EJ

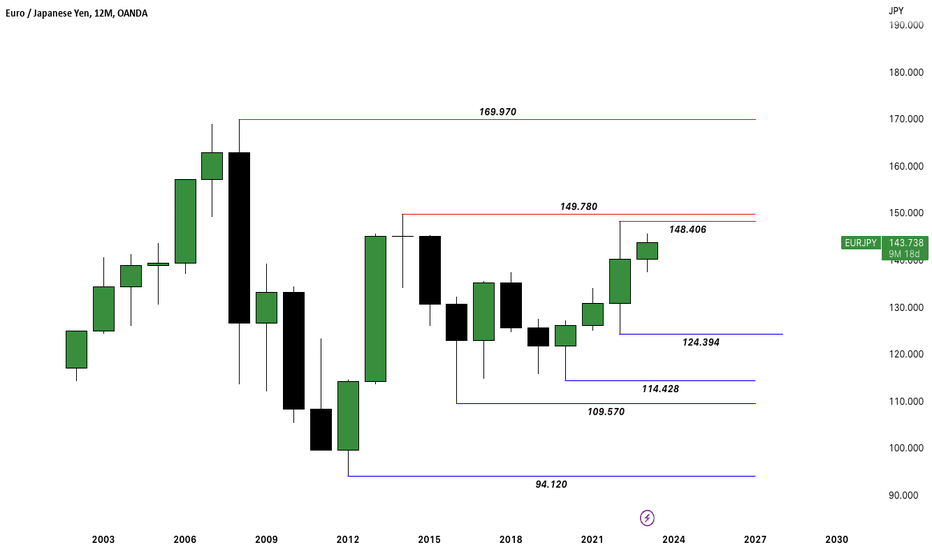

EJ Yearly ChartHello Traders!

BoJ (Bank of Japan) has not raised rates since 2016.

The current rate is negative.

ECB (European Central Bank) has recently raised rates over the years.

The current rate is positive.

It is reflected in the price action. Central bank traders want the best ROI (rate of return).

