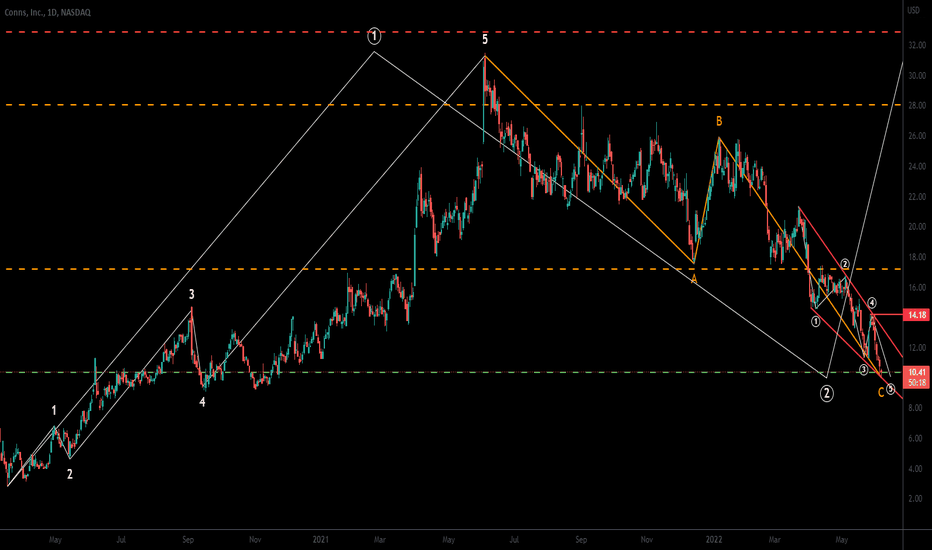

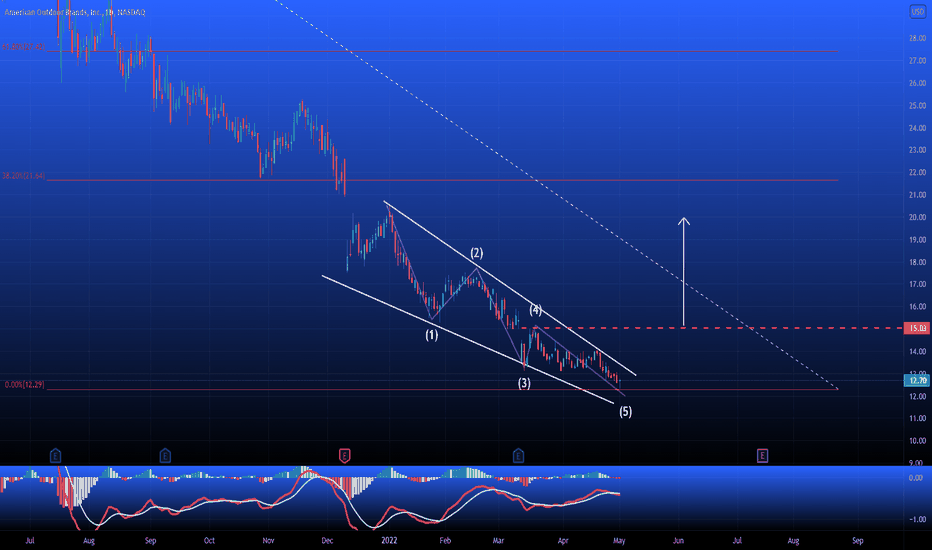

CONN wave major wave 2I believe Conn is setting up for a major move up. Wave 2 of a much larger wave is about complete with an ending diagonal wave C. Wait for the break of the red horizontal line to confirm larger wave 3 is on the way. Trade at your own risk. Good luck!

