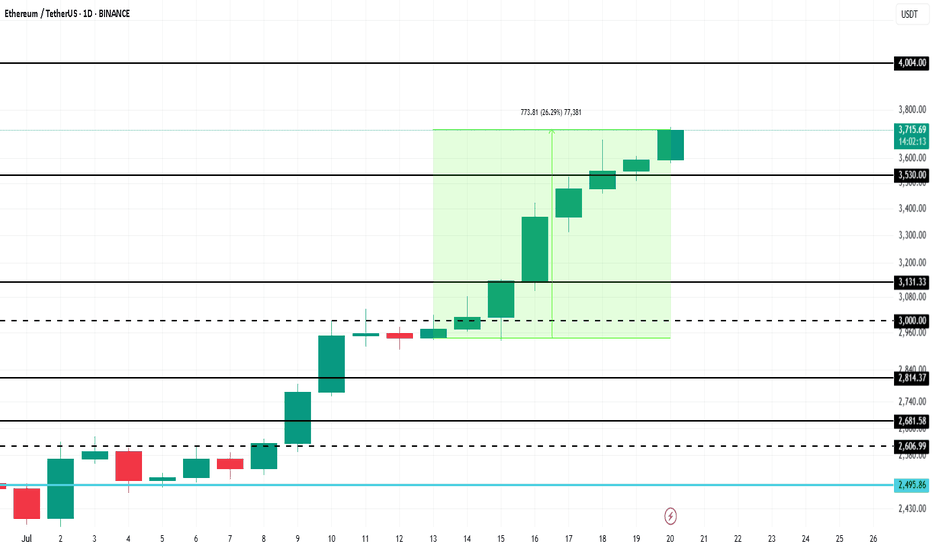

Ethereum Price Hits 6-Month High, Up Next $4,000BINANCE:ETHUSDT has managed to navigate recent market volatility with significant support from investors. As companies increasingly mirror Bitcoin’s corporate treasury use case, Ethereum is gaining traction.

BINANCE:ETHUSDT price surged 26% over the past week , reaching $3,715 and marking a 6-month high. The rally strengthened after ETH formed a Golden Cross last week. With this bullish momentum, Ethereum is now targeting $4,000 in the coming days, benefiting from investor confidence and growing institutional interest.

However, if BINANCE:ETHUSDT bullish momentum weakens and investors opt to sell, the price could decline to $3,131 . This would erase recent gains and invalidate the current bullish outlook.

Ethereum (Cryptocurrency)

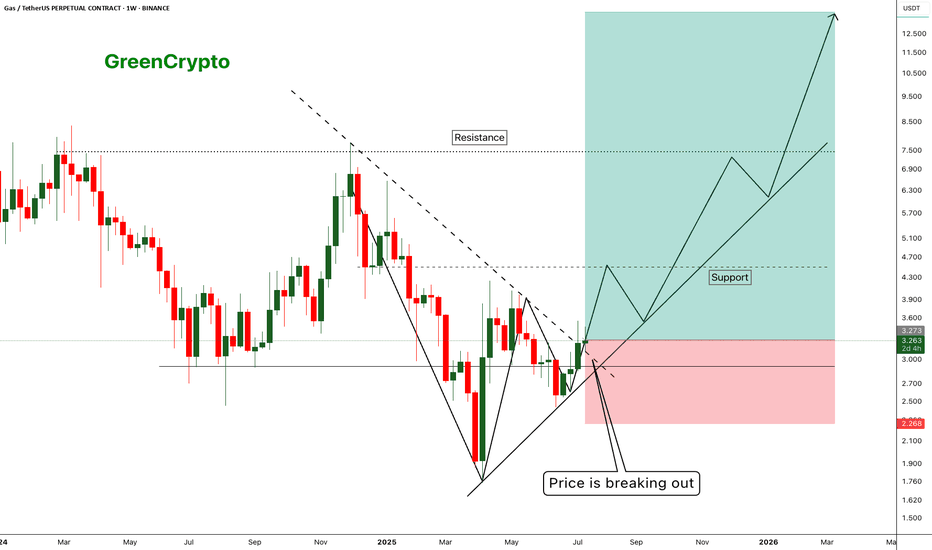

GAS - Huge Risk:Reward Trade 1:10 - Is there any Gas Left ?- Gas has finally managed to breakout from the resistance trendline and now trading just above the resistance

- I'm expecting this trend to continue along the support line shown in the chart.

