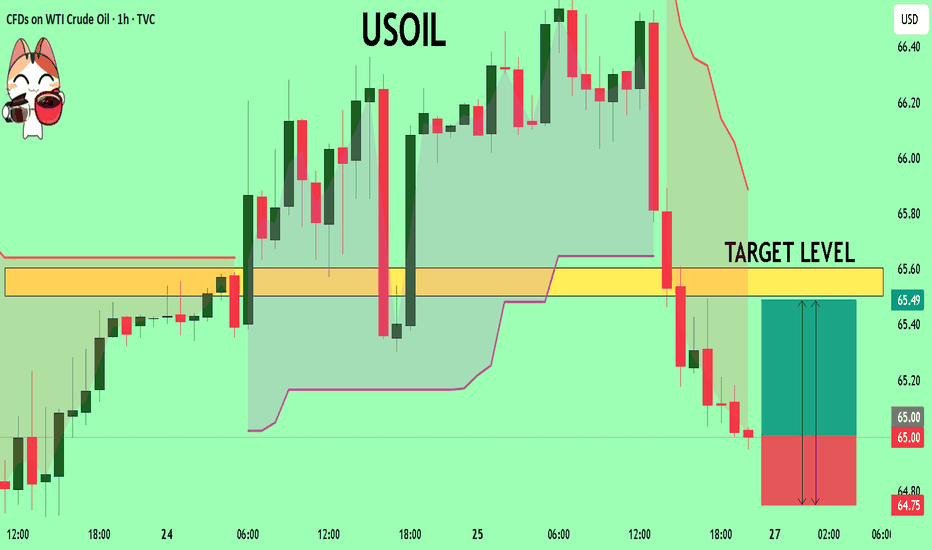

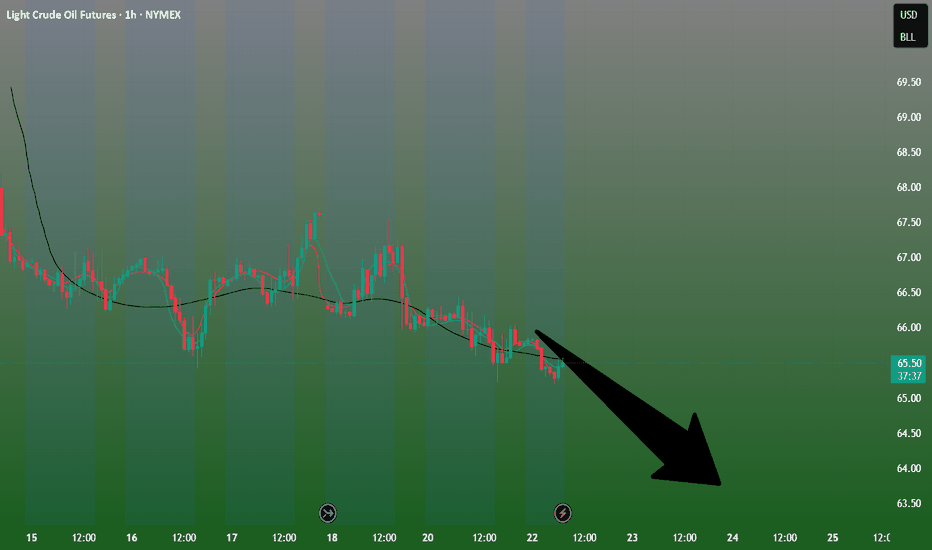

USOIL My Opinion! BUY!

My dear friends,

Please, find my technical outlook for USOIL below:

The instrument tests an important psychological level 65.00

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 65.50

Recommended Stop Loss - 64.75

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Energy Commodities

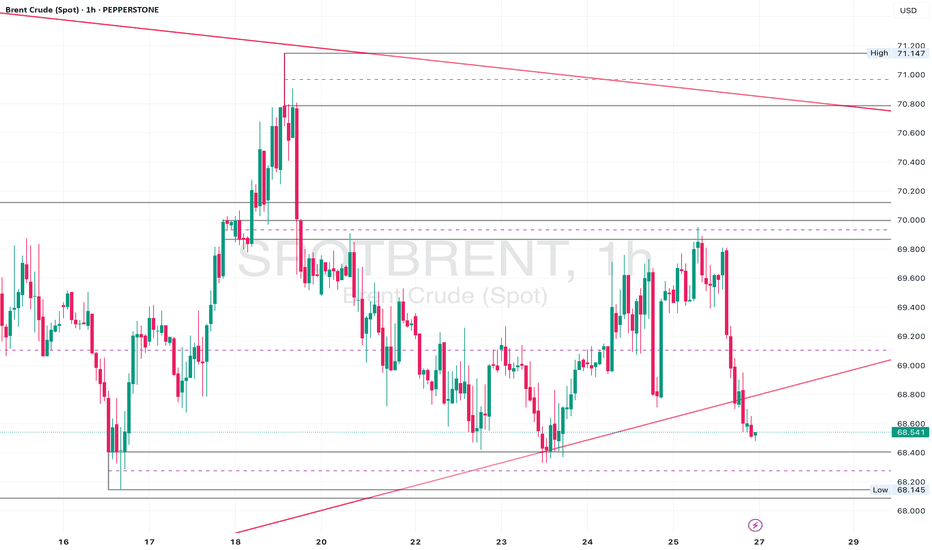

Brent Crude Sitting at Key Support – 69.20 Hold for a Rebound?Daily Analysis:

Price is holding above the ascending trendline and forming higher lows. Multiple rejections from the 68.00 region suggest strong demand. As long as we remain above the trendline, bulls stay in control.

4H Analysis:

Pullback after rejecting 71.00. Now sitting inside the 69.60–69.20 demand area. Bullish channel is still valid unless we break below 68.50.

1H Analysis:

Price broke the rising channel but is now hovering near key support. Bullish re-entry possible if lower timeframe aligns around 69.60.

Confirmation & Entry:

If we see bullish engulfing or pin bar at 69.60–69.20, this could signal a long setup back to 71.00. Invalidated on clean break below 68.50.

