slew of automakers, among other things.

Our view is that Tesla could be in the midst of a strategic pivot from making cars to becoming a Tier 1 supplier. For Tesla's pivot, we see charging infrastructure, batteries, and drive units as being key in gaining access to OEMs as customers," RBC said in a recent note.

The bank highlighted that for Tesla to hit its 2023 delivery target of 1.8 million vehicles, it would have to deliver 476K units in the fourth-quarter.

"This would require production to quickly return to normal levels," RBC said.

RBC reiterated its "Outperform" rating and $305 price target, representing potential upside of 20% Spike.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: positive swing to resistance.

Next Wave: buy wave to the ceiling.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/18 AMC

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #5

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #3

EPS 2-Year Trend: the company trend in EPS is neutral.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press, I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus, I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: positive swing to resistance.

Next Wave: buy wave to the deviation.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/18 AMC

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #5

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #6

EPS 2-Year Trend: the company trend in EPS is neutral.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus, I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press, I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus, I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

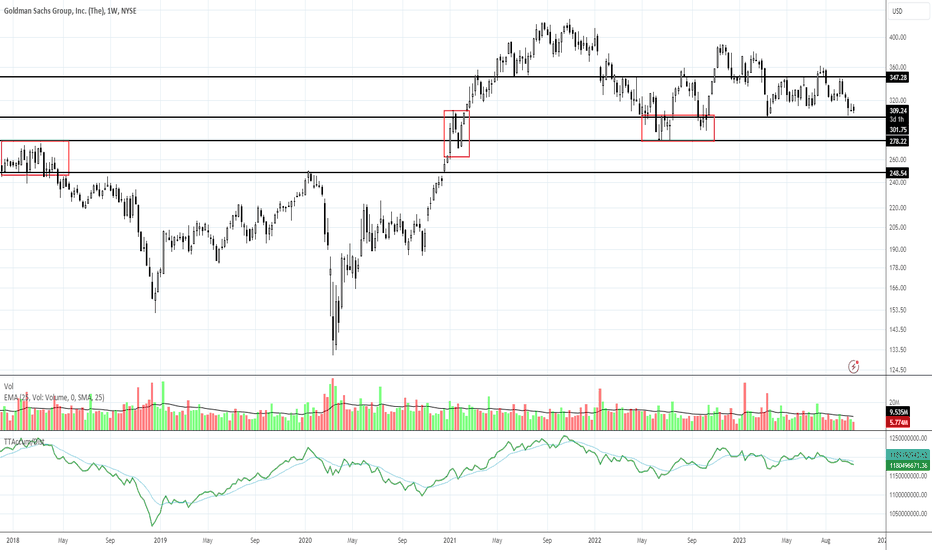

GS Earnings and Institutional HoldingsNYSE:GS has had a sudden huge decline in its Institutional Holdings from last quarter--a whopping 12%. That's huge. This suggests that often the selling is from Buy-Side Institutions.

Goldman Sachs has a buyback program of 30 billion dollars underway, approved end of February 2023. The Buybacks started in March and have continued until recently. I showed the buyback activity on the daily chart in this article earlier this month.

The Support from corporate buybacks poses problems for selling short. The stock is also prone to HFT triggers with frequent gapping. The first Support level is just above the 2022 lows.

The company reported earnings this morning and gapped down at open but is holding onto the sideways range it's been in for 2 weeks so far.

However, Quarterly and Annual Reports are starting to show signs of weakness as this company struggles to reinvent.

NYSE:GS is also facing loss of revenues from IPO underwriting as the NASDAQ Private Market is undermining the high income usually generated from IPOs by underwriters.

IMO, the investment banking industry is slowly becoming obsolete as DeFi, Fintech, Blockchain technologies and Crypto currencies continue to advance and erode traditional revenue streams.

