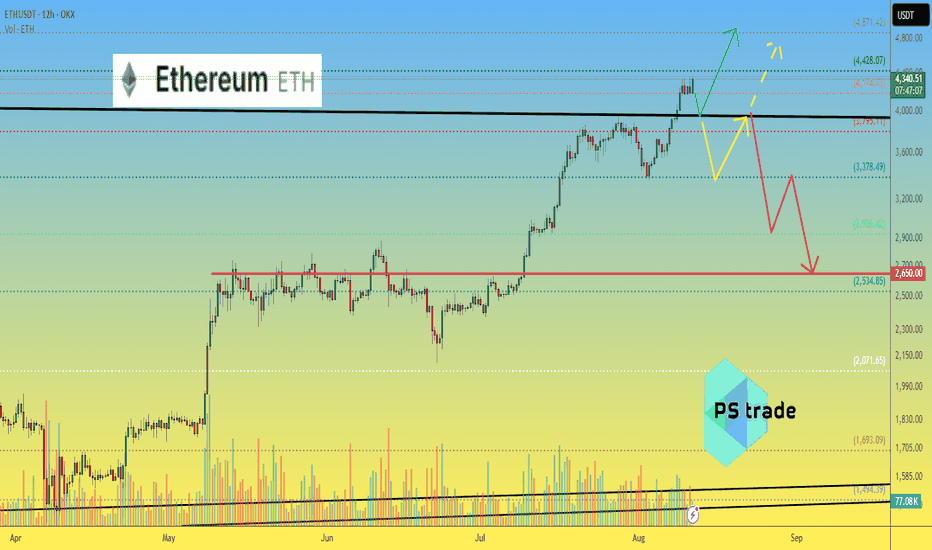

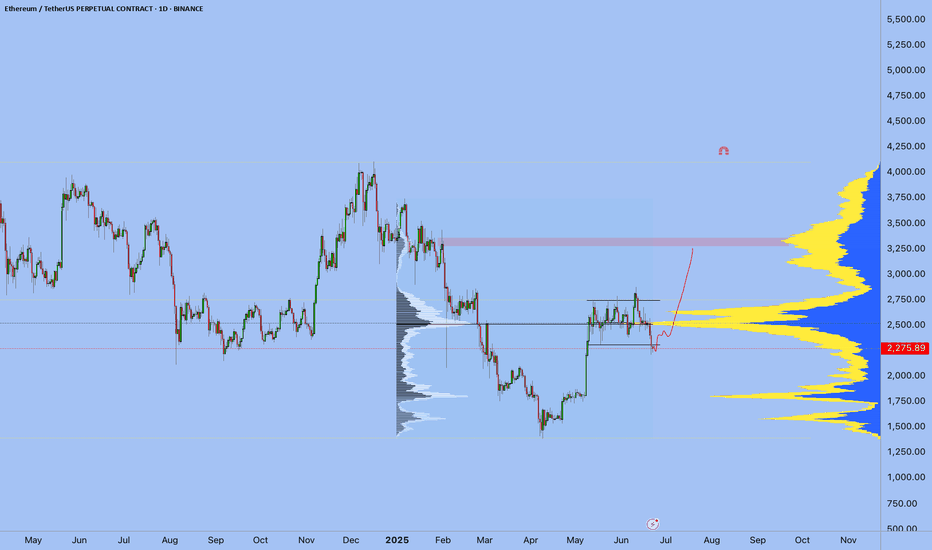

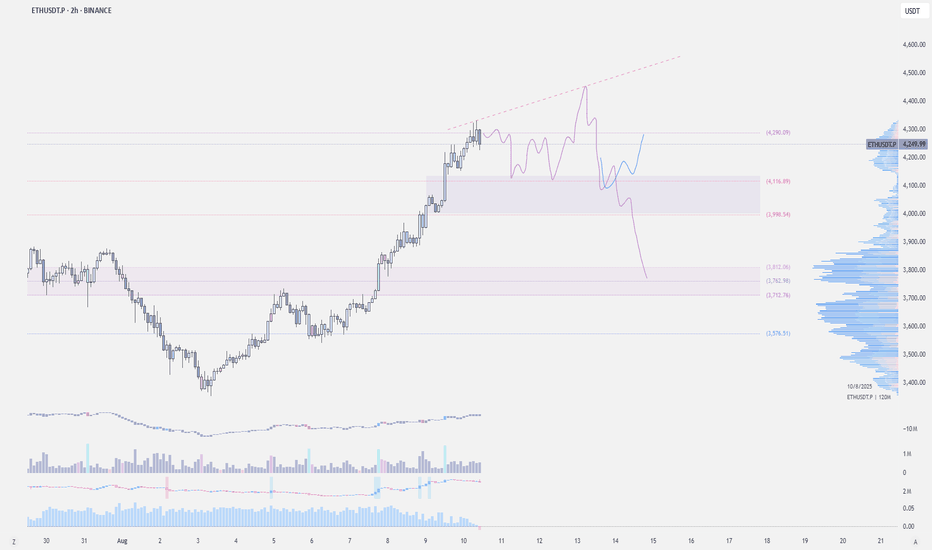

Ethereum ETH price analysis📉 Three possible scenarios for #Ethereum CRYPTOCAP:ETH :

🟢 Bullish:

Minor correction to $3950–$4000, followed by a breakout to new all-time highs (ATH).

🟡 Neutral:

Drop to $3400, bounce to $3950 — and then the decision point: breakout or breakdown?

🔴 Bearish:

Deeper correction to $2650 — possibly the last great buying opportunity before the next major rally.

👉 Which scenario for OKX:ETHUSDT resonates most with you?

Let us know in the comments!

