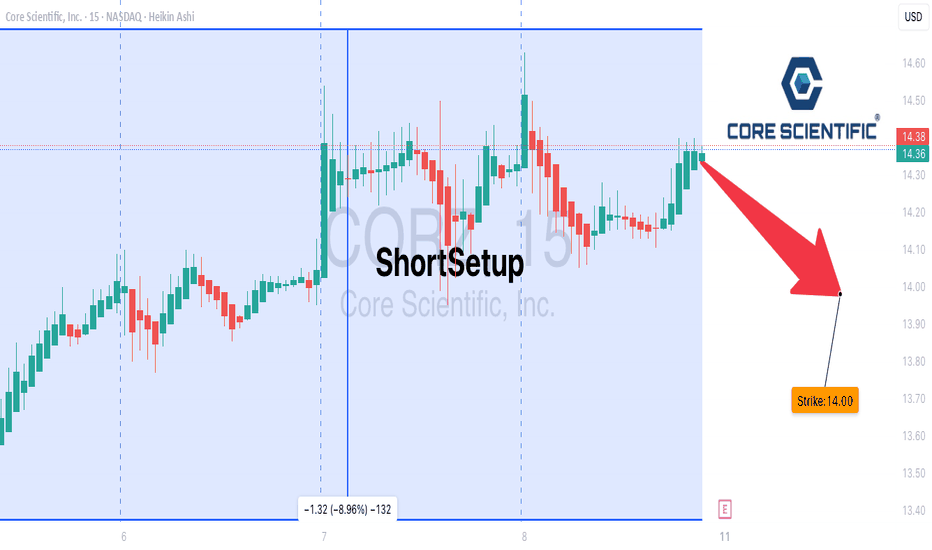

CORZ Earnings Alert — Bearish Setup Ahead of BMO Report****⚠️ CORZ Earnings Alert — Bearish Setup Ahead of BMO Report**

Core Scientific (CORZ) faces heavy fundamental headwinds with declining revenue (-55.6%) and negative margins, despite some bullish options flow and technical support near \$14.

**📉 Market Sentiment:**

* Moderate bearish conviction (75%)

* Mixed signals: cautious optimism from options flow vs. weak fundamentals

* Watch M\&A uncertainty and regulatory risks

**🛠 Trade Setup:**

* **Instrument:** CORZ

* **Direction:** PUT (SHORT)

* **Strike:** \$14

* **Entry Price:** \$0.16

* **Profit Target:** \$0.48 (200-300% gain)

* **Stop Loss:** \$0.08

* **Expiry:** 2025-08-08

* **Size:** 1 contract

* **Entry Timing:** Pre-earnings close

**🔑 Key Levels:**

* Support near \$14

* Resistance at \$15

* Expected Move: -\$2.50

**⚠ Risk Management:**

* Cut losses at 50% premium decline (\$0.08)

* Exit by market open next day if no target hit

---

**#CORZ #CoreScientific #EarningsTrade #PutOptions #BearishSetup #OptionsTrading #CryptoStocks #MAndA #RiskManagement #TechnicalAnalysis #TradingView #StockMarket #Volatility #ShortSetup**

Earningstrade

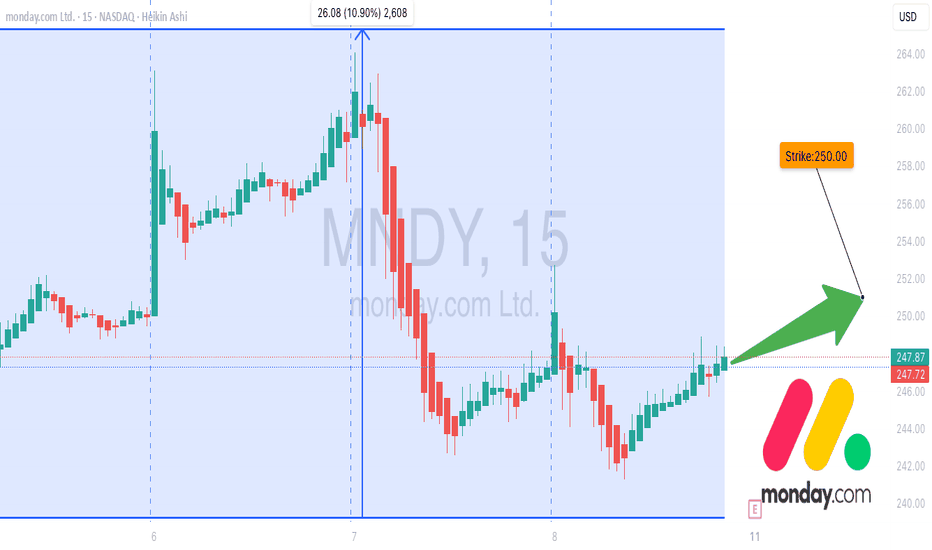

MNDY Earnings Play — Strong Bullish Momentum Ahead of AMC**🚀 MNDY Earnings Play — Strong Bullish Momentum Ahead of AMC**