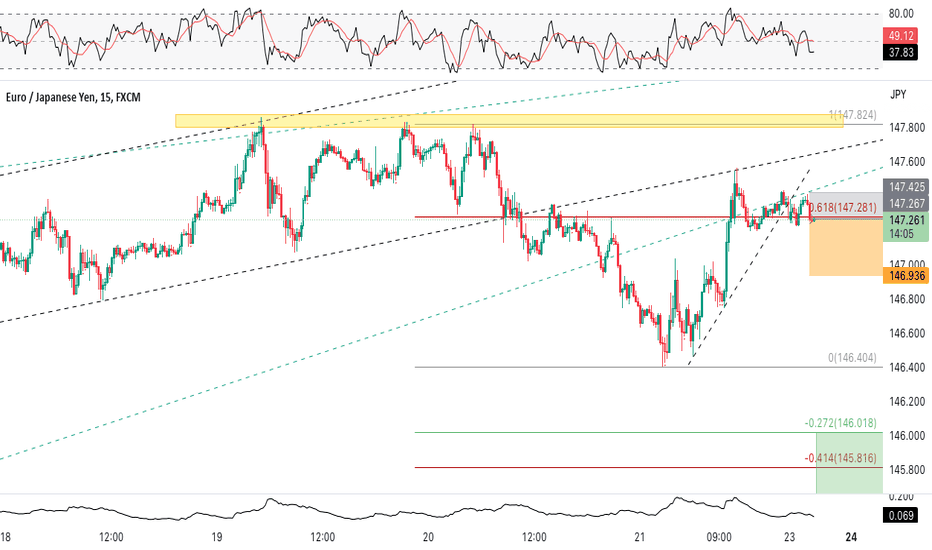

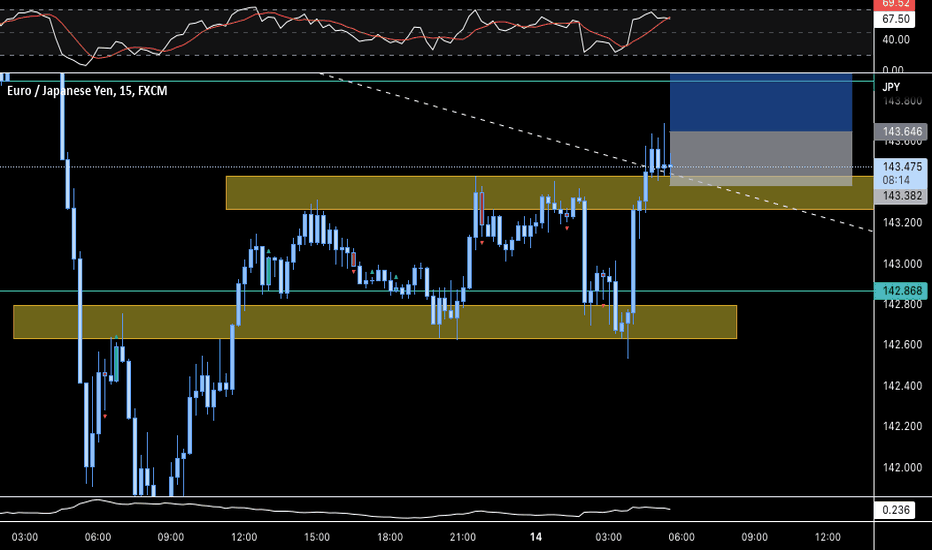

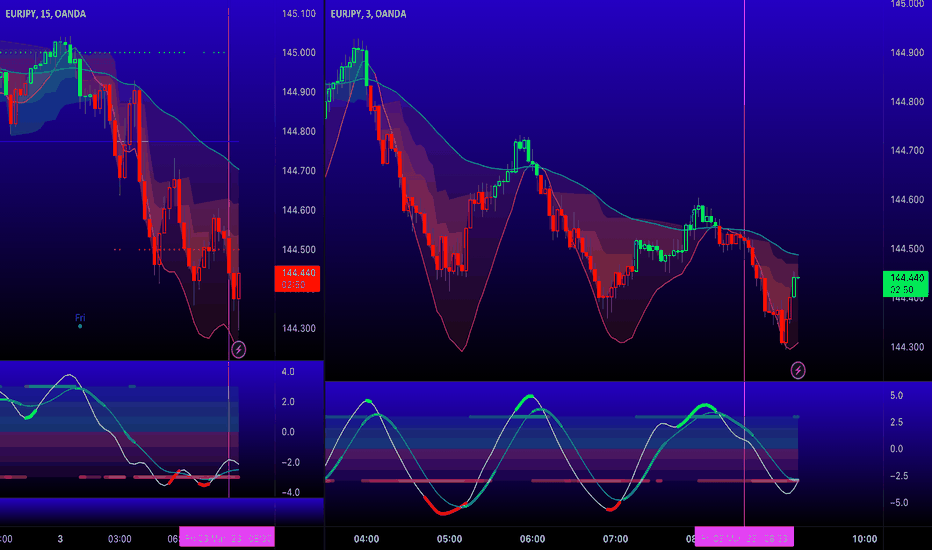

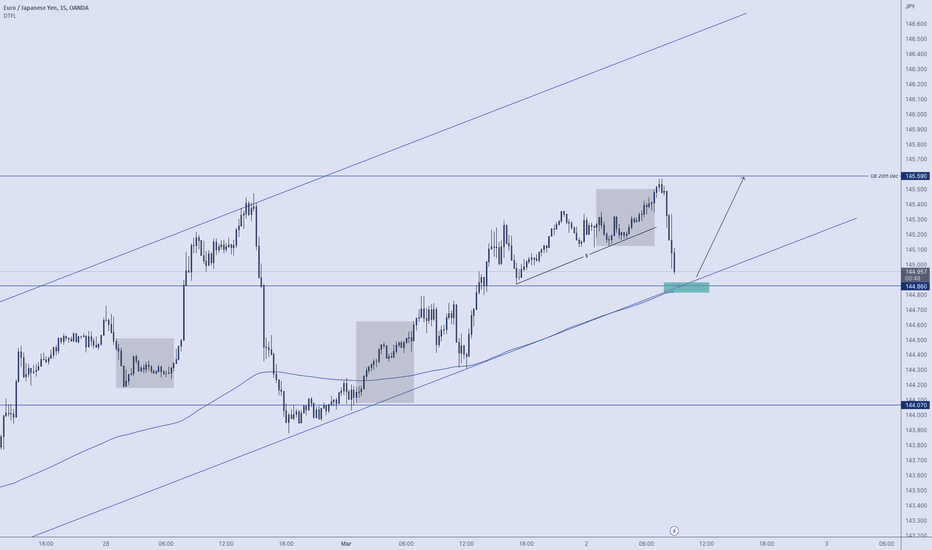

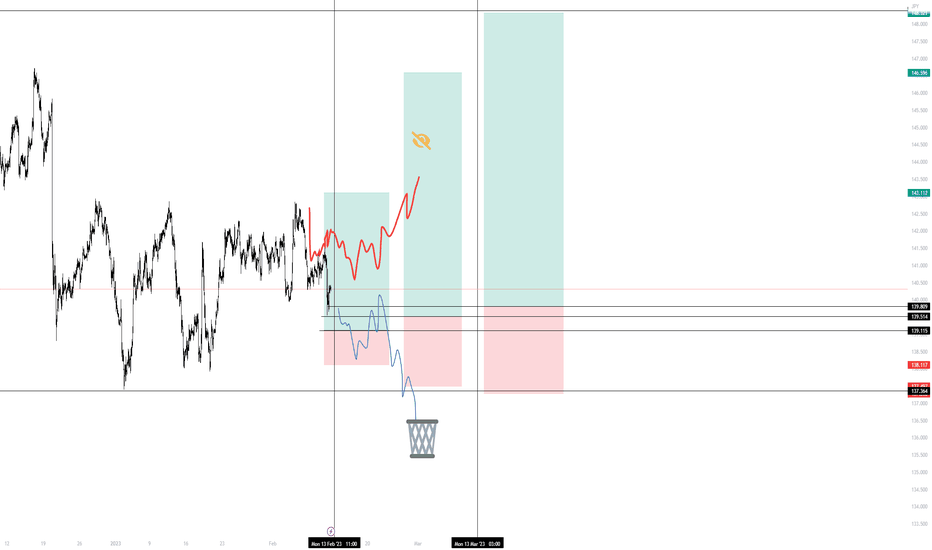

EURJPY - Wanted a Scalp Before PMIOANDA:EURJPY

Friday!

Normal it means slow chop (after London session, into NY) after a weeks of news, but today, we have PMI coming up and wanted to steal TP at 10 hard pips.

Another reason why 10 pips TP, because I wanted to get out before PMI news release, price action forming a triple bottom, and 10 pips right around the 3rd bottom.

So thats my reason, and I'm sticking to it...

This one was an easy one, well, nothing is easy, but easy in a sense that I just went in the direction of the trend.

