CVNA EARNINGS TRADE IDEA — July 30 (AMC)

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC)

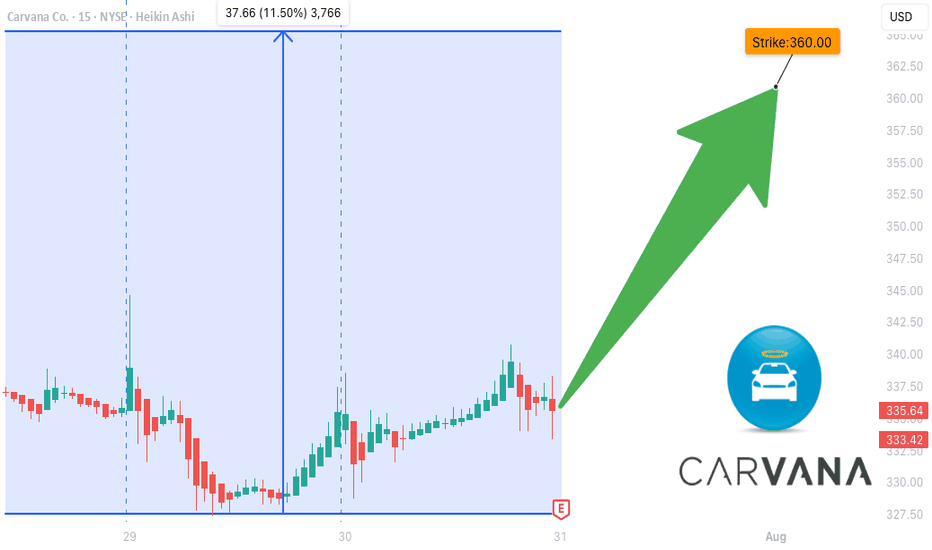

**Carvana (CVNA)**

📊 **Bullish Confidence**: 85%

📈 **Earnings Play Setup**

💣 Big Volatility + Strong History = Explosive Potential

---

### ⚙️ FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +38.3% YoY

🔁 **8/8 EPS Beats** (114.5% avg surprise)

🟡 **Profit Margin**: 2.7% (Thin but improving)

⚠️ **Debt-to-Equity**: 344.78 (High leverage risk)

💬 **Sector Rotation**: Growth favors high-beta names

💡 **Beta**: 3.60 → Big post-earnings swings likely

---

### 📊 OPTIONS FLOW HEATMAP

🔥 Heavy Call Volume @ \$360–\$370

🟢 Bullish OI Stack

📉 Put/Call Skew: CALL DOMINANT

💥 IV Elevated = Lotto ticket pricing

---

### 📈 TECHNICALS

💵 Price: \$336.50

🧱 Resistance: \$343.68

📉 RSI: 44.5 (Neutral – Room to Run)

📊 200D MA: \$252.21 → Long-term bullish positioning

---

### 🔥 TRADE IDEA:

**CVNA 08/01 \$360 CALL**

🎯 **Entry**: \$11.25

🚀 **Target**: \$33.75 (200% ROI)

🛑 **Stop**: \$5.60

📊 **Size**: 1 contract

⏰ **Entry Timing**: Pre-Earnings Close (AMC play)

---

### 📉 RISK / REWARD

* 🟥 Max Loss: \$11.25

* 🟩 Profit Target: \$33.75

* ⚖️ RR Ratio: 1:3

* 💼 Portfolio Risk: 2–3%

---

### 🧠 STRATEGY INSIGHTS

✅ Historical beat rate = STRONG

✅ Bullish options skew = CONFIRMED

⚠️ High debt = risk, but momentum > fear

📌 Tip: If IV crushes post-earnings, exit fast. This is a *structured speculative play* — not a hold-and-hope.

---

📢 "Speculation is fine. Structure it."

💬 Tag a trader who *YOLOs with stop losses* 👇

\#CVNA #EarningsPlay #OptionsTrading #TradingView #HighBeta #LottoPlay #RiskManaged #CallOptions #BullishSetup #IVCrushProof #EcommerceStocks #EarningsSeason

