Slight Bearish Bias Driven by Key Fundamentals on EURUSDEURUSD Analysis for 04/10/2024: Slight Bearish Bias Driven by Key Fundamentals

On October 4, 2024, the EURUSD currency pair demonstrated a slightly bearish bias, driven by a mix of fundamental factors and market conditions that traders and investors should consider. Below is a breakdown of the key elements that contributed to the downward pressure on the pair:

1. Stronger US Dollar Supported by Economic Data

One of the primary drivers behind the bearish momentum in EURUSD was the strength of the US Dollar. On October 4, 2024, the U.S. released better-than-expected economic data, particularly in the areas of job growth and manufacturing output. These positive data points boosted investor confidence in the USD, further supported by hawkish remarks from Federal Reserve officials suggesting that interest rates may remain elevated for a prolonged period.

The robust performance of the U.S. economy reinforced expectations that the Federal Reserve could maintain its aggressive stance on monetary tightening, leading to an increase in demand for the USD. The stronger dollar naturally weighed on the EURUSD pair, pushing it into a bearish zone as the market priced in the possibility of further rate hikes.

2. Weaker Eurozone Inflation Data

On the European side, the euro faced pressure due to weaker-than-expected inflation data from key Eurozone countries. The latest CPI readings revealed that inflation in the Eurozone is slowing down, raising concerns that the European Central Bank (ECB) might be hesitant to pursue further rate hikes in the near future.

The ECB’s more dovish outlook, in contrast to the Fed’s hawkish stance, created a divergence in monetary policies between the Eurozone and the United States, contributing to the bearish sentiment in EURUSD. Traders speculated that the ECB would likely adopt a more cautious approach in order to support the slowing Eurozone economy, which weighed on the euro.

3. Geopolitical Tensions in Europe

Another factor contributing to the bearish bias in EURUSD on 04/10/2024 was the ongoing geopolitical uncertainty in Europe. Continued tensions surrounding energy supply issues in the region, exacerbated by political disagreements between key European countries and external suppliers, have caused instability in the euro. The energy crisis in Europe is making investors cautious, further eroding confidence in the euro.

4. Risk-Off Sentiment

Global markets were in a broader risk-off mode on October 4, 2024, as concerns about the global economic slowdown and geopolitical instability grew. Investors sought safe-haven assets, including the USD, while riskier assets like the euro faced downward pressure. The general risk-off environment encouraged selling in EURUSD, especially as global investors moved towards the more stable US dollar amidst uncertain global conditions.

Conclusion: EURUSD Outlook

The combination of a strong US dollar, slowing Eurozone inflation, divergent central bank policies, and geopolitical tensions in Europe contributed to the slight bearish bias seen in EURUSD on 04/10/2024. While the U.S. economy continues to show resilience, the Eurozone faces challenges, particularly in terms of inflation and geopolitical risks, further increasing the likelihood that EURUSD will continue to experience bearish pressures in the near term.

As a trader or investor analyzing EURUSD, it’s essential to monitor both U.S. and Eurozone economic data closely, as well as central bank communications, as these will play a critical role in determining the future direction of the pair. For those with a bearish outlook, short positions could be explored, while those expecting a reversal should stay alert to any signs of dovish shifts from the Federal Reserve or improvements in Eurozone inflation data.

Keywords for SEO:

- EURUSD analysis

- Slight bearish bias

- EURUSD forecast

- Federal Reserve interest rates

- US Dollar strength

- Eurozone inflation data

- ECB monetary policy

- Trading EURUSD

- Geopolitical tensions Europe

- EURUSD daily update

- EURUSD bearish outlook

Ecbmonetarypolicy

Anticipating a Slightly Bearish Bias on EURUSD for 02/10/2024.EURUSD Analysis for October 2, 2024: Anticipating a Slightly Bearish Bias

As we head into October 2, 2024, the EURUSD currency pair is showing potential for a slightly bearish bias based on the latest fundamental factors and current market conditions. Traders and investors are keeping a close eye on several key drivers that could influence the pair today. In this article, we'll delve into the core reasons for this bearish outlook and highlight the critical elements that may impact the EURUSD price movement.

1. Diverging Economic Data Between the Eurozone and the U.S.

One of the primary factors contributing to the slightly bearish sentiment for EURUSD today is the divergence in economic performance between the Eurozone and the U.S. economy. Recent data from the Eurozone, particularly weaker-than-expected manufacturing PMI figures and concerns about stagnation in key economies like Germany, have cast doubt on the region’s growth prospects. This has added pressure on the Euro, potentially pushing it lower against the U.S. Dollar.

On the other hand, the U.S. economy continues to show resilience, supported by stronger-than-expected GDP growth and robust labor market performance. This economic divergence favors the U.S. Dollar, strengthening it against the Euro.

