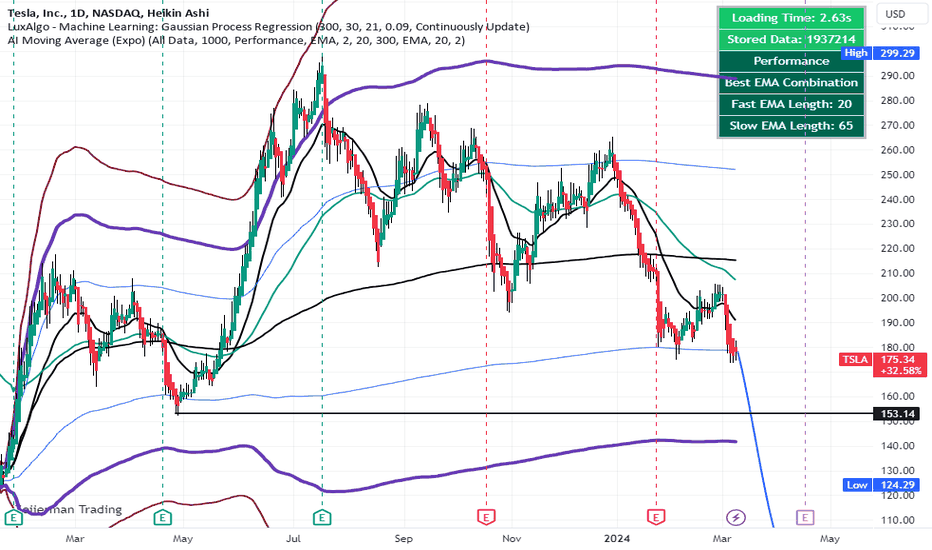

TSLA continues its downtrend toward Apirl earnings SHORTOn a TSLA chart, TSLA has been trending cown since last May. On the anchored VWAP lines,

it topped out crossing above the second upper VWAP about the first week of January '23 then

crossing under the same line on January 20, 23 Between August and October price tested and

consolidated about the first upper VWAP line. It then fell to the mean VWAP line and returned

in a retracement to the first upper VWAP line by December. paradoxically, price rose

after an earnings miss in October. From December through early February price fell through the

mean VWAP and received support with the first lower VWAP band. The faster EMA in black

crossed under the slower green EMA in early January. TSLA is last significant uptrend or

correction was a month before that. At present a continued trend direction of down

is predicted by the optimized EMA20/65 lines now diverging from a compression with the EMA

20 in black under the green EMA 65 line. A predictive modeling indicator by Lux-Algo

forecasts the persistent downtrend. TLSA could pick up support at the level of the pivot during

the April '23 earnings report or lower still at the second lower VWAP line at about 141.

Fundamentals can trump technicals but things out there are not looking great for TSLA