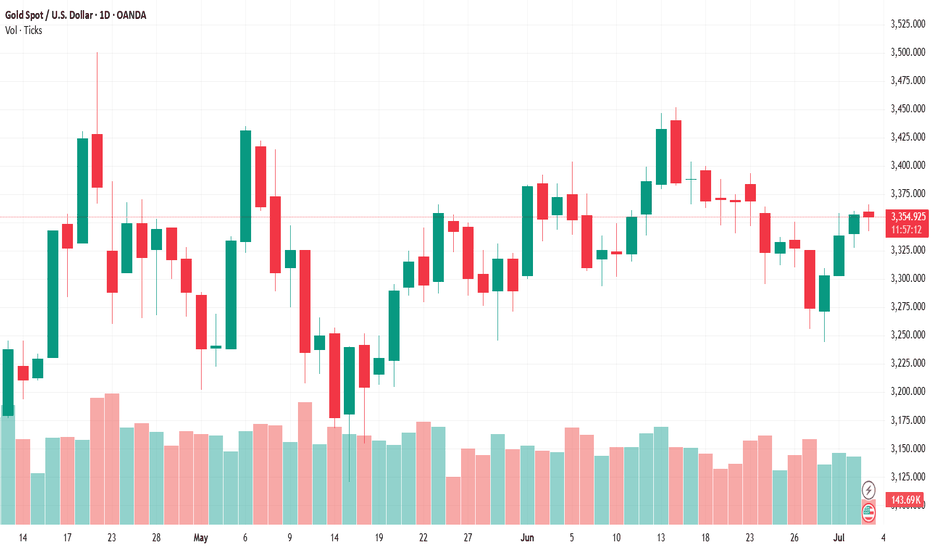

XAUUSD Gold Trading Strategy July 3, 2025XAUUSD Gold Trading Strategy July 3, 2025:

Yesterday's trading session went in line with our prediction when the gold price approached the 332x support area and then bounced back strongly. However, at the beginning of today's Asian session, the price corrected sharply after peaking at 3365.

Fundamental analysis: The number of ADP jobs in the United States recorded a decrease of 33,000 in June, the lowest since March 2023, which shows that the labor market is clearly weakening, raising concerns about the slowdown of the US economy.

Technical analysis: After approaching the 332x support area, the gold price bounced back strongly, currently the gold price is still following the MA 20. We will wait at the support areas to be able to trade, however, today's reports and news can strongly influence, leading to unpredictable fluctuations in the gold price; In addition, we should also be careful before the short profit-taking phase that may occur today or tomorrow.

Important price zones today: 3322 - 3327, 3338 - 3343 and 3375 - 3380.

Today's trading trend: BUY (scalp).

Recommended orders:

Plan 1: BUY XAUUSD zone 3337 - 3339

SL 3334

TP 3342 - 3350 - 3360 - 3380.

Plan 2: BUY XAUUSD zone 3322 - 3324

SL 3319

TP 3327 - 3340 - 3360 - 3380.

Plan 3: SELL XAUUSD zone 3378 - 3380

SL 3383

TP 3375 - 3365 - 3355 - 3345 - Open (small vol).

Wish you a safe and profitable trading day.🌟🌟🌟🌟🌟

Emma

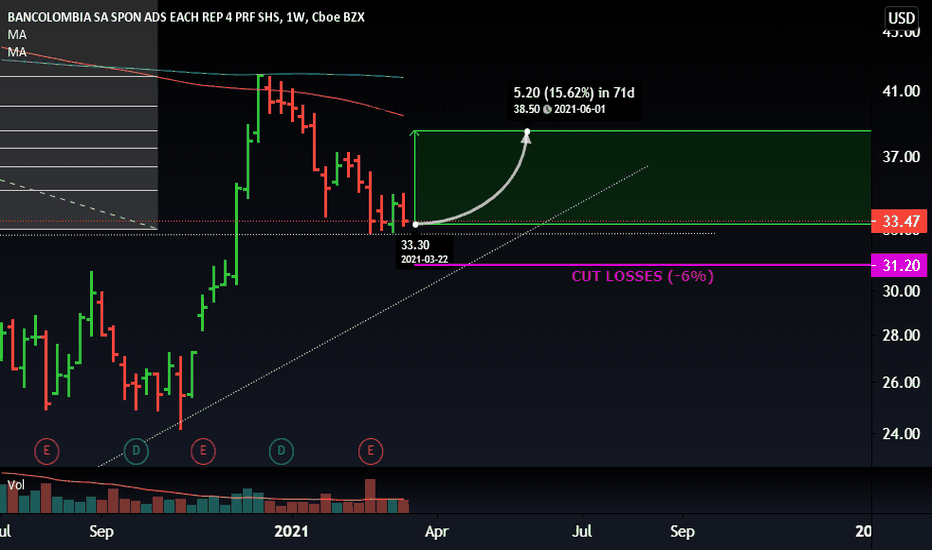

Buy $CIB- NRPicks 21 MarBancolombia S.A. offers various banking products and services to individual and corporate clients in Colombia, Panama, Puerto Rico, El Salvador, Costa Rica and Guatemala. The company operates through eight segments: Banca Colombia, Banca Panamá, Banca El Salvador, Banca Guatemala, Trust, Investment Banking, Brokerage and Off Shore.

To enter in context, GDP in the fourth quarter recorded an annual negative variation of 3.6% and a year-on-year contraction of 6.8%. This result shows that economic activity experienced a process of clear improvement with better-than-expected results. As for the pandemic, Colombia has not yet exceeded the most difficult levels but investors have good expectations.

As for the company reported losses per share of -0.309 and quarterly revenue of $1.07B

- Value

- P/S 1.60

- P/B 1.03

- Dividend Yield 3.68%

Technical:

- Support at $32

- Average RSI levels

- MACD Level (12, 26) -3.04