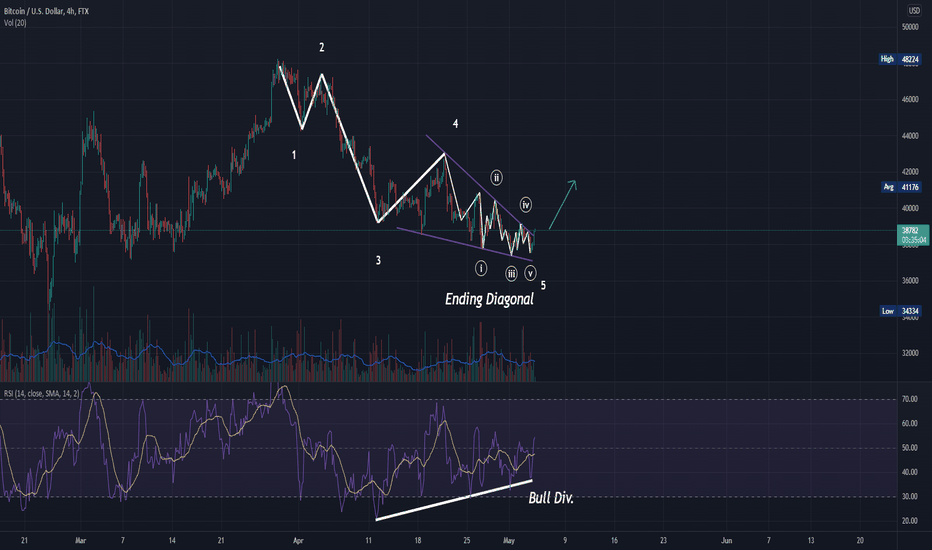

Ending Diagonal

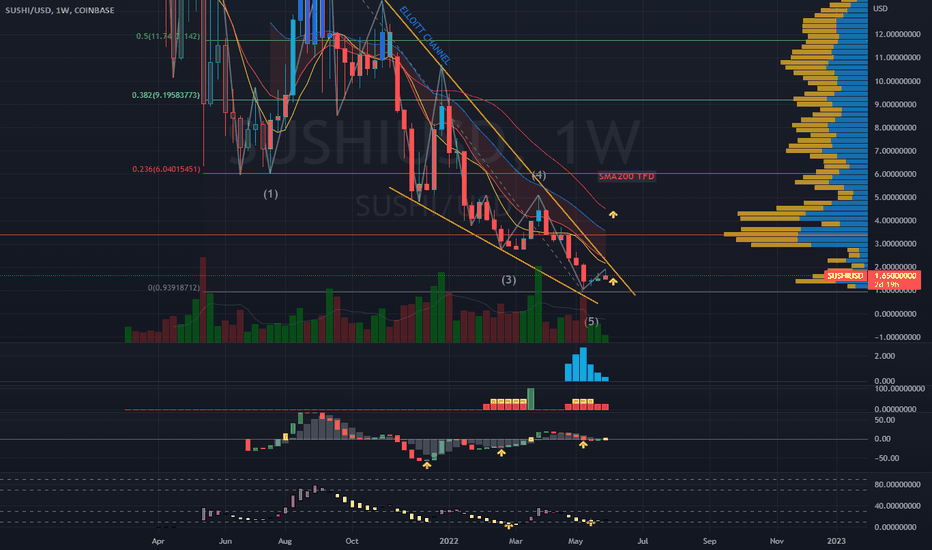

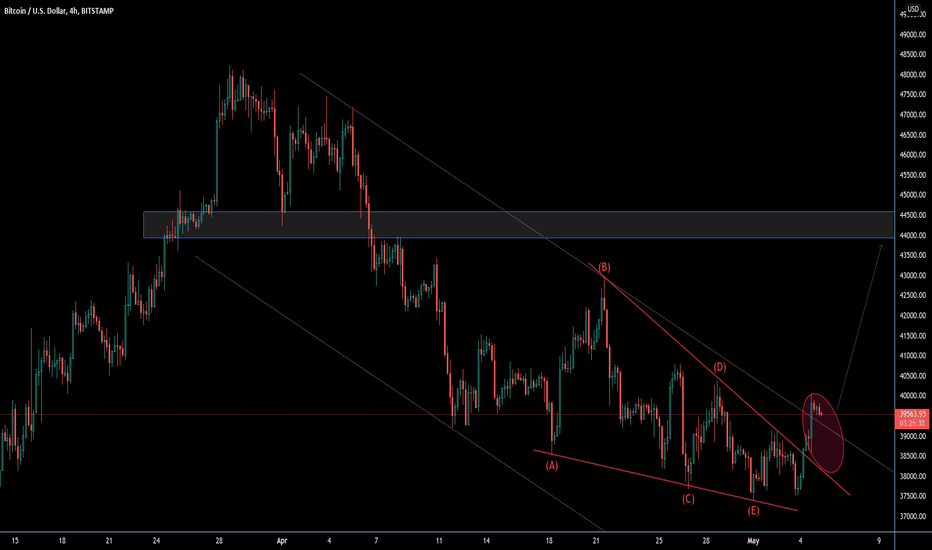

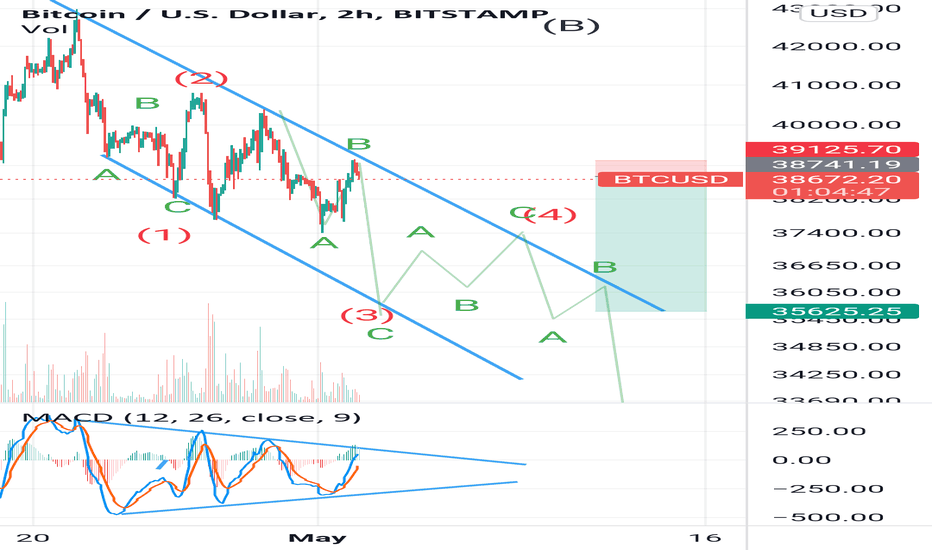

SUSHIUSD| TFW Analysis Ending Diagonal - Bullish DivergencePrice action and chart pattern weekly wave analysis

> TFW continues in an ending diagonal of a potential final ABC correction wave 5 downtrend stage.

> Medium term trading - Entry @ downtrend Elliott Channel breakout

> 1st Target @ SMA200 TFD / just above wave 4 zone @ 0.382

> Stoploss @ Wave 5 zone with 20-30% downside risk - RRR: 4:1

Indicator:

1. Smart money volume 2.6X

2. Banker chip entry signal at downtrend Wave 3 and 5.

3. BBD triple bullish divergence crossover baseline and above

4. Stochastic bullish divergence signal 1st uptrend ribbon in oversold zone

Always trade with affordable risk and respect your stoploss

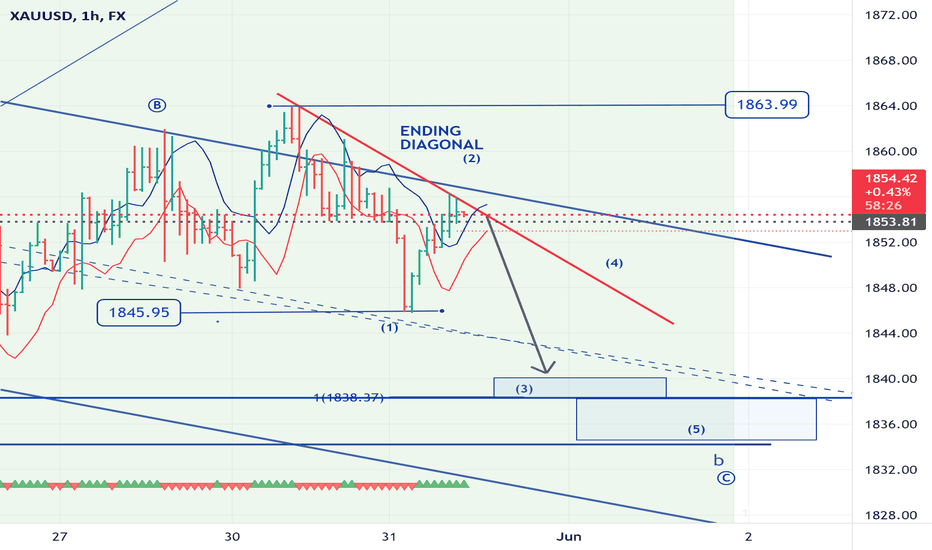

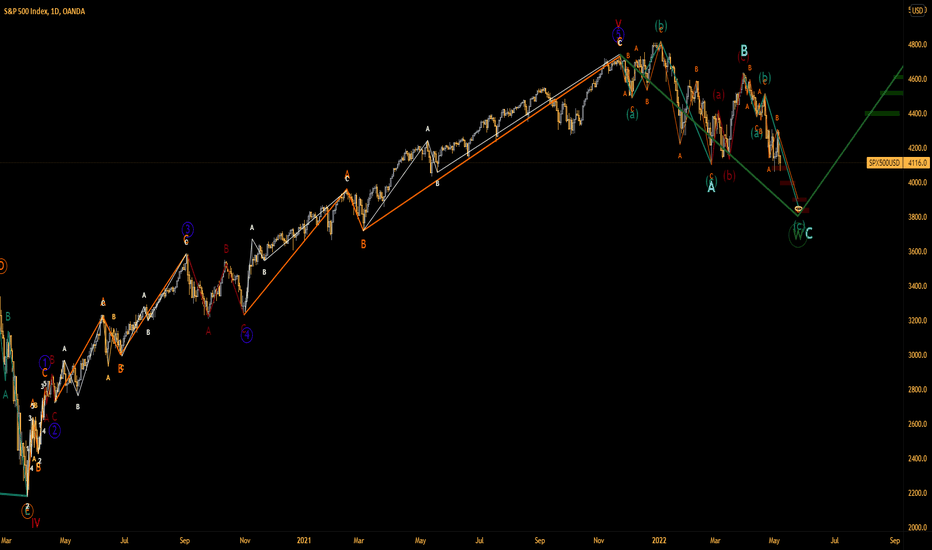

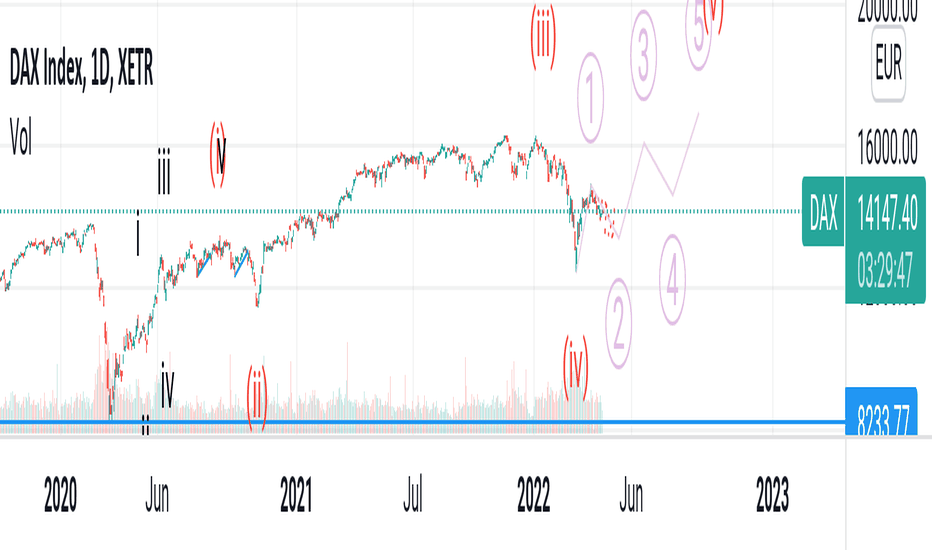

When will S&P500 finish its first correction wave ?!?Hello traders!