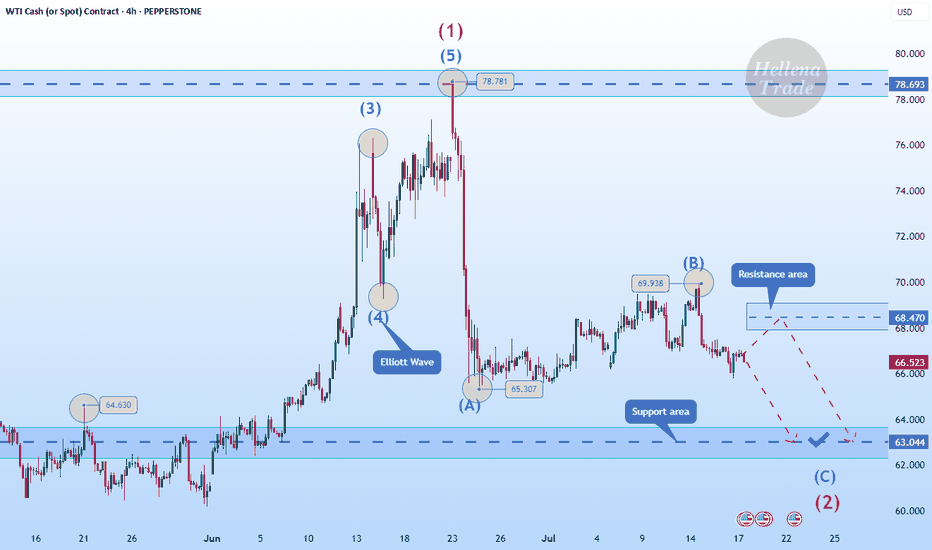

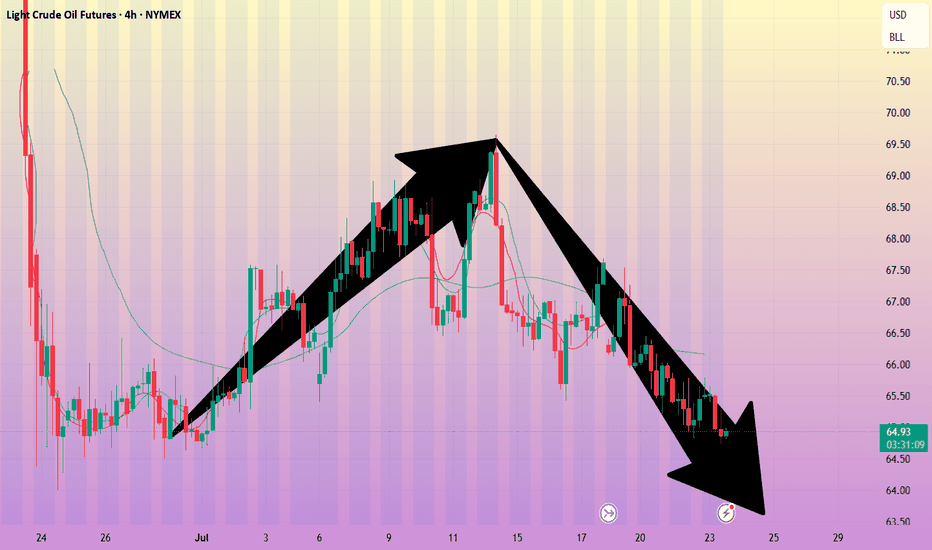

Hellena | Oil (4H): SHORT to support area of 63.000.Colleagues, I believe that wave “B” has formed at the level of 69.938, and now we expect the downward movement to continue with the aim of completing wave ‘C’ of the middle order and wave “2” of the higher order in the support area of 63,000.

It is quite possible that the price could reach the 60,000 level, but I think that for now it is worth focusing on the nearest targets.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

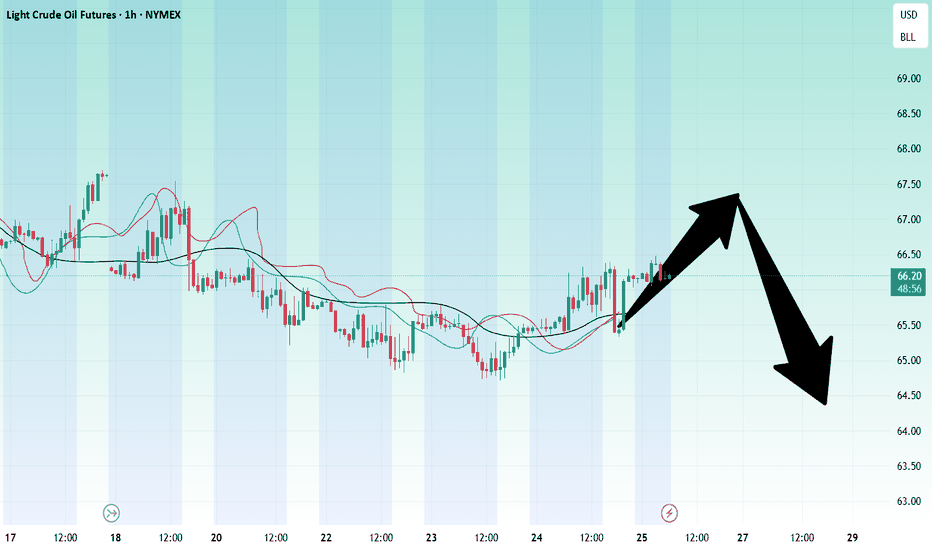

Crude oil market analysis: Crude oil has not moved much, but it Crude oil market analysis:

Crude oil has not moved much, but it is a good short-term operation opportunity. Sell small when it rebounds, sell big when it rebounds. Crude oil will basically not trap you. It is difficult to end the selling in the short term. It will basically decline in the future. You can sell when it rebounds near 67.00 today. If it breaks 64.00, it will directly dive. The daily line of crude oil has formed a shock pattern. You can sell at the break position of 64.00.

Operation suggestions:

Crude oil---sell near 67.00, target 65.00-63.00

Crude oil trading reminder: triple positive support

💡Message Strategy

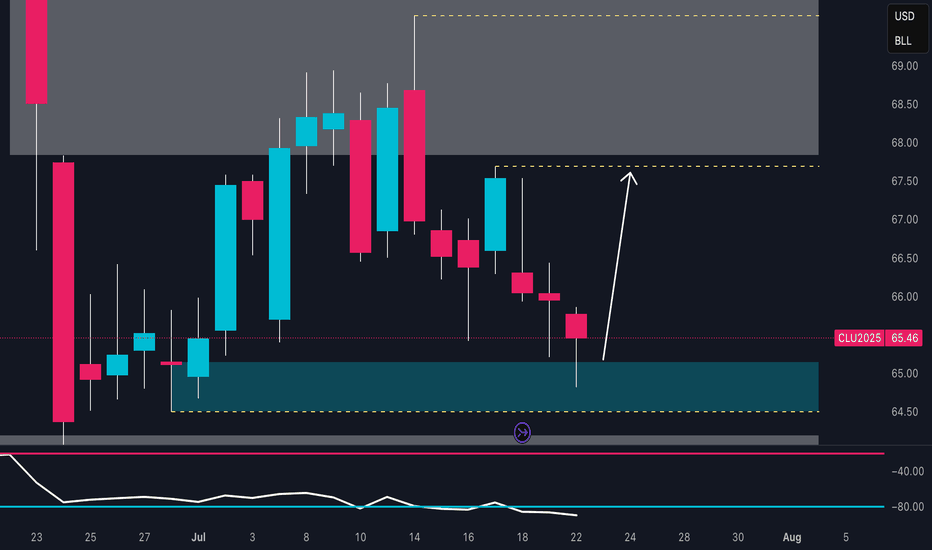

After three consecutive days of sluggishness, both U.S. and Brent crude oil remained above the 100-day moving average on Thursday (July 24). U.S. crude oil is currently up 0.4%, trading around 65.46; Brent crude oil is currently up 0.1%, trading around US$68.67 per barrel. The three engines of trade negotiations, unexpected decline in inventories, and geopolitical games are ignited at the same time. Oil prices showed signs of stabilizing, allowing bulls to "smell" the long-awaited rebound opportunity.

1. The trade war breaks the ice: the US, Japan and Europe have reached a series of agreements to ignite market hopes.

2. Inventories plummeted by 3.2 million barrels! The balance of supply and demand suddenly tilted.

3. Geopolitical black swan: The war between Russia and Ukraine burns the energy supply chain

📊Technical aspects

The short-term (4H) trend of crude oil fluctuated upward slightly. The moving average system gradually formed a bullish arrangement, and the short-term objective trend direction was upward. In terms of momentum, the MACD indicator opened upward above the zero axis, and the bullish momentum was sufficient.

In terms of form, the oil price broke through the neckline, and the head and shoulders bottom reversal pattern was established. It is expected that after the intraday crude oil trend retests the neckline position, the probability of forming another upward rhythm is high.

💰Strategy Package

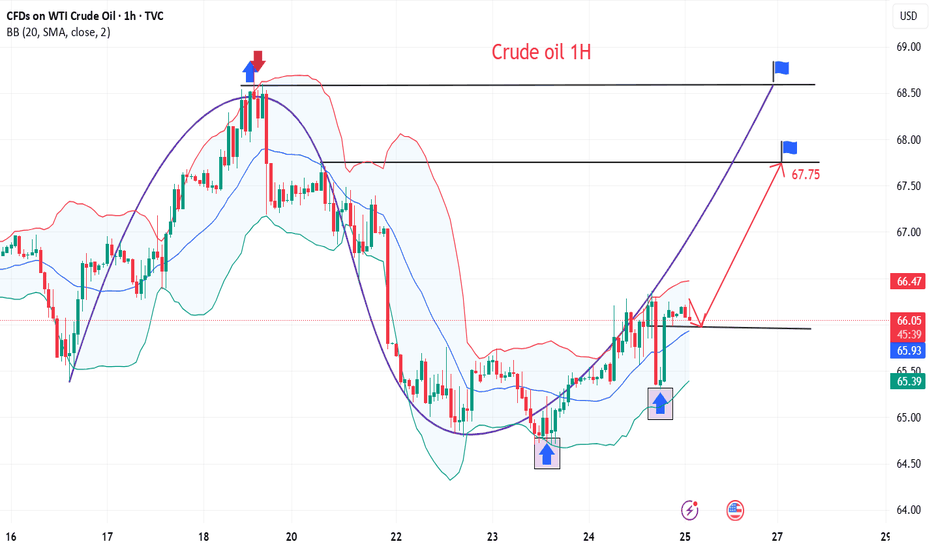

Long Position:65.50-66.50,SL:64.00,Target:67.75-68.00

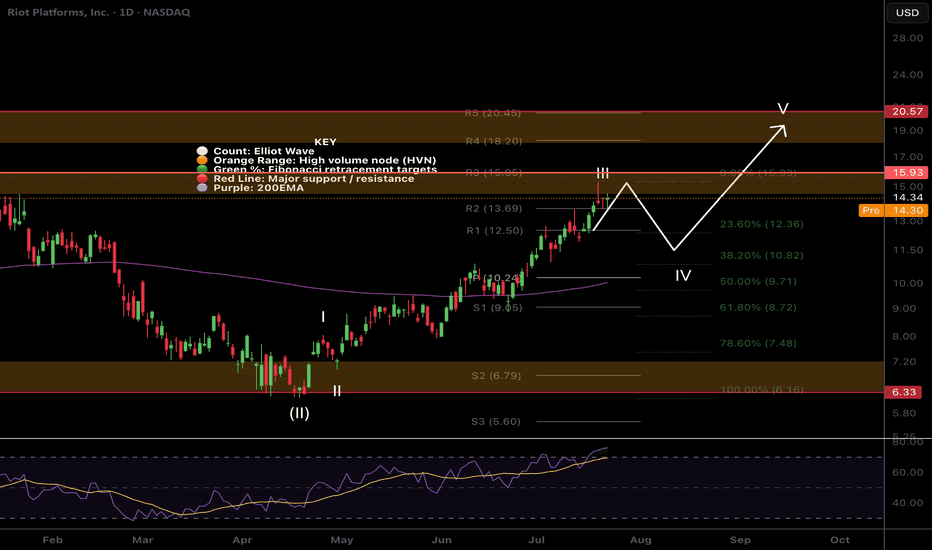

$RIOT Targets hitNASDAQ:RIOT has hit my take profit target at the High Volume Node and R3 daily pivot where it has found resistance.

Wave III appears to be complete with wave IV expected targets being the 0.382-0.5 Fibonacci retracement, also the daily pivot point and ascending daily 200EMA, $10.24.

Analysis is invalidated if we continue to the upside with a new swing high. RSI is overbought no bearish divergence.