Entry Price: 3.281

Stop Loss: 2.271

TP1: 3.944

TP2: 4.589

TP3: 6.775

TP4: 8.412

TP5: 13.512

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

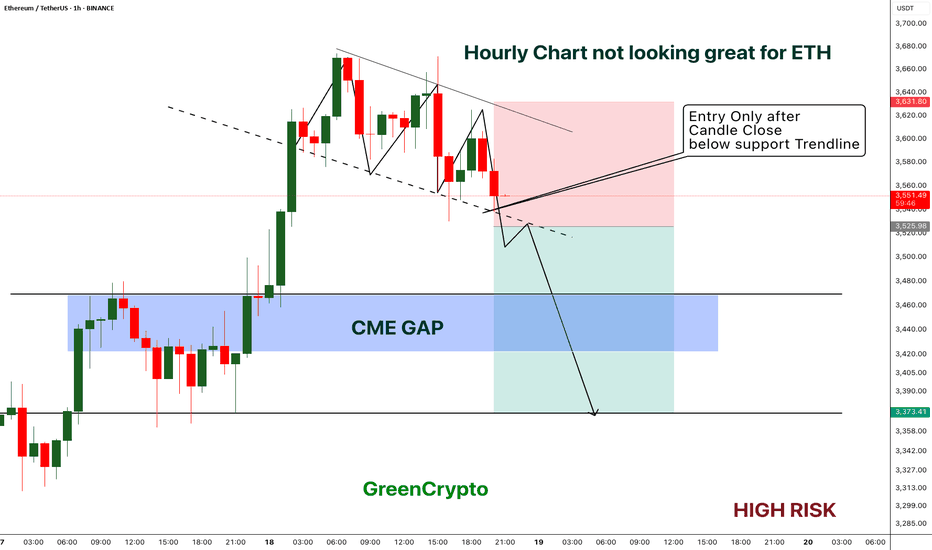

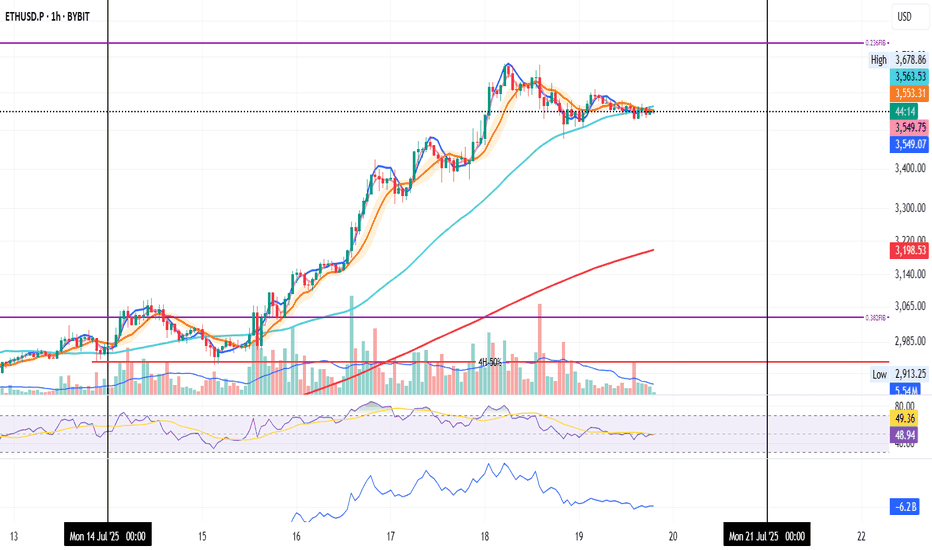

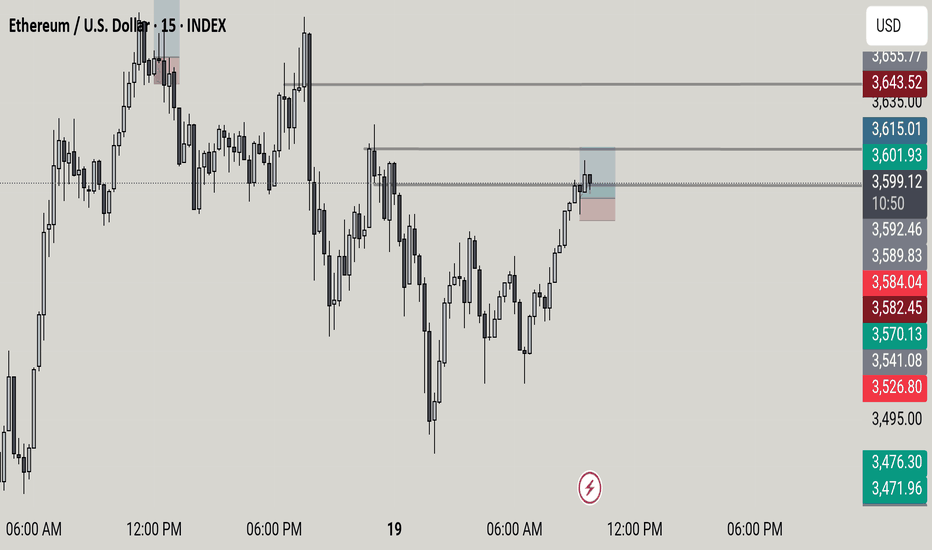

ETH - Short Trade with HIGH RISK- ETH got reject from resistance multiple times on 1H timeframe and now the price is playing near the support.

- I'm expecting overall market to cooldown this weekend, this could push the ETH to break the support

- ETH has CME gap around 3422 - 3467 range, im expecting this CME gap to be filled soon.

Entry Price: Below 3525

Stop Loss: 3631

TP1: 3471.15

TP2: 3381.76

Move SL to breakeven on TP1 hit.

Don't forget to keep stoploss.

Cheers

GreenCrypto

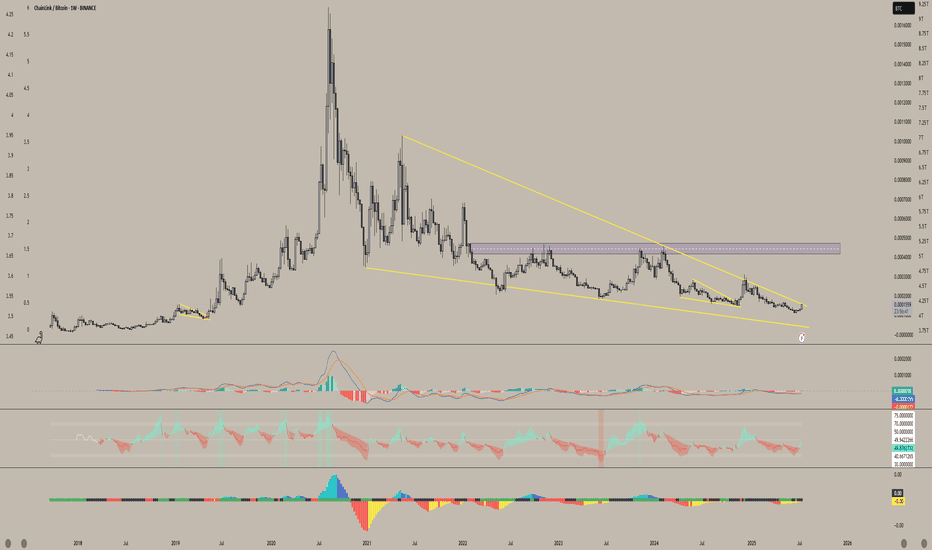

Link/BTC When will we see the pump Chainlink has always been one of my favorite cryptos—and pairing it with BTC just makes sense. I have strong faith in this project, and I believe the days when trendline resistance and support hold Chainlink back are numbered. This beast looks ready to break free.

We’re possibly just weeks, maybe even days, away from a breakout of this 4-year falling wedge. Once that happens, I see LINK/BTC teleporting upward—especially as quantitative tightening ends and Jerome Powell stops being a hater. The stars are aligning for Chainlink to soar. With everything going on behind the scenes between swift and Mastercard and the many more I can list I see this being the underdog.

