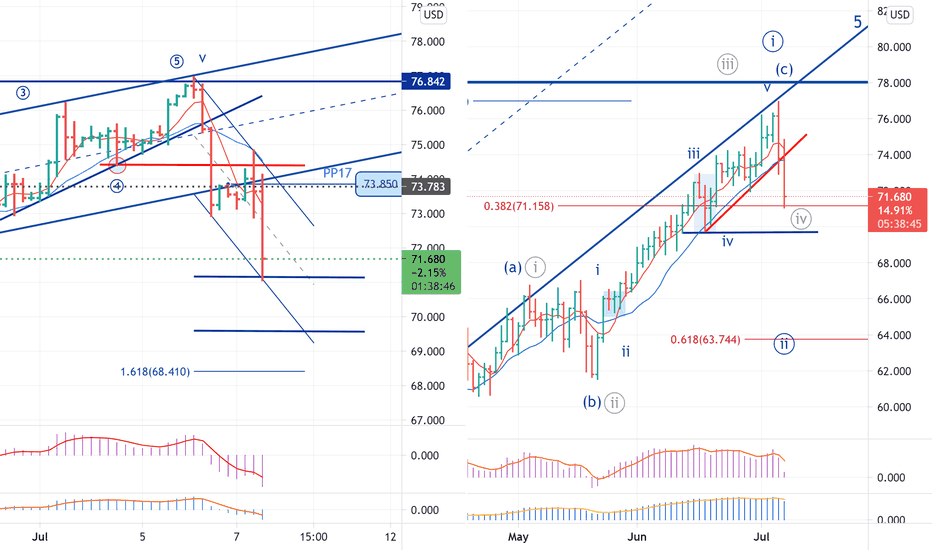

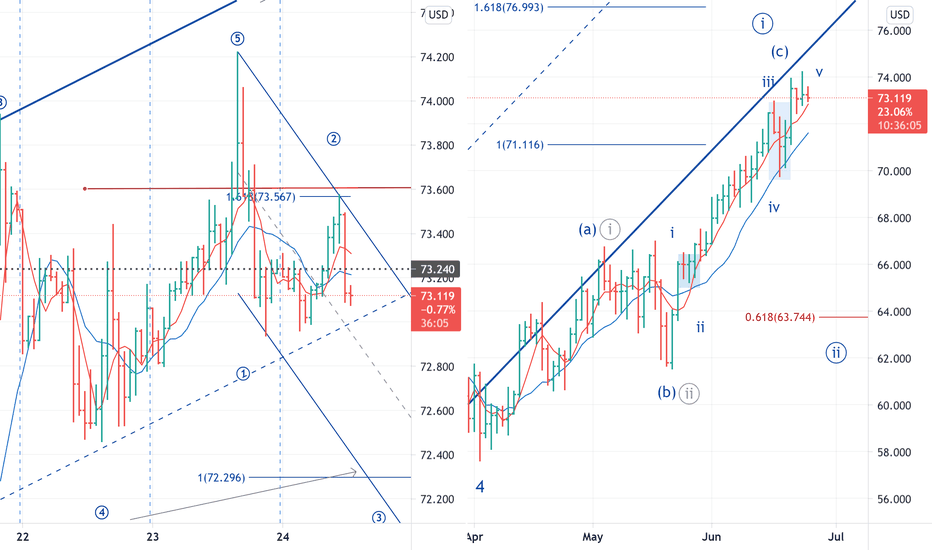

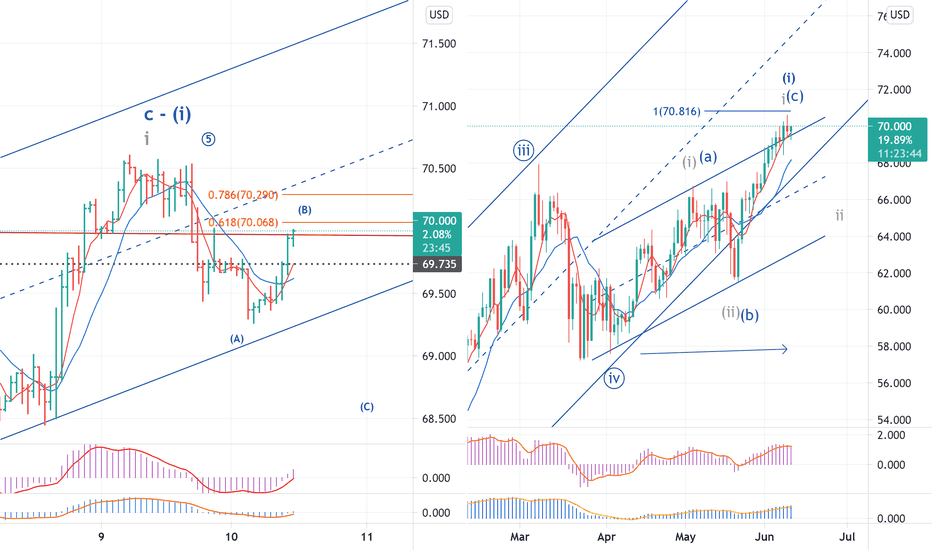

USOIL - Elliott wave – update – subminuete wave V ended

USOIL - Elliott wave – update – subminuete wave V ended

subminuete wave V of (C) of ((1)) ended in ending triangle

downtrend correction should be corrective mode to wave ((II)) - possible target 63.70

ALT: subminuete wave V of ((III)) ended

correction in wave ((IV)) unfoldig - invalidation 71.15 FIB 0.382

critical price area

previus daily close 73.78

PP 73.85 UP

FIB 0.382 - 71.15

Ending Diagonal

Elliott Wave Analysis: WHEAT Is Still Looking For The BottomHello traders and investors!

Today we will talk about commodities, specifically WHEAT, in which very interesting development.

Well, as you know, commodities have been very bullish for the last year and some of them made strong and impulsive rise, but this is not the case for WHEAT, as we see slower price action and corrective wave structure from the lows.