Safe trading

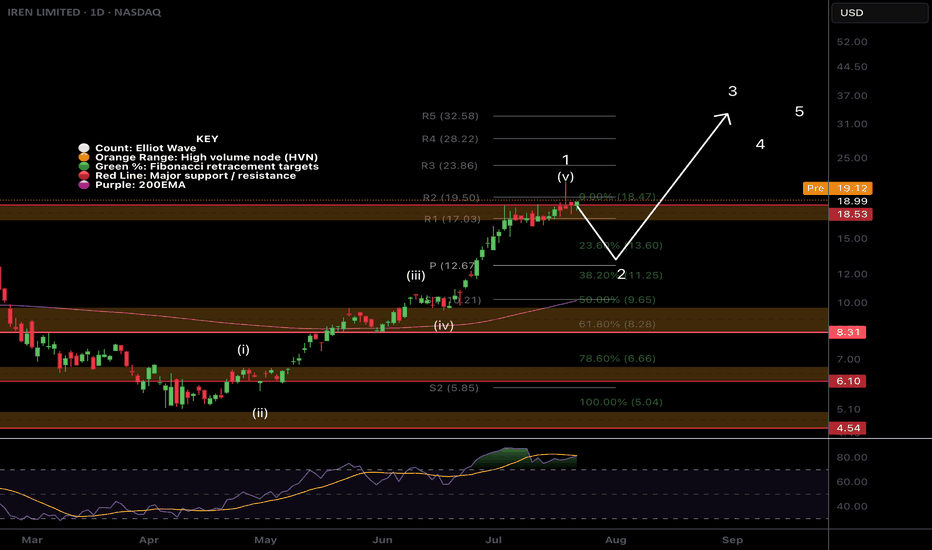

$IREN More downside after huge rally!NASDAQ:IREN is printing bearish divergence on the daily RSI at all tie high resistance.

An Elliot wave motif wave appears complete and wave looks underway with a shallow target of the daily pivot, 0.382 Fibonacci retracement and ascending daily 200EMA.

The daily red wick after printing a 20% start to the day is reminiscent of a blow off top in this asset trapping newbs with FOMO price discovery pump. Market behaviour in action!

Analysis is invalidated if price returns to all time high.

Safe trading

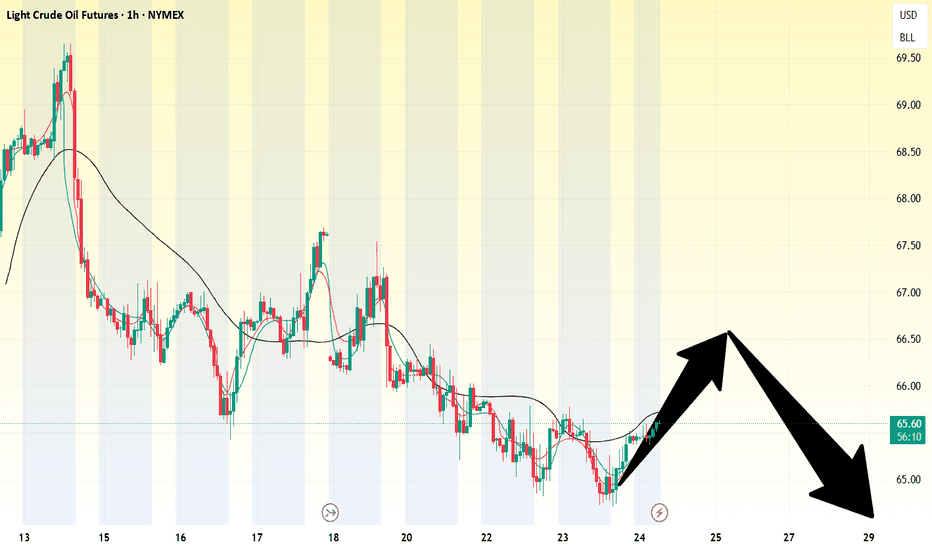

Crude oil ----- Sell near 67.50, target 65.00-63.00Crude oil market analysis:

Crude oil has been falling recently, but the decline is not large, and the rebound will not be large. Consider selling crude oil if it rebounds slightly. The crude oil idea is bearish. It is difficult for crude oil to rise sharply without fundamentals, but we insist on taking losses in operation. If there is no loss, a piece of news will make it take off directly. Crude oil focuses on 64.00 support, and suppresses 67.50 and 69.50. Consider selling opportunities when the Asian session rebounds to 67.50.

Fundamental analysis:

Tariffs have not affected the market recently, and no major news has been announced. The market is relatively calm.

Operational suggestions:

Crude oil ----- Sell near 67.50, target 65.00-63.00

Crude oil-----sell near 66.00, target 65.00-63.00Crude oil market analysis:

The recent daily crude oil line has been fluctuating slightly. It is still bearish to sell at a high price. Crude oil is unlikely to rebound or rise sharply without fundamental support. The hourly crude oil suppression position is 66.40 and 67.50. Today we are close to 66.00 to consider selling opportunities. The daily moving average of crude oil is starting to go down. If 64.00 is broken, it will start to fall sharply.

Operational suggestions

Crude oil-----sell near 66.00, target 65.00-63.00

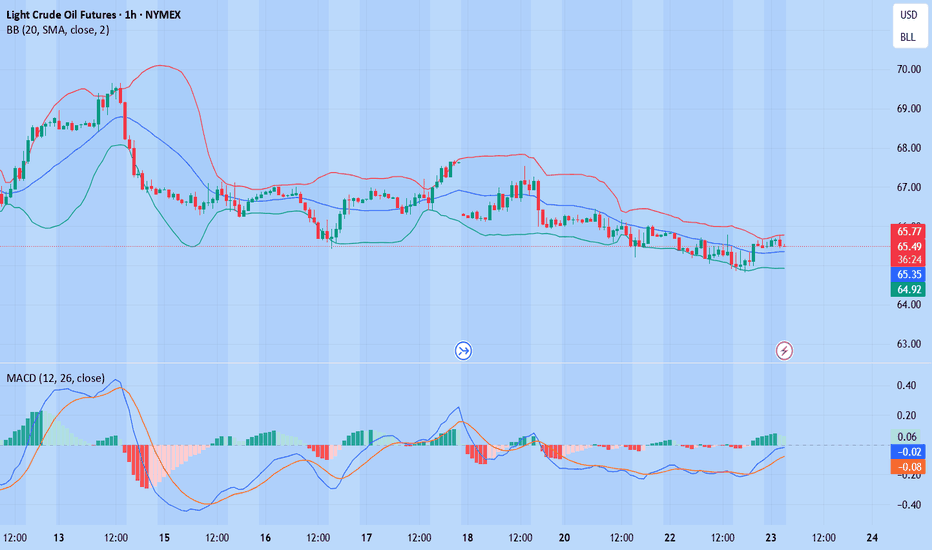

WTI(20250723)Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

Technical analysis:

Today's buying and selling boundaries:

65.22

Support and resistance levels:

66.22

65.85

65.61

64.84

64.60

64.22

Trading strategy:

If the price breaks through 65.61, consider buying, the first target price is 65.85

If the price breaks through 65.22, consider selling, the first target price is 64.84

XNGUSD Technical Update – What the Chart Is Telling Us NowIn this video, I break down the current XNGUSD (Natural Gas) chart using pure price action analysis on the daily timeframe.