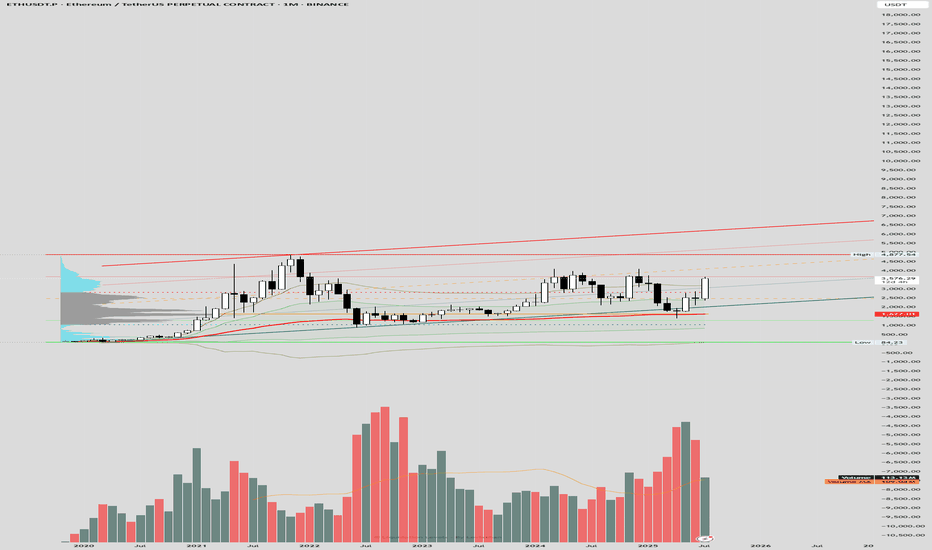

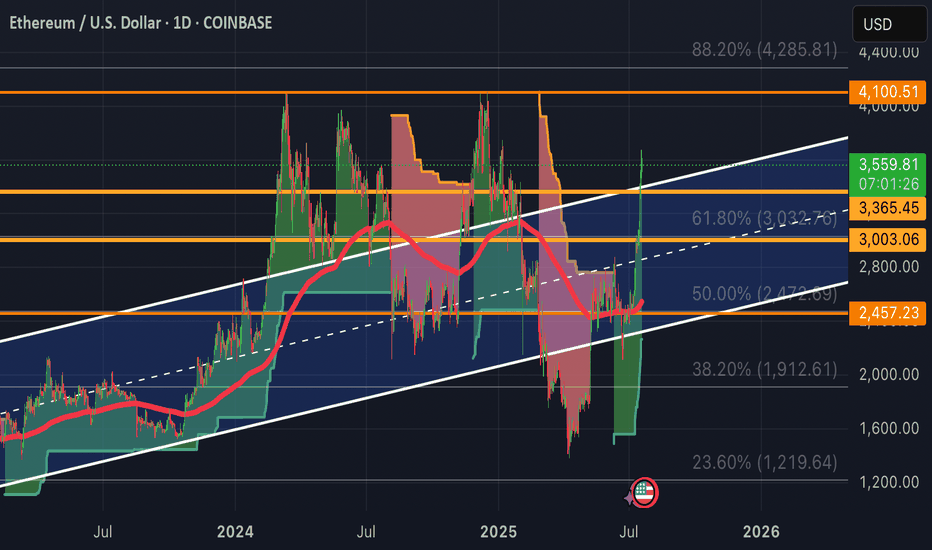

ETH Monthly Chart (AVWAP)The chart highlights a bullish structure with the AVWAP providing key dynamic support and resistance levels. The price has recently approached the upper AVWAP deviation around $4,977.54, aligning with the prior bull flag scenario's resistance zone. The red trendline indicates a potential upper boundary, while the green and orange lines suggest intermediate supports and resistances, with the current price near $3,579.48 testing the middle range. The lower AVWAP deviation near $842.23 serves as a critical invalidation level. Volume remains supportive, with spikes corresponding to price movements, and the volume moving average (109.4k) indicates steady activity.

Real-time data shows ETH trading at $3,565-$3,600, consistent with the chart's mid-range levels, driven by ETF inflows and on-chain activity. A breakout above $3,700-$4,000 with increased volume could target $3,834-$4,000 or higher, while support at $2,533-$2,700 remains vital. Sentiment on X and web sources is optimistic, though volatility persists due to external factors.

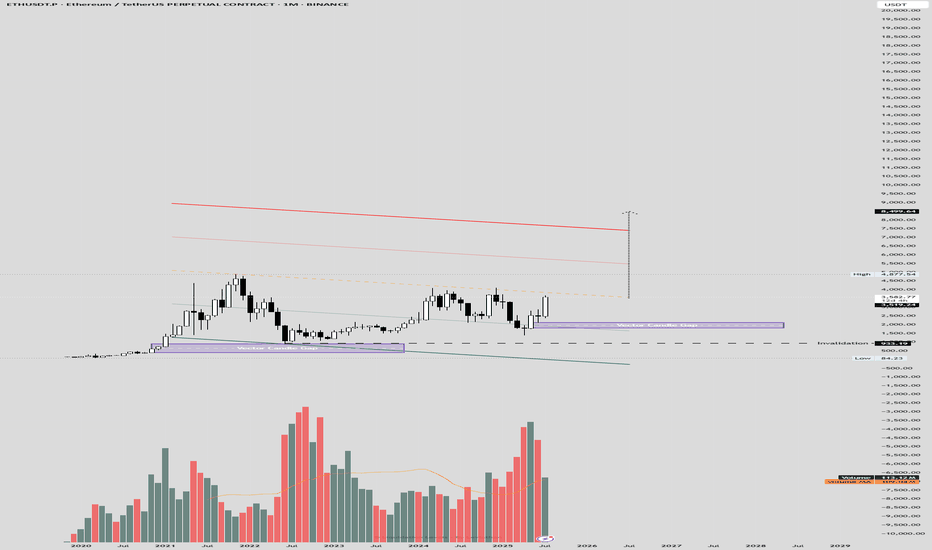

ETH Monthly ViewThe monthly chart suggests a potential bull flag pattern, with a strong upward trend followed by consolidation. The "Vector Candle Gap" indicates a breakout zone around $4,977.64, with recent price action testing resistance near $3,700-$4,000. Volume trends support the bullish case, showing increased activity during the initial rise and consolidation. The moving average reinforces an upward trajectory, but a downward-sloping trendline and support at $933.19-$2,800 suggest invalidation risks if the price drops below these levels.

Real-time data shows ETH trading at $3,565-$3,600, bolstered by institutional inflows into spot ETH ETFs and on-chain activity. The bull flag aligns with a potential target of $3,834-$4,000 if the breakout sustains with strong volume. Key support lies at $2,533-$2,700, with sentiment on X and web sources remaining optimistic, though volatility persists due to macroeconomic and regulatory factors.

ETH on the 1H timeframe

Indicators are showing slight weakness:

MLR < SMA < BB Center

Price is trading below the 50MA

RSI is under the midpoint, and green volume is fading

This could just be a pause before the next leg up

but I’m curious whether the last high of $3,678.86 was this week’s top,

or if price will try to break it tomorrow.

Always take profits and manage risk.

Interaction is welcome.

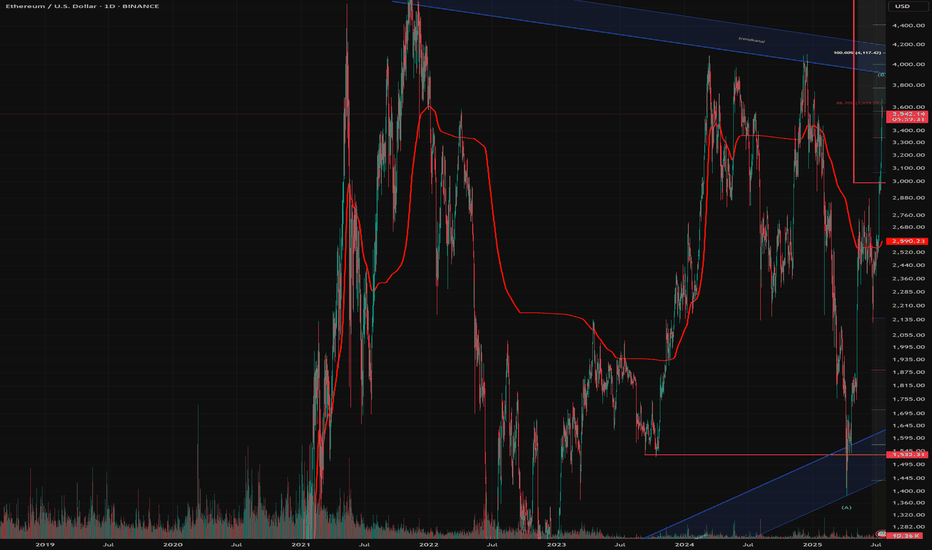

MY VIEW ON ETH - BULLISH & BEARISHMy analysis of Ethereum (ETH): Bullish and bearish scenario

The analysis of Ethereum is currently quite complex. The price structure does not show clear impulses in the form of classic wave movements, but frequently overlapping patterns that indicate ABC correction waves.

I therefore present both my primary and an alternative scenario for a bullish (rising) and a bearish (falling) trend.

Primary bullish scenario:

Wave 2 seems to be completed at the lower end of the blue trend channel and at the 70.70-% FiB. We could currently be in red wave 3. However, the structure of this movement is more reminiscent of an ABC formation, which could indicate a weaker impulse.

Should the price break through the upper edge of the blue trend channel and exceed the 100% Fibonacci level at around USD 4,424, several important Fibonacci zones would converge in the “profit area” marked in red. In this case, a setback as part of the red wave 4 could not be ruled out.