We are talking about (A)-(B)-(C) flat correction where wave C has ended within an ending diagonal (wedge) pattern. The whole structure belongs to a higher degree wave IV correction of a bigger monthly wedge shape that can send the price back to lows for wave V before market finds the bottom.

What we want to say is that maybe it's time for a slow down in the commodity market, where WHEAT could be on of the weakest, especially after recent strong and impulsive decline back below lower ending diagonal pattern, which confirms that correction from the lows is completed, but real bears may show up below 600 region!

Be humble and trade smart!

If you like what we do, then please like and share our idea!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

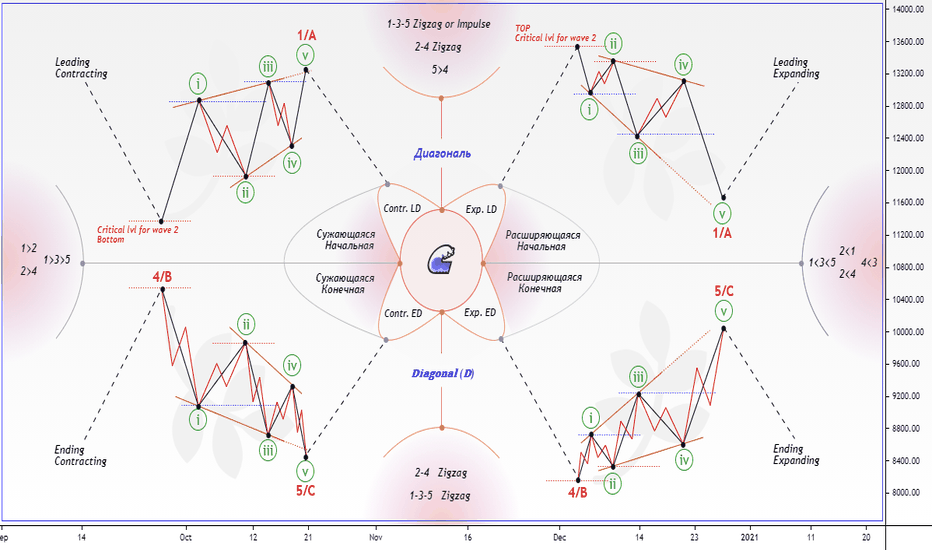

💨𝙀𝙡𝙡𝙞𝙤𝙩𝙩 𝙒𝙖𝙫𝙚 𝙋𝙖𝙩𝙩𝙚𝙧𝙣: 𝘿𝙞𝙖𝙜𝙤𝙣𝙖𝙡🌊●●● 𝘿𝙞𝙖𝙜𝙤𝙣𝙖𝙡 (D)

❗❗ 𝙂𝙚𝙣𝙚𝙧𝙖𝙡 𝙧𝙪𝙡𝙚𝙨

● A diagonal always subdivides into five waves.

● Wave 2 never goes beyond the start of wave 1 .

● Wave 3 always goes beyond the end of wave 1 .

● Wave 4 never moves beyond the end of wave 2 .