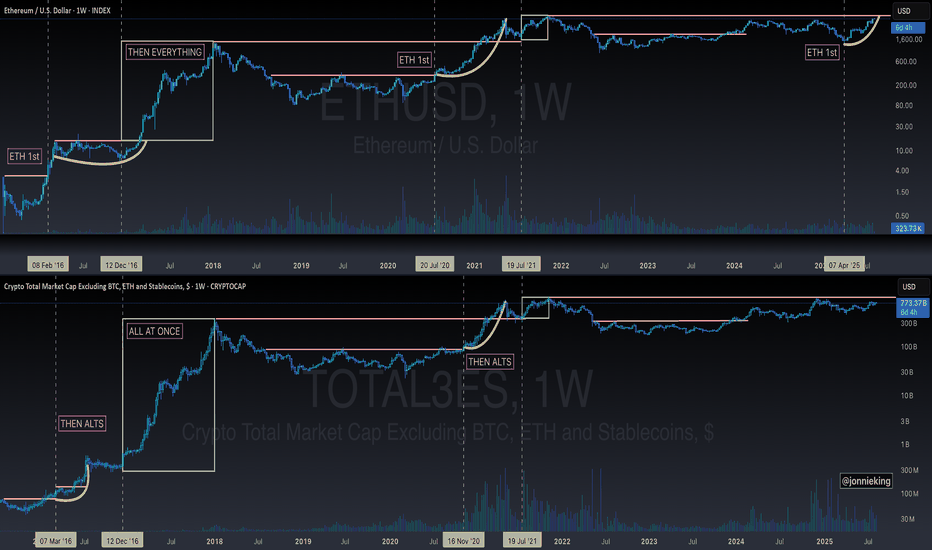

ETH-D

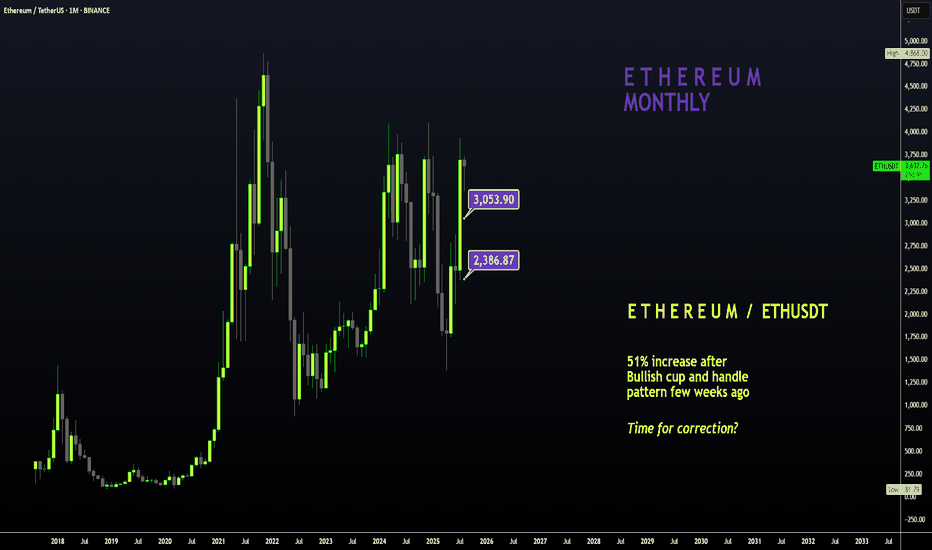

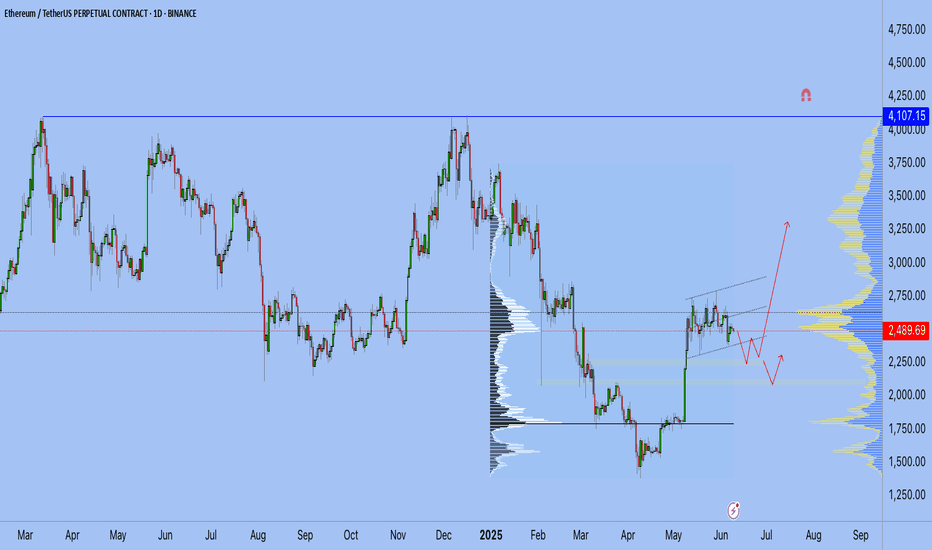

ETH | NEW ATH or DUMP ?Ethereum recently peaked at $3900. And allthough this is not a new ATH (close by a few hundred dollars), it is a local high for the year.

My last update was on an inverse Head and Shoulders pattern on ETH, which has since increased over 50%:

(The original idea here:)

The question now, is what's next for ETH - further increase, or are the increases over for the near term and is a correction more likely?

I'm going to say that the increases for ETH are over for now. This is because we correction is most definitely due after such a large increase in a fairly short timeframe. I'm not saying we're heading into a full out bearish cycle, but a 20-25% correction would be most normal at this point.

Additionally, XRP has also made it's peak and lost the high, now trading just under $3. This is a strong sign that the alts have likely already rallied, since XRP used to be the last to increase (if it increased at all, historically. (Thanks Jedd).

I was very lucky to call that top here:

Either way, buyers may use this correction to scoop up on smaller alts over the next few weeks. This ultimately depends on whether the market has ONE MORE pump, and if the correction will bounce back from a 20-25% pullback.