2. Monetary Policy Divergence: ECB vs. Federal Reserve

The monetary policy stance of the European Central Bank (ECB) versus the Federal Reserve is another important factor driving the bearish outlook for EURUSD. The ECB has recently adopted a more cautious stance, signaling that further rate hikes may be limited due to concerns over economic growth. This dovish tone is weighing on the Euro as market participants anticipate a slower pace of tightening.

In contrast, the Federal Reserve has maintained a more hawkish approach, with hints of further rate hikes if inflationary pressures persist. This divergence in policy direction increases the appeal of the U.S. Dollar, adding to the downward pressure on EURUSD.

3. Geopolitical Risks in Europe

Geopolitical tensions in Europe, including ongoing uncertainty surrounding energy security and the war in Ukraine, continue to weigh on investor sentiment. These factors are likely to keep the Euro under pressure, as risk-averse investors may flock to safe-haven assets like the U.S. Dollar. Any escalation in these tensions could exacerbate the bearish trend for EURUSD.

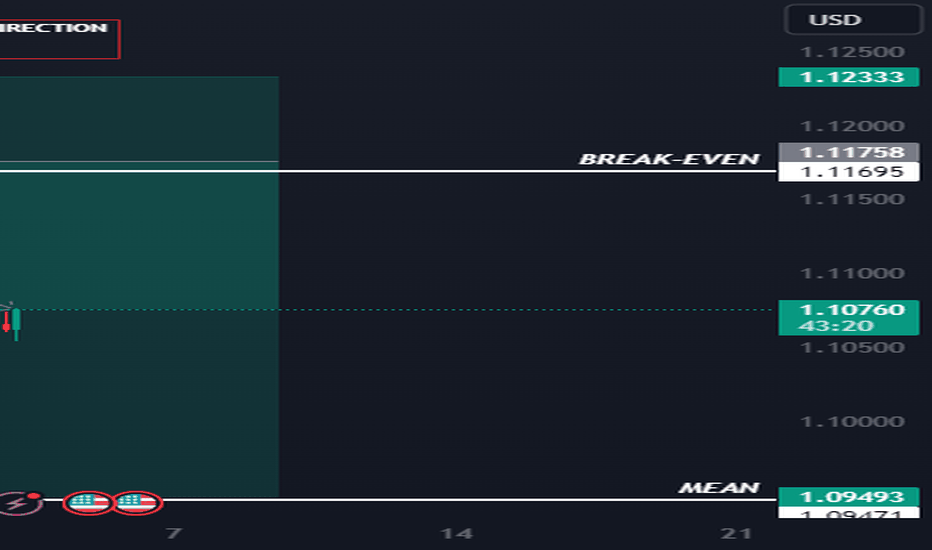

4. Market Sentiment and Technical Analysis

From a technical perspective, EURUSD appears to be trading below key resistance levels, reinforcing the bearish outlook. The pair has struggled to break above the 1.0600 level, and the downward trendline remains intact. Short-term momentum indicators, such as the Relative Strength Index (RSI), suggest bearish momentum is building, supporting a case for a further decline.

Additionally, with risk sentiment favoring the U.S. Dollar amid global uncertainty, the Euro may struggle to find strong support unless positive economic data or ECB intervention changes the narrative.

Conclusion: EURUSD to Maintain a Slightly Bearish Bias Today

Given the combination of weaker Eurozone economic data, diverging monetary policies, geopolitical risks, and bearish technical indicators, EURUSD is likely to face a slightly bearish bias on October 2, 2024. Traders should closely monitor developments in Eurozone economic reports and any potential statements from ECB officials for further clues on the pair’s direction.

Keywords for SEO:

EURUSD analysis, EURUSD forecast, EURUSD today, EURUSD October 2 2024, EURUSD bearish bias, Euro to USD forecast, Forex trading EURUSD, Eurozone economic data, ECB monetary policy, EURUSD technical analysis, EURUSD price action, EURUSD market sentiment, Forex strategy EURUSD, TradingView EURUSD article.

By staying informed of these key drivers, traders can better position themselves in the market and make informed decisions regarding the EURUSD pair today.