● Wave 4 always ends within the price territory of wave 1 (overlap).

● An ending diagonal always appears as wave 5 of an impulse or wave C of a zigzag or flat .

● A leading diagonal always appears as wave 1 of an impulse or wave A of a zigzag.

● Waves 1 , 2 , 3 , 4 and 5 of an ending diagonal, and waves 2 and 4 of a leading diagonal, always subdivide into zigzags.

● In a leading diagonal, wave 5 always ends beyond the end of wave 3 .

❗ 𝙂𝙚𝙣𝙚𝙧𝙖𝙡 𝙜𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● Waves 1 , 3 and 5 of a leading diagonal usually subdivide into zigzags but sometimes appear to be impulses (all zigzags or all impulses ).

● Within an impulse , if wave 1 is a diagonal, wave 3 is likely to be extended.

● Within an impulse , wave 5 is unlikely to be a diagonal if wave 3 is not extended.

● A leading diagonal in the wave one position is typically followed by a zigzag retracement of 78.6 %.

●● 𝘾𝙤𝙣𝙩𝙧𝙖𝙘𝙩𝙞𝙣𝙜 𝘿𝙞𝙖𝙜𝙤𝙣𝙖𝙡 (Contr.D)

❗❗ 𝙍𝙪𝙡𝙚𝙨

● In the contracting variety, wave 3 is always shorter than wave 1 , wave 4 is always shorter than wave 2 , and wave 5 is always shorter than wave 3 .

● Going forward in time, a line connecting the ends of waves 2 and 4 converges towards with the line connecting the ends of waves 1 and 3 .

❗ 𝙂𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● In the contracting variety, wave 5 usually ends beyond the end of wave 3 . (Failure to do so is called a truncation.)

● In the contracting variety, wave 5 usually ends at or slightly beyond a line that connects the ends of waves 1 and 3 . (Ending beyond that line is called a throw-over.

● In the contracting variety, wave 3 may be equal .618 to .786 the length of wave 1 , and wave 5 may be equal .618 to .786 the length of wave 3 .

●● 𝙀𝙭𝙥𝙖𝙣𝙙𝙞𝙣𝙜 𝘿𝙞𝙖𝙜𝙤𝙣𝙖𝙡 (Exp.D)

❗❗ 𝙍𝙪𝙡𝙚𝙨

● In the expanding variety, wave 3 is always longer than wave 1 , wave 4 is always longer than wave 2 , and wave 5 is always longer than wave 3 .

● Going forward in time, a line connecting the ends of waves 2 and 4 diverges from with the line connecting the ends of waves 1 and 3 .

● Wave 5 always goes beyond the end of wave 3 .

❗ 𝙂𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● Waves 2 and 4 each usually retrace .66 to .81 of the preceding wave.

● In the expanding variety, wave 3 may be equal to 1.618 the length of wave 1 , and wave 5 may be equal to 1.618 the length of wave 3 .

● In the expanding variety, wave 5 usually ends slightly before reaching a line that connects the ends of waves 1 and 3 .

Elliott Wave Principal 2005 and Q&A EWI .

USOIL - Elliott wave – update count – wave 5 unfolding

minor wave 5 unfolding -motive ending diagonal triangle - 5 waves zigzag

zigzag minute ((i)) ended

zigzag minute ((ii)) unfolding

ALT: minor wave 5 unfolding - motive impulsive - minute ((iii)) still running to/through 76.99