Monday.com (MNDY) shows powerful fundamentals with 30% revenue growth and a perfect 8-quarter earnings beat streak. Options flow and technicals align for a potential explosive move post-earnings on **2025-08-08 (After Market Close)**.

**🔥 Key Stats:**

* Revenue growth: 30.1% TTM

* EPS consensus: \$3.70 (85% confidence in a beat)

* IV Rank: 75% (watch for IV crush post-earnings)

* RSI near 25 → oversold, setup for bounce

* Strong call volume at \$250 strike

**🛠 Trade Setup:**

* **Instrument:** MNDY

* **Direction:** CALL (LONG)

* **Strike:** \$250

* **Entry Price:** \$17.40

* **Profit Target:** \$52.00 (200-400% gain)

* **Stop Loss:** \$8.70 (50% premium cut)

* **Expiry:** 2025-08-15

* **Size:** 1 contract

* **Entry Timing:** Pre-earnings close

**⚠ Risk Management:**

* Position size max 2% portfolio

* Exit within 2 hours post-earnings to avoid IV crush and theta decay

---

**#MNDY #MondayDotCom #EarningsTrade #OptionsTrading #CallOptions #BullishSetup #PreEarnings #TechnicalAnalysis #RSI #IVRank #SwingTrade #TradingView #StockMarket #HighReward #RiskManagement**

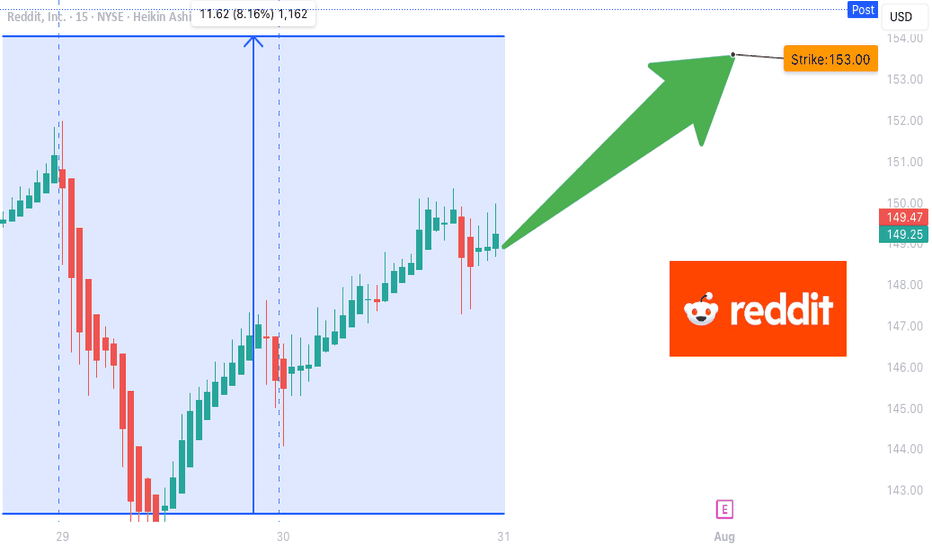

RDDT Earnings Play — July 30 (BMO)

## 🚀 RDDT Earnings Play — July 30 (BMO)

**🎯 Bullish Call Trade | 75% Confidence | High Momentum Setup**

---

### 📈 REDDIT, INC. (RDDT) – EARNINGS SNAPSHOT

🧠 **Revenue Growth**: +61.5% TTM — AI + Ads combo paying off

💸 **Margins**:

• Gross: 90.8% ✅

• Op: 1.0% 🚩

• Profit: 8.1% 👍

🧾 **EPS Surprise Streak**: ✅ 5 for 5 | Avg. +191%

🎯 **Target Price**: \$155.58 (+9.5%)

⚖️ **Forward P/E**: 222.6 — Rich but justified?