Alternative (bearish) scenario:

It is possible that the blue V-wave could turn into a white ABC structure. In this case, an additional wave 4 would be omitted, which could result in a stronger sell-off.

Secondary scenario - bearish:

If Ethereum fails to play out the primary bullish count scenario, I expect that we will continue to be in an overarching correction phase. This assessment also fits in with the typical market slowdown during the summer months.

In this case, a green ABC correction could form, whereby wave C could theoretically still rise to the 100% Fibonacci level at USD 4,416. However, this would be an overextended wave B.

In addition, we are already in the area of the sales or profit zone, which indicates that only a limited rise is possible.

Subsequently, I expect a stronger downward movement towards the green buy area between the 1.618 Fibonacci level and around USD 1,866.

LEAVE YOUR COMMENTS AND ASSESSMENT

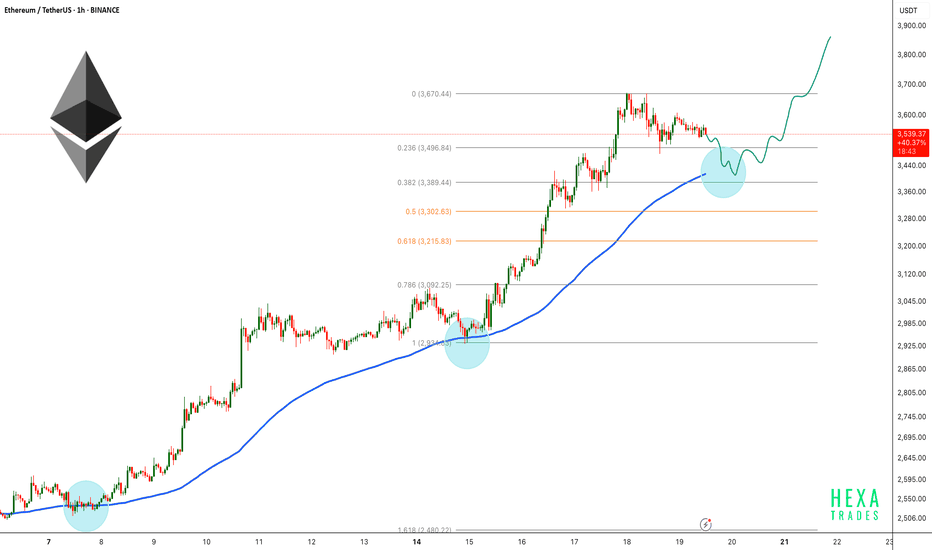

ETH Healthy Retest Before Next Rally!Ethereum continues to trade within a strong uptrend on the 1-hour chart, respecting the 100 EMA consistently throughout the rally. After a strong impulse move, the price is now consolidating near the recent highs.

ETH price could retest the 0.382 Fibonacci level and the 100 EMA before continuing upward. A successful retest would signal strength and could lead to a bullish continuation toward the $3900 - $4000 range.

Similar historical retests of the 100 EMA led to strong rallies, and we could see a repeat of that pattern if support holds.

Cheers

Hexa

BITSTAMP:ETHUSD CRYPTOCAP:ETH

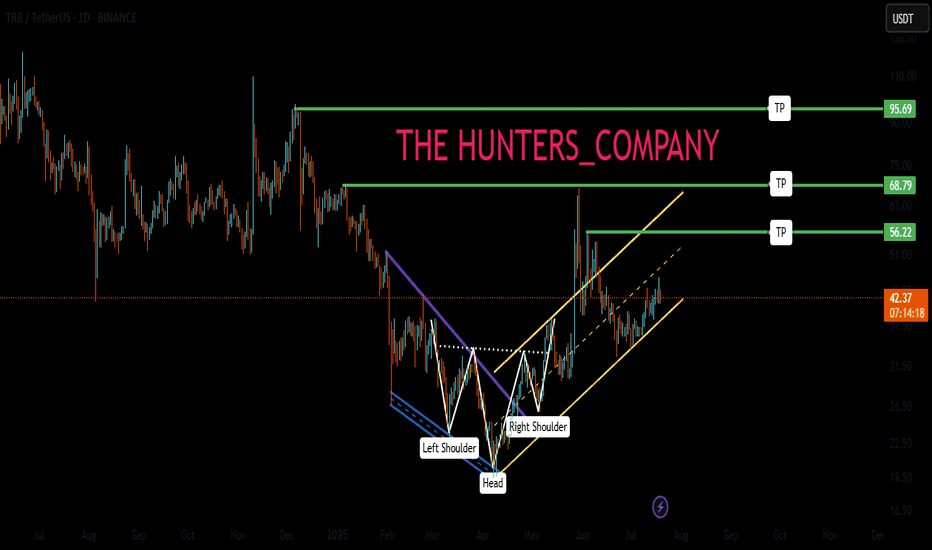

TRB : FREE SIGNALHello friends🙌

📈Given the price reaching its bottom and the buyers supporting it, you can see that a classic head and shoulders pattern has formed and buyers have entered. For this reason, you can buy with capital and risk management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

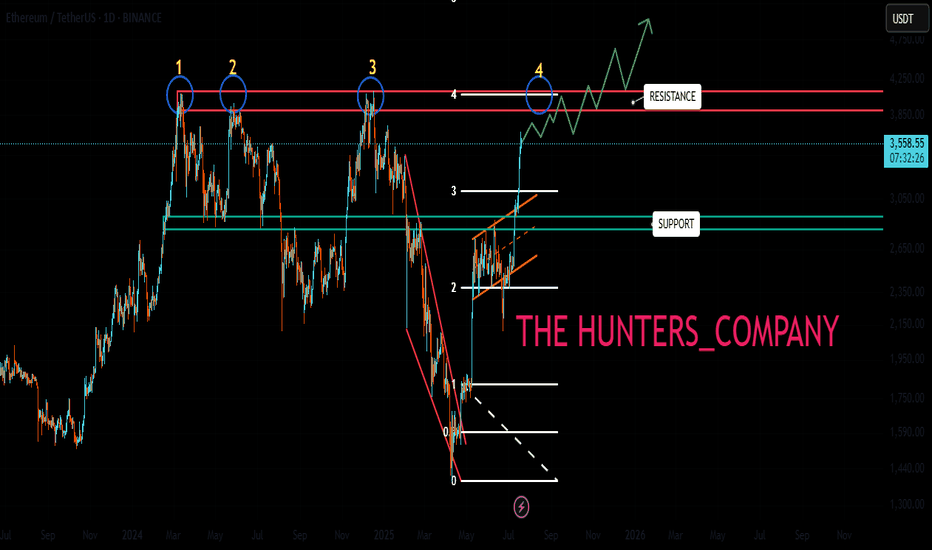

ATH FOR Ethereum!!!Hello friends🙌

As you know, Ethereum has been on an upward trend these days and we can say that buyers have entered, but not completely...👀

🔊Now, considering the resistance that Ethereum is facing, namely the number 3900 to 4100, we need to see what reaction the price will see this time when the price reaches this resistance for the 4th time?

✔We will most likely make a small correction and this time this major resistance will be broken again and we will witness a higher ceiling.

✔Otherwise, I have an important and key support that we have identified for you and if the price drops, this support is a good area to buy again.