critical price area

previus daily close 73.24

PP 73.60 DW

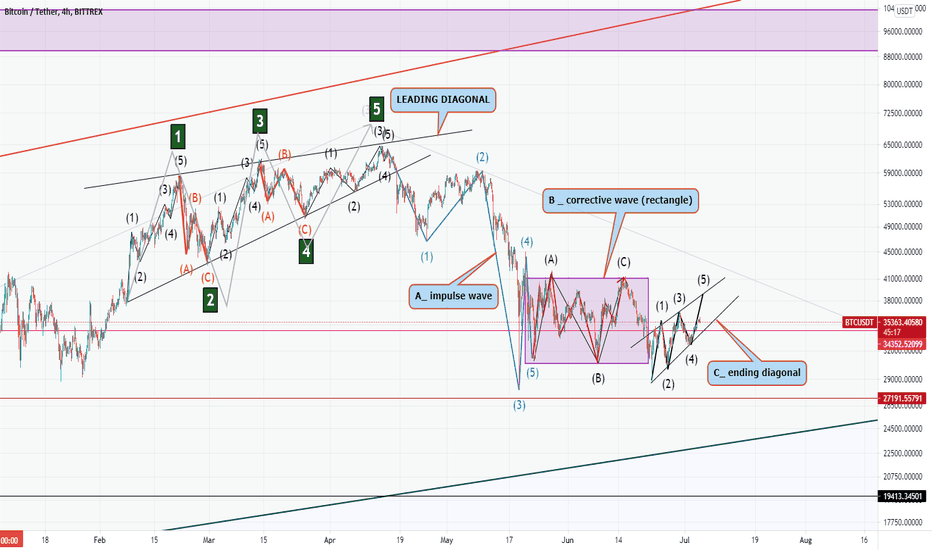

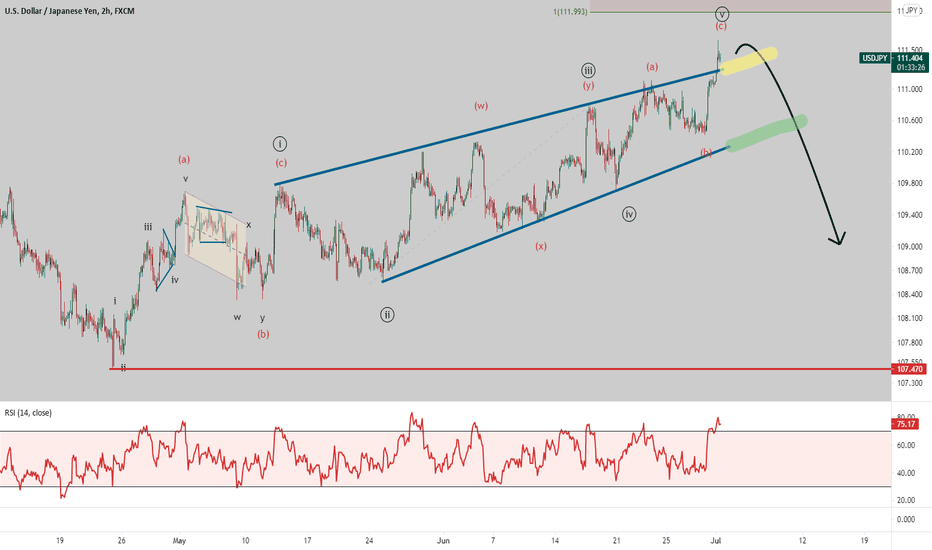

Powerful Elliott Wave Diagonal Pattern for USDJPYOne of the benefits of Elliott wave is that it provides context for describing market behavior. A correct interpretation of the Elliott wave pattern can help you forecast important turning points.

With these turning points identified, solid risk to reward ratio opportunities can be bubbled up as well.

We have such a case within USDJPY.

The choppy and overlapping uptrend has the look and feel of a diagonal pattern. If this is the case, USDJPY is on the verge of turning lower and could possibly reach 107.47.

Watch the yellow highlight...a breakdown below it will be the initial warning signal that a top may have formed.

A breakdown below the green highlight will confirm the top.

If this is the correct Elliott Wave pattern carving right now, then USDJPY will have to remain below 112.00 or some other pattern is at play.