This update builds on my previous post, where I shared a comprehensive outlook supported by fundamentals, including supply/demand imbalances, geopolitical risks, and long-term LNG export growth.

In this video, I focus purely on the technical picture—highlighting key levels, market structure, recent consolidation, and where I see potential opportunities unfolding next.

📈 If you're trading or investing in Natural Gas, this is a must-watch update to stay in tune with the current market dynamics.

Remember: This is not financial advice. Always do your own research and manage risk appropriately.

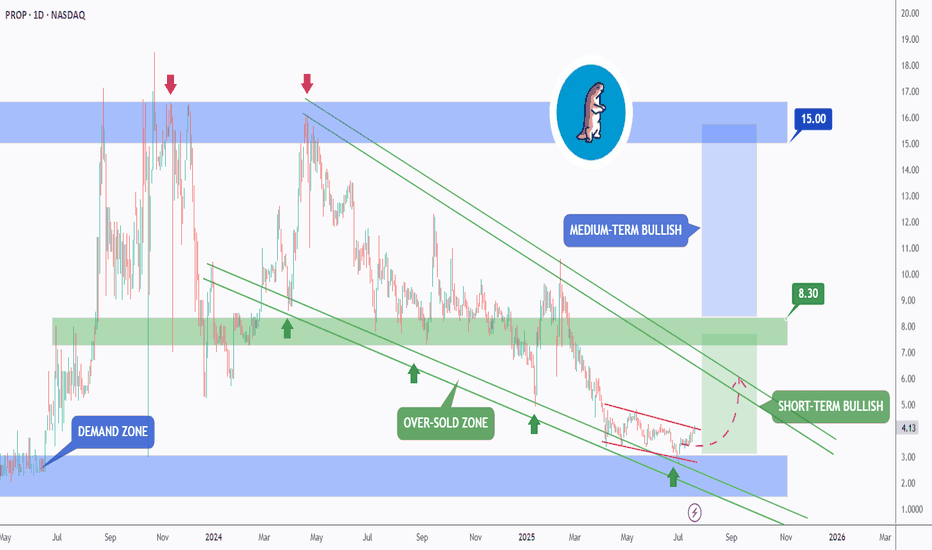

A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scale in time. That leaves oil and gas as the most reliable players; and one U.S. company may be perfectly positioned to ride that wave.

📊 Technical Analysis

NASDAQ:PROP PROP has been in a steady downtrend, moving within a falling wedge pattern (marked in green). Right now, it’s retesting the bottom of that wedge, typically where things get oversold.

Even more interesting, PROP bounced off a major monthly demand zone last week, a signal that buyers may be stepping in.

In the short term, if the blue demand zone holds, we could see a push toward the $7 mark, which lines up with the top of the wedge.

But to really confirm a medium-term reversal, we’ll need a clean break above the $8.3 resistance. If that happens, the door could open to a rally toward $15, a key level from early 2024.

🛢️ Why PROP? A Hidden Play With Room to Run

Prairie Operating Co. (NASDAQ: PROP) isn’t your typical small-cap oil stock. They own 65,000 acres in Colorado’s DJ Basin and use modern drilling tech to stay lean and efficient. That means they can still make money even when oil prices dip.

As energy demand continues to climb, PROP could be sitting in the sweet spot , especially with the world so focused on tech stocks. But behind every AI boom is a growing energy need, and companies like PROP are the ones powering it.

One well-known Wall Street firm recently gave PROP a Buy rating with a $21.75 price target; that’s a potential 281% upside from where it stands today. And that’s not even counting the potential boost from energy-friendly policies under the current administration.

📌 One to Watch in 2025

PROP might just be one of the most under-the-radar energy plays going into the new year.

The biggest moves often start quietly; and this one has all the ingredients to surprise.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