And finally, observe risk and capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

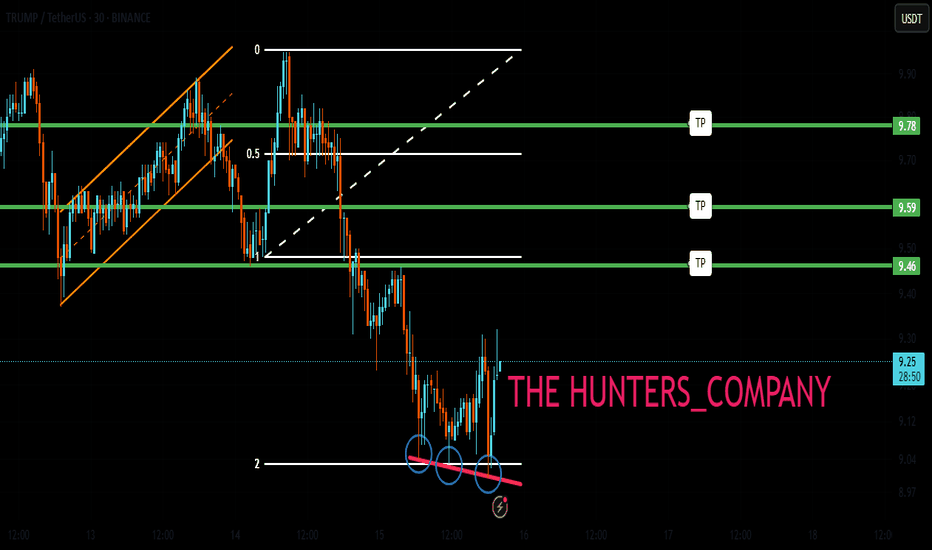

TRUMP UPDATEHello friends🙌

👀You can see that the price formed a reversal pattern after falling at the specified support and the buyers supported it.

⚠Considering the entry of buyers, the price is expected to move to the specified targets, of course, don't forget about capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

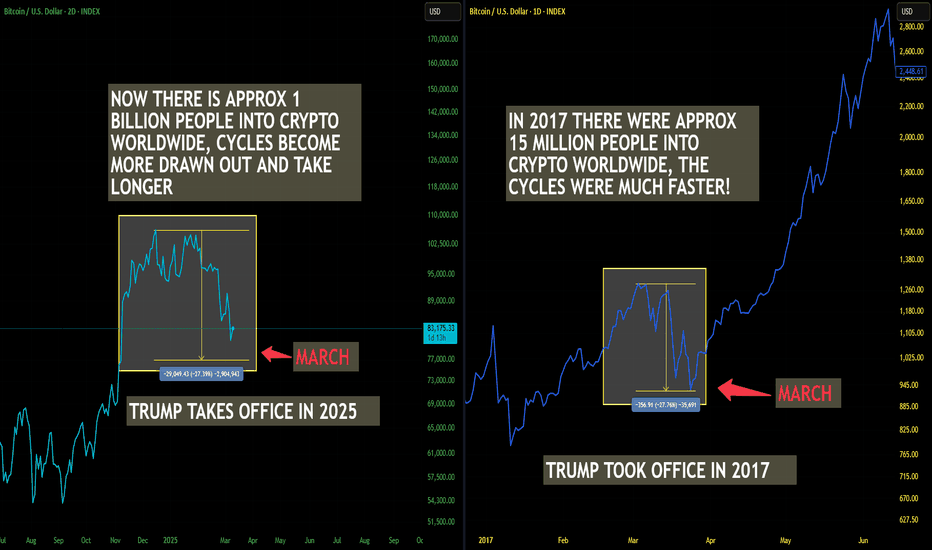

Bitcoin Interesting Fractal And Timing! GOING STRAIGHT UP!I noticed that the timing and pattern of how this is playing out in 2025 in Bitcoin is very similar to that of 2017. This fractal is not identical but its damn close. In 2017 there were approximately 15 million people in crypto, very few leverage exchanges, and trading was no where near what it is today. Now we have exchanges everywhere, hundreds of them most with leverage which we didn't really have before. Also not to mention that now we have big players getting in and they aren't buying and selling on the daily, they are buying it all and holding it, hence why we aren't seeing the typical "Alt season". The sloshing effect we had in the early days when traders would rotate out of Bitcoin into alts is not happening as it used to.

In 2017 Trump took office and in the end of March the bull run started in full swing. Something very similar is also happening now that we are in March and these fractals are lining up. Let see how this plays out. I think we are on the cusp of a giant mega bull run like you've seen before.

Crypto traders last year made mega profits cashing out multiple billions in capital gains. Once the selling stops around the end of March and beginning of April from people selling to pay taxes I think its on. This is not financial advice this is just my opinion. Lets see how this chart ages. Thank you for reading.

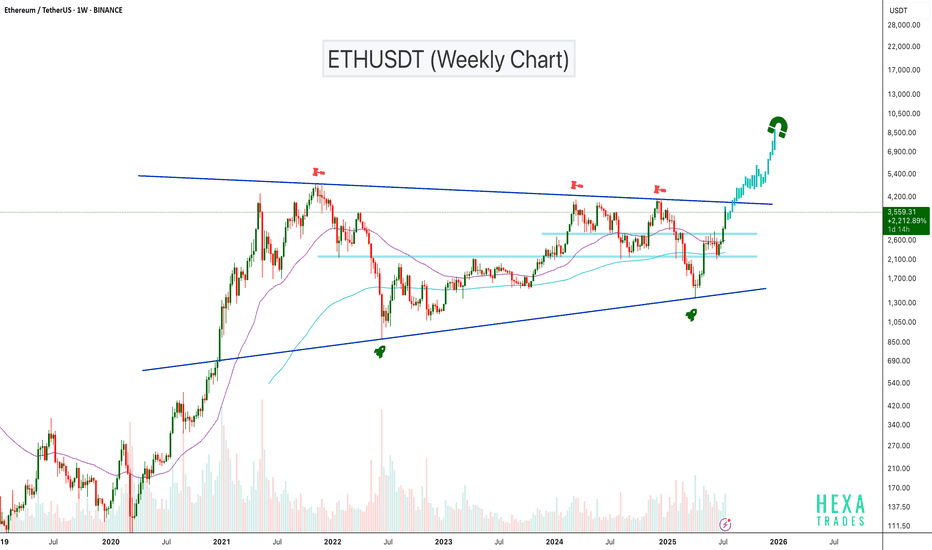

ETHUSDT Gearing Up for Explosive MoveBINANCE:ETHUSDT has been trading inside an ascending triangle pattern for the past 1,600 days. The price is now moving toward the triangle's resistance zone with strong volume support. A confirmed breakout above this resistance could trigger a powerful bullish move, with potential targets in the $6,000–$8,000 range.

