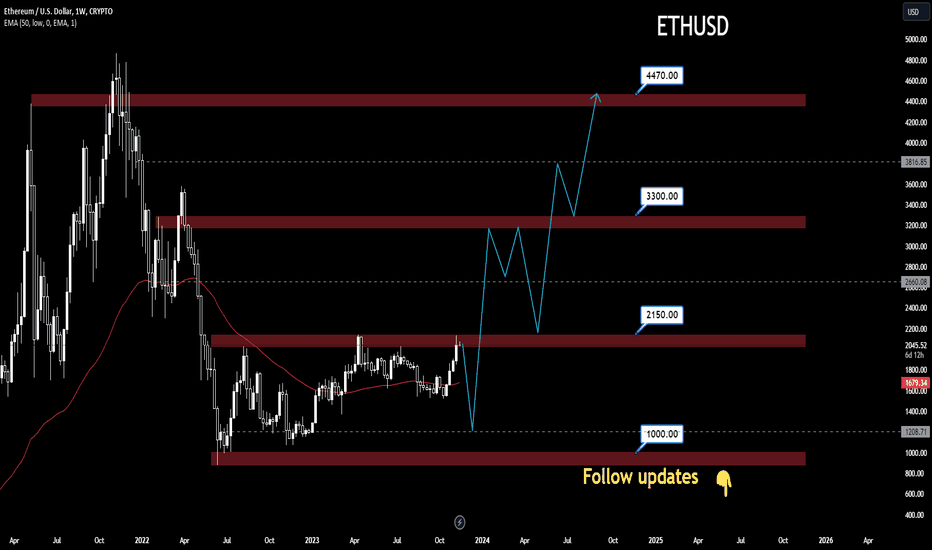

Ethereum Price Forecast📊In the W1 , we had the same movements that caused the price to stop in those levels , and according to the past chart, we can expect a stop at the 3300$ and 4470$ levels in the next price movements, which will lead to a deep correction.

🔗 For more communication with us, send a message in TradingView.