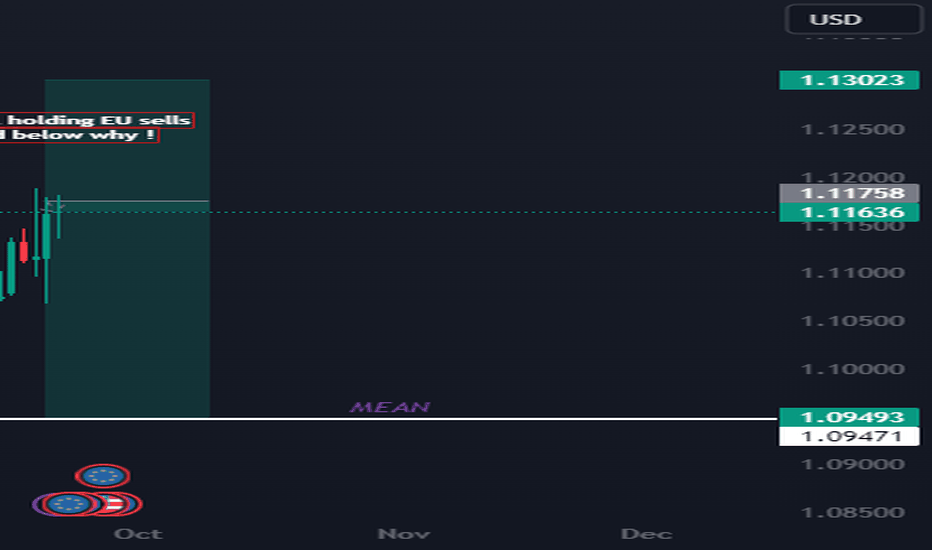

EURUSD Analysis: Slight Bearish Bias Expected (25/09/2024)The EURUSD pair continues to show signs of a slight bearish bias this week, in line with market conditions and fundamental factors. In this article, we will break down the key drivers influencing EURUSD as of 25/09/2024, along with a technical outlook. This analysis provides insights for traders and investors aiming to position themselves for potential downside movement in the EURUSD market.

Fundamental Analysis: Factors Pressuring EURUSD

1. U.S. Dollar Strength

The U.S. dollar has maintained its strength due to a series of factors, including recent hawkish remarks from the Federal Reserve. Fed officials have continued to emphasize the possibility of keeping interest rates higher for longer to combat inflation. This has provided significant support for the dollar, making it an attractive safe-haven asset, while simultaneously putting pressure on the euro.

2. Diverging Central Bank Policies

The European Central Bank (ECB) has recently adopted a more cautious tone regarding future rate hikes. With inflation in the eurozone stabilizing, the ECB may opt for a wait-and-see approach, potentially slowing the pace of tightening or halting rate hikes altogether. This divergence in monetary policy between the ECB and the Fed is expected to contribute to further downside pressure on the EURUSD.

3. Weak Eurozone Economic Data

Economic data from the eurozone remains relatively soft. The latest PMI data showed a contraction in the manufacturing and services sectors, further weakening the euro. Lower-than-expected growth forecasts and potential deflationary pressures also undermine the euro's strength.

4. Geopolitical Uncertainty

Ongoing geopolitical risks, such as tensions in Eastern Europe and concerns over energy security, continue to cloud the eurozone’s economic outlook. These factors have led to capital outflows from Europe, with investors seeking the safety of the U.S. dollar.

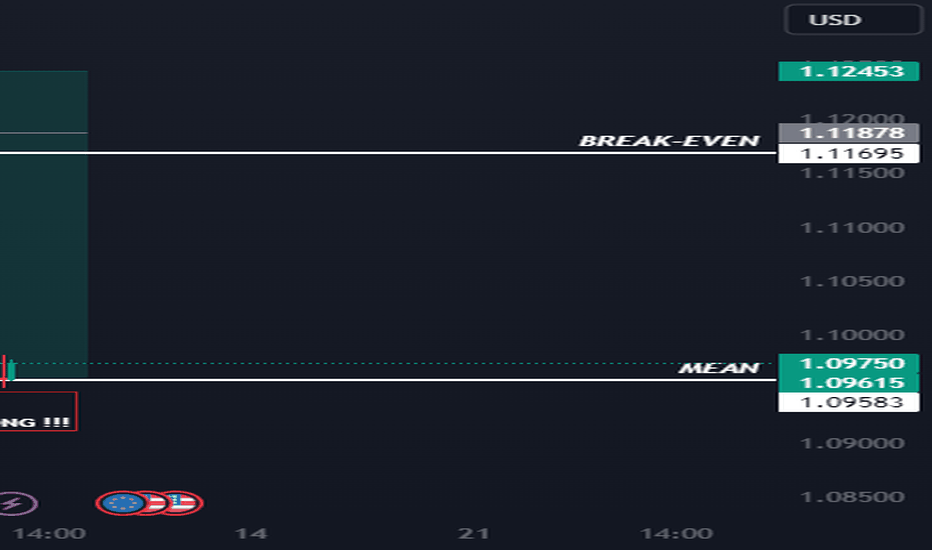

Technical Analysis: EURUSD Price Action

On the technical front, EURUSD has struggled to break above key resistance levels near 1.10700, confirming the bearish sentiment. The pair has been trading in a downward channel since mid-September, and with recent price action rejecting the 50-day moving average, momentum indicators signal further downside potential.