Cheers

Hexa🧘♀️

BITSTAMP:ETHUSD

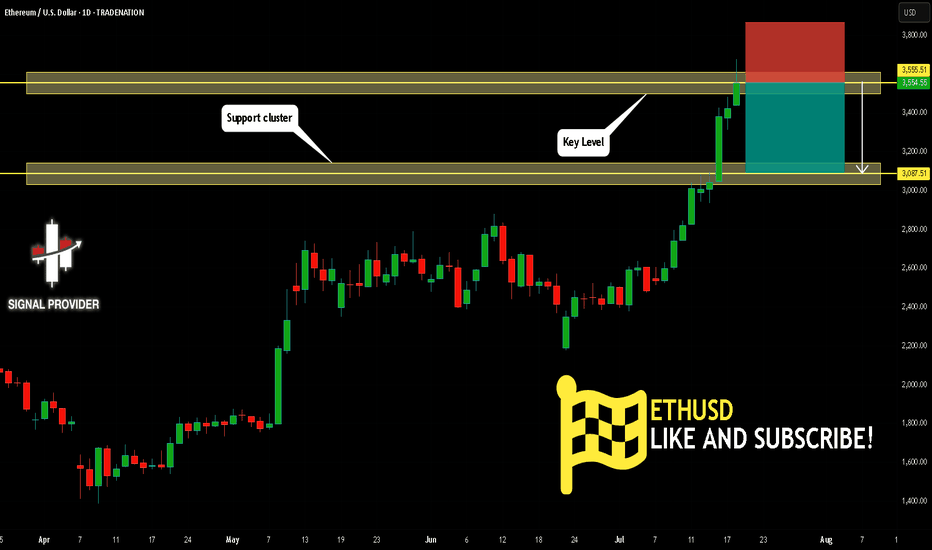

ETHUSD Will Fall! Short!

Take a look at our analysis for ETHUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 3,555.51.

Considering the today's price action, probabilities will be high to see a movement to 3,087.51.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

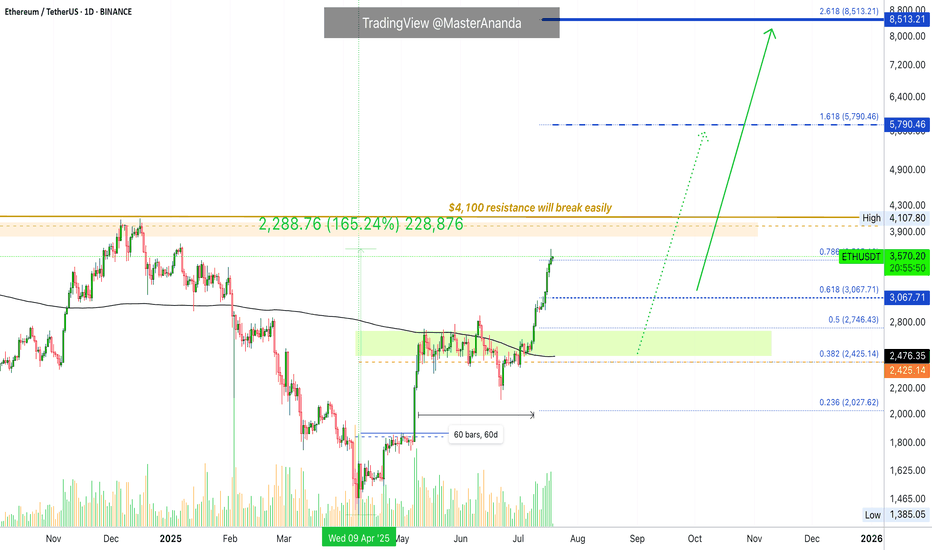

Ethereum · No Reason To Stop · Will Continue RisingEthereum will continue rising. Remember Ether is number two and it is awesome, to start, and it follows Bitcoin like darkness follows the light. There is no reason for Ether to move down. There is no necessity for ETH to stop its major advance, in fact, it has been lagging behind and it needs to catch up. Bitcoin is waiting and will continue waiting but it won't wait forever so Ethereum must wake up and is waking up. We are going up.

Ethereum has grown 165% since its 7-April low. This is more than XRP and its capital is twice as much. Boom! The best part? Ethereum will continue growing straight up for weeks and months. It needs to be trading at a new all-time high as soon as possible just so that the market can feel at ease and know, once again, that Crypto is here to stay.

What has been suppressed can't stay suppressed forever. Crypto went through a fight but challenges only made us that much stronger. We are now happy and grateful for everything that we went through because we know that we can take anything the world throws at us.

The chart. Green, green, green straight up. Two months of consolidation. That's the key. ETHUSDT went sideways for almost two months and this reveals what comes next. The advance outside the consolidation range has been happening for 8 days. 60 days of sideways can support at least an entire month of growth. When the entire month is consumed, we can expect a retrace, nothing more, followed by additional growth.

In short, Ethereum will continue rising. If you see a shakeout, know that growth will always resume in a matter of days. If you see a drop, know that this is a bear-trap, the bulls now own the game. If you are in doubt, come read my articles and I will publish something that you will understand and agree is right, so you can continue holding until you can reach the big prize.

The time to sell will come, but it isn't now. Right now is the time to hold strong. Not only Ethereum, but Cardano, XRP, BTC, Dogecoin, Solana and the rest of the altcoins. This is only the start.

I expect Ether will continue rising. $8,000 now looks like such an easy target...

Very good indeed. If you enjoy the content, follow me.

Namaste.

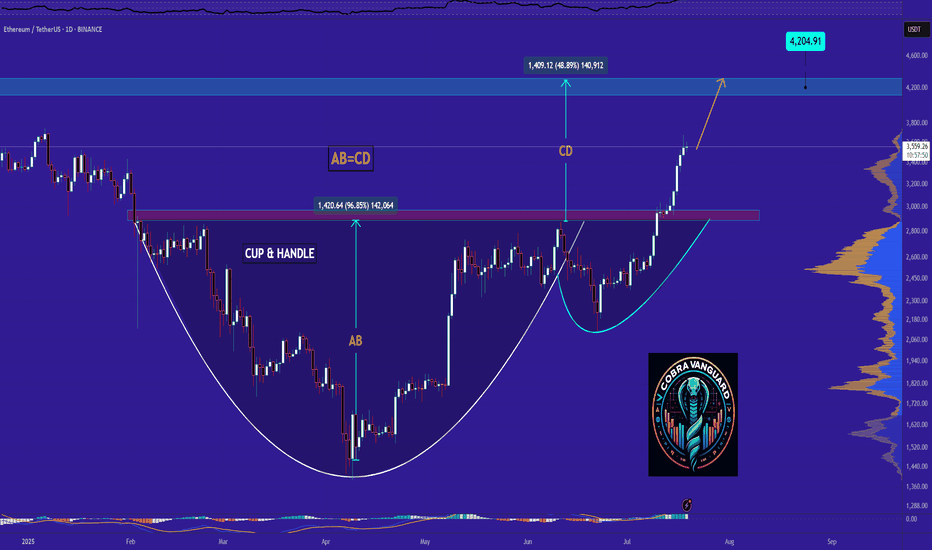

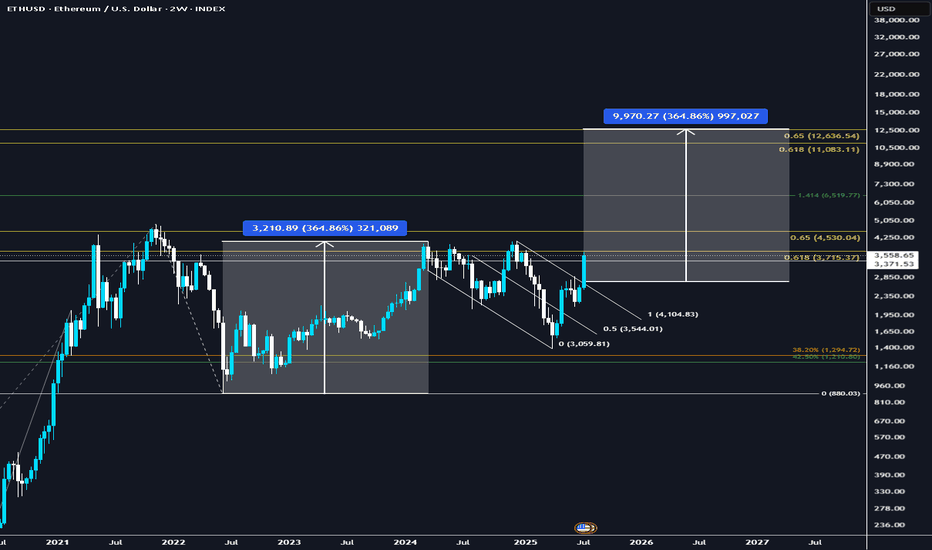

ETH to $12,600I think ETH, with all the current fundamental shifts happening in the past 6 months, is prime to run to the golden pocket, a perfect measured move and cup & handle pattern playing out.