_________________

BINANCE:ETHUSDT

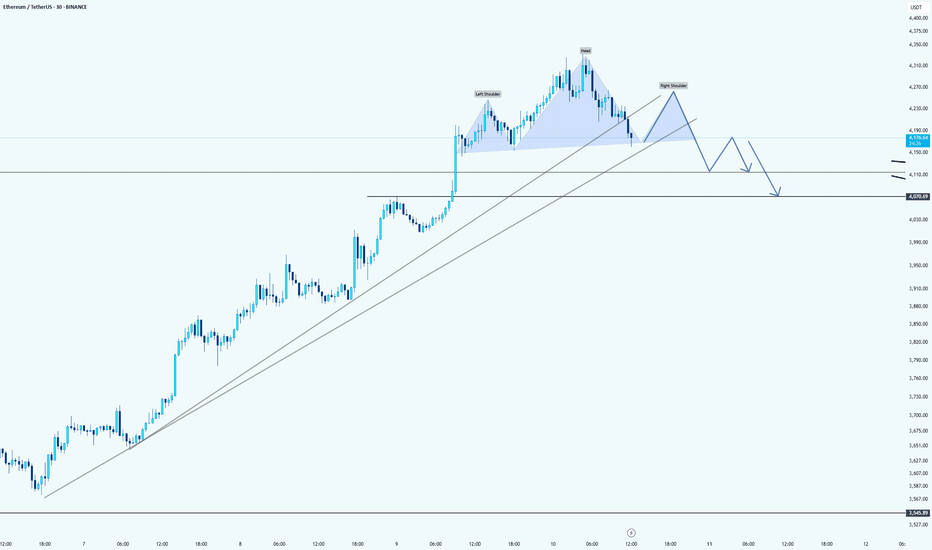

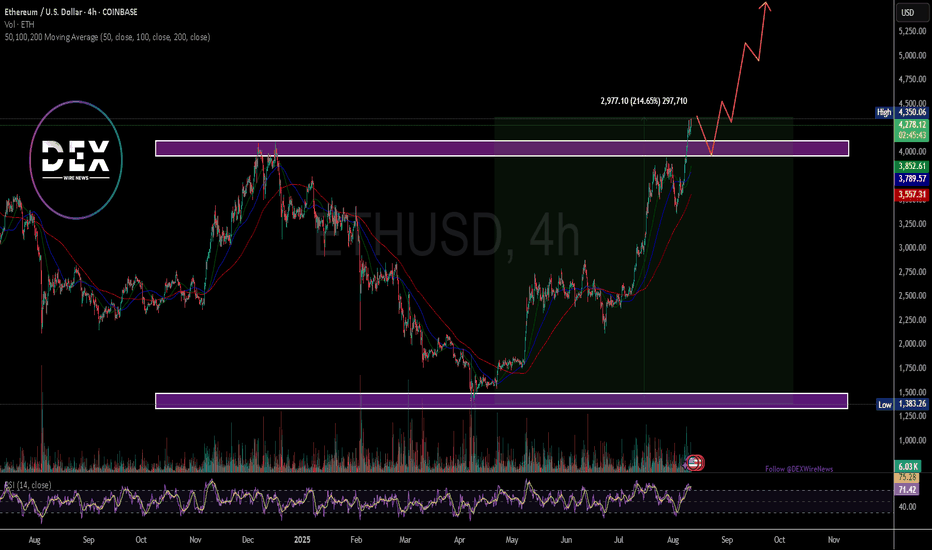

Ethereum: just a little bit correction hereHello guys!

Chart Pattern: Head and Shoulders

The chart shows a Head and Shoulders pattern forming on the Ethereum price action. The trendline drawn across the neckline of the pattern is a crucial support level to monitor.

Potential Breakdown:

If Ethereum fails to hold above the neckline (around $4,130), we might see a pullback and potentially a breakdown from the pattern. This suggests a bearish outlook for ETH in the short term.

Target:

A possible target for this bearish move could be around th e $4,050 - $4,100 range , where the price could find support from the upward trendline (in light gray). The price may retrace towards these levels before deciding whether it will continue higher or confirm further downside.

Uptrend Support:

Ethereum remains in an overall uptrend, as indicated by the sloping upward trendline beneath the price action. If the price pulls back to this trendline and holds, there could still be bullish potential.

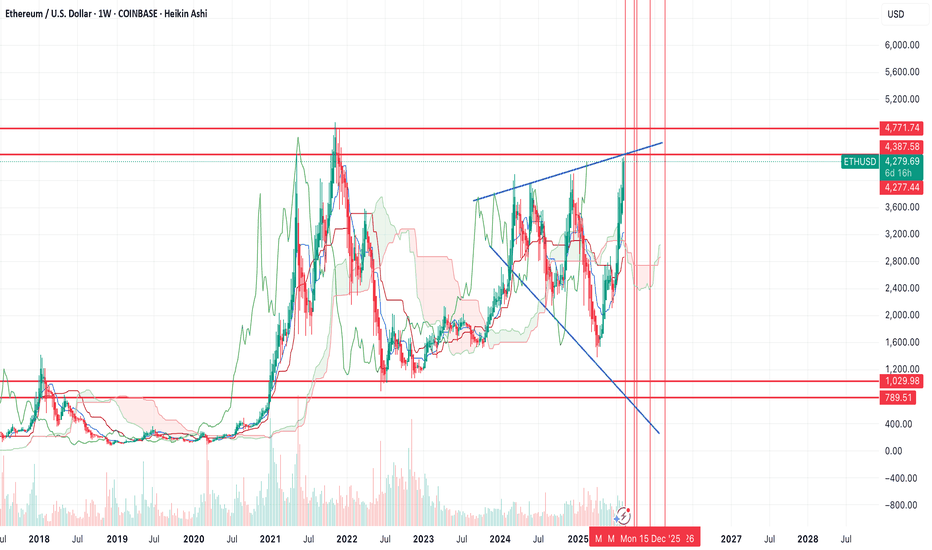

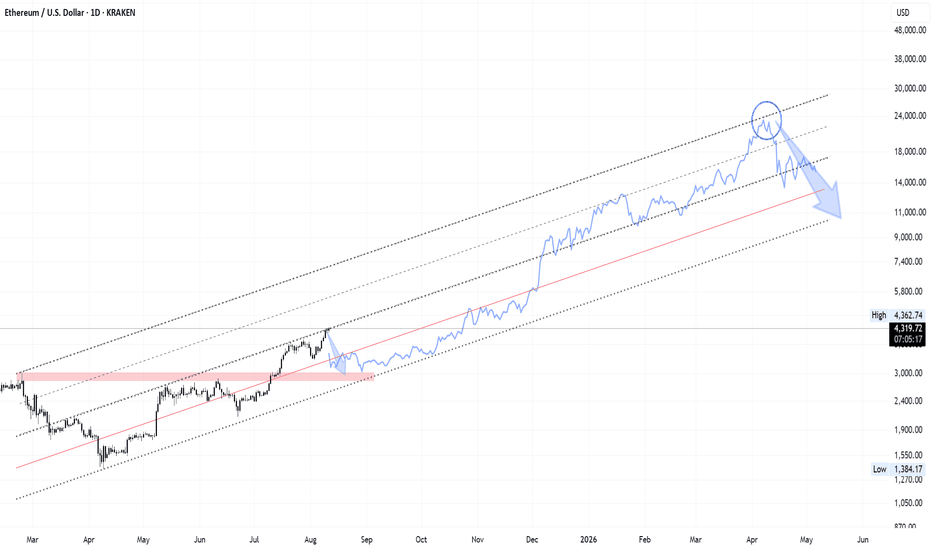

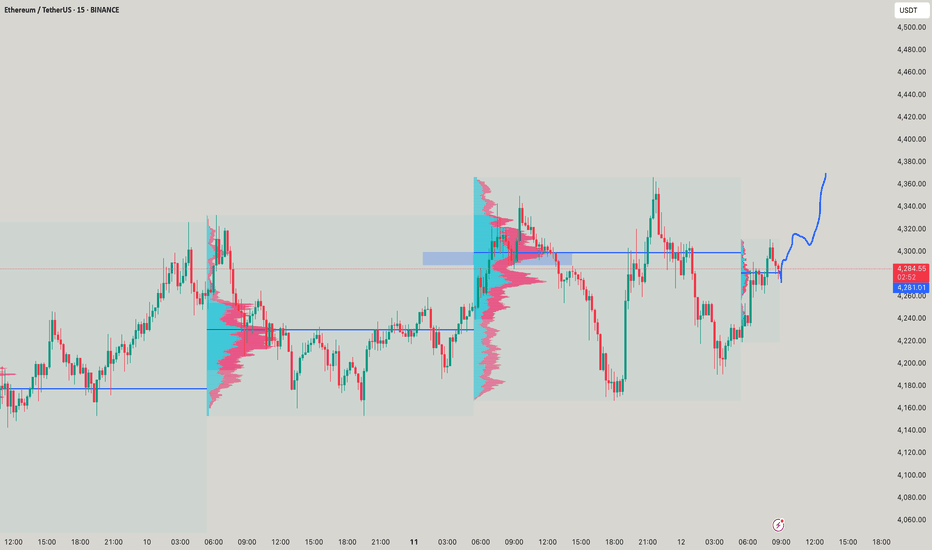

Was that it for $ETH this year?ETH just tapped the most important level to the upside $4300, and unless it can flip the $4387ish as support and continue higher, I think that's likely it for the year. Needs to take out the top resistance to be in a full bull trend.

