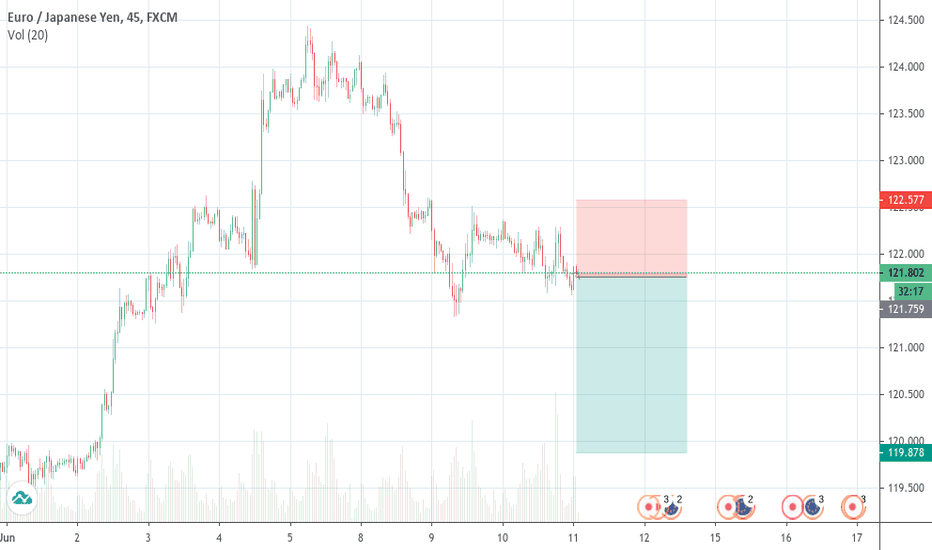

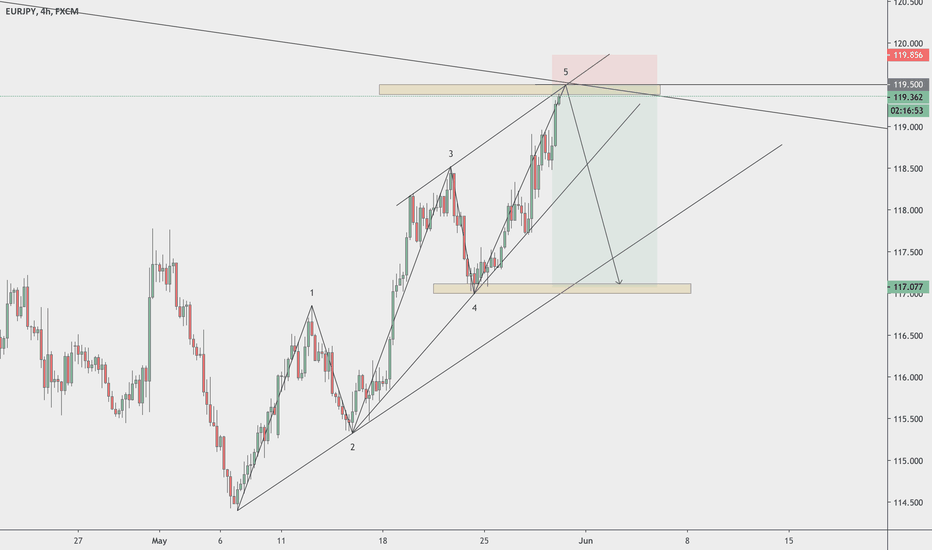

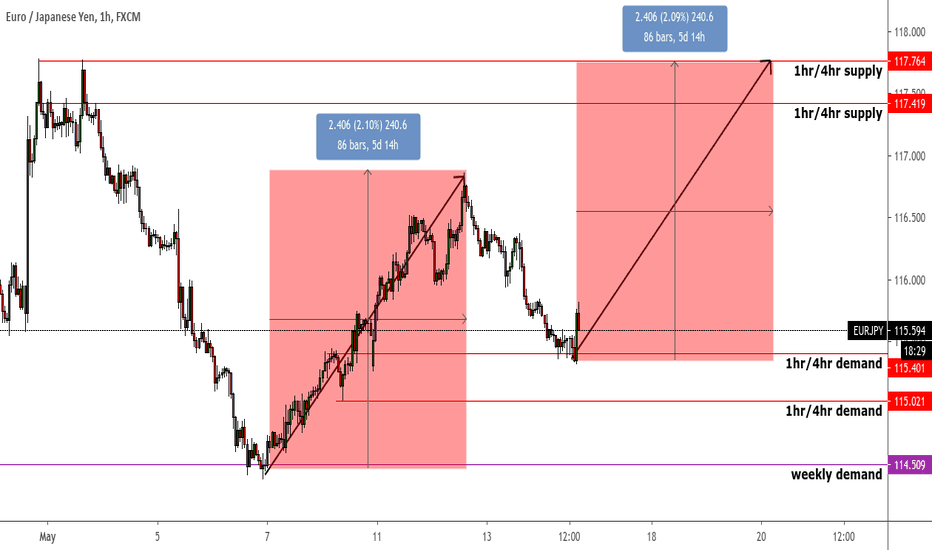

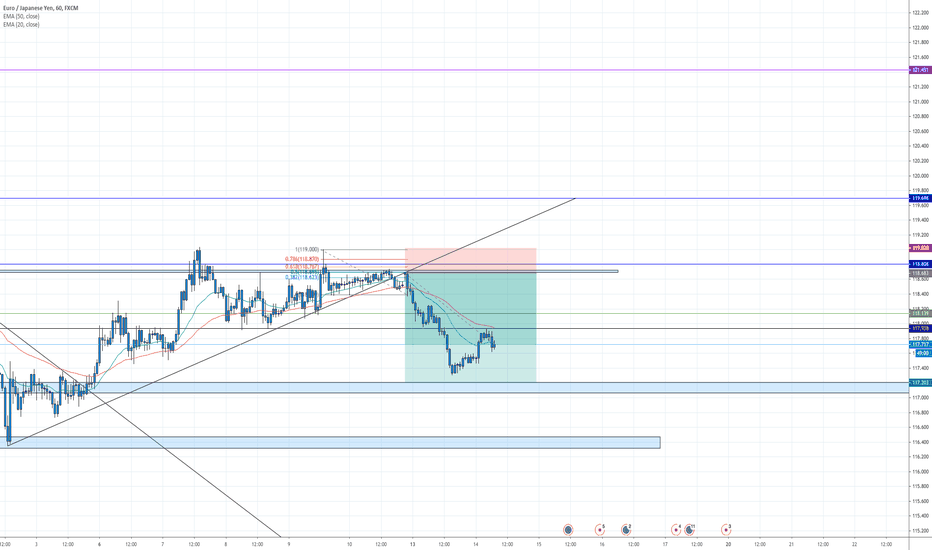

Elliott Wave View: EURJPY Can See More DownsideElliott Wave View in EURJPY suggests the decline from 6.1.2020 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 6.1.2020 high, wave 1 ended at 120.23 as an impulse. Afterwards, the bounce in wave 2 ended at 122.11 as a zigzag. Up from wave 1 low, wave ((a)) ended at 121.81 and wave ((b)) pullback ended at 120.31. The pair then extended higher in wave ((c)), which ended at 122.11. The pair then resumes lower in wave 3 as another 5 waves impulse in lesser degree.

Down from wave 2 high, wave (i) ended at 121.4, and bounce in wave (ii) ended at 121.867. Pair resumes lower in wave (iii) towards 121.15 and wave (iv) bounce ended at 121.508. Final leg wave (v) ended at 120.45 and this completed wave ((i)). Pair then bounced in wave ((ii)) and ended at 121.23. Currently, wave ((iii)) is in progress as an impulse where wave (i) of ((iii)) ended at 119.8. Near term, while bounce in wave (ii) of ((iii)) stays below 121.23, and more importantly below 122.11, expect pair to extend lower again. As far as pivot at 122.11 high stays intact, expect rally in EURJPY to fail in the sequence of 3 ,7, or 11 swing for further downside.