1️⃣ Institutional floodgates opening

Spot ETH ETFs have seen massive inflows—billions flowing in just weeks.

BlackRock and other majors are prepping ETFs that may include staking, turning ETH into an institutional yield asset. This is serious structural demand, not retail hype.

2️⃣ Regulatory clarity coming in hot

The GENIUS Act and stablecoin bills in the U.S. are pushing regulatory clarity into crypto markets fast. This reduces uncertainty and increases appetite for ETH from corporates and funds.

3️⃣ Technicals are clean and bullish

ETH flipped $3,300 into support and is holding strong.

Next major resistances at $3,800–$4,100, with ATH at $4,800 firmly back on the radar.

Short-term structure is clear: higher highs, higher lows, solid volume backing it.

4️⃣ On-chain and supply dynamics

Whales are aggressively accumulating—large wallet inflows confirm that.

Staked ETH keeps hitting new highs (~30% of supply locked), tightening available float.

This supply squeeze + ETF demand = bullish cocktail.

5️⃣ Ethereum’s ecosystem dominance is intact

ETH still hosts the lion’s share of stablecoins and DeFi.

Layer-2 scaling is progressing fast, upgrades like EIP-4844 and Pectra coming soon, reducing gas fees and improving UX—critical for future adoption.

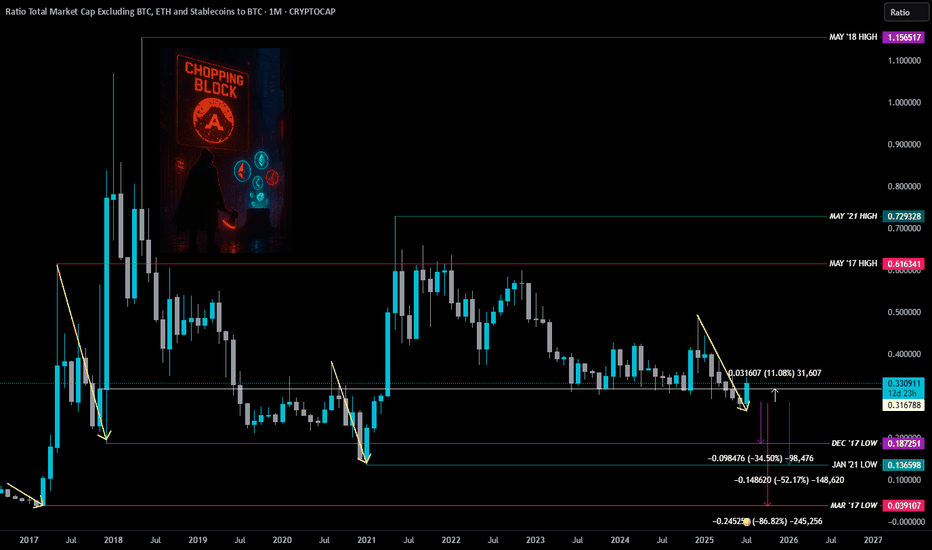

Is Your Altcoin on the Chopping Block?-Update: Originally posted on July 8, 2025… but swiftly vanished into the void by a moderator (rookie mistake—I neglected the sacred posting rules). Turns out, publishing has rules… that I did not interpret accurately?

To my loyal circle of 5 followers: if this feels like déjà vu, my sincerest apologies for the rerun. But with the winds shifting and the drums beating for alts season, I figured it was worth a resurrection.

Let the thrills—and the calls—begin. 🎭📈

Whenever you see “-Update:” that’s the latest as of today — 07/18/25.

Is Your Altcoin on the Chopping Block? 🪓

Brace yourself—this might sting.

Odds are, your favorite altcoin is walking a tightrope. And while I’m not here to spread doom, I am here to give you a wake-up call. Don’t shoot the messenger.

TradingView recently dropped a chart that cuts through the noise: Total3ESBTC.

It’s a ratio of the Total Crypto Market Cap (minus BTC, ETH, and stablecoins) to Bitcoin.

Translation?

👉 A clear, undistorted look at how the altcoin market is actually doing—without ETH clouding the view or stablecoins muddying the waters.

Think of it like night-vision goggles for spotting altcoin strength—or weakness—in the shadows of BTC dominance.

Perfect tool to sniff out market rotation—that sweet spot where Bitcoin hands the baton to alts or rips it back.

So why should you care?

Because the writing's on the wall... and most altcoins might not survive what's coming.

Let’s break it down:

ZOOMED OUT – MONTHLY VIEW 🔭

Before every major altcoin run, there’s always a major low.

You’ll notice three big ones:

🔴 March 2017 (Pink Line)

🟣 Dec 2017 (Purple Line)

🟢 Jan 2021 (Green Line)

Yes, some individual alts have pumped. A few even went full parabolic.

But if altcoins as a whole were ready to fly? They would've taken off already.

-Update: Yes, they finally did it this week… but hold that excitement—there’s more to the story.

Instead, the altcoin ratio broke a critical support (White Line) back in May... and even closed below it. That’s not bullish—it’s a red flag flapping in the wind.

– Update: We just sliced through that white line, but for most alt’s to stay strong, we need a monthly close above it.

Strangely enough (or coincidental, if you believe in coincidences) ...

🗓️ All the major altcoin market highs happened in MAY.

Not once. Not twice. Every. Single. Time.

🔴 May 2017

🟣 May 2018

🟢 May 2021

Call it coincidence. Call it cycle magic.

Maybe it’s a message from the crypto gods—and they don’t whisper for no reason.

So if we just had another May, and the ratio is still sliding with no reversal in sight… ask yourself:

Was that the high?

Or are we still heading toward the low that resets the board?

Here’s the hard pill 💊

If altcoins are ever going to go up again, odds are they’ll need to hit one of these historical lows first.

That’s not a prediction. It’s just how the markets have moved before major alt run.

📉 That means more pain ahead.

We’re talking potential drops of:

🔻 -32% to revisit Dec '17 levels

🔻 -51% to retest Jan '21 lows

🔻 -85% if we go full wipeout to March '17

Harsh? Yeah.

But better you hear it now than wonder “what happened?” when the floor caves in.

The worst part?

Most won’t believe this until it’s already too late.

-Update: Those lows haven’t been tested yet—might be wise to hold off on loading your bags to the brim. Patience pays.

Now here’s the uncomfortable twist:

There’s a legit case to be made that we may never see another “real” alt season again.

Why?