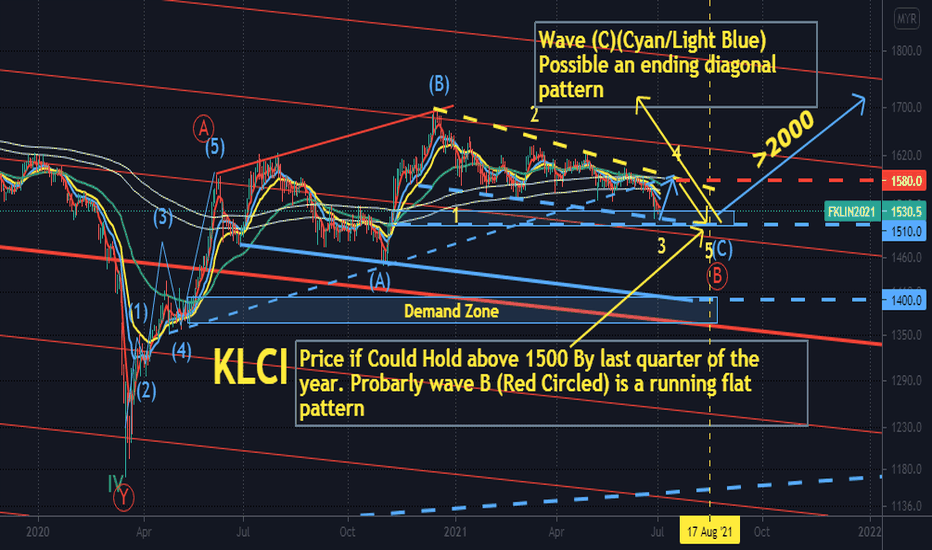

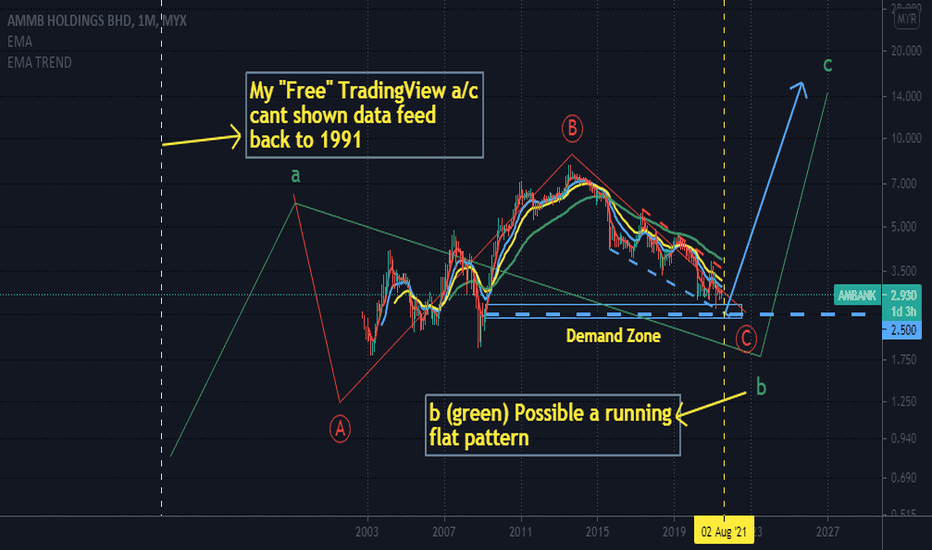

AMBANK wave C (red) possible reach "Terminal" at 2.50. 29/6/21 AMBANK possible forming a running flat pattern in wave b (green).. Now at wave C (Red Circled ) where price could reach its terminal of wave C (Red Circled ) at around Rm 2.50.. which is the confluence zone of 1) The lower Trend Line of wave C (Red Circled) ending diagonal pattern 2) Next Major Demand Zone