- Support Level: 1.09000 is a crucial support level to watch for EURUSD this week. A break below this could accelerate the bearish move, potentially targeting the 1.08500 level.

- Resistance Level: The 1.10700 level remains a key resistance, and a move above this could invalidate the bearish outlook, though this seems unlikely given the fundamental backdrop.

Outlook for the Week: Slight Bearish Bias for EURUSD

Given the combination of strong U.S. dollar fundamentals, the divergence in central bank policies, weak eurozone economic data, and technical resistance, the EURUSD is likely to maintain a slightly bearish bias through the remainder of this week.

Keywords for SEO: EURUSD analysis, EURUSD today, EURUSD forecast, EURUSD bearish, euro dollar, forex trading, U.S. dollar strength, ECB monetary policy, Fed rate hikes, forex market analysis, EURUSD price action, technical analysis EURUSD, eurozone economy.

Conclusion

EURUSD is likely to continue on its bearish trajectory, with potential downside towards key support levels this week. Traders should closely monitor U.S. dollar fundamentals, especially any new developments from the Federal Reserve, as these will play a crucial role in shaping EURUSD’s movement. Keep an eye on eurozone data releases and geopolitical headlines for any shifts in market sentiment that could impact this currency pair.

EURUSD: Bearish Bias Anticipated for the Week of 25/09/2024The EURUSD pair has displayed significant volatility in recent weeks, with fundamental factors and macroeconomic data driving price action. As we look ahead to the week starting 25/09/2024, the prevailing market conditions suggest a slight bearish bias for EURUSD. Here's a brief analysis of the key drivers influencing this outlook:

1. Diverging Central Bank Policies

The Federal Reserve has maintained a relatively hawkish stance, signaling potential interest rate hikes later in 2024. The ECB (European Central Bank), however, has been cautious, reflecting concerns about slowing growth in the Eurozone, especially after recent data indicating sluggish economic performance in major European economies like Germany and France. This policy divergence is expected to exert downward pressure on EURUSD as the dollar remains supported by higher yields, while the euro faces headwinds due to weaker growth prospects.

2. Slowing Economic Growth in the Eurozone

Recent data from the Eurozone, particularly the German ZEW Economic Sentiment index and PMI reports, have shown a marked slowdown in industrial activity and business confidence. This has raised concerns about a potential recession, which could further weigh on the euro. In contrast, the U.S. economy continues to outperform, with robust retail sales and stable job growth supporting a stronger USD.

3. Inflationary Pressures and Monetary Policy Uncertainty

The ECB has also been grappling with persistent inflation, but the likelihood of further rate hikes appears to be diminishing. With inflation still elevated, but growth faltering, the ECB may choose to adopt a more dovish stance moving forward. Meanwhile, the Fed remains committed to controlling inflation, with Chair Jerome Powell signaling that rates could stay elevated for longer. This contrast in inflation management strategies continues to favor the U.S. dollar over the euro.

4. Geopolitical Risks in Europe

Ongoing geopolitical tensions, particularly related to the conflict in Ukraine, continue to cast a shadow over the Eurozone economy. Rising energy prices, uncertainty in supply chains, and potential disruptions to trade all contribute to the euro's vulnerability. These factors, while less impactful on daily price movements, play a significant role in the long-term bearish sentiment surrounding the EURUSD pair.

Technical Outlook

From a technical standpoint, EURUSD has been trading near key support levels around 1.0650. If this level is breached, the pair could see further declines toward 1.0550. The 50-day moving average is pointing downward, signaling continued bearish momentum. However, the pair could find temporary support if market sentiment shifts or if the ECB surprises with a more hawkish stance than expected.

Conclusion: Slight Bearish Bias Expected for EURUSD

Based on the current market conditions and fundamental factors, it appears that the EURUSD is likely to experience a slightly bearish bias heading into next week. The combination of diverging monetary policies between the Fed and ECB, slowing Eurozone growth, inflationary pressures, and ongoing geopolitical risks all suggest downward pressure on the pair. Traders should closely monitor key support levels and any updates from central bank policymakers, as these could influence the direction of EURUSD in the near term.

---

Keywords for SEO:

EURUSD outlook, EURUSD forecast, EURUSD next week, bearish EURUSD, Euro to Dollar analysis, EURUSD trading analysis, EURUSD technical analysis, EURUSD fundamental factors, ECB monetary policy, Federal Reserve impact on EURUSD, Eurozone economic slowdown, Forex trading EURUSD, EURUSD price action analysis, Forex weekly forecast, EURUSD key support levels, EURUSD technical indicators.