Ethidea

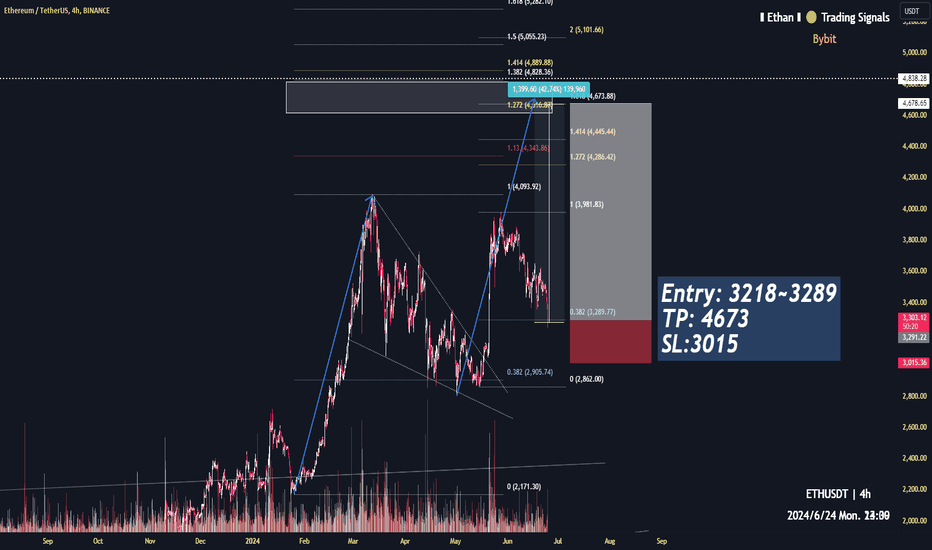

ETH target 4700 (perp)4h time frame

-

TP: $4700

SL: $2705

-

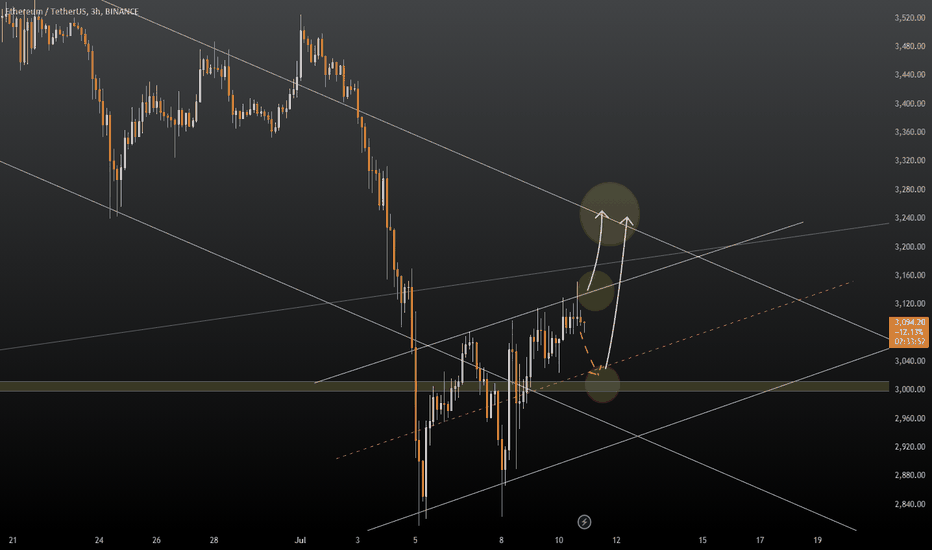

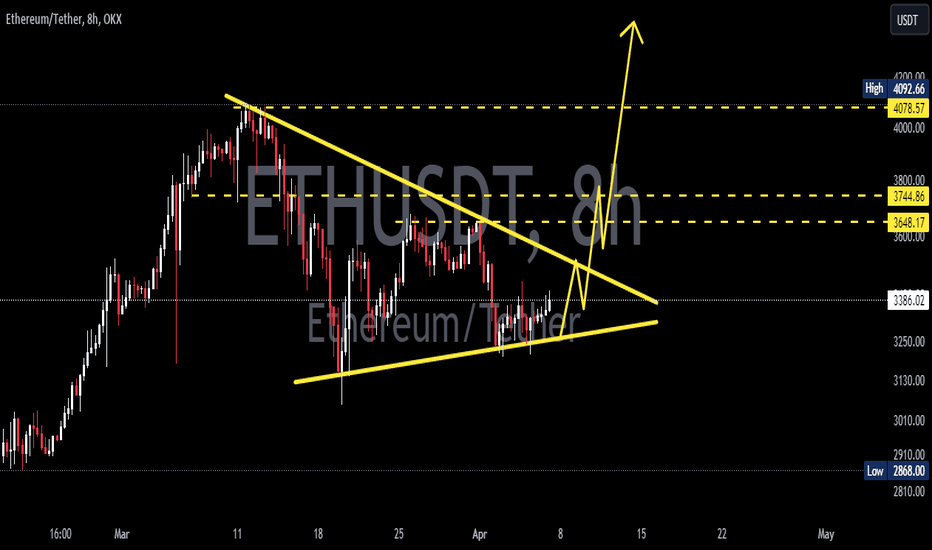

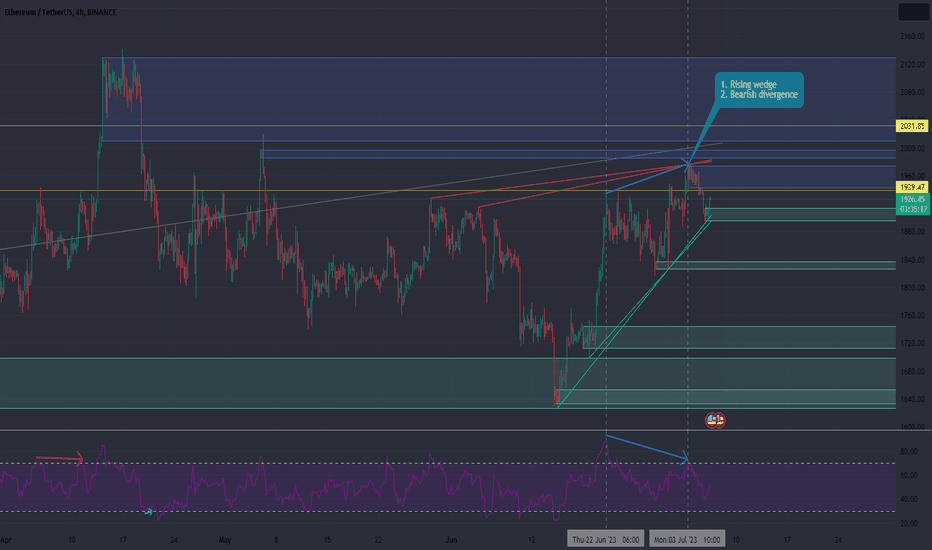

ETH jumped out the substantial wedge structure, and had a drawdown to retest it. According to several times that ETH tested 0.382 Fibonacci projection, which build a robust bottom around $2850 for further pumping. Uptick is coming once ETH confirms this breakout, that will make an instant surge to $4700 in future.