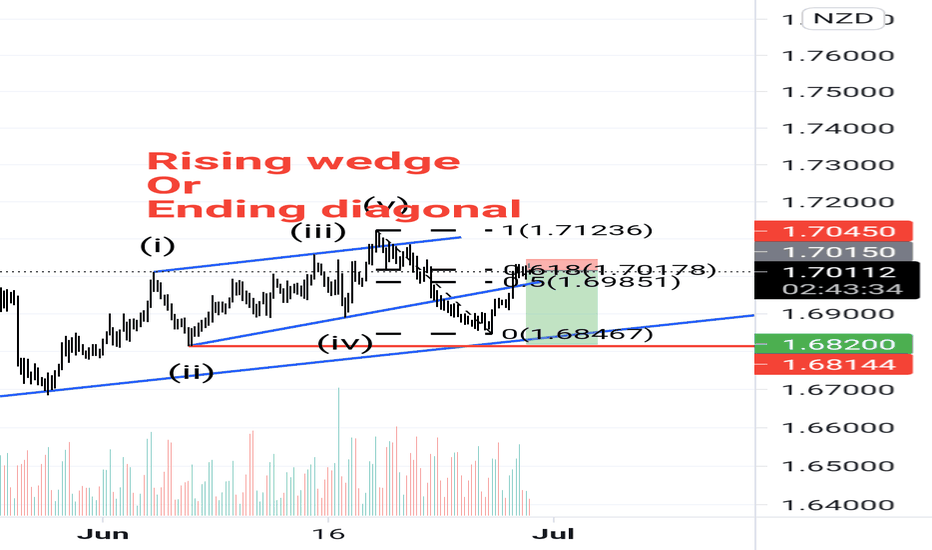

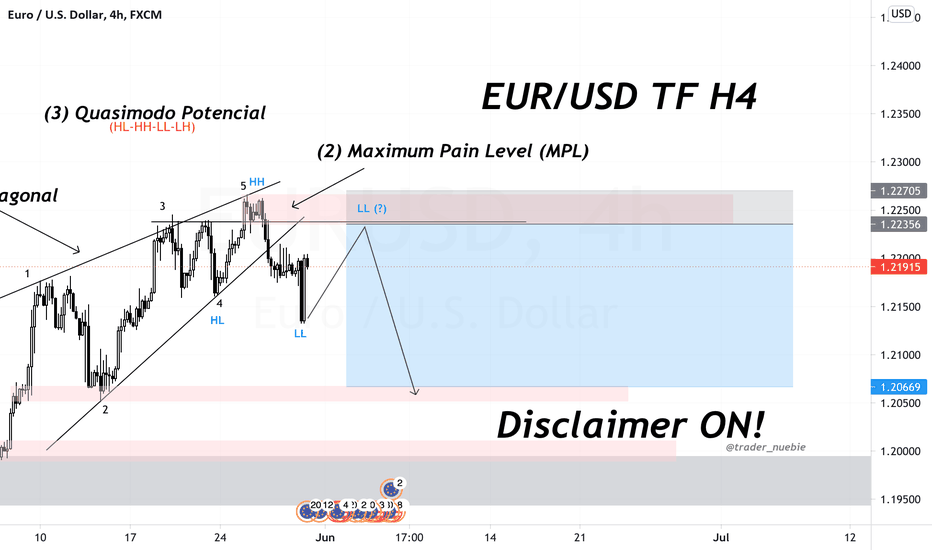

EURNZD, 4hr tf, sell the wedge pattern breakoutTrade ideas for EURNZD by Hardi

As you can see, a potential rising wedge pattern could be in play. The target should be around 1.6810-20 area.

Right now price retracing at the 61.8 fibonacci level after breaking below the support. This could be a short opportunity for this pair as it is now at an interesting level.

Using elliott wave principle, we might assume this as ending diagonal as well. Both pattern point towards the same target area.

Sell EURNZD 1.7015

Stop loss 1.7045

Take profit 1.6820 (6.2R)

Use only 1-2% risk

Good luck

USDJPY Bearish Reversal UnderwayHI traders,

USDJPY has been making series of overlapping three-wave pattern. This pattern can be easily labeled in Elliott Wave as an ending diagonal.

Ending diagonal usually forms at the end of a trend and leads to an explosive reversal. If this count is correct, we should expect more weakness in USDJPY in the weeks ahead.

Target below the origin of the diagonal, wave 4 low, is plausible in the weeks ahead.

What's your view on USDJPY? Let me know in the comment.

USOIL - Elliott wave – update count – ending diagonal in ((V))

ending diagonal in minute wave ((V))

5 waves - zigzags (simple, double, triple-zigzags)