I'm very bullish on ETH over the long term, however, in the short term the market looks extended here and I think we can see a major correction.

Will people longing here be stuck buying the highs like they were in Dec 2024 when everyone thought we were going to new highs? TBD. But I think they might be.

Here's why:

1. I think BTC has topped in the short term . If this corrects significantly, it's going to take all of crypto with it.

2. The reason why I think BTC miners haven't really run yet, is because the overall crypto market isn't bullish yet . We need to flip the $1.2T level on the chart for the entire crypto market to be in a bull trend.

3. The charts all look very similar to how they did right before the covid drop. I don't know what causes a large move down, but I can't ignore the signs.

If you're bullish here, you want to see the $4300 level get flipped as support. However, I think it's possible that we can see the lower supports get tagged before we see the resistances get taken out. Here is my long term chart of ETH (I think we go up to $18k+).

If you don't agree, all good, keep doing your thing.

Just want to provide an alternative perspective to the bullish narrative here because it seems like the entire market believes the exact same outcome is likely.

Also note: I don't plan on shorting ETH - I do not short the crypto market - I only aim to buy lower levels.

Good luck from here on out!

ETH update 9.06.2025Hello everyone, many of you asked me to publish my vision for ETH.

Here you go!

I believe that the previous impulse movement was only the first upward movement, and now we are in a sideways correction movement — call it what you will, but the fact is that the exit from this flat will be upward.

1. End of the year

2. ETH is accumulating on the Onchain

3. Liquidity overflow from BTC can be seen on the ETHBTC chart, and the overflow began at the very bottom

4. What else can large conservative players accumulate?

5. We are going after liquidity from above and should break 4100 by September

Best Regards EXCAVO

Breaking: Ethereum Is Set To Reclaim the $5k Price Pivot The price of the notable Altcoin- Ethereum ( CRYPTOCAP:ETH ) is set to reclaim the $5k resistance amidst growing interest and buying momentum.

For the past 3 months Ethereum ( CRYPTOCAP:ETH ) spiked 200+% breaking out from a cup and handle pattern amidst growing interest ikn the Ethereum chain.

Crypto Pundits on X, LinkedIn and Discord envisage the influx of memecoins on the Ethereum ( CRYPTOCAP:ETH ) chain- while most skeptics think the layer 1 blockchain is dead, Ethereum's sojourn to the $5k pivot is just days away as popular folks like Eric Trump the son of the present president of USA hints on investor's to buy Ethereum's dip.

As of the time of writing, CRYPTOCAP:ETH is up 0.58% already breaking the $4k resistance trading at $4276. With the Relative strength Index (RSI) at 71, CRYPTOCAP:ETH is on the verge of reaching overbought region. CRYPTOCAP:ETH might experience a respite before picking momentum up.

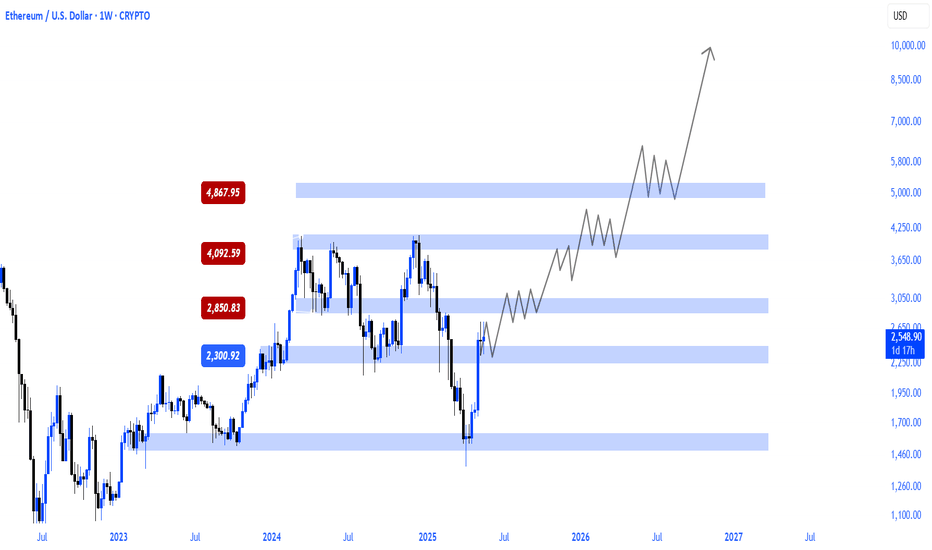

ETH ROAD TO 20K+I think we are getting closer to the final accumulation stage on ETH.

We can see a potential shape of huge channel in log scale.

After forming median of the channel I would like to see a big and fast correction near 30% from here towards 2900 support which must hold imo.

After that test of smthg around 3600 rgion and double bottom would be the best option just before few months of consolidation before breaking up and starting blow off top part.

Top of that channel depends on timing so the later the better I guess.

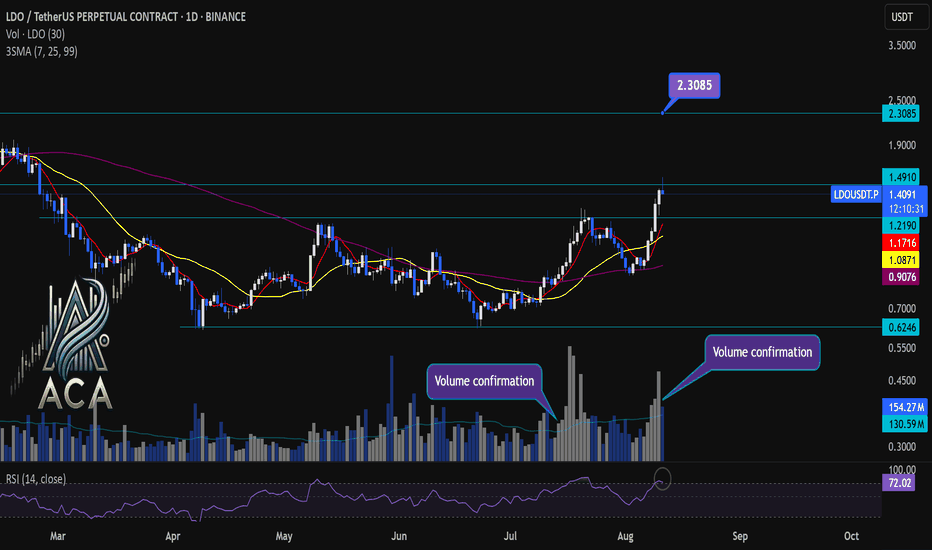

LDOUSDT Daily Chart Analysis | Strong Momentum BuildingLDOUSDT Daily Chart Analysis | Strong Momentum Building

🔍 Let’s dive into the LDO/USDT perpetual contract and analyze the latest price action, highlighting a powerful bullish setup and key technical signals on the daily chart.

