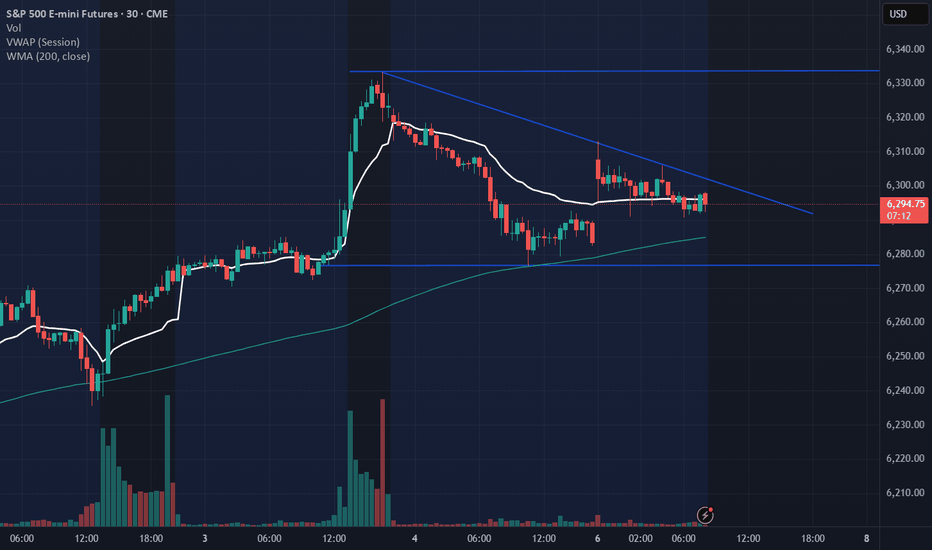

ES1! S&P500 Might Lose Momentum As Tariffs Deal Not Set...price could probably be testing all time highs. Before plunging....

if the volumes comes with it and reaches the all times high levels, that could be a nice short entry point for potential profits.

Otherwise, it could probably just fill the gap on week open and keep going down in a regular pattern until August as Trumps Tariffs Deals deadline is around that time possiblily...

Entrpreneur

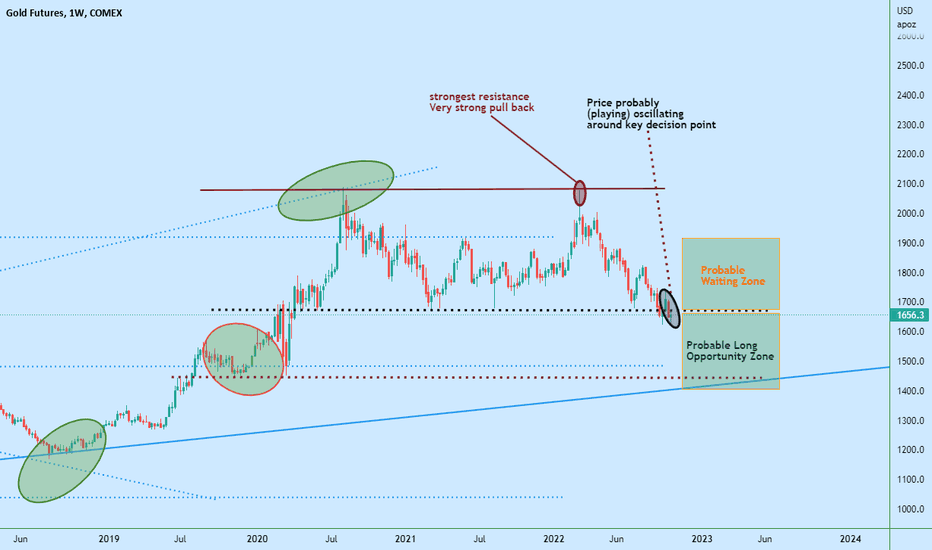

KEY POINT - PROBABLE OPPORTUNITY ZONE IDENTIFIED - GC - WEEKLYKEY POINT - PROBABLE OPPORTUNITY ZONE IDENTIFIED - GC - WEEKLY

From previous analysis which is still relevant, we are extending the analysis idea to this new configuration.

After having waiting so long for this point to be triggered, we have now the GC Gold Future price oscillating and playing around a potential highly probable critical price point.

We have what is seems to be a confirmation of a super strong resistance on top around the $2083 level.

The bleu line slope going up is the possible bottom at the moment.

Two zone have been identified as being possibly the waiting zone if price evolves above the potential critical price point and the other zone being a possible opportunity to enter long.

The idea of this analysis is marked as a long opportunity but you might see the price drop to enter the opportunity zone before rising again.

Stay aware of strong pullback down still potentially possible on the blue upward slope line. Meaning that opportunities to enter long will even be more probable from there.