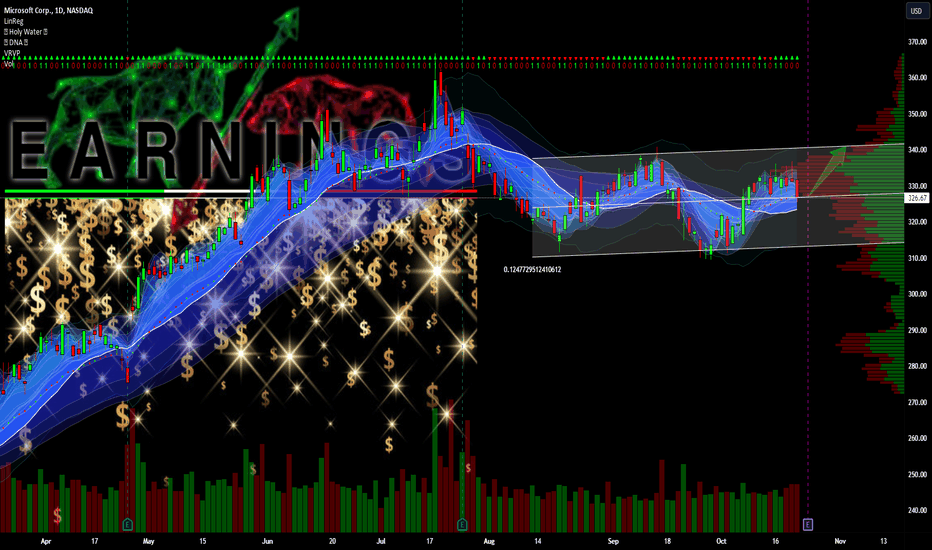

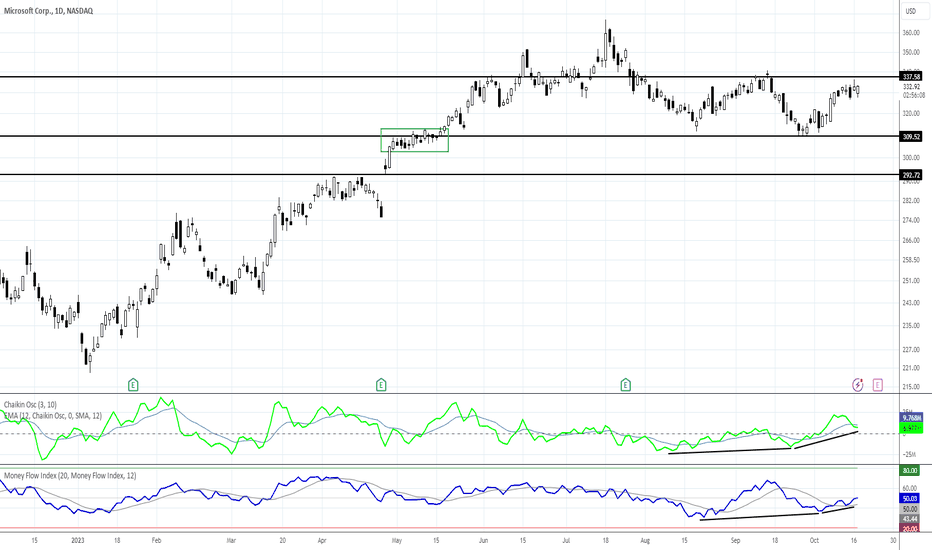

MSFT Showing Strength on Retest Ahead of EarningsPercentage of Shares Held by Institutions is a bit low at 69% for NASDAQ:MSFT stock right now. However, the indicators are showing some strength as it retests the lower level of resistance above its current price.

NASDAQ:MSFT reports earnings next week on Tuesday. Microsoft has focused on AI for small businesses, the market niche that helped move it out of its 16-year slump until 2016, and during the pandemic. The pandemic anomalies in revenues should be patterned out this earnings season.

The stock has ample support at the most recent lows. It is a heavily weighted component of all 3 indexes, so an important report for Q3.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: positive swing to resistance.

Next Wave: buy wave to the deviation.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/17 BMO

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise of Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #7

Revenue 2-Year Trend: the company trend in Revenues is negative.

_______________________________________________

EPS Anticipations: positive surprise of EPS.

EPS Surprise-Confidence: on a scale of 0-9, #4

EPS 2-Year Trend: the company trend in EPS is negative.

_______________________________________________

📝 S Y N O P S I S

🟢BUY: If the earnings report is above the Wall Street consensus I expect the market will buy the +surprise.

⚪NEUTRAL: If the earnings report is released with complicating press then I expect the market will avoid the surprise and invest in alternative securities.

🔴SELL: If the earnings report is below the Wall Street consensus I expect the market will sell the -surprise.

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

💵 E a r n i n g s J o u r n a l📶 S T A T I S T I C A L A N A L Y S I S

Current 50-Day Market Trend: short/sellers/negative.

Next Swing: negative swing to support.

Next Wave: buy wave to the deviation.

Next 50-Day Market Trend: long/buyers/positive.

Trade Type: Touch & Go don't wait for a close.

💵 E A R N I N G S A T A G L A N C E

Release Date: 10/19 BMO

Quarter: FQ3'23

_______________________________________________

Revenue Anticipations: positive surprise for Revenues.

Revenue Surprise-Confidence: on a scale of 0-9, #5

Revenue 2-Year Trend: the company trend in Revenues is positive.

_______________________________________________

EPS Anticipations: positive surprise for EPS.

EPS Surprise-Confidence: on a scale of 0-9, #9

EPS 2-Year Trend: the company trend in EPS is positive.

_______________________________________________

📝 S Y N O P S I S

"I expect the market will buy the +surprise if the earnings report hits the Wall Street consensus, or sell the -surprise if the earnings report misses the Wall Street consensus."

🔎 R E S E A R C H D E P T H

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.