CL1!/USOIL/WTIUSD/CLK2017 [Corrective wave Elliott wave Zigzag]Head and Shoulder pattern Entry 53.40

Target 1 =>52.15

Target 2 =>50.40

Neck line 52.70 ==> Price breaks the neck line and makes a nice move down.

=> zig zag pattern ABC

** Head and Shoulder or Descending Triangle pattern

Elliott wave 3

Target 1 = 52.15 Elliott wave 4 have the possibility

CL1! USOIL WTIUSD CLK2017

Ending Diagonal

ATVI Ending Diagonal?Not big fan of selling into corrections but look how fast the price has moved down from recent Ending Diagonals (good RSI divergence to support these).

Most of the ending diagnosis retrace back to the end of wave 2 so we could see a correction down to 44.60

There could be one more move up before the correction (Although RSI suggests that may not be the case)

Drop down to a lower time frame to confirm the breakout before taking the trade in case we do get one more move up.

EURUSD - UP UP AND AWAY!!!!!!Hi All,

I think the end is near for this pair as USD rallied despite the massively low employment figures. I seems like the remaining USD buyers are closing their orders which has creating an even bigger divergency across the board so a rally from EUR should happen imminently.

Here's a quick recap of my wave count of the final wave C which looks complete.

Starting from the low at 1.03411

Wave 1: Leading Diagonal impulse move to the upside.

Wave 2: Looking like an running wave A) double ZZ combo (WXY), wave B) Expanded Flat

Current wave C) I have counted the primary and sub waves as labelled with wave 4 fib extensions, wave 2 (ZZ) and wave 4 (Flat) - rule of alternation all met and wave 5 is an ending diagonal which is a terminal move so a change of direction is expected.

Hopefully we will see a big rally by EUR next week as it is the start of wave 3 in a bigger timeframe.

Best of luck all...

Don

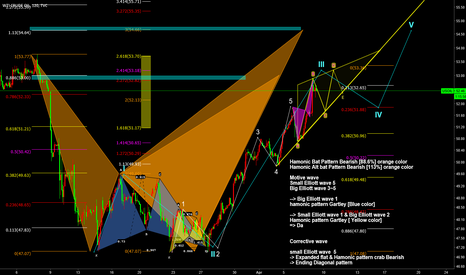

USOIL/ CL1! /WTIUSD / Elliott wave & Hamonic pattern Hamonic Bat Pattern Bearish orange color

Hamonic Alt bat Pattern Bearish orange color

Motive wave

Small Elliott wave 5

Big Elliott wave 3~5

--> Big Elliott wave 1

hamonic pattern Gartley

--> Small Elliott wave 1 & Big Elliott wave 2

Hamonic pattern Gartley

=> Da

Corrective wave

small Elliott wave 5

-> Expanded flat & Hamonic pattern crab Bearish

-> Ending Diagonal pattern

USOIL CL1! CL2! WTIUSD NYMEX:CLK2017

GOLD Outlook + Wave Count: Cypher completeWe have a possible leading diagonal followed by a breakdown into the completion of a cypher pattern. Price clearly makes a reversal at the cypher's completion, however since the bearish impulse in leg D is relatively strong I will be on the sidelines until further clues present themselves.

FTSE100 Wave Count: Potential Ending Diagonal?Unlike the Nikkei and SPY, the FTSE100 is less decisively bullish. It looks as though we may be in the midst of an ending diagonal that may present a selling opportunity. For now, I am cautiously bullish but on the sidelines until further signals present themselves.

GOLD - Loosing GroundYesterday #Gold break below the 1240 #support (#endingdiagonal) but managed to bounce back. I already expect Gold to start its major #correction for the move started 1120 but before that one last leg up is still in play (because of ending diagonal #elliotwave pattern). yesterday break of the support indicate that the fall may come quicker than we expect and #Gold may not reach the #pricetarget 1270-75 area. we may be heading for a #truncated5thwave (in ending diagonal) which could cause prices to fall from 1260-63 area to begin the #majorcorrection.

UPDATE ON USDCHF ANALYSIS - 1H CHARTHey traders,

I linked my previous analysis on USDCHF in this idea published so you see the full idea.

By now we are getting uptrend impulses so my next trade is a buy; however, if market starts making an ending diagonal pattern I will plan a sell at the breakout.

Carlos

GOLD - EXPECTING A FINAL PUSH BEFORE THE MAJOR DROPWith reference to my previous updates, GOLD has now reached around 1240.00, (support for ending diagonal). From this point Gold is expected to make its last attempt higher which could lead Gold Price towards 1270-75 area to complete the 5 wave pattern (started from the low around 1120) before starting the major correction.

GBPAUD: Potential Sell Opportunity In An Ending Diagonal Price is forming a potential Ending Diagonal giving an opportunity for a short position. The fall in price is expected to test the "lower structure line" although it can fall short of it.

Trade with care. Use a strategy you have tested and verified.

6.1.8. Family.

More Than Just Trading.

Ending diagonal to retrace the bullish moveThere is a chance that AUD/CHF could significantly go down during next few weekly sessions. The reason for that is the formation of an ending diagonal in a C wave position which is much clearer to see on a daily timeframe.

The present analysis goes side by side with similar projection for some other pairs:

EUR/AUD - up

EUR/NZD - down

NZD/CHF - down