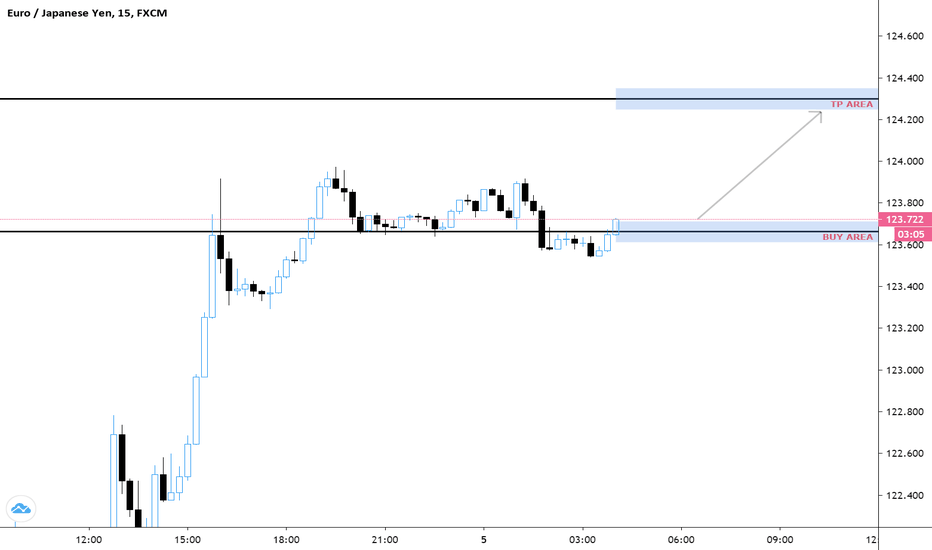

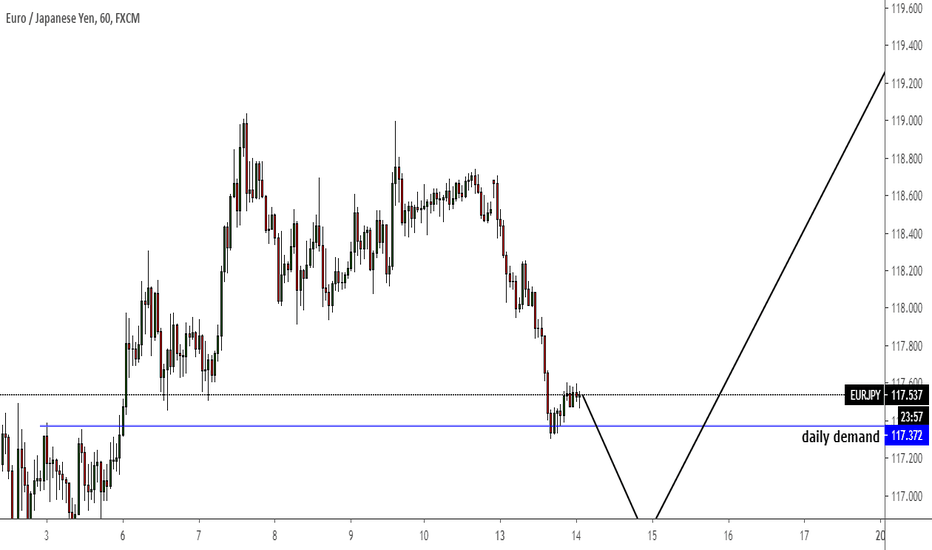

EJ

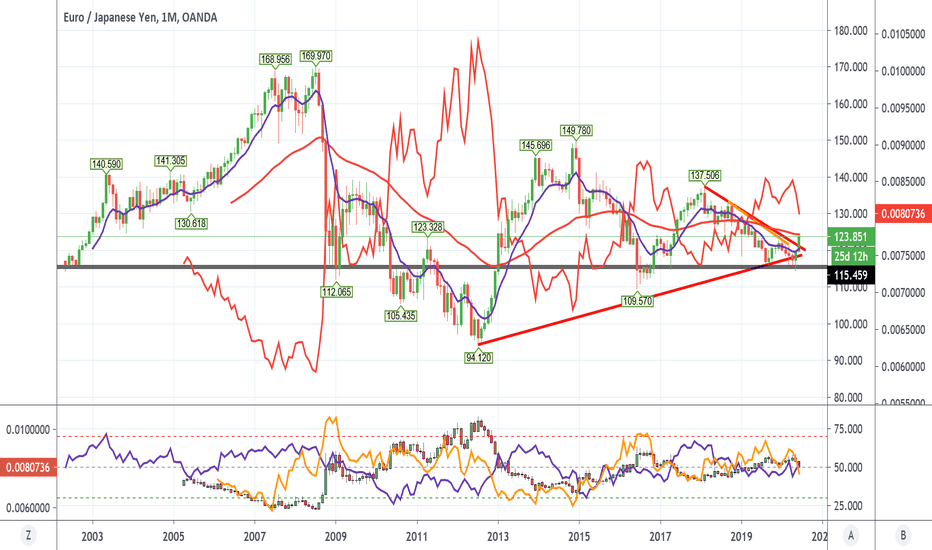

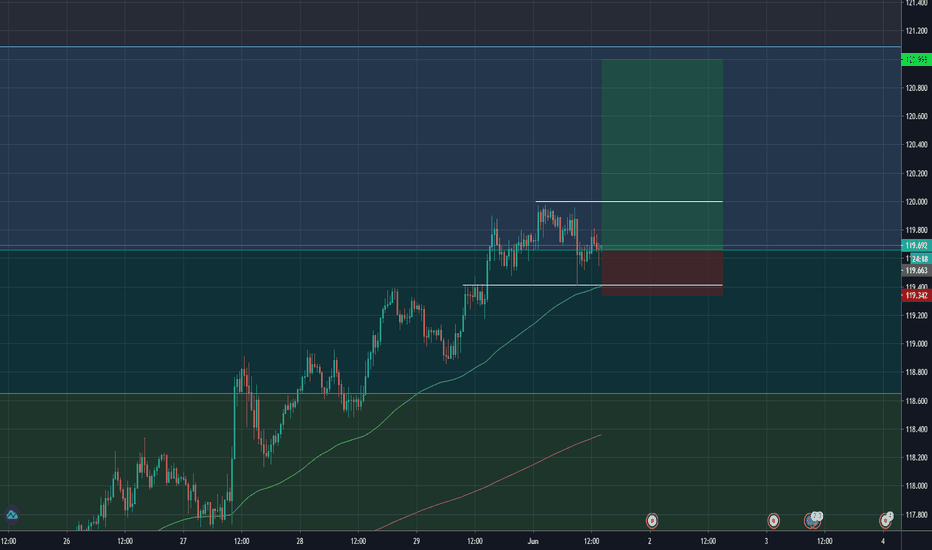

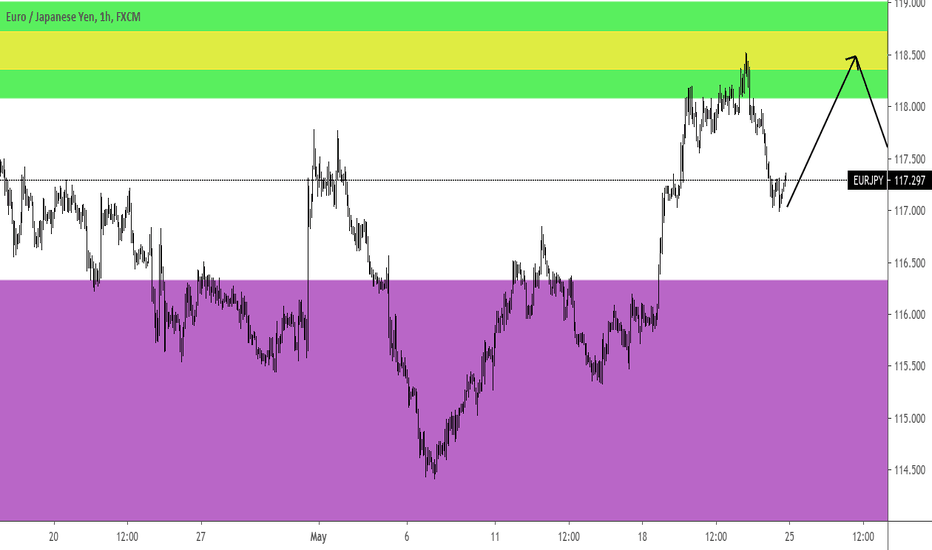

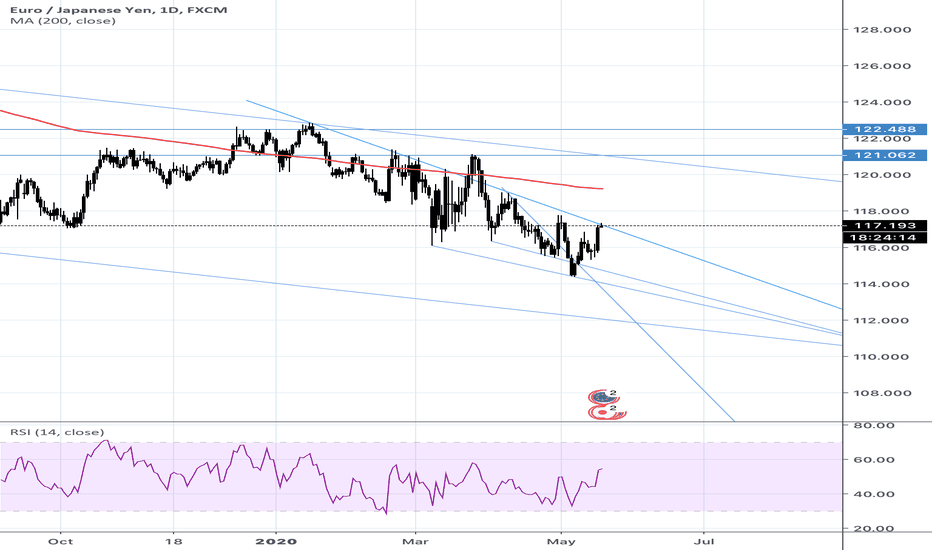

Euro taking strength from yenThe euro took strength over yen on monthly chart when this happen in past, euro has made massive moves up, the euro has bounced off monthly trend line which is another good sign, i'm not a long term trader i do intra day but this would be a nice one to hold on for months if euro can keep strength over yen, peace out squares