I think we are all looking at the indices charts that keeps falling with the effect of the crisis and economy management from the Fed and central banks.

**According to Truflation, the inflation rate is at 11.4% in the USA**

This economic crash is not yet to stop, we will be experiencing crazy time in the incoming month and years...!

BUT ANYWAY , today we are analyzing the S&P500 with the Elliott Waves from the crash of the Covid-19, and what we can see is that:

The 5 of the Impulse Extended Ending Diagonal Wave has been confirmed the 22 Nov '21

- An EED have 5 waves that are subdivided into correction waves 3-3-3-3-3.

- In an expanding diagonal ending, wave 1 is small, wave 3 is medium and Wave 5 is long.

Since then, we are in an ABC pattern that we are about to finish in the incoming week

For me, it is the first Wave of the correction pattern that we are about to be witness in the incoming month and until next year.

Because the worldwide economy is not looking good, in my opinion I would say that we are finishing Wave W of a WXYXZ.

ZOOM IN for a better view of the objectives that have been found for the end of the downtrend (light blue C of the ABC) :

1/// 4000 is strong by being the 100% of the ABC pattern

2/// 3900 is strong by being the 113% of the ABC pattern

3/// 3850/3825 is the strongest by being the 123%/127,2% of the ABC pattern and near the 38.2% of the entire Impulse Wave Retracement

ZOOM OUT for a better view of the overall structure of the S&P500

You can also check my analysis on the NAS100 where the structure is pretty much the same.

.

.

Please feel free to ask question and recommendations in the comment section, I would be more than happy to answer your questions