-

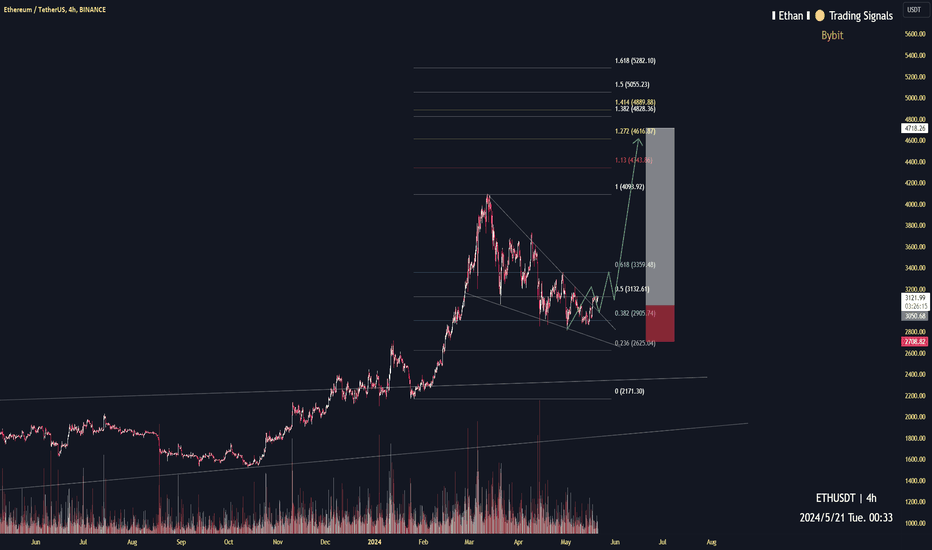

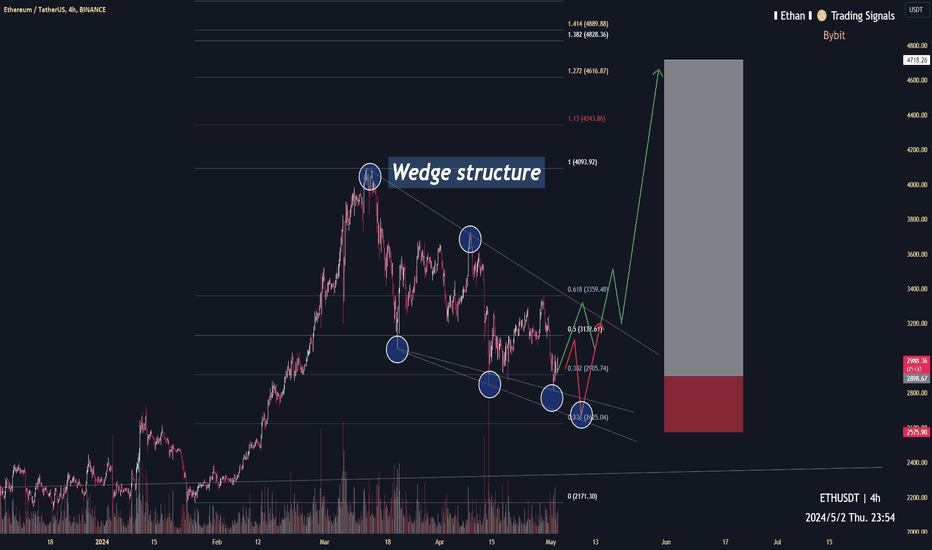

ETH target 4700 (perp)4h time frame

-

TP: $4616~$4890

SL: $2575

-

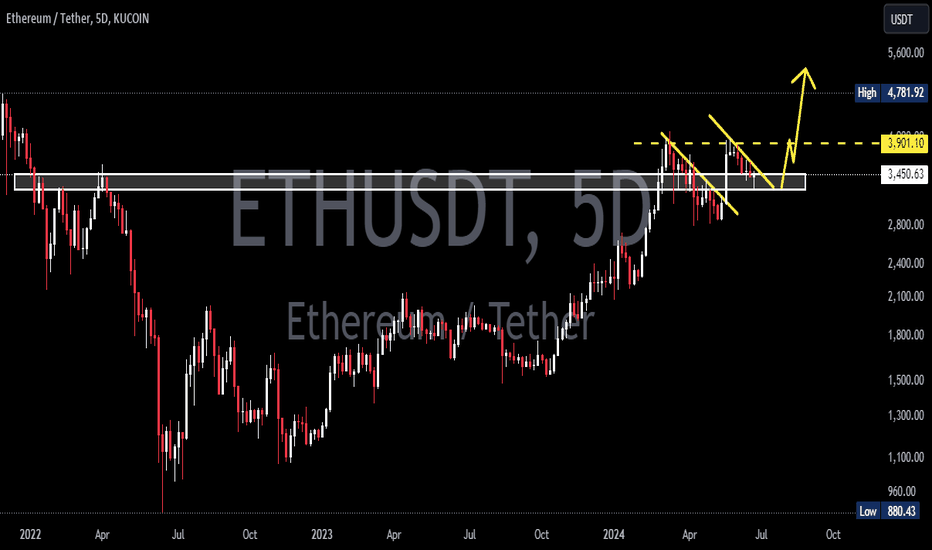

ETH is creating a potential wedge structure, that hasn't been confirmed yet. A standard structure is made of 6 six touching points at least, it's not completed due to lack of one more point on the wedge top. Also, there are two paths if we consider it as a continuation patter, first is the green one, that leave $2817 as the last low and keep going up, second is the red path, which make another low to build a robust bottom before pumping.

No matter what scenarios, they can reclaim $4800 in future if sustain continuation of the bull trend since $2171.