Trade well

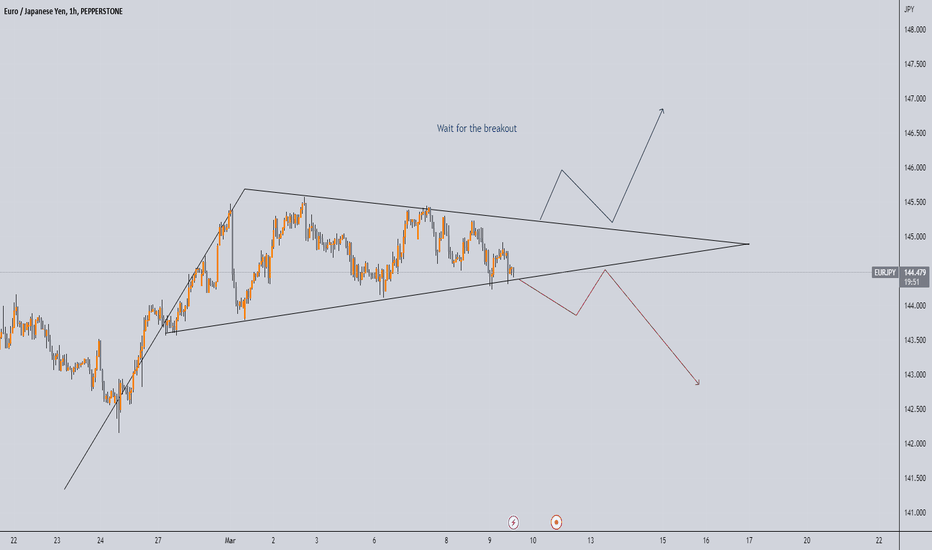

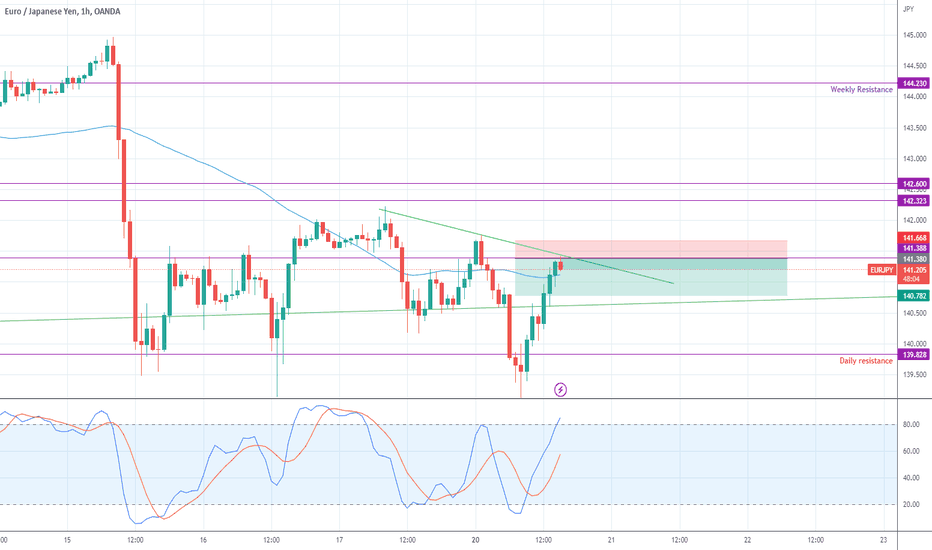

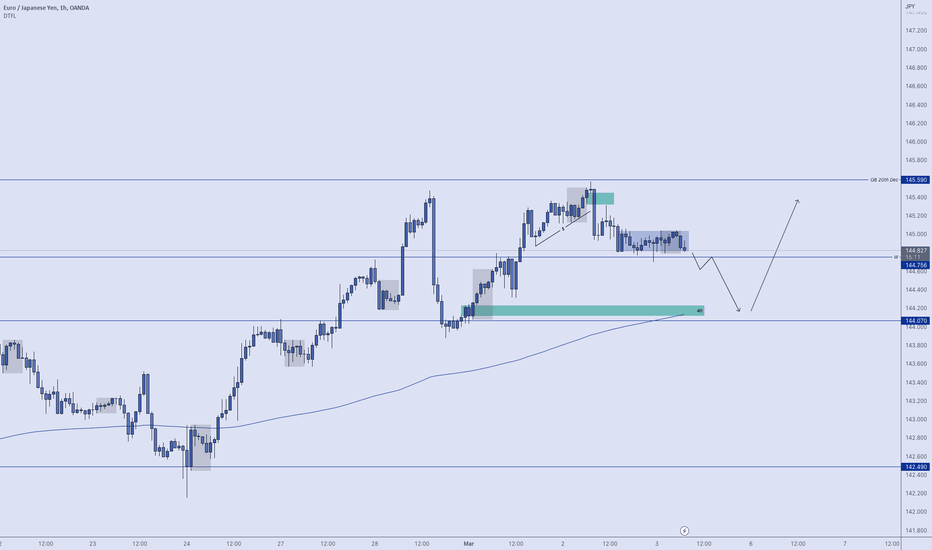

EurJpy MP Trading Bias: Open

Market Cycle: n/a

I'm going to hold on to the short bias from yesterday for now, but HTF is still bullish,,

Accumulation is evident just above the weekly level, this could also get rejected and we move bullish from here, so I want a strong break out and retest before shorting..