(i) of ((V)) is over in abc

three waves down to (ii) should follow

ALT: wave ((IV)) is not over yet

critical price area

previus daily close 69.73

PP 70.00 DW

FIB: 70.06 – 70.29

static S/R : 70.00

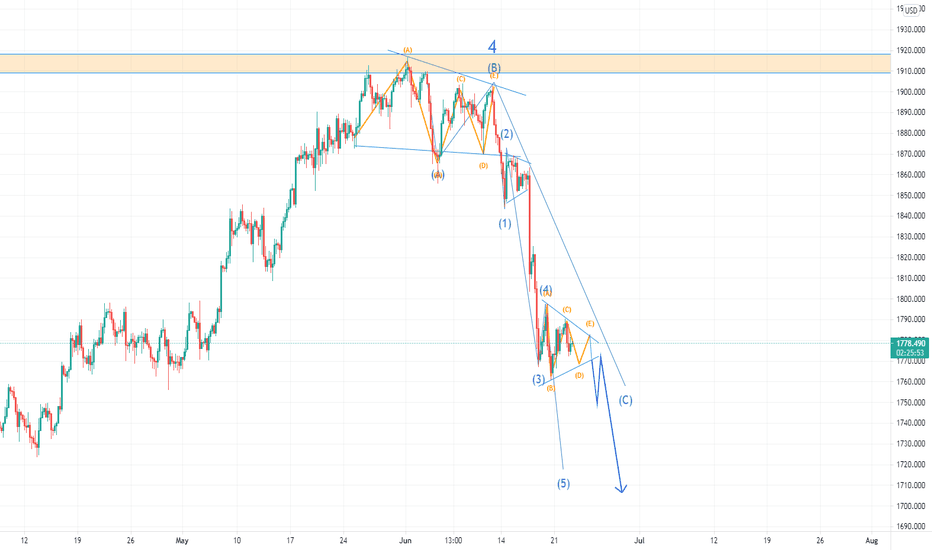

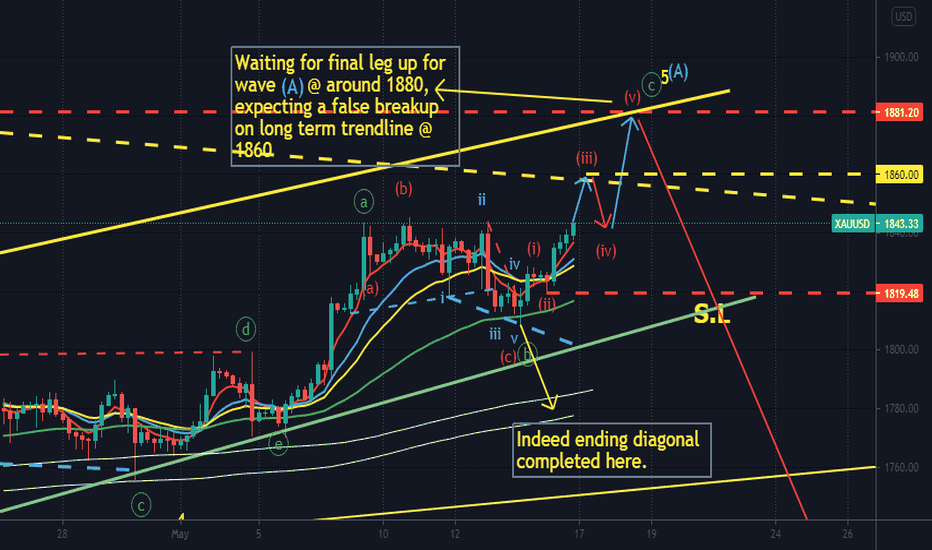

GOLD. Is Pullback done? Probably Not. 5 June 21Gold maybe is forming an expanding ending diagonal, Short at around 1900, ( where is an intersection of down trend line with pitchfork median line ). Stop Lost at 1910..Target Profit at around 1840 << where there is an intersection of 1) 4h 200 EMA 2)Pullback Zone of Long Term Down Trend line Breakout 3) Pitchfork lower support line..>>

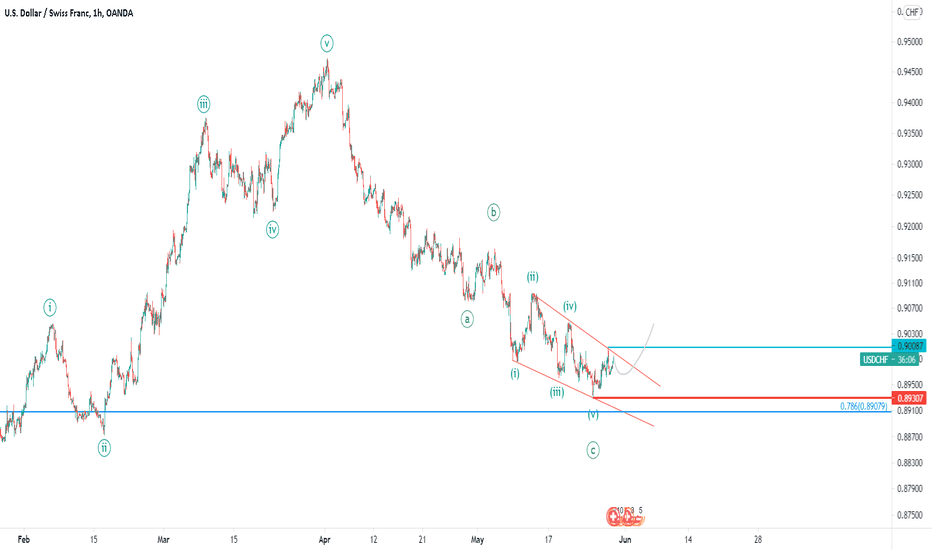

USDCHF H1 - Ending diagonalIn h1 timeframe, it seems wave C after an ending diagonal 5 waves finished.

but I have to wait for final signs.

I think break out the price of last top that shown on chart with green line is a good sign to shown that wave C is finished.

and it can be a good trigger for a long position.

the red line can be a good stop loss if my analysis will not be correct.