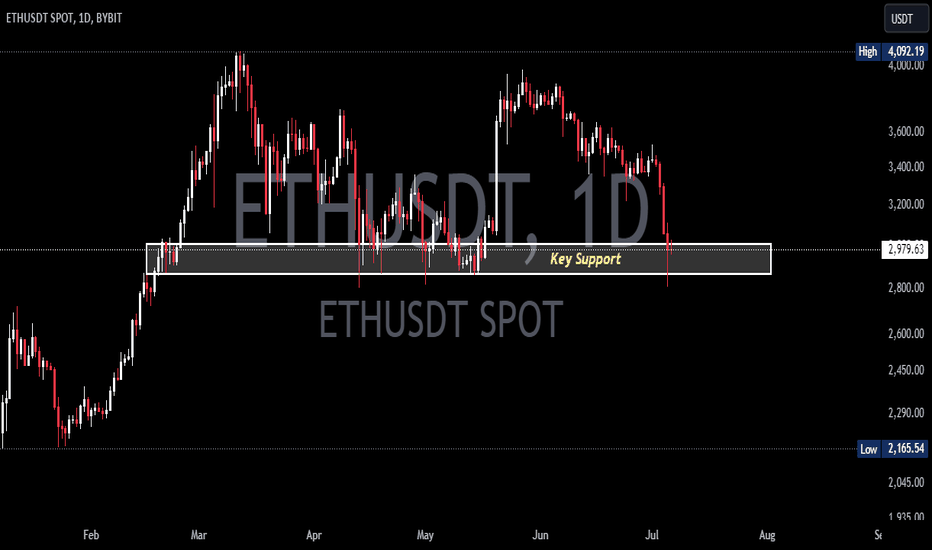

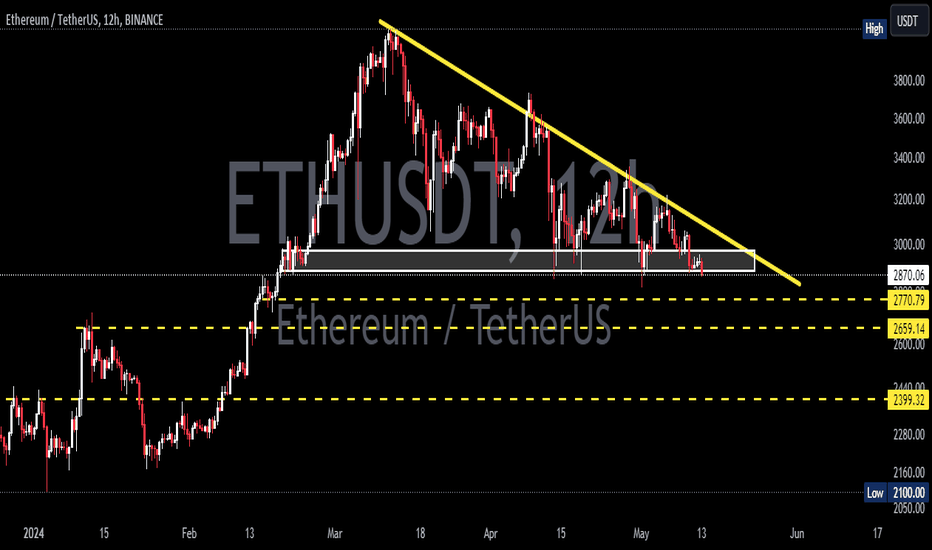

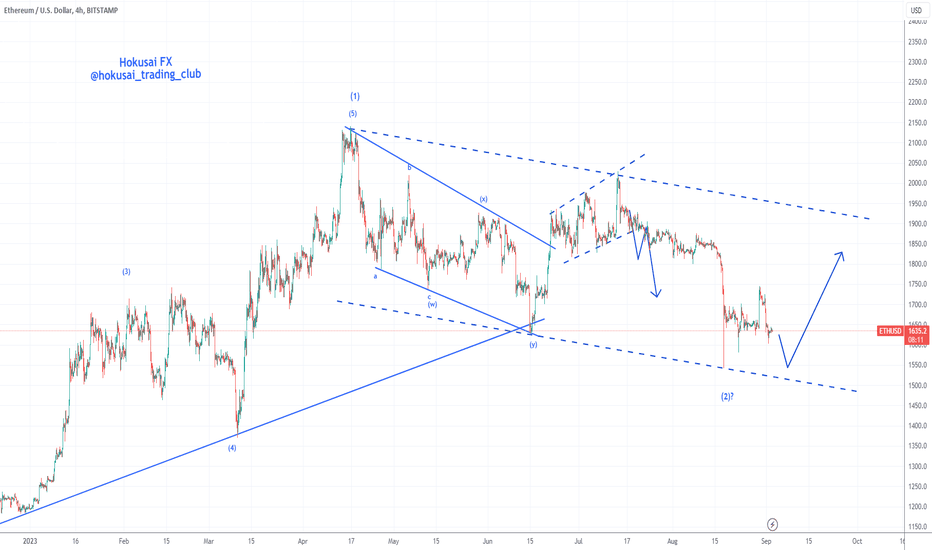

ETHUSDT: Is ETH About To Kick Off It's Next Bull Run?Hey everyone!

2023 turned out to be a great year, as expected!

2024 shaping up to follow similar footsteps.

ETFs are providing an on ramp for traditional finance money to enter the space, with the ETFs accumulating over 9B of capital in under a month.

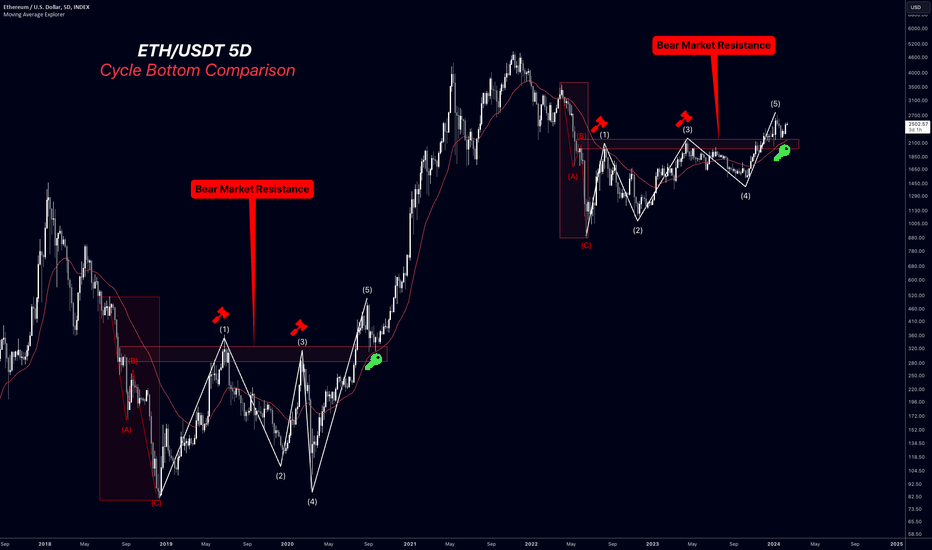

As I was doing HTF analysis on ETH, this fractal comparison came to light.

Since I've seen it, I can't unsee it

1. Exact same ABC correction marks cycle bottom

2. 5 wave structure under bear market resistance

3. 2 rejections under bear market resistance (wave 1 & 3)

4. Fifth wave breaks bear market resistance

5. Exact same retest on 50 EMA & previous bear market resistance

Maybe the ETFs speed up the usual "halving pattern"?