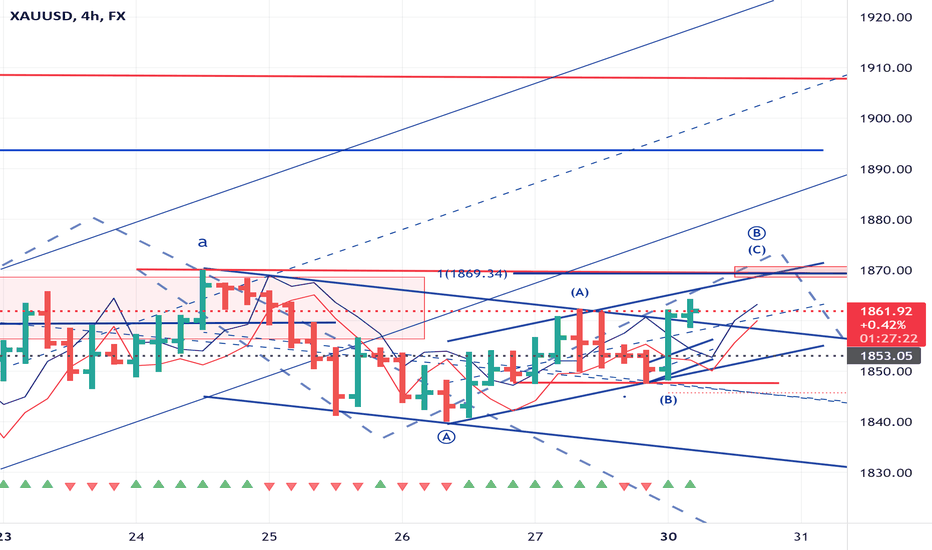

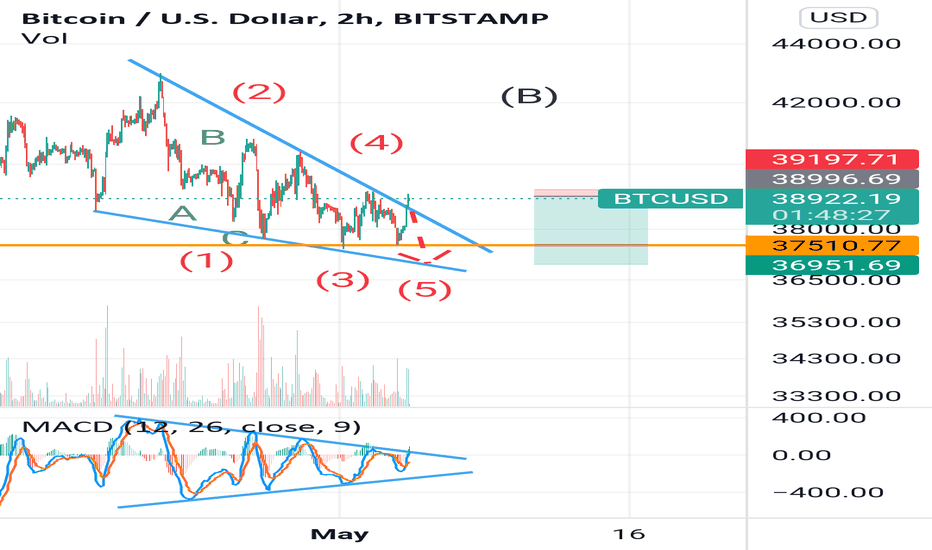

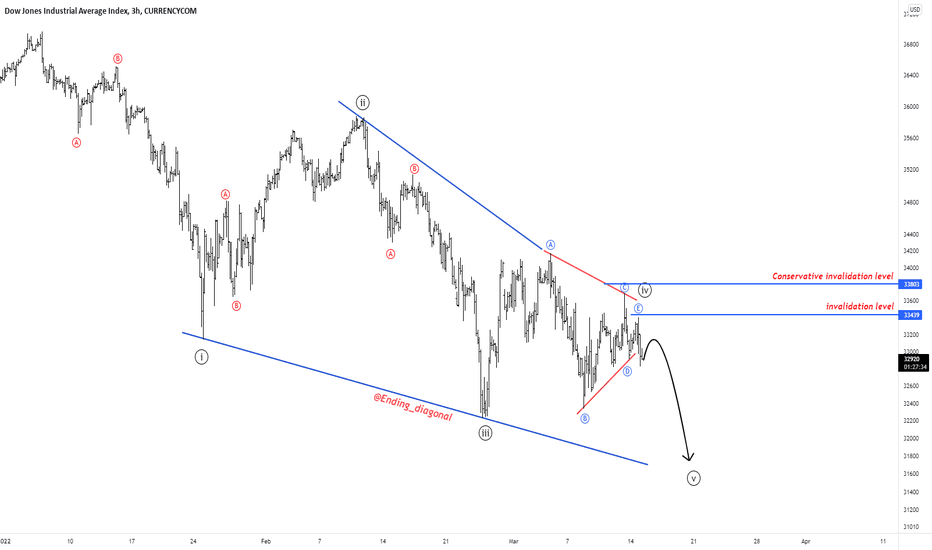

US30 : Ending DiagonalMain pattern : Ending diagonal

Current wave position : wave 4 (triangle)

I see the price will continue the decline to complete wave 5 of ending diagonal.