**Score: 8/10**

📊 Sector: Comm Services (AI-driven tailwinds)

---

### 💥 OPTIONS FLOW SNAPSHOT

💰 Calls Stack at \$150 & \$160

🛡️ Puts cluster \$140–\$149 = Hedges, not bearish bets

📉 IV High = Juicy premiums

📈 Gamma Bias: Positive Skew

**Score: 7/10**

---

### 🔍 TECHNICAL CHECK

📍 Price: \~\$145.32

🧭 20D MA: \$147.89

📊 RSI: 59.5 (Momentum neutral, room to run)

🔓 Resistance: \$150

🛡️ Support: \$140

**Score: 6/10**

---

### 🌎 MACRO CONTEXT

🧠 Sector tailwinds from AI hype + digital ad rebound

🛑 No major regulatory red flags

**Score: 8/10**

---

## 🔥 THE TRADE SETUP

**📈 Direction**: Bullish

🎯 **RDDT 08/01 \$150C**

💸 **Entry**: \$9.55

🛑 **Stop Loss**: \$4.78

📈 **Target**: \$19.55+

🧮 **Size**: 1 Contract = \$955 Risk

🕒 **Entry Timing**: Pre-earnings close

📆 **Earnings Time**: BMO (Before Market Open)

📊 Expected Move: \~5%

📈 Setup = High risk / High reward, theta-sensitive

---

## ⚡ TRADE PLAN

✅ Take partial profit at 100%, full at 200%

⏳ Exit within 2H post-ER if target unmet

🛑 Cut below \$4.78 to cap drawdown

---

## 🧠 CONVICTION SCORE

🎯 75% Bullish Bias

📊 Based on fundamentals, options, and flow

📉 Risk = Valuation + Thin Op Margin

📈 Reward = Explosive upside w/ surprise history

---

💬 **Watch for \$150 breakout. If cleared post-ER = moonshot to \$160 possible.**

📢 #RDDT #EarningsTrade #RedditStock #CallOptions #AIStocks #TechMomentum #OptionsFlow #IVSurge #TradingViewIdeas #SwingTrade #OptionsStrategy #VolatilityPlays #RDDTstock

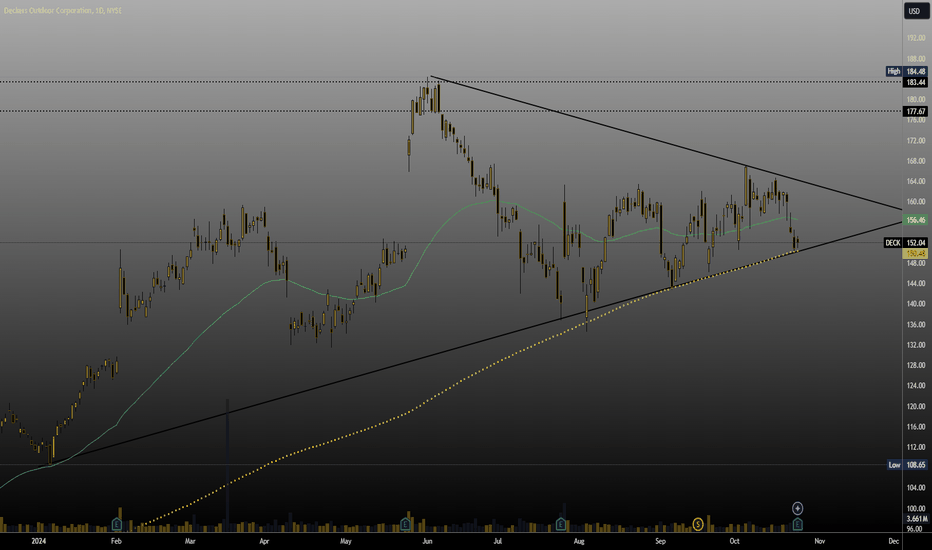

$DECK: Earnings Beat with Bullish Breakout on DeckDeckers Outdoor ( NYSE:DECK ) just closed at its 200-day moving average, forming a classic falling wedge ahead of its strong earnings beat and raised guidance. With massive short interest ready to cover, this stock is primed for an explosive breakout next week. My price targets are $177.67 and $184.48. Watch for momentum as shorts scramble to exit. Solid fundamentals and technicals aligning—time to pay attention.