This charts say 3K+ en route soon, invalidation being a break of the key!

Thanks for reading, please comment and like!

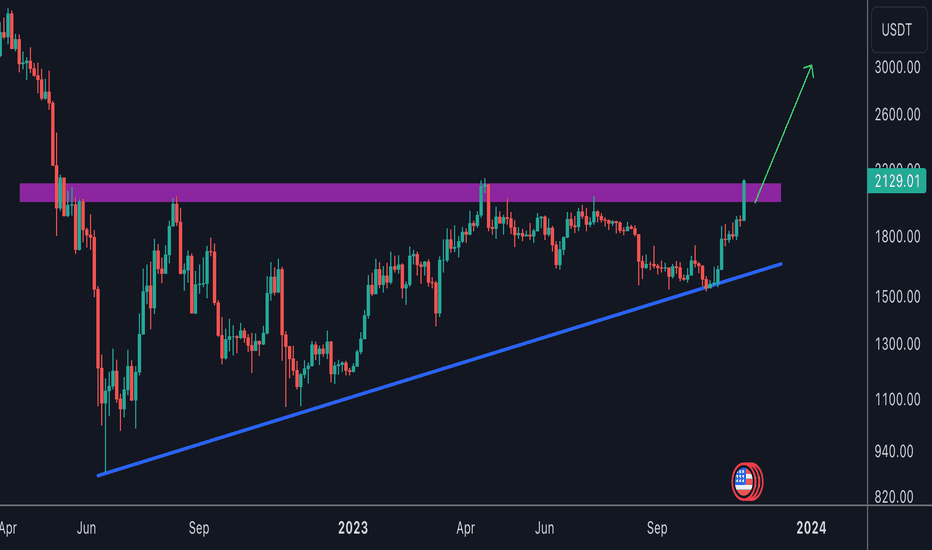

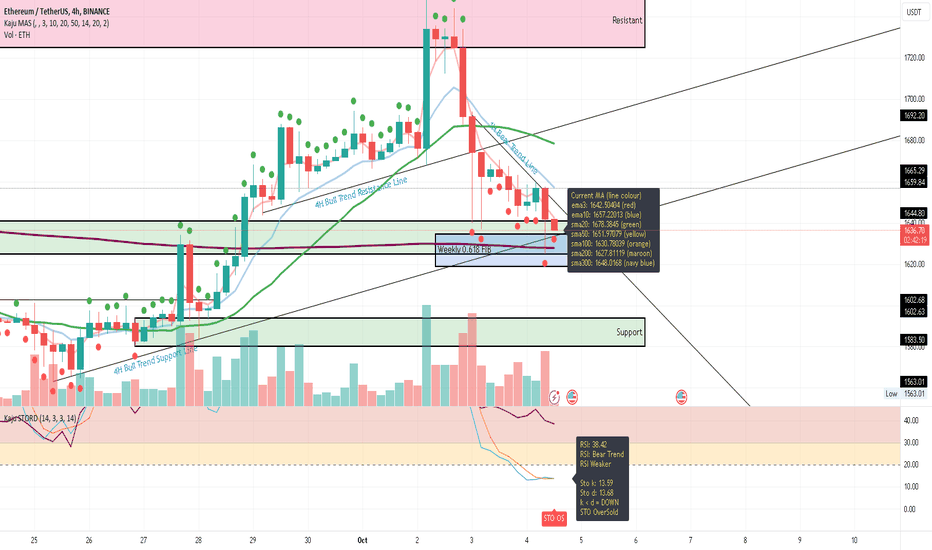

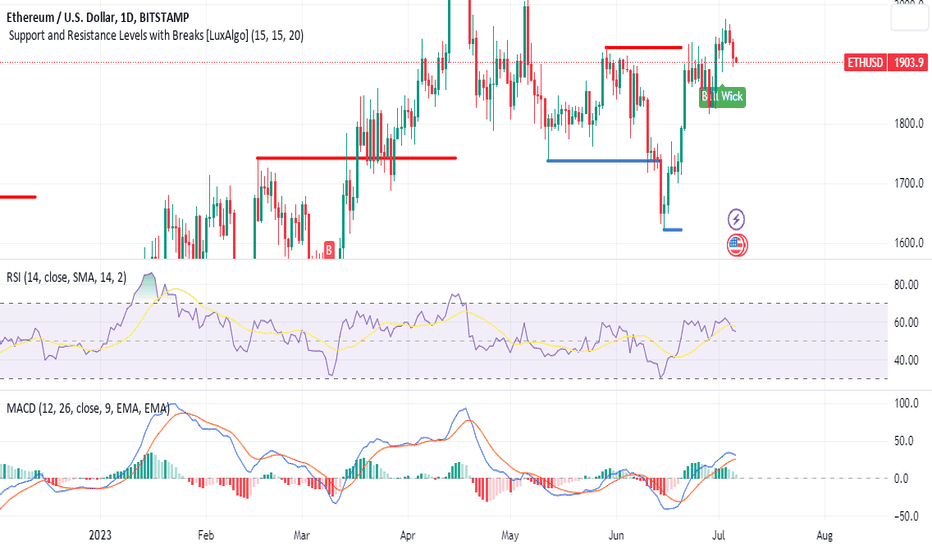

ETH at weekly 0.618 FIB Retracement-ETH reached a new high at 1751 in recent weeks, creating a resistant zone 1725-1751. It then drops about $126 to a support zone @1625-1641

-This support zone is also a weekly 0.618 Fib Retracement zone.

-STO oversold

-Current Price above ma 200

-Next support @1580-1594

Watch the Price above 1H Bear Trend Line for another test at the resistant zone.