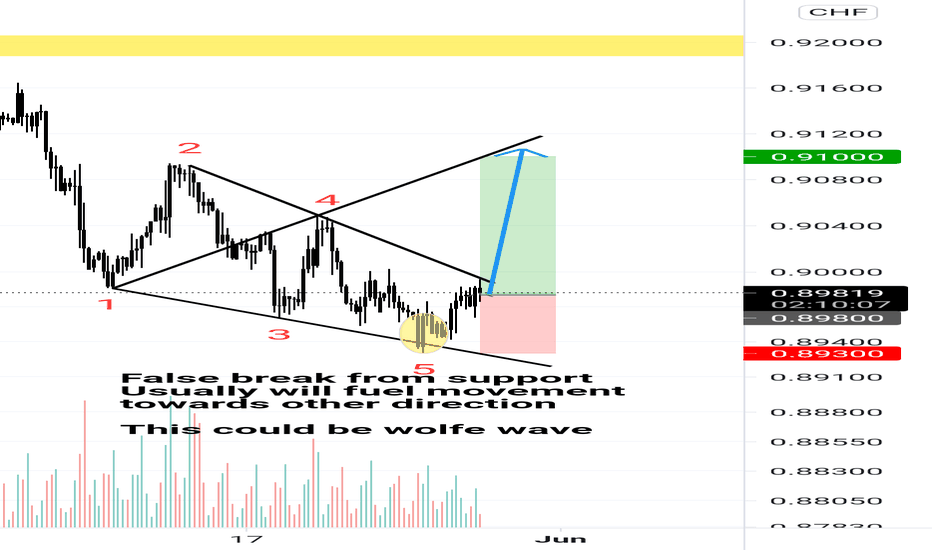

UDDCHF, 4hr tf, reversal pattern to the upside

Price making a ending diagonal / falling wedge / wolfe wave pattern.

Overall all patterns are reversal pattern to the upside so we might see USDCHF continue north.

Buy USDCHF 0.8980

Stop loss 0.8930

Take profit 0.9100 (2.4R)

Use only 1-2% risk

Good luck

Elliott Wave Analysis: XRPBTC May Retest 2017 LowsHello Crypto traders!

Today we will talk about XRPBTC cryptocurrency cross pair as we see an interesting development.

Well, XRPBTC is down since the beginning of 2018 and we see it trading in third leg C, but wave C is a motive wave and it has to completed with five waves, ideally as part of an ending diagonal (wedge) pattern, which can retest 2017 lows before we will see a bullish reversal.

Something similar has already happened between 2015 and 2017 and if we consider that BTC.Dominance is trading at the lows and strong support, then we would not be surprised if XRPBTC remains in the downtrend for some time.

Be humble and trade smart!

If you like what we do, then please like and share our idea!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

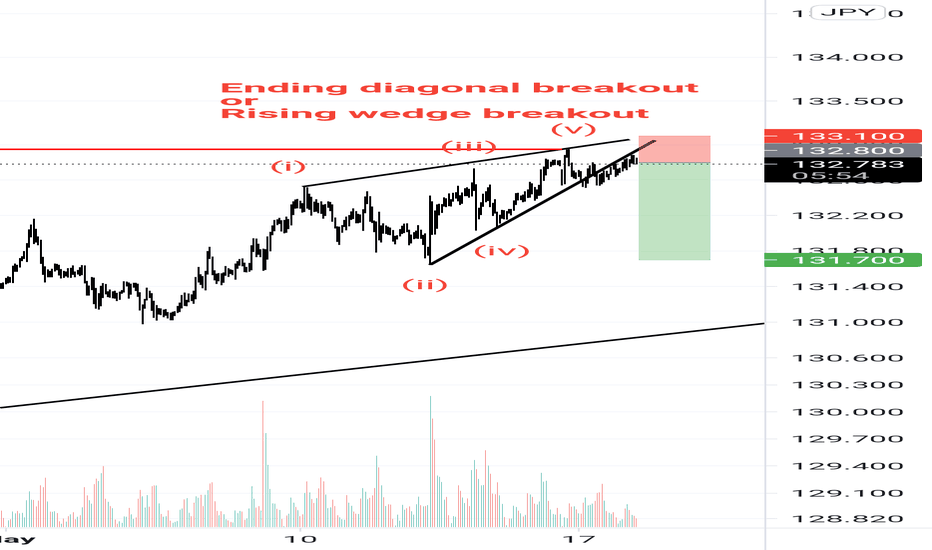

EURJPY, 1hr chart, ending diagonal / rising wedge

As you can see price making a rising wedge pattern or ending diagonal depending on your view using chart pattern or elliott wave.

Overall both patterns target is around 131.70-60 which is the bottom of wedge/diagonal.

Sell EURJPY 132.80

Stop loss 133.10

Take profit 131.70 (3.6R)

Use only 1-2% risk

Good luck