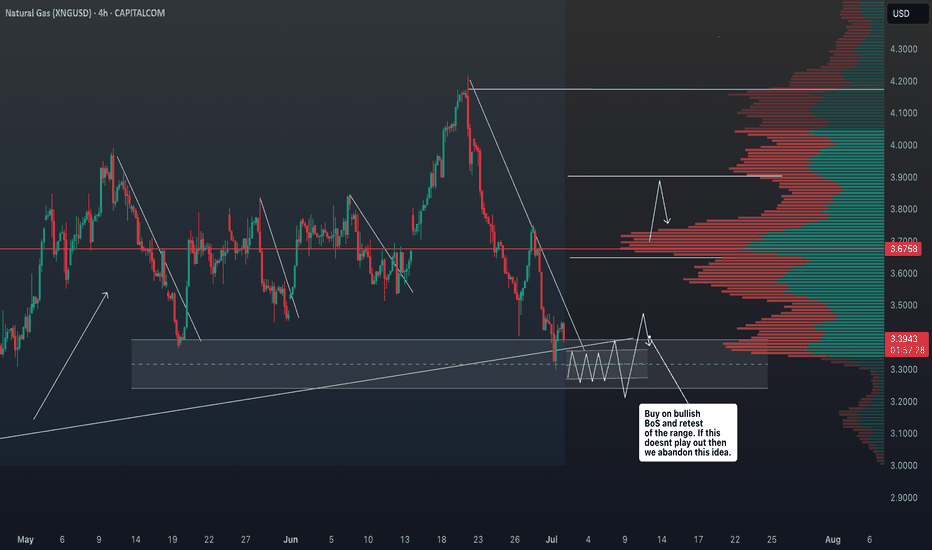

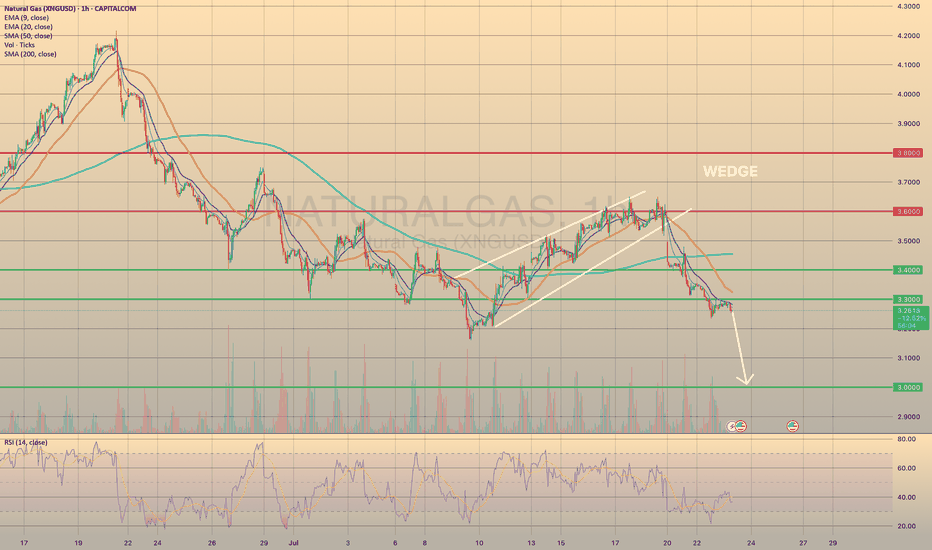

XNGUSD PULLED BACK FROM 3.3000 RESISTANCE LEVEL. WHERE TO GO NEXXNGUSD PULLED BACK FROM 3.3000 RESISTANCE LEVEL. WHERE TO GO NEXT?

This Monday natural gas prices have successfully broken down bearish wedge formation. As we may observe, the price went down through all major support levels, establishing a new short-term bearish trend. Recently the price broke through the 3.3000 and successfully retested it. It is crucial, due to this level is the last mid-term major support before the 3.000.

Additionally, the weather in the vast area U.S. is supposed to be milder at the end of July - beginning of August, which would curb nat-gas demand from electricity providers for air conditioning usage. To sum up, the decline towards 3.000 level is expected.

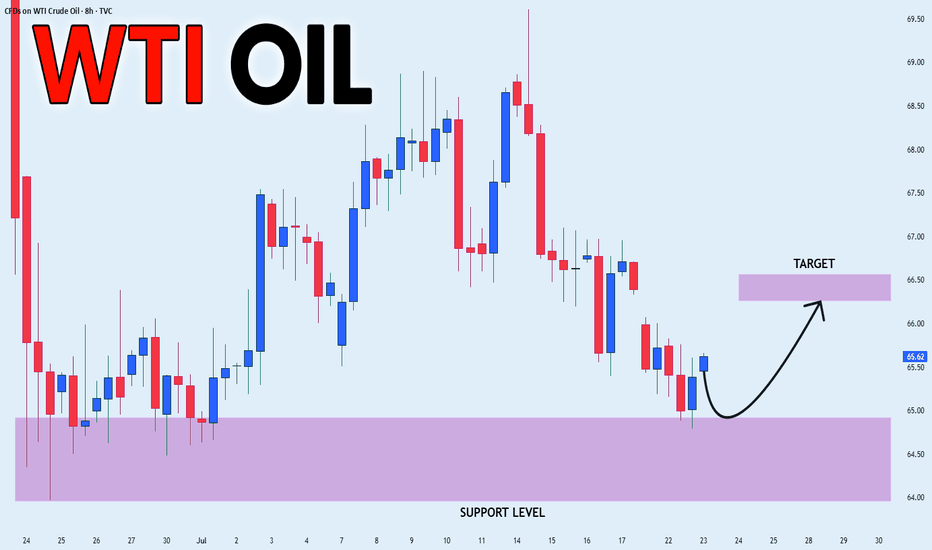

USOIL POTENTIAL LONG|

✅CRUDE OIL has retested a key support level of 65.00$

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 66.27$ is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

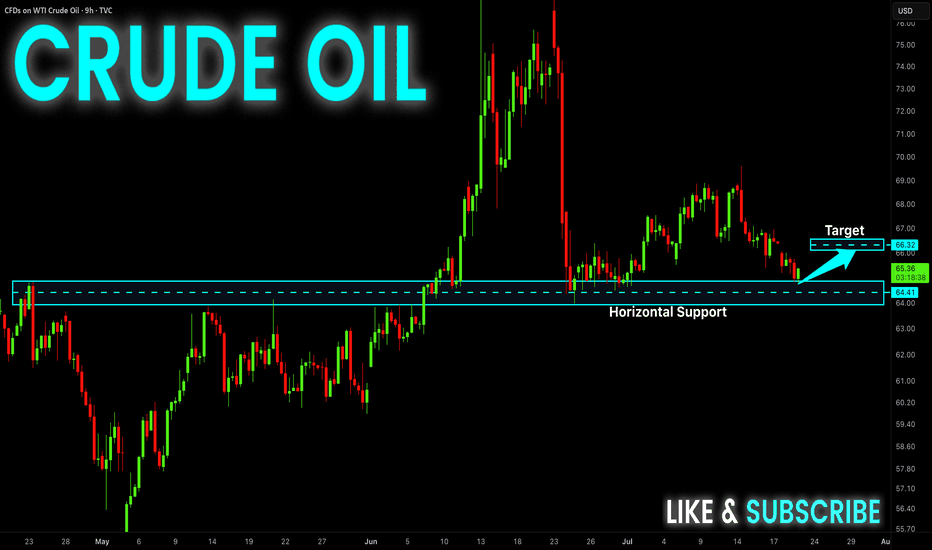

Crude Oil Rebound Incoming? Key Demand Zone 📈 1. Technical Analysis – Daily Chart (CL1!)

The price has returned to a demand zone between 64.60 and 65.30, an area that previously triggered strong bullish reactions.

The July 22nd candle shows a clear lower wick, indicating potential buyer absorption and a possible short-term reversal.

The next key resistance lies between 67.80 and 68.80, which aligns with a well-defined supply zone.

Daily RSI remains weak but shows signs of bullish divergence, suggesting potential accumulation.

Bias: bullish from current levels, targeting 67.50 – 68.00. Invalidation on a daily close below 64.40.

2. Institutional Sentiment – COT Report (CFTC, July 15, 2025)

Non-Commercials (Speculators)

Long: 308,915 (↓ -24,223)

Short: 146,488 (↑ +22,724)

Net Position: sharply declining → bearish divergence in speculative sentiment

Commercials (Hedgers)

Long: 857,803 (↑ +66,342)

Short: 1,046,199 (↑ +18,118)

Net Position: still negative, but improving → reduced hedging = less downside pressure

📉 Interpretation:

Funds are closing longs and adding shorts, showing bearish positioning. However, commercials are slowly reducing their hedging exposure, which could indicate short-term stabilization if the technical support holds.

3. Seasonality

Periods analyzed: 20, 15, 10, 5, and 2 years

July historically shows negative average returns:

-0.71% (20Y)

-1.26% (15Y)

-1.37% (10Y)

The seasonal pattern indicates continued cyclical weakness into August.