What do you think?

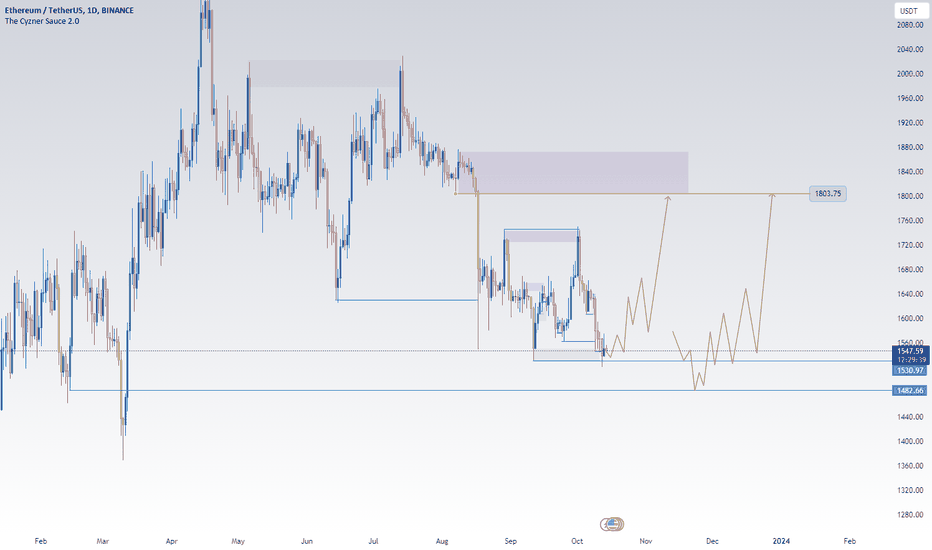

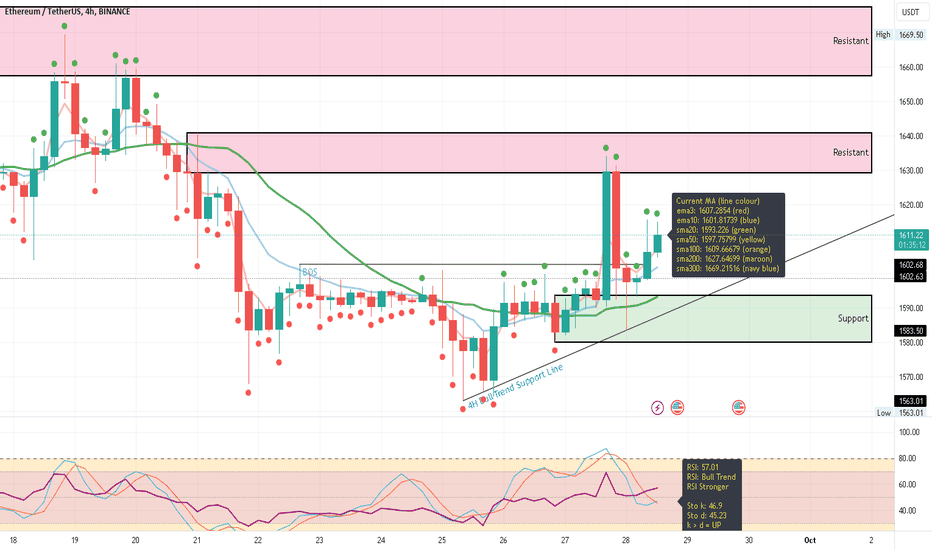

ETH continuously Bull trend?Current Resistance: 1629-1641

Current Support: 1580-1594

RSI: Bullish

Current Trend: Bullish with higher High and higher Lows, BOS

Since the BOS, ETH reaches a new high @1634.10 before retracing back into the current support zone @1580-1594. ETH continues to have Higher Lows and appears to be heading back into the current resistance zone.

Will ETH break up to another new high or would it bounce down?

What do you think?

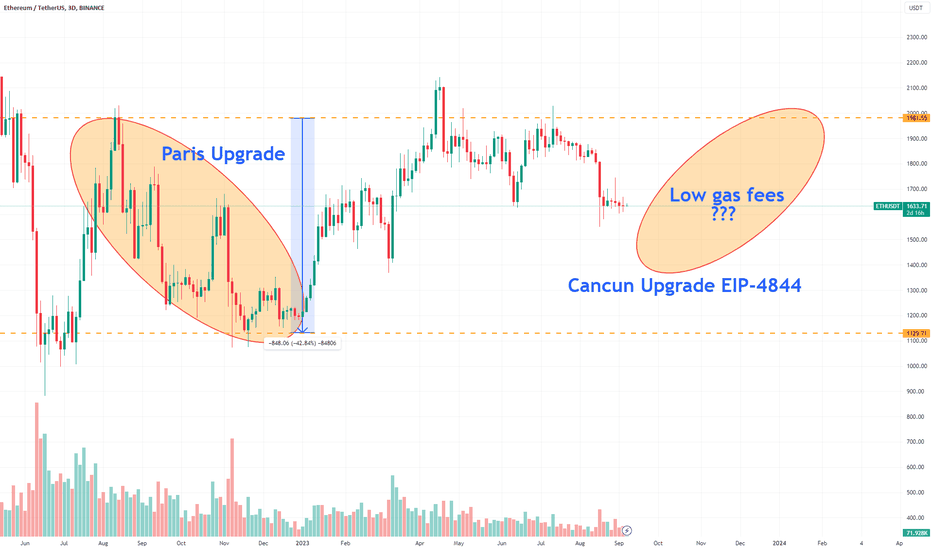

Ethereum: What's Next?In August 2022, the Ethereum Foundation issued a cautionary statement that the forthcoming Paris upgrade would not lead to a decrease in gas fees. As a result, #ether prices experienced a decline of more than 40%.