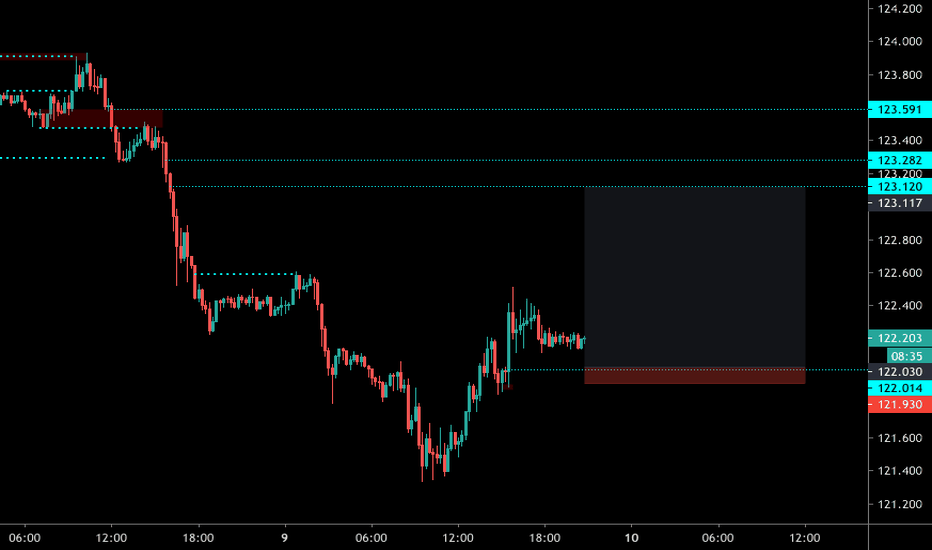

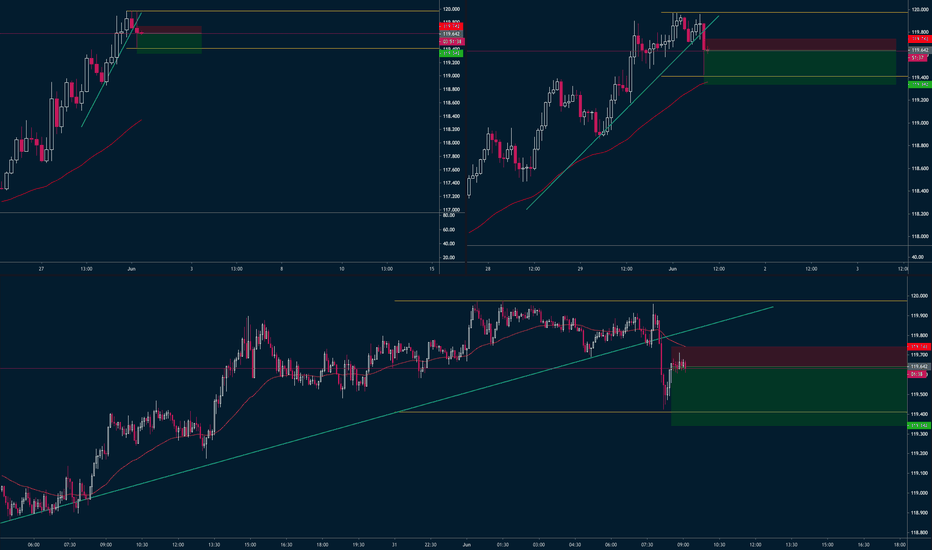

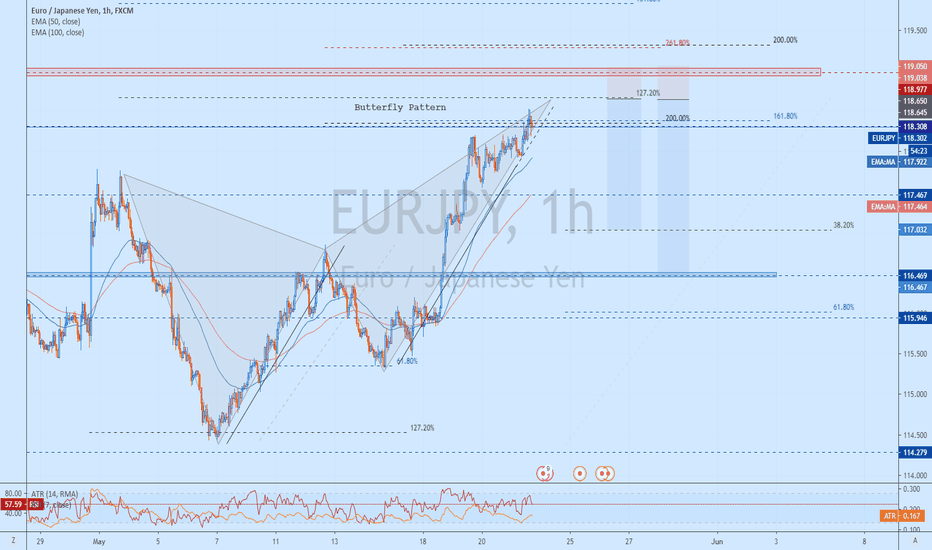

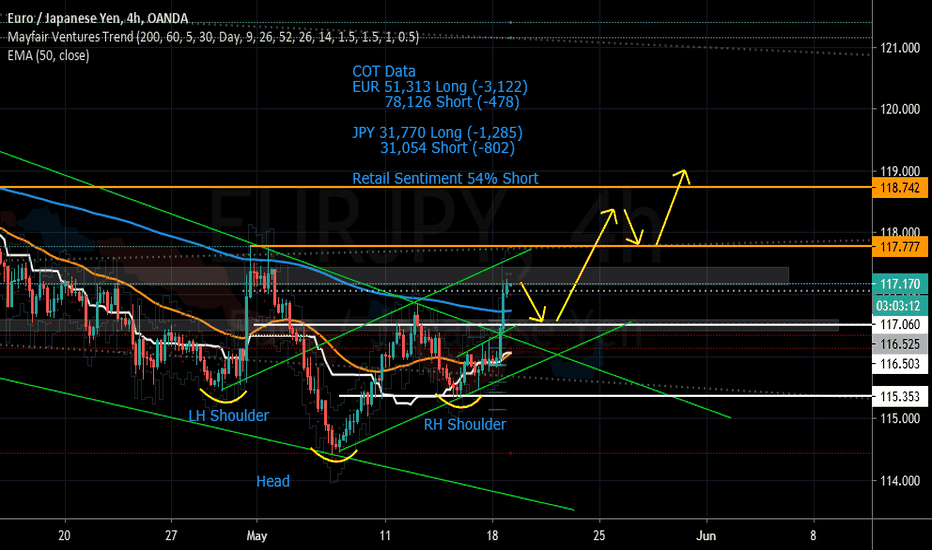

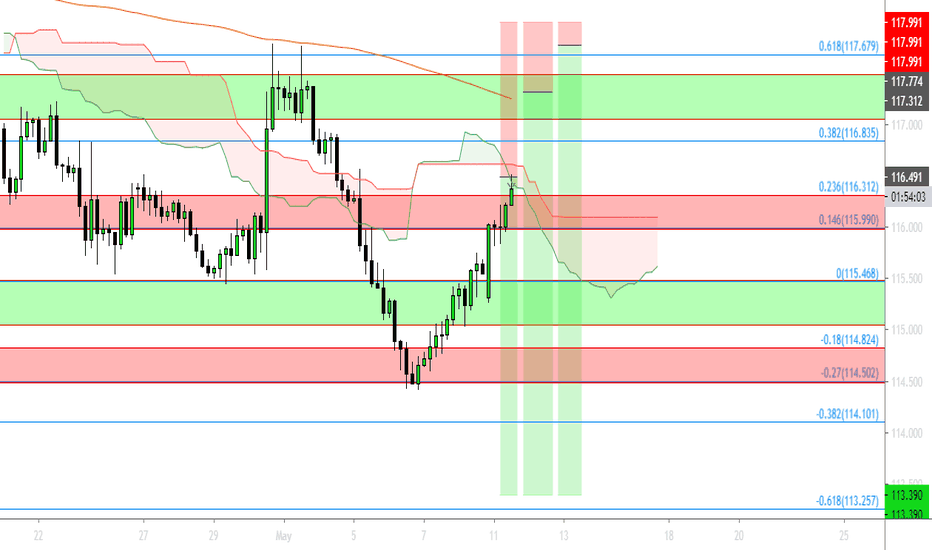

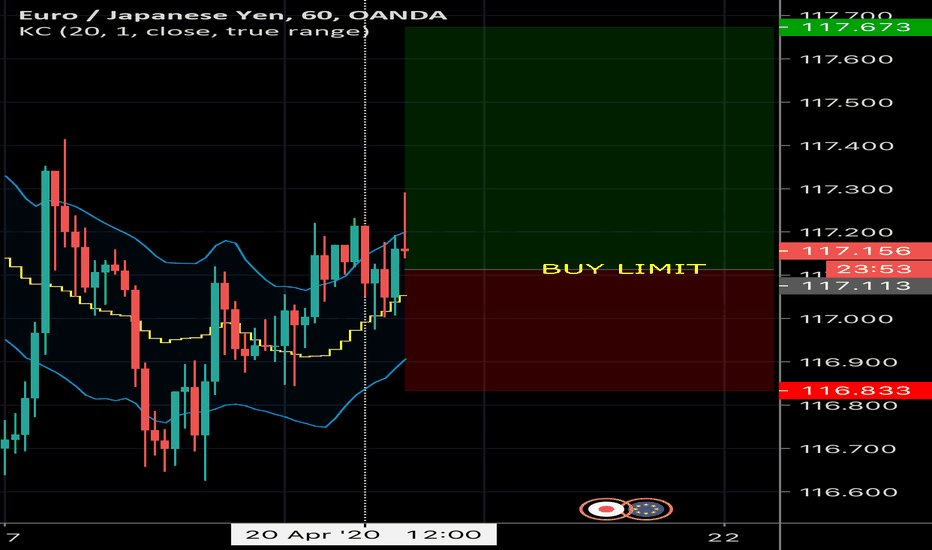

EURJPY Short term LongThere's potential of a trend turnaround due to an inverse head and shoulders pattern forming along with finding support on the dynamic 618 fib level and the 50 EMA.

Price has now broken above the 200 EMA and is currently at an area of resistance. This could create a retracement back to the 618 fib level (white line) and continue in a bullish momentum. Failing support at 116.50 level then this idea becomes void.

COT data shows JPY is neutral and has nearly 50/50 split but EUR still has a short bias which is why I think this would be short term and client sentiment is currently 54% short.

This is my first public idea so go easy on me :) and I welcome constructive feedback.