📌 Interpretation:

The summer period typically brings seasonal bearish pressure, which aligns with current 2025 performance.

🌐 4. Macro & Fundamentals

EIA inventory builds for 3 consecutive weeks → demand weakness in the U.S.

No additional OPEC+ cuts announced → supply remains ample

Stable inflation data in the U.S. and China → no uptick in energy demand

Overall macro data is neutral with a slightly bearish short-term bias

USOIL Long From Support! Buy!

Hello,Traders!

USOIL made a retest of

The horizontal support

Level of 64.86$ from where

We are already seeing a bullish

Reaction so we will be expecting

A further local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

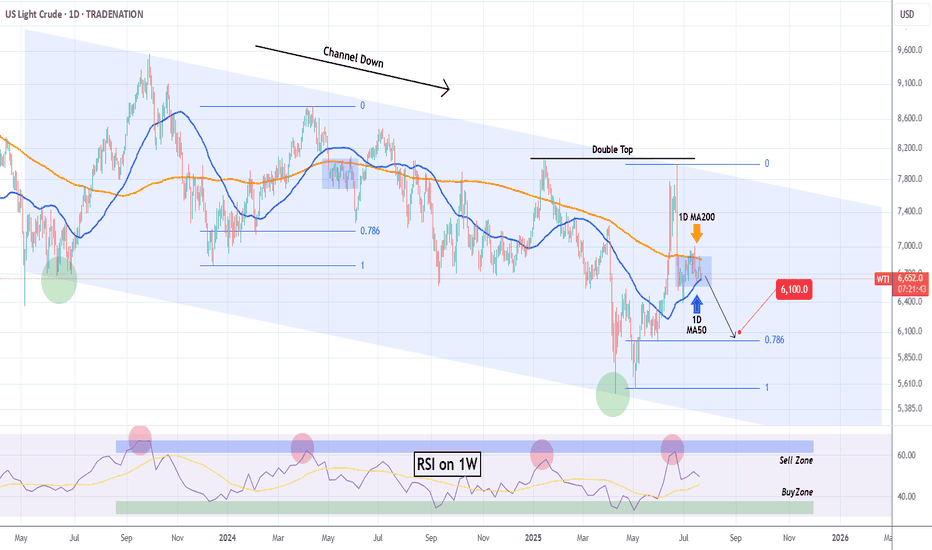

WTI OIL Extreme 1D MA50-200 squeeze to deliver break-out!WTI Oil (USOIL) has been consolidating for almost the past 30 days within the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line). The squeeze is now so tight that the trend will be revealed soon with a break-out.

Based on the 2-year Channel Down, that should be bearish, resembling the May 2024 consolidation that broke downwards and almost hit the 0.786 Fibonacci retracement level. Notice also the similar Sell Zone rejection on the 1W RSI.

As a result, we expect WTI to decline and target $61.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

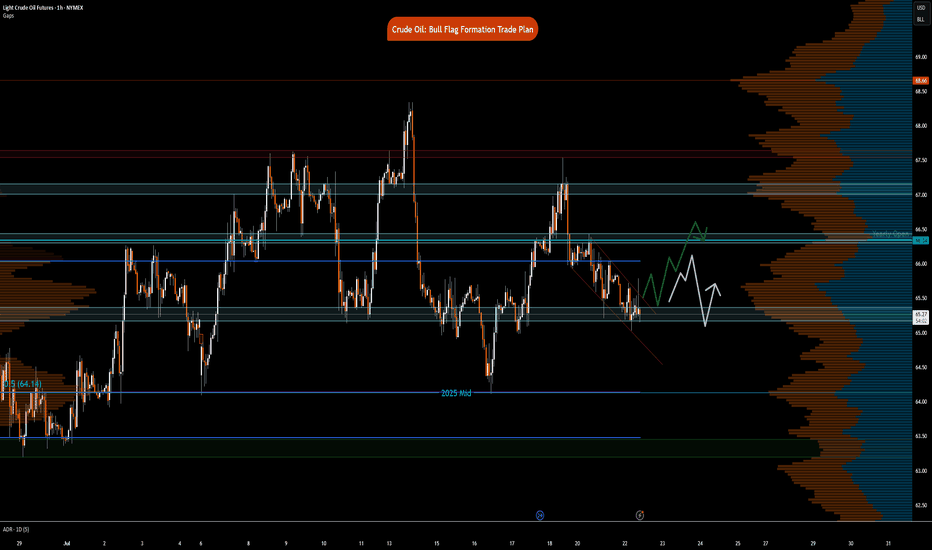

Crude Oil- Bull Flag formation Trade PlanNYMEX:CL1! NYMEX:MCL1!

Big Picture:

Let the price action and market auction be your guide

What has the market done?

The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance.

What is it trying to do?

The market is accepting prices in this range and building value. It has been in price discovery mode with a multi-distribution profile since June 24th.

How good of a job is it doing?

The market is currently forming a bull flag formation and attempting to push higher on the hourly time-frame.

What is more likely to happen from here?

Key Levels:

Neutral Zone 1: 67.16-67

Neutral Zone 2 : 66.45-66.30

Yearly Open: 66.34

Neutral zone 3 : 65.23-65.03

2025- Mid Range : 64.14

Scenario 1: False break, pull back and push higher

In this scenario, we expect prices to attempt to break bull flag formation, fail, however, neutral zone 3, acts as support for buyers to step back in to push prices towards yearly open and neutral zone 2.

Scenario 2: Break but fail to sustain push higher

In this scenario, we expect prices to break out of bull flag formation, however, fail around the 66 zone. Price reverts lower towards neutral zone 3 to further consolidate.