However, this development also provided a glimpse of the possible upcoming driver for #Ethereum investors: the prospect of reduced gas fees. This has since emerged as a pivotal component that the coming Cancun upgrade, known as EIP-4844 aims to address.

Please note that if you have a long-term belief in #Eth , you are likely to achieve better returns by holding rather than engaging in active trading.

#ETH - thoughts out loud №4Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

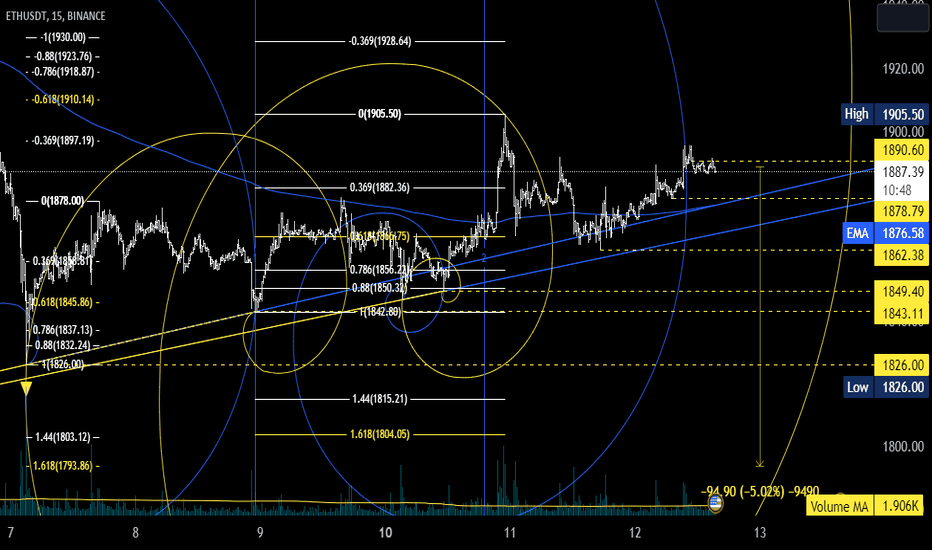

Today, we have important news, the situation on the chart reflects the idea of professional operators to implement their plans immediately during the news release, cascading levels with a large number of stop losses have been formed. We can see that if we are long, then at more favorable prices, and if we are short, then we have room to fall, and perhaps someone will not be pleased, but this is the truth as it is.

Thank you all for your attention, I wish you success .

Sometimes you win /sometimes you learn .

- thoughts out loud

- thoughts out loud

- thoughts out loud

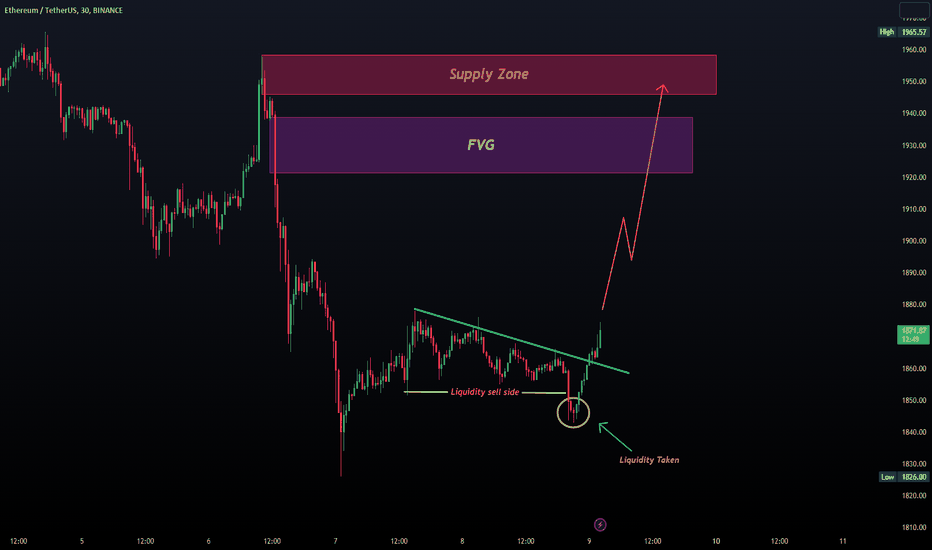

ETH Correction Phase after Bear Rally: Is it Sustainable? I want to discuss Ethereum (ETH) and the possibility of a correction phase following its recent bear rally, with a new target of $2000. However, it is crucial to approach this potential development cautiously and consider the sustainability of any price changes.