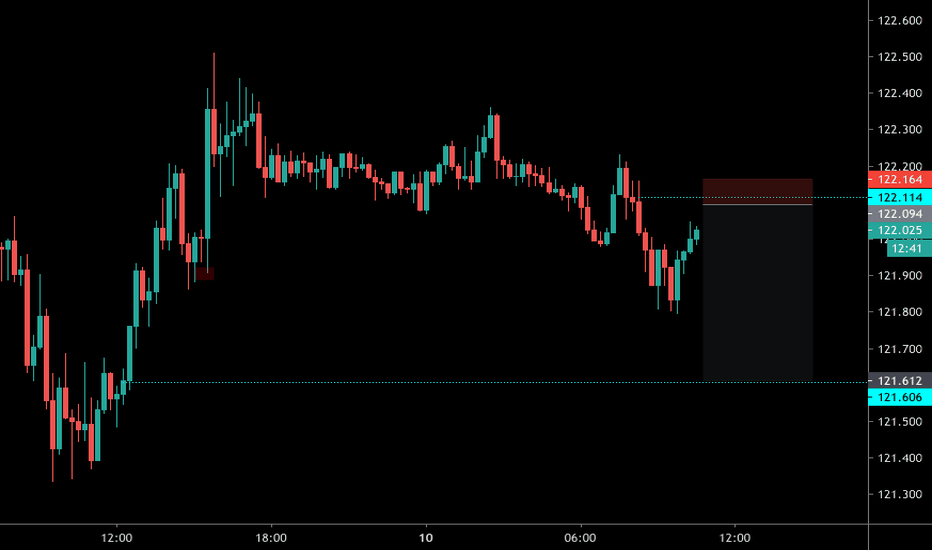

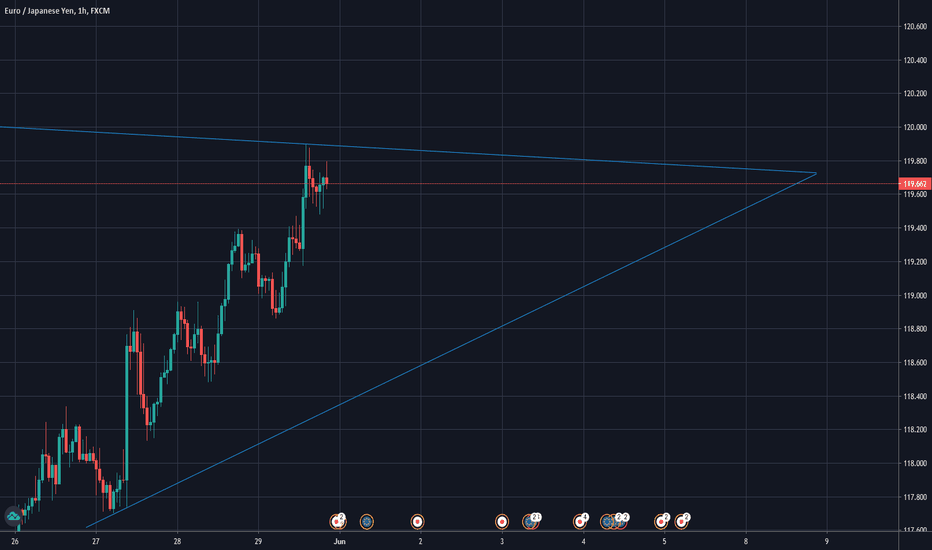

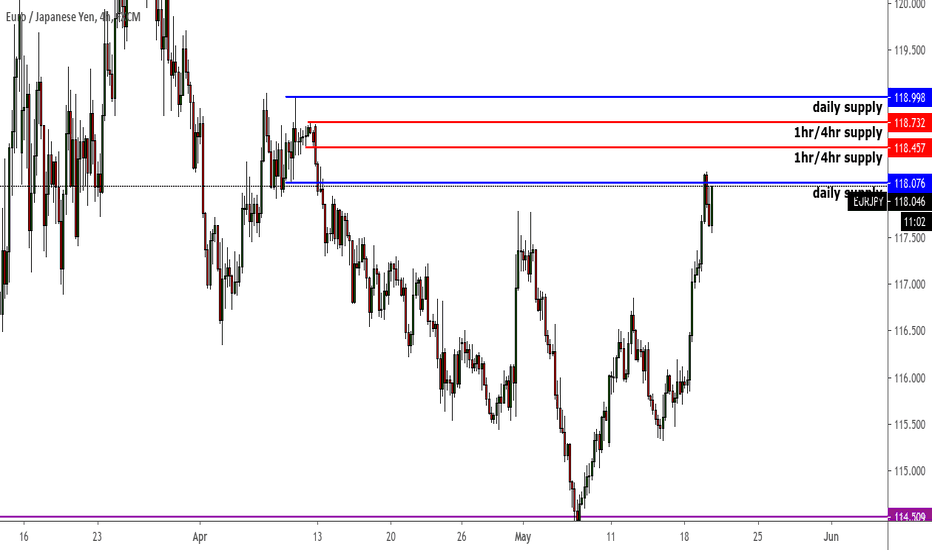

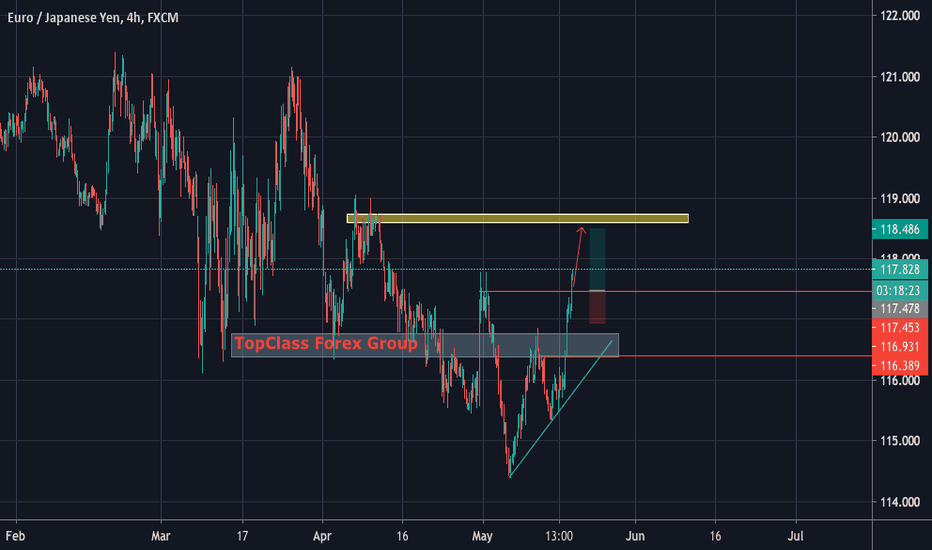

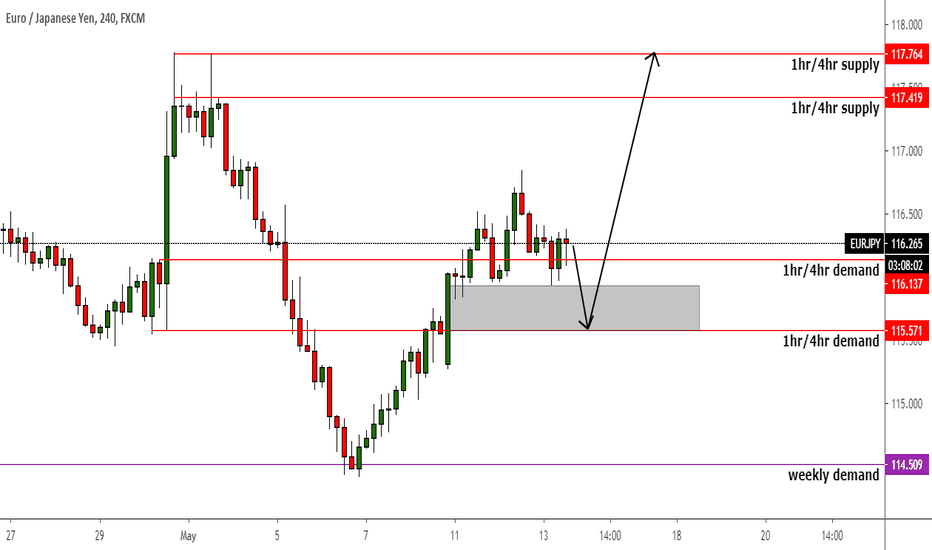

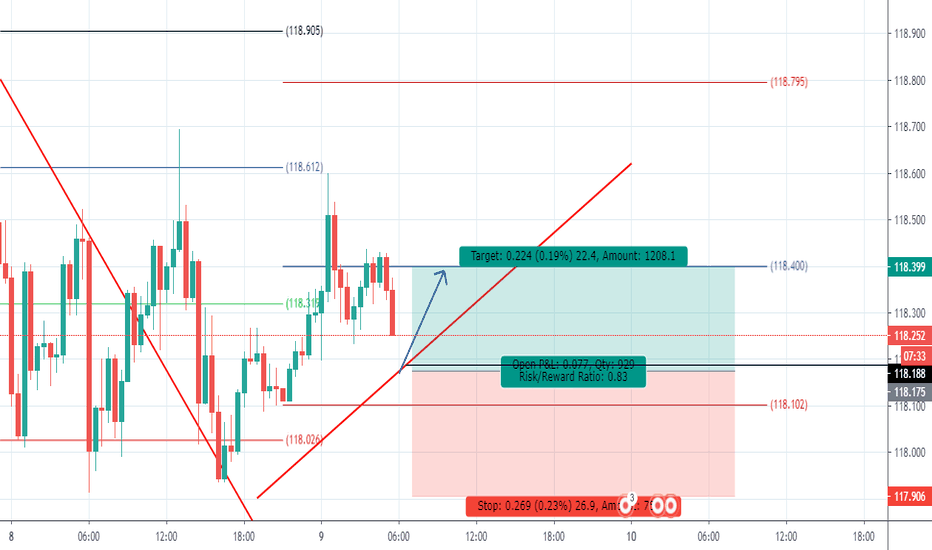

EURJPY (short)Reason For Entry

- The brake of 4H trendline

- A retest of 1H resistance

- .5 Fib retracement

Reason For SL

- Above highs

- Inside 4H trendline

- Above strong resistance

Target

- Targetting previous lows

Comment

- This trade I had lined up since the market close on Friday, however, I never placed an order to enter as I wanted to see where market open.

- Ideally, I should have been more focussed and kept a close on this trade as its running at around 8% with zero drawdown

- Next time I will be sure to keep a close eye on market open and proceed from there