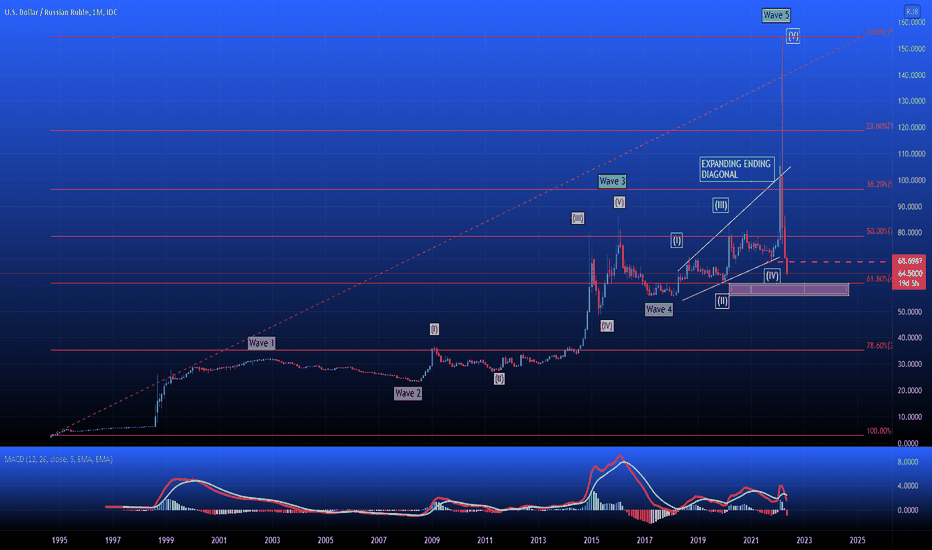

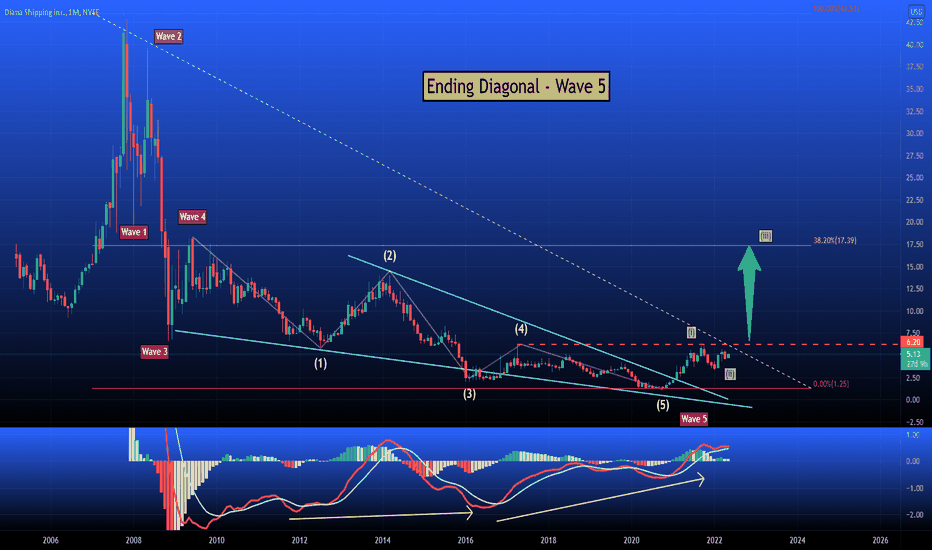

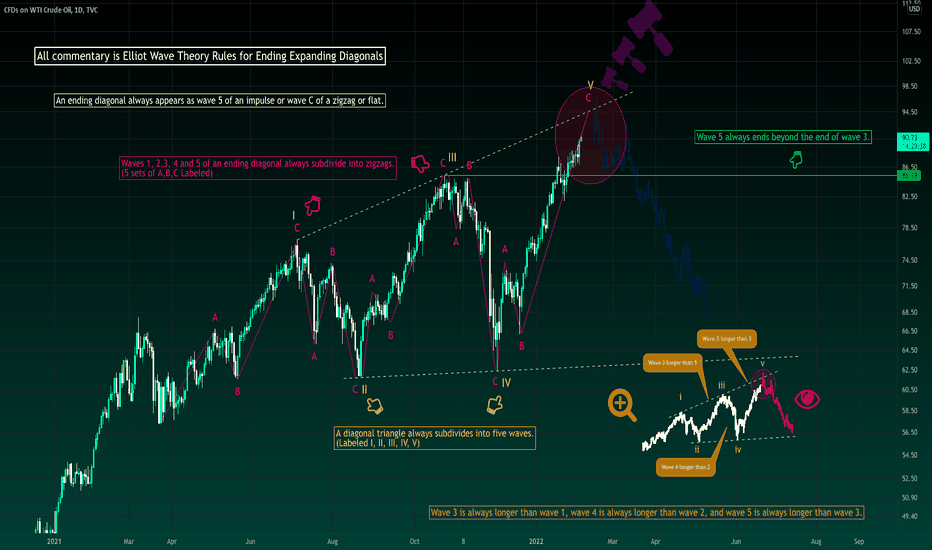

TEXTBOOK Ending Expanding DiagonalDino juice looking like a page out of an Elliot Wave Theory textbook. All rules have been illustrated to be present and not broken.

This is probably the most extensive analysis I've done so I would love to hear any feedback. Always do your own due diligence.

Supposedly these patterns are "extremely rare"..

Ending expanding diagonal

Rules (these are “hard” rules; they cannot be broken)

A diagonal triangle always subdivides into five waves.

An ending diagonal always appears as wave 5 of an impulse or wave C of a zigzag or flat.

Waves 1, 2,3, 4 and 5 of an ending diagonal always subdivide into zigzags.

In the expanding variety, wave 3 is always longer than wave 1, wave 4 is always longer than wave 2, and wave 5 is always longer than wave 3.

In the expanding variety, wave 5 always ends beyond the end of wave 3.