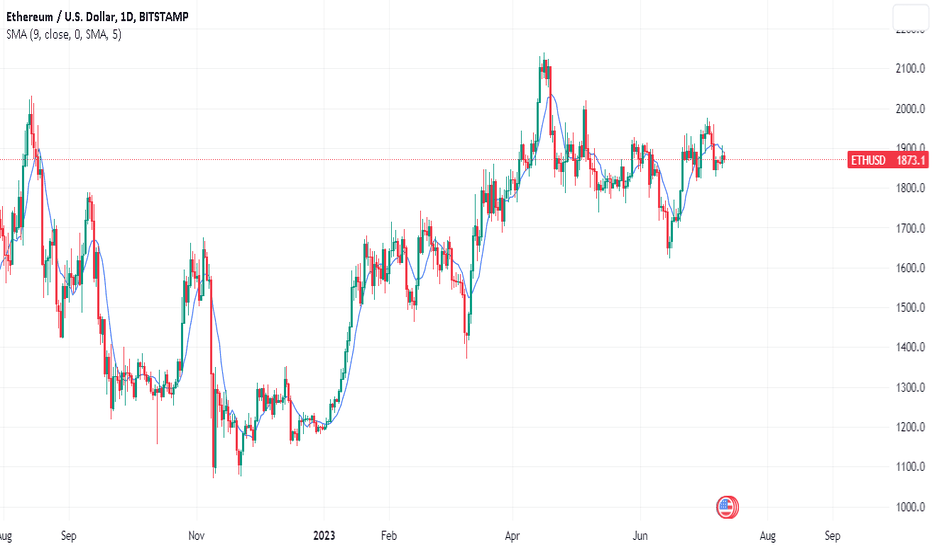

As many of you know, ETH has experienced a remarkable surge in value over the past few months, reaching unprecedented heights. This impressive rally has undoubtedly captured traders' attention seeking lucrative opportunities within the cryptocurrency space. However, it is essential to remember that markets are inherently volatile, and what goes up must eventually come down.

While a correction phase may be imminent for ETH, assessing the sustainability of any potential price changes is essential. Market dynamics, investor sentiment, and external factors can all influence the direction of cryptocurrencies, making it difficult to predict their long-term behavior accurately. Therefore, it is crucial to exercise caution and approach the situation with a measured perspective.

Considering the potential for a correction phase, evaluating your current positions in ETH may be prudent. Diversification is vital in any investment strategy, and adding a few positions in ETH could be careful. However, it is equally important to carefully manage risk and only allocate what you are comfortable with, as the market's unpredictability remains a significant factor.

As always, I encourage you to conduct thorough research, stay updated with market news, and consult with trusted advisors before making any investment decisions. The cryptocurrency market is known for its volatility, and it is essential to remain vigilant and informed.

In summary, while the possibility of a correction phase looms over ETH after its recent bear rally, it is crucial to approach the situation with caution. The sustainability of any price changes is uncertain, and it is essential to evaluate your current positions and consider diversification. Remember to manage risk prudently and make informed decisions based on reliable information.

important Trading Insight: Exercise Caution as Momentum FallsRecently, we have observed a notable trend in Ether's Relative Strength Index (RSI), which has consistently exceeded 60. This indicates an overbought condition, suggesting that the asset may be due for a correction or a period of consolidation. Coupled with this, the Moving Average Convergence Divergence (MACD) indicator has shown signs of profitability decline.

Furthermore, it is crucial to pay attention to the presence of bullish wicks, which act as support and resistance levels on price charts. These wicks indicate potential reversals or temporary pauses in the prevailing trend. As traders, it is imperative to recognize and respect these levels when making trading decisions.

Given these indicators, I encourage you to exercise caution and remain vigilant in your trading activities. It is crucial to reassess your risk management strategies and consider adjusting your positions accordingly. As momentum falls, it becomes increasingly important to focus on preserving capital and minimizing potential losses.

While the cryptocurrency market can be highly dynamic and unpredictable, the risk of sudden price swings and market volatility increases during these moments of declining momentum. Therefore, I urge you to approach your trades cautiously and avoid making impulsive decisions based solely on short-term market movements.

Remember, successful trading requires discipline, patience, and a well-thought-out strategy. Take the time to thoroughly analyze the market conditions, monitor key indicators, and consider the potential risks before executing any trades.

In conclusion, as Ether's RSI surpasses 60, MACD profitability falls, and bullish wicks emerge on the charts, you must be cautious and exercise prudence in your trading decisions. By doing so, you can better protect your capital and navigate the market's uncertainties more effectively.

ETH Struggles at $1900 - A Cautious Approach is AdvisedToday, I wanted to bring your attention to the recent struggles faced by Ethereum (ETH), which currently stands at a price of $1900. While the crypto market remains highly volatile, it is crucial to approach such situations with caution and prudence.

ETH has been facing significant challenges in maintaining its price at the $1900 level. This recent turbulence raises concerns about the short-term stability and potential downward pressure on Ethereum's value. As responsible traders, it is essential to evaluate the current market conditions and make informed decisions regarding our investment strategies.

In light of these developments, I would like to encourage you to consider holding off on any immediate ETH investments or further purchases until we witness a clearer trend. By exercising patience and closely monitoring the market, we can mitigate potential risks and make more informed decisions about our crypto portfolios.

As crypto traders, we understand the importance of staying updated and navigating the market wisely. Here are a few factors to consider before making any decisions regarding ETH:

1. Market Sentiment: Observe the sentiment of the crypto community, paying attention to expert opinions and market analysis. This will provide valuable insights into the overall market sentiment towards ETH.

2. Technical Analysis: Conduct thorough technical analysis, including examining key support and resistance levels, chart patterns, and indicators. This will help identify potential price movements and trends.

3. Fundamental Factors: Stay informed about any significant developments or news related to Ethereum, such as protocol upgrades, partnerships, or regulatory changes. These factors can significantly impact the price and future prospects of ETH.

Remember, in times of uncertainty, it is crucial to prioritize risk management and protect our investments. By taking a cautious approach and carefully evaluating the market conditions, we can position ourselves for potential opportunities while minimizing potential losses.

Collaboration and knowledge sharing can help us make more informed decisions and navigate the crypto market effectively.

Hold off on ETH investments for now and closely monitor the market conditions before making any further decisions. Let's exercise patience, evaluate the market sentiment, conduct technical analysis, and stay informed about fundamental factors. By doing so, we can make more informed choices and protect our investments in the volatile crypto market.