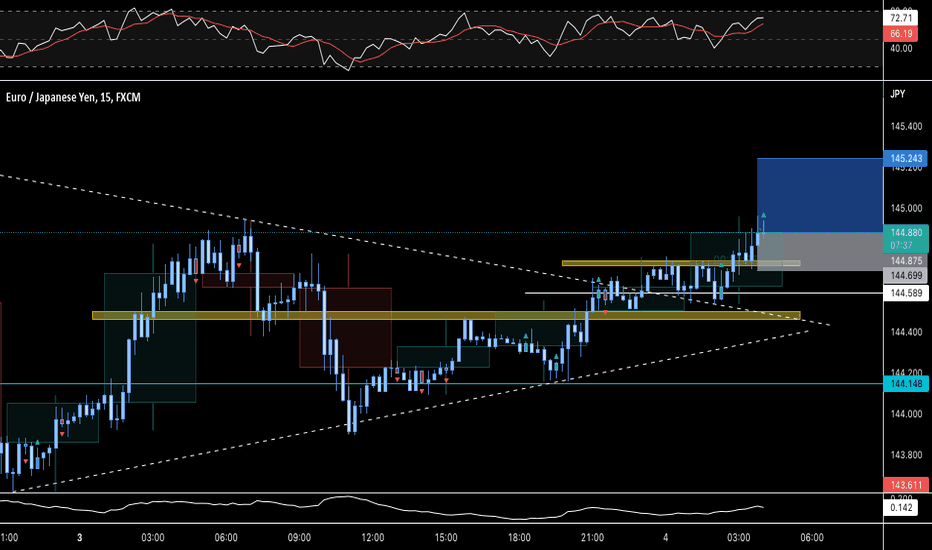

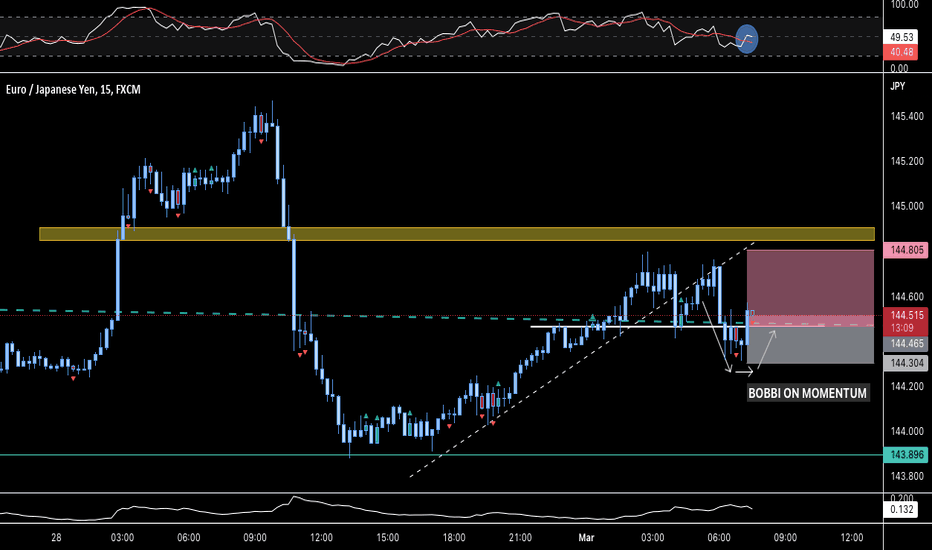

NY: EUR/JPY BOBBI - MOMENTUMTaking a quick market execution long on EJ following a break of our RSI moving average with confidence that EUR is showing strength and JPY weakness across the board. Used our playbook setup "BOBBI" (Break Out Break Back In) with momentum as our entry criteria. Asia and London have treated us well, lets see what NY has in store