🪙 Liquidity is being siphoned by stablecoins

📈 Speculation is migrating to AI stocks

⚠️ Risk appetite is narrowing

Altcoins used to be the Wild West. Now? They’re the illiquid backyard of a global casino.

BUT… Let’s put on our degen-tinted glasses for a second.

Suppose the Fed hits the panic button:

🛩️ Rates cut

💸 QE returns

🚁 Helicopter money rains from the sky (not that they’d ever do that… right?)

– Update: Crypto Week is announced and broadcasted to the herd.

What happens then?

That’s when this chart—this ugly, broken, bleeding chart—might finally spring back to life.

– Update: Clearing those lows would’ve made this week feel a lot more convincing. But if you’re looking for signs of life—ETH/BTC chart might just be lighting the way. 🚀

Stay Sharp! 🐋R hUNTING!

THIS IS NOT FINANCIAL ADVICE. FOR EDUTAINMENT PUPOSES ONLY.

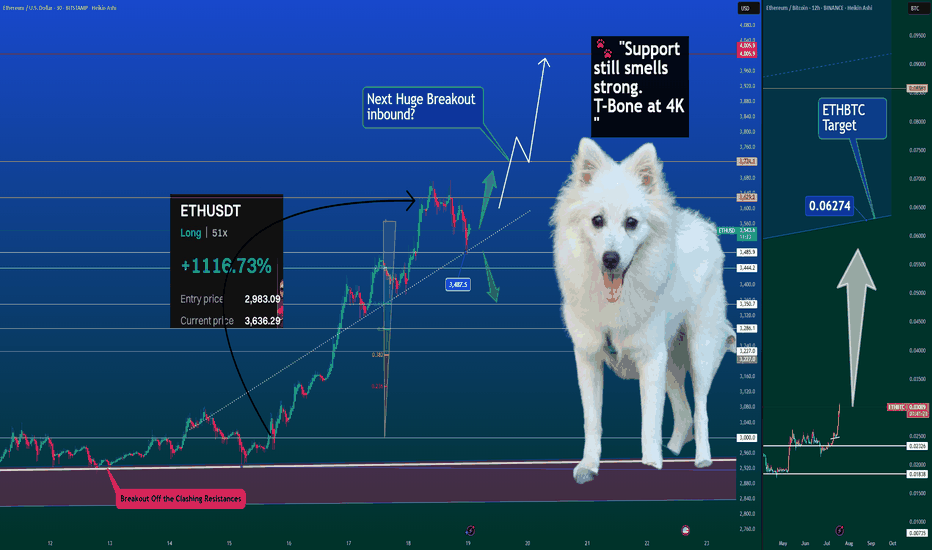

Is ETH Season Officially Here? 🚀🐾 Ethereum Breaking Out – Is ETH Season Officially Here? 📈💥

Ethereum is showing strength across the board — outperforming Bitcoin, reclaiming trendline support, and eyeing a possible breakout continuation. While macro narratives swirl (crypto legislation, rate cut vibes, political tailwinds), ETH is finally doing what ETH does best — lead.

📊 Chart Breakdown:

ETHUSDT is respecting the dotted trendline off the breakout.

Price is hovering around $3487 support, an area that aligns with Fib retracement and the last impulse base.

If bulls can maintain structure, $4000–$4050 is a natural magnet above.

📈 On the ETHBTC side, we’re aiming for the 0.06274 level — this ratio breakout is classic ETH season behavior, where Ethereum not only rises but pulls the rest of the market with it.

👀 And yes… even Elon my Dog is sniffing this one out:

🐾 "Support still smells strong. T-Bone at 4K." Then we go higher for the Cow.

📊 Order Flow Data Confirms:

Premium: Still slightly negative — market hasn’t fully rotated in.

Funding: Light and positive — sustainable, not euphoric.

Open Interest: Saw a soft reset — leverage was cleared out, opening room to rally.

Spot volume: Steady and supportive, not chasing.

🔥 +1116% ROI from the last long from $2,983.09. If you’re holding ETH — you’re holding the mic right now. Let's not drop it.

This could just be the beginning — and when ETH leads, the rest tends to follow.

Elon and the whole 🐶 Dog Team are on high alert. Breakout energy is thick.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

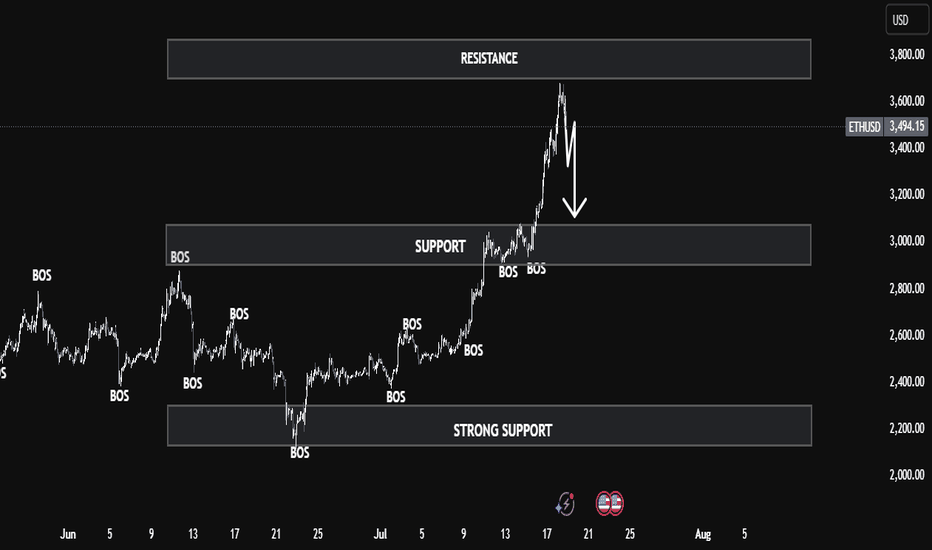

ETHUSD Smart Money Breakdown – Price Rejection from Premium ZoneEthereum has shown a strong impulsive rally after multiple Breaks of Structure (BOS) from early June, signaling a clear shift in market sentiment from bearish to bullish. Each BOS indicates that demand zones have been respected and liquidity has been efficiently used to fuel higher prices — a classic signature of institutional involvement.

🧠 Smart Money Insight

As price aggressively rallied into the resistance zone ($3,600–$3,800), the market entered a premium pricing area, where smart money typically offloads positions and hunts liquidity from late buyers. This area has historically been a high reaction zone — and as seen on the chart, ETH shows signs of buyer exhaustion, suggesting a possible short-term reversal.

🔁 Anticipated Market Behavior

A corrective move is likely from this resistance, and the first target for retracement lies in the support zone around $3,000–$3,200. This level aligns with:

Previous BOS retest area

Fair value imbalance fill

Mid-range equilibrium

If momentum continues downward, the next zone of interest will be the strong support region at $2,200–$2,400, which served as a major accumulation zone. That’s where large orders previously entered the market — and a strong reaction is expected again.

📊 Market Structure Summary:

BOS Confirmations: Validated bullish structure

Liquidity Grab: At resistance – potential sweep and reversal

Premium Zone Rejection: Smart money short opportunity

Discount Zone Targets: Support & strong support zones

✅ Conclusion

ETH is at a critical decision point. If price holds below resistance with continued bearish pressure, a retracement is not only healthy — it's expected. Traders should wait for confirmation of lower timeframe structure breaks before entering shorts, and target the $3,000 zone first, with eyes on $2,200 if momentum persists.