Guidelines (guidelines can be broken but it’s rare that they are)

Within an impulse, wave 5 is unlikely to be a diagonal triangle if wave 3 is not extended.

In the expanding variety, wave 5 usually ends slightly before reaching a line that connects the ends of waves 1 and 3.

source: worldcyclesinstitute.com

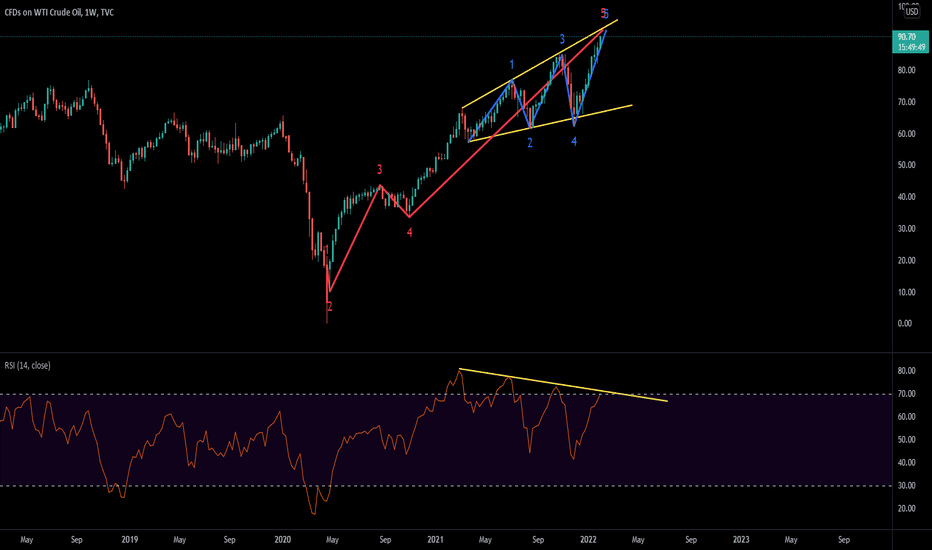

Crude Oil WTI Wave 5 Ending Diagonal Hello everyone. I just wanted to bring this to your attention. There's a very high probability WTI will pull back significantly. As illustrated above, I believe Crude is almost completing the final wave 5 of what I believe is a wave 1 of a much larger sequence. The wave 5 is a complex, one called ending diagonal. If I was long on oil futures I would be closing my position ASAP. And be looking to shorting here, along with some energy companies. Please keep in mind I'm only sharing what I'm doing, I'm not a financial advisor and I'm not telling you what to do. Good Luck everyone