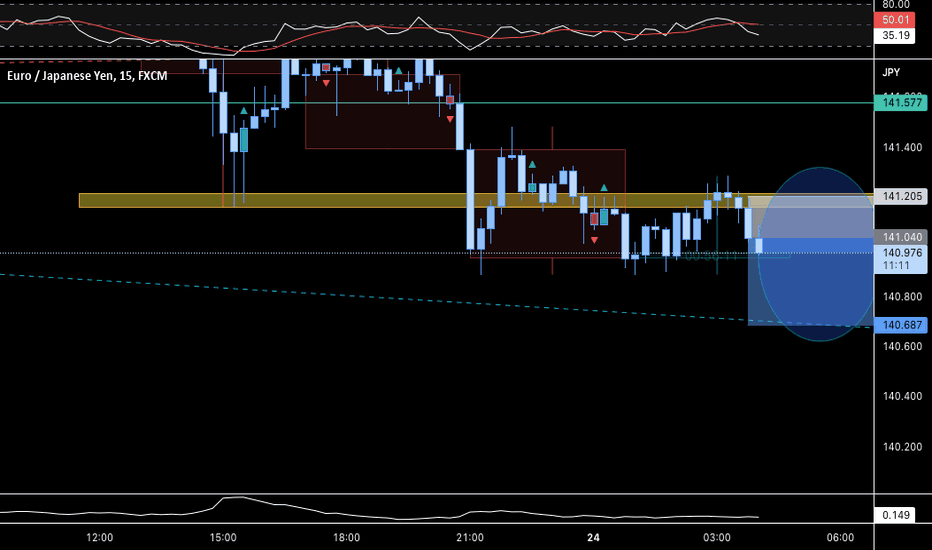

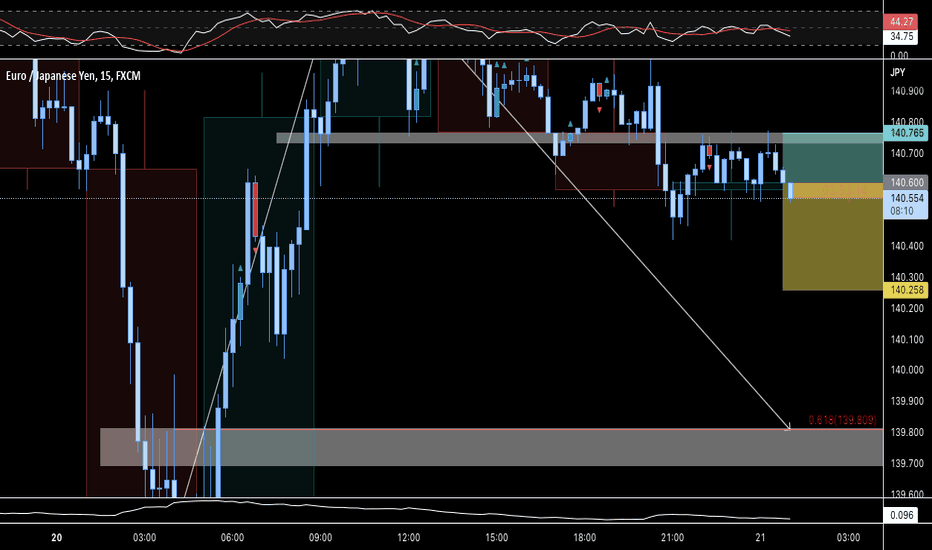

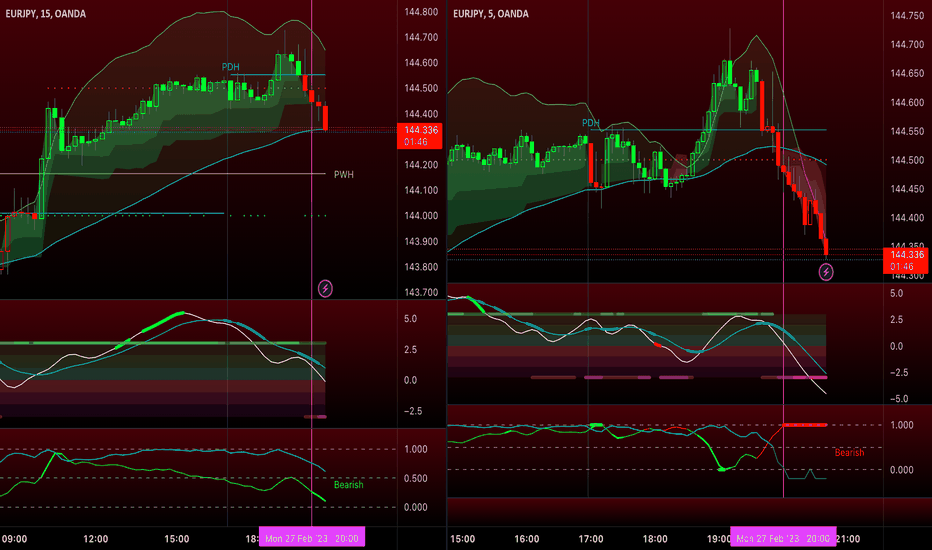

EURJ/PY - Tight Stop Loss Just NowOANDA:EURJPY

Took a short in between 2 JPY news release.

Original TP was 15pips, moved SL tight to +1

Stopped out before price action hit original TP

Oh well, the market makers stop-hunted my stops, I was their big fish to take out, LOL

I'm ok with it, play it safe, trade management is the name of the game.

Ill get it next time.