⏳ Daily Overview

The daily chart reveals a strong surge in momentum as the price breaks out of its recent range, accompanied by a decisive uptick in trading volume. The 3SMA setup (short-term, mid-term, and long-term moving averages) is aligning bullishly, marking the beginning of a strong uptrend.

📊 Key Highlights:

- RSI (14) is entering the overbought zone (currently at 73.39), reflecting surging buyer demand and intensifying momentum.

- Price has broken out of the range box with elevated volume, confirming the move.

- Multiple volume confirmation spikes signal conviction behind the breakout.

- Immediate resistance is being challenged; the next key target to watch is $2.3085.

- For continued upside, we must see a daily candle close with solid volume above the current resistance level.

🚨 Conclusion:

Momentum is clearly accelerating on LDOUSDT, supported by volume and moving average bullish alignment. If price closes above resistance with strong volume, a continued rally toward the $2.3085 target is likely. Keep an eye on RSI levels and volume for further confirmations as this trend builds!

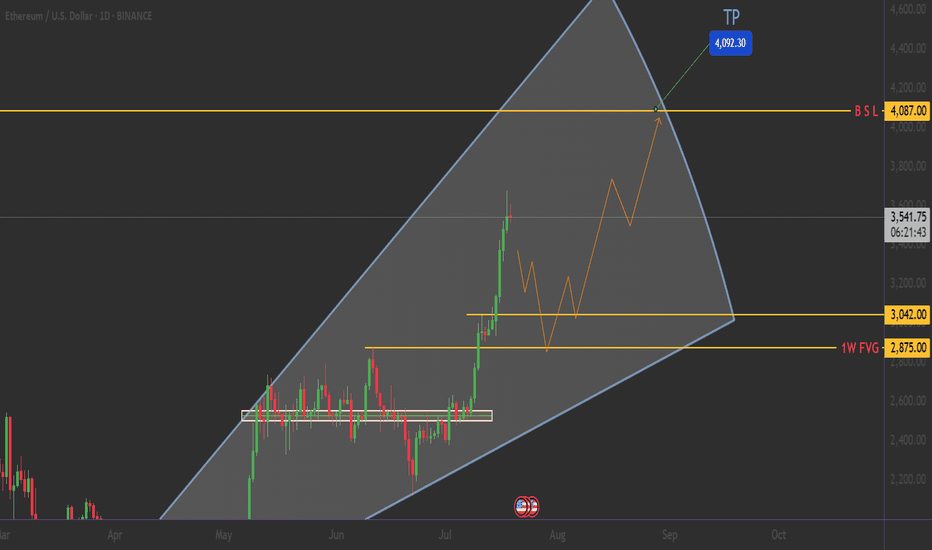

ETHEREUM: The $4,000 Triangle - Breakout or Breakdown?🎯 THE MEGA SETUP: Giant Symmetrical Triangle

🔍 What We're Looking At: 📐 Triangle Specifications:

🟢 $3,042.00 - Triangle Lower Trendline

🟢 $2,875.00 - 1W FVG (Fair Value Gap)

🔴 $4,087.00 - BSL (Buy Side Liquidity)

🔴 $4,200.00 - Psychological barrier

_______________________

🛡️ CONSERVATIVE LONG:

Entry: $2,800 - $2,850 (Triangle support bounce) 📊

Stop Loss: $2,740 (Below triangle) ❌

Targets: $3,500 → $3,800 → $4,200 🎯

! Smash that follow button for more killer setups! 🔥📊

____________ NOTE __________

⚠️ RISK MANAGEMENT

⚠️ DYOR

Remember: No setup is guaranteed. Always manage risk and never invest more than you can afford to lose.

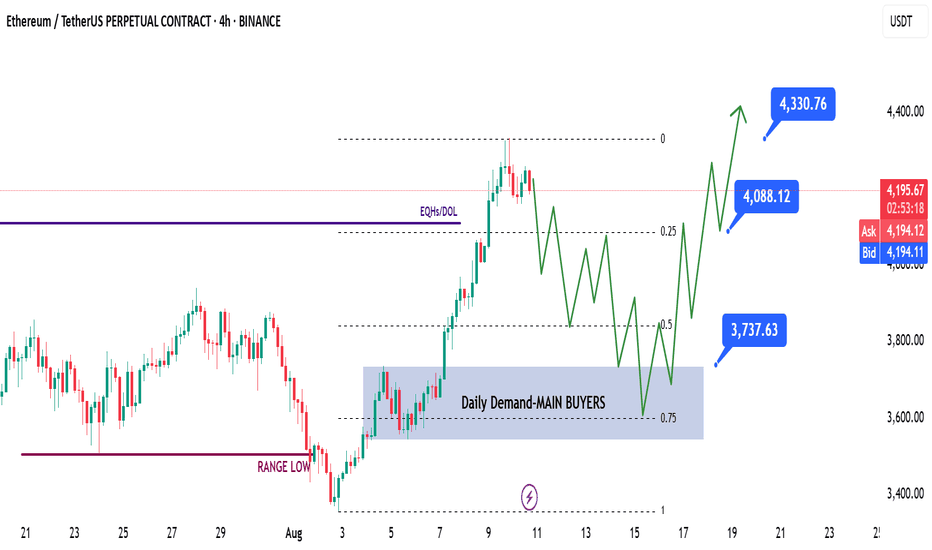

ETH | Swing Long IdeaETH | Swing Long Idea

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increased risk appetite across global markets are creating favorable conditions for further upside in crypto assets.

📈 Technical Analysis

Price has run the HTF liquidity level at $4100.

While the breakout above $4100 was aggressive, it appears price may require additional liquidity before pushing higher.

This idea focuses on a possible ETH retracement and continuation pattern over the coming days to weeks.

📌 Game Plan

If a deep retracement occurs, I’ll be watching the 0.5 Fibonacci discount zone and the 0.75 retracement level for optimal entries.

Key focus: daily demand zone at $3750 — ideally aligned with the 0.75 retracement.

I won’t wait for an exact touch of the 0.75 level; instead, I’ll watch for strength and a clear break of structure to trigger entries.

🎯 Setup Trigger

Look for a 12H–4H break of structure shift after the daily demand zone at $3750 is hit.

📋 Trade Management

Stoploss: 12H–4H swing low that caused the break of structure

Targets:

TP1: $4088

TP2: $4330

TP3: $5000 (possible swing point)

Will trail stops aggressively to secure profits as price moves in my favor.

💬 Like & follow if you found this breakdown helpful — more setups coming soon!