Earningsplays

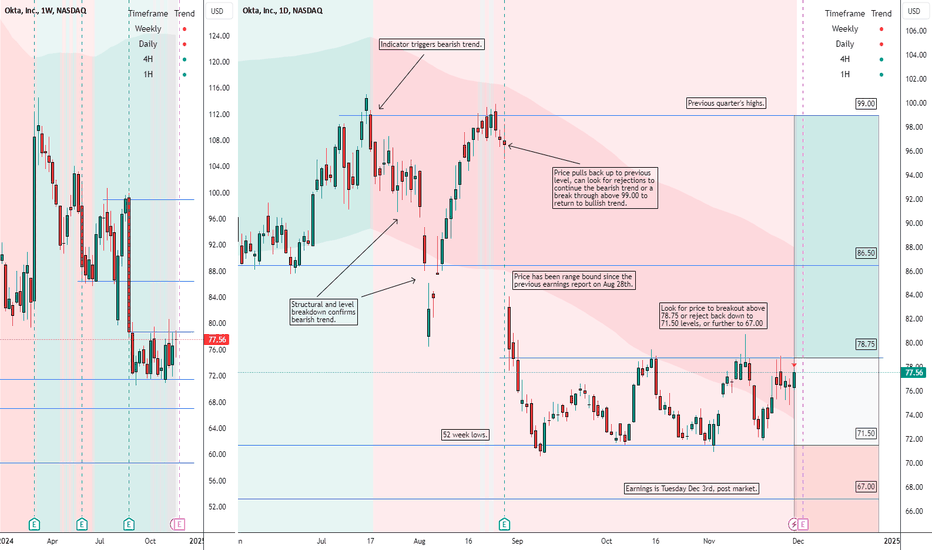

OKTA $OKTA | RANGE BOUND EARNINGS PLAY - Nov. 3rd, 2024OKTA NASDAQ:OKTA | RANGE BOUND EARNINGS PLAY - Nov. 3rd, 2024

BUY/LONG ZONE (GREEN): $78.75 - $99.00

DO NOT TRADE/DNT ZONE (WHITE): $71.50 - $78.75

SELL/SHORT ZONE (RED): $58.75 - $71.50

Weekly: Bearish

Daily: Bearish

4H: Bullish

1H: Bullish

NASDAQ:OKTA price movement has been range bound since the previous earnings report on Aug28th. I am now looking for this upcoming earnings report on Nov3rd post market to be the new catalyst for breaking out or down from this range. The bottom level of the range marks the 52 week lows. For the time being, price has made its way to the top of the range, if there is a negative reaction to the earnings report, price may only dip back down to the bottom of the range and stay within the sideways levels.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, earnings, earningsplay, earningsreport, upcomingearnings, oktaearnings, $oktaearnings, NASDAQ:OKTA , oktaearningsreport, oktatrades, oktatrade, oktarange, oktapricerange, oktatradesetup, oktaanalysis, oktarangelevels, oktapricelevels, oktaoptions, optionstrading,

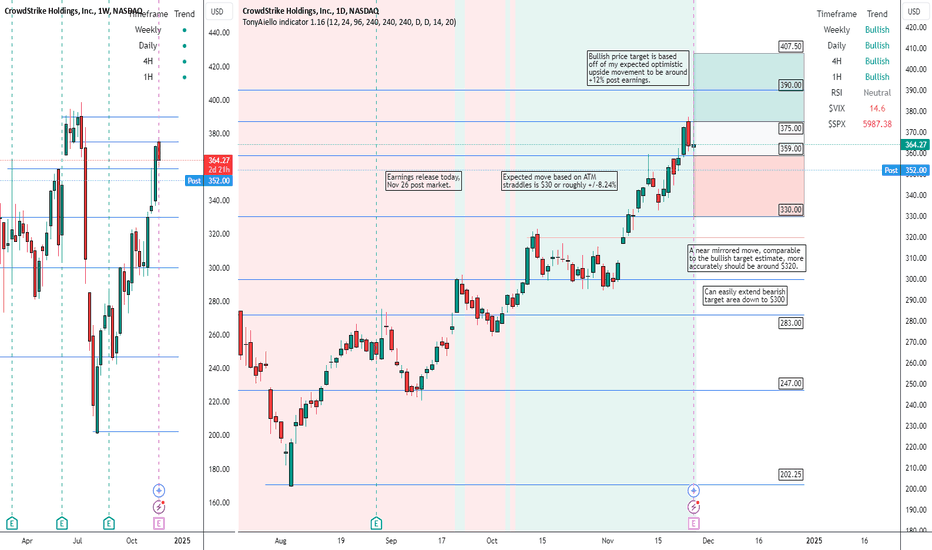

CROWDSTRIKE $CRWD | EARNINGS TARGETS Nov. 26th, 2024CROWDSTRIKE NASDAQ:CRWD | EARNINGS TARGETS Nov. 26th, 2024

BUY/LONG ZONE (GREEN): $375.00 - $407.50

DO NOT TRADE/DNT ZONE (WHITE): $359.00 - $375.00

SELL/SHORT ZONE (RED): $330.00 - $359.00

Weekly: Bullish

Daily: Bullish

4H: Bullish

NASDAQ:CRWD earnings release today, Nov 26 post market. Expected move based on ATM straddles is $30 or roughly +/-8.24%. Bullish price target is based off of my expected optimistic upside movement to be around +12% post earnings. A near mirrored move, comparable to the bullish target estimate, more accurately should be around $320. Can easily extend bearish target area down to $300.

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, options, optionstrades, earningsmove, crwd, crwdearnings, crowdstrikeearnings, earningsplay,