Trade well

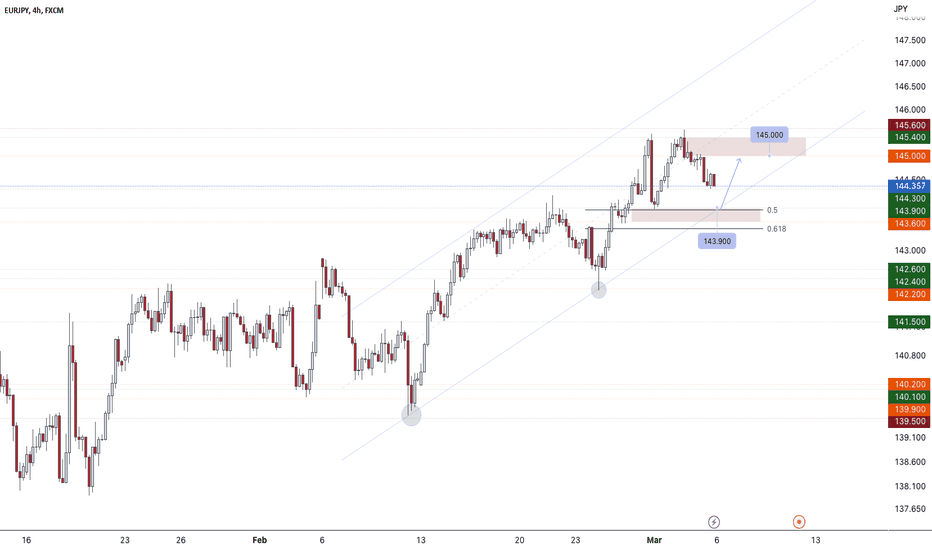

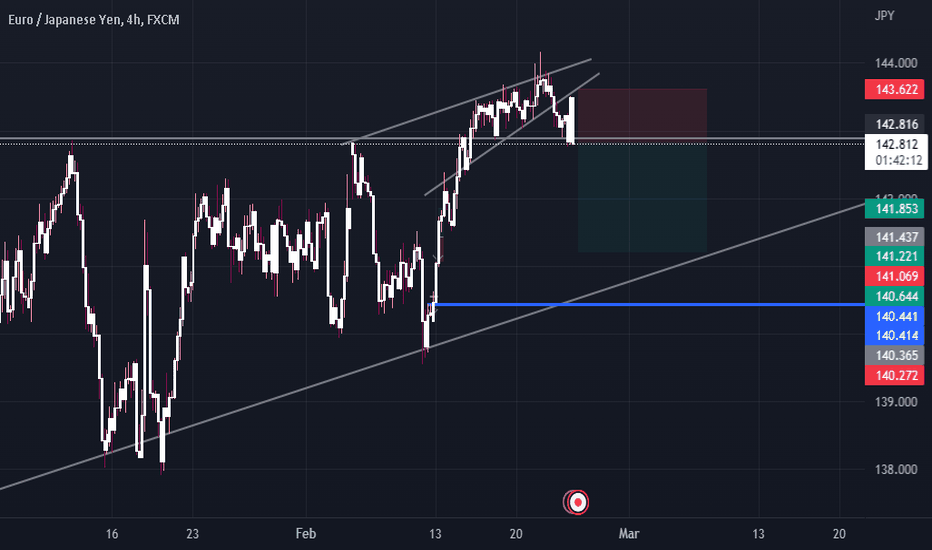

EurJpy - Manipulation Point Trading Bias: Open

Market Cycle: n/a

Similar to the PA on GJ, my instinct suggests we are going long, even if it's for a short time only.

Notice the wick rejection from the 4h FVG, we certainly now have buyers in the market..

Potential backside trade over 142.900, but be mind-full of the round no KL of 143.00