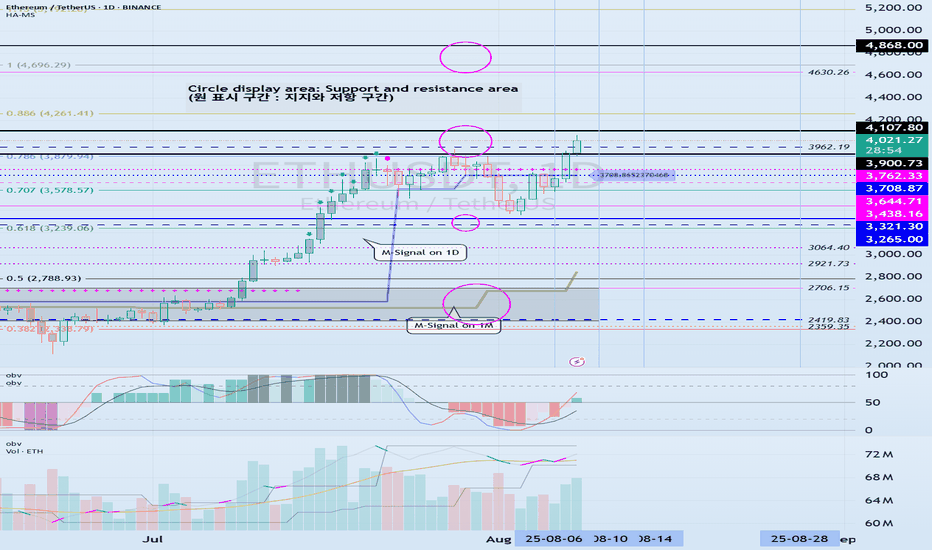

The key is whether the price can hold above 3900.73-4107.80

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

(ETHUSDT 1D chart)

This period of volatility is expected to last from around August 6th to 14th (maximum from August 5th to 15th).

The key question is whether the price can find support and rise above the 3900.73-4107.80 range after this period of volatility.

The next period of volatility is expected to occur around August 28th, so we need to see if the price can hold until then.

If the price declines, we need to check for support around the HA-High ~ DOM (60) range of 3708.87-3762.33.

If not, there's a chance it could fall below 3265.0-3321.30.

-

(1M Chart)

The TC (Trend Check) indicator has risen above 0, suggesting a high possibility of further upside.

Therefore, the key point to watch is whether it can rise above the 4630.26-4868.0 range.

For an uptrend to continue,

- The StochRSI indicator must remain upward with K > D.

(If possible, it's best to avoid K entering the overbought zone.)

- The On-Board Volume (OBV) indicator of the Low Line ~ High Line channel must remain upward.

(If possible, it's best to maintain OBV > OBVEMA.)

- The TC (Trend Check) indicator must remain upward.

(If possible, it should remain above 0.)

If the above conditions are met, the uptrend is likely to continue.

To sustain an uptrend by breaking above key support and resistance levels,

- The StochRSI indicator must remain below the overbought zone and remain above D.

- The On-Board Volume (OBV) indicator of the Low Line ~ High Line channel must rise above the High Line and remain upward.

- The TC (Trend Check) indicator must remain upward. (If possible, it should remain above the 0 point.)

When the above conditions are met, there is a high probability that the price will rise after breaking above important support and resistance levels.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more in detail when the bear market begins.

------------------------------------------------------

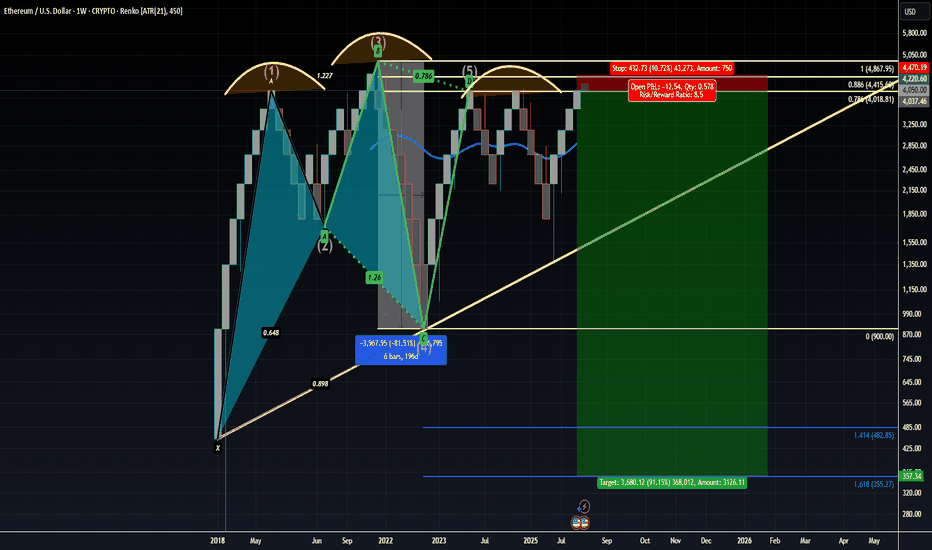

Ethereum Struggles to Complete above the 0.786 Bearish 5-0 ZoneWhile on the intra-bar price action on ETH has gotten pretty excited above the 0.786 it is still worth considering that ETH has not completed any bars above the 0.786 since the breakout and that at a moments noticed much of the current price action above the main 0.786 PCZ could later find itself being filtered out of the Renko charts as a whole depending on how many Average True Ranges above the 0.786 PCZ ETH possible move.

Based on the fact that the current candle is simply still in the projection phase I'd caution longs here and remain accumulative of longer dated puts. There is also a 2x leveraged ETF of ETH called ETHU which has OTM monthly call options trading at 20-40 dollar premiums. I'd consider farming off of those premiums in the form of Bear Vertical Spreads as a way to hedge off the costs of holding the long puts.

Overall, we are still trading at the PCZ of the Bearish 5-0 which seems to also be in the similar shape of a Bearish Head and Shoulders pattern; the measure move of which could take ETH down to around $355 upon the break of $1,600