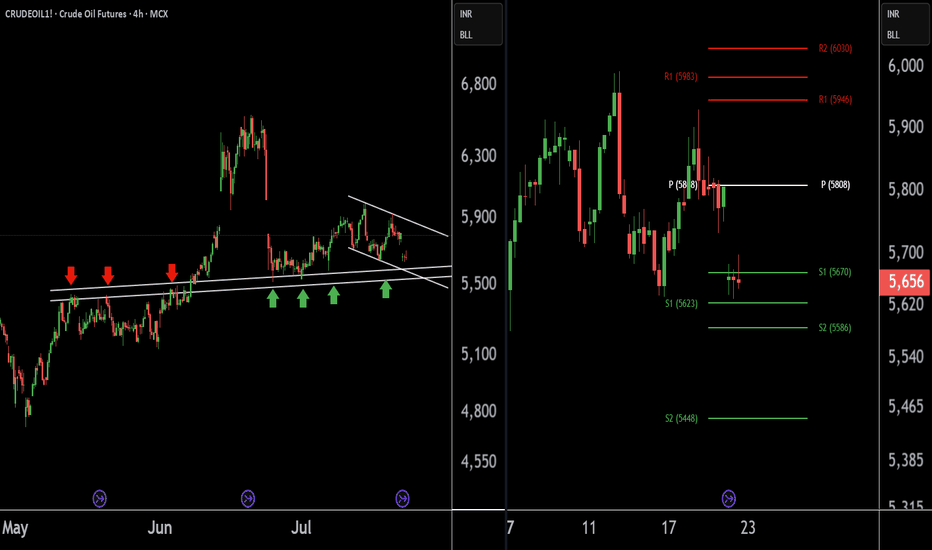

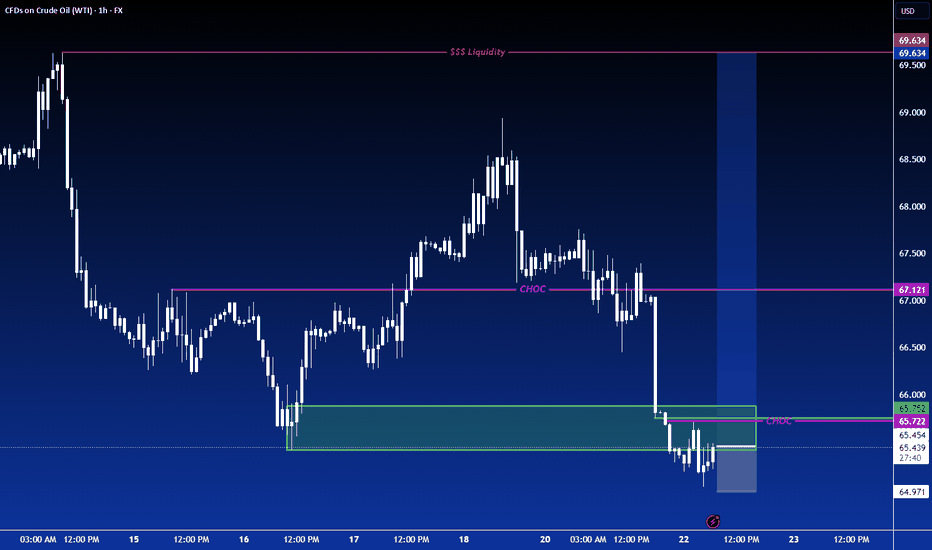

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

Crude oil-----sell near 67.50, target 65.00-63.00Crude oil market analysis:

Crude oil has started a new contract. The new contract is still not moving much at present, and the contract spread is not much. The daily line has begun to decline. Today's idea is to sell at a rebound of 67.50. The suppression position is 67.50 and 69.00, and the support is around 64.00. If this position is broken, there will be a greater room for decline.

Fundamental analysis:

There is no major news in the recent fundamentals. The situation in the Middle East is still relatively stable. There is no new rest on tariffs, and the impact on the market is limited.

Operational suggestions:

Crude oil-----sell near 67.50, target 65.00-63.00

LONG ON USOIL OIL has just completed a sweep of sell side liquidity, leaving behind lots of BUY side liquidity.

DXY is falling on top of economic news stating trump will possibly fire Jerome Powell.

All this with OPEC increase oil production.

I expect oil to make a $5-$10 move throughout the rest of the week.

That's 500-1000 pips!

Natural Gas Price Drops by 7%Natural Gas Price Drops by 7%

As the XNG/USD chart shows today, natural gas is trading around $3.333/MMBtu, although yesterday morning the price was approximately 7% higher.

According to Reuters, the decline in gas prices is driven by:

→ Record-high production levels. LSEG reported that average gas output in the Lower 48 rose to 107.2 billion cubic feet per day so far in July, surpassing the previous monthly record of 106.4 billion cubic feet per day set in June.

→ Favourable weather forecasts. Although the peak of summer heat is still anticipated, forecasts indicate that temperatures over the next two weeks may be lower than previously expected.

As a result, today’s XNG/USD chart appears bearish.

Technical Analysis of the XNG/USD Chart

The chart indicates that since mid-May, natural gas prices have been fluctuating within a descending channel (marked in red), with July’s peak (E) highlighting the upper boundary of the pattern.

A key resistance area is now represented by a bearish gap, formed between:

→ the former support level at $3.525;

→ the $3.470 level – which, as the arrow suggests, is already showing signs of acting as resistance.

Under these conditions, it is reasonable to assume that the price may continue forming a downward market structure A-B-C-D-E, consisting of lower highs and lows, potentially moving towards the channel’s median – which approximately corresponds to July’s low (around the $3.200 level).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

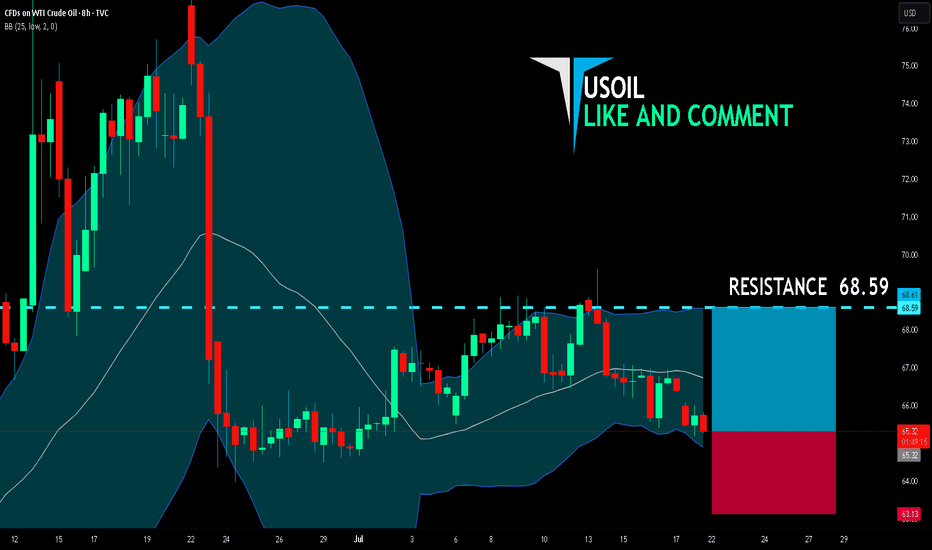

USOIL BULLS ARE STRONG HERE|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 65.32

Target Level: 68.59

Stop Loss: 63.13

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