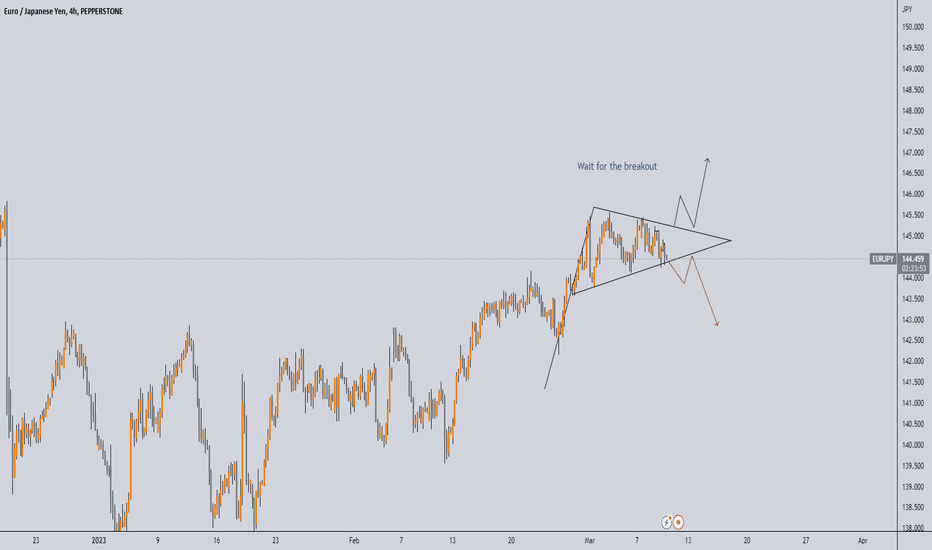

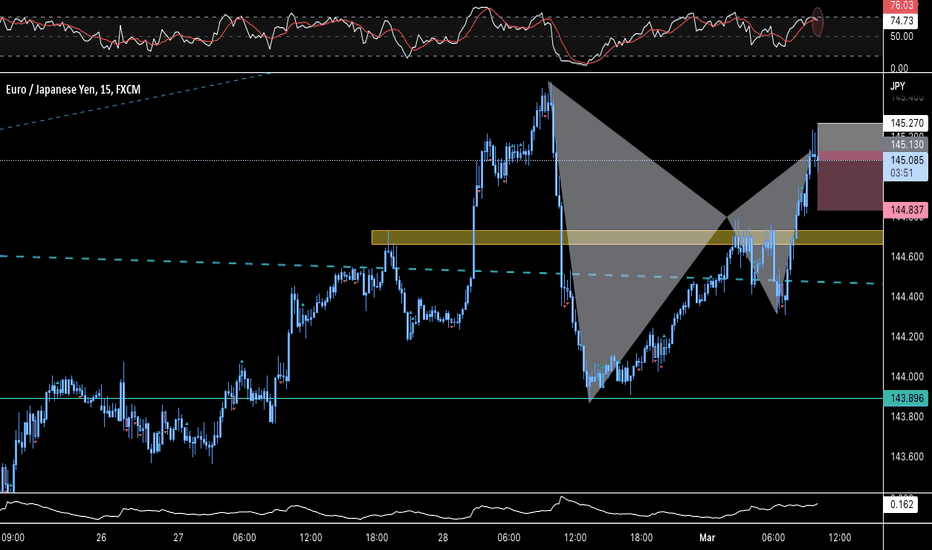

experimenting with eurjpyI have analyzed the currency pair of Euro/Japanese Yen (EUR/JPY) and determined that it is currently showing an upward trend based on a technical analysis of the currency pair.

First, let's examine the overall trend. Over the past six months, EUR/JPY has shown a steady increase, with the pair trading above its 50-day moving average and 200-day moving average. This is a bullish signal, indicating that the trend is up and that the pair is likely to continue its upward trajectory.

Next, let's look at the recent price action. In the past two weeks, EUR/JPY has broken out of a symmetrical triangle pattern, which is a bullish pattern that signals an imminent uptrend. The break of the triangle is confirmed by an increase in volume, indicating a strong demand for the euro.

Furthermore, the Relative Strength Index (RSI) is also signaling a bullish trend for EUR/JPY. The RSI is a momentum indicator that measures the strength of a currency pair's price action. Currently, the RSI is above 50 and trending higher, indicating that the euro is gaining strength against the Japanese yen.

Finally, it's worth noting that the euro has been benefiting from an overall improvement in the Eurozone economy, with positive economic data releases and the European Central Bank's recent signal of a potential tapering of its asset purchase program. These factors are contributing to an increase in demand for the euro, which is driving the upward trend in EUR/JPY.

In conclusion, based on the technical analysis, the EUR/JPY currency pair is exhibiting a strong upward trend, with a bullish signal from both the overall trend and recent price action, along with a strengthening euro. As a result, this may be a good time for investors to consider adding EUR/JPY to their portfolios.