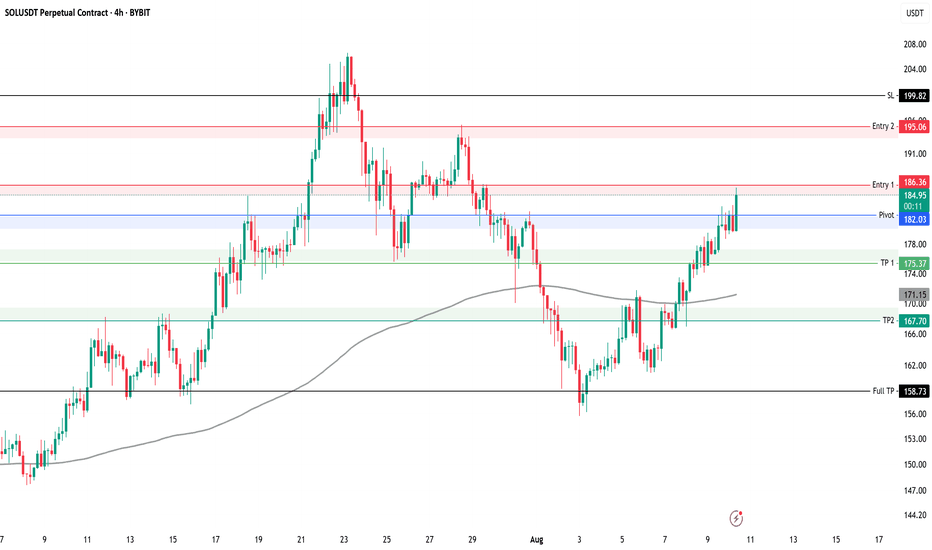

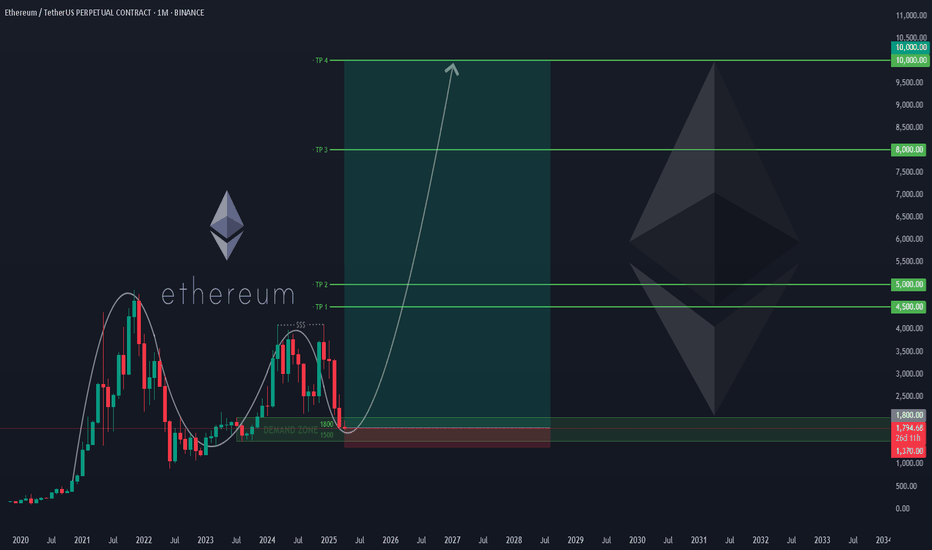

#ETH #ETHUSDT #ETHEREUM #LONG #SWING #Analysis #Setup #Eddy#ETH #ETHUSDT #ETHEREUM #LONG #SWING #Analysis #Setup #Eddy

ETHUSDT.P Swing Long Analysis & Setup

Important area of the upper time frame for swing are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

🗒 Note: The price can go much higher than the second target, and there is a possibility of a 500% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

⚠️ Warning : The stop loss is dramatic and large. Place the stop loss based on your strategy and after getting entry and confirmation on the entry point behind the last shadow that will be created. (( This is just my opinion and is not meant to be 100% correct, so be careful with your capital. ))

Spot Investing : ((long 'buy' position)) :

🟢 Entry 1 : 1800

🟢 Entry 2 : 1500

First entry point calculations :

⚪️ SL : 1370 ((23.89%))

⚫️ TP1 : 4500 ((150%))

⚫️ TP2 : 5000 ((177.78%))

⚫️ TP3 : 8000 ((344.44%))

⚫️ TP4 : 10000 ((455.56%))

‼️ Futures Trading Suggested Leverages : 3-5-7

The World Let it be Remembered...

Dr. #Eddy Sunshine

4/4/2025

Be successful and profitable.

Do you remember my first Ethereum swing long signal?

My first swing long signal was provided on Ethereum, which was spot pumped by more than 100% and was profitable :

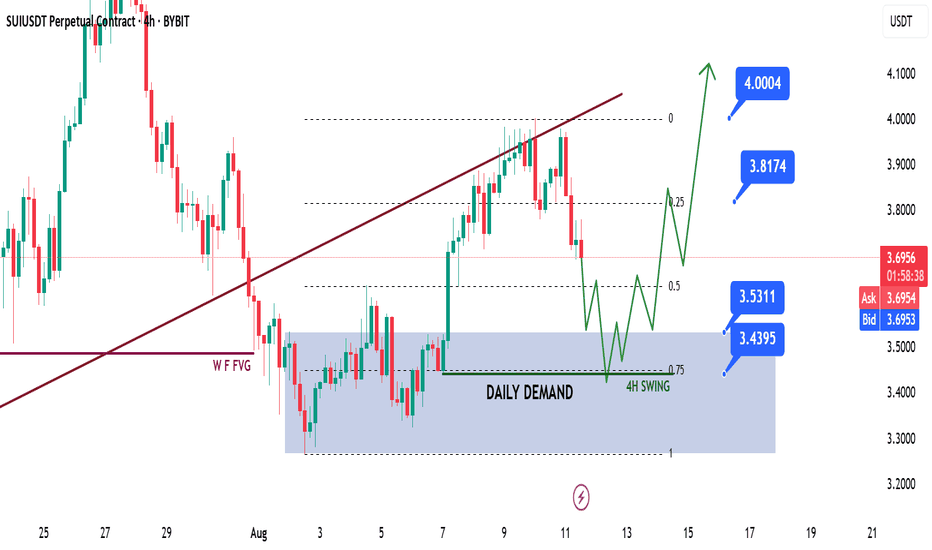

SUI | SUI Network Swing Long IdeaSUI | Swing Long Idea

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increased risk appetite across global markets are creating favorable conditions for further upside in crypto assets.

However, tomorrow’s CPI data is a key risk event for markets. It will be released at 08:30 AM NY local time, and could cause notable volatility across risk assets.

📈 Technical Analysis

Price began a retracement after a strong bullish expansion.

The move deepened following a break of the bullish trendline.

Price bounced from the Weekly Fair Value Gap (W-FVG) and retested the broken trendline, only to face rejection again.

This suggests price may still want to head lower to collect liquidity before continuing higher.

📌 Game Plan

Primary watch level: Daily demand zone (blue box) at $3.53.

This level could be enough to spark continuation higher, but ideally I’d like to see the 4H swing liquidity at $3.44 taken out first to strengthen the setup.

🎯 Setup Trigger

Wait for a 4H break of structure after the game plan levels are met.

📋 Trade Management

Stoploss: 4H swing low that caused the break of structure

Targets:

TP1: $3.81

TP2: $4.00

TP3: $4.44

Will trail stops aggressively to secure profits as the trade moves in my favor.

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

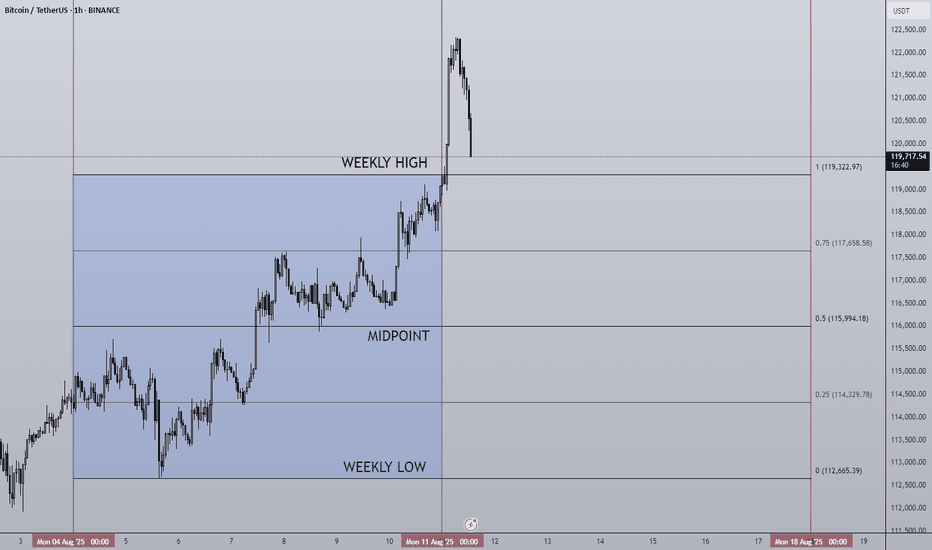

11/08/25 Weekly OutlookLast weeks high: $119,322.97

Last weeks low: $112,665.39

Midpoint: $115,994.18

BTC takes back the spotlight as the week ends! Breaking through the previous weeks high just hours after weekly close and stopping just shy of ATH. This rally comes off the back of a successful bounce from $112,000 area and mirrors the previous weeks drawdown almost perfectly setting up an interesting week ahead.

I am still wary of August seasonality, yes BTC and the broader altcoin market especially ETH have seen great gains so far this month but history shows August is not kind to the bulls;

August '24: -8.74%

August '23: -11.27%

August '22: -13.99%

August '21: +13.42%

August '20: +2.74%

August '19: -4.84%

August '18: -9.0%

Now history doesn't necessarily repeat itself but it does rhyme. Should BTC SFP and accept below the weekly high I would say a $115,000/ Midpoint retest is a logical move. RSI has been posting bearish deviations on HTF (1W&1M) which can suggest a shift in trend is coming but further proof of this would be needed before then

This week CPI & PPI take place on Tuesday and Thursday respectively. With a September interest rate cut on the horizon this data release may be more important than it has been in recent months so I'm keeping a close eye on the result.

Previous: 2.7%

Forecast: 2.8% (+0.1%)

For altcoins many have had great rallies, ETH predominantly after breaking through $4000, again many indicators are showing a local top is due so I am looking at price action context for any clues of a pullback to come, until then the trend is your friend.

Good luck this week everybody!

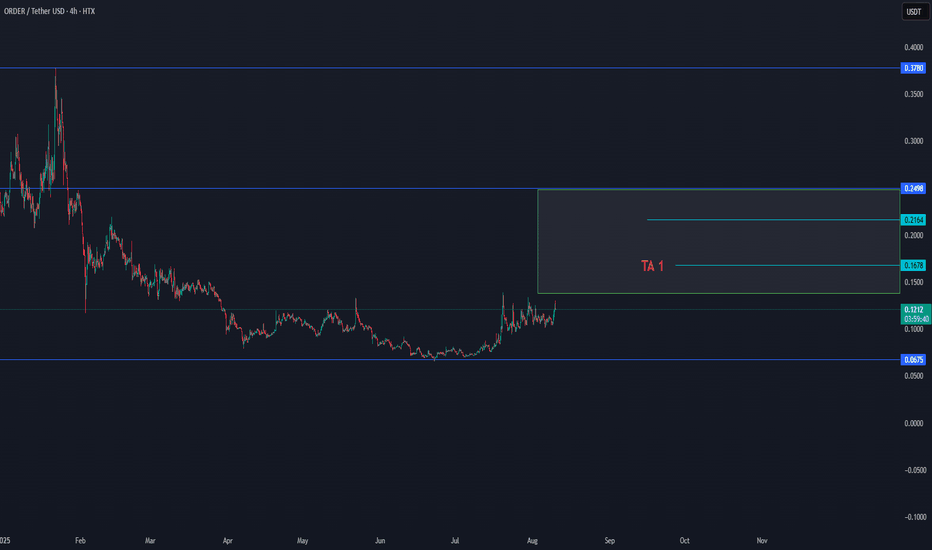

ORDER/USDT NEW TREND VOLUMEThe order shows a new trend in volume, which can be confirmed in the coming hours.

We will follow this coin for the coming confirmation flow.

Order/usdt started from $0,1072 with a new confirmed volume, which has now paused since $0,1214. The trend can stay here for a time, stable and build new uptrend volume to up $0,16 as the first target. As long as the coin stays up $0,09, the trend is healthy.

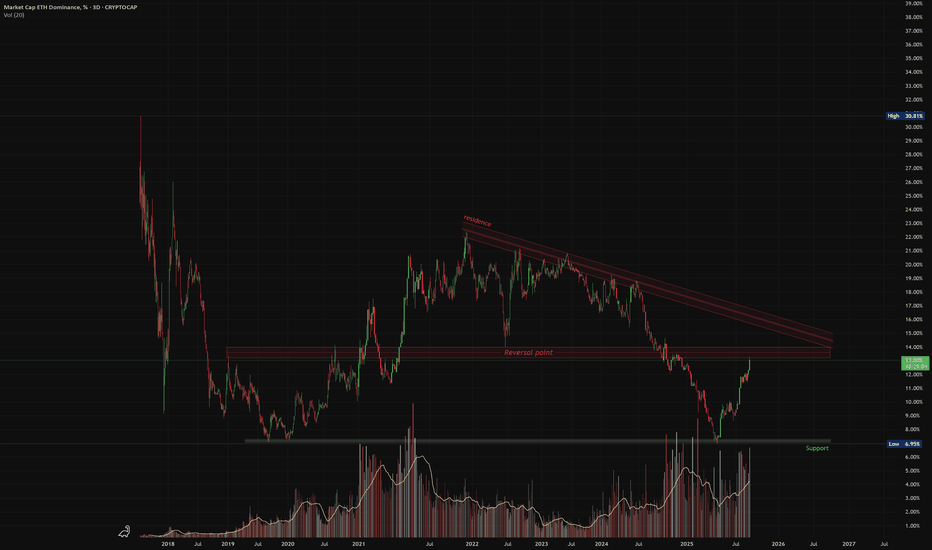

ETH Dominance – Possible Pullback at Key ResistancePair: ETH Market Cap Dominance (%)

Timeframe: 3D

Structure: Descending Trendline + Horizontal Resistance

Volume: Rising on approach to resistance

📉 What’s happening?

ETH dominance has rallied from support and is now approaching a historically strong resistance zone marked by multiple rejection points. Price is also near the long-term descending trendline, which has acted as a ceiling for over a year.

🔻 Caution Zone:

Resistance between 18.5%–19.2%

Historical reversal area (marked as “Reversal Point”)

📌 Pullback Triggers:

Bearish candle formation at resistance

Declining volume on further push up

Failure to close above the descending trendline

Bias: Short-term pullback likely unless ETH dominance breaks and closes above resistance with strong volume.